Take Precautions: A Study on Social Credit System and Venture

Capital Scale

Yuecen Wang

1

, Haozhe Zhou

1

, Yingkai Yin

2

and Yirong Ying

2

1

School of Economics Shanghai University, Shanghai, China

2

Faculty of Geosciences and Environmental, Southwest Jiaotong University, Chengdu, China

Keywords: Social Credit System, Credit Investigation System, Venture Capital.

Abstract: The study of social credit system can not only analyze and alleviate the problem of information asymmetry,

but also provide more information about entrepreneurial characteristics for venture investors. This paper

selects Shanghai as a sample and uses the data from 2010 to 2019 to make a regression analysis of the

relationship between social credit system and venture capital scale. The empirical results show that with the

increase of the credit score of a city, the proportion of the venture capital received by the city in the national

venture capital will increase. When the credit ranking of a city declines, the proportion of venture capital

received by the city in the national venture capital will decrease accordingly. Moreover, the rise of the absolute

level of social credit system has a greater impact on the scale of venture capital than the rise of the relative

level.

1 INTRODUCTION

Innovation and entrepreneurship have become a

necessary requirement for transforming the pattern of

economic development and improving the quality of

economic development. ‘The Opinions of The State

Council on promoting high-quality Development of

Innovation and Entrepreneurship and creating an

upgraded version’ clearly points out that venture

capital should fully play its role in supporting

innovation and entrepreneurship. Venture capital

institutions often face obstacles in expanding the

scale of venture capital investment when they invest

in the state of information asymmetry. Therefore, a

deep study of the relationship between the promotion

of social credit system and the expansion of venture

capital scale is of positive guiding significance for

giving full play to the role of credit as a new factor of

production, optimizing the allocation of resources

and improving the efficiency of investment.

This paper selects Shanghai as a sample and uses

the data from 2010 to 2019 to make a regression

analysis of the relationship between social credit

system and venture capital scale. The empirical

results show that with the increase of the credit score

of a city, the proportion of the venture capital

received by the city in the national venture capital

will increase. When the credit ranking of a city

declines, the proportion of venture capital received by

the city in the national venture capital will decrease

accordingly.

2 LITERATURE REVIEW

According to modern credit science, credit

investigation is an activity of collecting, sorting out

and saving the credit information of natural persons

according to law, and then providing credit

assessment, credit report and other services to carry

out credit management and provide them to

information users. Some scholars also define credit

reference as tradable carbon credit based on the credit

value used for social welfare or private social

investment (Raji, et al, 2021). Credit bureaus and

registries have become nearly universal. There are

three categories of the social credit investigation

system in China: the banking financial institutions

represented by the Credit investigation Center of the

People's Bank of China; Public institutions

represented by government public credit information

centers; Credit investigation of social institutions

characterized by spontaneous development. The

development of China's social credit investigation

306

Wang, Y., Zhou, H., Yin, Y. and Ying, Y.

Take Precautions: A Study on Social Credit System and Venture Capital Scale.

DOI: 10.5220/0011175200003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 306-312

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

institutions shows obvious government-led

characteristics, and the government has a huge

advantage in promoting the social credit investigation

system.

