Regional Dynamics of Self-employment Development in the Republic

of Sakha (Yakutia)

Nikolay Ivanov

1

, Natalya Rodnina

1

, Marina Tsynzak

1

and Olesya Popova

1

1

Department of Industrial Economics and Management,

Arctic State Agrotechnological University, Sergelyakhskoye sh.,

Yakutsk, Republic of Sakha (Yakutia), Russian Federation

Keywords: Self-employment, growth rates, small and medium-sized businesses, social responsibility, professional

income tax, types of economic activity, unemployed, employed.

Abstract: The article presents the main indicators identifying the seed stage of self-employment development in the

Yakutia. The study used summary and reporting data on the growth rate of small and medium-sized businesses

in municipalities. Chronological observation of the changes occurring within the framework of the

development of this business indicates that the heterogeneity of indicators for different administrative-

territorial units contributes to the emergence of the self-employed category of the population. In addition, the

article discusses the concept of self-employment and its status, which in the system of legislative regulation

may have different approaches to interpretation based on event facts. However, the status of the self-employed

is very vulnerable and imperfect, since the voluntary form of applying for professional income for taxation

will become more difficult to control and monitor, since only theoretically described and characterized

approaches that can be used to determine.

1 INTRODUCTION

A new tax agent appears in the microeconomic

environment of Russia, whose activities are legalized

by a special tax regime “tax on professional income”

or “special tax regime” for the self-employed.

However, the experiment on the introduction of a new

tax, which began on January 1, 2019, practically

introduces additional opportunities for the

development of medium and small businesses, and

researchers of this trend study the prospects and

practice of the new business format.

There is no doubt that the development of small

and medium-sized businesses is accompanied by

problems and prospects, the solution of priority tasks

and strategies, as well as a comprehensive analysis

and assessment of business efficiency. Obviously, the

tax innovation should have a positive effect not only

in solving microeconomic problems with the

employment of the population, but also guarantee the

prospect of retirement services for that category of

citizens who receive their modest income by

performing one-time jobs and providing personal

services typical of self-employed citizens.

The practical interest of the new tax agent is

limited by the fact that he is prohibited from hiring

personnel. In addition, a self-employed person cannot

be engaged in a number of economic activities

involving the involvement of other subjects of labor

relations in labor activities.

