Framework to Predict Energy Prices and Trades in the Wholesale

Market of PowerTAC

Filipe Pinto Reis

a

, Helena Viegas Ferreira

b

and Ana Paula Rocha

c

Faculdade de Engenharia da Universidade do Porto, Rua Dr. Roberto Frias, 4200-465, Porto, Portugal

Keywords:

Energy Market Prediction, Energy Market Simulation, Microservice Architecture, Machine Learning, Deep

Learning, Regression, Classification.

Abstract:

Machine and Deep Learning techniques have been widely used in the PowerTAC competition to forecast the

price of energy as a bulk, amongst other ends. In order to allow agents to quickly set up, train, and test

python-built models, we developed a framework based on a micro-service architecture suitable for predicting

wholesale market prices in PowerTAC. The architecture allows for algorithms to be implemented in Python as

opposed to the language used in PowerTAC, Java. This paper also presents two datasets, one for the task of

classifying whether trades occur, and another for the task of predicting the clearing price of trades that occur.

We benchmark these results with basic methods like linear regression, random forest, and a neural network.

1 INTRODUCTION

Until the rise of renewable energy, fossil fuels were

the main source of energy and because of their

method of extraction, their supply is easy to predict.

However, this non-renewable energy is unsustainable

and creates a very negative impact on the environ-

ment because of the greenhouse gases, as (Lashof

and Ahuja, 1990) have shown. Renewable energy is

great for the environment, but it also has a downside.

The production depends on natural phenomenons that

can’t be controlled (Mackay et al., 2010), which

makes the stock unpredictable. This urged authors

like (Kani et al., 2020) and (Shahriari et al., 2020)

to find ways to improve this predictability.

Due to its complexity, the energy retail market can

not be analyzed by simple game-theory, so a simu-

lated environment was created to study and evaluate

brokers economically motivated in the retail energy

markets. PowerTAC is an open, competitive market

simulation platform that models a regulated distribu-

tion utility, a wholesale market, and a population of

energy customers. An agent wins a simulation by ob-

taining the largest balance at the end of the competi-

tion (Ketter et al., 2020).

In this simulation brokers buy and sell energy in

three different markets.

a

https://orcid.org/0000-0002-8186-3910

b

https://orcid.org/0000-0001-8526-5785

c

https://orcid.org/0000-0002-8129-9758

• The Wholesale market in the PowerTAC simula-

tor works as a periodic double auction (PDA) and

represents a traditional power exchange such as

NordPool, FERC, or EEX. A set of auctions hap-

pens every simulation hour where the brokers bid

to buy energy in bulk. Every time-slot there are

24 auctions, varying only on when the energy that

they’re bidding on arrives. This means an agent

can buy energy that will arrive anywhere from 1

to 24 hours later. It is possible that, in a given

time-slot, trades do not happen for some of the

future time-slots.

• The tariff market is where brokers retail their en-

ergy to final customers by enticing them to make

an energy contract.

• The load balancing market is a market where bro-

kers can buy or sell energy from each other when-

ever they make bad predictions about how much

energy they need to buy in the wholesale market,

i.e., they buy too much or too little energy.

Our work focuses only on the wholesale market,

more specifically, solving two problems. Predicting

when trades occur and, if they do, what’s the clearing

price for the energy. For simplification’s sake, instead

of making predictions for all 24 bidding slots that oc-

cur each slot, we only consider the first slot, where the

energy that is bid on is received one time-slot after the

bidding takes place.

Reis, F., Ferreira, H. and Rocha, A.

Framework to Predict Energy Prices and Trades in the Wholesale Market of PowerTAC.

DOI: 10.5220/0010898000003116

In Proceedings of the 14th International Conference on Agents and Artificial Intelligence (ICAART 2022) - Volume 1, pages 359-366

ISBN: 978-989-758-547-0; ISSN: 2184-433X

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

359

In PowerTAC, all the information is provided to

the broker agent by asynchronous messages. At the

beginning of a game, after the brokers sign in but be-

fore the brokers start playing, each broker receives

the game parameters, the broker identities, the cus-

tomer records, and the default tariffs. During two fic-

tional weeks, no competitor can buy or sell energy in

the market. The information about the bootstrap cus-

tomer data, the bootstrap market data, the bootstrap

weather data, the weather report, and the weather

forecast of these two weeks is also received before the

game starts. The bootstrap market data does not cor-

rectly reflect the future clearing prices because only

a single standard seller exists. Once per time-slot,

the predictor will receive the public information about

the 24 clearing prices of the wholesale market, the

weather report, and the weather forecast. When no

trades occur, neither the message of the wholesale

market clearing data or the wholesale market order

books is provided to the broker agent.

