The Effect of the Government Intern Control System, and

the Implementation of Regional Financial Accounting

Information System to the Performance of the

Government Agencies in the Southern District of

Bengkulu

Dri Asmawanti, Vika Fitranita, Irwansyah, and Nipi Puspita Sari

Faculty of Economy and Business University of Bengkulu, Bengkulu, Indonesia

onesyah2000@yahoo.com,elnicahya@gmail.com

Abstract. This study aims to examine the effect of the government's internal

control system, and the application of regional financial accounting information

systems to the performance of South Bengkulu district government agencies. The

samples in this study were echelon 2, 3, and 4 civil servants in the Regional

Devices Organization. The data used are primary data by distributing a

questionnaire of 30 children in the Organization of Devices in the district of

South Bengkulu. Data analysis was performed by multiple linear regression. The

results of the hypothesis testing of the government internal control system, and

the regional financial accounting information system have a positive effect on the

performance of the government agencies in the southern district of Bengkulu.

This indicates that the better the government internal control system, the better

performance of local government agencies. As well as the better implementation

of regional financial accounting information systems, it can improve the

performance of good local government agencies.

Keywords: Government ꞏ Control System ꞏ Financial ꞏ Accounting

1 Introduction

Local government is an institution that runs the government that has the trust of the

community. The trust given by the community to government administrators must be

balanced by good performance, so that services can be effectively improved and

touched the community. Good performance is meant here is the performance of local

government agencies that avoid fraud, misuse, waste, and avoid acts of corruption,

collusion, and nepotism, and good performance of government agencies are able to

develop initiatives and regional creativity and resources to encourage economic growth,

improve services to the community and increase community empowerment in the

context of regional autonomy.

Because the government's performance has a high enough risk, the government

formed a strategy to improve good performance in the future. The strategy used in

government is to implement a government internal control system, and implement a

Asmawanti, D., Fitranita, V., Irwansyah, . and Sari, N.

The Effect of the Government Intern Control System, and the Implementation of Regional Financial Accounting Information System to the Performance of the Government Agencies in the

Southern District of Bengkulu.

DOI: 10.5220/0010528400002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 725-736

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

725

regional financial accounting information system. This strategy helps the government

in realizing good performance as needed by the community.

The phenomenon of agency performance in the southern bengkulu government can

be seen from the results of the examination of LKPD FY 2011-2018 in the south

bengkulu regional government. This can be seen from the news published by

bengkulu.bpk.go.id, namely the local government of south bengkulu experienced a

decline in opinion in 2014 to 2015 which was issued by the BPK for the south bengkulu

government, with a decrease in this opinion shows that the performance of local

government agencies South Bengkulu is not good in financial management

performance.

Several previous studies on the performance of government agencies illustrate that

the government's internal control system, and the application of regional financial

accounting information systems can affect the performance of government agencies, as

examined by Agustina (2007) proves that the government's internal control system

positively influences the financial performance of the Aceh district government North,

this is done by the government so that the performance of government agencies has

improved even better in the eyes of the community. Then Roviyantie's research (2011)

which states that the application of regional financial accounting information systems

implemented by the government has a positive effect on government performance.

Related to the performance of government agencies, in this study the authors are

interested in researching and testing factors that are thought to have an influence on the

performance of government agencies in the South Bengkulu regional government,

namely the government's internal control system, and the application of regional

financial accounting information systems that can improve performance local

government agencies.

Based on the background above, the researcher carries the title of the research,

namely: "The Effect of Government Internal Sensing Systems, and Application of

Regional Financial Accounting Information Systems on the Performance of South

Bengkulu Regency Government Agencies".

2 Theoretical Framework and Hypotheses

2.1 Agency Theory

Agency theory is the employment contract relationship between the community and the

government, where in the relationship they both trust and hand over the task to the

government to run the government in accordance with the wishes of the community.

Relationships that arise between the community and the government (agents) are called

agency relationships. This agency relationship can cause conflicts between the two.

