Research on the Impact of Innovation Output on IPO Underpricing

Rate based on Multiple Linear Regression Model

Qiyu Cheng and Sihan Wang

Zhejiang University, International Campus, Wenzhou, China

Keywords: Innovation Capacity Output, Science And Innovation Board, Degree Of IPO Price Suppression, Multiple

Linear Regression Model, Book Value Of Intellectual Property, Invention Patent Intensity.

Abstract: In the context of the reform of the registration system of China's science and technology innovation board,

this paper empirically investigates the impact of a company's innovation output capability on the degree of its

IPO depression, using 212 companies listed on the science and technology innovation board since 2019 as a

research sample. In this paper, the company's intellectual property book value and invention patent intensity

are used as indicators of the company's innovation output capability. This paper establishes a multiple linear

regression model that affects the company’s IPO underpricing rate, and explore the impact of the company’s

innovation output capacity on the degree of IPO underpricing. The results find that both the book value of

intellectual property and the intensity of invention patents have a positive effect on the degree of IPO

depression of the company, among which the former has a more significant effect. It is suggested to improve

the assessment process of the actual innovation capacity of science and technology companies. Also, it can

be urgent for relevant departments and organizations to guide secondary market investors to correctly

understand the value of enterprises, as well as to participate in investment and pricing activities in an orderly

manner.

1 INTRODUCTION

1.1 Background of the Study of the

Problem

Due to the late establishment of the Chinese stock

market, the short development time of the capital

market and the imperfection of the relevant system,

the IPO price suppression in the Chinese A-share

market has been at a high level for a long time, with

the average price suppression rate even exceeding

140%. The severe price suppression makes IPOs

rarely break in the primary market, weakening the

efficiency of market resource allocation. New shares

are generally undervalued in the primary market, a

phenomenon that is particularly evident in the KSE,

increasing the cost of financing for KSEs, weakening

their financing, and reducing the efficiency of

resource allocation in the primary market. At the

same time, it has been a long-standing iron law in the

secondary market that new stocks are undefeated, and

influenced by various factors such as investor

sentiment and information asymmetry, the prices of

new stocks often jump wildly on the first day of

listing in the secondary market, seriously affecting

the fairness and rationality of market pricing.2020 In

June 2020, the STB began to implement the

registration system reform on a trial basis, and the

stock market as a whole evolved in a market-oriented

direction, with the role played by the market in

valuation and pricing is increasing day by day, and

this initiative helps to guide the market towards

rationalization, enhance market activity and the

effectiveness of resource allocation, and guide the

rationalization of the market valuation and pricing

process. This paper aims to explore the impact of

innovation output capacity on the degree of

underpricing of stocks listed on the Sci-Tech

Innovation Board for the first time, and to explore the

relationship between stock valuation pricing and its

intrinsic value after the registration system reform.

Cheng, Q. and Wang, S.

Research on the Impact of Innovation Output on IPO Underpricing Rate based on Multiple Linear Regression Model.

DOI: 10.5220/0011177700003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 335-345

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

335

1.1.1 Changes in IPO Review and Pricing

Brought about by the

Registration-based IPO System

The reform of the registration system of the China

Science and Technology Innovation Board (STIB)

has clarified the issuance and listing review and

registration procedures, shortened the working days

required for registration review by the SFC, and

further optimized the STIB delisting indicators. The

registration system has improved the order of entry

and exit in the capital market, effectively combating

the investment behavior of the market and

emphasizing the focus and screening of the intrinsic

value of companies. This initiative creates a high-

quality capital market and financing environment for

science-based companies under the new normal of

economic environment. At the same time, it hedges

the negative impact of the epidemic on the capital

market, accelerating the recovery of capital market

vitality, as well as boosting the high-quality

development of China's economy.

1.1.2 Innovation Capacity is Becoming an

Increasingly Important Indicator of

the Value of Listed Companies

With the gradual implementation of China's

innovation-driven development strategy, improving

innovation capability and truly realizing value

innovation are important requirements for companies

to achieve differentiation and improve industry

competitiveness. In recent years, enterprises are

interested in the key significance of innovation

activities such as technological output for their long-

term survival and development, and more and more

listed companies are taking the initiative to disclose

data on technological innovation, using R&D

expenditure, patent quantity, intangible assets, etc. as

indicators to measure their innovation capability and

conduct empirical research related to enterprise value

(Lu, 2009). In this paper, we will start from the

innovation output capability of enterprises and

introduce indicators such as relative patent intensity

and intangible assets to explore the correlation

between them and enterprise value, and then explore

the impact on the IPO suppression of enterprises.