In section 2 a review of different PowerTAC

agents’ approaches is presented, followed by section

3, where the methodology explained. Section 4 shows

the obtained results, along with an analysis of the re-

sults. Finally, section 5 presents the conclusions that

can be drawn from this work, the advantages and lim-

itations of the proposed solution, and aspects for im-

provement in future developments.

2 RELATED WORK

The first PowerTAC competition was in 2012. Since

then, the PowerTAC brokers improve in every edi-

tion. For a complete and holistic view of the competi-

tion, we recommend the work of (Ketter et al., 2020),

which specifies 2020’s competition.

Several agents have their code open source, an ex-

ample of this is the agent SPOT (Chowdhury et al.,

2017), an agent that uses machine learning and suc-

cessfully predicts market prices in a PDA, the Pow-

erTAC wholesale market. Chowdhury et. al used

three machine learning algorithms; a REPTree (De-

cision tree), Linear Regression, and a Multilayer Per-

ceptron (Neural network). They selected some poten-

tial information between the one available in the sim-

ulation at runtime to train a price predictor. Specif-

ically, they used 8 prices from the past bidding, as

recent trading histories reflect the present wholesale

market economy. To predict the energy price in a spe-

cific hour, their models consider the clearing prices

for the previous hour and the price in the matching

time-slot in the past day and week. The rest of their

inputs are weather forecast data, number of partici-

pants in the game, and the moving average prices pre-

dicted by the baseline agent. Besides this, the authors

also investigate the feasibility of using learning strate-

gies to predict the clearing price in the wholesale mar-

ket. The paper demonstrates learning strategies are

promising ways to improve the performance of their

agent, SPOT, in future competitions

¨

Ozdemir and Unland presented some generic data-

driven electricity price forecasting approaches and

prove that weather data can successfully reduce the

electricity price forecasting error up to a certain de-

gree (

¨

Ozdemir and Unland, 2016). Their work uses

additional drivers like weather observation data to

minimize forecasting error. Thoroughly, their hybrid

model firstly makes price predictions based on histor-

ical market-clearing prices. This model alters a sea-

sonal regression model by changing the aged terms

with a belief function. Afterward, those predicted

prices are reassessed by correlating the weather ob-

servations and market-clearing prices.

The Crocodile Agent (Grgi

´

c et al., 2018) was also

very successful by placing third in the finals of Pow-

erTAC 2018. The authors use game theory and the Ef-

ficient Market Hypothesis to model their agent, creat-

ing a complex multi-module agent. Specifically, their

agent contains a Tariff Rate Creator, Smart Tariff Cre-

ator, Tariff Manager, Portfolio Manager, and a Whole-

sale Manager. Their Wholesale Manager uses rein-

forcement learning to minimize a cost-function de-

fined in their work and create bidding strategies.

The agent Maxon (Urban and Conen, 2017) has 4

types of tariffs available. Each of these tariffs is best

suited to different scenarios and is also improved over

time. This agent also makes predictions about how

much energy he’ll need to buy using a multi-linear re-

gression model. Using this prediction, the agent tries

to buy the energy in the wholesale market by placing

orders in different slots in advance, so as to counter

agents trying to monopolize this market.

(Rodr

´

ıguez Gonz

´

alez et al., 2019) has also orga-

nized their agent into well defined modules, namely

Data Management (divided into Customer Data View

and Wholesale Data View), Retail Market (containing

Production Tariff Expert and Consumption Tariff Ex-

pert), and Wholesale Market (featuring the Wholesale

Expert). Regarding the Retail Market, this agent uses

Reinforcement Learning on Markov Decision Pro-

cesses to get two objectives; attract as many producers

as possible and bring in enough consumers to reduce

the energy imbalance in client portfolio. Regarding

the Wholesale Market, the agent uses mathematical

approximations to estimate the price of energy so as

to decide whether to buy, sell, or hold on to energy.

The related work shows a clear interest in mak-

ICAART 2022 - 14th International Conference on Agents and Artificial Intelligence

360

ing price predictions for markets. This validates the

usefulness of our work, because predictions can be

made using machine and deep learning. Our work

presents a micro-service oriented architecture which

makes it possible to use different languages to code

the agent, particularly python, which is a program-

ming language of choice for cutting edge machine

learning approaches. Alongside this advantage, this

architecture also makes code easier to maintain and

test, as it is loosely coupled (Yousif, 2016). The use of

a common interface for all prediction models makes it

easy to train and test several models at the same time.

