Value Evaluation of White Wine Enterprise based on DCF Model:

Taking Moutai Ltd. of Guizhou as an Example

Ziyang Deng

a

Hubei University of Economics, Hubei, Wuhan, China

Keywords: Free Cash Discount Flow Model, Enterprise Value Evaluation, Kweichow Moutai.

Abstract: As a leading enterprise in China's liquor industry, Kweichow Moutai's business performance and financial

status have always been a hot issue of concern. Especially in recent years, its stock price fluctuation is obvious,

has attracted the majority of investors to its investment enthusiasm. This paper will use the DCF free cash

discount flow model to evaluate the enterprise value of Kweichow Moutai, and analyze the internal value of

Kweichow Moutai Company (hereinafter referred to as Kweichow Moutai), to derive its internal value and

compare it with the company's market value, so as to explore the feasibility of the DCF model to evaluate the

liquor enterprises.

1 INTRODUCTION

Guizhou Moutai Limited by Share Ltd is a landmark

enterprise in the Baijiu industry. It founded in 1999.

The registered capital is RMB 185 million. 2001

Guizhou Maotai is listed on the Shanghai Stock

Exchange. Its main business includes: Maotai liquor

and series liquor. Production and sales of. Other

businesses include: production of beverages, food

and packaging materials. Production and sales; anti-

counterfeiting technology development, research and

development of information industry related

products; hotel management, accommodation,

catering, entertainment, bath and parking lot

management services, etc. As of December 31, 2019,

the controlling shares of Guizhou Maotai Liquor Co.,

Ltd. East is Guizhou Maotai distillery (Group) Co.,

Ltd. (actual holding proportion 58.00%), and the

actual controller is the state owned assets supervision

and Administration Committee of Guizhou

Provincial People's government Meeting (Zhang,

2021).

Under the situation of China's continuous

economic development, the Baijiu industry is in a

good position. National income water. The

continuous improvement of people's living standards,

the further improvement of people's lives and the

increase of consumers' disposable income. The long

a

https://orcid.org/0000-0001-9266-2631

term will help improve the competitiveness of famous

Baijiu enterprises and China's new economic

structure. New opportunities brought Moutai to a

high quality growth in the Baijiu industry. A new

stage of the exhibition.

In 2020, COVID-19 led to a short run in Baijiu

consumption demand, and manufacturers stopped.

Production, franchised stores or other distributors

also stop operation, so it is necessary to consider

sudden changes. Only under the influence of

economic development conditions or other uncertain

factors can we maintain sustained economic growth

(Zhou, 2021).

Moutai Group is involved in liquor, wine, health

wine, real estate, hotel, etc., with Kweichow Moutai

Co., Ltd. as the core enterprise. The main product is

Kweichow Moutai. Kweichow Moutai has a long

history and profound cultural connotation. It is a

typical representative of Daqu sauce flavor liquor in

China. It is in the leading position in China's liquor

industry and has a great impact on the trend of the

liquor industry (Wang, 2021).

In recent years, Moutai's stock price has

fluctuated significantly and is at the commanding

heights of the liquor industry, and its investment

value has naturally attracted many investors. This

paper will evaluate the value of Kweichow Moutai

from the perspective of investors, which is conducive

to grasping the future development trend of the liquor

190

Deng, Z.

Value Evaluation of White Wine Enterprise based on DCF Model: Taking Moutai Ltd. of Guizhou as an Example.

DOI: 10.5220/0011170300003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 190-193

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

industry and helping more investors to make

investment decisions.

2 THE DCF MODEL

2.1 Brief Introduction to the DCF

Concept

The DCF cash flow discount model is to restore the

expected cash flow of the enterprise for a specific

period in the future to the present value. Only by

ensuring its future profitability can an enterprise get

a reasonable enterprise value, and its value can be

recognized by the theoretical and practical circles. In

this evaluation case, the historical cash flow of

Kweichow Moutai in the past period of time was first

analyzed (generally about ten years), so as to predict

the free cash flow of enterprises for a future period of

time. Then the discount rate is obtained through the

risk-free reward rate, the risk reward rate and the beta

coefficient, and finally the value of the enterprise is

obtained through the discount model (Song, 2021).

