Financial Risk Prediction of Listed Companies based on Text and

Financial Data

Xu Wei and Yonghui Chen

Southwest University of Science and Technology School of Computer Science and Technology, Mianyang, China

Keywords: Deep Learning, CNN, Financial Risk, Annual Report Text.

Abstract: This paper uses the relevant financial data of 4348 A-share listed companies from 2010 to 2019 and the

discussion and analysis of operation in the annual report as the research sample, and uses the Pytorch

framework to build a neural network model to predict whether the listed companies fall into financial crisis.

The experimental results show that when text data is combined with traditional financial index data, the

prediction accuracy of the deep learning model can reach about 85%, which can significantly improve the

accuracy of financial risk prediction compared with using only financial data.

1 INTRODUCTION

The financial crisis of listed companies is one of the

main drivers of the financial risk and gains primary

attention from creditors and investors. The financial

risks of listed companies may further propagate

recession and thus jeopardize the economy at large

(Ding 2012). Therefore, it is of great significance to

pay attention to the financial situation of listed

companies.

The research of financial risk prediction is

usually based on the company's stock market

transaction information and the company's financial

index data (Ye 2017, Song 2019, Hosaka 2019,

Zhang 2021). However, as an unstructured and

qualitative data form, the annual report text of listed

companies also plays a very important role in how to

convey information to the public. For example, the

annual report submitted by a listed company to the

regulator contains all the information about the

company in the past year (Feng 2019). Among them,

“Discussion and Analysis of Operating Conditions”

mainly analyzes the operating conditions, operating

models, and operating strategies of listed companies.

It is a summary of the overall operating conditions

of the past year and a generalization of future

operating directions. Recent research has proven that

qualitative company reports contain important

information that can predict financial risks

(Campbell 2014). Since it is difficult to obtain and

quantify text data, it is still challenging to effectively

combine financial text with financial data in a

financial model (Lang 2015). In this research, we

propose a new deep learning method that combines

financial text and financial data to predict financial

risks. We found that text data can supplement

traditional accounting and market-based variables to

predict financial risk, and the deep learning model

that combines financial text and financial data has

higher prediction accuracy than a model that uses a

single type of input.

2 MATERIALS AND METHODS

2.1 Data

2.1.1 Financial Indicator Data

In this paper, financial indicator data of A-share

listed companies from 2010 to 2019 were obtained

from the Jukuan database. Since financial indicators

are subject to change during the year, the data on

financial indicators as of the date of disclosure of the

company's annual report by the listed companies are

taken.

Based on relevant studies, a total of 30 financial

indicators are selected in this paper to analyze the

solvency, operating capacity, development capacity,

profitability, risk level, cash flow, and ratio structure

indicators of enterprises. Based on

general indicators,

as many financial factors affecting the business

conditions of enterprises are considered as possible,

240

Wei, X. and Chen, Y.

Financial Risk Prediction of Listed Companies based on Text and Financial Data.

DOI: 10.5220/0011172500003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 240-244

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

and rich indicators are selected for feature learning

to avoid artificially removing features that have a

significant impact on the prediction results. The

selected financial indicators include current ratio,

quick ratio, cash ratio, gearing ratio, cash flow ratio,

accounts receivable turnover, inventory turnover,

current asset turnover, total asset turnover, operating

income growth rate, operating profit growth rate, net

profit growth rate, net flow from operating activities

growth rate, total assets growth rate, return on assets,

total net asset margin, return on net assets, net

operating margin, return on investment, financial

leverage, operating leverage, consolidated leverage,

net cash flow from operating activities per share,

cash recovery rate, operating index, cash asset ratio,

working capital ratio, fixed asset ratio, equity

concentration index and z-index(Table 1).

Table 1: Financial index system of financial risk prediction.

