A Decentralised Real Estate Transfer Verification based on

Self-Sovereign Identity and Smart Contracts

Abubakar-Sadiq Shehu

1,2 a

, Ant

´

onio Pinto

3 b

and Manuel E. Correia

1,3 c

1

Department of Computer Science, Faculty of Science, University of Porto, Porto, Portugal

2

Department of Information Technology, FCSIT, Bayero University Kano, Kano, Nigeria

3

CRACS & INESC TEC, Porto, Portugal

Keywords:

Self Sovereign Identity (SSI), Smart Contracts, Identity Management, Real Estate and Digital Deeds

Validation.

Abstract:

Since its first introduction in late 90s, the use of marketplaces has continued to grow, today virtually every-

thing from physical assets to services can be purchased on digital marketplaces, real estate is not an exception.

Some marketplaces allow acclaimed asset owners to advertise their products, to which the services gets com-

mission/percentage from proceeds of sale/lease. Despite the success recorded in the use of the marketplaces,

they are not without limitations which include identity and property fraud, impersonation and the use of cen-

tralised technology with trusted parties that are prone to single point of failures (SPOF). Being one of the most

valuable assets, real estate has been a target for marketplace fraud as impersonators take pictures of properties

they do not own, upload them on marketplace with promising prices that lures innocent or naive buyers. This

paper addresses these issues by proposing a self sovereign identity (SSI) and smart contract based framework

for identity verification and verified transaction management on secure digital marketplaces. First, the use of

SSI technology enable methods for acquiring verified credential (VC) that are verifiable on a decentralised

blockchain registry to identify both real estate owner(s) and real estate property. Second, the smart contracts

are used to negotiate the secure transfer of real estate property deeds on the marketplace. To assess the viability

of our proposal we define an application scenario and compare our work with other approaches.

1 INTRODUCTION

Web 2.0 is one of the many advancements that the

Internet has witnessed since its creation. It has seen

significant growth, primarily in marketplace and elec-

tronic transactions where practically anything, includ-

ing real estate, can be offered for rent, lease, or sale

on marketplaces and blogs (Facebook, Airbnb, Uni-

places and others) for residential, commercial or in-

dustrial usage. Globally, real estates are considered

one of the most valuable assets (commonly used as

collateral for obtaining loans from both formal fi-

nancial institution such as banks and informal credit

providers) (Yadav and Kushwaha, 2021), contributing

a significant share to Governments GDP. For exam-

ple in 2020 it accounted for about 7.5% of the Chi-

nese economy (Pain and Rusticelli, 2022) and 17.5%

in the USA for fixed investment and total housing

spending in 2019, real estate commercial properties

a

https://orcid.org/0000-0002-2894-6434

b

https://orcid.org/0000-0002-5583-5772

c

https://orcid.org/0000-0002-2348-8075

contributed 3.1% (EUR 452 billion) to the European

economy, a value comparable to the combined con-

tribution of the automotive and telecommunications

industries. (EPRA, 2020).More so, real estate is the

primary component of agriculture and, as a result, it is

inextricably related to food security. While properties

are easily available for buyers choice, determining

the authenticity and correctness in real estate market-

places can be a daunting challenge. Typically, inter-

actions with individuals in real estate transaction re-

quires proper identification, often with a large amount

of paperwork issued by different institutions, which

takes a lot of time to confirm from the issuers. More

so, these services are centralised and siloed, therefore,

any failure on the process can completely undermine

the progress of an entire transaction.

To curb the aforementioned issues, Governments,

businesses and researchers have been working on im-

proving the security of digital commercial transac-

tions and associated treatments of personal data. This

led to the idea of Web 3.0 (Ragnedda and Destefa-

nis, 2019) which introduces fairer and more secure

communication and data exchange methods, enabling

Shehu, A., Pinto, A. and Correia, M.

A Decentralised Real Estate Transfer Verification based on Self-Sovereign Identity and Smart Contracts.

DOI: 10.5220/0011384700003283

In Proceedings of the 19th International Conference on Security and Cryptography (SECRYPT 2022), pages 469-476

ISBN: 978-989-758-590-6; ISSN: 2184-7711

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

469

users to be sovereign on their own identity, through

decentralisation and the use of blockchains.

Self-sovereign identity and smart contract are

among the recent advances in secure data exchange

and verification. Blockchain can be used to store and

verify secure transaction, while smart contract pro-

vides an ecosystem for secure transaction negotiation,

both without the need to rely on any third party that

verifies their identity. This paper proposes an SSI and

smart contract based real estate verification frame-

work, whose aim is to prevent fraud in transfer pro-

cesses, ensure secured identity verification and miti-

gate tax evasion in transactions.

Contribution. A good number of research works

some of which are discussed in Section 2, aimed to

address these issues have focused on decentralising

the real estate registration process, while some other

works focused on identity, fraud and verification is-

sues. Therefore, we present a framework that en-

sures the secure creation, verification of VC and a

transfer process that manages real estate transaction

based on smart contracts (Szabo, 2018).This works

was inspired by our previous works (Shehu et al.,

2018)(Shehu et al., 2019) and is guided by GDPR

principles in (Voigt and Von dem Bussche, 2017).

To our knowledge no work has combined SSI, smart

contracts and IPFS peer-to-peer distributed file sys-

tem (Benet, 2014), to address real estate verification,

property transfer and associated secure data storage

issues.

The contributions of this paper are as follows:

1. Review Study: We did an extensive survey of re-

lated state of the art works on dematerialised real

estate management that uses blockchain and other

SSI components. We identified some limitations

that we address on the framework for securing real

estate transactions that we are proposing in this

paper.

