Financial Regulation based on the Implementation of Financial

System Assessment Indicators: Regional Aspect of Methodology

Elena A. Razumovskaya

1

a

, Aleksey V. Ledebev

2

b

and Adil Basheer Dhahir Dukhkhani

3

c

1

Ural State University of Economics, Yekaterinburg, Russian Federation

2

Fund for the Development of Qualifications and Competencies in the Urals Region, Yekaterinburg, Russian Federation

3

Ministry of Education, Higher Education and Scientific Research Republic of Iraq, University of Wasit, Iraq

Keywords: Financial Regulation, Regional Development, Socio-Economic Development, Financial and Real Sectors,

National Economy.

Abstract: The presented research is of a review nature. The subject of the research is the financial and economic

indicators of the Russian Federation's national economy, based on the analysis of which the authors attempt

to propose a methodology for assessing the sustainability of regions. The assessment of the contribution of

individual regions to the socio-economic development (SED) of the country is relevant for many countries of

the world, regardless of the territory's size. The administrative status of the regions is also irrelevant for this

assessment. The main and, perhaps, the only indicator of assessing the contribution of the region to socio-

economic development is the gross regional product (GRP), by analogy with the gross domestic product

(GDP), calculated as the sum of the added values created in the region of goods for the period. In this regard,

the authors consider it a promising scientific and methodological task to expand the tools of this assessment

for the formation of a more effective socio-economic and financial policy of the state. The research hypothesis

is to find a mechanism for regulating the national economy by targeting individual financial parameters. The

existing methods of such regulation are limited mainly by changes in the Central Bank rate, which indirectly

affects the real economy through the cost of financial resources for economic entities. However, the regulation

can be expanded, becoming significantly more effective and, at the same time, less restrictive. The scientific

potential of the presented research is determined by the influence exerted by state regulation on the

sustainability of the socio-economic development of individual regions and the national economy as a whole

through the implementation of a targeted financial policy. The authors are convinced that the result of the

research are proposed additions to the methodology for assessing the contribution of individual regions to the

socio-economic development of the country, has scientific and methodological novelty and is suitable for

practical application in the analysis of the financial and real sectors of the regions.