3 METHODOLOGY

The programming language used in PowerTAC agents

is Java. Despite Java’s many strengths, Python has

been a programming language of choice for data sci-

ence and machine learning, making it perfect to gather

and treat information useful in the wholesale auctions.

This is the reason that lead us to a micro-service ar-

chitecture, where the broker acts as a central service

that communicates with other services with very well

defined responsibilities. The only other service de-

veloped in this work is the forecasting service, which

makes predictions related to the wholesale market,

more specifically, labeling if there will be trades in

a specific time-slot and predicting the clearing price

when the trades do happen. For simplicity’s sake,

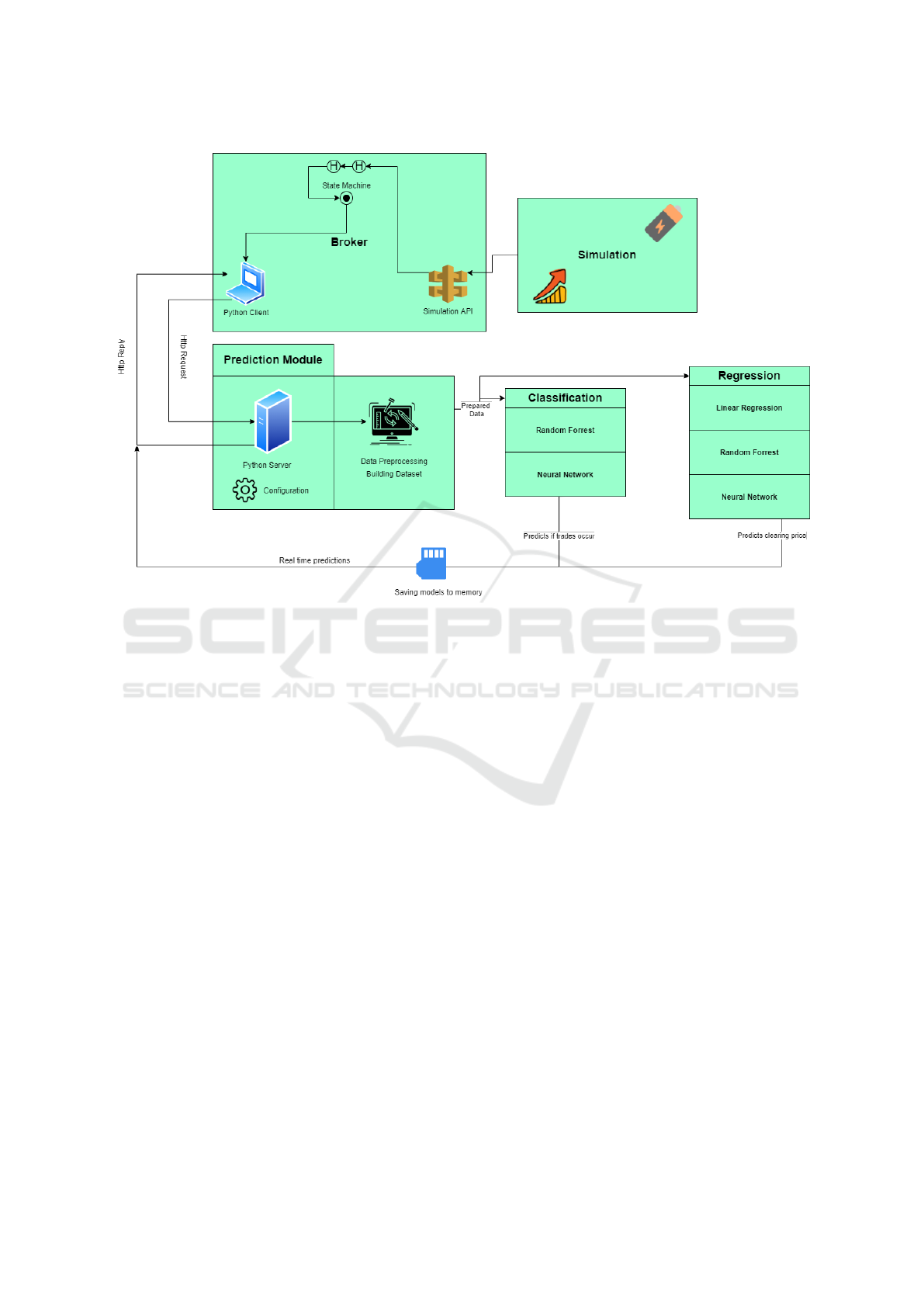

we’ll refer to the micro-service with the responsibili-

ties we just described as the prediction module. Fig-

ure 1 contains an overview of the whole system’s ar-

chitecture. While the simulation is running, the bro-

ker is constantly receiving messages. These messages

are broken down into pieces and re-grouped to create

single messages containing a line of features which

can be fed to a machine learning model. Whenever

a new message is ready on the side of the broker, he

sends it to the python server in the prediction mod-

ule. If the prediction module is running on training

mode, it will save this new line to the data sets used

to train the models. If it’s running on testing mode,

the features are passed to each a classifier of each of

the tasks, and the results is returned in the body of the

http response that the prediction model sends to the

broker.

3.1 Broker Agent Service

The broker agent contains listeners that can be pro-

grammed to do different actions upon receiving a

message of a certain type. We’ve identified three

types of messages that matter to us, namely clearing

price, weather report, and weather forecast. We’ve an-

alyzed what’s the correct order these messages should

appear in for each time-slot and created a state ma-

chine to make sure we can build a consistent message

for each time-slot. If we can’t build it, we don’t use

this time-slot to train the models. There’s a clearing

price for each auction of the wholesale market, mak-

ing it 24 clearing prices. Each weather report contains

four fields: temperature, wind direction, wind speed,

and cloud cover. The weather forecast is a agglomer-

ate of 24 messages like the weather report, with the

exception that they’re forecasts for the next 24 time-

slots.

3.2 Forecasting Service

It’s the prediction module’s responsibility to solve

two tasks:

• Predict trade: To predict whether trades will oc-

cur or not, which is a classification problem.

• Predict clearing price: To predict the clearing

price for one energy bidding slot when trades do

occur, which is a regression problem.

On start up, the prediction module will either