2.2 Advantages and Disadvantages of

DCF Model

Based on the company's own growth rate and

expected future cash flow, it is less affected by market

wrong sentiment; the valuation framework is

rigorous, requires a large amount of information, a

comprehensive perspective, and considers the long-

term development of the company.

Parameter selection is difficult, and data

estimation has strong subjectivity and uncertainty;

the calculation is complex, and the accuracy of

valuation is greatly affected by the input value (Li,

2018).

2.3 Specific Operation Steps

1) Estimate the enterprise free cash flow (FCFF)

Free Cash flow (FCFF) = (After-tax net profit + after-

tax interest expense + depreciation and amortization +

other non-cash expenses) - working capital addition -

capital expenditure (1)

2) Determine the discount rate for the discount

Weighted average cost of capital (WACC) = (equity

market price * expected return rate of equity + debt

market price * (1-tax rate) * company debt cost) / /

(equity market price + debt market price) =

proportion of equity to market value * equity

expected return rate + proportion of debt to market

value * (1- tax rate) * company debt cost (2)

Expected return rate of equity: Capital asset

pricing model (CAPM) is generally used to calculate.

Expected return on equity = risk-free interest rate +

market risk * (market yield-risk-free interest rate) +

adjustment factor (3)

Risk-free yield: generally replaced by Treasury

yield, about 3% -4%;

Market yield: due to the unstable yield of A-share,

the yield of US stocks with Chinese characteristics,

about 10% -11%;

Market risk: the market risk of the company's

industry is calculated by a comparable company in the

same industry;

Adjustment factor: that is, the special risk of the

enterprise, generally between 1% -5%.

Debt cost: generally determined according to the

current debt yield of the enterprise, such as bank loan

interest rate, bond interest rate, etc. (Lu, 2007).

3) Final value and cash flow discount value plus

total value of the enterprise value

The final value calculation formula

TV=FCF2025 (1+g) / (WACC-g) (4)

in which, the sustainable annuity growth rate of the

enterprise g is generally expressed by the growth rate

of gross national product (GDP).

After the free cash flow discount, the cash flow

discount value and the final value will be added total

to get the enterprise value.

4) Calculate the equity value

On the basis of the enterprise value, (-) deducting

interest-bearing liabilities, (+) plus excess assets, that

is, to get the equity value of the enterprise (Wang,

2021).

3 DCF ANALYSIS OF

KWEICHOW MOUTAI

3.1 Calculate the Free Cash Flow of

Enterprises

Cash flow = EBITDA (1 income tax rate) increased

depreciation increased amortization - increased

working capital - capital expenditure. (5)

The income tax rate is calculated at 25%.

