Study of the Impact of Driving and Restraining Factors on Ensuring

the Development Sustainability of the Bicycle Market in Russia

O. V. Astafeva

a

, D. V. Zhatikova and I. A. Osipova

Financial University under the Government of the Russian Federation, 49 Leningradsky Prospekt, GSP-3, 125993,

Moscow, Russia

Keywords: Bicycle market, risks of bicycle production, environmental factors.

Abstract: The aim of the work is to study the factors affecting bicycle manufacturers in order to substantiate the

feasibility of developing domestic bicycle production. The article examines the bicycle market and compares

the key characteristics of the largest domestic bicycle manufacturers, it also analyzes the influence of factors

in the far and near external environment on bicycle manufacturers in Russia and assesses the key risks. The

paper concludes that the Russian market is one of the most attractive from the point of view of the

development of the bicycle business in the world, since it is experiencing a great increase in the popularity of

the bicycle both for sports and for entertainment and also as a means of transportation for the population, the

number of domestic manufacturers is extremely small, and the market development potential is quite high.

1 INTRODUCTION

The worldwide COVID-19 pandemic and the self-

isolation associated with it have made people

appreciate outdoor moments. Since the spring of

2020, borders between countries have been closed,

fitness clubs have suspended their work. Cycling is

one of the few safe ways to relax and exercise that is

left available. The surge in demand for bicycles and

bicycle accessories was noticed by such large online

giants as Ozon, AliExpress, Wildberries and Avito.

According to the press service of the online retailer

Ozon, the demand for bicycles in April and the first

half of May 2020 increased by 36% across Russia

compared to the same period in 2019. The Russian

bicycle manufacturer Forward has also experienced

an increase in demand in the post-quarantine period.

For only five months of 2020, the enterprise produced

90% of the last year's annual production volume

(Interfax, 2020). As a result, it can be assumed that

the development of a project for organizing the

production of bicycles is a promising business idea.

The key research issue of the work is to study the

feasibility of starting up a bicycle production and

assess its effectiveness.

a

https://orcid.org/0000-0001-6445-4456

2 MATERIALS AND METHODS

In order to draw a conclusion about the feasibility and

possibility of effective functioning of domestic

bicycle production, it is necessary to analyze the

Russian bicycle market, identify its growth potential,

and study the key market players. In this regard, in the

preparation of this scientific article, a wide range of

information sources and research tools were used:

- data from Rosstat, Wordstat.yandex.ru,

marketing agencies and large online marketplaces;

- survey of owners and buyers of bicycle shops;

- the information about the activities of bicycle

factories, which is freely available on the network;

- communication with the employees of sports

shops and the use of one’s own knowledge in cycling

topics.

Due to the fact that in the modern world more and

more attention is paid to the issues of a healthy

lifestyle, in recent years there have been many

scientific works and articles devoted to the study of

the problems of cycling and its influence on the

physical activity of the population. Among such

works are scientific articles by Astafeva O. V.,

Nizeev A. D., Osipova I. A., 2020; Bakota D,

Ortenburger D, Płomiński A., 2018; Fiore D.C.,

264

Astafeva, O., Zhatikova, D. and Osipova, I.

Study of the Impact of Dr iving and Restraining Factors on Ensuring the Development Sustainability of the Bicycle Market in Russia.

DOI: 10.5220/0010698300003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 264-269

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Fellows K.M., Henner T.A., 2020; Geurts E., Coninx

K., Hansen D., Dendale P., 2018; Kireeva N.S.,

Slepenkova E.V., 2019; Kolumbet A.N., Natroshvili

S.G., Babyna T.G., 2017; Perfilova I.A., Dyshakov

A.S., Graham C., 2020.

3 RESULTS AND DISCUSSION

3.1 Analysis of the Bicycle Market and

Its Potential in Russia

There are currently a small number of domestic

bicycle factories in Russia. On average, this market,

together with imports, is about five million bicycles

and bicycle frames. The largest part (about 60%) is

imported and 40% of bicycles are produced in the

territory of the Russian Federation. Most two-

wheeled vehicles are assembled on the site from the

parts shipped from China.