2 MATERIALS AND METHODS

Since July 1, 2020, the expansion of the coverage of

the tax on professional income has affected the

territory of the subject of the Russian Federation - the

Republic of Sakha (Yakutia). During the time of its

influence on the regional space of the republic, the tax

innovation interested many supporters, who preferred

to take advantage of the experimental novelty

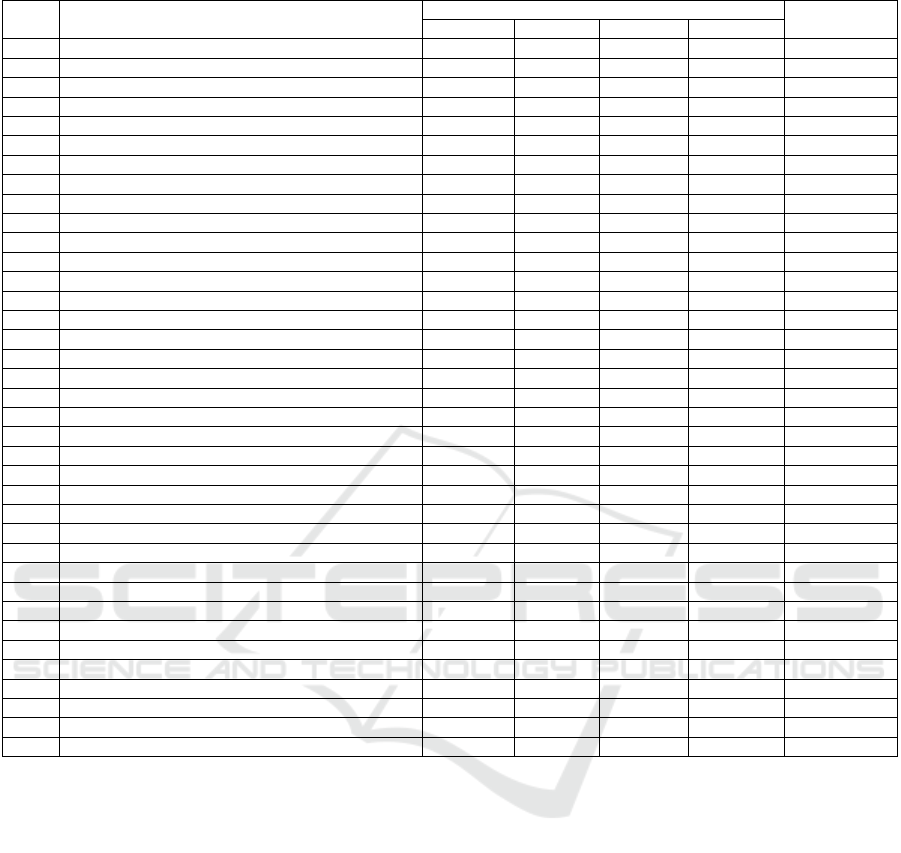

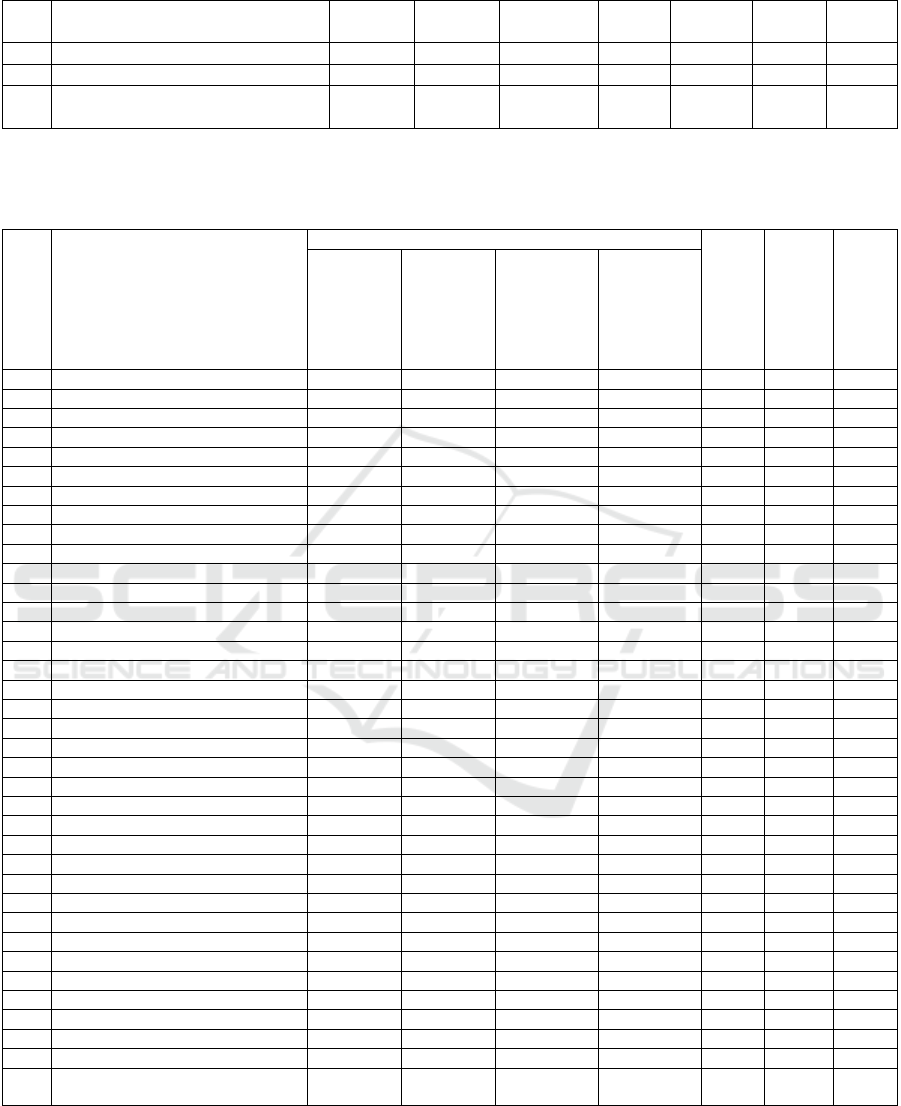

The grouping of data in Table 1 shows that since

July 10, 2020, the Republic of Sakha (Yakutia) has

seen a 7-fold increase in the number of self-employed

citizens. At the beginning of September 2020, 2,573

tax agents were registered with the tax authority, who

declared themselves as self-employed citizens. In

absolute terms, in terms of the growth rate, it took

place in the Gorny municipal district, reaching an

indicator of 2900%, and in the city of Yakutsk, the

growth of officially self-employed citizens in terms

of quality was 1221 tax agents.

364

Ivanov, N., Rodnina, N., Tsynzak, M. and Popova, O.

Regional Dynamics of Self-employment Development in the Republic of Sakha (Yakutia).

DOI: 10.5220/0010705400003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 364-375

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Table 1: Dynamics of the number of self-employed citizens in the Republic of Sakha (Yakutia) as of October 16, 2020

No.

The name of the municipal formation (municipal

district)

Critical dates 2020

Growth rate,

%

10.07 04.09 02.10 16.10

1 Abyysky 1 1 1 5 500

2 Aldan 15 51 68 84 560

3 Allaihoskiy 1 3 3 3 300

4 Amginsky 3 16 28 35 1167

5 Anabar national (Dolgan-Evenk) 1 2 7

6 Bulunsky 4 7 9 11 275

7 Verkhnevilyuisky 5 18 32 41 820

8 Verkhnekolymsky 5 7 7

9 Verkhoyans

k

1 13 20 20 2000

10 Vilyuisky 5 21 29 41 820

11 Mountainous 1 15 26 29 2900

12 City of Yakuts

k

195 759 1061 1221 626

13 Zhatay 4 14 17 22 550

14 Zhiganskiy national Even

k

3 12 14 15 500

15 Kobyaysky 15 22 25 1250

16 Lensky 17 53 79 92 541

17 Megino-Kangalassky 11 47 68 87 791

18 Mirninsky 21 126 180 210 791

19 Momsky 2 6 8 11 550

20 Namsky 8 27 33 41 513

21 Neryungri 26 108 146 179 654

22 Nizhnekolymsky 2 4 5 5 250

23 Nyurba 5 27 45 54 1080

24 Oymyakonsky 1 8 12 12 1200

25 Olekminsky 3 16 29 37 1233

26 Olenek Evenk national 1 2 4 4 400

27 Srednekolymsky 2 5 6 600

28 Suntarsky 5 30 42 51 1020

29 Tattinsky 5 21 31 33 660

30 Tomponsky 3 11 15 18 600

31 Us

t

-Aldansky 4 21 34 43 1075

32 Us

t

-Maisky 2 5 4 9 450

33 Us

t

-Yansky 2 6 8 8 400

34 Khangalassky 8 43 62 76 950

35 Churapchinsky 4 22 31 40 1000

36 Even-Bytantai National 1 2

Total 369 1538 2180 2573 697

Source: the data in the table are compiled from the reporting data of the administrations of municipalities (municipal districts)

of the Republic of Sakha (Yakutia) as of 16.10.2020

Analysis of the situation in the development of

medium and small business allows us to note some

aspects. In particular, the problems faced by small

and medium-sized businesses in the context of

globalization and the transformation of market and

economic relations force the owners of small and

medium-sized businesses to make not entirely

adequate decisions.

One problem of the Russian medium and small

business, which is highlighted by the young

researcher, reflects the essence of the fact that “The

main problem in the implementation of tax policy is

the lack of division by tax legislation of business

participants into real entrepreneurs (who deliberately

chose this path, developing , who successfully and

effectively operate, understand and accept all the

risks associated with activities "at their own peril and

risk"), and those for whom small business is self-

employment, an attempt to somehow survive in

difficult economic conditions on their own and feed

their families. This means that both must pay taxes on

an equal footing, although the financial situation and

opportunities for activities are different” (Tereshkina,

2014).

The second or classical problem is associated with

the analysis, which “showed that the activities of

small and medium-sized enterprises are accompanied

by a low level of liquidity and a high level of

entrepreneurial risk. This is primarily due to a

decrease in sales volumes due to poor study of

demand, lack of a sales network, advertising;

mismanagement of working capital; ignorance of

how much and how to produce and sell, so that the

Regional Dynamics of Self-employment Development in the Republic of Sakha (Yakutia)

365

proceeds not only cover the costs, but also bring

profit” (Mashrapov, 2015).

The problem at the meta-economic level, which

reinforces a special problem in the interaction of the

traditional type of economic system in the modern

digital economy, is reflected in the fact that “A

significant layer of the mass agricultural economy is

not considered as a subject of an investment project -

small business, microbusiness - is deleted from state

support for investments. Herewith, the existing

methodology for assessing the efficiency of the state

program does not provide for a serious analysis of the

return on the spent state budget funds” (Chistyakova,

2018).

In the face of meta-economic stratification, a

problem is quite serious, which corresponds to the

experience of survival of small and medium-sized

businesses in conditions of intense competition and

the dominance of big business. Therefore, “It is very

tragic, for representatives of small and medium-sized

businesses in Yakutia, the problem with the “profit

hunger”, as it is commonly called in their circles,

should be pointed out. If in previous periods the

average monthly net income of an entrepreneur in this

sector of the economy was 40-45 th RUR, today,

businessmen call the amounts 2-3 times less,

complaining that the market has become too

oversaturated, and the main contingent of consumers

finds other sources of making a purchase ”(Lavrova,

2014).

It is highly likely that there is a lack of

entrepreneurial literacy among medium and small

businesses, which are characterized by typical errors

and mistakes in professional activity. Therefore, it is

advisable if “an agrarian business specializing in

raising cattle with a dairy focus is quite rationally

capable of making a scenario calculation pursuant to

the accepted methodological formats of financial and

economic activities, in which representatives of the

urban population may become co-owners of a part of

the herd. This method of attracting investment and

consumer interest of a city dweller quite rationally

contributes to solving issues of ensuring economic

security, a guaranteed flow of products by regular

buyers, getting rid of per capita costs for intermediary

services, creating a stable sales market and receiving

financial resources for the provision of additional

services” (Lavrova, 2013). This vision of the situation

leads to the fact that self-employed citizens in rural

areas, who are able to feed and maintain cattle, may

quite reasonably provide services of this kind for

citizens who do not have such abilities and

opportunities, that is, mainly for city dwellers.

