How Has the Pandemic Changed the Agroindustrial Complex

N. A. Kolomeitseva

a

and I. A. Glotova

b

Voronezh State Agrarian University named after Emperor Peter I, Voronezh, Russian Federation

Keywords: Agroindustrial Complex, Pandemic, Export, Food Security, World Trade.

Abstract: Nowadays, the coronavirus pandemic is a serious trial for all countries of the world. Global food security is

one of the high priorities. Senior officials around the world have realized the need to investigate the impact

of the pandemic on global trade. Like many sectors of the economy, the agro-industrial complex is undergoing

a transformation, the true scale of which can only be appreciated after the end of the crisis. The pandemic has

become a driver for the growth of the vegetable protein market: the increasing cost of producing animal

products and concerns about their safety are prompting consumers to look for an alternative. The article

reflects the measures taken by the Ministry of Agriculture of the Russian Federation to maintain the domestic

market, describes the current agricultural products export situation. As of December 31, 2020, Russian exports

of agricultural products amounted to USD 30,658.3 million, which is 18.7% higher compared to the same

period last year.

1 INTRODUCTION

As the pandemic spreads, countries are facing new

challenges and the ability to respond quickly to

changes become important to economic viability.

Playing a key role in ensuring food security, the

agribusiness sector is undergoing a transformation,

the true scale of which can only be appreciated after

the end of the crisis.

In this situation, the standards and rules of world

trade are changing, the principles of ensuring food

security are being reassessed, the seemingly

sustainable models of production, logistics and retail

are being transformed, new eating habits and patterns

of purchasing food products are emerging. The

restructuring of households' preferences, a drop in

their incomes and the instability of food supply are

putting pressure on individual commodity markets,

which in turn have a complex effect on the global

agro-industrial complex. The greatest effect of the

pandemic falls on food-importing countries and

developing countries that depend on agricultural

exports.

To minimize the negative consequences, on

March 26, 2020, the G20 leaders made proposals for

maintaining economic stability, which can be divided

a

https://orcid.org/0000-0002-5549-6619

b

https://orcid.org/0000-0002-9991-1183

into 4 blocks: medicine, financial system support,

trade and international interaction.

G20 leaders agreed rally to ensure the

uninterrupted supply of medical supplies, essential

agribusiness products and other goods across borders

to maintain the health and well-being of people. The

coronavirus pandemic and the resulting quarantine

measures have had a serious impact on some

segments of the global food market. The coronavirus

has caused uncertainty around the world for

consumers and businesses alike.

Thus, there was a decrease in demand for products

focused on the HoReCa segment: crustaceans, some

types of meat, fish, wine and dairy products due to the

closure of catering, hotel and other channels of

distribution.

Consumers are refuse their usual grocery

shopping spots in favor of online stores and trusted

supermarket chains. People began to spend more time

in their homes and home-cooked meals became

popular again; the demand for snacks and on-the-go

food is falling. At the same time, the pandemic is

driving the growth of the vegetable protein market:

the rising cost of animal products and concerns about

their safety are prompting consumers to find new

alternatives (Benzeval et al., 2020).

Kolomeitseva, N. and Glotova, I.

How Has the Pandemic Changed the Agroindustrial Complex.

DOI: 10.5220/0011119600003439

In Proceedings of the 2nd International Scientific and Practical Conference "COVID-19: Implementation of the Sustainable Development Goals" (RTCOV 2021), pages 299-304

ISBN: 978-989-758-617-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

299

The pandemic of a coronavirus infection,

COVID-19, has set challenges for many product

manufacturers (Long and Khoi, 2020). Enterprises

around the world find themselves in a difficult

economic situation. A ban has been introduced by

China (the largest food buyer in the world) on the

supply of products from enterprises where cases of

coronavirus have been identified.

There was also a shortage of seasonal labor in a

number of regions of the world due to the departure

of labor migrants (Malaysia - palm oil, Europe and

the United States - producers of vegetables and

fruits).