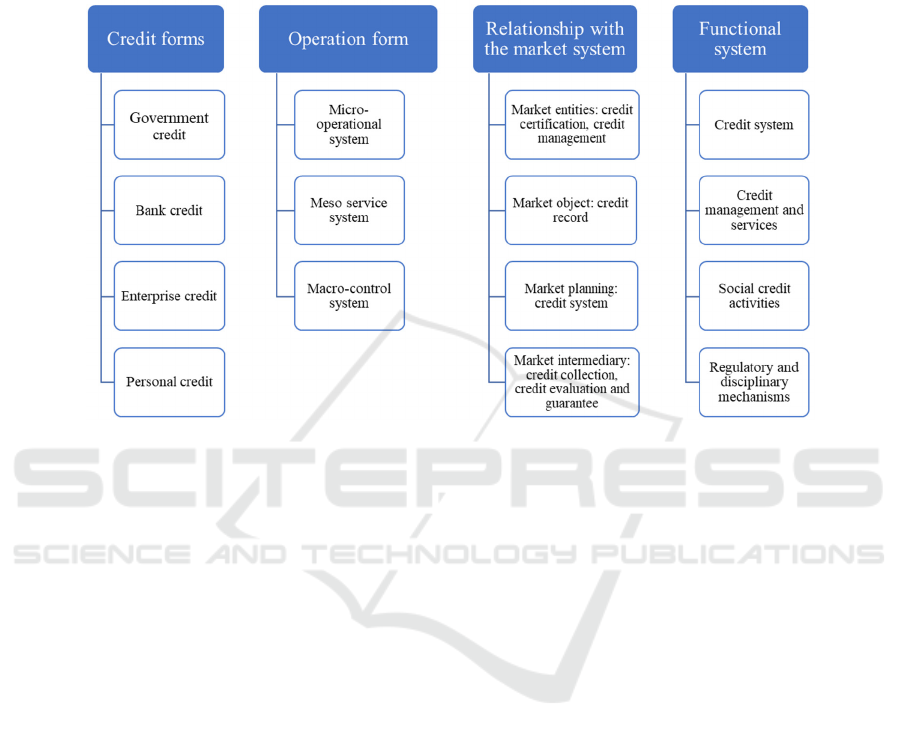

The content of social credit system is extremely

rich and the architecture is also quite complex. The

current viewpoints of scholars are to decompose the

content of social credit system from four angles:

credit form, operation form, relationship with market

system and functional system. The details are shown

in Figure 1.

Figure 1: The content of social credit system divided by four levels.

In short, the social credit system is mainly divided

into three parts: the government, banks, enterprises

and individuals complete their basic credit activities

in the market; the government established a series of

supporting laws and regulations as the founder of the

social credit system; the government also needs to

carry out supervision, regulation and other work to

maintain the operation of the system. Figure 1 shows

that the social credit system is essentially an

extension of the credit investigation system in the

economic and financial field. First, the credit

investigation system is managed by the People's Bank

of China. The social credit system is led by the

National Development and Reform Commission and

the People's Bank of China, with the participation of

many other government departments. Second, the

credit investigation system mainly collects the

negative information of market participants in

lending, guarantee, lease, credit card and other

activities. Social credit system involves participants

in the market credit and public credit field of good

and bad information. Third, credit investigation

system focuses on the economic field; social credit

system covers many fields of social development.

Fourthly, the informatization carrier of credit

investigation system is mainly the Credit

investigation system of the People's Bank of China.

The informatization carrier of social credit system is

the national credit information sharing

platform. Fifth,

from the perspective of the form of credit record

presentation, the credit investigation system is

presented in the form of personal credit investigation

Report; The social credit system is presented in the

form of individual public credit Report and enterprise

legal person public credit Report.

From the perspective of complex system, social

credit system can be divided into three sub-systems:

narrow social credit system, social credit system and

social civilization system. The three sub-systems are

based on two credit data systems. The narrow social

credit system is based on the basic database of

financial credit information. The system mainly acts

in the economic field, and its main tools are credit

investigation system and rating, etc. Its main

objectives are to regulate credit release, rectify and

standardize the order of market economy, realize the

government's market credit supervision, reshape

business ethics, and establish a punishment

mechanism for economic dishonesty.

Social credit system and social civilization system

are based on the national public credit information

sharing platform. The social credit system mainly

acts on the social field, and the main tools are

blacklist system and memorandum of joint

Take Precautions: A Study on Social Credit System and Venture Capital Scale

307

punishment for trust-breaking. Its main goal is to

construct urban credit system, industrial

credit system,

joint punishment for trust-breaking and joint

incentive for trust-breaking, establish market joint

prevention mechanism, and implement credit

education project. The social civilization system

mainly acts in the social field and the

ideological field,

the main tool is the resident credit classification and

blacklist system, the main goal and task is to achieve

the reconstruction of social morality, the construction

of advanced culture and legal society and also the

innovation of social governance.