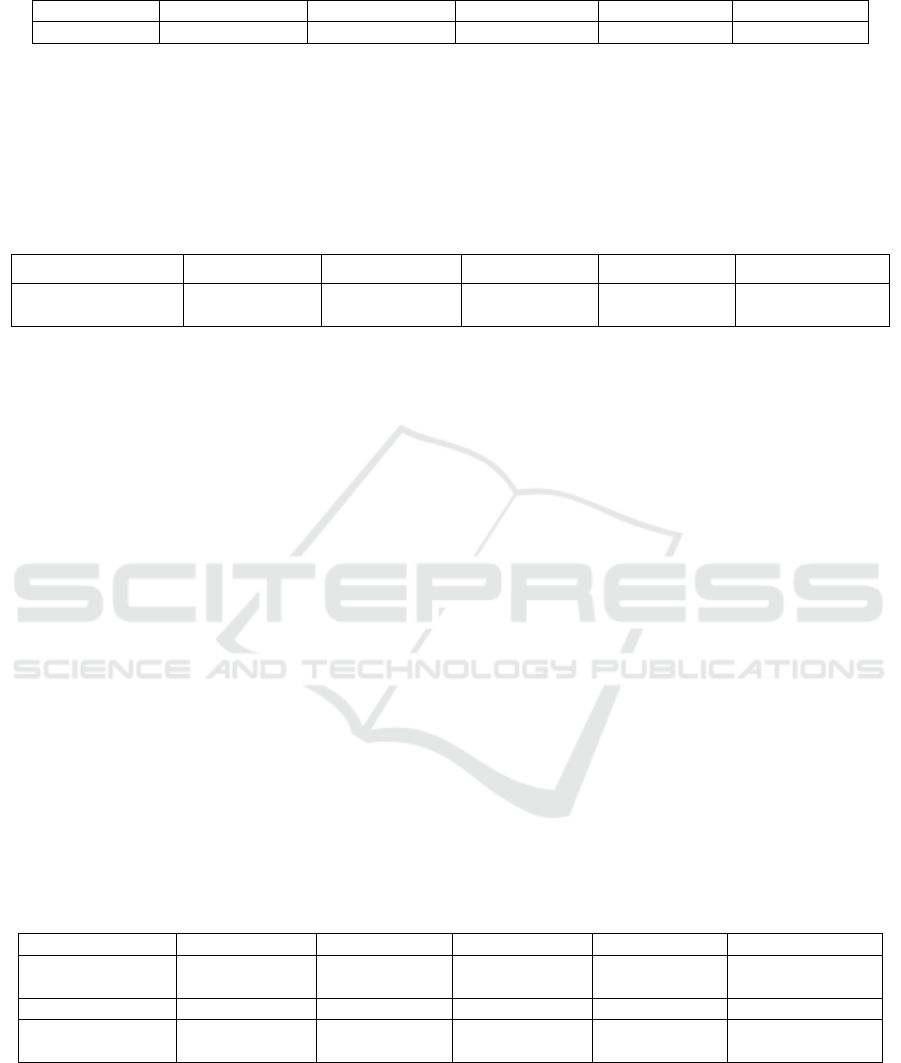

According to the annual report, Table 1 of the balance

sheet, profit statement and cash flow sheet of

Kweichow Moutai over the years.

Value Evaluation of White Wine Enterprise based on DCF Model: Taking Moutai Ltd. of Guizhou as an Example

191

Table 1: Cash flow statement of data over the years.

Pro

j

ect

y

ea

r

2020 2019 2018 2017 2016

Cash flow 28757038300 21381278450 17099530261 9573181252 10575906002

As can be seen from the above table, the overall

cash flow of Kweichow Moutai Co., Ltd. was an

upward trend from 2016 to 2020, and only decreased

in 2017 (Zhang, 2020). Therefore, according to the

cash flow of the company in 2016-2020, the average

growth rate of the enterprise is calculated as 28.66%,

thus making the cash flow forecast for Kweichow

Moutai Company.

3.2 Forecast the Enterprise's Cash

Flow in the Next 5 Years

Table 2: Cash flow of the enterprise in the next five years.

Project 2021 2022 2023 2024 2025

Businesses forecast

cash flow

36,997,638,408 47,599,660,073 61,239,790,877 78,788,629,602 101,366,253,308

3.3 The Calculation of the Discount

Rate

The discount rate is calculated using a weighted

average cost of capital:

WACC=(E/V) ×Re+(D/V)×Rd×(1-Tc) (6)

Among them, Re is the share capital cost, the

necessary return rate of investors; Rd is the debt cost;

V=E + D is the market value of the enterprise; E / V

is the percentage of share capital in total financing,

capitalization ratio; D / V= debt percentage of total

financing, asset-liability ratio; Tc is the enterprise tax

rate.

The CAPM model was used to determine the cost

of equity:

Re=Rf+β(Rm-Rf) (7)

In practice, the yield of Treasury bonds is

generally selected to replace the risk-free return rate

Rf, and with the continuous operation as the

accounting assumption, the yield of the 10-year

Treasury bonds in 2021 is 3.15%.

Rm, select the CSI and Shenzhen 300 index, and

query that the average risk reward rate of the

evaluation base date (of June 3, 2021) is 6.42%. That

is, the Rm is 6.42% (Shen, et al, 2017). The

coefficient indicates the volatility of a certain

enterprise relative to the whole industry, reflecting

the price fluctuations of individual stocks to the entire

stock market. According to GuoTai'an database,

Kweichow Moutai Co., Ltd. has a coefficient of 2.17.