1 INTRODUCTION

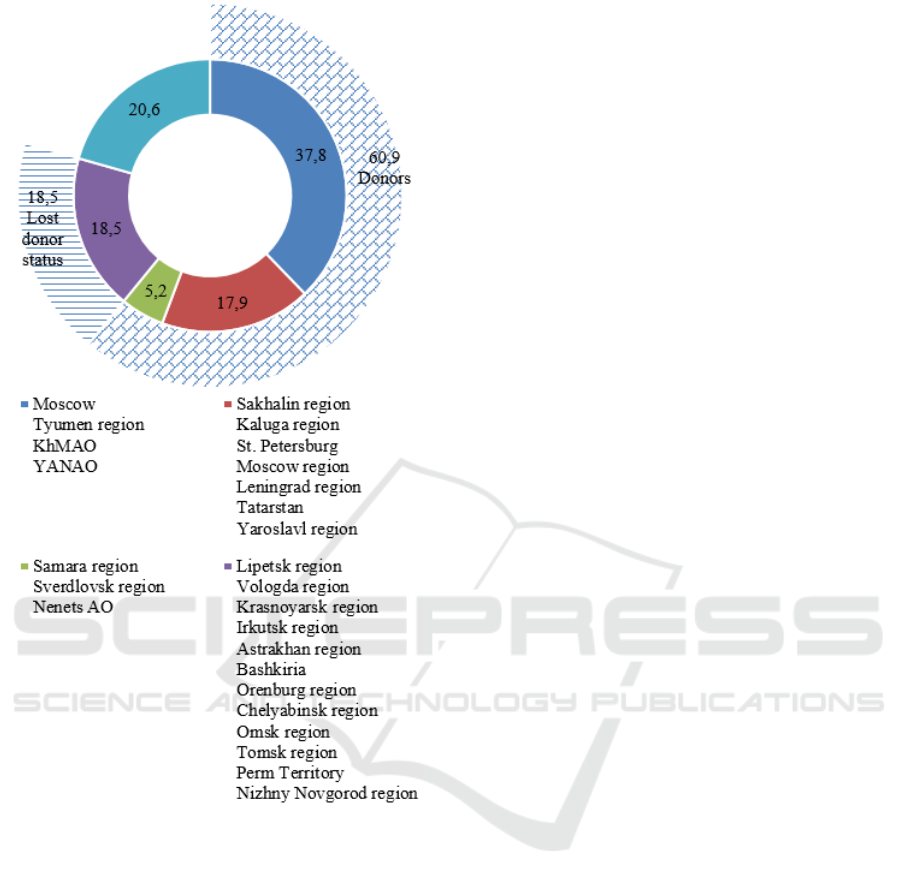

For the Russian Federation, the task of stimulating

regional development is particularly acute, since in 15

years (from 2006 to the beginning of 2021) the

number of donor regions has decreased from 25

(providing about 80% of federal budget revenues) up

to 14 (Figure 1).

Experts believe that the main reasons for this

dynamic are the centralization of income, which is

fixed by the inter-budgetary policy. In addition to the

a

https://orcid.org/0000-0003-3566-9225

b

https://orcid.org/0000-0002-9149-2439

c

https://orcid.org/0000-0003-3566-9225

analysis of tax revenues, the authors have proposed a

number of other indicators, the totality of which

should be considered a methodology. The proposed

methodology, as well as any other, should be

discussed in scientific circles and tested before being

recommended for use. Moreover, the authors believe

that the methodology can be transformed by adding

new indicators or making changes to the proposed

coefficients.

Razumovskaya, E., Ledebev, A. and Dukhkhani, A.

Financial Regulation based on the Implementation of Financial System Assessment Indicators: Regional Aspect of Methodology.

DOI: 10.5220/0010668300003223

In Proceedings of the 1st International Scientific Forum on Sustainable Development of Socio-economic Systems (WFSDS 2021), pages 349-354

ISBN: 978-989-758-597-5

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

349

Figure 1: Structure of regional tax revenues in the

consolidated budget of the Russian Federation, %

The opinion about the influence of financial

indicators on the dynamics of macroeconomic

indicators is very obvious and even axiomatic – this

is true for all modern states. It is based on this opinion

that the financial and socio-economic policy of any

state is formed. The search for sources of economic

development and tools to stimulate it is the focus of

research in the world and domestic financial science

(Razumovskaya and Lebedev, 2019; Lebedev and

Razumovskaya, 2020; Drobyshevsky, Trunin,

Bozhechkova, 2018; Drobyshevsky et al., 2020;

Bernanke, 2020; Blanchard and Summers, 2018;

Brand, Bielecki, Penalver, 2017). The theoretical and

methodological aspects of these sources and tools are

traditionally associated with institutional concepts,

while the practical ones are no less important to the

authors. In this regard, the authors set the task of

analyzing the dynamics of the financial parameters of

the domestic financial system in comparison with the

dynamics of the macroeconomic ones to identify the

correlation between them. Such a correlation, if

confirmed, will confirm the relationship between

these parameters, which, if at all obvious, needs to be

interpreted as a cause-and-effect relationship and an

assessment of the degree of trend volatility. The

present research attempts such an interpretation.

The context of this research suggests that the

objects of direct state regulation are the parameters of

the financial system, and through it - the pace and

direction of changes in economic indicators, which

assess the socio-economic development of all

economic entities. This type of research consists in

assessing the quantitative financial and economic

parameters that form the basis of monetary analysis.

The expected result of the research should be

justification of objective financial parameters,

regulation of which, ultimately, is directed to the

financial policy of the state, which is usually

attributed to: the key rate and reserves of the Central

Bank, monetary aggregates, total assets of

commercial banks (Drobyshevsky, Trunin,

Bozhechkova, 2018; Drobyshevsky et al., 2020;

Bernanke, 2020). These parameters fully reflect the

condition of the financial system and can be used to

assess its impact on socio-economic development,

since they determine the cost of financial resources in

the national economy (Blanchard O.J., Summers,

2018; Brand, Bielecki, Penalver, 2017; Chakraborty,

Goldstein, MacKinlay, 2020).

2 RESEARCH METHODOLOGY

The most common and generally accepted method in

the comparative analysis of data is the relative or

coefficient method, which involves calculating the

ratio of one of the considered values to another or a

certain generalizing value. The result, obviously, will

be the "share" – in this research - the contribution of

an individual region to the indicator of national

development. Such an indicator would be appropriate

to take the gross product – regional and domestic,

respectively.