Selected indicators Abbreviation Calculation description

Solvency

X1 Current ratio RA Current assets / current liabilities

X2 Quick ratio RAT Quick assets / current liabilities

X3 Cash ratio CR Monetary capital / current liabilities

X4 Asset liability ratio LEV Total liabilities / total assets

X5 Cash flow ratio CASHCL Net operating cash flow / current liabilities

Operating

capacity

X6 Accounts receivable turnover ARTURNOV

Average balance of operating income / accounts

receivable

X7 Inventory turnove

r

INTURNOV Operating income / inventory

X8 Turnover rate of current assets VOL

Net income from main business / average balance of

current assets

X9 Total asset turnove

r

TATO Operating income / total assets

Development

capacity

X10 Growth rate of operating revenue RG

Increase in operating income / operating income of

the previous period

X11 Operating profit growth rate PGR

Increase in operating profit / operating profit of the

previous perio

d

X12 Net profit growth rate EG

Increase in net profit / net profit of the previous

period

X13 Growth rate of net flow from

operating activities

GNFOA

Increase in net operating cash flow / net operating

cash flow of the previous perio

d

X14 Growth rate of total assets TAGR

Increase in total assets / total assets at the beginning

of the period

Profitability

X15 Return on assets ROA

Profit without financial expenses / average total

assets

X16 Net interest rate of total assets ROT Net profit / total assets

X17 Return on net assets ROE After tax profit / net assets

X18 Net operating interest rate NPM Net profit / operating income

X19 Return on investment ROI Average total profit / total investment

Risk level

X20 financial leverage DFL

Change rate of earnings per share of common stock /

change rate of EBIT

X21 Operating leverage DOL

Change rate of EBIT / change rate of production and

sales volume

X22 Integrated lever DTL

Change rate of net profit / change rate of main

b

usiness income

Cash flow

analysis

X23 Net cash flow from operating

activities per share

NCFOPS

Net operating cash flow / number of common shares

outstanding

X24 Cash recovery rate CRA

Net operating cash flow / total assets at the end of the

period

X25 Operating index OI Net operating cash flow / gross operating cash flow

Ratio

structure

X26 Cash asset ratio CAR Cash assets / total assets

X27 Working capital ratio WCR Total working capital / assets

X28 Fixed assets ratio LTCR Fixed assets / total assets

Internal

governance

X29 Equity concentration index HERF

Number of shares of the largest shareholder / total

number of shares of the company

X30 Z index Z

Number of shares of the first largest shareholder /

number of shares of the second largest shareholde

r

Financial Risk Prediction of Listed Companies based on Text and Financial Data

241

In the actual data, the numerical ranges of

different features are different, which may appear in

the feature space. Individual features with large

values have a dominant impact on the sample. To

make all features on the same scale, it is necessary

to map them to the same scale, to improve the

accuracy of the model and speed up the fitting

speed, so the samples should be normalized in this

experiment. You can use the MinMaxScaler

provided in the preprocessing class in Sklearn, the

specific formula is (1). Where min represents the

minimum value of each feature in the data, and max

is the maximum value of each feature.

𝑋

scale

(1)

2.1.2 Text Data

We obtained the annual reports of all listed

companies from 2010 to 2019 in PDF format from

Eastmoney.

Python provides many class libraries for parsing

PDF files, among which PDFMiner and

PDFPlumber are some of the most common parsing

methods. This paper finally uses PDFMiner to

analyze the annual report in PDF format. After

obtaining the text, clean it first, and use the regular

formula to extract the chapter of “Discussion and

Analysis of Operating Conditions” in the annual

report. It is worth mentioning that, according to the

requirements of the CSRC, “Discussion and

Analysis of Operating Conditions” was not used as a

separate chapter before 2016, but inserted into other

chapters. Therefore, different methods should be

taken to extract the annual reports in different

periods. In this study, we exclude the blank samples

in the section of “Discussion and Analysis of

Operating Conditions” and finally obtain 28549 text

data.

2.2 Methods

2.2.1 Text Representation

Before combining text with financial indicator data

into the model, we need to consider how to represent

the text. The usual approach is to convert text into

vectors. That is, the text is mapped into a new space

and represented by multi-dimensional continuous

real number vectors.

We use the word2vec model based on Skip-gram

(Deoras 2013). The goal of the Skip-gram model is

to make a word predict the words around it. For a

sequence of words W1, W2, W3, ..., Wn, we

maximize log p.

max

∑

∑

,

log 𝑝𝑤

∣𝑤

(2)

In formula (2), c represents the number of words

before and after the word is considered.

In this paper,

according to the size of the text data training set, the

dimension of the word vector is set at 100 and the

fixed-length is set at 5. Negative sampling is used to

calculate log p, and the sub-sampling of words is

proportional to their inverse frequency. In

word2vec, words with similar semantics have high

cosine similarity and allow vector calculation of

words.

This paper uses Jieba word segmentation to

segment our financial text data set to obtain the

financial text corpus. We use the general vocabulary

training set to train a general word vector model,

and then use it for the second training. The final

word vector contains financial background

information, which is more suitable for our task. We

calculate the average of all word vectors in

each text,

i.e., each financial text is represented by a

100-dimensional vector.

