Green Credit Policy and Enterprise Strategic Transformation:

Empirical Test of Heavy Pollution Industry

Fenglin Duan

a

School of International Education,Wuhan University of Technology, 122 Luoshi Road, Wuhan, China

Keywords: Green Credit, Heavy Polluting Enterprises, Enterprise Strategy, Difference in Difference Method, Financing

Constraints.

Abstract: The implementation of the ‘green credit guidelines’ is an important measure to promote the green and low-

carbon development of China's economy. Under the background of big data economy and digital management,

how to better play the role of green credit policy and promote the green transformation of enterprises is an

important topic to be studied and solved urgently. This paper takes the implementation of green credit policy

as a quasi natural experiment, selects China's A-share listed companies from 2010 to 2018 as the research

sample, and empirically tests the impact of green credit policy on enterprise strategy and its mechanism by

constructing PSM-DID model. It is found that the implementation of green credit policy has significantly

improved the strategic incentive progress of heavy polluting enterprises. After a series of robustness tests, the

conclusion is still valid. The intermediary effect test results show that financing constraints play a significant

intermediary role in the promotion of green credit to the progress of enterprise strategy. The research of this

paper provides a certain theoretical basis and policy enlightenment for the strategic transformation of heavy

polluting enterprises and the adjustment of green credit policy.

1 INTRODUCTION

In recent years, with the increasingly serious problem

of environmental pollution, the party and the state

attach great importance to the construction of

ecological civilization. The report of the 19th CPC

National Congress clearly pointed out "developing

green finance" and took it as one of the ways to

promote green development. On October 29, 2020,

the proposal of the Central Committee of the

Communist Party of China on formulating the 14th

five year plan for national economic and social

development and the long-term objectives for 2005

pointed out that we should accelerate the promotion

of green and low-carbon development, improve and

optimize the legal and policy guarantee for green

development, vigorously develop green finance and

promote the green transformation of key industries

and important fields. In addition, 2020 is the 15th

anniversary of China's concept of "green water and

green mountains are golden mountains and silver

mountains" and the key year for the conclusion of the

13th five year plan. It can be said that green finance

a

https://orcid.org/0000-0003-23338-4444

was, is and will still be one of the important economic

construction goals in the future. At the same time, it

is an important measure and necessary way for China

to achieve green development. As a key measure to

guide the green allocation of credit resources, green

credit plays an important role in promoting green and

low-carbon economic development and promoting

green innovation of enterprises. In 2012, the former

CBRC issued the guidelines on green credit, which

put forward clear requirements for banking financial

institutions to effectively carry out green credit and

vigorously promote energy conservation, emission

reduction and environmental protection. On the one

hand, through green credit, give full play to the role

of banking financial institutions in guiding the flow

of social funds and allocating resources, and guide the

internal funds and social funds of the financial system

to flow from the pollution field to the green field. On

the other hand, it is required to promote green credit

from a strategic perspective, improve support for

green economy, low-carbon economy and circular

economy, and strengthen the supervision of financial

institutions on fund users, so as to better serve the real

262

Duan, F.

Green Credit Policy and Enterprise Strategic Transformation: Empirical Test of Heavy Pollution Industry.

DOI: 10.5220/0011173600003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 262-274

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

economy and promote the transformation of

development mode.

The existing literature on green credit in China

mainly focuses on the following aspects: First,

analyze the risk and uncertainty of green credit from

the macro level. For example, Shen Hongtao and Ma

Zhengbiao (Shen, Ma, 2014) studied from the

normative level of empirical analysis and believed

that the implementation of green credit must solve the

contradiction between environmental protection and

economic benefits, and correct the concept of GDP

only performance of local governments. Xu Sheng et

al (Xu, et al, 2018) analyzed the impact of green

credit on high-quality regional economic

development by studying the mechanism of green

credit on industrial structure upgrading. Second,

analyzed the implementation effect of green credit

policy from the micro level. For example, Wen Subin

and Zhou Liuliu (Wen, Zhou, 2017) found that green

credit can effectively drive enterprises to carry out

technological innovation and improve pollution

control level by analyzing the impact of green credit

on enterprise financial performance and enterprise

value. Chen Xingxing et al. (Chen, et al, 2019) took

the implementation of the green credit guidelines as a

quasi natural experiment. By constructing the

commercial credit index of 17873 A-share listed

companies from 2006 to 2015, they found that green

credit had a significant financing penalty effect,

increased the investment in environmental

governance of heavy polluting enterprises and

promoted the structural adjustment of heavy polluting

industries. Zhan Hua (Zhan 2021) analyzed the

measurement indicators of enterprise environmental

disclosure level and found that green credit promoted

the improvement of enterprise environmental

information disclosure level through financing

constraints and environmental performance channels.

In conclusion, we know that green credit inhibits the

credit financing of heavily polluting enterprises,

significantly improves the level of environmental

information disclosure of enterprises, helps to

promote technological innovation and industrial

structure upgrading of enterprises, so as to promote

the transformation of economic development mode

and the construction of ecological civilization.

However, there is little literature on the relationship

between green credit and enterprise strategy. Will the

implementation of green credit policy change the

strategic choice of heavy polluting enterprises? Does

this impact have differentiated performance among

different enterprises? This will become the core issue

of this paper.

This paper takes the implementation of green

credit policy as a quasi natural experiment, selects

China's A-share listed companies from 2010 to 2018

as the research sample, and empirically tests the

impact of green credit policy on enterprise strategy

and its mechanism by constructing PSM-DID model.

Based on the enterprise strategy theory of miles et al

(1978, 2003), enterprises are divided into

prospectors, defenders and analyzers according to the

differences of enterprise strategy and progress in this

paper. This paper expands the relevant research on

the economic consequences of green credit policy,

and has some enlightenment for the strategic

transformation of heavy polluting enterprises, which

has both academic and practical significance. The

contributions of this paper include: First, with the

help of green credit policy as a quasi natural

experiment, the double difference regression after

propensity score matching is used to better alleviate

the endogenous problem. Secondly, it examines the

impact of green credit policy on corporate strategy

from the micro perspective of listed enterprises, and

provides the theoretical basis of impact mechanism

and heterogeneity. Thirdly, it examines the economic

consequences of the green credit policy from the

strategic level of the company, which provides an

empirical reference for promoting the green and low-

carbon development of the domestic capital market.