2. System Framework: We propose an SSI and

smart contract framework for verifying real estate

transfer processes. The SSI layer of the frame-

work is used to define methods and the process

of acquiring VCs (electronic equivalence of our

physical documents/credentials e.g national cards

and others) (Consortium et al., 2019) for actors

(real estate, owner, buyer and marketplace) that

are linked and verifiable on a distributed ledger.

While smart contracts are used to implement the

negotiation, the real estate owner remains in con-

trol and can deploy those smart contracts at will

on a marketplace, for intending buyers to engage

with. We enhance our framework with the IPFS,

a secure distributed storage system that we use to

store a hash and an encrypted copy of the com-

plete real estate description.

3. Demonstration Pilot: To conceptualise the pro-

posed framework, we present an application sce-

nario for verification of real estate transfer, and

analyse the characteristics of each component.

4. Evaluation: From a functional point of view we

elaborated the strengths and possible weaknesses

of our proposal and propose future work.

Outline. This paper is structured as follows: Sec-

tion 3 provides a background study and associated

technologies. We discuss related works of the pro-

posed framework in Section 2. In Section 4 we pro-

vide an overview of our proposed solution and dis-

cuss it components and actors. Section 5 discusses

application scenario of the proposed framework for

use of SSI and smart contract transfer method. We

discuss security characteristics and robustness of the

proposed work and the three main components in Sec-

tion 6. We conclude the paper in Section 7 and discuss

future work.

2 RELATED WORKS

While emphasising the need for adopting blockchain

solution in real estate to enable and facilitate low-cost

P2P commercial interactions, the authors in (Norta

et al., 2018) proposed a B2B crowdfunding platform

for commercial real estate leveraging the Evareium

digital real estate fund token system, with quality

goals such as overall system security, seamless infor-

mation flow between platform sub-infrastructures. In

a bid to address fraud in buying, selling and temper-

ing with real estate records, and eliminate the use of

centralised land registry method in Saudi Arabia, the

authors in (Ali et al., 2020) proposed a blockchain

based framework using a permissioned hyperledger

fabric blockchain, in which users can utilize smart

contracts to buy, sell, and update property records.

The system keeps track of all prior purchasers and

sellers of a property, which can be validated on the

network. The work in (Gupta et al., 2020) proposed

a real estate investment solution introducing liquid-

ity using blockchain and a tokenised special purpose

vehicle for investors to purchase ERC 777 standard

security tokens at their leisure. Drawbacks of the

method include complete reliance on third-parties for

identity verification of investors, likewise the paper

work can be time consuming and prone to forgery.

The authors in (Kothari et al., 2020) proposed a trans-

parency tamper proof platform for real estate. The

SECRYPT 2022 - 19th International Conference on Security and Cryptography

470

system is composed of an owner, buyer and validator.

A major drawback of this system is the over reliance

on third party and authenticity of advertised proper-

ties are not verified. To prevent fraud in traditional

real estate transactions, the work in (Yadav and Kush-

waha, 2021) proposed a blockchain-based system for

digitising real estate transactions to reduce the risks

of fabricating documents and other fraudulent behav-

iors. In their claim, the work employs a consensus

mechanism that minimises multi casting node over-

head transmissions by 50 %. The work in (Mendi

et al., 2020) proposed a blockchain framework to re-

duce the tax evasion in real estate transactions within

Turkey, using framework used hyperledger and incor-

porating all parties involved in the transfer of own-

ership; land registry office to monitor the sale, bank

for payment of funds, municipality for tax on buyer

and seller. The authors in (Bhanushali et al., 2020)

proposed a system to address lost or damaged deeds

of real estate using a smart contract. To sell or buy

in real estate, a user fulfills the smart contract’s re-

quirements and receive a digital deed, which is then

uploaded as a new block in a blockchain. A major

drawback of this method is the non verification of the

property with a users identity. Any user who is able to

present proof of a real estate fulfills the smart contract

requirement.

3 PRELIMINARIES

Self Sovereign Identity: Self-sovereign identity

(SSI) and smart contract are among the the advances

of Web 3.0 and data decentralisation. SSI provides

a decentralised data structure, where the data owner

can be self-reliant from services, free to create their

VC (which are digital equivalence of physical doc-

uments) and revoke or delegate them at will. De-

centralised identifiers, VCs, and immutable registers

(blockchain) have been major drivers of SSI. In SSI, a

blockchain registry is a distributed ledger that is glob-

ally accepted by SSI actors as a source of truth, where

they can easily confirm the validity and authenticity

of a credential without revealing its content. Since its

introduction, SSI methods have been implemented in

a couple of areas to address trust, privacy, and secu-

rity issues in IoTs, ehealth, finance, real estate among

others. With SSI, users are able to limit the practice

of data extraction and personal information collection

by services without their consent.

The SSI leverages on a trust triangle consisting

of three actors (issuer, holder and verifier). Issuer

is an entity that is able to verify identity attributes

of a holder and issue a VC. A holder is an identifi-

Presents credentials or

creates proofs

Credential issuer

Verifiable Data Registry

Issues credential

to holder

Digital wallet

Verifier

Trust

stores credential

in wallet

Identity owner

Figure 1: Self-Sovereign identity trust triangle.

able entity that receives credentials from issuers, then

presents them as proof of claim to a verifier. Veri-

fiers are service provider (SP), that sets access policy

for holders and provide their services based on the

policies. The relationship between these actors is de-

picted in Figure 1.