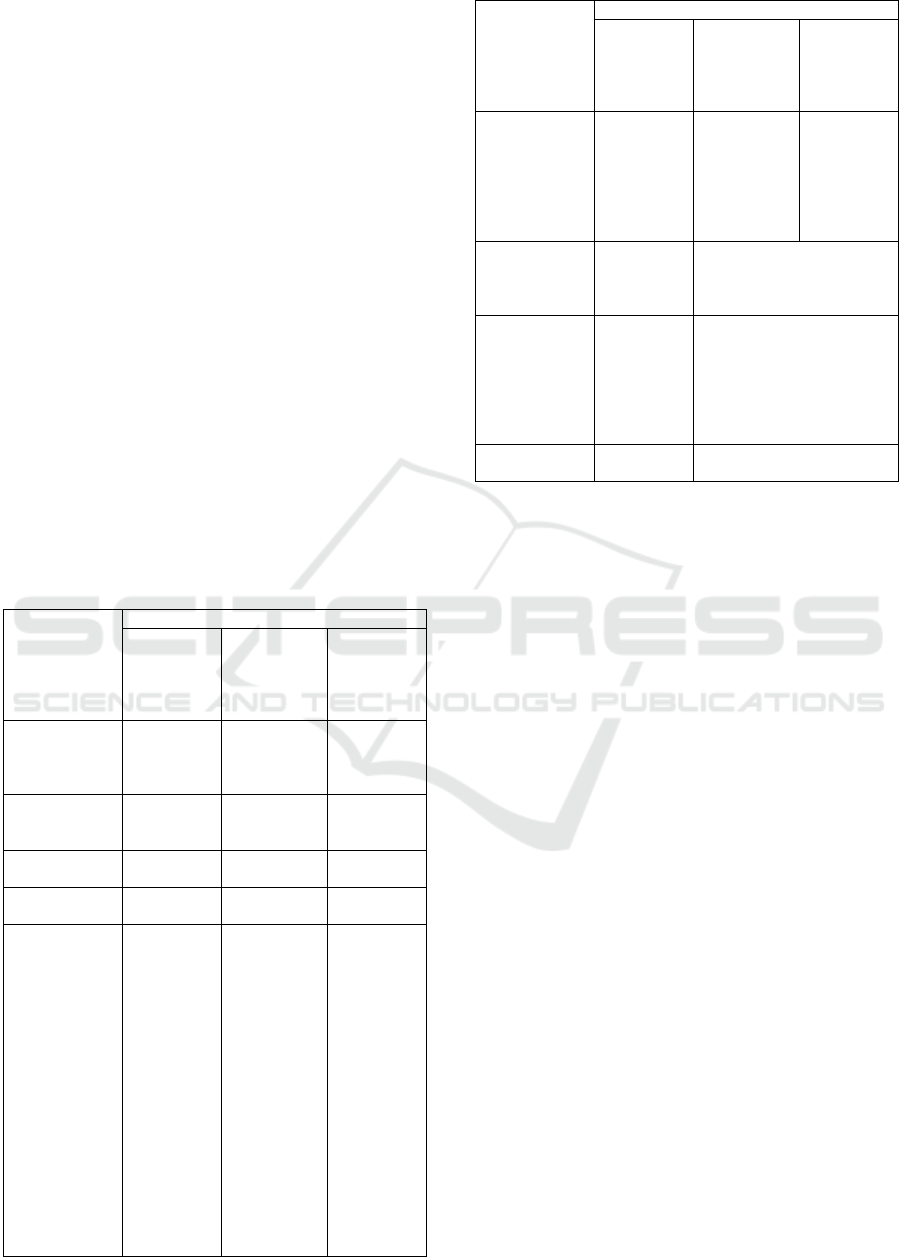

To sum up, the main content of social credit

system can be summarized as Table 1. The social

credit system is more than what people usually

mention. From the perspective of using tools, it not

only includes the credit investigation system

established by the government in the economic field

and the service system composed of numerous credit

information service agencies in the market, but also

includes the joint punishment memorandum for trust-

breaking, blacklist system, residents' credit rating

system, which can play a role in the field of social

credit and social morality.

Table 1: The content of social credit system.

Item

Social credit system

Social

credit

system in

narrow

sense

Social credit

system

Social

civilization

system

Field

economic

field

social field

the whole

social

ideology

field

Form

economic

contract

non-standard

commitment

social

public

morality

Tool

credit

reporting

blacklist

system

blacklist

system

State

Start from

2003

Start from

2014

Start from

2016

Objectives and

tasks

Regulation

and

supervision

of credit

distribution

; Rectify

and

standardize

the order of

the market

economy;

Realize the

government

market

credit

supervision

; Reinvent

b

usiness

Construction

of urban

credit

system;

Construction

of industry

credit

system;

Construction

of joint

punishment

and joint

incentive for

trust-

breaking;

Establish

market joint

prevention

Rebuilding

social

morality;

Building

advanced

culture;

Building a

society

ruled by

law;