train models with a pre-compiled data-set or load pre-

trained models. The models we use are also config-

urable. Each model has to be wrapped in a class that

implements an interface. The purpose of this interface

is to unify the way models are used and easily config-

ure the server to use different regression and classifi-

cation models. When the prediction module receives

a request a pipeline is activated: the server extracts the

JSON response, passes it to a pre-processing module

that unpacks the data and saves it to a file to contin-

uously build a data-set, all configured models make

their predictions, and finally, a pre-configured model

returns the prediction in the http response so that the

broker can use that information in real time.

To predict whether trades occur or not (the clas-

sification problem) we use two models, firstly a Ran-

dom Forest with 100 estimators, no maximum depth

per tree, and mean squared error as the function to

measure the quality of a split. Secondly, a Neural Net-

work with 3 hidden layers of 10 neurons each. Re-

garding the prediction of clearing prices for energy

in bidding slots, we use three models, a Linear Re-

gression, a Random Forest with 400 estimators and

no maximum depth, and a Neural Network with two

hidden layers of 8 and 16 neurons, respectively. The

hyper parameters of the models were chosen ad hoc,

meaning that, in theory, better results can be achieved.

Framework to Predict Energy Prices and Trades in the Wholesale Market of PowerTAC

361

Figure 1: Overview of the architecture.

4 EXPERIMENTS AND RESULT

ANALYSIS

All tests were performed on a computer with an i7-

10510U quad-core processor with 16GB of RAM,

1.80GHz. The proposed prediction approaches have

been tested in a broker agent using the PowerTAC

simulator.

We used the Java version present in the Simula-

tion and Python version 3. All the algorithms and

the cross-validation function used the Scikit-Learn li-

brary.

In order to train, test, and validate the models

we created a data-set containing messages sent by

the broker across different instances of the simulation

with different initial configurations.

The tasks Predict clearing price and Predict trade

have a data set with 27131 and 23678 entries, re-

spectively. The data-set for Predict trade is very un-

balanced, with 999 (4.2%) of the entries have label

0 and 22679 (95.8%) have label 1, as trades occur

most often than not. Both data sets use the same

features, namely, number of competitors, number of

customers, current temperature, current cloud cover,

current wind direction, and current wind speed. In

addition to the previously mentioned, the simulation

also provides a forecast of temperature, cloud cover,

wind direction, and wind speed for the following 24

hours, which we also use as features. The first 6 plus

the following 4 times 24 sums up to 102 features per

line.