Blockchain: In 2009, blockchain attracted the

world’s attention through the first known real-world

application of bitcoin cryptocurrency (Nakamoto,

2008), as a distributed and decentralised system con-

sisting of an immutable public database, that are cryp-

tographically hashed in peer-to-peer public transac-

tions. A block is made up of a series of transactions

that are not managed by a single centralised organisa-

tion, but are instead publicly available and trustwor-

thy to all network users. Traditionally, blockchains

are classified either as public and private (Soltani

et al., 2021), or as permissioned and permissionless.

Blockchain shares a consensus algorithm that al-

lows immutable transactions to be completed and syn-

chronised, it also generates an ordered list of stored

and associated information through a chain of blocks

that usually contain the previous hash block, data

content, participant signature and timestamp. The

previous hash block causes the information in the

blockchain to remain immutable.

Smart Contract: The first published work on smart

contract was by Nick Szabo in 1994 (Szabo, 2018).

Smart contracts are digital contracts that are stored

on blockchain they are akin to physical contracts.

They inherit the properties of blockchain such as im-

mutability, distributed and trustless network. Typi-

cally smart contracts are used to automate the execu-

tion of an agreement that is triggered through proto-

cols and conditions, so that all participants are imme-

diately certain of the outcome, without the involve-

ment of an intermediary or the loss of time.

Interplanetary File System (IPFS): IPFS is an

open-source set of protocols (Benet, 2014) which in-

A Decentralised Real Estate Transfer Verification based on Self-Sovereign Identity and Smart Contracts

471

SSI

layer

Transparent

information,

communication and

modalities for the

exercise of the rights of

the data subject

Secured data

correlation

Cryptography

Blockchain

Zero

knowledge

proof

Proxy

re-ecnrytpion

Fuzzy

extractor

Pseudonymisation

& minimisation

Transparency

awareness, secure

transmission and

storage

IPFS

Access

control

Blockchain

RAIAP:

Pseudonimity

and data [104]

Interoperable

GDPR data

sharing [52]

Risk

minimisation

in sharing

data [121]

1. Securing rights of

data subject [119]

2. Enabling trust in

healthcare data

exchange with

Federated blockchain

[71]

3. GDPR data

complaint [30]

4. BCFL, data forensic

evidence [19]

1. Transparent

logging [118]

2. Trust, secure data

sharing and storage

[109]

3. Medsba: a novel

and secure scheme to

share medical data

based on blockchain

technology and

attribute-based

encryption [46]

Certificate

validation and

revocation

Revocation

management

Validation

efficiency and

distribution

Blockchain

Cryptography

Blockchain

Cryptography

Pseudonymisation

Assymetric

accumulators

Zero

knowledge

proof

Offline

certificate

management

[6]

1. Verification,

revocation and re-

issuance [131][34]

2. Cross domain

authentication

and revocation

[50]

3. Certificate

status validation

[141]

4. Certificate and

Revocation

transparency

[135]

Revoked

certificate

distribution

[100]

Certificate

management

[20]

Lightweight

automated

certificate

revocation

[54]

1. Trust

management [117]

2. Secured

revocation and

filtering [58][125] [7]

Revoked

certificate

distribution

[48][47]

PKI

Authentication

Right to

restriction of

processing

personal data

Data consent,

privacy and

intergrity

Content

filtering

Blockchain

Access

control

1. DNS-IdM secure

data sharing [12]

2. GDPR IoT

compliance [21]

NOVIDChain

Privacy health

data [5]

Privacy

management in

Banking [134]

1. Privacy protection for

GDPR [31]

2.MedSBA seucre

medical data Sharing

[109]

3. PrivySharing

Pivacy-preserving data

sharing [81]

4.GDPR data

management

complaint [129]

Decentralised

key

PKI

IdM with VC

and FIDO

[26]

Cryptography

Blockchain

Anonymisation

Hashing

IPFS

Delegation

management

Control and

transparent

delegation

Access

control

Access

control

Blockchain

Cryptography

Scalable delegation

system [78]

1. Assured and

varifiable

delegation[105]

2. IoT delegation

[101]

3. Unauthorised

permission

delegation [123]

1. Access and

delegation control

[94]

2. User-managed

access delegation

[75]

3. Distributed

account

management [144]

Guardianship &

delegation

Data portability

[115]

Delegated content

erasure [108]