To order to maintain a stable situation in the

domestic market in 2020, the Ministry of Agriculture

of the Russian Federation developed additional

measures to support the internal market:

As a part of decision of the Government of the

Russian Federation of March 31, 2020 № 385

«On the introduction of a temporary

quantitative restriction on the export of grain

crops outside the territory of the Russian

Federation to states that are not members of the

Eurasian Economic Union, and the

establishment of a case in which temporary

periodic customs declaration of goods is not

applied» quotas were introduced for grain

export (wheat, rye, barley and corn) in the

amount of 7 million tons for the period April 1

to June 30, 2020 (Decision of the Government

of the Russian Federation of March 31, 2020);

The decision of the Board of the Eurasian

Economic Commission of March 31, 2020 №

43 «On amendments to the Decision of the

Board of the Eurasian Economic Commission

of April 21, 2015 № 30 «On measures of non-

tariff regulation» established a temporary ban

on the export of from the countries of the

Eurasian Economic Union of certain types of

food products (onions, garlic, turnips, rye, rice,

buckwheat, millet, grits, flour and pellets from

cereal grains, buckwheat grain collapsed,

soybeans, sunflower seeds, ready-made food

products from buckwheat). Export was

prohibited for the period from April 12, 2020

to June 30, 2020 (Decision of the Board of the

Eurasian Economic Commission of March 31,

2020);

The decision of the Council of the Eurasian

Economic Commission April 3, 2020 № 33

«On amendments to some decisions of the

Commission of the Customs Union and on

approval of the list of critical imports»

approved the decision of the Commission of the

Customs Union on the introduction of tariff

benefits for potatoes, onions, garlic, cabbage,

carrots, pepper, rye, long grain rice, buckwheat,

buckwheat groats, ready-to-eat foods for

babies, the basis for breast milk substitutes,

until June 30, 2020 (Decision of the Council of

the Eurasian Economic Commission April 3,

2020).

All the measures mentioned above made it

possible to keep the food-security inside the country

at the same level as before the pandemic.

2 RESEARCH METHODOLOGY

Simultaneously, much attention was paid to the

export of agricultural products. In accordance with

the decision of the President of the Russian

Federation of May 7, 2018 № 204 «On the national

goals and strategic objectives of the development of

the Russian Federation for the period up to 2024», it

is necessary to ensure by 2024 the achievement of the

export volume of agricultural products in the amount

of USD 45 billion.

The pandemic and related restrictions had low

influence on russian agricultural exports.

As reported by the Federal Customs Service of

Russia and Rosstat, agricultural exports in 2021 were

USD 21,776.3 million in comparable prices as of

October 31, 2021, down 5.3 percent from the same

period in 2020.

The export structure is shown in Table 1 below.

Table 1: Structure of exports of agricultural products as of

October 31, 2021.

Products Export (31.10), USD

million

Average price per ton,

USD million

2020 2021 % 2020 2021 %

Fat and oil 3716 5454 +47% 581 919 +58%

Grains 7491 8190 +9% 202 255 +26%

Fish and

seafood

4325 5241 +21% 2274 3207 +41%

Meat and

dairy

products

917 1195 +30% 1648 1981 +20%

Products of

food and

processing

industry

3323 3646 +10% 467 556 +19%

Other

agricultural

products

3229 3626 +12% 442 553 +25%

The overall

resul

t

23001 27352 +19% 381 513 +35%

Source: Federal Customs Service, 7.11.2021.

RTCOV 2021 - II International Scientific and Practical Conference " COVID-19: Implementation of the Sustainable Development Goals

(RTCOV )

300

The top 10 countries-importers of russian

agricultural products include: Turkey, Kazakhstan,

Egypt, South Korea, the Netherlands, Ukraine, Saudi

Arabia Kingdom and Azerbaijan.

Under the current conditions, manufacturers and

exporters should look for new countries to supply

russian products to world markets and constantly

work to improve competitiveness. For these purposes,

constant interaction between the authorities and

business at seminars and exhibition-congress events

(forums, EXPOs, business missions) is of great

significance.