3 RESULTS AND DISCUSSION

3.1 Self-employment of Citizens and

Professional Income Tax

Numerous studies of market instability and social

injustice respond to a high degree of dissatisfaction

with the economic reality of the population, who are

forced to solve their problems in non-standard ways.

For the most part, it is the desire to acquire and

consume new, seductive and requiring a large amount

of money spending, the most practical and smart

citizens receive incomes that need to be declared and

make payments to the budget at the personal income

tax rate.

However, there is an opinion that “There is a large

group of self-employed citizens in Russia, defined by

us, as we suggest,“ informal entrepreneurs ”, which

does not fall under any of the categories of small

business provided for by the current legislation. There

are many citizens in the country who, having their

main occupation, find the opportunity to fulfill some

orders that correspond to their interests, hobbies, the

need for additional income, for instance, they may

teach to draw, conduct tutoring, and therapeutic

gymnastics. Such hobbies of a citizen may be

associated with a commercial interest” (Chernysheva,

2010). Opinions of this nature are quite consistent

with the following definition: “Self-employment is

understood as an independent organization and

conduct of entrepreneurial activity” (Pavlovskaya,

2015).

Accordingly, the fiscal innovation, introduced

from July 1, 2020, updates the tax status “Self-

employed citizen” and interprets it in the academic

environment as similar to those assigned to a specific

category of person, which “conducts a freely

regulated type of business. It is worth considering that

this sector in the segment of working citizens is

difficult to establish, since it includes both individuals

and individual entrepreneurs. The alienation of the

self-employed population is primarily associated with

the development of a small form of business that does

not require a staff of employees, and, consequently, a

large number of costs, that is, it implies a simplified

structure of business relations” (Ageeva, 2019).

Although “the position of state authorities,

management and control is such that self-employed

citizens, for the purposes of accounting, tax and other

obligatory contributions to the budget of the Russian

Federation, include individuals: 1) personally

providing services to other individuals for personal

and household needs; 2) those engaged in the

production and sale of goods on the basis of personal

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

366

labor; 3) not registered as individual entrepreneurs; 4)

receiving income on their own; 5) not attracting hired

workers and employees; 6) receiving a patent for the

right to conduct a particular labor activity; 7)

submitting a notice of tax registration” (Berdnikova,

2019).

The likelihood of self-employed status is fixed in

the academic environment, “But at the moment in the

domestic legislation there is no definition of the legal

status of self-employed individuals, as well as the

procedure for registration as such” (Krivin, 2020).

However, there is a gap that is not legally supported,

which is reflected in a complex and controversial

aspect as fixing the minimum and maximum income

limit calculated by self-employed for a certain period

of time.

De jure, the self-employed is limited by a number

of legal norms, based on which the authors

confidently assume that the size of the maximum

possible annual income of a self-employed cannot

exceed 8 RUR mln. Since the law on the development

of medium and small businesses establishes the

criterion for a micro-enterprise that may employ up to

15 employees, when, pursuant to the decree of the

Government of the Russian Federation of 2016, the

maximum income limit for a micro-enterprise is

regulated in the amount of 120 RUR mln. The ratio of

these parameters allows us to justify the maximum

income limit for the self-employed. In this context,

mention should be made of the entry into force from

January 1, 2021 of the amendment to Art. 224 of the

Tax Code of the Russian Federation, the tax rate is

15%, which is levied, from some types of income

exceeding 5 RUR mln per calendar year for personal

income tax.

Based on economic and legal information

obtained by a logical method of calculation, the

maximum income limit for self-employed may vary

within 5-8 RUR mln. per calendar year, provided that

the self-employed is over 5 RUR mln of annual

income will be forced to perform tax deductions at a

rate of 15%. Although the law on the tax on

professional income defines the maximum amount of

income considered when determining the tax base for

the tax under study, which does not exceed 2.4 RUR

mln in the current calendar year.

Thus, a tax innovation means a triad constraint

that identifies the self-employed status for taxation

along the following trajectories:

- compliance with the tax on professional

activities within 2.4 units in RUR mln;

- in the same dimension within 2.4 and 5 units in

RUR mln at a personal income tax rate of 13% in the

general tax regime;

- also within the limits of 5 and 8 units in RUR

mln in the general taxation regime at the personal

income tax rate of 15%;

- and over 8 RUR mln, the self-employed taxpayer

status must be converted into microenterprise status.

The following tendency arises, requiring

additional clarification of the legal status of the self-

employed. In addition to the restrictions on self-

employed citizens included in the law and pursuant to

paragraph 1 of Art. 3 dated 19.04.1991 # 1032-1 RF

Law “On Employment in the Russian Federation” an

unemployed person is a citizen who does not have a

job or earnings, therefore it is categorically

impossible to recognize him as self-employed. If an

unemployed person gets a job, he loses his desired

status, which makes it possible to orient the social

responsibility of the state on the problems of

unemployment, providing for the opportunity for the

unemployed to receive assistance in social adaptation

as a self-employed person.

Table 2: List of organizations that exchange information with the Federal Tax Service of Russia

Item

No.

Legal name of the organization

Trade name of the

organization

INN Partner site

1 Alfa-Bank JSC Alfa-Bank 7728168971 https://samozanyat. roketbank.ru

2 PJSC "Sberbank of Russia" Sberban

k

7707083893 https: /

/

prostobank.onlain

3 PJSC "AK Bars" BAN

K

AK Bars Ban

k

1653001805 https://www.akbars.ru

4 Bank "Cube" (JSC) Prosto Ban

k

7414006722 https://samozanyat. roketbank.ru

5 Investment Bank "Vesta" LLC Vesta Bank 6027006032 https: /

/

prostobank.onlain

6 JSC "Kiwi Bank" KIBI Bank, Rocketban

k

3123011520 https://samozanyat. roketbank.ru

Source: [2, p.136]

Accordingly, supporting the opinion of other

researchers who have formulated an exhaustive

answer to the natural question "How does a self-

employed person work?" In particular, “The working

conditions are simple and straightforward. A person

downloads the My Tax application and registers in it

as a payer of professional income tax. To do this, one

does not need to draw up any paperwork and go to the

tax office, everything is done through the My Tax

mobile application, or in the taxpayer’s personal

account on the official website of the Federal Tax

Service of Russia, or in a special bank application.

Regional Dynamics of Self-employment Development in the Republic of Sakha (Yakutia)

367

Sberbank and other banks have this” (Samitov, 2020).

This opinion is supported by the information given in

Table 2

The informative value of Table 2 confirms the

interest of some banking structures, which have

included in their economic activities customer service

under the status of self-employed. Moreover, the

attractiveness of working with such clients is due to

the fact that “A new tax regime was introduced for the

self-employed with a rate of 4% when working with

individuals and 6% with legal entities. The

registration process is simple and does not require

visiting tax authorities, everything may be done

through a mobile application, checks are generated

without cash registers” (Bakirova, 2020). Perhaps

they saw the prospects for further development of

events, which reveal the horizons of charging

commissions for servicing banking and monetary

transactions that are made by the self-employed.