Transparent

information,

communication and

modalities for the

exercise of the rights of

the data subject

Right to restriction of

processing personal

data

Guardianship &

delegation

Rights of data subject

Certificate validation

and revocation

Final Edition

1

2

4

5

3

6

7

On chain

data

processing

Off chain

processing

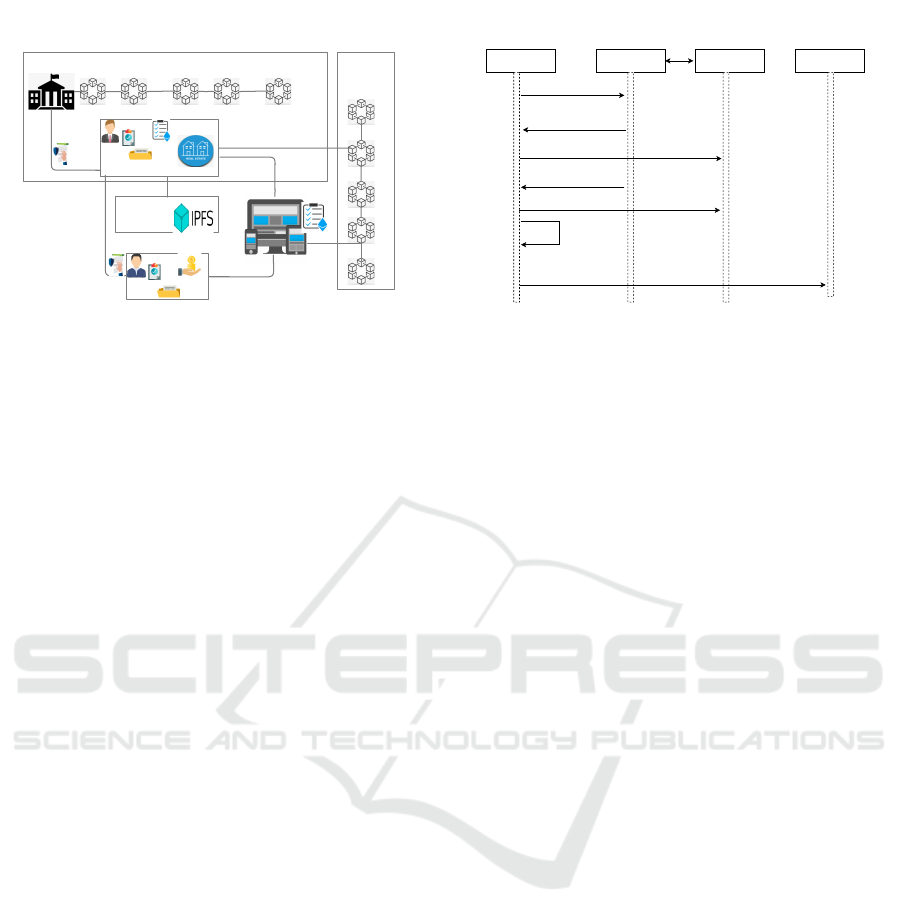

Figure 2: A high-level architecture of proposed system.

tegrates various existing concepts including peer-to-

peer (P2P) networking, Linked Data, and other do-

mains to allow participants share file fragments. Con-

tent on IPFS is uniquely labeled and addressed using a

multihash, which is a self-describing datatype that in-

corporates features from git’s versioning model, cryp-

tographic hashing, and Merkle Trees to make file re-

trieval easier. Contents are identified and accessible

using names rather than location.

4 A SOLUTION FOR VERIFIED

REAL ESTATE TRANSACTION

BASED ON SSI AND SMART

CONTRACTS

In this section we analyse the our proposal as follows:

firstly, the overall architecture is described with all ac-

tors, then, identity management and verification pro-

cess is analysed, lastly, the ownership transfer pro-

cess and data storage procedures are discussed. The

generic overview of the proposed framework is de-

picted in Figure 2. It is divided into three nodes; iden-

tity management node, on-chain data processing and

off-chain external data storage. The identity manage-

ment node which follows an SSI method.

On chain data processing node consist of two

Ethereum based smart contracts for negotiating the

transfer of real estate. While the off chain external

storage layer stores a comprehensive digital informa-

tion of the real estate (description, pictures, videos)

and ownership transfer history.

4.1 Identity Management Process

Securely verifying the real estate and users (market

place, owner and buyer) in a decentralised manner

forms the core of this work.

User

Verified Credential

Issuer

Issuer domain

Distributed external

storage

physical presentation and

proof of physical document

Pub

kuser

, Pri

kuser

)

Pass phrase

0

Pass phrase

0

1. local generation and

storage of passphrase

2. Generate hash

value for key pair and

passphrase

3. Generate a verified

certificate hash conmbination

Pub

kuser

, Pri

kuser

),

nPri

kuser

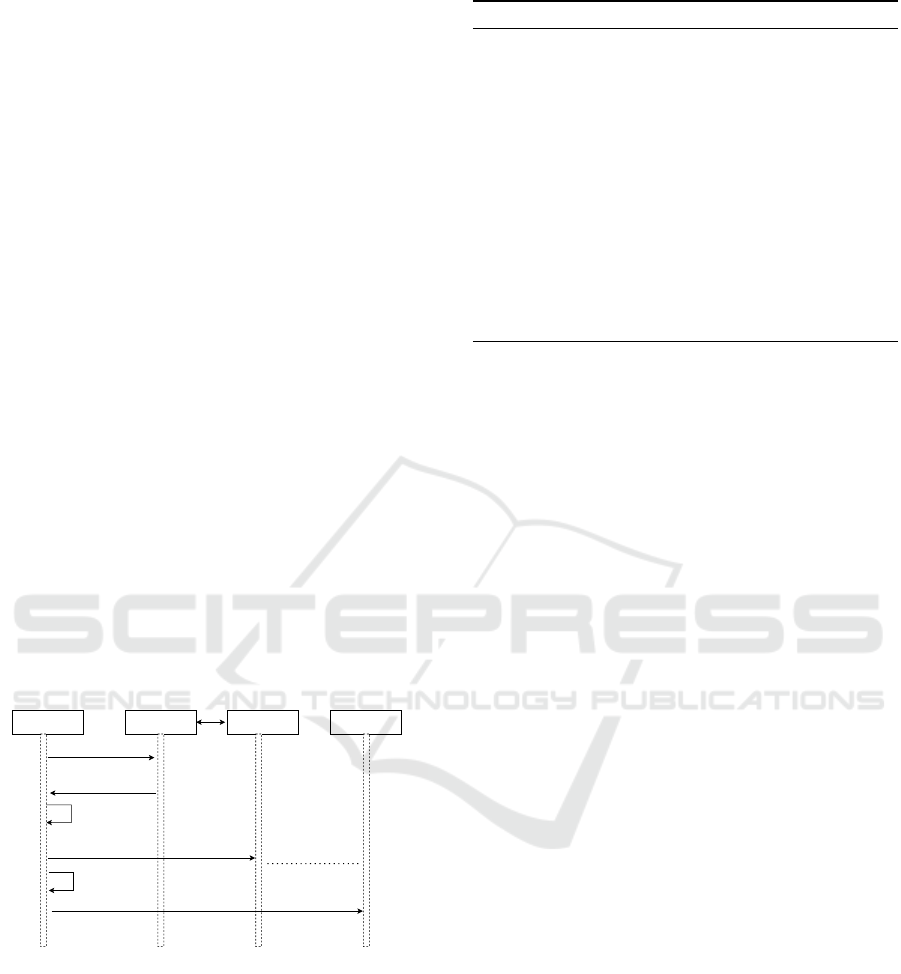

Figure 3: Owner registration process.