1.2 Research Value of the Problem

Compared with the existing literature, the

contribution of this paper as long as the research is as

follows: ① The research object is science and

innovation companies to explore whether the science

and innovation board is tilted towards companies

with strong innovation capability at the valuation

pricing level. ② Most scholars in the past have

mostly used R&D inputs to measure the R&D

innovation capability of enterprises mainly, ignoring

the role of the capability of the actual outcome output

in valuation pricing. This paper starts from the

innovation output capability of enterprises and

explains the impact of innovation capability influence

on the IPO suppression of science and technology

innovation enterprises from a new perspective,

making the evaluation system of valuation pricing

more complete.

2 REVIEW OF THE

LITERATURE AND

THEORETICAL

FOUNDATIONS

2.1 Study on IPO Price Suppression

2.1.1 Interpretation of the Concept of IPO

Price Suppression Rate

IPO (initial public offerings) pricing, which is a

reasonable valuation of the intrinsic value of the

proposed listed company, has always occupied an

important position in the financial field (Dong, Liu,

Xu). Since the proposed listed company cannot

predict the market demand for its shares, the issuer

will give its issue price to the investment bank, which

will be responsible for issuing and underwriting the

shares of the proposed company. Due to the

uniqueness of a company's IPO listing event and the

lack of historical trading data for the IPO company's

stock, underwriters usually need to combine different

valuation methods to more accurately predict the

price of a company's IPO stock (Roosenboom, 2007).

Due to the difficulty of IPO pricing, it is usually

necessary to make judgments about the

reasonableness of the pricing. In addition to the

method of valuing and judging reasonableness by

using comparable companies (companies with

financial and industry characteristics similar to those

of the proposed IPO) as a reference, a central measure

of the efficiency of the IPO market is the degree of

IPO price suppression (CHAMBERS, 2009,

DIMSON, 2009). A central measure of the efficiency

of the Initial Public Offering (IPO) market is the

extent to which issues are underpriced.

The IPO price suppression phenomenon, which

refers to the pricing of initial public offerings of listed

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

336

companies below the market price on the first day of

listing (Li, 2020, Li, 2020), is widespread in stock

markets around the world, and the degree of IPO

price suppression in China's main board market is

particularly significant (Gao, 2020). China's

securities market has experienced a high degree of

IPO depression in the A-share market for a long time

since the establishment of a unified stock issuance

system in 1993. In China, although the high IPO price

suppression has promoted the rapid development of

the capital market in the early years, the long-term

high price suppression has affected the efficiency of

resource allocation in the primary market for stock

issuance. Also, the high IPO price suppression has

affected the normal financing function of the

secondary market. With a long period of high IPO

price suppression, IPO subscribers can often obtain

risk-free excess returns in the primary market, while

small and medium-sized investors in the secondary

market can often only buy new shares at high levels.

This obviously unbalanced risks and returns of

investors in the primary and secondary markets have

resulted in a large number of secondary market

investors transferring funds to the primary market to

wait for new shares to be purchased. Seriously, the

secondary market financing function is low.

2.1.2 Causes and Mechanisms of Action of

IPO Price Suppression

The phenomenon of IPO price suppression in IPO

pricing was first identified by Hatfield and Reilly in

their study that investors in IPOs tend to enjoy higher

short- and long-term return returns than the general

market (Reilly, 1969, Hatfield, 1969). There has been

foreign literature on IPOs, mainly based on the

premise that secondary markets are efficient and

based on the theory of information asymmetry to

explain the phenomenon of IPO price suppression.

Among them, Rock proposed the winner's curse

hypothesis in 1986, explaining IPO price suppression

as compensation by stock issuers to informationally

disadvantaged investors in order to induce them to

join the market to buy shares (Rock, 1986) (Allen,

1989, Faulhaber, 1989) (Levis, 1993). Baron

proposed the investment bank buyer monopoly

hypothesis in 1982. As issuers and underwriters face

the risk of disclosing negative information during the

subscription period, underwriters routinely resort to

discounted offering strategies to reduce the risk of

breakage (Baron, 1982, Myerson, 1982). In addition,

the information transmission theory suggests that in

the IPO market, potential investors lack knowledge

of the true value of a listed company, and the

company entrusts a reputable underwriter to send

signals of lower risk and make investors believe that

they can gain excess returns by purchasing the

company's new shares through IPO price suppression

(Li, 2020, Li, 2020).