The data used by the regression algorithms can

be found on https://github.com/MHelena45/feup-

tne-PowerTAC/blob/main/WholesalePred/data.csv

and the data used by the classification algorithms

can be found on https://github.com/MHelena45/

feup-tne-PowerTAC/blob/main/WholesalePred/

data-classification.csv.

Two sets of evaluation metrics were used to eval-

uate the performance of the algorithms. In regres-

sion, the metrics considered were the mean absolute

error (MAE), the mean squared error (MSE), and the

root mean squared error (RMSE). In classification, the

metrics were the F1 score and accuracy, although F1

score is much more important, since the data-set is

unbalanced. While the former evaluates the error be-

tween predicted prices and actual clearing prices, the

latter uses the forecast label and the correct label.

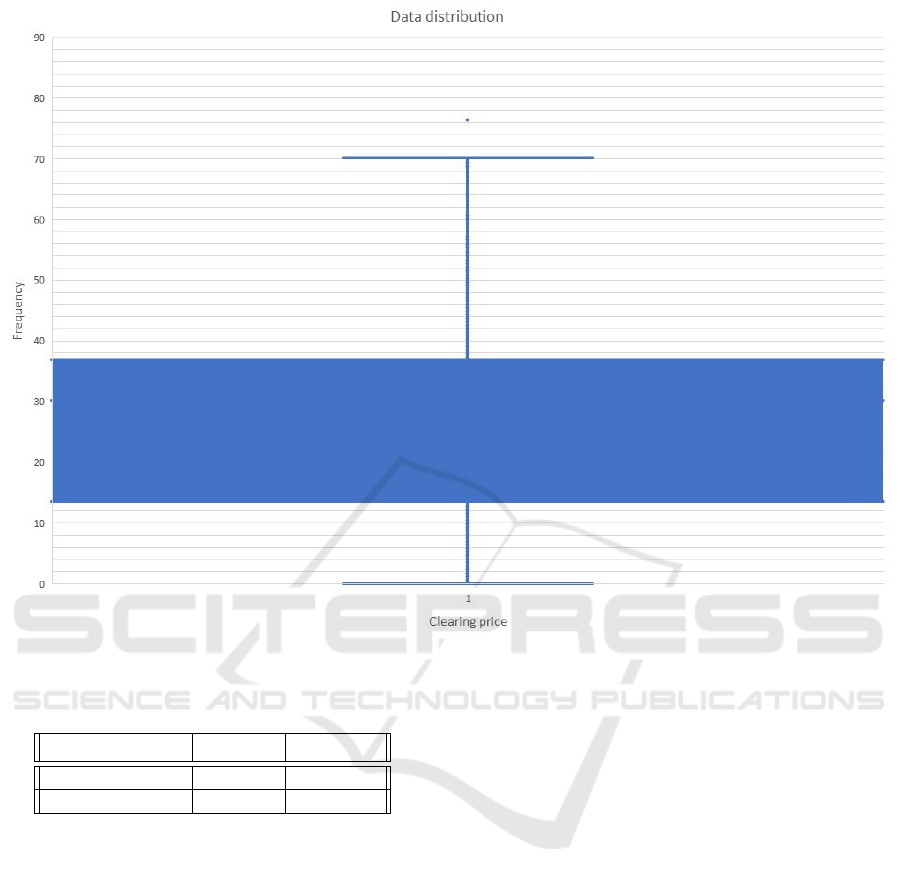

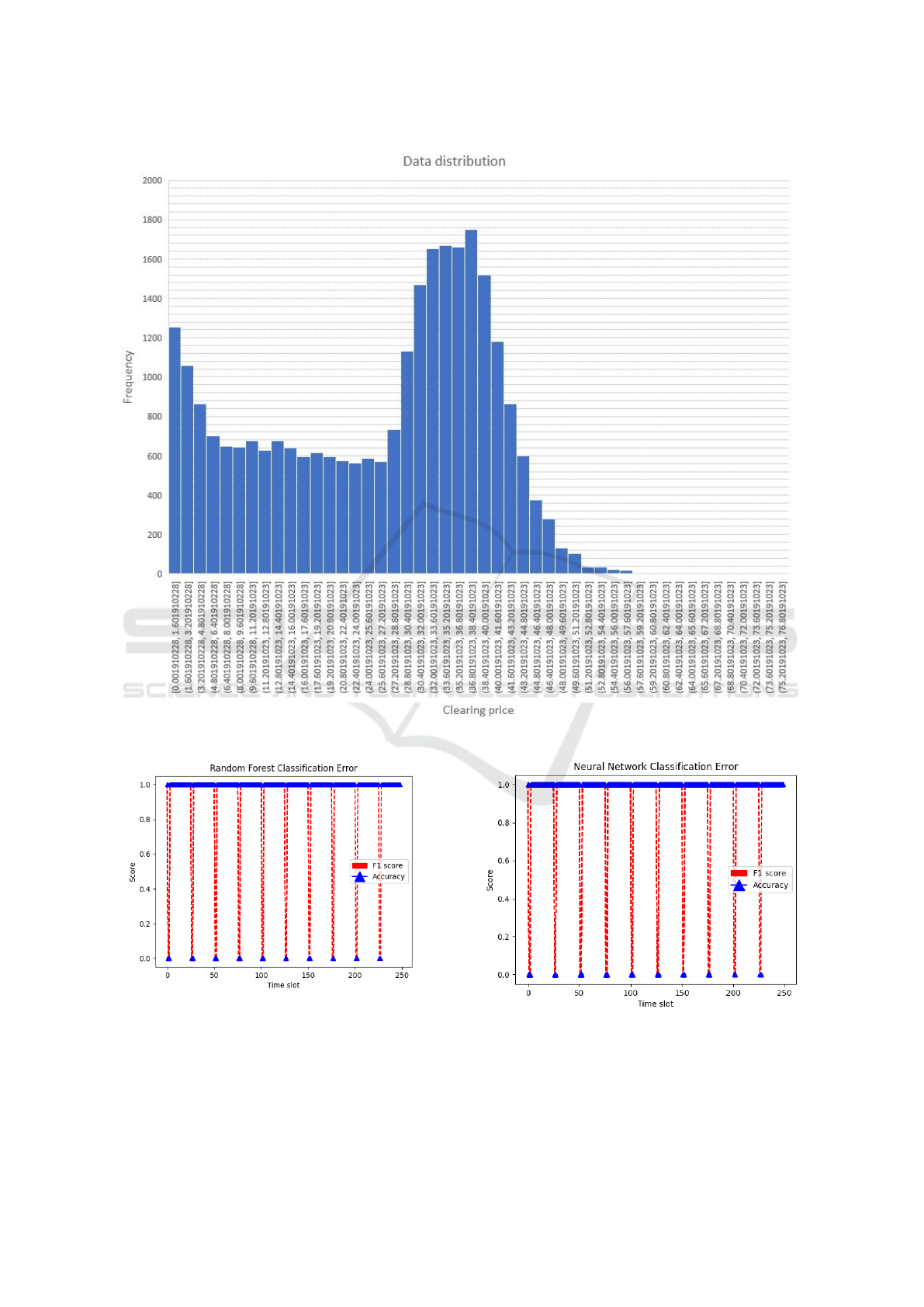

The distribution of the clearing prices is demon-

strated in figures 2 and 3. The clearing prices vary

between 0.0019 and 76.3560, but are mostly concen-

ICAART 2022 - 14th International Conference on Agents and Artificial Intelligence

362

Figure 2: Box plot with the clearing prices.

Table 1: Results of different evaluation metrics for the clas-

sification algorithms.

F1 score Accuracy

Random Forest 0.9965 0.9933

Neural Network 0.9980 0.9961

trated in the range 14 to 37. The range that had the

highest frequency was 36.80 to 38.40.

4.1 Classification Algorithms for

Predicting Trade

This section presents the cross-validation results for

the task of classifying whether trades will occur in a

given time-slot or not.

In the figures 4 and 5, relative to Random For-

est and the Neural Network, respectively, the instant

score is measured: if the predicted label was differ-

ent than the correct label, the accuracy and the F1

score would be 0 in that time-slot; if the predicted la-

bel is equal to the correct label, the accuracy and the

F1 score would be 1.

The results of the 5-Folds cross-validation of the

classification algorithms are present in table 1. Both

the Neural Network and the Random Forest algo-

rithms have accuracy and an F1 score close to one,

making both excellent to predict trades in the whole-

sale market.