In the first half of 2021, Molvest Group supplied

610 tons of dairy products to foreign markets, which

is 4 times (315.7%) more than in the same period last

year. Particularly, at the beginning of 2021 the

producer entered Chinese market with high quality

permeates. Permeates are widely used in the

confectionery and dairy industries. The product is in

demand in sports nutrition, and the breadth of its

requesting continues to expand. Negotiations are

currently underway to supply dry protein blends with

concentrated forms of animal proteins, such as milk

whey proteins and blood plasma proteins of

slaughtered animals, to Singapore, Japan and the

United Arab Emirates (Official website of company

group «Molvest»).

The main tasks of the Government of the Russian

Federation for the coming years are the opening of

new sales markets and further work to diversify

export supplies. The main directions for the

fulfillment of these tasks are:

active political support for Russian non-

resource supplies. It is necessary

to eliminate tariff and non-tariff barriers in

order to open new sales markets as well as work

to expand the number of companies accredited

to supply to the foreign markets;

organizing favorable conditions for expanding

the export-oriented base, attracting foreign

investment in the russian manufacturing sector;

facilitate access of small and medium-sized

enterprises to foreign markets. It is necessary to

simplify procedures, such as obtaining export

permits, obtaining phytosanitary/veterinary

certificates, as well as to create favorable

conditions for e-commerce export;

emergence of new regional and international

«institutions to support the export of

agricultural products» (Lusk, 2020).

Various events are used to promote russian goods

abroad. Usually these are exhibitions in different

countries, where there are meetings of consumers and

producers of products. There it is possible to taste

goods, communicate with manufacturers, and make

arrangements for supplies.

In 2021, Gulfood, SIAL Shanghai, China

International Import Expo, Saudi Agriculture, Green

Week and Anuga were the key events to promote

russian agricultural production abroad (Official

website of the Ministry of Agriculture of the Russian

Federation).

Gulfood (based in United Arab Emirates) is one

of the key exhibitions for Russian exporters of

agricultural products, the largest in the Gulf

region. The event is held in February. That expo is

attractive to the business community and food

producers, as well as governmental delegations from

different countries to discuss increasing international

trading at the B2G sessions.

SIAL Shanghai is one of the world's largest food

and beverage exhibitions in China (Shanghai).

Thematically, the exhibition is divided into four

sections: foodproduct, meat, diary, vineandbeverage.

The event is held in May.

China International Import Expo is the first

specialized import exhibition in the world, held in

China (Shanghai) in June. The expo is co-hosted by

the Ministry of Commerce of China and the Shanghai

Municipal Government. The expo has the purpose of

promoting the Chinese domestic market to foreign

companies, and to boost domestic consumption.

Saudi Agriculture is a comprehensive exhibition

showcasing the latest technological progress, such as:

equipment, tools, machines and services in the field

of agriculture. This exhibition also presents a variety

of agro-industrial products to promote the

development of the agricultural sector of the

Kingdom of Saudi Arabia. The event is held in

October.

The exhibition «Green Week» traditionally

demonstrates the products of various areas from agro-

industrial complex – food, timber and woodworking

industry, landscaping and horticulture. Recently there

has been a growing interest in the «Green Week»

from experts from Central and Eastern Europe,

especially from Russia. International Green Week is

held in January at Messe Berlin, which combines 26

exhibition halls with a total area of 160,000 square

meters and open-air exhibition areas, conference

rooms, offices, an exhibitor service center, various

gastronomic facilities. During Green Week, in

addition to viewing the exhibition, you can take part

in symposia, meetings with experts, various seminars

and round tables in different pavilions. The Berlin

International Congress Center provides its largest hall

for the official opening ceremony of the «Green

Week» and comfortable rooms for all kinds of

conferences.

How Has the Pandemic Changed the Agroindustrial Complex

301

Anuga is one of the largest trade shows in the

world specializing in food and beverages. The

exhibition is held every two years in October in the

Federal Republic of Germany (Cologne). The

exhibition has a 100-year history and is the oldest in

the food and beverage industry.