User Identification: Considering the fact that the

asset at hand is a physical property, we initiate the

identification process with a pre-requisite physical

identification of the owner as well as the real estate.

In the course of this work we assume the credential

issuer to be a Government/state office which owns a

distributed and verifiable data registry that stores dig-

ital information of residents and businesses. At the

state office, a user presents physical documents con-

taining personal attributes (e.g name, date of birth,

address and others) for identification on which due

diligence is conducted. For subsequent processes, an

owner may initiate a registration on the registry’s mo-

bile or web domain by creating a user name and pri-

vate key. Either way two postal mails are sent to the

user’s registered address, first mail contains a public

and temporary private key that has to be changed. A

user would then have to access the Government’s do-

main to register the credentials received and change

associated key. Once done, the system automatically

triggers the request for the second mail which con-

tains a unique and changeable mnemonic passphrase.

Owner’s account is still under verification until the

passphrase is received and changed. Once completed

owner is able to request for physical and equivalent

VC. The VC contains a public key (Pub

kowner

) that is

locally stored on owner’s digital wallet, a private key

(Pri

kowner

) that unlocks owner’s account and a hash hf

of the key pair that serves as the identity of the owner

VC

owner

=( hf (Pub

owner

, Pri

owner

), Pri

owner

, Pub

owner

).

The hash value is deposited in decentralised the reg-

istry of the issuer to uniquely identify owner. On

the decentralised state mobile or Web domain, owner

logs-in with their self generated private key and con-

firms the already provided attributes during the regis-

tration. From the key pair, owner is able to derive new

hash credentials for unique identification that will be

case specific, and even choose from an array of ser-

vices (public/private) provided, with which they want

SECRYPT 2022 - 19th International Conference on Security and Cryptography

472

to link their identity to. This process is described

shown in Figure 3.

Real Estate Identification: Been a landed prop-

erty, real estates are owned by private or state entities,

therefore, the identification process follows similar

approach of owner identification. We assume a real

estate is newly acquired, therefore the owner needs

to obtain a VC for it, and bind it to their own VC.

At the registry office, the owner presents their VC

with proof of ownership (such as deed document or

certificate of ownership) that fully describes the prop-

erty, the map location, purchase receipt with preced-

ing owners identities (VC hashes) and a plan for the

property if any. The land registry office dispatches

two address verification mail; first to the preceding

owner of the property and second to the verified ad-

dress of the owner, which contains a key pair gener-

ated from the owner’s public key and a changeable

password for access to land registry domain to com-

plete the registration. Once received, the preceding

owner has to confirm the transfer of property using

owned VC. Thereafter, the owner is able to link the

property’s public key to VC and locate it on the land

registry map (description of this property is greyed

out and saved to a distributed external storage). A

hash is generated from the key pair, property loca-

tion on the map, owner’s VC and property public key

which is then pinned to external distributed storage

that is publicly accessible as shown in Figure 4.

Propery owner Land registry Land registry domain External storage

physical presentation, vc and

cert of ownerhsip

Pub

kproperty

locate property location on

map,

link Vc and

Pub

kproperty

Pin property hash

generate hash=

property location+

pub

k property

+ vc

greyed location as ownwed

Figure 4: Real estate registration process.

4.2 On Chain Data Processing

We assume that a buyer/client and decentralised

marketplace acquire their VCs using same process

with real estate owner. The proposed infrastruc-

ture is composed of two smart contracts that form

the bases for real estate transfer; which are capabil-

ity smart contract SC

capability

and transfer smart con-

tract SC

transfer

. Both contracts are fashioned on an

Ethereum blockchain.

Algorithm 1: SC

capability

creation.

1: procedure Owner verification and contract creation process

2: Input: acct, AP, B, start, end, minValue, DR, R

0

, VC

property

, IPFS

hash

,

status

3: Read values

4: if Id, R

0

, B, VC

property

= owner then

5: start transfer

6: if li f etime ≥ 1 then

7: Create instance of SC

capability

8: else if li f etime ≤ 0 then

9: Reject creation process

10: else

11: Create acct, AP, value, DR, status

12: while Status = active do

13: Return ← IPFS

hash

14: Return ← SC

capability

SC

capability

: This contract is created and owned by

the real estate owner, it hold’s all necessary informa-

tion that identifies them. To determine method for

proof of identity, we define SC

capability

properties in

relation to it’s attributes and enumerate what action

(access request, delegation, transfer of property and

revocation) the owner can perform with it. To achieve

this we define the access control (AC) state and iden-

tify its variables; AC (A, P, R), where A, is a set of

public keys (Pub

ku

...Pub

ku..

n

), R (set of all attributes

on VC), P (set of all possible permissions). From

these variables an owner is able to derive capability

properties for their smart contract: (AP, R

0

, Pp

0

, DR,

B), where AP ⊆ A × P is access policy, R

0

6⊂ R is a set

of extra context awareness attributes, Pp

0

⊆ P × p

0

is

access scope, DR is the delegation relation and B is

set of binary relations between entities (which could

be real estate in question or other entities).