2 THEORETICAL ANALYSIS

AND HYPOTHESIS

2.1 Green Credit Policy and Enterprise

Strategic Transformation

The guidelines on green credit put forward clear

requirements for China's banking financial

institutions to effectively carry out green credit and

vigorously promote energy conservation, emission

reduction and environmental protection. The policy

promotes the implementation of incentive and

restraint measures through a series of measures,

promotes the standardization and institutionalization

of the system, and shows the strong determination of

the Chinese government to deal with environmental

problems. This paper holds that the implementation

of green credit policy will promote the strategic

transformation of China's heavily polluting

enterprises from the following three aspects, and

there are two possibilities for the change of enterprise

strategy.

Green Credit Policy and Enterprise Strategic Transformation: Empirical Test of Heavy Pollution Industry

263

First, the green credit policy has a significant

financing penalty effect. Green finance measures

require commercial banks to strictly control the

direction and scale of credit and curb the lending

space for polluting projects, Thus, heavy polluting

enterprises face higher financing threshold and

financing cost (Liu, et al., 2019; Chen, 2019).

According to Su Dongwei and Lian Lili (Lian 2018),

the financing decisions of enterprises are greatly

affected by the supply of financial markets. The

increase of credit threshold has significantly reduced

the long-term debt financing of heavily polluting

enterprises. On the one hand, under financing

constraints, heavily polluting enterprises lack funds

to carry out projects, so they may change from

prospectors to defenders and adopt a more

conservative enterprise strategy. On the other hand,

considering the obvious capital oriented mechanism

in the green credit policy, heavily polluting

enterprises may tend to change their development

mode and find a new way out (Wang, 2021, Wang,

2021), so they may choose a more radical enterprise

strategy and change from defender to prospectors.

Second, the green credit policy has an investment

restriction effect on heavily polluting enterprises.

Under the green financial measures, the financial

asset allocation of heavily polluting enterprises is

interfered by the government and the market, and the

financing cost of non green projects increases.

Therefore, the inefficient investment of enterprises,

especially over investment, has decreased

significantly (Wu, et al., 2012). In addition, the green

credit policy requires heavily polluting enterprises to

reduce pollutant emissions and improve their

environmental governance capacity. Under the

condition of limited financial resources,

environmental governance investment must have a

"crowding out effect" on productive investment in the

short term (Wang, etc. 2021). The investment of

heavy polluting enterprises is limited, and the

enterprise strategy may tend to be conservative.

However, from the perspective of transformation and

development, facing the dilemma of double

restrictions on financing and investment, heavy

polluting enterprises may increase green investment

in order to find a new development outlet (Wang, etc.,

2021), making the enterprise strategy from

conservative to radical.

Third, the green credit policy will bring greater

public pressure and moral condemnation to heavily

polluting enterprises. In addition to reducing the debt

financing of heavily polluting enterprises, public

opinion will also affect the investment and financing

behavior and enterprise strategy of enterprises

through supervision mechanism and reputation

mechanism (Zhu, Tan, 2020). On the one hand,

public opinion pressure forces heavily polluting

enterprises to strengthen environmental governance,

improve the level of environmental information

disclosure and reduce inefficient investment (Zhan,

2021). In this case, the corporate strategy may tend to

be conservative , making the corporate change

from prospectors to defenders. On the other hand, the

social reputation mechanism will promote enterprises

to establish a corporate image in line with the concept

of green development. Heavily polluting enterprises

may increase green investment, seek strategic

transformation and adopt more radical strategies to

change from defender to prospectors.

Based on the above analysis, this paper puts

forward the following assumptions:

Hypothesis H1a: Green credit policy will turn

heavy polluting enterprises from prospectors to

defenders.

Hypothesis H1b: Green credit policy will turn

heavy polluting enterprises from defender to

prospectors.

2.2 Intermediary Effect of Financing

Constraints

Firstly, the green credit policy has reduced the total

amount of funds and financing channels of heavily

polluting enterprises to a certain extent, making

enterprises face more severe financing constraints.

From the perspective of banking financial

institutions, under the strict green financial measures,

commercial banks are bound to strictly control the

credit gateway of heavily polluting enterprises and

improve their loan threshold. Banks use credit

supervision means to strictly control the credit

approval process for enterprises with high energy

consumption and high pollution, Raise the financing

threshold and cost of enterprises (allet, 2015; Zhu,

Tan, 2020). From the perspective of the whole capital

market, green credit guides social funds from the

polluting field to the green field. Under this policy

guidance, the willingness of external creditors to

provide debt capital for heavily polluting enterprises

is weakened (Wu, et al., 2012), investors will reduce

their investment in polluting enterprises, so the debt

financing level of heavily polluting enterprises will

decline. Secondly, the aggravation of the financing

constraint level of enterprises will change the

strategic choice of enterprises. Specifically, there are

two possible changes. On the one hand, after the

implementation of the green credit policy, heavily

polluting enterprises facing financing constraints lack

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

264

free cash flow for investment. Therefore, managers

will be more cautious in making investment

decisions, reduce unnecessary investment and choose

defensive enterprise strategies (Hovakimian, 2011).

Using the investment cash flow sensitivity model,

Fazzari et al (Fazzari, et al, 1988) found that

financing constraints will inhibit enterprise

performance, which makes the corporate change from

prospector to defender and choose a more

conservative strategy. On the other hand, green credit

dynamically increases the opportunity cost of

environmental pollution through credit channels. In

order to get rid of the current situation of financing

constraints, heavily polluting enterprises tend to

increase clean investment and reduce polluting

investment. Enterprises hope to seek transformation

and development through green innovation (Wang,

2021). Therefore, they may adopt a more radical

corporate strategy, changing from defenders to

prospectors. Based on the above analysis, this paper

puts forward the following assumptions:

Hypothesis H2: The level of corporate financing

constraints plays an intermediary role between green

credit policy and corporate strategy.

3 RESEARCH DESIGN

3.1 Sample Selection and Data Source

This paper takes the listed companies on China's

Shanghai and Shenzhen main board, small and

medium-sized board and gem as the research object,

and the data sample interval is 2006-2018. The

sample data are taken from guotai'an financial

database (CSMAR). In order to improve the

reliability of the data, this paper processes the original

data as follows: (1) Exclude listed companies in the

financial industry and ST listed companies. (2)

Eliminate the data that are obviously abnormal, such

as sample with an asset liability ratio greater than 1

or a share price bubble less than 0. (3) Samples with

missing or partially missing data are excluded. (4) A

total of 1% tail reduction is performed on both sides

of continuous variables to avoid the influence of

extreme values. After the above processing, this

paper obtains the unbalanced panel data of 14966

samples from 2006 to 2018.

3.2 Variable Setting

3.2.1 Enterprise Strategy Type

Drawing on the empirical measurement method of

enterprise strategy proposed by Bentley et al.