Innovating

social

governance

Item

Social credit system

Social

credit

system in

narrow

sense

Social credit

system

Social

civilization

system

ethics;

Establish a

punishment

mechanism

for

economic

dishonesty

system;

Implement

honesty

education

project

Data platform

Financial

credit

information

database

National public credit

information sharing

platform

Management

department

People's

Bank of

China

led by the National

Development and Reform

Commission and the

People's Bank of China,

with the participation of

many other government

departments

Main role credit

Social rules

39.58

The advantages of establishing a credit

investigation system can not only reduce the cost of

screening and monitoring (Hauswald, Marquez,

2003), but also increase the credit scale (Bennardo, et

al., 2015). Moreover, it can effectively reduce

adverse selection problems (Libeti, et al., 2017).

However, the potential cost of establishing a credit

investigation system is that it may reduce the

information rent of banks (Scott, et al., 2001) and

reduce the credit supply (Sutherland 2018).

Credit investigation system also has a certain

impact on financing cost in many ways. When

evaluating commercial loan applications, especially

for small and micro enterprises, banks will consider

the credit score of company holders to determine their

loan rate (Kamilah, et al., 2020). There is strong

evidence that enterprises with high credit rating have

lower financing costs. Martinez Peria and Singh

(2014) showed that the credit investigation system

reduced the financing cost of enterprises by 1.3

percentage points. Loan business model influences

the popularization of credit investigation system

(Mishra, et al., 2019, Liberti, et al., 2021).

Nevertheless, by 2020, 88% of economies have had

private credit investigation bureaus or public credit

investigation registries (World Bank 2020).

From the perspective of credit risk, information

sharing can form a reputation constraint mechanism

in repeated games, punishing default behaviors,

increasing default costs, and it can help reduce credit

risk (Bos, et al., 2015). Some scholars have studied

the relationship between credit investigation system

and non-performing loans of banks and found that the

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

308

economic impact of information system reform is

quite large, which reduced the non-performing loan

ratio of banks by nearly 40% (Saibal Ghosh, 2019).

Therefore, bank regulators can consider establishing

a credit investigation system as a macro-prudential

supervision over the growth of non-performing loans

(Wahyoe, et al., 2017).

To sum up, information asymmetry can lead to

adverse selection, moral hazard and credit mismatch

in the credit market. By establishing a credit

investigation system to share credit information,

banks can enhance their ability to select investors

from different risk categories, reduce adverse

selection of borrowers and promote the increase of

credit scale. At the same time, the reputation

constraint mechanism can improve the default cost,

reduce credit risk, and solve the financing difficulties

of small and micro enterprises.

3 MODEL SETTING

3.1 Research Hypothesis

If a social credit system, including the credit

investigation system, has established a shared credit

information collection, and with the continuous

improvement of this system, the availability of

corporate credit information and even more

characteristic information continues to increase, then

adverse selection The problem will be alleviated.

With a relatively complete social credit system, it is

easier for venture investors to screen start-ups and

make investment decisions. This means that the

improvement of the social credit system also means

that the default cost of start-ups will increase, and the

problem of moral hazard will also be alleviated.

Therefore, this article makes the following

assumptions:

H1: The higher the degree of Changsha’s social

credit system, the larger the scale of venture capital.

3.2 Sample Selection and Data Sources

Considering the representativeness of the sample

cities’ regional geographic location and venture

capital scale, as well as the availability and

completeness of data, this article chooses Changsha

as the analysis object. All the investment events of all

venture capital institutions in the sample cities from

2010 to 2019, the per capita GDP data of the sample

cities from 2010 to 2019, and the proportion of the

output value of the secondary and tertiary industries

in GDP are all taken from the wind database. The City

Business Credit Environment Index (CEI) is mainly

taken from the “CEI Blue Book”. For years with

missing data, the mean value of two consecutive

years is used as an interpolation substitute. In

particular, due to the lack of data in 2014, data of

2013 is the average of previous years, and the 2014’s

is the average of 2013 and 2015.

3.3 Variable Definition and Model

Setting

According to the research purpose and related

literature, this paper chooses the ratio of venture

capital investment to the national total venture capital

investment to measure the scale of entrepreneurship.

This article chooses city’s commercial credit

index as the measure of the level of social credit

system construction. The Urban Commercial Credit

Index is jointly compiled by the Integrity Research

Center of the Chinese Academy of Management

Science and other institutions. It is based on the

theory of social credit system, urban credit system,

and enterprise credit management theory. It provides

financial credit instruments, commercial credit sales,

and enterprise comprehensive evaluation of factors.