There are some peculiarities related to the fact that

“If the income is not constant, then the application of

the NPD does not create an additional tax burden: in

the absence of income during the tax period,

mandatory, minimum or fixed payments do not arise.

Herewith, the self-employed may receive free

medical care, since they are members of the

compulsory health insurance system” (Konkin,

2020). It is also likely that there are certain

shortcomings of the private order, which prescribe

mandatory rules, not to fulfill orders from the

previous employer and provide him with services

within 2 years after registration as self-employed,

prudently adopted by the legislator in order to prevent

the mass transfer of workers to the status of self-

employed. Otherwise, the violation of this imperative

will be recognized as an employment relationship.

In the publication aspect of scientific works, one

may come across such conclusions, reflecting the

following conclusions: “The reasons for the

introduction of this tax are easy to determine if looked

at the average unemployment rate in the country,

which now stands at 5.4%. A clear discrepancy

between the number of those laid off and this

percentage of unemployed may be seen. This may

only be explained by the fact that citizens start a

business in the shadow economy, which is not

reflected in official statistics. Therefore, the state

needs to legalize self-employed citizens"(Kurnosova,

2020). It is on these explanations that the authors’

approach is confirmed, which concludes the tax

innovation in the triad limitation of the self-

employed.

Of course, the self-employed status will be subject

to certain rankings. For example, “In the rating of the

reasons for the attractiveness of self-employed status

for Russians, the first place is taken by the

opportunity to devote more time to the family, the

second place is given by the respondents to the

emergence of greater interest in their work, and the

third is the financial benefits from the new

employment format. The fourth and fifth places are

shared by the opportunity to choose their own

customers and draw up their own work schedule on

their own “ (Safonov, 2020). Thus, the likelihood of

the group dynamics of an increase in the number of

self-employed is alarming, the consequences of

which may affect the personnel shortage, provoked

by an artificial means. Therefore, it is strategically

required to perform on-line monitoring in order to

timely prevent problems with personnel in the

business environment.

3.2 Self-employment in the Analysis of

the Current State and Development

of Medium and Small Businesses

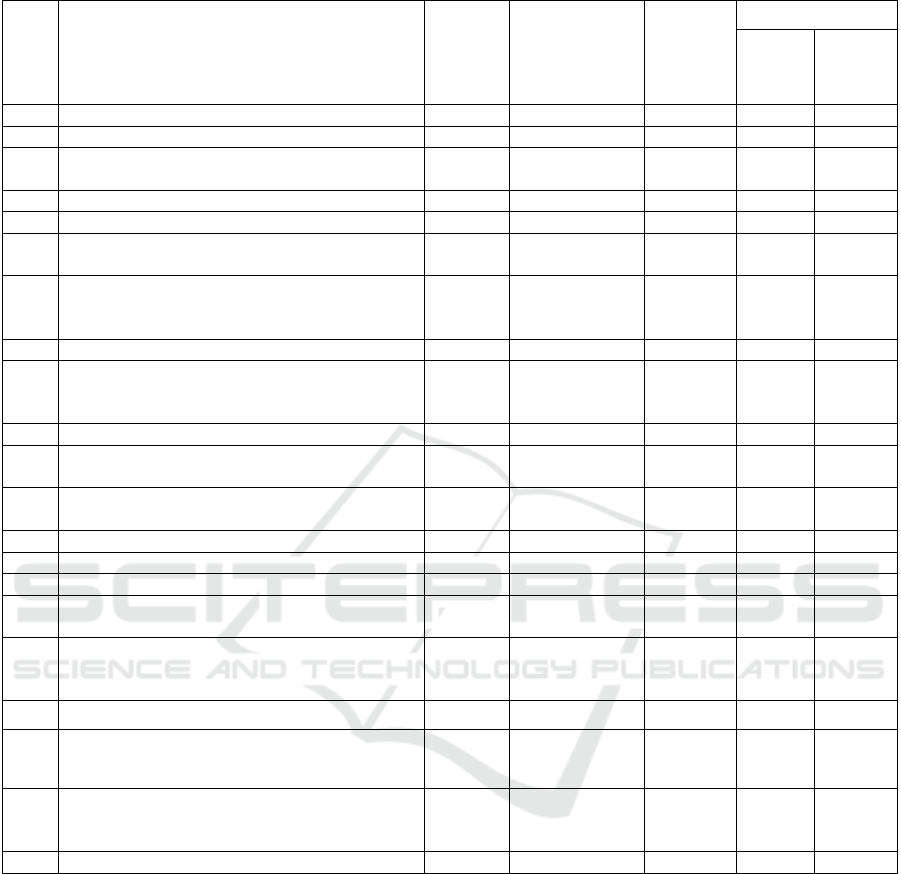

The analysis of the current state and development of

small and medium-sized businesses (SMEs) is based

on statistical indicators based on the results of

economic activity for 2017 and 2019. taking into

account the indicators of self-employment. The

characteristic by type of economic activity within the

distribution of individual entrepreneurs reflects the

growth of SMEs as of January 1 of the current year.

It is required to highlight some sectors of the regional

economy, in particular, information technology and

mining, hotels and catering, which statistically

confirm real growth. However, in the economic

structure of individual entrepreneurship such as

activities in the field of health and social services;

agriculture, forestry, hunting, fishing and fish

farming; financial and insurance activities, there is a

decrease in the number of SMEs (tab. 3)

The informativeness of the tabular data may be

interpreted in a comparative assessment of two

critical indicators pursuant to the criterion of the

maximum - "activity in the field of information and

communication" and the minimum - "activity in the

field of health and social services", the gap between

which is insignificant in quantitative terms, but

significant in qualitative terms. There is also a

noticeable quantitative statics, which is not uniform

in its influence on the qualitative dynamics.

The Regional Center for Employment of the

Population states data on the number of unemployed

citizens, in particular for November 2020, in

quantitative terms, equal to 32,986 unemployed,

which in qualitative terms was fixed at 133% as of

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

368

Table 3: Statistical data on the distribution of individual entrepreneurs by type of economic activity

No.

Type of activity

as of

January

1

2018

as of January

1

2019

as of

January

1

2020

in % to

the

bottom

line

1

January

2019

Total

37669 36408 35653

100.0

97.9

1

of which by type of economic activity:

2

agriculture, forestry, hunting, fishing and

fish farming

4487

4003

3642

10.2

91.0

3

mineral extraction

41 33 35

0.10

106.1

4

p

rocessing

2855 2769 2669

7.5

96.4

5

provision of electricity, gas and steam;

air conditioning

68

60

60

0.2

100.0

6

water supply; water disposal, organization of

waste collection and disposal, liquidation of

p

ollution

126

121

125

0.4

103.3

7

construction

3743 3685 3770

10.6

102.3

8

wholesale and retail trade; repair of motor

vehicles

vehicles and motorc

y

cles

10 974

10 659

10 299

28.9

96.6

9

trans

p

ortation and stora

g

e

6228 6046 5902

16.6

97.6

10

activities of hotels and enterprises of public

caterin

g

1124

1139

1199

3.4

105.3

11

activities in the field of information and

communication

704

663

710

2.0

107.1

12

financial and insurance activities

178 168 157

0.4

93.5

13

real estate activities

713 768 794

2.2

103.4

14

p

rofessional, scientific and technical activities

2411 2348 2350

6.6

100.1

15

administrative activities and related

additional services

838

798

788

2.2

98.7

16

government management and support of

military

securit

y

; social securit

y

5

3

3

0.008

100.0

17

district

348

376

388

1.1

103.2

18

activities in the field of health and social

services

342

315

272

0.8

86.3

19

activities in the field of culture, sports,

organization of

leisure and entertainment

425

427

439

1.2

102.8

20

p

rovision of other types of services

2036 2005 2026

5.7

101.0

Source: the data in the table are compiled from the reporting data of the administrations of municipalities (municipal districts)

of the Republic of Sakha (Yakutia) as of 16.10.2020.