This conflict occurs because of differences in interests, where the government (agents)

have direct access to information, with this information access the government cannot

be trusted to act in the best interests of the community. While the public wants to obtain

the maximum welfare of the government they have.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

726

2.2 Framework

The role of the government's internal control system, and the application of the regional

financial accounting information system can be used to direct the government in

managing regional finance so that it can improve the performance of the regional

government apparatus in accordance with the provisions of the prevailing laws and

regulations. One of the main interests of government internal control systems and

regional financial accounting information systems in financial management is that local

governments must perform optimal performance in carrying out their duties and

responsibilities properly, so as to achieve the planned objectives.

The role of the government's internal control system, and the application of the

regional financial accounting information system in carrying out regional financial

management for the performance of local government institutions is one way to prevent

acts of abuse of authority carried out by local government officials. Based on the

description above, the research theoretical framework can be described in the following

chart:

2.3 Research Hypothesis

Based on the study of theory, the hypotheses constructed in this study are as follows:

H1: The government's internal control system has a positive effect on the performance

of the southern Bengkulu district government agencies

H2: The application of the regional financial accounting information system has a

positive effect on the performance of Bengkulu district government agencies.

3 Research Methods

This type of research is included in the type of research with a quantitative approach,

which is a method that describes the actual situation systematically, factual and accurate

about the influence of the government internal control system (SPIP) and the

application of regional financial accounting information systems (SIAKD) on the

performance of local government agencies. This study examines the hypothesis of the

relationship between two independent variables, namely the government's internal

control system, and the application of the regional financial accounting information

system with the Performance of Local Government Agencies in South Bengkulu.

Therefore, this research prioritizes research on primary data in the form of

questionnaires.

3.1 Operational Definition and Variable Measurement

3.1.1 Dependent Variable

The dependent variable in this study is the performance of local government agencies.

Where the measuring indicators are as follows:

The Effect of the Government Intern Control System, and the Implementation of Regional Financial Accounting Information System to the

Performance of the Government Agencies in the Southern District of Bengkulu

727

• Indicators for planning, choosing or setting organizational goals and determining

project policy strategies, programs or activities, procedures, methods, budget

systems and standards needed to achieve goals.

• Evaluation indicators, a systematic process of checking, determining, making

decisions or providing information on activities or programs that have been carried

out to what extent an activity or program of activities has been achieved.

• Supervision indicators, as determining what has been done, are meant to evaluate

the performance of work and if necessary, implement corrective actions so that the

results of the work are in accordance with the established plan.

• Indicator of independence, an attitude that allows someone to act freely to do

something on their own and for their own needs without help from others.

3.2 Sampling Method

The population in this study were all Regional Government Organizations (OPD) of

South Bengkulu Regional Government consisting of 30 South Bengkulu OPD. The

number of respondents in this study was 120 people. Each OPD was represented by 4

respondents, namely the head of the office (Kadis), the office secretary (Sekdis), the

section chief (Kabag), and the sub-section head (Kasubbag). Respondents' criteria in

this study were echelon 2, 3, and 4 echelon civil servants in the OPD. The sample used

in this study was selected using the purposive sampling method. Where the

determination of the sample has specific criteria that fit the purpose of the study so that

it can answer the research problem.

3.2.1 Data Collection Sources and Techniques

Data collection techniques in this study are primary. Data collection in this study uses

a direct survey. The instrument used was a questionnaire (questionnaire). Distribution

of questionnaires visited directly and distributed questionnaires to all respondents who

had been determined.

3.2.2 Data Analysis Method

Data analysis in this study was carried out using the help of the SPSS (Statistica

Package For Social Sciences) program. Version 16.0 For Windows. There are several

data analysis techniques used in this study, namely: Statistik Deskriptif, uji kualitas

data, uji validitas, uji reliabilitas.

