TrustLend: Using Borrower Trustworthiness for Lending on Ethereum

Wisnu Uriawan

1,3 a

, Youakim Badr

2 b

, Omar Hasan

1 c

and Lionel Brunie

1

1

Institut National des Sciences Appliqu

´

ees de Lyon, 20 Avenue Albert Einstein, Villeurbanne CEDEX, France

2

The Pennsylvania State University, Malvern, PA, U.S.A.

3

Department of Informatics, UIN Sunan Gunung Djati, Jl. A.H. Nasution No.105 Bandung, Indonesia

Keywords:

Blockchain, Ethereum, Lending Platform, P2P, Scalable, Trustworthiness Score.

Abstract:

The practice of personal lending, also known as Peer-to-Peer (P2P) lending, has been increasing globally.

However, providing unsecured loans to peers without requiring collateral remains a challenge. We present

a platform called TrustLend, which enables using borrower trustworthiness as an alternative to collateral in

personal lending transactions. TrustLend is a blockchain-based platform implemented on Ethereum. We

introduce a borrower trustworthiness score with variable selection rules to help lenders decide on reliable

candidates as borrowers. We describe the prototype implementation, which is a Decentralized Application

(DApp) that uses smart contracts. The prototype demonstrates fundamental features and supports borrowers,

recommenders, and lenders/investors in establishing loans and approvals. Finally, the prototype shows how

end-users can easily access loans with minimum collateral without hidden costs and swift transactions.

1 INTRODUCTION

In general, micro-businesses and individual debtors

find it difficult to get loans from banks without ac-

cess to loan guarantors, and collateral (Pokorn

´

a and

Sponer, 2016). In P2P lending, borrowers directly in-

teract with peer lenders, making financing more ac-

cessible and efficient (Mammadli, 2016; Or

´

us et al.,

2019; Zhang et al., 2019) which means a higher credit

risk for lenders. Credit risk is the possible loss a bank

or other lender suffers after offering a loan to a bor-

rower. This includes the risk of the borrower default-

ing on the loan on time and the potential risk of de-

fault due to a decrease in credit score (Li et al., 2016)

or a reduction in the borrowers’ ability to repay.

P2P lending continues to increase worldwide ev-

ery year. For example, in 2013, it reached 3.5 billion

U.S. dollars. P2P lending is a new trend of the “shar-

ing economy” an exponential increase is estimated to

reach one trillion U.S. dollars in 2050. However, a

P2P lending platform can also create risks for lenders

when the borrower cannot make payments according

to the agreement. Trustworthiness (Bartoletti et al.,

2018; Kanagachidambaresan et al., 2012) is a critical

a

https://orcid.org/0000-0001-6922-4705

b

https://orcid.org/0000-0002-8976-7894

c

https://orcid.org/0000-0003-1717-3867

component in deciding for lenders whether borrow-

ers are accepted or rejected to get some loans. The

bank or financial institutions have taken many bor-

rower assets due to not fulfilling payments or expe-

riencing delays in payments. Blockchain technology

is emerging and successfully applied in many busi-

ness applications, such as banking and other financial

institutions (Larios-Hern

´

andez, 2017; Lee and Shin,

2018; Rana et al., 2019).

Blockchain technology encourages our motivation

to study the potential of the Ethereum blockchain

(Norta and Leiding, 2019). Recently, it has been ap-

plied in P2P and crowdfunding lending systems (Yum

et al., 2012). The benefit of this new technology has

led to explosive growth in the blockchain-based ap-

plication, which exists within a highly secure sys-

tem. Distributed ledger technology allows transaction

and problem settlement without third-party risk (Zhao

et al., 2017). The access to credit provided by the per-

sonal lending platform is intended to let the world of

blockchains grow beyond the economic limitations of

simply traditional money transactions. Loans (Cap-

ital, 2021; Zhao et al., 2017) is not only an impor-

tant economic factor, but they are also a vital compo-

nent of personal financial freedom and give individu-

als greater purchasing power.

This paper introduces TrustLend as a personal

lending platform Ethereum blockchain-based and

Uriawan, W., Badr, Y., Hasan, O. and Brunie, L.

TrustLend: Using Borrower Trustworthiness for Lending on Ethereum.