Finally get the social credit score of each city and

rank it. The social credit score ranges from 1 to 100.

The higher the score, the higher the construction level

of the city’s social credit system. Existing research

results show that CEI is a reliable indicator to

measure the degree of perfection of the city’s credit

system and the results of its operation. Considering

that the changes in the social credit system may not

have an immediate impact on the decision-making of

venture investors, this article chooses the first-order

lag and second-order lag of CEI as explanatory

variables.

The model established in this paper is as follows:

112 23

y

ttt tt

a b CEI b CEI b Controls

ε

−−

=+ + + +

Where,

y

t

is the explained variable, which

measures the scale of venture capital investment.

1t

CEI

−

and

2t

CEI

−

are explanatory variables, which

measures the degree of perfection of a city's social

credit system.

t

Controls

is control variable. We

choose GDP per capita (ten thousand yuan), the

proportion of secondary industry output

value in GDP,

and the proportion of tertiary industry output value in

GDP to exclude the influence of local economic

development level and industrial structure on venture

capital scale.

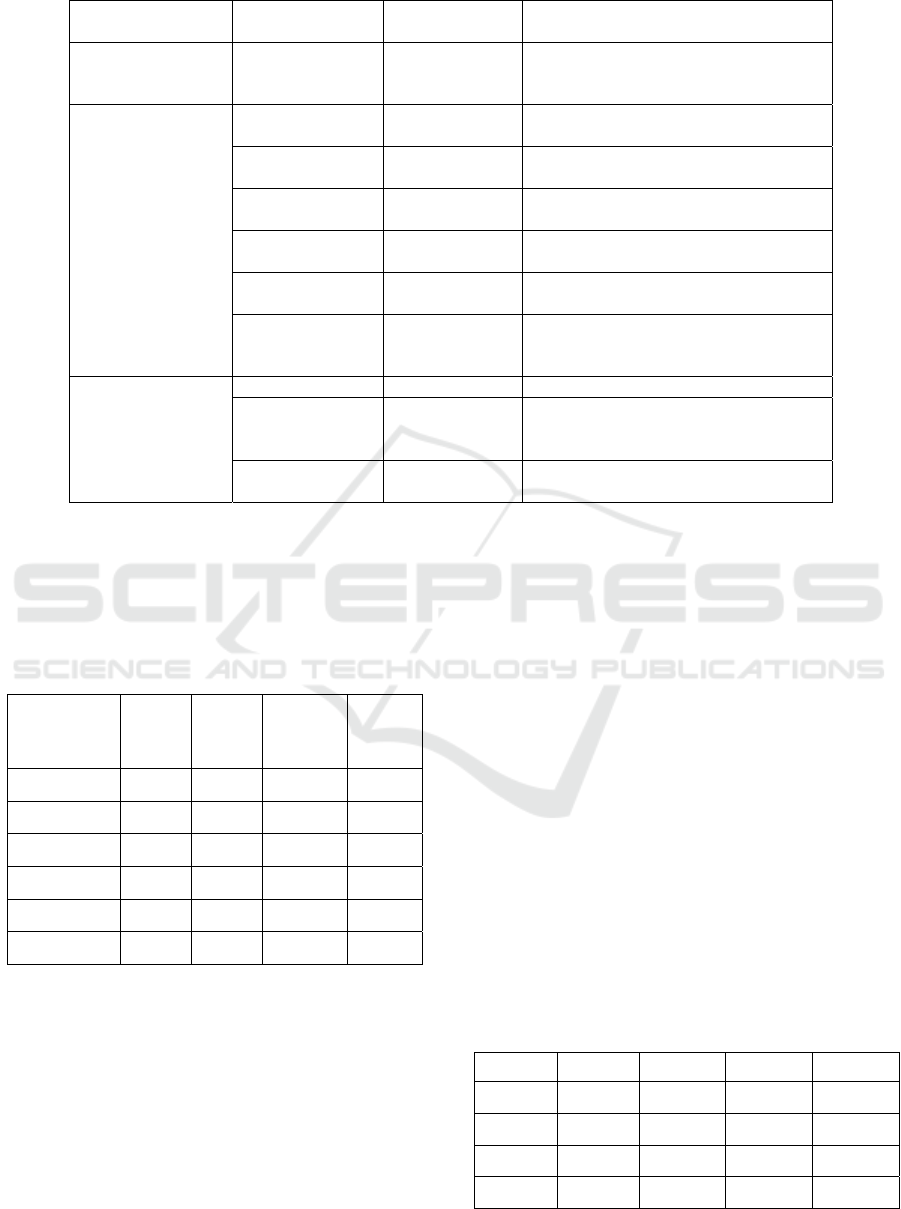

All of variable names, symbols and definitions in

model (1) are shown in Table 1.