3.2.3 Data Analysis Tool

In this study the data analysis tool used in this study is multiple linear regression. This

analysis is used to find out how much influence the independent variable has on the

dependent variable. With the following equation:

Y = βo + β1 X1 + β2 X2 + Ԑ

Where:

Y = Performance of Local Government Agencies

βo = Constant

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

728

β1; 2; = Regression Coefficient

X1 = government internal control system

X2 = application of regional financial accounting v information systems

Ԑ = Error

In multiple regression there are several classic assumptions that must be met, in order

to produce a linear estimator that is accurate and close to or equal to reality. These basic

assumptions are known as classical assumptions.

4 Results and Discussion

4.1 Population and Research Samples

And indicators of utilization of performance information, is a person utilizing work or

tasks assigned to him by carrying out his duties in accordance with his responsibilities,

4.2 Independent Variable

4.2.1 Government Internal Control System

In this study the government's internal control system is measured using indicators as

follows:

• Environmental control indicators, conditions in government agencies that affect

the effectiveness of internal control. In the government environment control is very

important so that internal control can be implemented properly and correctly.

• Indicators of control activities, the leadership of Government Agencies must carry

out control activities in accordance with the size, complexity, and nature of the

tasks and functions of the Government Agency concerned.

Based on the criteria made the number of samples in this study amounted to 120

questionnaires distributed, where the questionnaires that did not return 12, and 108

returned questionnaires, the questionnaires returned were all able to be processed

because they were qualified as research samples. The number of samples in the

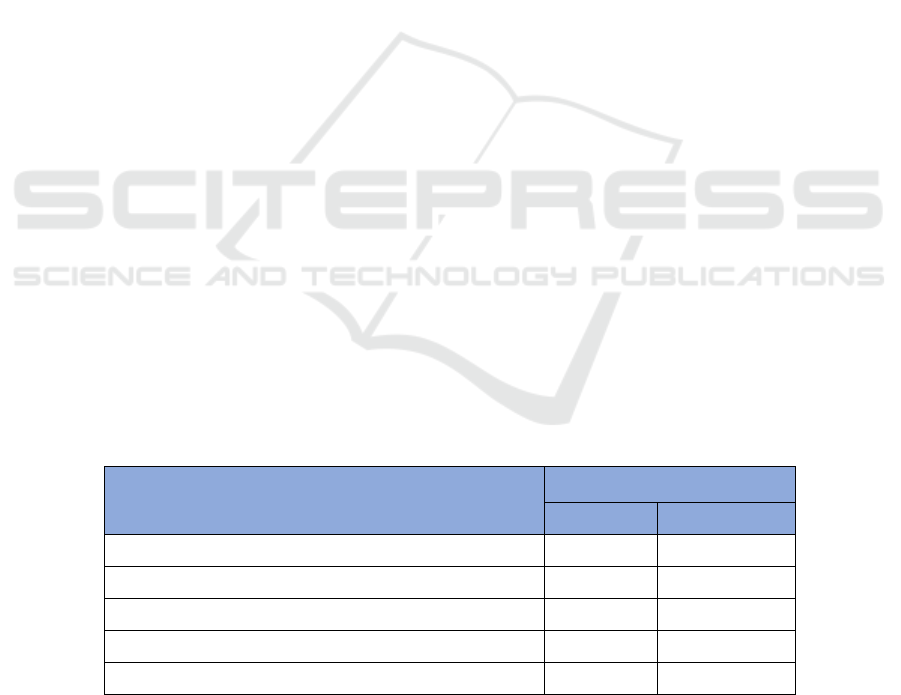

observation year are presented in Table 1 below:

Table 1. Delivery and Return Questionnaire Detail.

