Increasing the Quantity of the Actuaries in Indonesia with

E-learning

Yulial Hikmah

Administration and Business Department, Vocational Education Program, Universitas Indonesia

Keywords: The Actuaries, E-learning, SWOT Analysis

Abstract: An actuary is an expert who can apply mathematical theory, probability and statistics, as well as economics

and finance to solve the actual problems in a business, especially those related to risk. The need for an actuary

profession in Indonesia is increasing along with the dynamics that occur both in economic, social and

regulatory aspects in Indonesia. However, the number of actuaries in Indonesia is still minimal. In Indonesia,

a person is said to be an actuary if he passed the exam of the Indonesian Actuary Association. The passing

rate of the exam is quite low. This profession is mostly only known by the people in the big cities. This study

aims to analyze the e-learning method as a way to increase the number of actuaries in Indonesia. This research

is a qualitative study. Data are collected by the electronic sources and interviews with the actuaries. The

analytical method used is the SWOT Analysis. This study finds that e-learning can increase the percentage of

passing Actuary Professional Exams. Thus, e-learning can increase the number of actuaries in the various

regions in Indonesia.

1 INTRODUCTION

Based on The Society of Actuaries of Indonesia

(PAI), the actuary is an expert who can apply

mathematical theory, probability and statistics,

economics and finance to solve actual problems in a

business, especially related to risk. Someone is said

to be an actuary if he follows a series of Actuarial

professional examinations held by The Society of

Actuaries of Indonesia (PAI). The Indonesian

government itself requires that every insurance

company has at least one actuary.

Moore, M.G. (1973).

This was confirmed by the Decree of the Ministry

of Finance of the Republic of Indonesia No. 426 /

KMK.06 / 2003 in article 3 paragraph 16 which states

that each life insurance company must have at least

one certified actuary. This is in line with the program

of Financial Services Authority (OJK) which targets

1000 actuaries in 2018. Based on Deputy Director of

Statistics and Information of IKNB, Arie Munandar,

The number of actuaries in Indonesia in 2018 was

571. This is still far from the OJK Program.

According to Rosenberg (2001) that e-learning refers

to the use of internet technology to deliver a series of

solutions that can increase knowledge and skills.

Therefore, actuarial science e-learning can be a

solution in fulfillment of the number of actuaries in

Indonesia because actuary candidates can study

independently wherever and whenever with modules,

questions and discussions offered by e-learning so e-

learning can increase the opportunity to pass the

exam.

Moore, M.G. & Thompson, M.M. (1990).

2 LITERATURE REVIEW

2.1 The Actuaries

Actuary is an expert who can apply the theory of

mathematics, Probabilita and statistics, as well as

economics and financial sciences to solve the actual

problems of a business especially related to risk.

(

Nielsen, et. Al 2007).

These business problems are linked to events that

occur in the future, the likelihood of such events

occur, when the event will occur and how much funds

need to be set aside to address the costs that arise if

the event The event. An actuary generally works in

the financial industry, such as life insurance

companies, general insurance companies, health

insurance companies, pension funds, actuarial

consultants and investments

Verduin, J.R. & Clark, T.A.

126

Hikmah, Y.

Increasing the Quantity of the Actuaries in Indonesia with E-learning.

DOI: 10.5220/0010048700002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 126-129

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

(1991). . Many also actuaries that have penetrated in

other areas related to risk management that require

strong analytical and logic skills.

The professional test of actuary consists of 11

(eleven) exam subjects as follows: Have taken and

passed the exam points for the level of actuarial Ajun

7 (seven) exam points and 1 (one) Professional

seminar, i.e. F-10: Investment and asset Management

, F-20: Actuarial Management , F-31: Actuarial

aspect in life insurance; Or, F-32: Actuarial aspect in

pension fund; Or , F-33: Actuarial aspect in general

insurance; Or F-34: Actuarial aspect in health

insurance.The professional test of Ajun Aktuaris

consists of 8 (eight) exam subjects as follows: A-10:

Financial Mathematics, A-20: Probabilita and

statistics , A-30: Economy , A-40: Accounting , A-

50: Statistical method , A-60: Actuarial Mathematics,

A-70: Modeling and risk theory , A-80:

Professionalism

2.2 SWOT Analysis

SWOT analysis is a method used to analyze and

position environmental and environmental resources

within the region, in the form of strengths,

weaknesses, opportunities and threats.Strengths and

Weaknesses are internal (controlled) factors that

support and hamper organizations to achieve their

respective missions.