Take Precautions: A Study on Social Credit System and Venture Capital Scale

309

Table 2: Variable definitions.

Variable types Variable names

Variable

symbols

Variable definitions

explained variable

Scale of venture

investment

y

The permillage of venture capital

amount to the total national venture

ca

p

ital amount

(

‰

)

explanatory

variables

CEI ranking cei_rank

Ranking of urban commercial credit

environment index

CEI score cei_score

Score of urban commercial credit

environment index

first order lag of

CEI score

L1_score First order lag of CEI score

second order lag

of CEI score

L2_score Second order lag of CEI score

first order lag of

CEI rankin

g

L1_rank First order lag of CEI ranking

second order lag

of CEI score

ranking

L2_rank Second order lag of CEI score ranking

control variables

GDP

p

er ca

p

ita

g

d

p_p

c GDP

p

er ca

p

ita

(

ten thousand

y

uan

)

the proportion of

secondary

industr

y

second_pro

The proportion of secondary industry

output value in GDP

the proportion of

tertiar

y

industr

y

tetiary_pro

The proportion of tertiary industry

out

p

ut value in GDP

4 EMPIRICAL ANALYSIS

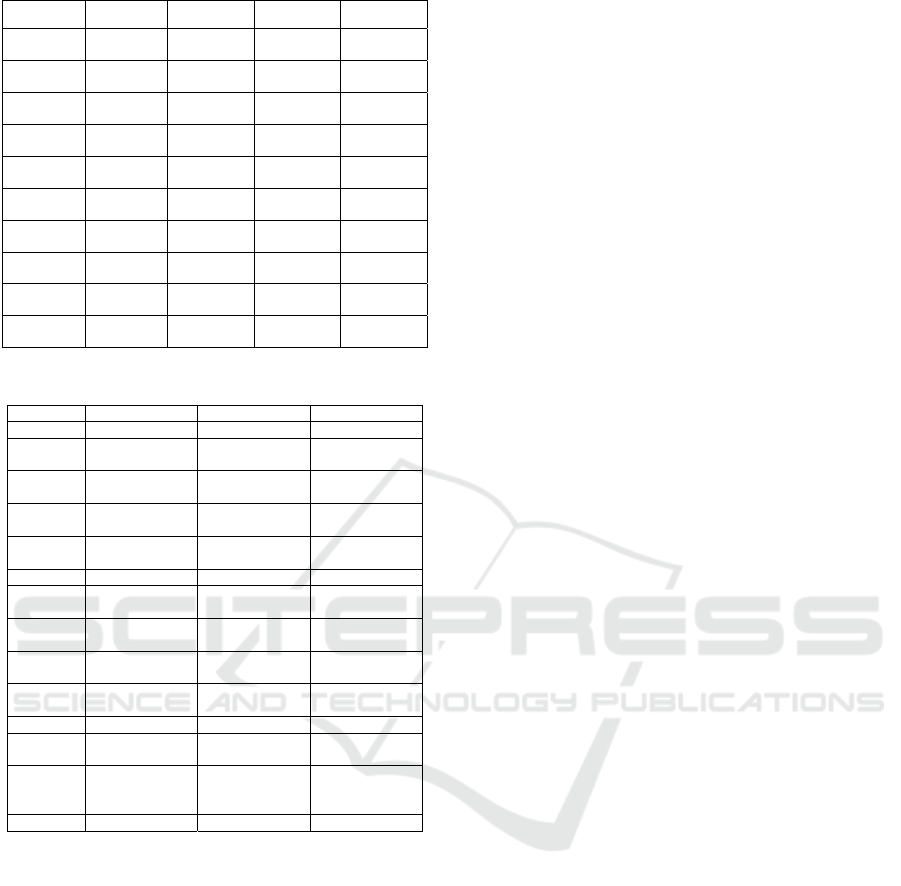

4.1 Descriptive Statistical Analysis

Table 3: Descriptive statistics of variables.

mean std min max

y 43.51 89.47 0.02 355.45

CEI_score 84.35 2.07 80.09 87.00

CEI_rank 2.11 0.33 2.00 3.00

gdp_pc 11.06 2.52 8.26 15.73

second_pro 33.22 4.86 26.99 41.30

Tertiary_pro 66.32 5.00 58.09 72.74

Among the sample cities selected in this paper,

the average ratio of venture capital investment in

cities to the total amount of national venture capital

investment is 4.351%. The maximum value was

3.55%, and the minimum value was only 0.002%.