Despite the growing demand every year, the

number of bicycle brands is growing at a very slow

pace In Russia. At the moment, the main bike brands

on the domestic market are Stels, Forward and

Stinger, as well as small sub-brands of the same

manufacturers, but with a narrower segmentation,

such as Altair and Format - from a Perm

manufacturer, children's bicycles Novatrack - from

Kaliningrad Stinger bicycle manufacturers. Stern

bicycles are produced for Sportmaster, a large retail

sporting goods store. The main parts are imported

from China, but the assembly and engineering are

entirely carried out in Russia. The key competitors

today are Velomotors (Stels bicycles) and Forward,

which divide the market geographically: a home

region for Stels - is Central Russia, that is why their

bicycles are most often bought here, but in the Urals

the situation is different, and the number of Forward

bicycles is prevailing. In general, the bicycle market

is poorly represented by the strong authentic brands

with a good reputation, while the demand for bicycles

of good quality with a stable and strong image is

growing.

In parallel, new Russian brands of bicycles are

developing simultaneously with them, which make

both design and engineering in Russia, while the

production of spare parts and components is

completely imported from China. One of the brightest

and rather successful representatives of this group is

the Shulz bicycles from St. Petersburg. These

bicycles have become very popular in different

regions of our country, mainly for their lightweight

and comfortable folding frames and an adequate

price. A little later, this manufacturer also launched a

line of children's bicycles, which a lot of buyers

throughout the country took a liking to. Another

brand from this category is Stark bicycles, which are

the result of joint work of Russian and German

specialists. Their production is located in Taiwan.

This brand offers budget-friendly, but quite high-

quality models. Let's compare the listed bicycle

manufacturers according to certain parameters in

table 1.

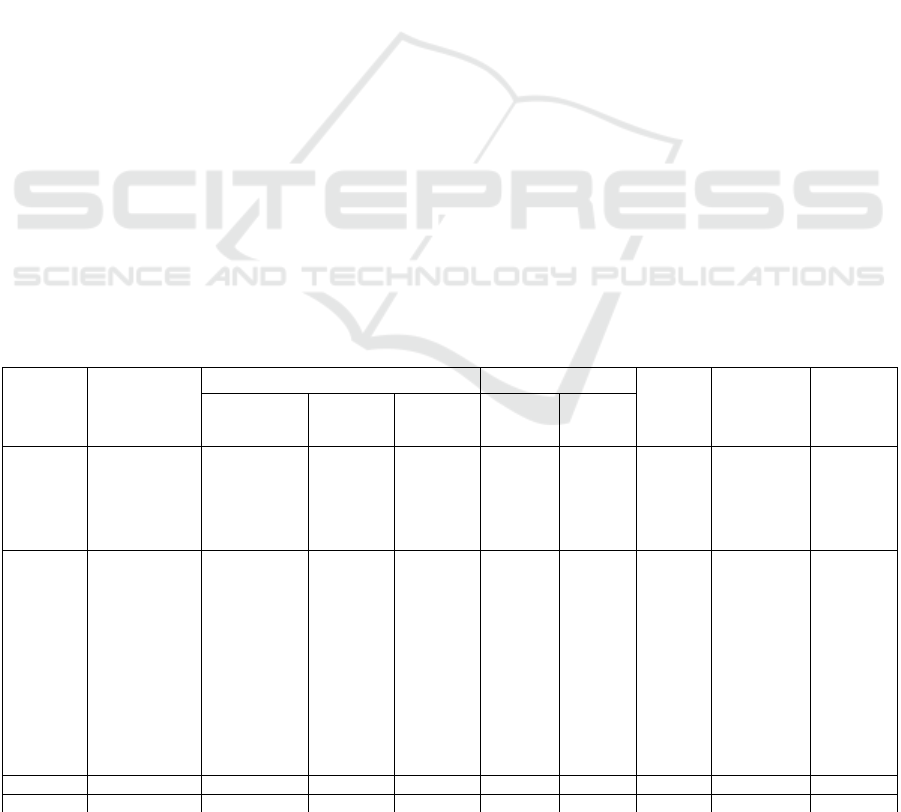

Table 1: Comparative characteristics of Russian bicycle manufacturers.