Some domestic scholars study the impact of

institutional reform on IPO price suppression from

the perspective of the IPO system. The IPO issuance

system in China's capital market has gone through

three stages: the audit system, the approval system

and the registration system. Due to the late start and

immature development of China's capital market, the

marketization of IPO pricing is low. Before the

reform of the registration system for IPO issuance of

A shares, the administrative intervention in IPO

issuance was more obvious, and the IPO issuance of

enterprises received heavy restrictions. The number

of enterprises that could go public was very limited

and the listing cycle was long, causing the platform

of listed enterprises to become a scarce resource (Li,

2020, Li, 2020). Companies and underwriters often

need to drive down the stock issue price to ensure a

smooth IPO. This makes the IPO pricing deviate from

the actual intrinsic value of firms to a high degree and

weakens the pricing efficiency of IPOs. Under the

long-term IPO price suppression and inflexible stock

supply, IPOs receive frenzied pursuit from investors,

a strong speculative atmosphere in the secondary

market, often blind speculation on IPO prices,

irrational investors follow the trend to buy shares, and

the price of IPOs in the secondary market is further

inflated, further leading to a high degree of IPO price

suppression in the A-share market.

2.2 A Study on the Impact of Firm

Innovation Capability on IPO Price

Suppression

The causes of the extent of IPO price suppression are

now widely discussed by scholars both at home and

abroad. On the one hand, underwriters tend to depress

IPO prices in order to compensate for the costs

required to obtain additional information about the

firm Dong, Liu, Xu) (Benveniste, 1989, Spindt,

1989). Among other things, the more shares

institutional investors receive, the more the IPO

pricing deviates from the firm's internal value and the

less efficient the pricing is Dong, Liu, Xu).

In terms of investor concern, current research

identifies underpricing due to irrational behavior of

small and medium-sized investors as the main reason

why the first day price of IPOs is much higher than

the issue price (Zou, 2020, Cheng, 2020, Chen, 2020,

Ginger, 2020). There is room for arbitrage in the

Research on the Impact of Innovation Output on IPO Underpricing Rate based on Multiple Linear Regression Model

337

primary and secondary markets under the current

system, and investor sentiment and speculative

psychology lead to serious overvaluation of IPO

stock prices after listing (Song, 2019, Tang, 2019).

Chi Jing and Padgett find through their study that the

first-day increase of IPO stock limits the signal of the

firm's true value to outside investors, and government

control over IPO issuance exacerbates the extent of

IPO price suppression (Chi, 2005, Padgett, 2005).

On the institutional side, by comparing the IPO of

technology companies listed on the STB and the main

board A-shares in the past year, Takatada verifies

through an empirical study that the key factor of IPO

price suppression of Chinese companies is the change

of the IPO system, and that the reform of the

registration system of stock issuance on the STB is

conducive to the role of the market in pricing and

resource allocation in IPO.

In terms of R&D intensity, at this stage, scholars

at home and abroad have conducted more studies on

the impact of R&D investment on IPO pricing, but

have not yet reached a unified conclusion. From the

perspective of IPO companies, companies with high

R&D intensity and strong technical strength hope to

signal the company's strong R&D capability and gain

investors' recognition through high-quality R&D

investment disclosure, which leads to higher stock

issue pricing and a lower degree of IPO price

suppression (Qiu, 2013, Peng, 2013, Yao, 2013).

Some scholars also argue that large R&D investment

exacerbates cash flow constraints and fails to deliver

current earnings, exposing firms to a situation of high

risk and uncertainty of earnings profile. As a result,

underwriters tend to be associated with undervaluing

firms in order to hedge risk and the degree of IPO

depression rises (Schankerman, 1985, Pakes, 1985)

(Han, 2001, Chuang, 2001).

Most of the existing domestic and international

empirical studies exploring the pricing efficiency of

IPOs on China's A-share STB have focused on the

impact of R&D investment on the causes of IPO price

suppression. The influence factor of innovation

capacity output (IPR output/IPR owned) of STB IPO

firms has been less explored.

A company's intellectual property rights contain

patents, trademarks, copyrights, trade secrets, etc.

Patents, as an important part of a company's

intellectual property, are often discussed more by

domestic and foreign scholars as one of the main

R&D information disclosed by listed companies. It is

widely believed at home and abroad that the core

asset of patented technology owned by a company

can influence the value of the company and its market

value after IPO. The relationship between patent

output and company value has been widely discussed

and verified in mature capital markets in Europe and

the U.S (Li, 2012, Hong, 2012, Wu, 2012). Griliches

first found the positive impact of the growth in the

number of patents on the growth of company market

capitalization and argued that this impact is

particularly significant for smaller companies

(Griliches, 1990). Subsequently, many foreign

scholars have verified the positive relationship

between patent ownership and firm value in their

studies of listed companies in different industries in

European and American capital markets, especially

high-tech listed companies (Hall 2001, Jaffe 2001,

Trajtenberg 2001). Similar findings have been

obtained from relevant studies conducted by our

scholars. By analyzing data on total intangible assets

of listed companies from 1999-2003, it was found

that the market recognizes companies' investment in

intangible assets, among which the value of

technological intangible assets is mainly reflected in

high-tech industries (Shao, 2006, Fang, 2006).