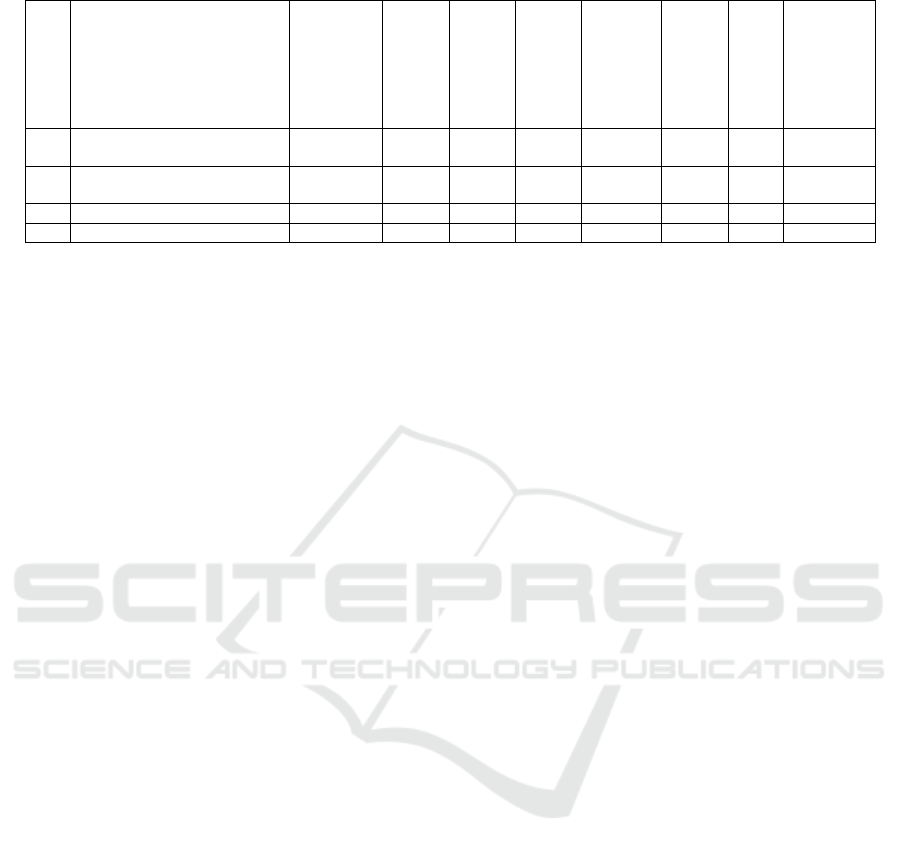

July 2020. The statistical picture is interesting in that

the trend is upward, which is confirmed by a 4-fold

increase in unemployed citizens expiring since the

beginning of 2020 (Table 4).

The dynamics of the indicators presented in Table

4 reflects a favorable climate, since the number of

officially registered citizens decreased by 20% in

July-October 2020. The number of people employed

in the economy of the republic in July-September

2020 increases by 2%. However, there is a

discrepancy between the indicators of the number of

unemployed citizens and the number recognized as

unemployed, recorded in the register of the

employment service of citizens, due to the fact that

53% of unemployed citizens have the status of

pensioners, disabled persons of group 3 and other

social strata of the population.

The growth in the number of SMEs for the period

from January 1, 2019 to September 1, 2020 is

observed in 7 districts (uluses) of the republic, which

belong to the Arctic group of districts (uluses) -

Anabarsky, Verkhnekolymsky, Zhigansky,

Nizhnekolymsky, Oleneksky, Ust-Yansky, Eveno -

Bytantaysky (Table 5).

Regional Dynamics of Self-employment Development in the Republic of Sakha (Yakutia)

369

Table 4: Dynamics of the unemployed, employed and self-employed in July-October 2020

No. Indicator UOM

December

2019

June

2020

July

2020

August 2020

September 2020

October 2020

Growth

rate, %

1 Number of unemployed

citizens

th. persons 8.3 24.6 29.0 32.6 32.3 33.3 133

2 Number of citizens recognized

as unemploye

d

th. persons 1.5 5.3 5.9 5.6 4.2 4.3 80

3 Employed th. persons 465.8 456.7 451 456.1 464.1 0 102.0

4 Number of self-employe

d

th. persons n/a n/a 0.4 0.9 1.5 2.2 591

Source: the data in the table were compiled by the authors from the reporting data of the administrations of municipalities

(municipal districts) of the Republic of Sakha (Yakutia) as of 16.10.2020.

The group dynamics of the number of SMEs in

Yakutia, grouped in Table 5, reflects the indisputable

leadership of the Olekminsky, Anabarsky and Eveno-

Bytantaysky districts (uluses). The growth in the

number of SMEs in the Olekminsky and Anabar

districts (ulus) is explained by the growing demand

for goods and services related to the maintenance and

provision of extractive industries, as well as

population growth due to the emergence of new jobs

and a relative increase in the population’s income,

which form effective demand.

According to the summary data of the tax

authority, the number of liquidated SMEs was

certified in relation to the number of registered

entities in March - August 2020 with an excess of 1.4

times in favor of the first, and the ratio of liquidated

SMEs to those registered for the noted period

pursuant to the LE criterion was 1 , 9, IE - 1.3 (Table

6).

The explanation for the negative ratio reflected in

Table 6, in which a sharp increase in the number of

liquidated SMEs is noticeable, is the situation

associated with the implementation of restrictive

measures due to the COVID-19 pandemic. Further,

before the 2nd wave of the COVID-19 pandemic,

there is a positive trend, which is characterized by a

narrowing gap between the indicators of liquidated

and registered SMEs. More detailed information on

the dynamics of liquidated and registered SMEs is

presented in Table 7.

A clear demonstration of the negative dynamics

presented in Table 7 in the summary indicates that it

is difficult for SMEs to compete in the market space

of Yakutia, including the conditions for the impact of

the pandemic on business results. Considering that

the pandemic was announced only at the end of

March, the totality of relations, liquidated and

registered SMEs is catastrophic as of March 2020,

compared to the following months through August

2020, that is, the reason for this difference cannot be

directly attributed to the pandemic. Of course, the rate

of reduction of the difference for the period of the

declared pandemic, in the final value with an

impressively negative indicator and in comparison

with the difference in March 2020, which reaches

⁓35%.

A qualitative picture of the growth rate of SMEs

by comparing equal periodizations makes it possible

to assess the real changes taking place in the region’s

economy.

Table 8 provides exhaustive information about the

natural course of events in the region’s economy,

associated with the fact that the existing economic

model is entering the stage of decline. This is due to

the fact that the growth rate for 9 months 2019 is 79%,

and the difference between the September and

December intervals is also decreasing, although in

comparison with 9 months. 2020, the growth rate

accelerates sharply.