Brands /

Parameter

s

Stels Forward Stinger Stern Shulz Stark

Forward Format Altair Adult

Stinger

Child

Novatrac

k

Types of

bicycles

sold

Urban,

mountain,

children's,

road, folding,

racing, cargo,

BMX

Mountain,

urban,

children's,

road, folding,

racing,

electric

Mountain,

urban,

children's,

road,

BMX,

racing

Mountain,

urban,

children’s

Mountain

, urban,

road,

BMX

Children'

s,

folding

Mountai

n, urban,

children

’s

Folding,

children’s,

road

Urban,

mountain,

children's,

folding,

BMX

Target

audience

Couples with

children;

residents of

megalopolises,

medium-sized

cities and small

settlements

Couples with

children; aged

people who

care about

their physical

condition

Profession

al athletes,

young

people

aged 20-

35 years

old

Students

aged 18-

26;

families

with

incomes

below

average

and

average

Professio

nal

athletes;

residents

of

medium

and small

towns

Couples

with

children

buying

bicycles

for their

children

Middle-

income

families,

male

half of

the

populati

on

Students

aged 18-26

years old,

young

people aged

20-35 years

old, families

with

children

Young

people

aged 20-

35 years

old,

students

aged 18-

26 years

old;

residents

of

megalopol

ises

Study of the Impact of Driving and Restraining Factors on Ensuring the Development Sustainability of the Bicycle Market in Russia

265

Table 1: Comparative characteristics of Russian bicycle manufacturers (cont.).

Sales

market

Stels dealer

network

throughout

Russia (mainly

the central

part),

specialized

sports retail

stores, online

stores and

marketplaces

Specialized bike shops both online and

retail, Forward dealer network throughout

Russia (most of it is in the Urals)

Stinger dealer

network throughout

Russia (mainly the

northern part),

specialized bike

retailers, online stores

and marketplaces

Own

network

of chain

retail

stores

Sportma

ster

through

out

Russia,

specializ

ed

online

stores

Sportma

ster and

Stern

Dealer

network of

specialized

bicycle

stores, own

branded

retail stores

Shulz

(Moscow,

St.

Petersburg)

and online

store

Shulz.ru

Stark

dealer

network

throughou

t Russia,

specialize

d sports

retail

stores,

online

stores and

marketpla

ces

Price

category

3000 – 66000 4200 – 37000 13000 –

230000

3600 –

23000

18000–

104000

4000 –

20000

2500 –

52000

8000 –

64000

7300 –

86000

Competiti

ve

advantage

The widest

range of

bicycles within

one brand,

affordable

price, the

oldest factory

with the

maximum

degree of

localization

and production

automation

High

manufacturab

ility of

production,

development

of new

models in

accordance

with

international

standards

with the

involvement

of

professional

athletes

The only

brand of

Russian

origin,

positionin

g itself as

a

manufactu

rer of

premium

bicycles, a

profession

al bicycle

team of

the brand

Affordabl

e cost of

bicycles,

high-

quality

Russian-

made steel

frames

In the

basic

segment,

well-

adjusted

geometri

es and

designs

of

bicycles

Wide

range of

children'

s

bicycles,

safety,

the best

value for

money

in its

segment

Good

brand

represen

tation in

its own

Sportma

ster

network,

large-

scale

advertisi

ng

campaig

n

Compact

design and

lightness of

frames, ease

of

transportatio

n and

storage; a

variety of

colors of

models and

the use of

design

solutions

Robust

frame

constructi

on; a high-

quality

line of

bicycles

for

extreme

riding,

performin

g tricks of

varying

difficulty

Let's also compare how the market share is

distributed between the top 5 largest Russian bicycle

manufacturers by distribution base - revenue for

2020. According to SPARK, the total revenue of the

main companies registered in Russia is

11,699,787,000 rubles. The largest market player at

the moment is “Velomotors+” LLC, which has two

more plants – ZhVMZ LLC in Zhukovka (Bryansk

region) and KVMZ LLC (Krasnodar Territory),

producing Stels bicycles, with a revenue of

8,892,319,000 rubles. The second place is occupied

by the company "Forward", its revenue –

2,358,579,000 rubles. The third place on the market

is occupied by LLC "TK Ateil", with their Stark

bicycles, their revenue - 254,379,000 rubles. The

fourth group is “Shultz” LLC (revenue – 191,938,000

rubles), which produces folding bicycles and

children's bicycles. And the fifth place - LLC

"Velobalt” Production Association" (Stinger

bicycles) with a revenue of 2,572,000 rubles, which

however, over the last year have somewhat lost their

positions in the market.