Garrison, D. R. 1993 , Porter, L.R.

(1997). While Opportunities and Threats are external

(uncontrollable) factors that enable and sacrifice

employees from their mission. By identifying the

factors in these four areas, organizations can be

involved in decision-making, planning and strategy

development.

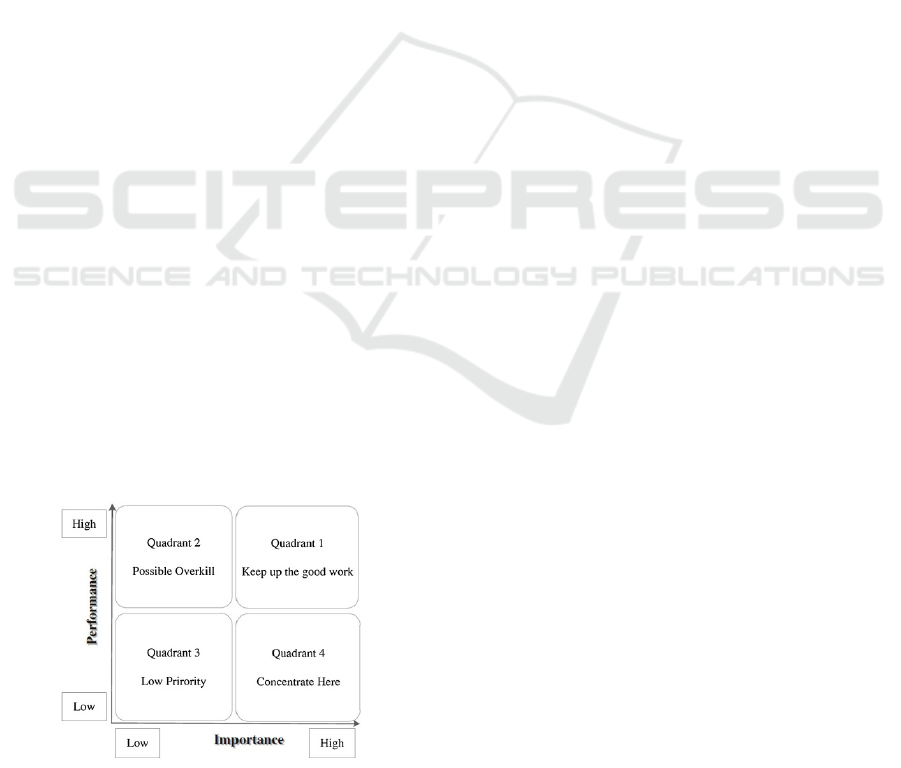

2.3 Importance Performance Analysis

The following Importance Performance Analysis

Matrix:

Figure 1. The Importance-Performance Analysis (IPA)

matrix (Hosseini & Bideh, 2013).

Based on the picture above are:

a. Quadrant 1 labeled attribute is very important

for customers, and the company provides a

high level of performance. Thus the attributes

in this quadrant are referred to as the main

strengths and opportunities to achieve or

sustain the competitive advantage of the firm.

b. Quadrant 2 labeled attributes are not important

to the customer, but the company provides a

high level. In this case, companies should look

for incoming resources for attributes in the

inner quadrant.

c. Quadrant 3 contains attributes with low

purpose and serves as a minor minor. So in this

quadrant there are not many priorities for

improvement.

d. Quadrant 4 attribute is very important for the

customer but the performance level is quite

low. These attributes are called major

weaknesses that require immediate attention to

improvement.

3 METHODOLOGY

3.1 Type of Research

This type of research is qualitative and descriptive

research. Descriptive method is the fact finding with

the right interpretation.