DOI: 10.5220/0011151900003283

In Proceedings of the 19th International Conference on Security and Cryptography (SECRYPT 2022), pages 519-524

ISBN: 978-989-758-590-6; ISSN: 2184-7711

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

519

presents its fully functional prototype design and im-

plementation details. The paper builds upon our prior

research work (Uriawan. et al., 2021). We describe

the prototype architecture and conduct experiments

and various personal loans simulations. This paper’s

remainder is structured as follows: Section 1 intro-

duces the potential of a personal lending platform.

Section 2 related work. Section 3 is our proposal for

the trustworthiness prototype for a personal lending

platform. Section 4 implements the prototype and in-

put/output design. Section 5 discusses. Section 6 con-

cludes and future work of this paper.

2 RELATED WORK

Everex is a financial technology that creates decen-

tralized, global credit histories and scorings for indi-

viduals and Small Medium Enterprises. Everex sup-

ported enables transfers, borrowing, and trading in

any fiat currency from anywhere in the world. Its

Crypto cash Ethereum ERC20 token-based, regulated

by fiat currencies, is tradable on the Everex Wallet

and third-party applications and exchanges. Ethereum

provides distributed ledger system and incorporates

Turing-complete programming languages on the pro-

tocol layer to realize smart contract capabilities. It

is implemented on the Ethereum blockchain and uses

Solidity as a smart contracts language (Modi, 2018;

Norta and Leiding, 2019).

ETHLend is an Ethereum-based decentralized

lending platform worldwide connecting borrowers

and lenders. It allows anyone to lend or borrow

with an Ethereum address. ETHLend is decentralized

lending on the Ethereum network by using ERC-20

compatible tokens or Ethereum Name Service (ENS)

domains as collateral. ETHLend solves the problem

of reducing the loss of loan capital on default (Tran,

2019). WeTrust is an Ethereum blockchain to give

mutual aid equal footing with existing social capital

and trust networks. Trusted Lending Circles to create

a Rotating Savings and Credit Association (ROSCA)

powered by smart contracts. It eliminates the need for

a trusted third party, which cuts fees, improves incen-

tive structures, and decentralizes risks. It will even-

tually incorporate mutual insurance, voting within re-

ciprocal aid organizations, and P2P lending (Token,

2018).

3 OUR PROPOSAL

This section presents the Trustlend architecture de-

scribing all functions, the lending platform proto-

type, trustworthiness score, and development princi-

ples. The architecture shows a DApp platform (Uri-

awan. et al., 2021) for Ethereum blockchain-based

personal lending to assist borrowers, recommenders,

and lenders/investors in the lending process.

This architecture minimizes or eliminates the

collateral need by assessing the borrower’s trustwor-

thiness score for the loan’s repayment users who

interact with the system as borrowers, recommenders,

and lenders/investors are shown in Figure 1.

Figure 1: Trustlend Architecture Design.

Smart contracts will handle trustworthiness scores,

recommendations, lenders/investors, and the wallet.

Borrowers’, recommenders’, and lenders’/investors’

transactions will be stored on the Ethereum

blockchain.

3.1 Trustworthiness Score

The trustworthiness score formula (Uriawan. et al.,

2021) is based on the user behavior attributes of risky

attitude, trustworthiness, time preference, and impul-

siveness (Arya et al., 2013). We adapt the trustworthi-

ness score formula in terms of the reliable borrowers

in Equation (1) and Equation (2). The trustworthiness

score that we propose is a value of borrowers set by

the smart contracts so that all parties (borrowers, rec-

ommenders, and lenders/investors) understand each

other’s obligations and risks that will be accepted.

The variables include loan risk, activity, profile, and

social recommendation.

Trustworthiness Score = Loan Risk score

+ Activity score + Pro f ile score

+ Social Recommendation score

(1)

with:

Trustworthiness Score: Borrower Trustworthiness

Score.

Loan Risk score: Information of the record from

another loan of Borrower.

Activity score: Business activity or job information

of Borrower.

Profile score: Personal information of Borrower.

SECRYPT 2022 - 19th International Conference on Security and Cryptography

520

Social Recommendation score: The recommendation

value of Borrowers from Recommender.

and we added positive weight for each variable,

in equation 2:

Trustworthiness Score = w

l

∗ Loan Risk score

+ w

a

∗ Activity score + w

p

∗ Pro f ile score

+ w

s

∗ Social Recommendation score

(2)

where {w in R | w ≤ 1}, and w

l

, w

a

, w

p

, and w

s

are

positive weights of the trustworthiness parameters

such that w

l

+ w

a

+ w

p

+ w

s

= 1. The weights of the

trustworthiness attributes are predetermined based on

their priority value that can modify by consensus. For

example, w

l

= 0.25, w

a

= 0.2, w

p

= 0.25, w

s

= 0.3.