However, the authors believe that this method

cannot fully reflect the analyzed component, since it

shows the share of added value created in the region,

while it is necessary to understand the sources from

which this added value was created. In addition, as

indicated, the value in the assessment under

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

350

consideration can and should take into account the

indicators:

1) share of the region's financing of national goals

– share of tax revenues in the consolidated budget;

2) share of transfer the region's financing;

3) creditworthiness of the region (as an option - in

the industry context);

4) market capitalization of regional companies;

5) investment adequacy.

The authors believe that the proposed set of

indicators is a methodology aimed at assessing the

economic potential of the regions, which determines

their sustainable development.

To assess the condition and dynamics of the

Russian financial system's financial indicators, the

authors used analytical and expert methods of

analyzing official data of the Bank of Russia and the

Federal State Statistics Service of the Russian

Federation. The analytical method is implemented in

the framework of comparative and dynamic analysis,

for which the analysis is processed by the authors and

presented in a single format suitable for the method

of expert assessments.

The analysis is supplemented by the analysis of

the domestic commercial banks' capitalization

dynamics.

3 RESEARCH RESULTS

The authors' proposal to supplement and develop the

methodological apparatus for assessing the

contribution of individual regional entities to the state

budget consists in an indicator showing how much

tax deductions provide the region's contribution to

the gross domestic product:

k

credit.

= (share of DFR in GDP, %) / (Share

of regional tax revenues, % of the federal

b

ud

g

et)

(1)

The authors believe that the coefficient (1) can

reveal the disproportion of the donor regions'

contribution to the value of the regional gross

product, as well as the insufficiency of the similar

contribution of the recipient regions. However, this

indicator should be calculated for an adequate

assessment of the status of the regions and their

development prospects.

The following indicator allows one to assess the

degree of the region's dependence on federal funding:

k

financial dependence

= (share of DFR in GDP,

%) / (Share of funding from the federal

b

ud

g

et, % of the re

g

ional bud

g

et)

(2)

In fact, the assessment of the degree of the region's

dependence on the funding that comes to its budget in

various forms from the federal budget allows one to

understand the significance of this funding for the

sustainability of the region.

The third indicator proposed by the authors

reveals the significance of the debt burden in its

development:

k

credit.

= (share of DFR in GDP, %) / (Share

of total debt liabilities of the region, % of

the re

g

ional bud

g

et)

(3)

Taking into account the nature of inter-budgetary

relations in the Russian Federation, coefficient (3),

along with coefficient (2), assesses the contribution

of federal credit financing and borrowing from other

sources to the development of the region.

Coefficient (4) makes it possible to see the impact

of the share of the region companies' total market

capitalization on the region's performance.

k

market cap.

= (share of DFR in GDP, %) /

(Share of the total capitalization of the

region companies, % of the capitalization

of the Russian Federation)

(4)

Indicator (4) should be calculated separately for

the financial and real sectors, as well as consolidated.

The final coefficient evaluates the value of

investments in the sustainable development of the

region:

k

inv. asset

= (share of DFR in GDP, %) /

(Share of the region's investment

expenditures, % of the re

g

ion's bud

g

et)

(5)

It is the indicator (5) that seems to the authors to

be the most significant from the point of view of

revealing the internal potential of the regions, since,

unlike credit financing or financing through budget

instruments, investments are a free, if it is possible to

say so, form of attracting resources: in sense of terms,

cost, repayment terms, and a number of others, which,

of course, makes the investment flexible.

For a full assessment of the potential of state

financial regulation of the national economy socio-

economic development

Conducting an extended research of the financial

system includes an analysis of the dynamics of socio-

economic indicators, so the authors analyzed the

array of analytical data, the results of which are

presented in Table 1.

Financial Regulation based on the Implementation of Financial System Assessment Indicators: Regional Aspect of Methodology

351

Table 1: Dynamics of Russian commercial banks

capitalization (The official website of the Central Bank of

the Russian Federation).

Periods

Total assets

of a

Commercial

Bank,

billion

rubles.

Change in total

assets

compared to

the previous

period, %

Total

assets per 1

Commercia

l Bank,

billion

rubles.