3.2 Assessment of the Impact of

Factors of External Environment

on Bicycle Manufacturers

The success of bicycle production depends not only

on the availability of demand in the market, but also

on many other factors in the far and near external

environment.

The external distant environment exists

independently of the project itself but has an indirect

effect on it. It primarily includes the authorities, the

public, the political and economic situation in the

country as a whole. Depending on the policy of the

state, customs conditions can be improved, domestic

producers can be supported, for example, with the

help of protectionist policies, tax legislation can be

tightened, subsidies and special economic zones can

be canceled. It is necessary to cooperate with the

Administration of the city where the production will

be located, to pay attention to the current policy of the

Government of the Russian Federation. The

economic situation will determine the solvency of the

population, the level of prices for the components and

equipment, as well as the wages of craftsmen. The

public will form an opinion about the company, it will

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

266

include the cycling communities of Russia ("Let's

bike it!"), accounts on social networks of bicycle

viewers, creators of bicycle parades and bicycle

masters, exhibitions of bicycle industry goods (Bike-

Expo 2021, Velo (bike) Park 2021), transport and

educational magazines (Velomoskva). Also, the

project will be influenced by the cultural component.

As of today, the fashion for healthy lifestyle is only

gaining momentum, and the bicycle as a means of

transportation and walking is becoming more and

more popular, therefore, the cultural environment is

undoubtedly an important element of the external

environment. It is necessary to take into account the

relationship with the coordinating and control bodies

(ministries, services, inspections), such as the fire

inspectorate (Ministry of Emergency Situations of

Russia), which monitors fire safety at the enterprise;

tax inspection; the labor inspectorate, together with

the Pension Fund of the Russian Federation and the

Social Insurance Fund, regulate the observance and

compliance of labor legislation and the correct

calculation of benefits; Rospotrebnadzor (Russian

Federal State Agency for Health and Consumer

Rights), which will control everything related to the

quality and safety of production areas (lighting, areas,

sanitary and epidemiological situation) and the

products themselves - bicycles; Rosprirodnadzor

(Russian Federal Service for Supervision of Natural

Resource Usage and Ecology) - compliance by the

enterprise with the norms of emissions of harmful

substances into the atmosphere, waste disposal;

Roskomnadzor (Russian Federal Service for

Supervision of Communications, Information

Technology, and Mass Media) - checking the

collection, storage and processing of personal data; as

well as the prosecutor's office, which exercises

general supervision over the activities of the

enterprise.

The external environment has a direct impact and

includes the areas of finance, sales, supply and

infrastructure, buyers, investors and competitors. The

sphere of finance will include: the Entrepreneurship

Support Fund, the Export Support Center, a soft loan

for business from a bank, subsidies from the budget

for the development of domestic production. Sales

sphere: own branded bike shops, specialized bike

online stores (velosite.ru, velosklad.ru, velostrana.ru,

bike-center.ru), large marketplaces (wildberries.ru,

ozon.ru), specialized dealer bike shops countrywide.

The scope of supply: partners in the supply of bicycle

frames made of aluminum alloys and carbon in China

(goldenwhelgroup.com, trinx.com), leading suppliers

of parts and components such as Shimano (gearshift

clutch/derailleurs), Sram, Tektro, Kenda, Maxxis,

Suntour. The infrastructure: brand stores, corporate

cars, provision of Russian cities with bike paths, bike

parking lots, special road signs, bike zones in parks.

Buyers will have a key influence on the product, as

the supply of bicycles will depend on the demand and

their preferences. Investors are needed to launch the

project itself and to ensure its normal functioning.

Competitors that already exist on the market occupy

a certain share, they have their own competitive

advantages, presented earlier in paragraph 3.1.

3.3 Risk Register of Bicycle Production

in Russia

Before launching production and starting its

activities, it is necessary to assess all kinds of risk

events that may arise at any stage of the project

implementation, in order to be ready for them and

know how to act in a given situation. The risks of a

bicycle production project can be divided into 4 main

blocks: technical, organizational, external and project

management risks (table 2).