Therefore, it can be concluded that the equity cost

of the enterprise Re is 10.25%, the debt cost takes the

long-term loan interest rate in May 2021 is 4.65%,

and the income tax rate is Rd is 3.49%. According to

the 2021 enterprise annual report, the enterprise

assets are 213,395,820,000 yuan, with the total

liabilities 45,675,130,000 yuan, the equity total

167,720,680,000 yuan. The income tax rate is 25%

and WACC 8.62%.

3.4 Forecast Enterprise Value

According to the confirmed parameters, Kweichow

Moutai Co., Ltd. evaluates the enterprise value.

Table 3: Forecast enterprise value table.

Project 2021 2022 2023 2024 2025

Businesses

forecast cash flow

36,997,638,408 47,599,660,073 6,123,979,0877 78,788,629,602 101,366,253,308

discount rate 8.62% 8.62% 8.62% 8.62% 8.62%

The value of the

discount

34,061,534,160 40,344,492,880 47,786,398,850 56,601,032,410 67,041,604,880

Therefore, the total cash flow of Kweichow

Moutai Co., Ltd. in the forecast period is 245,835.06

million yuan.

The sustainable annuity growth rate of enterprises

is generally expressed by the growth rate of gross

national product (GDP). In order to make the research

data more accurate, this paper selects the driving

percentage of the secondary industry from 2016 to

2019, and 2.50%, 2.40%, 2.30% from 2016 to 2019

2.20%. Its arithmetic average is 2.35%, so this article

adopts 2.35% is the sustainable annuity growth rate

of Kweichow Moutai Co., Ltd.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

192

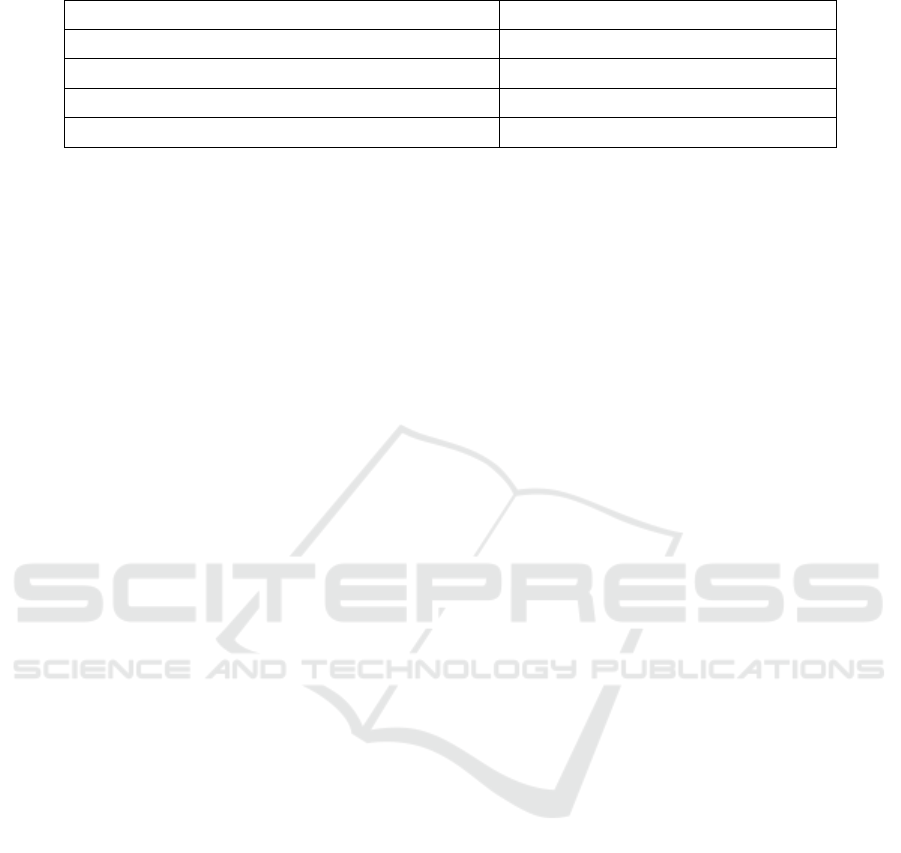

Table 4: Enterprise value.