Information

Respondents

Amount

Percentage%

Questionnaire distributed 120 100%

Questionnaire that did not return 12 10%

Returned questionnaire 108 90%

Number of Questionnaires that cannot be processed 0 0%

Number of questionnaires that can be processed 108 90%

Source: Primary Data Processed, 2019

The Effect of the Government Intern Control System, and the Implementation of Regional Financial Accounting Information System to the

Performance of the Government Agencies in the Southern District of Bengkulu

729

4.3 Descriptive Statistics

Descriptive statistics are intended to analyze data based on the results obtained from

respondents' answers to each indicator of measurement variables. This study examines

how much influence the factors related to the performance of local government

agencies in the South Bengkulu Regency OPD environment. The following is a

descriptive statistics table can be seen from Table 2:

Table 2. Descriptive statistics.

Variable N

Theoretical Range Actual Range

Std.

Dev.

Min Max Mean Min Max Mean

Performance of local

g

overnmen

t

108 11 55 33 34 54 46,45 2,974

agencies

Government internal

control s

y

ste

m

108 23 115 69 68 114 95,44 6,351

Regional financial

accounting information

s

y

ste

m

108 5 25 15 18 25 22,01 1,782

Source: Primary Data Processed, 2019

4.3.1 Validity Test Results

Test the validity of the data this study uses the CFA (Confirmatory Factor Analysis)

test where the KMO (Kaiser-Meyer-Olkin) value of the analysis shows a value> 0.50

and the value of the Significance of the Bartlett's Test of Sphericity desired is <0.05,

and MSA (Measure of Sampling Adequacy) value> 0.50. The results of testing the

validity of the data can be seen in :

Table 3. Validity test results.

No Variabel KMO Sig MSA Information

1 KIPD 0,669 0,000 0,708 Valid

2 SPIP 0,737 0,000 0,722 Valid

3 SIAKD 0,669 0,000 0,678 Valid

Source: Primary Data Processed, 2019

Based on the results of the processing carried out as summarized in Table 4.6, the results

show that the Cronbach's alpha value of the study variable is greater than the value of

0.70; thus it can be concluded that all research instruments or variables are reliable.

4.3.2 Classic Assumption Test

The classic assumption test is used to determine the accuracy of the regression model

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

730

which is the basis for seeing the effect of the independent variables on the dependent

variable. The classic assumption tests used in this study are:

4.3.3 Normality Test

This normality test is carried out using the Kolmogorof-Smirnov One Sample Test.

Testing data is normally distributed if the Asymp Sig (2-tailed) value generated from

unstandardized residuals is greater than the alpha value of 0.05 (5%). Data normality

test results can be seen in: Table 4.

Table 4. Normality Test.

Asymp Sig (2-tailed) Information

0,445

N

ormal

Source: Primary Data Processed, 2019

From table 4 it can be seen that unstandardized residuals have an Asymp Sig value of

more than 0.05, so that the data used in this study are normally distributed.

4.3.4 Multicollinearity Test

Multicollinearity test is a test to find out whether or not there is a significant correlation

between the independent variables of the model under study. This test aims to test

whether the regression model found a correlation between independent variables. A

good model should not occur correlation between independent variables. (Ghozali,

2013). The results of multicollinearity testing of research data are as follows.

Table 5. Multicollinearity test.

No Variabel Tolerance VIF Information

1 Government internal control system

0,994 1,006

Multicollinearity

Free

2 Regional financial accounting

information system

0,994 1,006

Source: Primary Data Processed, 2019

Multicollinearity test can be seen from the Tolerance Value and Variance Inflation

(VIF). The basis for decision making is if tolerance value <0.10 or VIF value> 10 then

multicollinearity occurs, and if tolerance value> 0.10 or VIF value <10 then there is no

multicollinearity in the data to be processed. Based on the explanation above, it was

concluded that the tolerance values of all research variables> 0.10 and VIF values <10.

Table 6. Multicollinearity test.

Variabel Koefisien t-hitung Sig. Result

Government internal control s

y

ste

m

0,243 6,278 0,000 Accept

Regional financial accounting

information s

y

stem

0,286 2,070 0,041 Accept

The Effect of the Government Intern Control System, and the Implementation of Regional Financial Accounting Information System to the

Performance of the Government Agencies in the Southern District of Bengkulu

731

which means that there are no multicollinearity symptoms in the regression equation

model.