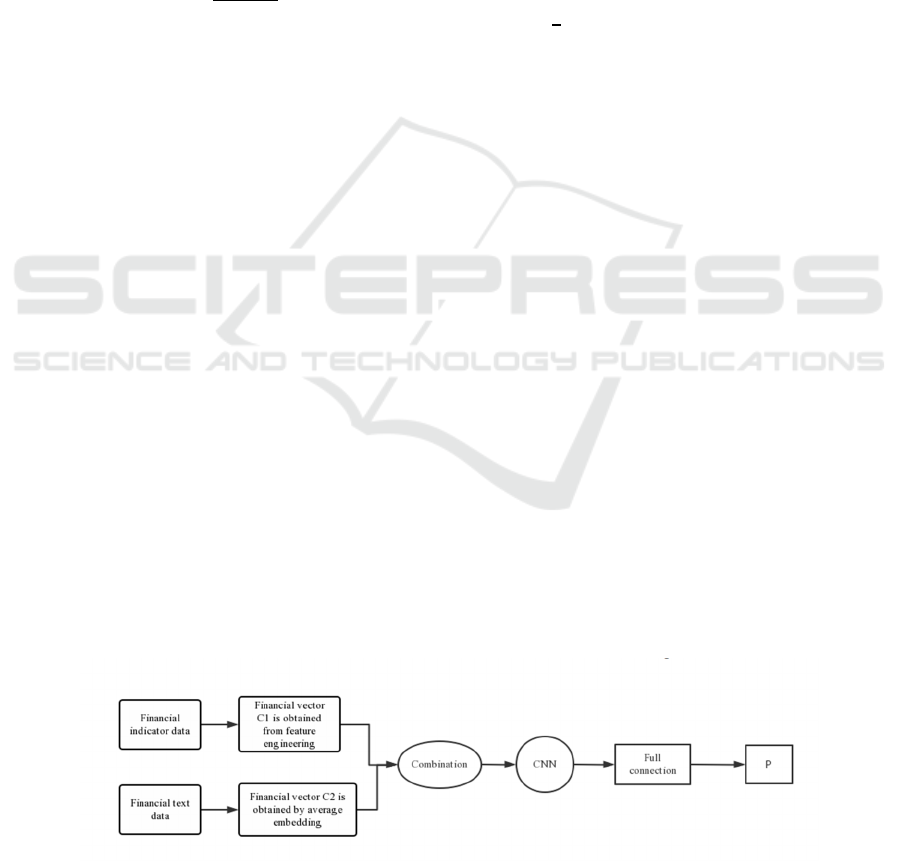

2.2.2 Model Building

We use Pytorch to combine financial index data

with text data to build our model. The model

structure is shown in Figure 1:

Figure 1 Schematic diagram of financial indexes and financial text combination model.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

242

The input of the model is a 130-dimensional

vector, which consists of two parts:

Financial indicator data: including 30

financial indicators, each of which is

normalized;

Financial text: the section of

“business

discussion and analysis” in the annual report.

The model splices the financial index data and

text data through the intersection of pd.merge

function of pandas library, and send them to the

convolutional neural network (CNN). The model

parameters of convolution neural network include

the number of convolution cores, the size of

convolution cores, the size of the pooling layer, and

so on. To select the best parameters to fit the model

in this paper, we reset the value range of parameters.

For example, the CNN convolution kernel size

d∈{2,3,4,5}, the number of CNN convolution cores

h∈{64,100,128,256}, the pool layer size c∈{5,6,7,8},

and the learning rate λ∈{0.01, 0.001, 0.0001},

epoch∈{5, 10, 15}, the weight value of cross-entropy

loss function f∈{0.1, 0.2, 0.3, 0.4, 0.5, 0.6, 0.7, 0.8,

0.9, 1, 2, 3, 4}.

3 RESULTS & DISCUSSION

We compare the model proposed in this paper with

other models. These models are:

S-CNN: Feature vectors are constructed based on

financial data, and then the CNN model is used to

extract features and realize classification.

S-SVM: The model based on financial data uses

SVM to classify.

S-XGB: The model based on financial data uses

XGBoost to classify.