(Bentley, et al, 2013) and Higgins et al. (2014), this

paper uses the following six indicators to construct

the enterprise strategy index: (1) The tendency of

enterprises to develop new products, which is

measured by the proportion of R & D expenditure in

sales revenue. (2) The ability of an enterprise to

effectively produce and distribute its products and

services, which is measured by the ratio of the

number of employees to sales revenue. (3) Enterprise

growth potential, which is measured by the historical

growth rate of sales revenue. (4) Product

expansibility, which is measured by the proportion of

sales expenses and management expenses in sales

revenue. (5) Organizational stability, which is

measured by the fluctuation of the number of

employees, that is, the standard deviation of the

number of employees divided by the average number

of employees. (6) Capital intensity, which is

measured by the proportion of fixed assets in total

assets. According to the research of Zhang Yanchao

et al (Zhang, et al, 2021), compared with defenders:

(1) Prospectors have stronger desire to develop new

products and higher research expenditure. (2)

Prospectors have lower requirements for production

efficiency and have a larger ratio between the number

of employees and sales revenue. (3) The revenue

growth trend of prospectors is obvious and the growth

is stronger. (4) Prospectors pay attention to the

expansion of product market and have higher sales

and management expenses. (5) The organizational

stability of prospectors is poor, and the tenure of

employees is generally short. (6)Prospectors pay

more attention to human capital investment, the

investment in fixed assets is relatively lower than that

of defensive enterprises, and the capital intensity is

lower.

The above six indicators take the moving average

value of the past five years, and each "year industry"

sample is divided into five groups from small to large.

For the first five variables, the minimum group is

assigned 0 and the maximum group is assigned 4. For

the last indicator, the reverse method is adopted. The

maximum group is assigned 0 points and the

minimum group is assigned 4 points. Finally, for each

"company year" observation value, the values of the

six indicators are summed up, and finally the

enterprise strategy index strategy with a value range

of 0-24 is obtained. This indicator measures the

Green Credit Policy and Enterprise Strategic Transformation: Empirical Test of Heavy Pollution Industry

265

degree of strategic radicalization of an enterprise. The

higher the strategic score, the more inclined the

enterprise is to become an prospector, and the higher

the degree of strategic radicalization of the enterprise.

3.2.2 Green Credit Policy

Treated is the company dummy variable. This paper

distinguishes heavy polluting enterprises according

to the notice on printing and distributing the classified

management directory of environmental protection

verification industry of Listed Companies in 2008

and the industry classification standard of CSRC in

2012. If the sample is a heavily polluting enterprise,

the variable is taken as 1, otherwise it is taken as 0.

Post is a time dummy variable. The green credit

guidelines were officially published in February

2012. Therefore, if the sample year is 2012 and later,

the variable is taken as 1, otherwise it is taken as 0.

3.2.3 Financing Constraint Index

Referring to the research of Jiang Fuxiu et al. (2016)

and Li Wenjing et al. (2017), this paper uses KZ index

to measure the level of enterprise financing

constraints. The index is calculated by Kaplan and

Zingales (1997). The larger the value, the higher the

degree of financing constraints faced by enterprises.

The calculation formula of KZ index is as follows:

𝐾𝑍 = −

𝑂𝐶𝐹

𝐴𝑠𝑠𝑒𝑡

+ 3.14𝐿𝑒𝑣𝑒𝑟𝑎𝑔𝑒

− 36.37

𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠

𝐴𝑠𝑠𝑒𝑡

−1.31

𝐶𝑎𝑠ℎ

𝐴𝑠𝑠𝑒𝑡

+ 0.28𝑇𝑜𝑏𝑖𝑛𝑄

(1)

In the formula, OCF, asset, dividers and cash are

operating net cash flow, total assets at the beginning

of the period, dividends payable and cash holding

level respectively, and leverage and tobinq represent

asset liability ratio and Tobin Q value respectively.

The larger the KZ index, the higher the level of

corporate financing constraints and the more

seriously affected by financing constraints.

3.2.4 Control Variable

Based on the research of Wang Yejing et al. (2021),

Meng Qingbin et al. (2019), Zhang Yanchao et al.

(2021) and Han Yanjin (2021), this paper sets 10

control variables, including enterprise size (Size0,

return on total assets (ROA), asset liability ratio

(Lev), cash flow (Cf), equity concentration (Top5),

combined title of board chair and CEO (Dual),

executive compensation (Pay), board size (Board),

state-owned enterprise (Soe) and listed years

(FirmAge).In addition, in this paper, in order to

control the impact of industry and year variables on

financial risk, the industry (Industry) dummy

variables are set according to the industry

classification standard of the industry guidelines for

listed companies (2012) of the CSRC. And the year

dummy variables are set according to the year. The

definitions of all variables in this paper are shown in

Table1.

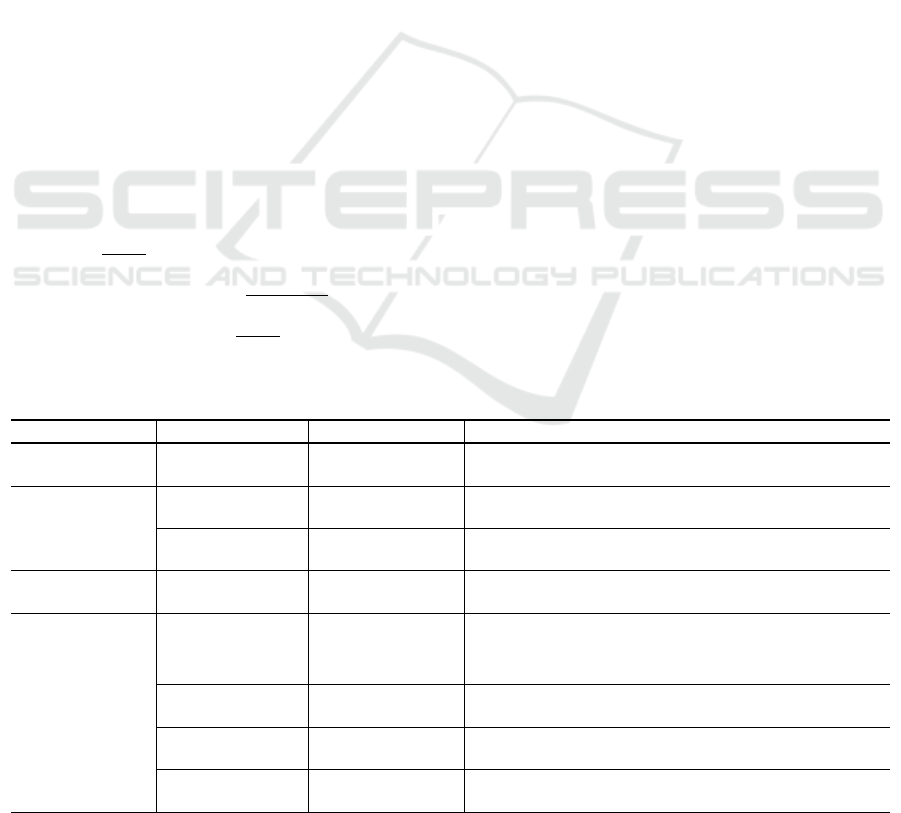

Table 1: Variable definition table.