Taylor, J. C. 2000, Knowles,

M.S. (1975) .

Descriptive research studies the problems

of society, as well as procedures applicable in certain

communities and situations, including on

relationships, activities, attitudes, views, and ongoing

processes as well as the effects of a phenomenon

3.2 Operational Definition

The operational definitions of this research are:

1. Potential is internal condition owned by

company, that is excess or strength (strength)

owned by insurance company in Indonesia.

2. Constraints are internal conditions that exist

within the company, namely weaknesses that

can hamper insurance companies in Indonesia

in running insurance business.

3. Opportunities are the external conditions of the

company, namely the opportunities that

insurance companies can take in Indonesia to

assist in achieving business objectives.

4. Threat is the external condition of the company,

that is the existence of things from outside the

company that can hinder the insurance company

in Indonesia in running its business.

Increasing the Quantity of the Actuaries in Indonesia with E-learning

127

5. Strategy is the various forms of ways or policies

undertaken by the insurance company to

achieve business objectives by using existing

potential and minimize the constraints

.

3.3 Data Types and Data Sources

The types and sources of data used in this study are:

1. Primary Data. Primary data is data obtained

from first source either individual or group

become object in this research. Primary data

is obtained through direct interview with

several actuaries.

2. Secondary Data. This data is data that has

been available and obtained from various

literature and references such as journals,

articles, to internet sites. Secondary data was

obtained from literature studies, such as

journal articles, mass media, the official web

of institutions, etc. The data obtained

contains information relating to the issues

discussed in this study.

3.4 Data Collection Methods

Data collection methods used in this study are:

1. Interviews, data collection techniques

conducted by asking questions to

respondents or resource persons, namely

Actuaries in insurance companies.

Questions raised are related issues in

research, namely on the potential and

constraints in the development of insurance

in Indonesia.

2. Documentation, conducted by collecting

data on Insurance. The data collected is

insurance development data in some

developing countries. In addition, also

search, review and review information or

data sourced from books, journals and the

internet on insurance to find the rationale

and problem solving.

3.5 Technical Analysis

Data analysis technique used in this research is

qualitative descriptive analysis technique. Qualitative

descriptive technique is the processing of qualitative

data that has been obtained through a simple

representation of facts / characteristics. This study

used SWOT analysis.

Schank, R.C. (2002). Sharma, S.

(2002)

Based SWOT analysis is the systematic

identification of various factors to formulate a

strategy

(Silong, et al.,2001). The strategic decision-

making process is always related to development,

mission, goals, strategy and policy. Then from the

SWOT analysis results, can be seen how the potential

and constraints of Cyber insurance development in

Indonesia. These potentials include strengths and

opportunities, while constraints include weaknesses

and threats. Data analysis tools used are Internal

Factor Evaluation Matrix, External Factor Evaluation

Matrix, SWOT diagram, and SWOT Matrix.The form

should be completed and signed by one author on

behalf of all the other authors.

4 RESULTS AND DISCUSSION

The company takes advantage of internal conditions

and external conditions in the development of the

company. A company cannot be separated from

understanding in the internal and external

environment of the company.

Robinson, B. (2001). on

the results of interviews conducted with several

actuaries and leaders of the company to review the

importance of the actuarial function of insurance

companies along with the study of literature,

identifying authors included in internal factors and

external factors. The following table identifies the

results of internal factors and external factors:

Table 1.

Internal

Environmental Analysis

External

Environmental

Analysis

1. E-learning Media: Web-

based and Android / iOS

2. The cost of

implementing E-learning

was still expensive

3. Promotion of E-learning:

socialization to

universities or

companies / electronic

media

4. E-learning Facilities:

Online modules,

questions and

discussion, exam

simulation

5. Competent human

resources needs:

6. Adequate human

resources involved:

Teachers

(competencies), IT

supports,

Administrators, etc.