01/01/2014 57,423 + 15.9 62.213

01/01/2015 77,653 + 35.2 93.109

01/01/2016 82,999 + 6.9 113.232

01/01/2017 80,063 – 3.5 128.512

01/01/2018 85,192 + 6.4 151.857

01/01/2019 94,084 + 10.4 186.675

01/01/2020 96,581 + 2.3 192.411

01/01/2021 103,698 +7.4 357.098

As can be seen from Table 1, the total assets of

commercial banks have increased significantly both

in absolute terms and per structural unit. During the

research period, the value of the total assets of

commercial banks almost doubled, and the growth

per commercial bank was more than five times.

The period of pandemic restrictions in 2020 has

generated significant shocks in the real sector, which

the Russian economy has not yet managed to fully

overcome. Russia's ongoing geopolitical standoff

with Western countries has triggered another

devaluation surge, fueled by Russia's disagreements

with the Organization of the Petroleum Exporting

Countries cartel over the synchronization of oil

production efforts in a world market significantly

weakened by the COVID-19 pandemic.

However, the pandemic shocks did not worsen the

performance of the domestic financial system – by the

beginning of 2021, the total assets of commercial

banks increased by more than seven percent, which

was obviously facilitated by the state policy in the

field of social assistance to the population and the

expansion of measures to stimulate crediting. Another

important parameter of financial system's condition,

the authors consider enlarged macro-financial

indicators: monetary aggregates, reserves of the

Central Bank and the volume of non-cash payments

(Table 2).

Table 2: Indicators of the Russian Federation's financial

system's condition at the beginning of the period (The

official website of the Central Bank of the Russian

Federation; Official site of the Federal State Statistics

Service).

Years

Reserves

of the

Central

Bank of

the

Russian

Federation,

million

USD

The

volume

of non-

cash

payment

s, billion

rubles.

M0,

billion

rubles.

M1,

billion

rubles.

М2,

billion

rubles.

2014 50,959.5 34,999 6,985.6 24,419.1 31,404.7

2015 38,546.1 40,514 7,171.5 24,939.1 32,110.5

2016 36,839.9 50,129 7,239.1 28,570.1 35,809.2

2017 37,774.1 61,985 8,034.3 30,703.1 39,275.9

2018 43,274.2 76,247 8,446.7 33,994.1 42,442.2

2019 46,849.5 78,946 9,339.2 34,351.8 47,109.3

2020 55,435.9 80,321 9,658.4 35,861.7 51,660.3

2021 59,742.1 86,128 12,523.9 37,785.6 58,652.1

As can be seen from Table 2, the volume of non-

cash payments continues to increase. The significance

of this indicator for assessing the financial system's

condition and the national economy is the ability to

analyze trends in the legalization of an unobserved

segment of the economy. The growth of the Central

Bank's reserves should also be considered as a

positive trend, as well as the growth of monetary

aggregates.