The Ministry of Agriculture of Russia is creating

a network of attaches with a mission to promote

agricultural cooperation. Today, attaches are already

establishing communication with partners in Mexico,

Thailand, Malaysia, UAE, India, Egypt, Indonesia,

Saudi Arabia, and China.

Their responsibilities include preparing proposals

for cooperation development, working on

international agricultural agreements and contracts,

establishing contacts with government and business

representatives, and facilitating negotiations between

russian companies and potential partners. The

establishment of a network of attaches will encourage

the promotion of domestic agricultural products and

foodstuffs on foreign markets, and strengthen the

country's export potential.

Among the Ministry's representatives abroad are

the best graduates of the Agricultural attache

professional training programme, which has been

implemented at Moscow State Institute of

International Relations since 2019. According to the

plan, attaches will be sent to 50 foreign countries by

the end of 2022.

The above tools for promoting and positioning

agricultural products in foreign markets are only a

part of the elements undertaken by the government to

increase the attractiveness of russian products for

foreign buyers. In addition to the measures taken by

the Russian Federation, each company itself develops

marketing strategies (Cohen, 2020).

Furthermore, we will review the export indicators

of agricultural products in the Voronezh region.

3 RESEARCH RESULTS

In 2020, the export of agricultural products in the

Voronezh Region decreased by 0.5% compared to

2019 and amounted to 1,771.9 thousand tons or USD

504.6 million. The 2020 plan was exceed by 3.6%

(USD 487.0 million).

Main export categories are:

wheat (598.4 thousand tons in the amount of

USD 128.7 million);

sunflower, cottonseed, safflower oil (114.6

thousand tons worth USD 101.8 million);

molasses (370.7 thousand tons for the amount

of USD 43.7 million);

beet pulp, bagasse (sugarcane pulp) (178.7

thousand tons, worth USD 28.8 million);

cake (146.4 thousand tons for the amount of

USD 25.0 million).

The main countries where products were supplied

from the Voronezh region were: Turkey (12.9%of the

total export of agricultural products), Latvia (9.5%),

Egypt (8.9%) and Uzbekistan (7.9%).

As of October 31, 2021, the export volume of the

agro-industrial complex of the Voronezh Region in

comparable prices amounted to USD 327.5 million,

which is 57.5% of the target value (USD 570 million)

(Table 2).

Table 2: Exports of the Voronezh region.

Agroindustrial

complex

USD millions,

31.10.2021

% of the

plan

The same

period of

2020,%

Forecast

(2021)

% of the

plan

Thousand tons

Plan for

2021

Fact

Fact,

31.10.2021

The same period

of 2020,%

TOTAL

570.0

413.9

57.5%

8.2% 548.7

76.8%

1,014.6 -28.1%

In comparable prices 327.5 -14.4% 437.7

Oil and fat 160.5 44.7% 221.3

197.2 -10.1%

In comparable prices 96.4 -13.1% 131.7

Grains 100.0 -9.0% 132.6

396.9 -25.7%

In comparable prices 80.6 -26.6% 105.4

Fish and seafood 0.1 -55.7% 0.1 0.0 -56.5%

In comparable prices

0.1

-58.6% 0.1

Meat and dairy 13.4 157.2% 16.4

3.6 14.8%

In comparable prices 10.0 92.1% 10.1

Food and processing 82.7 -21.7% 104.9

353.2 -37.9%

In comparable prices 99.1 -6.1% 132.8

Other agricultural

products

57.1 12.9% 73.4

63.7 -25.3%

In comparable prices 41.2 -18.5% 57.6

Source: Federal Customs Service, 7.11.2021

RTCOV 2021 - II International Scientific and Practical Conference " COVID-19: Implementation of the Sustainable Development Goals

(RTCOV )

302

It is predicted that in 2021 that goal will not be

achieved by the Voronezh region. The result will be

about USD 437.7 million or 76.8% of the value of the

planned indicator. Industries for which there is a

lagging export dynamics relative to the same period

in 2020 are: grain (-26.6%), fat and oil (-13.1%), food

and processing industry products (-6.1%), other

products agroindustrial complex -18.5%).