The average CEI score of the city was 84.35, and the

standard deviation was 2.07. The CEI scores of

sample cities were higher and the differences were

small. The mean and standard deviation of CEI

rankings were 2.11 and 0.33 respectively. The social

credit scores of selected sample cities are relatively

close, and the difference in ranking is slightly

smaller. The mean value of per capita GDP was

110,600 yuan, and the standard deviation was 2.52,

indicating a small difference. From the perspective of

industrial structure, the average proportion of

secondary industry output value in GDP is 33.22%,

26.99% on minimum, and 41.30% on maximum. The

average proportion of tertiary industry output value in

GDP was 66.32%, 58.09% on minimum and 72.74%

on maximum. The proportion of secondary and

tertiary industries in the sample cities is larger, and

the output value of tertiary industry is relatively

higher.

4.2 Regression Results

The regression results between Shanghai's social

credit system and venture capital scale are shown in

Table 3.

Table 4: Regression results of Shanghai (1).

(1) (2) (3) (4)

y y y y

L1_score 59.21*

(22.28)

44.35

(47.27)

gdp_pc -11.44

(27.03)

-10.34

(72.32)

43.73

(42.82)

15.74

(42.09)

second_pro -1792.95

(929.80)

-1612.16

(2304.28)

-128.60

(1642.48)

-1904.72

(2165.12)

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

310

(1) (2) (3) (4)

tetiary_pro -1757.68

(904.14)

-1588.88

(2223.09)

-160.27

(1587.25)

-1856.36

(2107.10)

L2_score 20.09

(49.39)

-6.88

(39.36)

L1_rank 13.59

(175.31)

L2_rank

cei_score

_cons 171454.11

(90909.89)

153826.84

(218641.06)

15205.98

(157930.46)

186350.09

(211729.29)

Obs. 9 8 8 9

R-squared 0.77 0.82 0.74 0.37

Adj

R-squared

0.54 0.36 0.39 -0.26

F 3.39 1.79 2.10 0.59

Table 5: Regression results of Shanghai (2).

(5) (6) (7)

y

y

y

L1_score 67.97*

(

24.45

)

gdp_pc 38.86

(

15.78

)

-10.89

(

27.43

)

11.48

(

40.49

)

second_p

ro

-67.98

(

840.93

)

-2705.51

(

1353.18

)

-390.65

(

804.03

)

tetiary_pr

o

-82.78

(

821.46

)

-2647.68

(

1317.84

)

-379.53

(

784.65

)

L2_score

L1_rank 193.93

(

140.68

)

-108.91

(

115.77

)

L2_rank 243.22

(94.34)

cei_score -42.61

(

35.30

)

_cons 6560.71

(82644.99)

260279.92

(132001.87)

41807.81

(79779.02)

Obs. 8 9 10

R-

squared

0.96 0.82

0.40

Adj

R-

squared

0.85 0.53

-0.17

F 9.06 2.81 0.56

Standard errors are in parenthesis

*** p<0.01, ** p<0.05, * p<0.1

The econometric analysis of this part is developed

in Model (1). In the case of columns (1) and (6), the

first-order lag term of the city's credit score, as an

explanatory variable, is significant at the level of

10%. At this point, the coefficients of L1_score are

59.21 and 67.966 respectively. This means that when

the urban social credit increases by one point, the

proportion of Shanghai's venture capital investment

in the national venture capital will increase by 5.92%

and 6.80%. In 2019, the proportion of venture capital

investment in Shanghai accounted for 17.18%, and

the CEI score was 85.488, ranking the second in

China. This result indicates that the improvement of

the construction level of urban social credit system

will increase the scale of innovation investment.