SC

transfer

: This contract is deployed by verified

market place. Since the market place is providing the

platform for the transfer of real estate property, an ini-

tial authentication and authorisation process is carried

out.

Smart Contract Creation: To create a SC

transfer

,

we assume a marketplace defines access requirements

through scope and policies, which are achieved by

identity verification processes (identification, authen-

tication and authorisation). To initiate these pro-

cesses, an owner contacts the market place and re-

quest access to SC

transfer

services by sending a request

that includes Req

access

→SC

transfer

: acct, hashId and

Pub

Kowner

where acct is the type of contract the owner

wants to deploy (sale, lease agreements, or power of

attorney contract), hashId, is the Id of the owner who

wants to deploy a contract, and Pub

Kowner

is the pub-

lic key. We assume that each call to a market place

A Decentralised Real Estate Transfer Verification based on Self-Sovereign Identity and Smart Contracts

473

get assigned a dedicated function in the smart con-

tract which serves as the controller who is able to

lookup owner’s Id on the distributed storage. To fur-

ther verify the authenticity of the acclaimed property,

owner’s call is responded to with a challenge policy

and requests for a VC linking the owner to the prop-

erty. Once received, owner looks up on their digital

wallet to confirm if verified attributes are sufficient

enough for authentication and covers request poli-

cies, if yes, owner is required to confirm the release

of verified attributes otherwise the process is discon-

tinued with an error message that requires owner to

provide more attributes that are not available. Using

a digital wallet, user manually wraps R

0

and B ,both

properties are signed with owner’s private key so that

marketplace controller may decode it with the shared

public key: Owner →marketplace: Pri

Kowner

(R’, B).

We assume that this exchange takes place over a se-

cured end-to-end communication. Upon receipt, mar-

ketplace controller confirms identity attributes on the

ledger, signed claim, device and location binding to

the owner that made the initial request, that nonce is

meant for the specific transaction and timestamp is

valid. Once this is confirmed real estate owner is able

to create SC

capability

and an IPFS link as shown in al-

gorithm 1, while a controller reviews the contract on

marketplace’s domain and deploys it as SC

transfer

, this

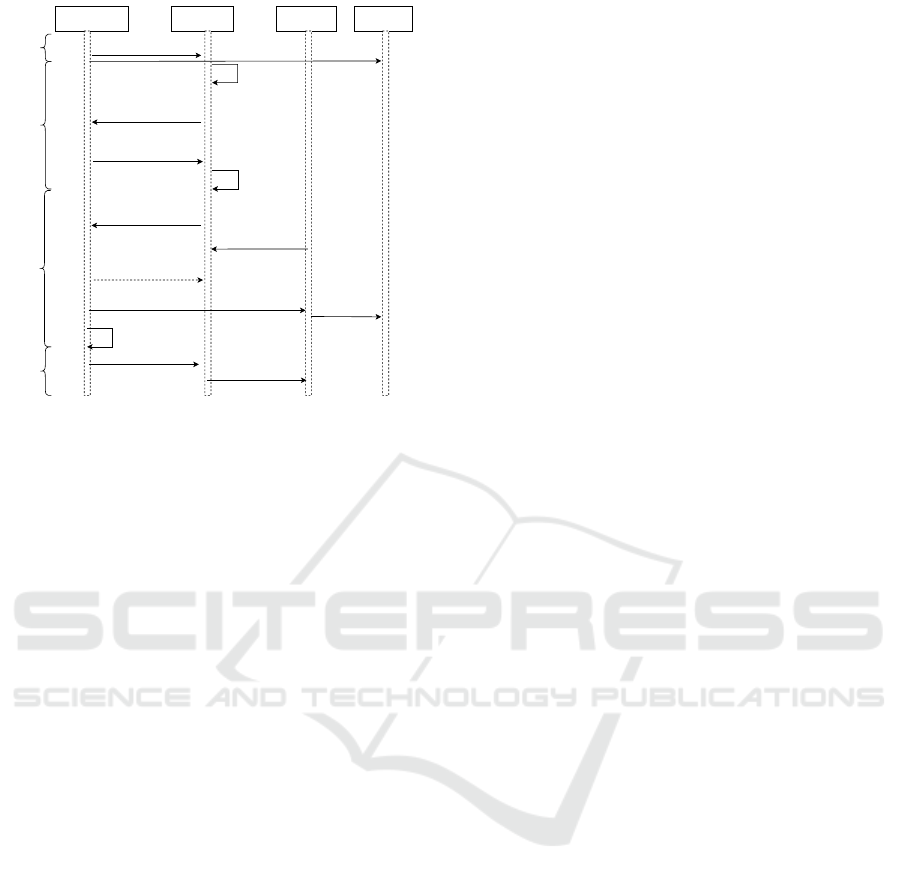

is shown in Figure 5.

Figure 5: Transfer contract.

4.3 Off Chain Data Processing

Despite benefits of blockchain, its not without some

limitations which include high cost of transaction

among others(Hughes et al., 2019), for this reason de-

centralised storage solutions such as IPFS, SWAMP,

BitTorrent, Filecoin among others are used to store

huge data that can be expensive to store on chain in

conjunction with blockchain system to create a decen-

tralised database. Although ownership of real estate

can be transferred or structure modified, it remains till

eternity (atleast the land). The immutability property

of IPFS serves well for real estate data storage.