In this example, social recommendation is given the

highest value whereas activity is given the lowest

value it’s show that the social recommendation is the

priority to measure the good borrower candidate.

3.2 TrustLend Prototype Development

Principles

The prototype principles we adopt are standards codes

and conventions, automated units testing, and static

analysis tools. Some regulations relate to our proto-

type, as follows (Brown, 2013):

1. Layering strategy, the prototype applies a layers

strategy to make every design flexible for the bor-

rowers, recommenders, and lenders/investors.

2. Placement of business logic, our prototype en-

sures that business logic permanently resides in

a single place for reasons related to performance

or maintainability among the borrowers, recom-

menders, and lenders/investors.

3. High cohesion and low coupling, our prototype

focuses on building small, highly cohesive blocks.

There is no need to require many dependencies to

do their job. Part by part development related to

our prototype architecture design.

4. Use of the HTTP session, the prototype can of-

ten depend on many things, including scaling

strategy, where session-backed objects are stored,

what happens in the event of a server failure,

whether using sticky sessions, the overhead of

session replication,

5. Always consistent versus eventually consistent,

prototypes have discovered that it often needs to

make trade-offs to meet complex non-functional

requirements.

4 IMPLEMENTATION

Trustlend is the personal lending platform prototype

is a client-blockchain serverless application, where

the entire flow of the app happens between the client

and the blockchain. The client code can be hosted

anywhere, and Amazon Web Services with Sim-

ple Storage Service features, Google Cloud, Github

Pages, Netlify, other cloud providers, or own server.

Our prototype is able to query the blockchain, and we

use a web3 provider Metamask. A browser extension

handles the actual web3 connection to a node shown

in Figure 2.

Figure 2: Prototype of a Trustworthy Personal Lending

Platform.

For example, all the business logic, loans, and

user history are handled and stored in the blockchain,

which is decentralized. However, the Ethereum

blockchain platform or any other Ethereum Virtual

Machines blockchain-based like Polygon charges fees

for each written transaction (Modi, 2018). We are

able to store the data not used in smart contracts cal-

culations to pay fewer fees, and choose the Interplan-

etary File System (IPFS) to store the loan descrip-

tion, images, and necessary data supported (Sicilia

et al., 2019). Once the data is stored in the IPFS, the

content identifier (CID) is returned and stored in the

loan smart contracts to find this data later. We use

NFT (Non-Fungible Token) (Buterin, 2014) storage

(Free, decentralized storage and bandwidth for NFTs)

to store the project’s info into IPFS.