4.3.5 Heteroscedasticity Test Results

Heteroscedasticity test is testing residual assumptions with non-constant variance. A

good regression model if the variance from one residual to another observation is fixed

or homokedacity. The model used to detect heteroscedacity is a glacier test with a

significant probability above (>) a level of confidence α = 5% or 0.05 (Ghozali, 2013).

The results of heterosecedasticity testing are as follows:

Table 7. Heteroscedasticity test results.

Variabel Sig

Information

Government internal control system 0,197 Heteroscedasticity free

Regional financial accounting information

system

0,061 Heteroscedasticity free

Based on Table 7 above, it is known that the probability value (Asymp.Sig.) Variable

of the government internal control system, the regional financial accounting

information system used in this study has a homogeneous variant (free of

heteroscedasticity).

4.3.6 Hypothesis Test Results

This research aims to find out whether the internal control system variables of the

government, and regional financial accounting information systems (independent

variables) affect the performance of local government agencies (the dependent

variable), and to find out whether the regression model used is feasible or not to be used

in further analysis, where the decision making criteria are determined using a

significance level of 0.05. The results of SPSS output on the F value and R2 value can

be seen in Table 8.

Table 8. Hypothesis Test Results.

R Square 0,285

Adjusted R2 0,272

F 20,962

Sig. 0,000

Source: Primary Data Processed, 2019

Based on the regression results in Table 8 above it can be seen that the statistical value

of F in the model is 20,962 with a significance value of 0,000. A probability value of

0,000 less than 0.05 indicates that the model used in the study is feasible to use. Based

on the table above it can also be seen that the Adj R Square Value of the regression

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

732

model is 0.272 which shows that, 27.2% of the variation of the performance of local

government agencies is explained through changes by the government's internal control

system, and regional financial accounting information systems while the remaining

72.8 % is explained by variations or other changes not found in this equation.

Testing the hypothesis in this study using linear regression analysis. Testing to

determine the effect of each independent variable on the dependent variable is also done

by looking at the probability value (significance), where if the significant value <0.05,

then it means the independent variable influences the dependent, conversely if the

significant value> 0.05 is means the independent variable does not affect the dependent

variable (Ghozali, 2013).

Table 8 shows that government internal control system variables on the performance

of local government agencies provide a significant calculation result of 0,000 <0.05 and

the beta coefficient shows a positive direction (0.243). This shows that the government's

internal control system has a positive effect on the performance of local government

agencies. Thus, hypothesis 1 stated in this study was accepted.

The table above shows that the regional financial accounting information system

variables on the performance of local government agencies provide a significant

calculation result of 0.041 <0.05 and the beta coefficient shows a positive direction

(0.286). This shows that the regional financial accounting information system has a

positive effect on the performance of local government agencies. Thus, hypothesis 2

stated in this study was accepted.

4.4 Discussion

Government Internal Control Systems Against Performance of Local Government

Agencies The first hypothesis (1) states that the government's internal control system

has a positive effect on the performance of government agencies empirically proven.

This means that the government internal control believes that the government internal

control system influences the performance of government agencies.

These results indicate that the better the role of government internal control systems,

the better the performance of local government agencies produced. The government

internal control system is a government internal control system that must be

implemented in the OPD environment in improving the performance of government

agencies. This fact is in line with Government Regulation No. 60 of 2008 that the

purpose of the government internal control system aims to provide adequate confidence

in the achievement of the objectives of the regional organization through the control

environment and control activities in improving the performance of local government

agencies.

Regional Financial Accounting Information Systems Against the Performance of

government agencies

The second hypothesis (2) states that the regional financial accounting information

system has a positive effect on empirically proven performance of local government

agencies. This means that respondents believe that the regional financial accounting

information system in the OPD where they work can improve their performance in

financial management.