7. Market Segments;

Students Backgrounds

(educations and regions)

1. Technological

Development: Students in

various regions (the

Internet has been reached

everywhere), but the

disruptions of internet

connection can inhibit the

learning process

2. Government Policy:

The obligation of insurance

companies and financial

sector to have at least one

actuary

3. Competition: Appear

the similar learning

methods

4. Students' interest was

high because a high of

actuaries’ salary

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

128

From external and internal factors above, then

obtained the SWOT matrix analysis as follows:

Table 2.

Internal

Factors

External

Factors

Strength Opportunity

1. The media used were

almost owned by

everyone (easily

accessible and not a

luxury thing)

2. The cost of e-learning was

affordable by students

3. Students Background

from various fields of

competence

4. Students became

independent, active, and

have initiative individuals

5. Students can learn

anywhere and anytime

6. Teachers and students can

use modules that were

structured and scheduled

1. The needs of actuary

numbers was increasing

2. There was a program of

1000 actuaries by

Financial Services

Authority (OJK)

3. There was no Actuarial

science E-learning in

Indonesia

4. Students’ interest to be an

actuary was increasing

because it’s salary

5. Students can come from

various regions

6. Students spend the low

costs to be an actuary

Weakness Threat

1. Requires a high cost for

organizers to make the

good facilities.

2. Lack of human resources

who have the internet

skills

3. The learning and teaching

process more inclined to

training than education

1. Internet connection that

has a problem can hamper

the learning process

5 CONCLUSIONS

Based on the results of SWOT analysis conducted, it

can be obtained that: Based on the government policy

that existence a program of 1000 actuaries and

increasing of students interest to be an actuary, e-

learning can be a good method to increase the

numbers of actuary in Indonesia.; E-learning method

can make the students study independently wherever

and whenever. Students also can do exam simulation

in order to increase competencies opportunity of

passing the exam.; Actuary candidates (students)

come from various region because the accessibility pf

internet, various competencies backgrounds because

e learning don’t require the linearity of competency

(actuarial science, statistics, and mathematics), and

the backgrounds of economics capability because the

cost of e-learning is achieved by students.;Required

the competent and technology adaptability human

resource in order to the e-learning process can works.

REFERENCES

Moore, M.G. (1973). Toward a theory of independent

learning and teaching. Journal of Higher Education, 44,

66-79.

Moore, M.G. & Thompson, M.M. (1990). The effects of

distance learning: A summary of the literature.

Research Monograph Number 2. University Park, PA: The

Pennsylvania State University, American Center for the

Study of Distance Education. (ED 330 321).

Nielsen, H.D., Tatto, T., Djalil, A., & Kularatne, N. (2007).

The cost-effectiveness of teacher training.

Verduin, J.R. & Clark, T.A. (1991). Distance education:

The foundations of effective practice. San Francisco:

Jossey-Bass Publishers.

Garrison, D. R. 1993. Quality and access in distance

education:Theoretical considerations. Dalam D.

Keegan (Ed.),Theoretical principles of distance

education, pp. 9-21. NewYork: Routledge

Taylor, J. C. 2000. New millennium distance education.

Knowles, M.S. (1975). Self directed learning, a guide for

leaners and teachers. Englewood Cliffs: Prentice Hall

Regents..

Porter, L.R. (1997). Creating the virtual classroom:

distance learning with the internet. New York:John

Wiley & Sons .

Robinson, B. (2001). Innovation in open and distance

learning: some lessons from experience and research. In

Lockwood, F., & Gooley, A (eds). Innovation in open

& distance learning: Successful development of online

and web-based learning. London: Kogan Page Limited.

Schank, R.C. (2002). Designing world-class e-Learning.

New York: McGraw-Hill.

Sharma, S. (2002). Modern methods of life-long learning

and distance education. New Delhi: Sarup and Sons.

Silong, A. D., Ibrahim, D. Z., & Saham, B. A. (2001).

Perception of working adults toward online learning in

a virtual university. Makalah disajikan pada the

International 7th Symposium on Open and Distance

Learning, 12-14 Nopember 2001, Yogyakarta,

Indonesia.

Increasing the Quantity of the Actuaries in Indonesia with E-learning

129