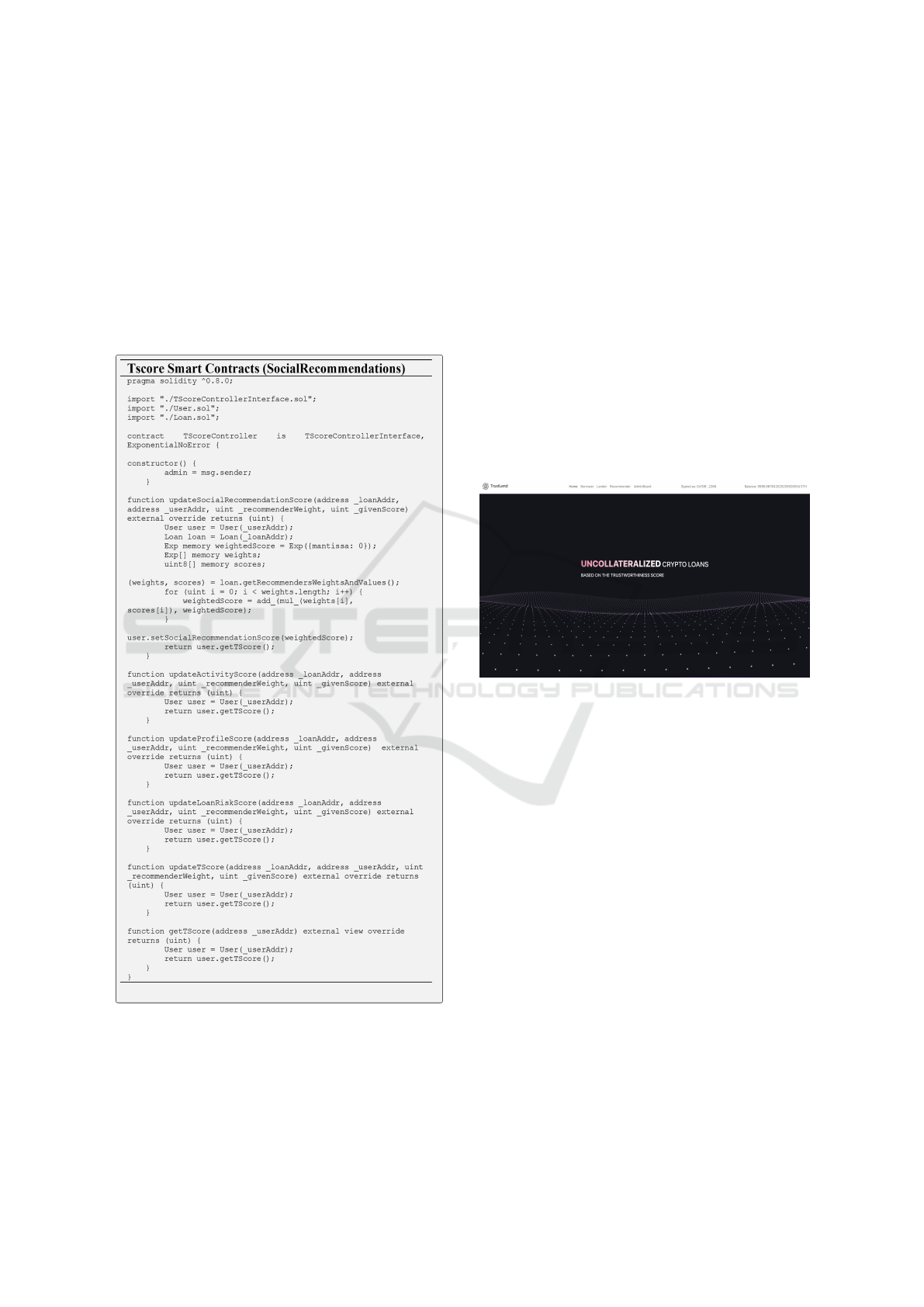

4.1 Trustlend Smart Contracts

The main smart contract that the client interacts with

is the loan controller. It creates loans, handles invest-

ments, recommendations, repayments, etc. From the

moment the user applies for a loan, the apply for loan

function in the loan controller is called and creates

a unique loan contract related to the loan in ques-

tion. The smart contracts necessary of information

about the loan, including 1) Borrower (represented

by User contract instance), 2) Requested amount,

3) Repayment’s count, 4) Interest, 5) Loan creation

TrustLend: Using Borrower Trustworthiness for Lending on Ethereum

521

date, 6) Last repayment date, 7) Return amount, 8)

Lenders/Investors (array), 9) Recommenders (array),

10) Tscorecontroller contract (to handle user’s trust-

worthiness score).

The recommenders and lenders/investors can call

functions in the loan controller to lend/invest and rec-

ommend by providing the address of the loan con-

tract. These smart contracts require a communica-

tion process and are defined as a legal agreement

between borrowers, recommenders, and lenders/in-

vestors shown in Figure 3.

Figure 3: Smart Contracts Trustworthiness score.