5 CONCLUSIONS

5.1 Build a Diversified Credit

Investigation System

We should speed up the construction of diversified

credit investigation system, further establish and

improve the long-term mechanism of credit

information collection and data sharing, break

information barriers, and increase credit information

exchange and sharing among industries. At the same

time, we should accelerate the construction of local

credit investigation platforms with "database +

service platform" as the core, promote information

symmetry between banks and enterprises, improve

the financing efficiency of micro enterprises, and

promote economic development.

5.2 Expand the Application Scenarios

of Credit Investigation System

We should strengthen the publicity of credit

investigation system, expand the application

scenarios of credit investigation system, and give full

play to the counter-cyclical adjustment function of

credit investigation system. At the same time, we

should improve risk awareness, integrate internal

corporate customer credit information, strengthen the

connection with judicial and tax platforms, actively

use fintech ways for analysis, and improve risk

prevention capabilities.

However, this paper only selects Shanghai as a

representative city for empirical research, and the

sample is relatively single. In addition, Shanghai, as

an international city, is relatively complete in the

construction of social credit system. However, in

China, there are many small cities that cannot achieve

such an excellent credit investigation system, which

may be slightly different from the conclusion of this

paper. In the future, we can carry out regression

statistics on the data of various counties and cities

across the country to reach a more comprehensive

conclusion.

ACKNOWLEDGMENT

This research was supported by National Social

Sciences Founding Project (Grant No.17BJY062).

Take Precautions: A Study on Social Credit System and Venture Capital Scale

311

REFERENCES

Ajwani-Ramchandani, Raji, and Joseph Sarkis. (2021).

Time to Consider Circular and Social Credits

Exchanges? J. Resources, Conservation and Recycling,

vol. 175: 105860, Web.

Andrew Sutherland.(2018). Does Credit Reporting Lead to

a Decline in Relationship Lending? Evidence From

Information Sharing Technology. J. Journal of

Accounting and Economics, vol. 66(1), pp. 123-141.

Bennardo, A., Pagano, M., Piccolo, S. (2015) . Multiple

bank lending, creditor rights, and information sharing.

J. Rev. Financ, vol. 19 (2), pp. 519–570.

Bos J, De Haas R, Millone M. (2015). Show Me Yours and

I'll Show You Mine: Sharing Borrower Information in

a Competitive Credit Market. J. BAFFI CAREFIN

Working Paper 1508, 2015.

Doblas-Madrid, A., Minetti, R. (2013). Sharing information

in the credit market: contract level evidence from US

firms. J. Financ. Econ, vol. 109, pp. 198–223.

Hauswald, R., Marquez, R. (2003). Information technology

and financial services competition. J. Rev. Financ.

Stud, vol. 16 (3), pp. 921–948.

Liberti J M, Sturgess J, Sutherland A.(2021). How

Voluntary Information Sharing Systems Form:

Evidence from a U.S. Commercial Credit Bureau. J.

Journal of Financial Economics, web.

Liberti, José María, and Mitchell A Petersen. (2019).

Information: Hard and Soft. J. The Review of

Corporate Finance Studies, vol. 8.1, pp. 1-41.

Mishra, P., N. Prabhala , and R. G. Rajan . (2019). The

Relationship Dilemma: Organizational Culture and the

Adoption of Credit Scoring Technology in Indian

Banking. J. Social Science Electronic Publishing.

Peria, Ms Martinez , and S. Singh. (2014). The Impact of

Credit Information Sharing Reforms on Firm

Financing?. J. Social Science Electronic Publishing.

Washington DC.

Saibal Ghosh. (2018). Loan Delinquency in Banking

Systems: How Effective Are Credit Reporting

Systems?. J. Research in International Business and

Finance, vol. 47, pp. 220-236.

Scott F, Srinivasan A, Woosley L. (2001). The Effect of

Credit Scoring on Small Business Lending. J. Journal

of Money, Credit and Banking, vol. 33, pp. 813-825.

Wahyoe Soedarmono and Djauhari Sitorus and Amine

Tarazi. (2017). Abnormal loan growth, credit

information sharing and systemic risk in Asian banks.

J. Research in International Business and Finance, vol.

42, pp. 1208-1218.

Williams Kamilah and Brown Leanora. (2021). Does

Information Sharing Matter? Cross-country Evidence

on Foreign Bank Presence. J. Journal of Economics and

Business, vol. 116: 105977, web.

World Bank.(2020). Doing Business 2020: Getting Credit.

World Bank, Washington. DC.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

312