Variable t

yp

e Variable name Variable s

y

mbol Definition

Dependent

variables

Enterprise

Strateg

y

Strategy

Refer to the measurement methods of Bentley et al.

(2013) and Wang Huacheng et al. (2016).

Independent

variables

Time dummy

variable

Post

Based on the green credit guidelines issued in 2012, it

is 0 before im

p

lementation and 1 after im

p

lementation.

Enterprise

dumm

y

variable

Treated

When the company belongs to heavy pollution

industr

y

, the value is 1; otherwise, the value is 0.

Intermediary

variable

Financing

constraint level

KZ KZ index of Kaplan and Zingales(1997)

Control variable

Enterprise size Size Natural logarithm of total assets

Return on total

assets

ROA Net profit divided by total assets

Asset liability

ratio

Lev Total liabilities divided by total assets

Cash flow Cf

Net cash flow from operating activities divided by total

assets

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

266

Equity

concentration

Top5 Shareholding ratio of the top five shareholders

Combined title of

board chair and

CEO

Dual

When the chairman and general manager are held by

one person, it is 1, otherwise it is 0.

Executive

com

p

ensation

Pay

Natural logarithm of top three executives'

com

p

ensation

Board size Boar

d

Number of board directors

State-owned

enter

p

rise

Soe

1 for state-owned enterprises and 0 for non-state-owned

enter

p

rises

Listed

y

ears FirmA

g

e Years of listin

g

3.3 Model Building

Taking listed companies in heavy pollution industries

as the experimental group, this paper uses the

following fixed effect double difference model to test

the impact of green credit policy on enterprise

strategy types. The specific model is as follows:

𝑆𝑡𝑟𝑎𝑡𝑒𝑔𝑦

,

=𝛼+𝛽

𝑃𝑜𝑠𝑡

×𝑇𝑟𝑒𝑎𝑡𝑒𝑑

+𝛽

𝑇𝑟𝑒𝑎𝑡𝑒𝑑

+𝛽

𝑃𝑂𝑆𝑇

+𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠

,

+

∑

𝐼𝑛𝑑𝑢𝑠 +

∑

𝑌𝑒𝑎𝑟 + 𝜀

,

(2)

In the model, 𝑆𝑡𝑟𝑎𝑡𝑒𝑔𝑦

,

is the enterprise

strategy type of company i at time point t.The

independent variable 𝑇𝑟𝑒𝑎𝑡𝑒𝑑

is taken as 1 when

company i belongs to heavy pollution industry,

otherwise it is taken as 0, which individually reflects

the strategic difference between heavy pollution

enterprises and non heavy pollution enterprises. The

independent variable 𝑃𝑜𝑠𝑡

,

is 1 after the

promulgation of the green credit policy, otherwise it

is 0, which reflects the difference of enterprise

strategy before and after the implementation of the

green credit policy. The coefficient 𝛽

of the

interaction term Post×Treated measures the

processing effect of green credit policy. Controls

include a series of control variables at the company

level. Industry and year control the fixed effects at the

industry and year levels respectively, and 𝜀

,

is the

random disturbance term. If 𝛽

is significantly less

than 0, it indicates that the implementation of green

credit policy has significantly transformed heavy

polluting enterprises from prospectors to defenders.

At this time, H1a is assumed to be true. Conversely,

if 𝛽

is significantly greater than 0, H1b is assumed

to be true.

Further, referring to the sequential test method of

intermediary effect proposed by Wen Zhonglin and

ye Baojuan (Wen, ye, 2014), this paper examines the

role channels of green credit policy affecting

enterprise strategic transformation. The test

procedures of intermediary effect are as follows:

𝑆𝑡𝑟𝑎𝑡𝑒𝑔𝑦

,

=𝛼+𝛽

𝑃𝑜𝑠𝑡

×𝑇𝑟𝑒𝑎𝑡𝑒𝑑

+𝜇𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠+𝜀

,

𝐾𝑍

,

=𝛼+𝜑𝑃𝑜𝑠𝑡

×𝑇𝑟𝑒𝑎𝑡𝑒𝑑

+𝜇𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠 + 𝜀

,

𝑆𝑡𝑟𝑎𝑡𝑒𝑔𝑦

,

=𝛼+𝛽

𝑃𝑜𝑠𝑡

×𝑇𝑟𝑒𝑎𝑡𝑒𝑑

+𝜏𝐾𝑍

,

+𝜇𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠+𝜀

,

(3)

(4)

(5)

In the model, the intermediary variable 𝐾𝑍

,

represents the financing constraint level of the

enterprise. If the 𝜑 and 𝜏 coefficients in equations

(3) and (4) are statistically significant at the same

time and the direction meets the expectation, it

indicates that the intermediary effect exists, that is,

the implementation of green credit will change the

strategic type of the enterprise by changing the

financing constraint level of the enterprise. At this

time, it is assumed that H2 is true.If at least one of 𝜑

and 𝜏 is not statistically significant, this paper adds

a bootstrap test to judge whether the mediating effect

exists.

4 EMPIRICAL RESULTS AND

ANALYSIS

4.1 Descriptive Statistics

Table 2 presents the descriptive statistical results of

the main variables. The average value of enterprise

strategy index is 12.08 and the median is 12. It can be

seen that Chinese listed companies are generally

analyzers, which is neither too radical nor too

conservative. The standard deviation of enterprise

strategic indicators is 4.897, indicating that there are

great differences in the strategic types of different

enterprises. The average ROA of total asset return is

3.201%. The average value and median of equity

concentration are 49.88% and 49.69% respectively,

which is in line with the reality of equity

concentration of Listed Companies in China. The

Green Credit Policy and Enterprise Strategic Transformation: Empirical Test of Heavy Pollution Industry

267

average value of property right is 0.582, which

reflects that in the research sample of this paper,

state-owned enterprises account for 58.2% and non-

state-owned enterprises account for 41.8%.