During the contract creation process, a real es-

tate owner deposits complete identity information/de-

scription of the property off chain on an IPFS net-

work, but shares a hash value of the storage on the

contract. A complete picture of the property is pro-

vided with street view, and map location. To prevent

unwanted re-use of acquired picture, each document

downloaded is watermarked with owner’s name, re-

questors Id and market place that deployed the trans-

fer contract.

5 APPLICATION SCENARIO

Leveraging on data decentralisation and trust less net-

work, we foresee that the proposed framework can

be applied for the transfer of dematerialised property

that posses a VC. However, for clarity we conceptu-

alise our proposal using a real estate transfer contract.

We assume that a buyer wants to acquire a real estate

property through a smart contract that is hosted by a

market place. The process is made up of four compo-

nents; a real estate owner that deploys SC

capability

by

calling the function of a market place, market place

deploys owner’s contract using SC

transfer

on decen-

tralised owned platform, client/buyer a bidder that ex-

presses interest on advertised property and external

IPFS storage. As described in Figure 6, the compo-

nents describe the transfer through initialisation, reg-

istration, offer and finalisation.

Initialisation: This signifies the commencement of

a transfer process where a real estate owner cumulate

already created SC

capability

as shown in Algorithm 1,

and deposits an IPFS link of the property on an IPFS

network. A function for SC

transfer

is then created to

deploy the SC

capability

.

Registration: As described in Algorithm 1, to de-

ploy the functions of SC

capability

, the smart contract

checks five conditions which includes; (1) is the con-

tract deployed by the owner (2) is the property linked

to the owner on distributed storage (3) is the start

time greater than current time (4) the market place

also calculates commission and charges on the trans-

action with government tax and requests for owner’s

approval before it is finally published (5) the owner is

not involved making an offer for transfer process.

Offers: Once all conditions are satisfied and the

marketplace deploys transfer contract, it becomes vis-

ible to the public. An owner also receives a share ID

of the contract which gives them upmost control over

the contract. or make an offer but has upmost con-

trol to start, stop or suspend the process at will. Once

the contract is running, a user who has acquired VC

through the identification process described in Sec-

tion 4.1, uses their verified certificate to request par-

SECRYPT 2022 - 19th International Conference on Security and Cryptography

474

Propery owner Market Place Cleint/buyer External storage

Creates SC

capabality

for sale/lease

Obtain SC

capability,

include state

conditions

tax value and commision

Request owner's

approval for commission

and tax notification

Deploys

SC

capabality bytecodes

Implement

SC

capabality bytecodes

and deploy

SC

transaferShare deployement ID

and lifetime control

Request participation

in offer by

spending ether

owner periodically

checks process

accept or decline offer

invoke transfer process

accept/denytransfer

creates IPFS link

sends a one time

use and user spcific

acess to IPFS location

Initialiasation

Registration

Bidding

Transfer

access property

decsription

Figure 6: Real estate transfer process.

ticipation by making an offer (spending an ether) that

is equal or higher than current value of the property.

Once the offer is made, a user receives a user-specific

access to a full description of the real estate property

such as videos, picture, maintenance mode, setup and

every other information that might be deemed useful

for the transfer process. Generally, buyers are able to

view current offers of other buyers, likewise the mar-

ket place. However, only the owner is able to confirm

the full identity of a buyer.

Transfer: The owner monitors the transfer process

until the lifetime elapses (it can also increase the du-

ration or terminate the entire process when there is a

suspicion of fraud). A decision is then made to ei-

ther accept or reject offers. Buyers who wish to opt

out of the transfer process, before the last minutes are

fined from the cost paid for the transaction. Once an

offer is accepted, a buyer is informed of the process

and is requested to proceed with payment before fur-

ther transfer process is made. To further protect other

buyers a percentage of their offer is used as a gas fee

for the transaction. However, once a winner is cho-

sen, buyers are requested to proof their identity once

again in other to accept a refund for their bids.

6 ANALYSIS

From a functional point of view, we analyse the

strengths and weaknesses of the proposed framework.

We also assess their level of robustness in processing

personal information.

Robustness of Proposed Framework: The pro-

posed SSI and smart contract based real estate verifi-

cation framework follows a complete decentralisation

method. The identification, registration, verification

and identity proofing is free from central storage of

data. Therefore, there is no means for SPOF.

Issuance, identity verification process and use of

VC prevent a malicious attacker from getting hold-on

physical documents to claim ownership or steal prop-

erty. More so, with a trust-less framework, collusion

is made difficult as verifier need not to be aware of

the physical location of an issuer but can verify the

signature of any document it has issued.

Robustness of Identification and Verification:

These methods are used to capture full attributes of

users. Before a real estate VC is issued, user’s VC

need to have been acquired, therefore linking these

documents prevents false claim and other fraud as

user proofs ownership of both documents before any

transaction.

From verified attributes of a VC, user can gener-

ate self acclaimed and context based attributes that are

only linked to the VC and verifiable on the distributed

register. Therefore, to prevent profiling a user can

generate as much context based credentials for trans-

actions without been traced.

Robustness of Data Processing: Data decentralisa-

tion is among the core parts of the proposed work.

Although, one of the drawbacks of blockchain is

the use of varying standards which causes fragmen-

tation in adoption, hence interoperability between

blockchains only occurs among technologies with

same open source implementation or using a trusted

party (Bellavista et al., 2021).

To ensure that data processed for the transfer

is available, we used the IPFS open source storage

which is independently available on Web desktop and

provides sufficient memory space that lasted for upto

48hrs. Also, we assume that a completed document

signifying the transfer of property is processed off-

chain and deposited on the IPFS network.