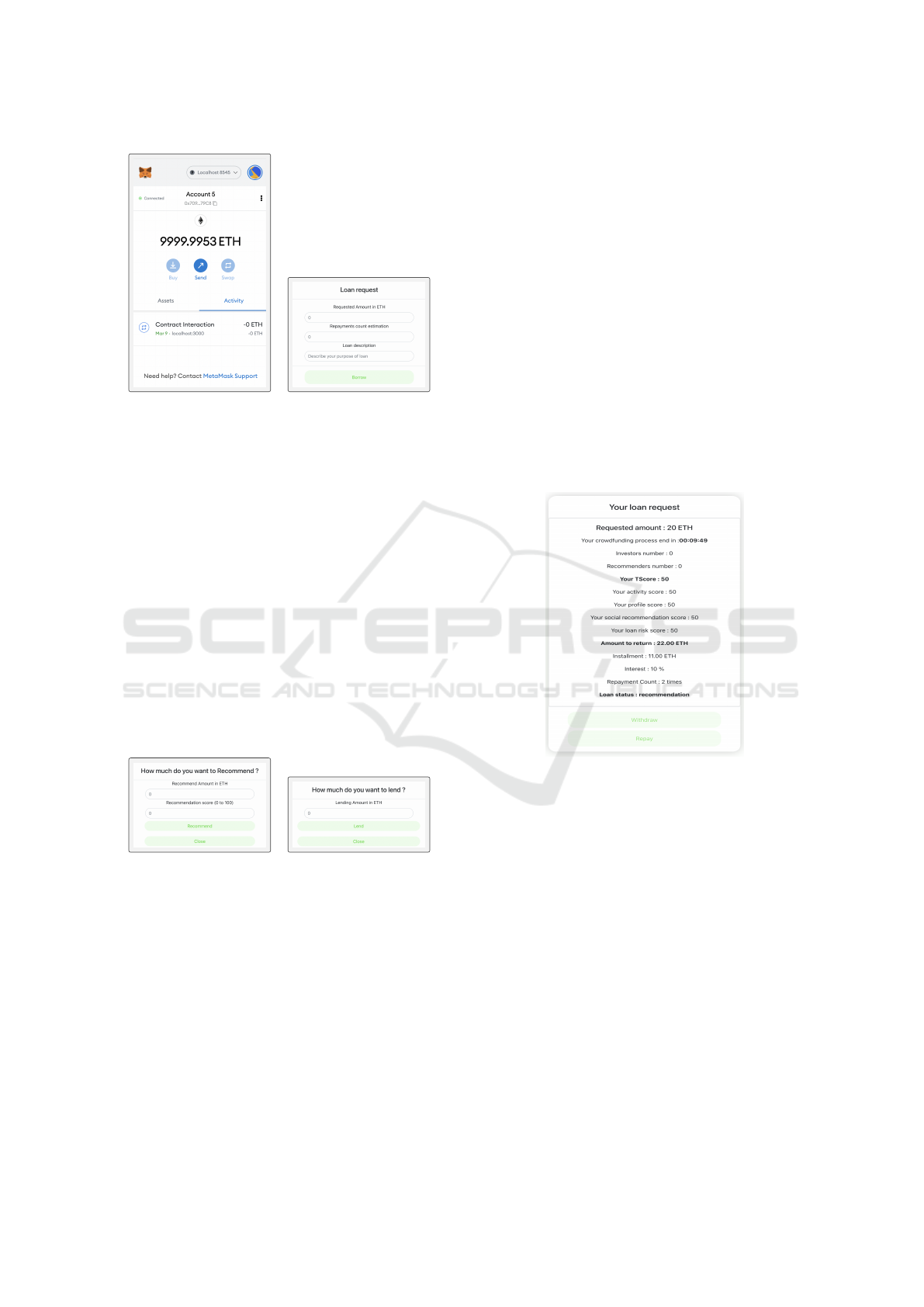

4.2 Lending Transaction Process

The Trustlend is built on React framework, an open-

source javascript library. The application the criti-

cal main pages, The prototyping functionality is of-

fered to three users: Borrowers, Recommenders, and

Lenders/Investors. The borrower can access their

menu on the borrower page. Before accessing the pro-

totype, they (Borrowers, recommenders, and Lender-

s/Investors) should have the Metamask wallet and lo-

gin. After the loan application has been received, the

borrower user can make installment payments accord-

ing to the agreement.

The lenders/investors user can access their menu

and lend/invest with a selection of borrowers who

propose the loan. In these cases, the lender/investor

user determines the allocation of funds for the de-

sired. The recommenders user can access the recom-

mendation score menu to give each borrower a recom-

mendation score and amount of funds (in ETH for-

mat). The lenders/investors use the trustworthiness

score to decide and grant the loan. The main page

Figure 4: Trustlend main page.

provides a menu for borrowers, recommenders, and

lenders/investors, is shown in Figure 4. Users can ac-

cess it after being connected to their Metamask wal-

let. The Trustlend combines trustworthiness score and

consensus in a legal agreement among the borrowers,

recommenders, and lenders/investors. Users obtain

permission only, such as security, immutability, and

ledgers that can be changed through the consensus.