Regional financial accounting information systems in the performance of financial

managers affect the performance of local government agencies (organizations) where

The Effect of the Government Intern Control System, and the Implementation of Regional Financial Accounting Information System to the

Performance of the Government Agencies in the Southern District of Bengkulu

733

they work, when in their work place the use of financial SIMDA software is in line with

the conditions set in the organization in accordance with statutory regulations, and

standards government accounting. Regional financial accounting information systems

help direct an organization to financial statements that are timely, reliable, relevant,

comparable. In addition, the regional financial accounting information system will

increase the speed of reporting time, improve security, increase cost efficiency and

improve the accuracy of results (quality of results) in the preparation of financial

statements.

5 Conclusion

This study aims to provide empirical evidence of the influence of the government's

internal control system, and the application of regional financial accounting

information systems to the performance of regional government agencies in South

Bengkulu Regency. From the data obtained and the analysis that has been carried out

in this study, the following conclusions are: The government internal control system

has a positive effect on the performance of the South Bengkulu district government

agency. This shows that the better the system of government internal control, the better

the performance of local government agencies. A good internal control system in this

study is only measured through indicators of the control environment and control

activities.The application of the regional financial accounting information system has

a positive effect on the performance of the South Bengkulu district government agency.

The better the level of implementation of the regional financial accounting information

system, the better the performance of local government agencies.

References

Afrida Nur. 2013. The Effects of Decentralization and Government Internal Control Systems on

the SKPD Managerial Performance.

Agustina Neo, Edi Zulfiar, Safrida Hamun. 2017. Effect of Government Internal Control Systems

and Understanding of Accounting Information Systems on Financial Performance. Journal

of Accounting and Development, Vol. 3, No.3. November 2017.

Asril Muhammad Yusuf. 2017. Effect of Competence of Human Resources, Application of

Regional Financial Accounting Information Systems, and Application of Government

Internal Control Systems to the Quality of Financial Statements of Medan City Government.

Thesis.

Choirunisah, Fariziah, 2008. Factors That Influence the Quality of Information on Financial

Statements Produced by the Accounting System for Agencies, Thesis, UGM Maksi,

Yogyakarta.

Diani, Dian Irma, 2009. The Influence of Accounting Understanding, Utilization of Regional

Financial Accounting Information Systems and the Role of Internal Audit on the Quality of

Regional Government Financial Reports (Empirical Study on Regional Apparatus Work

Units in Pariaman City). UNP Journal.

Khairudin 2016. The Effect of Transparency and Accountability of Regional Government

Financial Statements (LKPD) on the Level of Corruption of Local Governments. Journal of

Accounting and Finance Volume, 7. No, 2. September 2016: 137-154

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

734

Kurniawan, Edi. 2017. Effect of Competence in Human Resources, Utilization of Information

Technology, and the Role of the Government's Internal Control System on the Quality of

Mukomuko District Government Financial Statements. Thesis.Kinerja Perusahaan. Jurnal

Ekonomi, ISSN 1978-9998. Vol.4, No. 1, Juni 2011.

Dewi, AAA Ratna. (2004). Pengaruh Konservatisma Laporan Keuangan Terhadap Earnings

Rosponse Coeficient. Jurnal Riset Akuntansi Indonesia, 7(2), 207-223.

Kurniawan, Edi. 2017. Effect of Competence in Human Resources, Utilization of Information

Technology, and the Role of the Government's Internal Control System on the Quality of

Mukomuko District Government Financial Statements. Thesis.

Examination No.28.A / LHP / XVIII.BKL / 05/2017. An Examination of the South Bengkulu

Regional Government's Financial Report Has Been Conducted. (www.bengkulu.bpk.

go.id/?p=6321). Accessed September 17, 2017.

Martalia, Repi. 2018. The Influence of DPRD Member's Knowledge of the Budget on APBD

Supervision with the Moderating Variable of Public Accountability and Organizational

Commitment. Empirical Study of DPRD Members in Bengkulu Province. Thesis.