Table 2: Variable descriptive statistics.

Variable N mean median sd min max

Strategy 14966 12.08 12 4.897 2 24

Post 14966 0.670 1 0.470 0 1

Treated 14966 0.371 0 0.483 0 1

KZ 14966 4.002 3.753 2.182 -5.983 15.91

Size 14966 22.33 22.20 1.250 19.12 25.92

ROA 14966 3.201 2.968 5.809 -25.62 21.07

Lev 14966 49.22 50.08 19.87 5.353 89.27

Cf 14966 4.583 4.455 7.185 -15.56 23.95

Top5 14966 49.88 49.69 14.97 19.41 88.46

Dual 14966 0.173 0 0.379 0 1

Pay 14966 14.28 14.29 0.772 12.15 16.21

Board 14966 8.943 9 1.794 5 15

Soe 14966 0.582 1 0.493 0 1

FirmAge 14966 20.78 22 5.516 9 29

4.2 Correlation Analysis

Pearson correlation test was performed on the main

variables, and the results are shown in Table 3. There

is a significant positive correlation between the level

of financing constraints KZ and the degree of

enterprise strategic radicalization, indicating that the

intensification of financing constraints makes the

enterprise's strategic choice more radical, which

preliminarily verifies H2. In addition, the absolute

values of correlation coefficients between variables

are far less than 0.8, so there is no serious multi

collinearity problem in the model. At the same time,

most control variables have significant correlation

with enterprise strategic progress indicators, and the

setting of control variables is meaningful.

Table 3: Pearson correlation coefficient table.

Strategy Post Treated KZ Size ROA Lev Cf Top5 Dual Pay Board Soe FirmAge

Strategy 1

Post

0.201

***

1

Treated

0.205

***

-0.036

***

1

KZ

0.039

***

0.164

***

0.054

***

1

Size

0.064

***

0.221

***

-0.008

0.074

***

1

ROA

-0.067

***

-0.039

***

0.030

***

0.508

***

0.092

***

1

Lev

-0.036

***

-0.107

***

-0.050

***

-0.545

***

0.374

***

-0.338

***

1

Cf 0.002

-0.045

***

0.152

***

0.606

***

0.022

***

0.344

***

-0.163

***

1

Top5

-0.046

***

0.040

***

0.024

***

0.128

***

0.324

***

0.147

***

0.047

***

0.100

***

1

Dual

0.023

***

0.105

***

-0.019

**

0.013

*

-0.074

***

-0.004

-0.072

***

-0.026

***

-0.070

***

1

Pay 0.060 0.369 -0.135 0.237 0.486 0.241 -0.004 0.063 0.118 0.037 1

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

268

*** *** *** *** *** *** *** *** ***

Board

-0.033

***

-0.120

***

0.088

***

0.024

***

0.220

***

0.036

***

0.125

***

0.069

***

0.085

***

-0.159

***

0.057

***

1

Soe

-0.037

***

-0.184

***

0.023

***

-0.077

***

0.163

***

-0.041

***

0.185

***

0.022

***

0.136

***

-0.244

***

-0.121

***

0.258

***

1

FirmAge

-0.173

***

-0.351

***

-0.007

-0.162

***

0 -0.013

0.229

***

-0.008

-0.082

***

-0.174

***

-0.136

***

0.106

***

0.371

***

1

Note: *, * *, * * * respectively indicate that the correlation between variables is significant at the statistical levels of 10%, 5% and 1%.

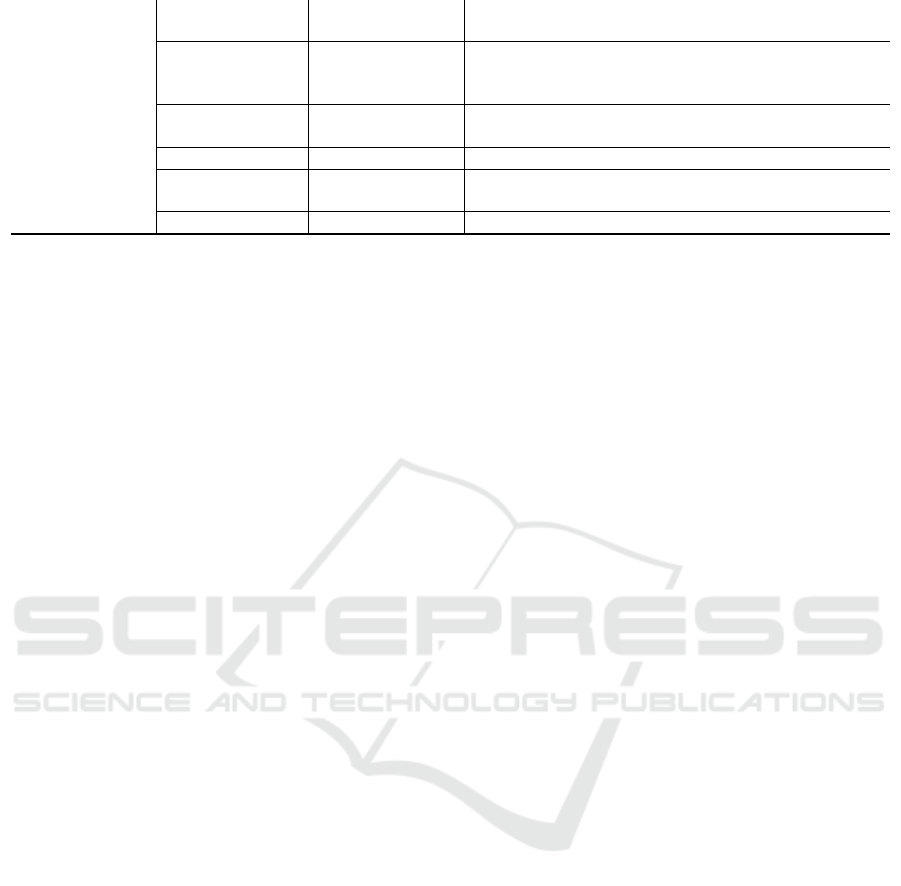

4.3 Parallel Trend Test

Bertrand (Bertrand 2004) pointed out that one of the

preconditions for the effectiveness of the double

difference estimation is that the experimental group

and the control group meet the same trend hypothesis

before being processed. Therefore, in order to verify

the applicability of the DID model, this paper

conducted a same trend test on the enterprise strategy

types of the green credit policy experimental group

and the control group, as shown in Figure 1 below.