7 CONCLUSION

In this paper we presented an SSI and smart contract-

based real estate transfer framework that can be used

to verify the identity of a genuine real estate owner,

real estate property and securely control the entire

transfer process within a digital marketplace. Our so-

lution uses a decentralised and distributed approach

to achieve the seamless verification process with data

A Decentralised Real Estate Transfer Verification based on Self-Sovereign Identity and Smart Contracts

475

integrity and personal data protection. The SSI meth-

ods ensure that only a verified real estate owner is

able to claim ownership of a property using verifiable

credentials.Those are acquired from an identity veri-

fication process and can be validated on a distributed

ledger. The smart contract is used to create the trans-

fer process by the owner and is deployed on a decen-

tralised marketplace. A distributed storage is used to

store a full description of the property which is ac-

cessible using a content identifier. We have also de-

fined an application scenario to test the validity of our

proposal. In addition we also provide a robustness

and security analysis of our framework with respect

to some specific previously identified threats. In the

future we plan to fully implement the remaining as-

pects of the framework, including the issuance of VC,

smart contract management, as well as integration of

policy makers to the framework for the issuance of tax

returns . We also hope to be able to mitigate the non

intended use of sensitive documents obtained via the

IPFS network.

ACKNOWLEDGEMENTS

This work is financed by National Funds through

the Portuguese funding agency, FCT - Fundac¸

˜

ao

para a Ci

ˆ

encia e a Tecnologia, within project

LA/P/0063/2020.

REFERENCES

Ali, T., Nadeem, A., Alzahrani, A., and Jan, S. (2020). A

transparent and trusted property registration system

on permissioned blockchain. In 2019 International

Conference on Advances in the Emerging Computing

Technologies (AECT), pages 1–6. IEEE.

Bellavista, P., Esposito, C., Foschini, L., Giannelli, C.,

Mazzocca, N., and Montanari, R. (2021). Interopera-

ble blockchains for highly-integrated supply chains in

collaborative manufacturing. Sensors, 21(15):4955.

Benet, J. (2014). Ipfs-content addressed, versioned, p2p file

system. arXiv preprint arXiv:1407.3561.

Bhanushali, D., Koul, A., Sharma, S., and Shaikh, B.

(2020). dipika. In 2020 International Conference on

Inventive Computation Technologies (ICICT), pages

705–709. IEEE.

Consortium, W. W. W. et al. (2019). Verifiable credentials

data model 1.0: Expressing verifiable information on

the web. https://www. w3. org/TR/vc-data-model/?#

core-data-model.

EPRA (2020). Real-estate-in-real-estate-economy.

https://www.inrev.org/system/files/2021-04/INREV-

EPRA-Real-Estate-Real-Economy-2020-Report.pdf.

Gupta, A., Rathod, J., Patel, D., Bothra, J., Shanbhag, S.,

and Bhalerao, T. (2020). Tokenization of real estate

using blockchain technology. In International Confer-

ence on Applied Cryptography and Network Security,

pages 77–90. Springer.

Hughes, L., Dwivedi, Y. K., Misra, S. K., Rana, N. P.,

Raghavan, V., and Akella, V. (2019). Blockchain re-

search, practice and policy: Applications, benefits,

limitations, emerging research themes and research

agenda. International Journal of Information Man-

agement, 49:114–129.

Kothari, P., Bharambe, A., Motwani, R., and Rathi,

A. (2020). Smart contract for real estate using

blockchain. In Proceedings of the 3rd International

Conference on Advances in Science & Technology

(ICAST).

Mendi, A. F., Sakaklı, K. K., and C¸ abuk, A. (2020). A

blockchain based land registration system proposal

for turkey. In 2020 4th International Symposium on

Multidisciplinary Studies and Innovative Technolo-

gies (ISMSIT), pages 1–6. IEEE.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic

cash system. Decentralized Business Review, page

21260.

Norta, A., Fernandez, C., and Hickmott, S. (2018). Com-

mercial property tokenizing with smart contracts. In

2018 International Joint Conference on Neural Net-

works (IJCNN), pages 1–8. IEEE.

Pain, N. and Rusticelli, E. (January 14, 2022). A sharp slow-

down in china’s property markets would damp global

growth. A sharp slowdown in China’s property mar-

kets would damp global growth, (3152676):1–4.

Ragnedda, G. and Destefanis, G. (2019). Blockchain and

Web 3.0. London: Routledge, Taylor and Francis

Group.

Shehu, A., Pinto, A., and Correia, M. E. (2019). Pri-

vacy preservation and mandate representation in iden-

tity management systems. In 2019 14th Iberian

Conference on Information Systems and Technologies

(CISTI), pages 1–6.

Shehu, A.-s., Pinto, A., and Correia, M. E. (2018). On the

interoperability of european national identity cards.

In International Symposium on Ambient Intelligence,

pages 338–348. Springer.

Soltani, R., Nguyen, U. T., and An, A. (2021). A survey of

self-sovereign identity ecosystem. Security and Com-

munication Networks, 2021.

Szabo, N. (2018). Formalizing and securing relationships

on public networks. First Monday.

Voigt, P. and Von dem Bussche, A. (2017). The eu gen-

eral data protection regulation (gdpr). A Practical

Guide, 1st Ed., Cham: Springer International Pub-

lishing, 10(3152676):10–5555.

Yadav, A. S. and Kushwaha, D. S. (2021). Blockchain-

based digitization of land record through trust value-

based consensus algorithm. Peer-to-Peer networking

and applications, 14(6):3540–3558.

SECRYPT 2022 - 19th International Conference on Security and Cryptography

476