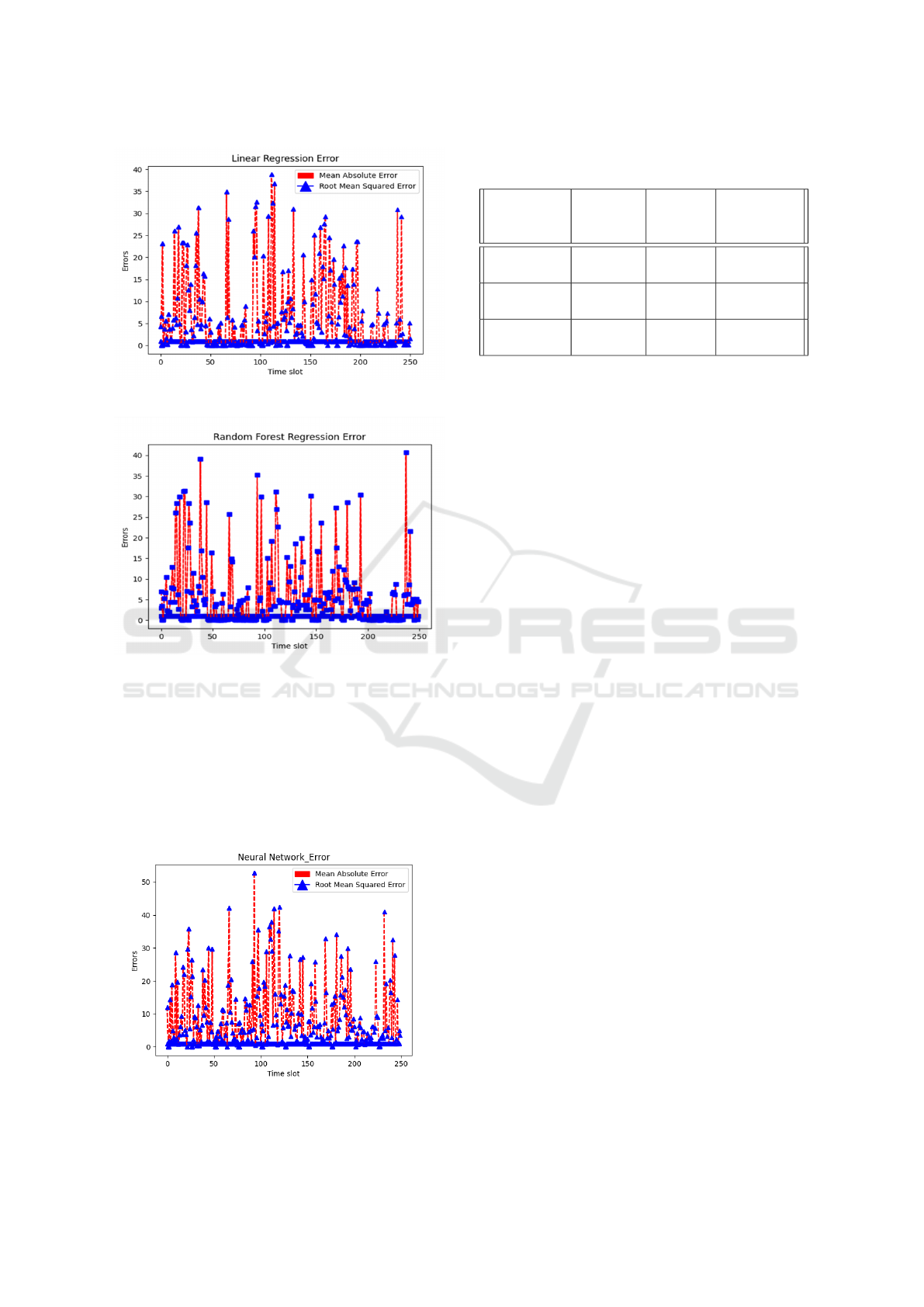

4.2 Regression Algorithms to Predict

Clearing Prices

The section presents the results of the regression al-

gorithms used for price predicting. The metrics mea-

sured are the mean absolute error and the root mean

squared error. In addition, it provides these two

metrics and the mean squared error for the cross-

validation.

The figures 6, 7, and 8 show the instant error using

Linear Regression, Random Forest and Neural Net-

work, respectively. The instant error represented here

includes two values: the value of the mean absolute

error; and the value of the root mean squared error in

each time-slot, without considering the error of previ-

ous time-slots. In the regression algorithms, the error

can vary between zero and a finite positive number.

When all errors are zero, the value predicted is the

same as the actual value.

Framework to Predict Energy Prices and Trades in the Wholesale Market of PowerTAC

363

Figure 3: Histogram with the clearing prices.

Figure 4: Random Forest Classification accuracy and F1

score in real time, after 250 time-slots.

The results of the 5-Folds cross-validation of the

regression algorithms are present in table 2. The re-

gression algorithms produced significantly different

results. The Random Forest algorithm performed the

Figure 5: Neural Network Classification accuracy and F1

score in real time, after 250 time-slots.

best results, followed by the Neural Network and the

Linear Regression.