However, in quantitative terms of the comparative

analysis, the average number of SMEs in 2019

significantly exceeds the indicators of 2020, which

means that the problem of reducing the number of

SMEs in 2019 is natural. And the growth rate in terms

of indicators for 2020 may be conditionally attributed

to the effect of the introduction of a tax on

professional activities.

The dynamics of the number and average number

of SMEs in the regions of the Republic of Sakha

(Yakutia) characterizes the quantitative and

qualitative indicators of the development of SMEs in

the regional economy. However, there is a trend that

should be analyzed as newly created SMEs.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

370

Table 5: Dynamics of the number of SMEs by districts of the Republic of Sakha (Yakutia)

No.

The name of the municipal formation

(municipal district)

Number of SMEs, units

Growth

rate, %

as of

1.01.2019

as of

1.09.2019

as of

01.01.2020

as of

01.09.2020

1 City of Yakuts

k

18905 18687 19073 17834 94

2 Aldansk

y

district 1540 1519 1535 1462 95

3 Zhata

y

342 315 315 301 88

4 Vil

y

u

y

sk ulus 674 613 624 612 91

5 Neryungrinsky district 3025 2925 2973 2802 94

6 Abyysky district 113 98 99 100 88

7 Allaikhovsky district 51 51 52 46 90

8 Bulunsk

y

district 165 151 162 154 93

9 Anabarsk

y

district 71 70 72 82 115

10 Amginsky district 559 523 524 492 88

11 Verkhnevilyuysky district 500 472 483 456 91

12 Verkhnekolymsky district 122 123 125 134 110

13 Verkho

y

ansk

y

district 425 403 415 413 97

14 Mountainous area 406 386 386 373 92

15 Zhi

g

ansk

y

district 129 121 123 136 105

16 Kobyaysky district 360 309 320 272 76

17 Lensky district 1242 1188 1200 1170 94

18 Megino-Kangalassky district 1050 1038 1028 1026 98

19 Mirninsk

y

district 2233 2164 2195 2082 93

20 Momsk

y

district 129 122 129 125 97

21 Namsky district 749 709 717 696 93

22 Nizhnekolymsky district 98 99 103 96 98

23 Nyurbinsky district 635 614 614 567 89

24 O

y

m

y

akonsk

y

district 403 380 386 355 88

25 Olekminsk

y

district 575 541 557 534 93

26 Oleneksk

y

district 98 92 92 119 121

27 Srednekolymsky district 188 177 180 168 89

28 Suntarsky district 653 639 633 591 91

29 Tattinsky district 675 666 661 613 91

30 Tom

p

onsk

y

district 407 396 393 365 90

31 Ust-Aldansk

y

district 601 616 611 544 91

32 Ust-Ma

y

sk

y

district 233 218 216 226 97

33 Ust-Yansky district 272 279 291 276 101

34 Hangalassky district 977 936 934 877 90

35 Chura

p

chinsk

y

district 751 720 717 726 97

36 Eveno-B

y

tanta

y

sk

y

77 74 79 86 112

Total 39435 38432 39017 36911 93.6

Source: the data in the table were compiled by the authors from the reporting data of the administrations of municipalities

(municipal districts) of the Republic of Sakha (Yakutia) as of 16.10.2020.

Table 6: Ratio of liquidated and registered SMEs, units

No. Indicato

r

Total LE IE

1 Number of liquidated SMEs 3778 1150 2628

2 Number of re

g

istered SMEs 2699 599 2100

3 The ratio of li

q

uidated to re

g

istered SMEs 1.4 1.9 1.3

Source: the data in the table were compiled by the authors from the reporting data of the administrations of municipalities

(municipal districts) of the Republic of Sakha (Yakutia) as of 16.10.2020.

Regional Dynamics of Self-employment Development in the Republic of Sakha (Yakutia)

371

Table 7: Dynamics of liquidated and registered SMEs in March-August 2020, units

No. All SMEs

March

2020

April

2020

May 2020

June

2020

July

2020

August

2020

Total

1 Liquidate

d

1072 460 364 576 763 543 3778

2 Registered 695 190 259 433 599 523 2699

3 Difference between registered and

liquidated SMEs

-377 -270 -105 -143 -164 -20 -1079

Source: the data in the table were compiled by the authors from the reporting data of the administrations of municipalities

(municipal districts) of the Republic of Sakha (Yakutia) as of 16.10.2020.

Table 8: Dynamics of the average number of SMEs by regions of the Republic of Sakha (Yakutia)

No.

The name of the municipal

formation (municipal district)

Average number of SMEs, people

Growth rate in 9

months 2019, %

Growth rate in

9 months of 2020, %

Growth rate for

2020/2019, %

as of

1.01.2019

as of

1.09.2019

as of

01.01.2020

as of

01.09.2020

1 City of Yakuts

k

32768 31305 22926 23171 70 101 71

2 Aldansky distric

t

3557 2885 2766 2942 78 106 83

3 Zhatay 209 170 170 181 81 106 87

4 Vilyuysk ulus 1075 998 998 942 93 94 88

5 Neryungrinsky district 6338 5753 5639 5529 89 98 87

6 Abyysky distric

t

6554554883 90 78

7 Allaikhovsky distric

t

61 92 92 85 151 92 139

8 Bulunsky distric

t

162 242 248 543 153 219 335

9 Anabarsky distric

t

42 41 42 65 100 155 155

10 Amginsky distric

t

711 646 646 619 91 96 87

11 Verkhnevilyuysky distric

t

435 288 293 259 67 88 60

12 Verkhnekolymsky distric

t

165 174 176 177 107 101 107

13 Verkhoyansky district 299 272 273 266 91 97 89

14 Mountainous area 247 293 300 315 121 105 128

15 Zhigansky distric

t

186 152 152 160 82 105 86

16 Kobyaysky distric

t

319 227 246 235 77 96 74

17 Lensky distric

t

1938 1856 1874 1821 96 97 95

18 Megino-Kangalassky distric

t

1011 1024 1019 1051 101 103 104

19 Mirninsky distric

t

3154 3014 2915 3004 92 103 95

20 Momsky district 128 140 140 146 109 104 114

21 Namsky district 624 537 533 484 84 92 77

22 Nizhnekolymsky district 261 228 229 178 88 78 68

23 Nyurbinsky distric

t

909 888 865 752 95 87 83

24 Oymyakonsky district 841 748 755 930 90 123 111

25 Olekminsky distric

t

932 820 817 768 88 94 82

26 Olenyoksky distric

t

78 91 91 111 118 121 144

27 Srednekolymsky district 103 86 86 101 83 117 98

28 Suntarsky distric

t

1095 1005 1000 886 91 89 81

29 Tattinsky distric

t

856 788 550 654 64 119 76

30 Tomponsky distric

t

538 547 540 548 100 101 102

31 Us

t

-Aldansky distric

t

357 321 319 299 89 94 84

32 Us

t

-Maysky distric

t

506 488 666 500 132 75 99

33 Us

t

-Yansky distric

t

431 395 409 318 95 78 74

34 Hangalassky distric

t

1121 853 852 884 78 103 80

35 Churapchinsky district 871 787 789 737 91 93 85

36 Eveno-Bytantaysky 110 108 108 81 98 75 74

Total

62493 58317 49578 49793 79

100.