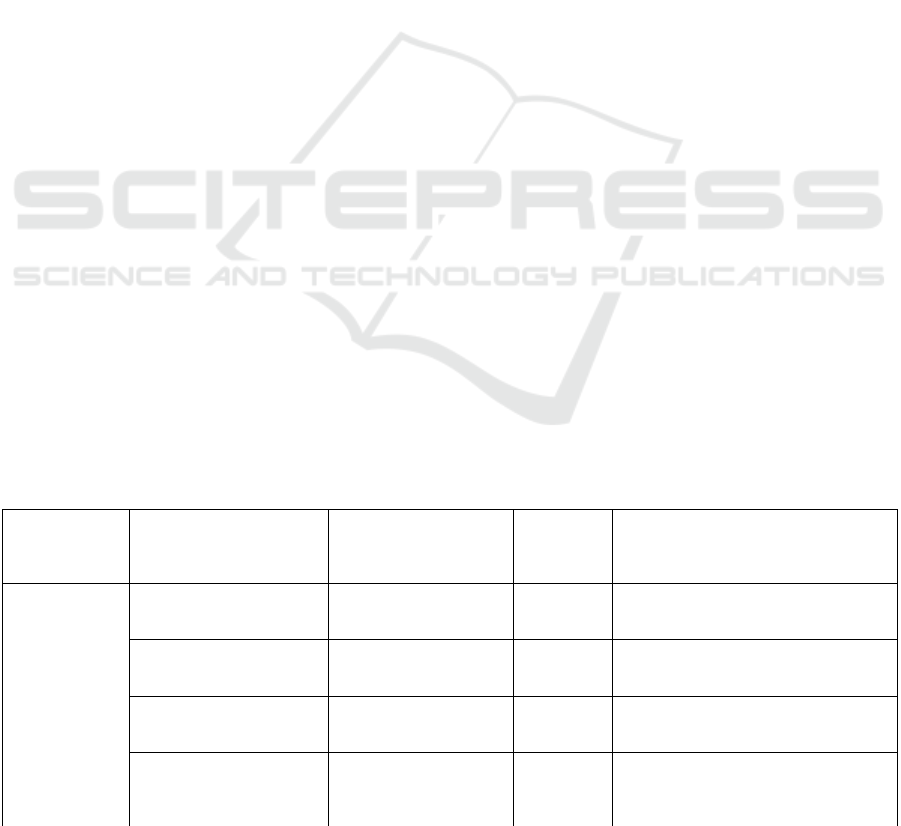

Table 2: Risk register.

Risk category Description of the risk and

the consequences of its

realization

Possible consequences of

risk realization

The

likelihood

of a risk

even

t

Risk reduction measures

Technical risks Non-compliance of the

product with quality

standards

Quality: the end product

is virtually useless

0,4 Constant control over all production

processes, careful selection of suppliers

Equipment malfunctions Timing: increase in time

- by 10-20%

0,42 Timely accrual of depreciation charges

for equipment, subsequent repair or

replacement of equipmen

t

The complexity of building

a continuous production

process

Content: Main content

areas are covered

0,2 Competent planning of production areas,

building the production cycle based on

the principles of lean production

Lack of production and

storage facilities

Timing: increase in time

by 5-10%

0,12 Assessment of the need for the number

of square meters for the production of a

unit of production at the planning stage

Study of the Impact of Driving and Restraining Factors on Ensuring the Development Sustainability of the Bicycle Market in Russia

267

Table 2: Risk register (cont.).

Purchase of defective

equipment

Cost: increase in cost by

20-40%;

terms: increase in time

b

y 10-20%

0,56 Purchase of production equipment only

from verified and certified importers

Purchase of low-quality

components

Cost: increase in cost by

10-20%;

terms: increase in time

b

y 5-10%

0,3 A careful approach to the selection of

suppliers of components

External

environment

risks

Changing the system of

product quality indicators –

GOST (State Standards of

quality)