The results show that before the implementation of

the green credit policy in 2012, the growth trend of

the enterprise strategic incentive progress of the

experimental group and the control group remains

roughly the same. While after the implementation of

the policy, the growth trend of the strategic incentive

progress of the experimental group and the control

group is obviously different. Therefore, the premise

of the same trend hypothesis is tenable, which means

that it is appropriate to use DID model to test the

impact of green credit policy on enterprise strategic

incentive progress.

Figure 1: Parallel trend of enterprise strategic progress.

4.4 Regression Result Analysis

The benchmark regression results are shown in Table

4. Columns (1) and (2) of Table 4 show the regression

results without control variables and with control

variables respectively. The degree of enterprise

strategic radicalization is significantly positively

correlated with the implementation of green credit

policy at the level of 1%, indicating that the green

credit policy can significantly improve the strategic

radicalization progress of heavily polluting

enterprises whether or not the influence of other

factors is controlled. Column (3) controls the impact

of year and industry. The results show that the

regression coefficient between green credit policy

and enterprise strategic incentive progress is 0.858,

which is significant at the level of 1%, that is, after

jointly controlling other factors, year and industry

fixed effects, the implementation of green credit

policy still plays a role in improving enterprise

strategic incentive progress. Based on the regression

results of column (1) (2) (3), hypothesis H1a is

verified.

Green Credit Policy and Enterprise Strategic Transformation: Empirical Test of Heavy Pollution Industry

269

Table 4: Test of the impact of green credit policy on enterprise strategic progress.

(1) (2) (3)

VARIABLES Strate

gy

Strate

gy

Strate

gy

Post×Treate

d

3.002*** 2.623*** 0.858***

(34.74) (28.88) (7.22)

Size 0.346*** 0.036

(8.23) (1.13)

ROA -0.074*** -0.024***

(-9.61) (-4.34)

Lev -0.010*** -0.005***

(-4.20) (-2.92)

Cf 0.005 0.032***

(0.90) (7.85)

To

p

5 -0.028*** -0.016***

(-10.09) (-8.14)

Dual -0.091 -0.159**

(-0.87) (-2.16)

Pa

y

0.131** 0.074

(2.18) (1.57)

Boar

d

-0.095*** -0.005

(-4.23) (-0.32)

SOE 0.440*** 0.703***

(4.93) (10.78)

FirmA

g

e -0.136*** 0.004

(-17.46) (0.60)

Constant 11.293*** 7.376*** 2.829***

(270.13) (8.46) (3.23)

Yea

r

NONOYES

Industry NO NO YES

Observations 16,934 14,966 14,966

R-square

d

0.067 0.102 0.567

Note: *, * *, * * * respectively indicate that the correlation between variables is significant at the statistical levels of 10%,

5% and 1%.The value of t is in parentheses.

Table 5 shows the regression test results of the

intermediary effect of corporate financing

constraints.Among them, column (1) is the regression

result when the intermediary variable is not included.

At this time, the estimation coefficient of

Post×Treated is significantly positive at the level of

1%, indicating that the implementation of green

credit policy has significantly improved the strategic

incentive progress of heavy polluting

enterprises.Column (2) shows the regression results

of the impact of policy implementation on

intermediary variables. The estimation coefficient of

Post×Treated is significantly positive at the level of

5%, indicating that green credit has significantly

tightened the financing constraints of

enterprises.Column (3) is the regression situation

after the intermediary variable is included. It can be

seen that the estimated coefficients of Post×Treated

and KZ are significantly positive at the level of 1%,

and the estimated coefficient of Post×Treated is lower

than column (1), indicating that the financing

constraint plays a significant intermediary role in the

impact of green credit on the strategic incentive

progress of enterprises (Wen and Ye, 2014), which is

verified The influence path of "green credit →

improvement of financing constraint level →

improvement of enterprise strategic incentive

progress".Based on the regression results of column

(1) (2) (3), the hypothesis H2 is verified.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

270

Table 5: Intermediary effect test of financing constraint level.

(1) (2) (3)

VARIABLES

Strategy KZ Strategy

Post×Treated 0.858*** 0.088** 0.850***

(7.22) (2.25) (7.15)

KZ 0.068***

(3.12)

Size 0.036 0.370*** 0.010

(1.13) (35.58) (0.29)

ROA -0.024*** 0.061*** -0.028***

(-4.34) (32.36) (-4.94)

Lev -0.005*** -0.057*** -0.002

(-2.92) (-98.59) (-0.72)

Cf 0.032*** 0.147*** 0.023***

(7.85) (108.46) (4.38)

Top5 -0.016*** 0.003*** -0.016***

(-8.14) (5.11) (-8.20)

Dual -0.159** 0.038* -0.157**

(-2.16) (1.74) (-2.14)

Pay 0.074 0.112*** 0.066

(1.57) (7.31) (1.41)

Board -0.005 0.016*** -0.006

(-0.32) (2.92) (-0.39)

SOE 0.703*** -0.019 0.702***

(10.78) (-0.84) (10.77)

FirmAge 0.004 -0.026*** 0.005

(0.60) (-14.34) (0.75)

Constant 2.829*** -4.270*** 3.112***

(3.23) (-3.29) (3.53)

Year YES YES YES

Industry YES YES YES

Observations

14,966 22,664 14,966

R-squared

0.567 0.692 0.567

Note: *, * *, * * * respectively indicate that the correlation between variables is significant at the statistical levels of 10%,

5% and 1%.The value of t is in parentheses.

5 ROBUSTNESS TEST

5.1 Replace Interpreted Variable

Referring to the practice of Sun Jian et al. (2016), this

paper replaces the strategic incentive progress index

strategy with the dummy variable PROS representing

offensive strategy and the dummy variable DEFE

representing defensive strategy. When strategy ≥ 18,

PROS takes 1, otherwise 0. When strategy ≤ 6, DEFE

takes 1, otherwise 0. Then, according to the model

(1), logit regression is used again for estimation. The

regression results are shown in columns (1) and (2) of

table 6, and the research conclusions remain

unchanged.

5.2 Change Estimation Method

In order to avoid the influence of company

characteristics on the regression results, this paper

controls the fixed effect at the company level and

clusters the standard errors at the company level. The

regression results are shown in column (3) in Table 6,

and the research conclusions remain unchanged. At

the same time, this paper changes the time interval of

policy impact. The sample interval set in column (4)

Green Credit Policy and Enterprise Strategic Transformation: Empirical Test of Heavy Pollution Industry

271

(5) (6) in Table 6 is 2 years before and after the

policy, 3 years before and after the policy, and 4 years

before and after the policy. The regression result is

positive and significant, which is consistent with the

previous conclusion.