Metamask wallet is required by prototype, and

users can install individual with terms and conditions

shown in Figure 5 (a). Users manage the private key

to receive the payments per transaction by their wal-

lets. Unsigned transactions are sent from the wallet to

the Trustlend for other payments transactions and ver-

ified by the borrowers, recommenders, or lenders/in-

vestors. The personal wallet screen is confirmed via

Metamask as third-party, then approved by the user

ID.

4.2.1 Borrower Page

The borrowers can access the prototype in Figure 5

(b). The system provides how the borrowers propose

SECRYPT 2022 - 19th International Conference on Security and Cryptography

522

(a) (b)

Figure 5: Trustlend Metamask Wallet (a) and Trustlend

Borrower Request a Loan (b).

some loans with terms and conditions. Some users

give some loans information, and signals are sent to

all recommenders and lenders/investors. The bor-

rower page is provided to borrowers when trying to

apply for some loans, with the proposed loan amount,

installment period, and loan description being the pur-

pose of the loan.

4.2.2 Recommender Page

The recommender can access the Trustlend with their

wallet. Trustlend will provide the borrowers who

need recommendations. Then the recommenders give

some ETH and score/value see in Figure 6 (a). The

Trustlend provides the recommendation page to en-

sure the lenders/investors can grant the loan.

(a) (b)

Figure 6: Social Recommendation score input (a) and

Lender/Investor page input (b).

4.2.3 Lender/Investor Page

The lender/investor page is for lenders/investors look-

ing for eligible borrowers. This page includes infor-

mation on borrowers, loan amount, and interest in

APY (Annual Percentage Yield) see in Figure 7. It

is possible to be customizable between borrowers and

lenders. The system will present borrowers who pro-

posed a loan. The lenders/investors will get an oppor-

tunity with several borrowers’ prospects, is shown in

Figure 6 (b).

The smart contracts as a legal agreement (Borrow-

ers, Recommenders, and Lenders/Investors sides) are

the core of the lending prototype we are proposing.

The excellent trustworthiness score of borrowers is a

significant factor in this lending prototype. Reduc-

ing collateral dependence is replaced by social recom-

mendation. Many lending platforms and banks still

require a guarantee, which is burdensome for the bor-

rower to provide.

4.2.4 Summarize the Loan Request

The borrower loan information describes the loans

proposed for each borrower, including the amount

requested, lenders/investors information, recom-

menders, trustworthiness score, collateral in crypto/-

token, and interest. It is reasonable to expect a high

credit score associated with the payments process, is

shown in Figure 7.

Figure 7: Trustlend Borrower Request a Loan.

5 DISCUSSION

The objectives of this prototype are to avoid impul-

sive borrowers who have difficulty resisting the temp-

tation to borrow and increase debt for consumptive

needs. Lenders/Investors are able to monitor the bor-

rower and manage their lend/investment by choos-

ing eligible borrowers to minimize their losses. Each

lender/investor can choose by determining borrowers

who can pay off and get the highest trustworthiness

score. The trustworthiness score formula is well de-

fined (such as weight percentage, variables, etc.), and

is not possible to change after deployment.

Blockchain technology has advantages with im-

mutability, integrity, and equal rights for all net-

work members to get some information, and protect

users’ data from unauthorized access and encryption.

TrustLend: Using Borrower Trustworthiness for Lending on Ethereum

523

There is no personal information of borrowers, rec-

ommenders, and lenders/investors shown. We provide

a prototype with an autonomous transactions process

supported by smart contract functions after deploy-

ment. Smart contracts pay attention to borrower trust-

worthiness scores on a personal lending platform so

that lenders can consider the potential risks that will

be incurred. The value of trust among borrowers, rec-

ommenders, and lenders has a strong influence on a

personal lending platform.

The disadvantages are that performing off proto-

type transactions will increase transaction time be-

cause the need for recommendation score and granted

from lender/investor must be approved. In particular,

all users are aware of the risk and the borrower’s trust-

worthiness.