43

80

Source: the data in the table were compiled by the authors from the reporting data of the administrations of municipalities

(municipal districts) of the Republic of Sakha (Yakutia) as of 16.10.2020.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

372

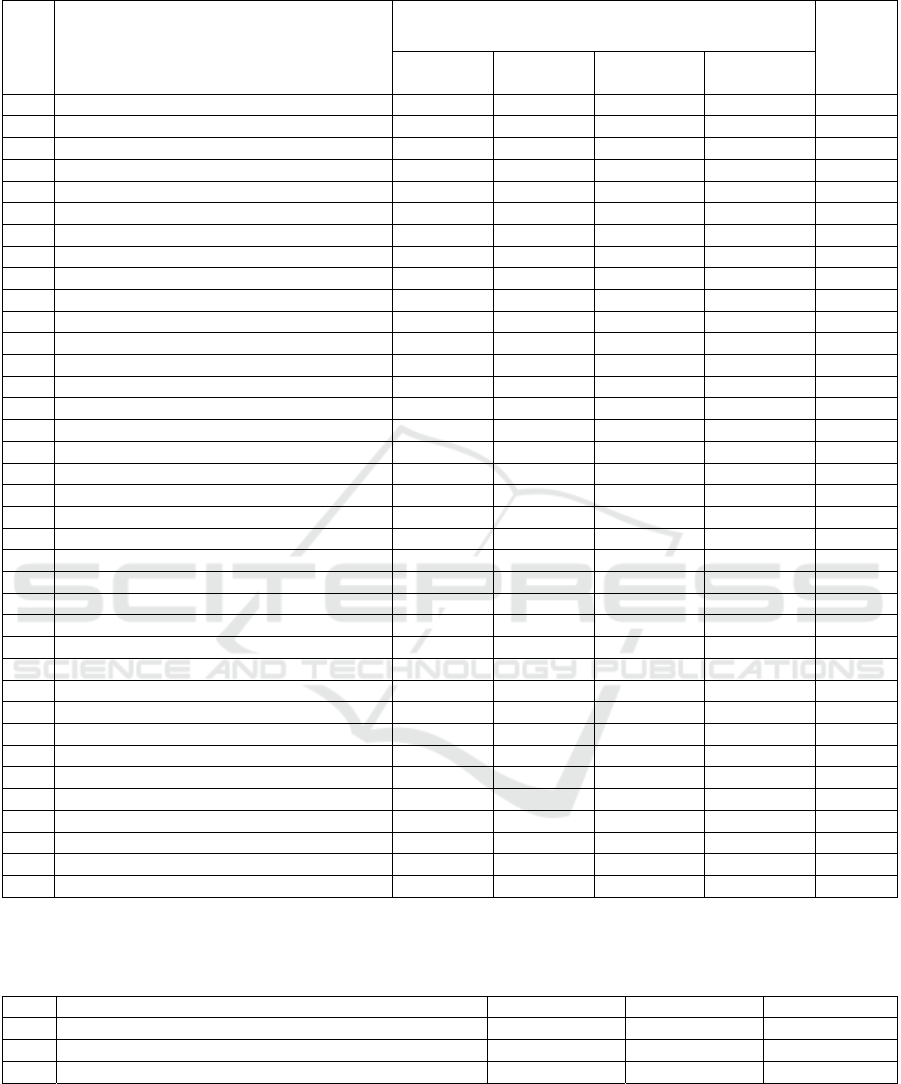

Table 9: Dynamics of newly created SMEs by districts of the Republic of Sakha (Yakutia)

No.

The name of the municipal

formation (municipal district)

Newly created SMEs, pcs.

Growth rate in 9 months 2019,

%

Growth rate in

9 months of 2020, %

Growth rate for 2020/2019, %

as of

1.01.2019

as of

1.09.2019

as of

01.01.2020

as of

01.09.2020

1 City of Yakuts

k

3404 2837 3770 1436 111 38 42

2 Aldansky distric

t

267 213 295 116 110 39 43

3 Zhatay 82 58 66 30 80 45 37

4 Vilyuysk ulus 120 79 13 56 11 431 47

5 Neryungrinsky district 525 346 473 194 90 41 37

6 Abyysky distric

t

18 11 14 12 78 74 59

7 Allaykhovsky distric

t

10 13 16 8 160 50 80

8 Bulunsky distric

t

34 16 26 12 76 46 35

9 Anabarsky distric

t

17 13 18 13 106 72 76

10 Amginsky distric

t

102 66 89 45 87 51 44

11 Verkhnevilyuysky distric

t

94 68 96 51 102 53 54

12 Verkhnekolymsky distric

t

25 21 26 10 104 38 40

13 Verkhoyansky district 99 66 91 45 92 49 45

14 Mountainous area 64 49 64 40 100 63 63

15 Zhigansky distric

t

24 14 24 18 100 75 75

16 Kobyaysky distric

t

84 29 55 17 65 31 20

17 Lensky distric

t

187 147 186 115 99 62 63

18 Megino-Kangalassky distric

t

218 172 209 135 96 65 62

19 Mirninsky distric

t

478 326 435 169 91 39 35

20 Momsky district 19 23 32 13 168 41 68

21 Namsky district 155 108 145 85 94 59 55

22 Nizhnekolymsky district 13 15 24 10 185 42 77

23 Nyurbinsky distric

t

97 87 119 58 123 49 60

24 Oymyakonsky district 84 54 68 42 81 62 50

25 Olekminsky distric

t

79 70 104 65 132 63 82

26 Oleneksky distric

t

18 11 12 12 67 100 67

27 Srednekolymsky district 40 36 46 22 115 48 55

28 Suntarsky distric

t

102 94 106 54 104 51 53

29 Tattinsky distric

t

107 88 109 57 102 52 53

30 Tomponsky distric

t

70 66 75 29 107 39 41

31 Us

t

-Aldansky distric

t

103 90 120 50 117 42 49

32 Us

t

-Maysky distric

t

41 37 40 24 98 60 59

33 Us

t

-Yansky distric

t

38 36 48 18 126 38 47

34 Hangalassky distric

t

186 149 188 104 101 55 56

35 Churapchinsky district 111 94 126 87 114 69 78

36 Eveno-Bytantaysky 10 9 13 7 130 54 70

Total 7127 5609 7341 3259 103 44.39 46

Source: the data in the table were compiled by the authors from the reporting data of the administrations of municipalities

(municipal districts) of the Republic of Sakha (Yakutia) as of 16.10.2020.

In accordance with Table 9, the dynamics are

high, since in these regions of the republic in 2019

there is a rapid increase in the number of newly

created SMEs in the context of between 114% and

185%, which served as a good start for maintaining

"inertia" for 2020. This positive phenomenon may be

justified by the existing three factors affecting the

reduction in the number of newly created SMEs on

the example of the Olekminsky district (ulus), which

are due to:

1) preparation starting from 2016 for the national

holiday Ysyakh Olonkho 2020, the event on which

was postponed by the order of the Head of the

Republic to 2023;

2) in 2019, a Business Incubator was created

pursuant to the state program of the Republic of

Sakha (Yakutia);

3) implementation of a megaproject on the

territory of the Olekminsky district: construction of

the VSTO oil pipeline.