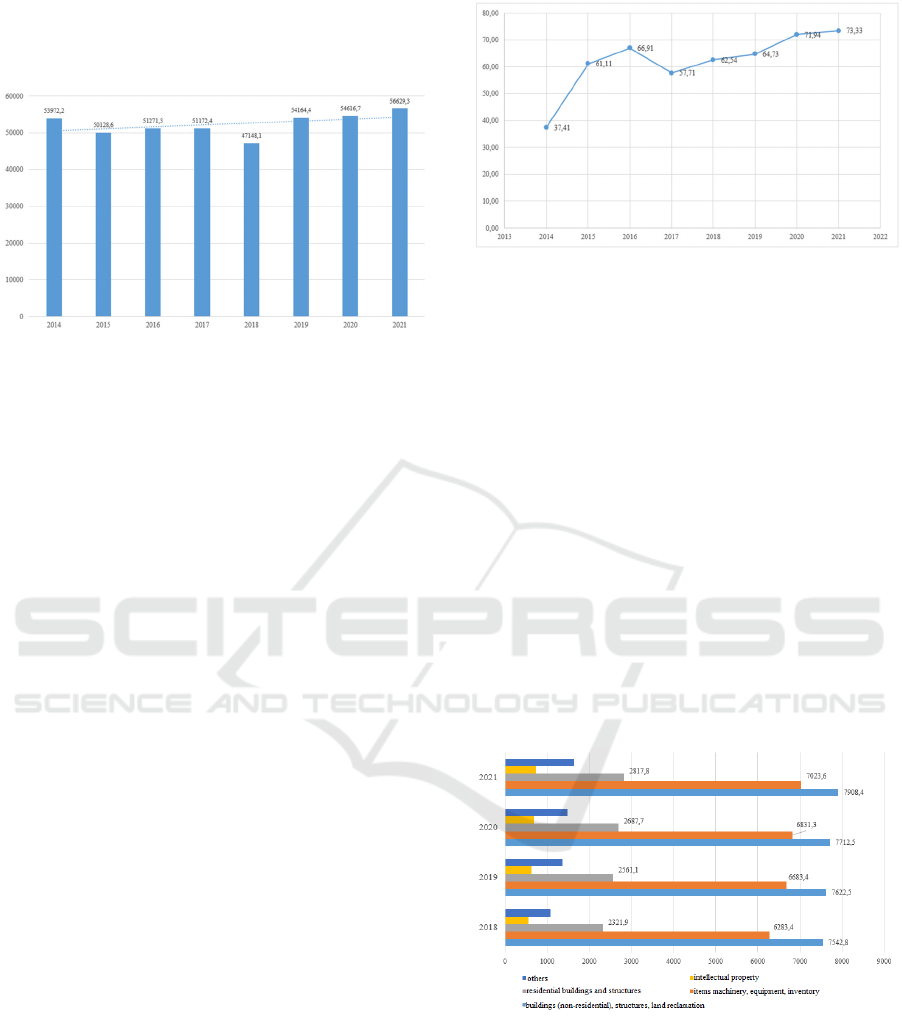

The clearly identified trends are shown in Figure

1.

Figure 1: Dynamics of macro-financial indicators of the

Russian Federation financial system, billion rubles.

In continuation of the research, the authors

analyzed the dynamics of one of the most important

indicators that characterize the potential stability of

the financial system and the entire economy – state

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

352

debt (Figure 2). The advantage of such an analysis is

its stable assessment of internal inflation-in a freely

convertible currency, in this case – US dollars (USD).

Figure 2: Dynamics of the external state debt of the Russian

Federation, mln. USD (Lebedev and Razumovskaya, 2020;

Official site of the Federal State Statistics Service)

Analysts' predictions suggest that by the end of 2021,

external financial liabilities will increase to twenty

percent of GDP, which is certainly far from the risk

category in which some European countries – Greece,

Italy, Spain and others-are located. The authors

consider the question of whether the sanctions

imposed by the United States administration on state

debt will become critical for Russia to be debatable

and political, while the difficulty of servicing even a

relatively small state debt for Russia takes place and

is due to the level of development and the degree of

diversification of production, which do not allow to

fully meet it (debt) in critical circumstances.

S&P Global Ratings, an international rating agency

left Russia's rating at the beginning of 2021 at the

level of "BBB -", which is below the investment

category, although with a stable prediction

(Fîrcescua, 2012).

In Russia, it is the devaluation risk associated with

state debt, which can significantly increase the debt

burden without additional borrowing, provided that

the credit resources were attracted in foreign

currency. Then the devaluation (Figure 3) will

increase the debt burden in the national currency.

Figure 3: Dynamics of the Russian ruble against the USD

(The official website of the Central Bank of the Russian

Federation; Official site of the Federal State Statistics

Service)

Figure 3 shows the volatility of the exchange rate

of the Russian Federation's national currency, so the

decline in the world that began in the spring of 2020

due to quarantine restrictions affects the Russian

currency. Compensation from devaluation losses can

be expected only with a significant increase in world

prices for hydrocarbons, the share of export revenues

of which is important for the state budget of the

country. In addition, these are foreign currency

receipts, which in ruble terms are growing at a higher

rate than the prices themselves. The interim results of

the analysis of the Russian economy's financial

parameters include the impact they have on the real

sector - this impact is focused on the dynamics of

investment, which is the source of real economic

growth (Figure 3).

Figure 3: Comparative dynamics of investments in fixed

assets by type of fixed assets in the Russian Federation,

million rubles (

Compiled by the authors according to

the Federal State Statistics Service of the Russian

Federation. Data for 2021-the authors' prediction

)

As can be seen, the growth rate of investment in

2020 slowed down, with the exception of

construction, which is significant outside the general

external context due to the importance that the

Financial Regulation based on the Implementation of Financial System Assessment Indicators: Regional Aspect of Methodology

353

construction industry has on the economy of any state,

acting as a engine and indicator of its condition and

dynamics. The increase in investment in the

modernization and renewal of equipment is of

particular importance - it is a category that can provide

intensive growth in labor productivity, an increase in

the share of value added in manufactured products,

which is the main source of GDP growth. In the period

under review, the volume of investments under the

item "machinery and equipment" increased by 4.8%.