Table 6: Robustness test results.

VARIABLES

Replace dependent variable Change estimation method Change time interval

(1)

PROS

(2)

DEFE

(3)

Firm Effect

(4)

[-2,2]

(5)

[-3,3]

(6)

[-4,4]

Post×Treated

0.293***

(7.26)

-1.294***

(-15.17)

0.183***

(2.68)

2.05***

(12.82)

0.312**

(1.95)

0.577***

(4.05)

KZ

Convars Control Control Control Control Control Control

Constant

9.958

(25.17)

-1.886

(-3.69)

19.984

(16.23)

8.056

(5.40)

1.844

(1.27)

2.016

(1.72)

Year YES YES YES YES YES YES

Industry YES YES YES YES YES YES

Firm NO NO YES NO NO NO

R2 0.29 0.09 0.11 0.27 0.52 0.53

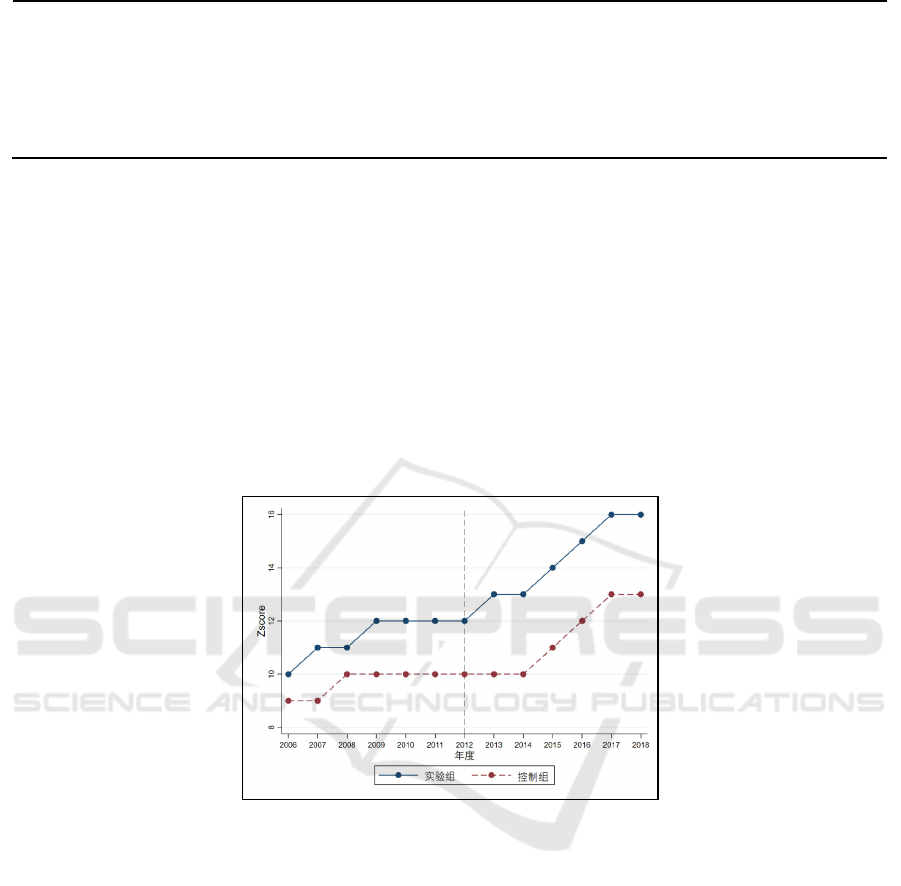

5.3 Propensity Score Matching(PSM)

In order to avoid the deviation of the results caused

by the possible problem of sample self selection, this

paper uses the propensity score matching method

(PSM) to perform 1:1 nearest neighbor matching on

the samples. Like the main regression, this paper

successively matches the control variables in the

PSM robustness test, including Size, ROA, Lev, Cf,

Top5, Dual, Pay, Board, Soe, FirmAge. The matching

process is shown in Fig.2. From the value and

comparison relationship of the specific statistics of

each variable before and after matching, it can be seen

that there are significant differences in each variable

before matching, and there is no significant

difference in the mean value of each variable after

matching. After the nearest neighbor matching of the

control variables, the double difference model is used

for regression estimation again. The regression

results of PSM-DID are shown in Table 7. The

empirical results of this paper are robust, and the

research conclusion is still valid.

Figure 2: Results before and after PSM matching.

Table 7: PSM-DID Inspection results.

(1) (2) (3)

VARIABLES

Strategy Strategy Strategy

Post×Treated

2.920*** 2.625*** 0.860***

(32.23) (28.90) (7.23)

Convars NO

YES YES

Constant

11.381*** 7.404*** 2.866***

(256.23) (8.49) (3.27)

Year NO NO YES

Industry NO NO YES

Observations

14,961 14,961 14,961

R-squared

0.065 0.103 0.567

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

272

6 CONCLUSION AND

ENLIGHTENMENT

At present, China is vigorously developing green

finance and promoting the green transformation of

key industries and important fields. The introduction

of green credit policy is of great significance to guide

heavy polluting enterprises to carry out strategic

transformation and realize green development as

soon as possible. Based on this, this paper takes the

formal implementation of the green credit guidelines

in 2012 as a quasi natural experiment, selects China's

A-share listed companies from 2006 to 2018 as a

research sample, constructs a PSM-DID model to

quantitatively evaluate the impact of green credit

policy on enterprise strategy and its action

mechanism. The study found that: First, after the

implementation of the green credit policy, the

strategic incentive progress of heavy polluting

enterprises has been significantly improved. After a

series of robustness tests such as replacing the

dependent variable, changing the estimation method

and changing the time interval, the conclusion is still

valid. Second, according to the intermediary effect

test, financing constraints play a significant

intermediary role in the impact of green credit on

enterprise strategic incentive progress. The green

credit policy intensifies the financing constraints of

heavy polluting enterprises, and then promotes the

strategy of heavy polluting enterprises from attack to

defense. Based on the above conclusions, the

empirical results of this paper have the following

enlightenment for the improvement and follow-up

implementation of green credit policy:

First, local governments should vigorously

implement the green credit policy to ensure that the

policy is implemented in place. The government and

commercial banks should give full play to the

financing punishment effect of green credit policy

and adjust the opportunity cost of environmental

pollution through credit channels, so as to promote

heavily polluting enterprises to increase clean

investment and reduce polluting investment.