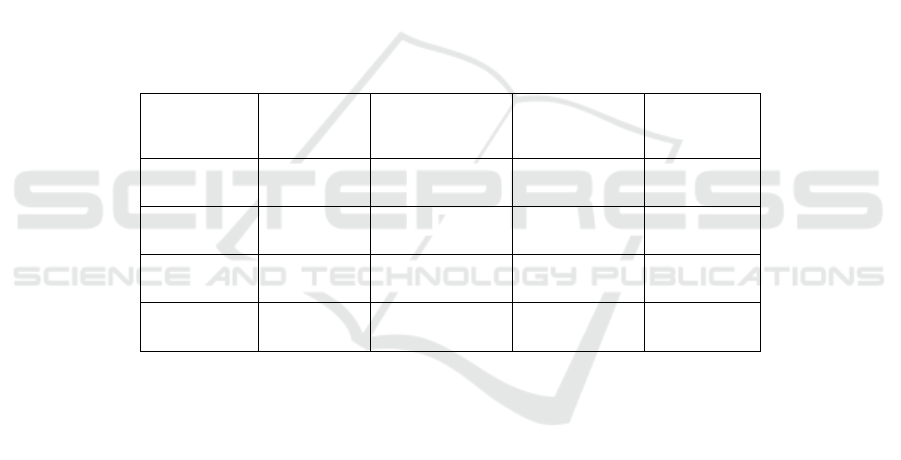

The evaluation results of each model are shown

in Table 2:

Table 2: Experiment summary table.

Accuracy

True Positive

Rate

True Negative

Rate

F1 Value

S-CNN 78.00% 89.02% 54.57% 0.676623

T&S-CNN 85.00% 93.38% 77.67% 0.848035

S-SVM 70.83% 75.60% 63.38% 0.689527

S-XGB 77.12% 89.02% 54.57% 0.676623

It can be seen from the table that the prediction

effect of the CNN deep learning model based on

financial data is not significantly better than the

traditional machine learning model based on

financial data. After the combination of financial

data and financial text, the CNN model is higher

than other models’ inaccuracy, true positive rate,

true negative rate, and F1 value. There may be two

main reasons:

The convolutional neural network model pays

more attention to information, which leads to

insufficient attention to important

information. After adding the financial text

features, although there is still a lot of

information, with the help of the financial text

features, important features are highlighted.

From the perspective of the financial text, the

more information combined with the data, the

better. In this way, after the combination of

important information and data, after the

screening of multi-layer neural networks, the

more important information can be selected.

4 CONCLUSIONS

As more and more financial documents appear in the

stock market, investors, regulators, and researchers

need more deep learning models to process and

analyze the information disclosures of listed

companies. Taking all A-share listed companies in

the recent ten years as samples, this paper builds a

financial risk prediction model based on financial

text and financial data. The experimental results

show that compared with using only financial data,

the F1 value of the financial risk prediction model

based on the combination of text and financial data

is significantly improved, indicating that the latest

Financial Risk Prediction of Listed Companies based on Text and Financial Data

243

progress of neural network can extract useful

information from financial text, and the financial

risk prediction combined with traditional financial

data can further improve the prediction effect.

REFERENCES

Campbell, J.L., Chen, H., Dhaliwal, D.S., et al. The

Information Content of Mandatory Risk Factor

Disclosures in Corporate Filings [J]. Social Science

Electronic Publishing.

Zhang, Chunmei, Zhao, Mingqing, Guan, Junqi. Financial

risk portfolio early warning model of manufacturing

listed companies based on lasso + SVM [J] Practice

and understanding of mathematics, 2021, 51 (5): 12.

Deoras A, Tomá? Mikolov, Kombrink S, et al.

Approximate inference: A sampling based modeling

technique to capture complex dependencies in a

language model[J]. Speech Communication, 2013,

55(1):162-177.

Ding, A.A., Tian, S., Yu, Y., et al. A Class of Discrete

Transformation Survival Models with Application to

Default Probability Prediction.

Hosaka, T. Bankruptcy prediction using imaged financial

ratios and convolutional neural networks[J]. Expert

Systems with Application, 2019, 117(MAR.):287-299.

Lang, M., Stice-Lawrence, L., Textual analysis and

international financial reporting: Large sample

evidence[J]. Journal of Accounting and Economics,

2015.

Ye, Lanzhou, Zhou J.Y., Management, S.O., Application

of Support Vector Machine in Risk Management of

Listed Companies[J]. Science Technology and

Industry, 2017.

Mai, F., Tian, S., Lee, C., et al. Deep learning models for

bankruptcy prediction using textual disclosures[J].

EUROPEAN JOURNAL OF OPERATIONAL

RESEARCH, 2019.

Song, Y., Peng, Y., A MCDM-Based Evaluation

Approach for Imbalanced Classification Methods in

Financial Risk Prediction[J]. IEEE Access, 2019, PP

(99): 1-1.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

244