Mardiasmo. 2006. Embodiments of Transparency and Public Accountability through Public

Sector Accounting: A Suggestion of Good Governance. Journal of Government Accounting.

Vol. 2 No.1.

MenPAN (State Minister for Administrative Reform) .2007. Success and Failure Rates of

Implementing Government Activities in Accordance with Programs and Policies.

Permatasari, Meriem, Temasmi. 2016. Effect of Employee Commitment and Government

Internal Control Systems on Local Government Performance in Pasuruan City. Thesis.

Full Moon Fifit. 2016. The Effect of Regional Financial Oversight, Accountability, and

Transparency in Regional Financial Management on the Performance of Local Governments

in Southwest Aceh district. Scientific Journal of Accounting Economics Students (JIMEKA).

Vol. 1, No. 2, 2016: 01-15.

Son Deki. 2013. The Effect of Public Accountability and Clarity of Budget Objectives on the

Management Performance of Regional Work Units (SKPD). Empirical Study on the Work

Unit of the City of Padang. Description.

Princess Yolanda Gustika. 2013. Effect of Organizational Commitment and Government Internal

Control System (SPIP) on the Performance of government agencies. Thesis.

Submission of Audit Reports on TA LKPD (2011-2018). Submission of LHP to the South

Bengkulu Regional Government conducted by the BPK (Supreme Audit Agency).

(https://bengkulu.bpk.go.id/?p=6324),

(https://www.rmolbengkulu.com/read/2018/05/28/8635), (https://betvnew.com/ inspektora-

bs-work-quick-fix-lhp-findings-bpk-ri)

Riantirno, Reynaldi and Nur Azlina. 2011. Factors Affecting Government Agency Performance.

Journal Volume.3. Number .3. November 2011

Ridwan Tolley, selviany Sukma, Kasim Yunus. 2017. The Influence of the Government Internal

Control System on the Performance of the Sigi District Work Unit. E-Journal Catalog, Vol.

5 No. 2. February 2017 pp 179-190

Roviyantie, Devi. 2011. Effect of Competence of Human Resources and Regional Financial

Accounting Systems on the Quality of Financial Statements. Journal of Siliwangi University.

Setyaningrum Dyah. 2012. Analysis of the Effect of Local Government Characteristics on the

Level of Disclosure of Financial Statements. Indonesian Journal of Accounting and Finance

Volume 9. Number 2. December 2012: 154-170.

Sinarwati Kadek Ni, Rahayu Sri Luh Ni, and Sulindawati Erni Gade Luh Ni. 2014. Influence of

Participation in Budgeting, Quality of Human Resources (HR), and Application of

Accounting Information Systems on Local Government Performance. E-Journal S1 Ak

University of Ganesha Education Department of Accounting S1 Program. Vol. 2 No. 1 of

2014.

Republic of Indonesia. Law Number 32 of 2004. Concerning Local Government.Law Number

33 of 2004. Concerning Central and Regional Government Financial Balance.

The Effect of the Government Intern Control System, and the Implementation of Regional Financial Accounting Information System to the

Performance of the Government Agencies in the Southern District of Bengkulu

735

Law No. 17 of 2003 concerning State Finance.

Law Number 1 of 2004 concerning State Treasury.

Republic of Indonesia Government Regulation Number 60 Year 2008. Concerning Internal

Control System.

Republic of Indonesia Government Regulation Number 56 of 2005 Concerning Regional

Financial Information Systems.

Regulation of the Minister of Home Affairs Number 59 of 2007. Concerning Regional Financial

Accounting Information Systems.

Regulation of the Minister of Home Affairs Number 13 of 2016. Concerning Regional Financial

Management.

Government Regulation Number 58 Year 2005 Article 4 paragraph (1). Declares Managed

Regional Finance in an orderly manner.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

736