Since 2018, there has been a decrease in the total

volume of exports of agricultural products due to a

change in the structure and a decrease in grain

associated with a change in the place of declaring

grain products.

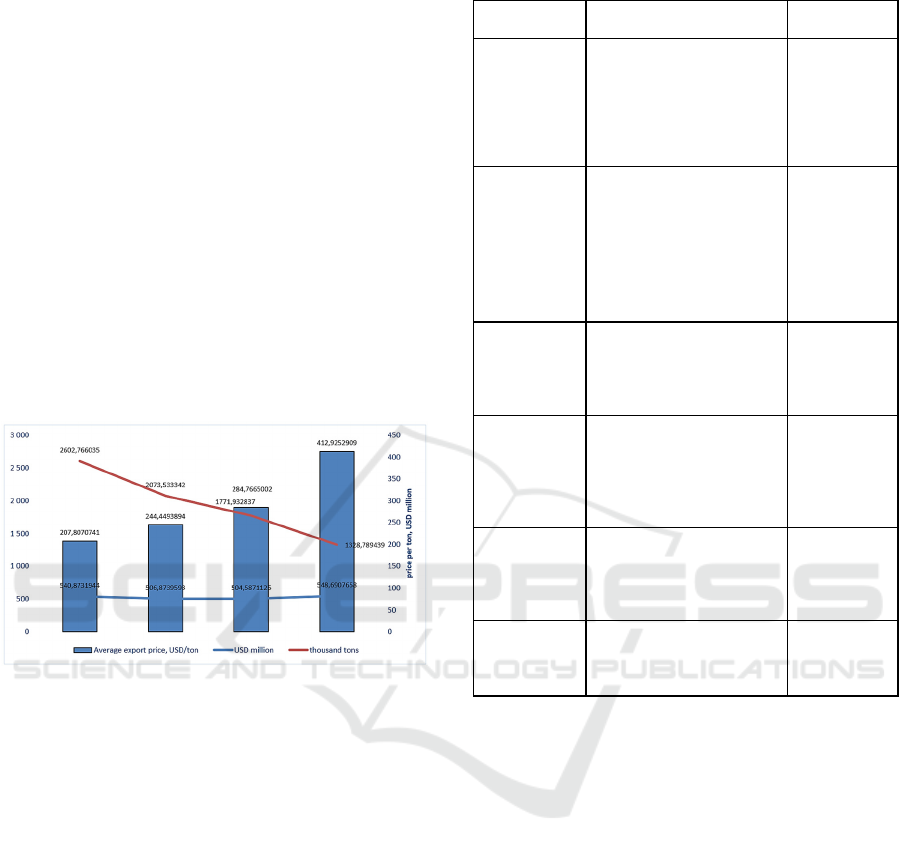

At the same time, in the period from 2018 to 2020

the export level of food and processing industry

products, fat and oil products, meat and dairy

products is increasing, the average export price per

ton of products is growing (from USD 208 per ton in

2018 to 285 in 2020) (Figure 1).

Figure 1: Average export price of agro-industrial products

of the Voronezh region for the last 4 years.

4 THE DISCUSSION OF THE

RESULTS

Since 2018, the Voronezh Region has completed the

implementation of export-oriented investment

projects (meat, dairy, fat and oil, confectionery, food

industries).

Currently, 5 export-oriented investment projects

are being implemented with a total value of over 21

billion rubles. The increase in the volume export

proceeds from the implementation of projects is

estimated at USD 139.3 million by 2024.

Below in Table 3 are the most important exporting

companies in 2020-2021 for the Voronezh region of

the Russian Federation.

Table 3: Major exporting companies in 2020-2021.