Regional Dynamics of Self-employment Development in the Republic of Sakha (Yakutia)

373

It is also worth highlighting 3 municipalities with

low indicators, which recorded a rapid decline in the

number of newly created SMEs. In Mirny, Bulunsky

and Kobyaysky districts (ulus), the share of newly

created SMEs at the level of 2019 and 2020 does not

reach 35%.

Accordingly, the natural economic processes in

the region do not allow assessing the degree of

influence of the tax on professional activities using

the standard analytical approach of the study.

Changes in the growth rate of the number of SMEs in

the republic in comparison with two-year parameters,

which turn out to be incompatible with the

introduction of a tax on professional activities, but are

more characteristic of the state of development with

global trends that negatively affect the activities of

SMEs.

4 CONCLUSIONS

The relevance and expediency of establishment of a

tax on professional income does not raise doubts.

Civil duties and social responsibility should be in the

first place for each citizen of Russia. That is why the

initiative to apply the tax on professional income on

the territory of the Republic of Sakha (Yakutia) from

July 1, 2020 should be justified by the fact that a

significant part of socially vulnerable and unprotected

categories of the population may legally engage in

professional activities. Herewith, such activity which

is not burdened by excessive document flow and

additional expenses. In addition, such form of

employment promotes the free choice of the citizen

on time and due dates of the professional obligations.

The prospect of the development of self-

employment in the conditions remote from the center

of the territory may allow to enhance the technology

of rendering services to the population and legal

entities in order to be able to accumulate retirement

services. However, there is uncertainty due to the

changes expected in the field of state pension policy,

due to which the self-employed category of the

population may deliberately hide income from

taxation. Obviously, in this situation, the tax

innovation should provide for a special regime of

control over the income of the self-employed. After

all, only those contracts that will be concluded by the

self-employed with legal entities will fall under

control, and those contracts that oblige the self-

employed to perform professional work for

individuals will be impossible to control.

By the fact of the current legislation, self-

employment within the limits of their activities is

already surrounded by tax restrictions. The Law on

Tax on Professional Income determines the

maximum amount in the amount not exceeding 2.4

RUR mln income in the current calendar year.

However, a self-employed citizen will not be able to

refuse the opportunity to earn an amount in excess of

the amount of income specified in the law. The

legislator in this situation does not model the social

and legal behavior of a self-employed citizen.

Although, if the maximum amount of income was

exceeded, it should have been mentioned in the Law

on the standard tax rate of 13% of personal income

tax, if the amount of income is in the range of 2.4-5.0

RUR mln and on the tax rate of 15% of personal

income tax, if the amount of income is 5.0-8.0 RUR

mln, while maintaining the status of a self-employed

citizen.

However, the excess of income from 8.0 RUR

mln, then in this situation it is the duty of a self-

employed citizen to formalize individual

entrepreneurship or to choose another organizational

and legal form.

Thus, it is possible to achieve specific social and

legal behavior of self-employed citizens, whose

organizational and legal status will be detailed and

defined so that the self-employed citizen does not

even think that he should solve problems that do not

fit into the legislative framework.

The likelihood of a group dynamics of an increase

in self-employed citizens is alarming, the number of

which may provoke a personnel shortage for the

business environment. According to statistical data on

the distribution of individual entrepreneurs by type of

economic activity in the republic, there is already

activity in such areas as health care and the provision

of social services, but they have catastrophically low

indicators (86.3%), agriculture, forestry, hunting,

fishing and fish farming (91%), and activity in the

field of information and communication leads

(107.1%) among individual entrepreneurship in the

republic.

Therefore, there is a need for legislative

enhancement of the norms governing the behavior of

the self-employed pursuant to the levels of income

derived from professional activity, taking into

account socio-economic differences and the degree of

development of territories.

REFERENCES

Ageeva, A. K., 2019. Introduction of the self-employed

citizens. In International Journal of Humanities and

Natural Sciences. 12-4(39). pp. 10-12.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

374

Apresova, N. G., 2020. The legal status of self-employed as

a taxpayer. In Courier of Kutafin Moscow State

University (MSAL). 7. pp. 130-137.

Bakirova, R.R., Khaziakhmetov, R.A., Gubaydullin, B.F.,

Sheina, A.Yu., 2020. Modern trends in tax

administration in the Russian Federation. In Journal of

Economics, Entrepreneurship and Law. 2. pp. 459-470.

Berdnikova, G.I., 2019. Theoretical and methodological

bases of research of employment and self-employment

of the population in Russia. In Corporate Economics.

4(20). pp. 45-51.

Voronina, L. I., Kasyanova, T. I., 2018. Mechanisms for

promotion and development of selfemployment of

unemployed citizens: a comparative analysis of foreign

and Russian experience. In Tomsk State University

Journal. Economy. 44. pp. 264-282.

Konkin, A. N., Chudaykina, T.N., 2020. Features of the

application of professional income tax in construction.

In Moscow economic journal. 12. pp. 615-621.

Krivin, D. V., 2020. Professional income tax in

Entrepreneurship: problem and prospects of

Experiment in science and practice. In University

proceedings. Volga region. Social sciences. Economics.

3(55). pp. 113-126.

Kurnosova, A.V., Chernousova, K. S., 2020. Analysis of

the introduction of a new tax regime for self-employed

citizens of the Russian Federation. In International

Journal of Humanities and Natural Sciences. 4-2(43).

pp. 99-102.

Lavrova, D. P., Ivanov, N. Yu., 2013. Mojor Errors and

mistakes of marketing position agrarian of small and

medium sized business. In Scientific Works of the Free

Economic Society of Russia. 179. pp. 281-286.

Lavrova, D. P., Ivanov, N. Yu., 2014. The state of

development of the small and medium-sized business

market in Yakutia. In Scientific Works of the Free

Economic Society of Russia. 189. pp. 368-372.

Mashrapov, N. K., 2015. On the issue of problems of small

and medium-sized businesses. In Problemy

sovremennoy ekonomiki (Novosibirsk). 24. pp. 72-74.

Nesterenko, Yu. N., Protasova, E. A., 2019. Self-

employment in Russia: State abd Potential for

development. In Population. 22(4). pp. 78-89.

Pavlovskaya, O. Yu., 2015. Material Support of Self-

employment for the Unemployed: Algorithm and

Aspects of Law Enforcement. In Pravo. Zhurnal

Vysshey shkoly ekonomiki. 1. pp. 67–80.

Samitov, R. M., 2020. Self-employed. In Economic

Scientific Journal «Investment Assessment». 1(15). pp.

46-55.

Safonov, A. Y., 2020. Prospects of self-employment in

agricultural complex. In Moscow economic journal. 6.

pp. 265-272.

Tereshkina, M. A., 2014. Problems of small and medium

business in Russia. In International Research Journal.

2-2 (21). pp. 79-80.

Chernysheva, Y. G., Shepelenko, G. I., 2010.

Differentiation status of the entrepreneur. In Vestnic of

Rostov-on-Don State Economic University (RINH). 3.

pp. 12-18.

Chistyakova, M. K., 2018. Development of small business

in the agroindustrial complex. In Bulletin of Agrarian

Science. 4 (73). pp.115-119.

Regional Dynamics of Self-employment Development in the Republic of Sakha (Yakutia)

375