Content: Minor areas of

content are slightly

covered

0,02 Development of a system for rapid

response to changes

Tightening of customs

legislation

Cost: cost increase by

10-20%

0,12 Search for alternative suppliers in the

domestic market

Strengthening the

competition

Content: Minor areas of

content are slightly

covered

0,1 Identifying the strengths and weaknesses

of competitors, strengthening one’s own

competitive advantages

Failure by contractors to

perform preparatory repair

wor

k

Timing: increase in time

by 5-10%

0,12 Finding reliable contractors at the

planning stage

Disruptions in time and

volume of supplied

components

Timing: increase in time

by 10-20%

0,54 Conclusion of contracts with trusted

suppliers, fines for violation of the

specified deadlines

Organizational

and managerial

risks

Lack of funds Timing: increase in time

> 20%

0,72 Thorough preparation of the project plan

and assessment of all incidental costs

Breaking partnerships with

spare parts suppliers

Timing: increase in time

b

y 10-20%

0,28 Conclusion of agreements on mutually

b

eneficial terms

Failure to comply with the

planned deadlines for the

performance of work and

the sale of goods

Content: Main content

areas are covered

0,42 A more thorough study of each moment

at the stage of project initiation

Insufficient qualification of

hired production workers

Quality: Downgrade

requires investor

approval

0,42 Continuous training and retraining of

personnel, sending personnel to

complete retraining courses

4 CONCLUSIONS

Based on the conducted research, it can be concluded

that the greatest risk for the company is borne by

organizational and project management risks: lack of

funding, disruptions in time and volume of supplied

components, purchase of defective equipment.

Without money and without spare parts for

assembling the main manufactured product –

bicycles, the operation of the enterprise is impossible.

Defective equipment will negatively affect the

deadline for the implementation of the plan and will

not allow the enterprise to carry out the production

process as a whole. The least probability of

occurrence and minimal damage are suggested by the

following areas: changes in GOST quality standards

(an unlikely event), insufficiently effective

interaction between top management and the project

group (project team members are professionals in

their field, they will not enter into conflict with their

employers) and increased competition (enterprises,

producing bicycles on the Russian market have been

around for many years and have a clear positioning,

which makes it possible to assess their future policy

in advance). Great attention should be paid to the

selection of suppliers, it is necessary to carefully

check the quality of the supplied equipment, to

establish cooperation with state business support

centers to obtain additional funding.

At the same time, it is profitable in Russia to open

the production of bicycles and develop cycling, which

is not only a convenient way to travel around the city,

but also supports the physical activity of the

population and contributes to the development of a

healthy lifestyle in the country.

The results of the study can be useful both for the

developers of programs for the development of small

and medium-sized businesses in the national

economy, and for organizations supporting healthy

lifestyle initiatives.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

268

REFERENCES

Russian news portal "Interfax". Cycle market of the Russian

Federation turned online during the quarantine, but

remained to be "Chinese". https://www.interfax.ru/

Astafeva, O. V., Nizeev, A. D., Osipova, I. A., 2020.

Developing of bicycle cafes on the analysis of trends in

healthy lifestyle. In II International Scientific

Conference GCPMED 2019 "Global Challenges and

Prospects of the Modern Economic Development".

Bakota, D, Ortenburger, D, Płomiński, A., 2018. Selected

aspects of biopsychosocial functioning of the senior

national team in cycle speedway representing Poland in

2015 at the World Championships in Poole. In

Pedagogics, psychology, medicalbiological problems

of physical training and sports. 222. pp. 68–76.

Fiore, D.C., Fellows, K.M., Henner, T.A., 2020. Injuries in

mountain biking and implications for care. In Muscles,

Ligaments and Tendons journal. 2. pp. 10.

Geurts, E., Coninx, K., Hansen, D., Dendale, P., 2018.

Impact of a mobile cycling application on cardiac

patients' cycling behavior and enjoyment. ACM

International Conference Proceeding Series. 11. Сер. In

Proceedings of the 11th PErvasive Technologies

Related to Assistive Environments Conference, PETRA

2018. pp. 257-264.

Kireeva, N.S., Slepenkova, E.V., 2019. Features of cycling

in the city of Moscow: monitoring results. In

Economics: Yesterday, Today and Tomorrow. 9 (2А).

pp. 223-237.

Kolumbet, A.N., Natroshvili, S.G., Babyna, T.G., 2017.

Bio-mechanical aspects of elite cyclists’ motor system

adaptation in process of competition activity. In

Pedagogics, psychology, medical-biological problems

of physical training and sports. 21(5). pp. 244–250.

Perfilova, I.A., Dyshakov, A.S., Graham, C., 2020.

Methodology of physical training for highly qualified

cyclists specializing in tandem cycling. Modern

University Sport Science. In The XIV Annual

International Conference for Students and Young

Researchers. Moscow. pp. 304-308.

Study of the Impact of Driving and Restraining Factors on Ensuring the Development Sustainability of the Bicycle Market in Russia

269