Supplied

products

Enterprises

Key importing

countries

Grain (wheat,

corn, barley)

LLC «Avangard-Agro-

Voronezh»,

LLC «Krosna»,

LLC «Yarovit EXP»,

OJSC «Verkhnekhavsky

elevator»

Egypt, Turkey,

Libya, Yemen,

Switzerland

Meat and dairy

products (pork

and pork offal,

butter, cattle

meat)

LLC «Bobrovsky Meat

Processing Plant»,

LLC «Borisoglebsk Meat

Processing Plant»,

LLC «7 Utra»,

LLC «Dairy Plant»,

LLC «Zarechnoye»

Ukraine, Hong

Kong,

Armenia,

Azerbaijan,

China

Oil and fat

(sunflower oil,

cake, mustard

oil)

LLC «Bunge CIS»,

GC «Blago»,

JSC «Pavlovskagroprodukt»,

LLC «MEZ" Yug Rusi»

LLC «Altair»

Uzbekistan,

China,

Denmark,

Latvia,

Tajikistan

Food and

processing

industry

products

(molasses, pulp,

sugar, malt)

GC «Prodimex», GC «ASB»,

LLC «Avangard-Agro-

Voronezh»

Turkey, Latvia,

Uzbekistan,

Netherlands,

Ukraine

Other

agricultural

products (yeast,

oil seeds and

fruits)

LLC «Saf-Neva»,

LLC «PK Mivok»

Latvia, France,

Turkey,

Poland,

Azerbaijan

Fish and

seafood (canned

fish, dried or

smoked fish)

LLC «Fosforel»

Germany,

Belgium, USA,

Kazakhstan,

Ukraine

Source: Federal Customs Service of Russia based on data

from column 31 of the customs declaration.

5 CONCLUSIONS

Nowadays the Voronezh region carries out measures

to support exporters of agricultural products. For

example, the state reimburses part of the costs for

purchasing of high-tech machinery and equipment

produced outside the territory of the Russian

Federation (it is necessary to increase export

revenues). Also tax benefits are provided for the

purchase of land that is used for the construction of

export-oriented enterprises.

All in all, the article examines the impact of the

pandemic on the agribusiness sector, including

measures to promote and position russian products of

the agro-industrial complex on foreign markets. The

situation with the export of agricultural products in

the Voronezh region and investment projects are

described in detail.

How Has the Pandemic Changed the Agroindustrial Complex

303

The Ministry of Agriculture of the Russian

Federation constantly monitors the situation in the

domestic and foreign markets and, if necessary,

regulates it with help of regulatory documents.

REFERENCES

Borsellino, V., Kaliji, S.A., Schimmenti, E., 2020. COVID-

19 Drives Consumer Behaviour and Agro-Food

Markets towards Healthier and More Sustainable

Patterns, Sustainability, 12(20), 8366.

Benzeval, M., Burton, J., Crossley, T.F., Fisher, P., Jаckle,

A., Low, H., Read, B., 2020. The Idiosyncratic Impact

of an Aggregate Shock: The Distributional

Consequences of COVID-19, Understanding Society

Working Paper Series: Essex, UK. https://www.

understandingsociety.ac.uk/sites/default/files/downloa

ds/working-papers/2020-09.pdf.

Long, N.N., Khoi, B.H., 2020. An Empirical Study about

the Intention to Hoard Food during COVID-19

Pandemic, Eurasia J. Math. Sci. Technol. Educ., 16, pp.

1–12.

Lusk, J., 2020. Ruminations on Solutions to the COVID

Related Food Disruptions. http://jaysonlusk.com/

blog/2020/5/12/ruminations-on-solutions-to-the-covid-

related-food-disruptions.

Cohen, M.J., 2020. Does the COVID-19 outbreak mark the

onset of a sustainable consumption transition? Sustain.

Sci. Pract. Policy, 16, pp. 1–3.

RTCOV 2021 - II International Scientific and Practical Conference " COVID-19: Implementation of the Sustainable Development Goals

(RTCOV )

304