Therefore, heavily polluting enterprises will have the

motivation to carry out green innovation and strategic

transformation. Second, local governments should

actively optimize the systems and regulations related

to green credit, establish an evaluation system for the

effect of policy implementation according to the

actual development of local enterprises, improve the

relevant institutional environment and ensure the

effect of policy implementation. Third, avoid "one

size fits all" green credit. Even if the empirical results

show that the green credit policy promotes the

heavily polluting enterprises to seek more radical

strategic transformation, the financing constraints

brought by the policy actually cause some obstacles

to the green transformation of enterprises. Enterprises

show more passive stress response, while active

strategic response is insufficient. Therefore, local

governments and banking institutions can provide

financial support for environmental protection

investment and green development for heavy

polluting enterprises in combination with the actual

situation, so as to better guide the green

transformation of heavy polluting enterprises and

stimulate the transformation power of enterprises.

REFERENCES

Allet M, Hudon M. Green Microfinance: Characteristics of

Microfinance Institutions Involved in Environmental

Management[J]. Journal of Business Ethics, 2015,

126(3):395-414.

Bentley, K. A., Omer, T. C., Sharp. N. Y. Business

Strategy, Financial Reporting Irregularities, and Audit

Effort. Contemporary Accounting Research, 2013,

30(2): 780-817.

Bertrand, M. How much should we trust differences-in-

differences estimates[J]. Risk Management and

Insurance Review,2004,119(1):173-199.

Chen Qi Has China's green credit policy been implemented

-- Based on the analysis of loan scale and cost of "two

high and one surplus" enterprises [J] Contemporary

finance and economics, 2019 (3): 118-129.

Chen Xingxing, Shi Yaya, song Xianzhong Green credit

constraints, commercial credit and corporate

environmental governance [J] International financial

research, 2019, (12): 13-22.

Fazzari S M, Petersen B C , Hubbard R G . Investment,

Financing Decisions, and Tax Policy[J]. Social Science

Electronic Publishing,1998,78(2):200-205.

Gayané Hovakimian. Financial constraints and investment

efficiency: Internal capital allocation across the

business cycle[J]. Journal of Financial Intermediation,

2011, 20(2):264-283.

Han Yanjin Enterprise strategic difference and executive

compensation -- new evidence from efficiency contract

theory [J] Scientific research management, 2021,42

(02): 181-189.

Higgins, D., Omer, T. C., Phillips, J. D. The Influence of a

Firm`s Business Strategy on Its Tax Aggressiveness.

Contemporary Accounting Research, 2015, 32(2): 674-

702.

Jiang Fuxiu, Shi Beibei, Ma Yunbiao Financial experience

of information publishers and corporate financing

constraints [J] Economic research, 2016,51 (06): 83-97.

Kaplan, S. N. and Luigi, Z., 1997, "Do Investment-Cash

Flow Sensitivities Provide Useful Measures of

Financing Constraints?", Quarterly Journal of

Economics, (1): 169-215.

Green Credit Policy and Enterprise Strategic Transformation: Empirical Test of Heavy Pollution Industry

273

Li Wenjing, Li Mangmang "Entity + finance": financing

constraints, policy catering or market competition——

Empirical research based on different property rights

[J] Financial research, 2017 (08): 100-116.

Liu X H, Wang E X, Cai D T. Green credit policy, property

rights and debt financing: Quasi-natural experimental

evidence from China[J]. Finance Research

Letters,2019,29:129-135.

Meng Qingbin, Li Xinyu, Zhang Xiuping Short selling

mechanism, capital market pressure and corporate

strategic choice [J] China industrial economy, 2019

(08): 155-173.

Miles, R. E., Snow. C. C. Organizational Strategy,

Structure and Process. New York: McGraw-Hill Press,

1978.

Miles, R. E., Snow. C. C. Organizational Strategy,

Structure, and Process. Stanford, CA: Stanford

University Press, 2003.

Shen Hongtao, Ma Zhengbiao Regional economic

development pressure, enterprise environmental

performance and debt financing [J] Financial research,

2014, (02): 153-166.

Su Dongwei, Lian Lili Does green credit affect the

investment and financing behavior of heavily polluting

enterprises? [J]. Financial research, 2018, (12): 123-

137.

Sun Jian, Wang Baiqiang, Cao Feng, Liu xiangqiang Does

corporate strategy affect earnings management? [J].

Management world, 2016 (03): 160-169 DOI:

10.19744/j.cnki. 11-1235/f.2016.03.013.

Wang Huacheng, Zhang Xiuping, Gao Shenghao Does

corporate strategy affect over investment [J] Nankai

management review, 2016,19 (04): 87-97 + 110.

Wang Liping, Xu Jiahui, Li Chuang Action mechanism and

stage evolution of green financial policy promoting

enterprise innovation [J] Soft science: 1-11.

Wang Xin, Wang Ying Research on green credit policy

promoting green innovation [J] Management world,

2021,37 (06): 173-188 + 11.

Wang Yanli, Lei Xiaodong, long Ruyin Does the green

credit policy improve the investment efficiency of

enterprises—— From the perspective of financial

resource allocation of heavily polluting enterprises [J]

China population, resources and environment, 2021,31

(01): 123-133.

Wang Yejing, Liu Yong, Shan Peng Research on the impact

of entrepreneurial orientation on enterprise strategic

focus [J] Scientific research: 1-16.

Wen Subin, Zhou Liuliu Influence mechanism of enterprise

carbon information disclosure on financial

performance -- the "inverted U" regulation of media

Governance [J] Management review, 2017,29 (11):

183-195.

Wen Zhonglin, ye Baojuan Intermediary effect analysis:

method and model development [J] Progress in

psychological science, 2014,22 (5): 731-745.

Wu chaopeng, Wu Shinong, Cheng Jingya, Wang Lu An

empirical study on the impact of venture capital on the

investment and financing behavior of Listed

Companies [J] Economic research, 2012,47 (01): 105-

119 + 160.

Xu Sheng, Zhao Xinxin, Yao Shuang Effect analysis of

green credit on industrial structure upgrading [J]

Journal of Shanghai University of Finance and

economics, 2018,20 (02): 59-72.

Zhan Hua How green credit affects enterprise

environmental information disclosure -- An Empirical

Test Based on listed enterprises in heavy pollution

industries [J] Nankai economic research, 2021, (03):

193-207.

Zhang Yanchao, sun Guangguo, Chen Siyang Industrial

policy, resource allocation and enterprise strategy [J]

Macroeconomic research, 2021 (06): 17-33 + 92.

Zhu Zhaohui, Tan Yafei Contract supervision and

investment efficiency of heavily polluting enterprises -

- a quasi natural experiment based on green credit

guidelines [J] East China economic management,

2020,34 (10): 74-86.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

274