Subject

Follow-up final value RMB 1,654,678.79 million yuan

Discount rate 8.62%

Current value of the final value of the subsequent period 1,094,371.33 million yuan

Enterprise value 1,900,513.85 million yuan

The subsequent final value of Kweichow Moutai

Co., Ltd. TV=FCF2025 (1+g)/(WACC-g) =

1,654,678.790 million, obtained in Table 4.

According to the data of the benchmark date of

Oriental Wealth Network (June 3, 2021), the market

value of Kweichow Moutai Co., Ltd. is 2.5 trillion

yuan, the predicted value of DCF model is 1.9 trillion

yuan, and the error with the market value of

Kweichow Moutai Co., Ltd. is 24%.

4 CONCLUSIONS

This paper uses the DCF model to evaluate the

enterprise value of Kweichow Moutai Co. The study

found that the cash flow of Kweichow Moutai Co.,

Ltd. has been positive and showing an increasing

momentum in recent years, indicating that this shows

that the business activities of Kweichow Moutai Co.,

Ltd. have actually generated capital value increase

(intrinsic value), and the ability of value-increase is

continuously improving. Although there are some

differences between the market value of Kweichow

Moutai Co., Ltd. and the calculated theoretical value,

there is an error rate of 24%, and the calculated results

are slightly lower than the market value. Compared

with the traditional value evaluation model, the DCF

model has more research value and research space,

which is relatively stable for cash flow. Enterprises

with high predictability have strong applicability. But

for companies with frequent and volatile cash flows,

its feasibility will reduce (Huang, et al, 2021). As an

old enterprise and Moutai and a leading enterprise in

the liquor industry, Kweichow Maotai Co., Ltd. is in

line with the hypothetical premise of DCF model

evaluation. Therefore, the DCF model can be used in

the enterprise evaluation of liquor enterprises.

ACKNOWLEDGEMENTS

Thanks to the foreign professors, the teaching

assistant and the paper teachers for giving me some

guidance, they have a great help to my paper, and I

would like to express my heartfelt thanks here.

REFERENCES

Huang, Y., Liu et al. (2021). Practical analysis of value

investment in China stock market, by Market Weekly,

September 1, pp.113-115.

Li, B. (2018). Study on the valuation of Maotai in Guizhou.

Huazhong University of Science & Technology,

Wuhan 430074, China, December.

Lu, C. (2007). Choosing and evaluating the free cash flows

in using the DCF Model. By ECONOMIC & TRADE

UPDATE, June 18, pp.101-102, 104.

Shen, J., Huang, Y. (2017). Research on the calculation of

discount rate in income method. By Science and

wealth, June 23, pp.221-221.

Song, S. (2021). Enterprise value evaluation of new energy

vehicles based on DCF model - Take BYD Co., Ltd. as

an example, by time-honored brand marketing, July 10,

2021, pp.89-90.

Wang, L. (2021). Based on DuPont analysis of the research

on the profitability of Kweichow Moutai, by Small and

medium-sized Enterprise Management and Technology

(Shanghai magazine), October 8, 2021, pp.95-97.

Wang, S. (2021). Research on enterprise value evaluation

based on DCF model. By National circulation

economy, March 19, pp.79-81.

Zhang, Y. (2020). Kweichow Moutai Financial Analysis

and evaluation, by Guangxi Quality Supervision Guide,

October 28, pp.133-134.

Zhang, Y. (2021). Financial statement analysis of Guizhou

Maotai company By Lanzhou University of Finance

and economics, Lanzhou 730020 China.

Zhou, R., Li. Z. (2021). Financial statement analysis of

listed companies based on Guizhou Maotai. Chengdu

University of technology, Chengdu, Sichuan, 610059.

Value Evaluation of White Wine Enterprise based on DCF Model: Taking Moutai Ltd. of Guizhou as an Example

193