The question of how significant the multiplier

effect of this category of investment can be is open,

since it can be leveled by an increase in the value-

added tax rate, introduced in the Russian Federation

from 2019, despite the state budget surplus.

4 CONCLUSIONS

Research on the assessment of the condition and

structure of the financial system by Russian and

foreign scientists is based mainly on the proposal of

independent indicators of the financial system's

ability to stimulate economic growth – that is, the real

sector (Ergungor, 2008; Fîrcescua, 2012). Such

indicators include, in particular, the financial depth

coefficient, which is defined as a set of financial

requirements and obligations of economic entities to

the country's GDP, in other words, the financial depth

reflects the ability of financial institutions to provide

financing for the activities of households, economic

entities and the state (Clarida, 2020; Charbonneau et

al., 2017). The authors agree that the availability and

accessibility of financial instruments and the

development of financial infrastructure give an idea

of the financial system's ability to accumulate and

distribute financial resources to ensure the necessary

economic growth rates for the country. A sufficient

value of the financial depth coefficient indicates an

increase in the ability of the financial system to

service financial resources traded on the financial

market, preventing significant and sharp volatility in

the quotations of financial instruments and the

currency exchange rate (Eggertsson, Juelsrud,

Summers, Wold, 2019). The authors believe that the

apparatus for assessing the state of the financial

system can be very diverse and reflect its goals – the

importance of the banking sector, the financial

market, financial regulation, and others.

The authors consider the presented results as

suitable (at least partially) for assessing the condition

of the state's financial system. A significant part of the

research conducted by the authors is based (along

with the presented ones) on a set of other parameters,

some of which are supplemented by the authors in the

methodological part. The assessment of the Russian

financial system's condition allows to conclude that

the dynamics of its key financial parameters should

be assessed as not corresponding to the period of

sustainable growth, despite the serious efforts of the

authorities to stabilize the domestic financial and

economic environment and to neutralize the

consequences of unfavorable external conditions that

continue to negatively affect the domestic economy.

REFERENCES

Razumovskaya, E.A., Lebedev, A.V., 2019. Theoretical

aspects of modeling the results of socio-economic

development of the national economy of Russia.

Lebedev, A.V., Razumovskaya, E.A. 2020. The

relationship between the results of socio-economic

development and the parameters of the structure of the

financial system of Russia.

The official website of the Central Bank of the Russian

Federation. Electronic resource.

https://www.cbr.ru/statistics/ms/

Official site of the Federal State Statistics Service.

Electronic resource. http://www.gks.ru/wps/wcm/

connect/rosstat_main/rosstat/ru/statistics/accounts/

Drobyshevsky, S.M., Trunin, P.V., Bozhechkova, A. 2018.

V. Long-term stagnation in the modern world.

Drobyshevsky, S.M., Trunin, P.V., Sinelnikova-Muryleva,

E.V., Makeeva, N.V., Grebenkina, A.M., 2020. The

article Optimal inflation in Russia: theory and practice.

Bernanke, B.S. 2020. The new tools of monetary policy.

Blanchard, O.J., Summers, L. H., 2018. Rethinking

stabilization policy: Evolution or revolution? NBER

Working Paper, No. w24179. https://doi.org/10.3386/

w24179

Brand, C., Bielecki, M., Penalver, A., 2017. The natural

rate of interest: Estimates, drivers, and challenges to

monetary policy.

Chakraborty, I., Goldstein, I., MacKinlay, A. 2020.

Monetary stimulus and bank lending.

Clarida, R. 2020. The Federal Reserve’s new monetary

policy framework: A robust evolution. Speech at

Peterson Institute for International Economics, 2020.

https://www.federalreserve.gov/newsevents/speech/cla

rida20200831a.htm

Ergungor, O.E. 2008. Financial system structure and

economic growth: Structure matters.

Fîrcescua, B. 2012. Crises Effects on Financial System

Structure in some Post-Communist Countries.

Charbonneau, K.B., Evans, A., Sarker, S., Suchanek, L.

2017. Digitalization and inflation: A review of the

literature.

Eggertsson, G.B., Juelsrud, R.E., Summers, L.H., Wold,

E.G., 2019. Negative nominal interest rates and the

bank lending channel. NBER Working Paper, 25416.

https://doi.org/10.3386/w25416

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

354