ICAART 2022 - 14th International Conference on Agents and Artificial Intelligence

364

Figure 6: Linear regression MEA and RMSE error in real

time, after 250 time-slots.

Figure 7: Random forest regression MEA and RMSE in real

time, after 250 time-slots.

5 CONCLUSIONS AND FUTURE

WORK

This project created a micro-service based framework

between the PowerTAC brokers written in Java and an

easy to use pipeline that facilitates training and testing

Figure 8: Neural network regression MEA and RMSE in

real time, after 250 time-slots.

Table 2: Results of different evaluation metrics for the re-

gression algorithms.

Mean

Absolute

Error

Mean

Squared

Error

Root Mean

Squared

Error

Random

Forest

5.99 67.31 8.20

Linear

Regression

10.86 167.33 12.94

Neural

Network

6.27 69.60 8.34

results for several models at the same time. We had

a quite successful go at the problems of a) predicting

the price of energy and b) classifying whether sales

occur in a time-slot or not. These two forecasts to-

gether are very useful tools for any PowerTAC agent

that wants to buy energy in the wholesale market at

lower prices. In the future, it would be interesting

to see how other models such as recurrent neural net-

works behave in the task of predicting clearing prices.

In addition, it would be relevant to understand which

are the most significant features and perform feature

engineering on the data.

REFERENCES

Chowdhury, M. M. P., Folk, R. Y., Fioretto, F., Kiekintveld,

C., and Yeoh, W. (2017). Investigation of learning

strategies for the spot broker in power tac. In Ceppi,

S., David, E., Hajaj, C., Robu, V., and Vetsikas, I. A.,

editors, Agent-Mediated Electronic Commerce. De-

signing Trading Strategies and Mechanisms for Elec-

tronic Markets, pages 96–111, Cham. Springer Inter-

national Publishing.

Grgi

´

c, D., Vdovi

´

c, H., Babic, J., and Podobnik, V. (2018).

Crocodileagent 2018: Robust agent-based mecha-

nisms for power trading in competitive environments.

Computer Science and Information Systems, 16:40–

40.

Kani, S. A. P., Wild, P., and Saha, T. K. (2020). Improving

predictability of renewable generation through opti-

mal battery sizing. IEEE Transactions on Sustainable

Energy, 11(1):37–47.

Ketter, W., Collins, J., and Weerdt, M. d. (2020). The 2020

power trading agent competition. ERIM Report Series

Reference 2020-002.

Lashof, D. A. and Ahuja, D. R. (1990). Relative contribu-

tions of greenhouse gas emissions to global warming.

Nature, 344(6266):529–531.

Mackay, E. B., Bahaj, A. S., and Challenor, P. G. (2010).

Uncertainty in wave energy resource assessment. part

2: Variability and predictability. Renewable Energy,

35(8):1809–1819.

¨

Ozdemir, S. and Unland, R. (2016). Wholesale Bid-

ding Approaches of an Autonomous Trading Agent

Framework to Predict Energy Prices and Trades in the Wholesale Market of PowerTAC

365

in Electricity Markets. In Derksen, C. and Weber,

C., editors, 3rd and 4th International Conference on

Smart Energy Research (SmartER Europe 2016 and

2017), volume AICT-495 of Smart Energy Research.

At the Crossroads of Engineering, Economics, and

Computer Science, pages 90–104, Essen, Germany.

Springer International Publishing. Part 1: SmartER

Europe 2016.

Rodr

´

ıguez Gonz

´

alez, A. Y., Palacios Alonso, M., Lezama,

F., Rodr

´

ıguez, L., Mu

˜

noz de Cote, E., Morales, E. F.,

Enrique Sucar, L., and Crockett, D. D. (2019). A com-

petitive and profitable multi-agent autonomous broker

for energy markets. Sustainable Cities and Society,

49:101590.

Shahriari, M., Cervone, G., Clemente-Harding, L., and

Delle Monache, L. (2020). Using the analog ensem-

ble method as a proxy measurement for wind power

predictability. Renewable Energy, 146:789–801.

Urban, T. and Conen, W. (2017). Maxon16: A success-

ful power tac broker. In Proceedings of the Interna-

tional Workshop on Agent-Mediated Electronic Com-

merce and Trading Agents Design and Analysis.

Yousif, M. (2016). Microservices. IEEE Cloud Computing,

3(5):4–5.

ICAART 2022 - 14th International Conference on Agents and Artificial Intelligence

366