6 CONCLUSIONS

The Trustlend is a prototype of trustworthy Ethereum

blockchain-based for personal lending that can pro-

vide a loan for borrowers who need without collat-

eral. The social recommendation as a guarantor to

convince lenders/investors to grant the loans to bor-

rowers. This prototype is one of the lending platforms

suitable for personal lending applications that apply

blockchain advantages dimensions: anonymous, de-

centralized, immutability, and secure. This prototype

proposes to minimize the difficulty by introducing the

trustworthiness score to support borrowers, recom-

menders, and lenders/investors. The Trustlend is ex-

pected to be implemented in private environments that

can be scalable to many members possible.

ACKNOWLEDGEMENTS

The first author wishes to acknowledge the MORA

Scholarship from the Indonesian Government and

INSA de Lyon LIRIS Laboratory UMR 5205 CNRS,

which partially supports and funds this research work.

REFERENCES

Arya, S., Eckel, C., and Wichman, C. (2013). Anatomy of

the credit score. Journal of Economic Behavior and

Organization, 95(47783):175–185.

Bartoletti, M., Cimoli, T., Pompianu, L., and Serusi, S.

(2018). Blockchain for social good: a quantitative

analysis. pages 37–42.

Capital, G. (2021). Rates, Terms & Speed of Funding.

Kanagachidambaresan, G. R., Dhulipala, V. R., and Ud-

haya, M. S. (2012). Markovian model based

trustworthy architecture. Procedia Engineering,

30(2011):718–725.

Larios-Hern

´

andez, G. J. (2017). Blockchain entrepreneur-

ship opportunity in the practices of the unbanked.

Business Horizons, 60(6):865–874.

Lee, I. and Shin, Y. J. (2018). Fintech: Ecosystem, business

models, investment decisions, and challenges. Busi-

ness Horizons, 61(1):35–46.

Li, H., Zhang, Y., Zhang, N., and Jia, H. (2016). Detecting

the Abnormal Lenders from P2P Lending Data. Pro-

cedia Computer Science, 91:357–361.

Mammadli, S. (2016). Fuzzy Logic Based Loan Evaluation

System. Procedia Computer Science, 102:495–499.

Modi, R. (2018). Solidity Programming Essentials.

Norta, A. and Leiding, B. (2019). Lowering Financial Inclu-

sion Barriers With a Blockchain-Based Capital Trans-

fer System. Infocom, pages 1–6.

Or

´

us, R., Mugel, S., and Lizaso, E. (2019). Quantum com-

puting for finance: Overview and prospects. Reviews

in Physics, 4:100028.

Pokorn

´

a, M. and Sponer, M. (2016). Social Lending and

Its Risks. Procedia - Social and Behavioral Sciences,

220:330–337.

Rana, R. L., Giungato, P., Tarabella, A., and Tricase, C.

(2019). Blockchain Applications and Sustainability

Issues. Amfiteatru Economic, 21(13):861–870.

Sicilia, M. A., Garc

´

ıa-Barriocanal, E., S

´

anchez-Alonso, S.,

and Cuadrado, J. J. (2019). Decentralized Persistent

Identifiers: A basic model for immutable handlers.

Procedia Computer Science, 146:123–130.

Token, A. (2018). WeTrust Whitepaper Table of Contents.

Bravenewcoin.Com, 1.

Tran, K. C. (2019). Ultimate Guide to Ethereum Lend-

ing: ETHLend, MakerDAO, BlockFi, SALT, Dharma

& Compound.

Uriawan., W., Hasan., O., Badr., Y., and Brunie., L. (2021).

Collateral-free trustworthiness-based personal lend-

ing on a decentralized application (dapp). In Proceed-

ings of the 18th International Conference on Security

and Cryptography - SECRYPT,, pages 839–844. IN-

STICC, SciTePress.

Yum, H., Lee, B., and Chae, M. (2012). From the wisdom of

crowds to my own judgment in microfinance through

online peer-to-peer lending platforms. Electronic

Commerce Research and Applications, 11(5):469–

483.

Zhang, J., Lyu, T., and Li, R. (2019). A Study on SMIE

Credit Evaluation Model Based on Blockchain Tech-

nology. Procedia CIRP, 83:616–623.

Zhao, H., Liu, Q., Wang, G., Chen, E., Zhang, H., and Ge,

Y. (2017). P2P lending survey: Platforms, recent ad-

vances and prospects. ACM Transactions on Intelli-

gent Systems and Technology, 8(6):1–28.

SECRYPT 2022 - 19th International Conference on Security and Cryptography

524