Fabrizi S. at al. further found through a series of

studies that patented technologies developed by

companies can convey to external investors On this

basis, Li Xiaoxia et al. explored the influence of

patent quantity and patent quality on the market

performance of listed companies after IPO, and

concluded that there is a positive relationship

between the number of patents and IPO market

performance of companies, among which, the

contribution of invention patents is particularly

significant (Li, 2019, Luo, 2019, Wang, 2019). Some

other scholars explain the impact of patent

technology on a company's financing ability and

value from the perspective of the company's future

cash flow and operational risk, thus providing some

thoughts on the IPO price suppression phenomenon.

Patents can affect a company's future cash flow by

affecting its operating performance and thus its future

cash flow (Zheng, 2012, Song, 2012). Li et al. argue

that technology brings more stable income, which can

reduce the uncertainty of the company's future

business situation and thus reduce the company's

business risk. Patents can signal to the market that the

company has good R&D capability and

comprehensive value, and reduce the risk of

financing failure (Li, 2019, Luo, 2019, Wang, 2019).

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

338

3 INTRODUCTION OF THE

RESEARCH CONCEPT AND

HYPOTHESIS FORMULATION

3.1 Introduction of the Research

Concepts in This Paper

This paper mainly adopts literature research method

and empirical research method to investigate the

impact of a company's innovation output capacity on

its IPO depression rate by taking innovative

companies listed on the KCI board as the object of

study, using IPO underpricing rate as the explanatory

variable, using IPR book value and invention patent

intensity as the explanatory variables, and setting

other control variables according to the existing

literature.

3.2 Formulation of the Research

Hypothesis in This Paper

Based on the above analysis, two hypotheses are

proposed in this paper.

H1: The higher the share of a company's

intellectual property in intangible assets, the stronger

the company's innovation potential and innovation

output capacity, the more the secondary market

recognizes the value of the company and has

confidence in its profitability, and the more severe the

price suppression. In other words, there is a

significant positive relationship between a company's

innovation output capacity and the degree of IPO

price suppression.

H2: The higher the number of invention patents

owned by a firm at a certain size, the higher the

proportion of technologies that can really create value

for economic growth, the more confidence secondary

market investors have in the firm's innovation

capability and the easier it is to overestimate the real

value of the firm's stock. There is a significant

positive relationship between the intensity of a

company's invention patents and the degree of IPO

price suppression.

4 MODEL CONSTRUCTION AND

EMPIRICAL STUDY

4.1 Study Sample and Data Sources

In this paper, the initial sample of China A-share KSC

IPO companies from 2019/7/22-2021/2/10 is used

and screened: special marker companies (sample of

companies with unprofitability, voting rights

difference, and red-chip structure) are excluded, and

a final sample of 212 KSC companies is obtained.

The data of financial indicators such as total assets,

gearing ratio, return on net assets, and years of

establishment for the sample of companies in this

paper are obtained from the WIND database.

4.2 Definition of Model Variables

4.2.1 Explained Variables

The explanatory variable is the IPO Underpricing

Rate

(IUR) of the firm. In the robustness test, the

Adjusted Initial Public Offering Underpricing rate

(AIUR) is used as the moderating explanatory

variable in this paper.

4.2.2 Explanatory Variables

The explanatory variables are Book Value of

Intellectual

Property (IPBV) and Intensity of Patent of

Invention (PI). The two are used as indicators of the

level of innovation capacity output of science and

innovation companies.

4.2.3 Control Variables

Control variable is the logarithm value of a

company’s

Total Assets (InTA), Debt to Asset ratio (LEV),

Return on Equity (ROE), Years of Establishment

(Years), The First Big Proportion of Shareholding

(TOPI), Industry Price Earnings ratio (IPE), First-day

Turnover rate (FTR), Online Demand-to-Offer ratio

(OTR), and the number of Shares sold in the online

offering. demand-to-offer ratio (OISR), Issuance

Cost (IC), and Earnings per Share (EPS).

4.3 Construction of the Model

To test the hypothesis, the following model (1) and

model (2) are developed in this paper, respectively.

𝐼𝑈𝑅 = 𝛽

+𝛽

𝐼𝐵𝑃𝑉 + 𝛽

𝑙𝑛𝑇𝐴 + 𝛽

𝐿𝐸𝑉 +

𝛽

𝑅𝑂𝐸 + 𝛽

𝑇𝑂𝑃𝐼 + 𝛽

𝐼𝑃𝐸 + 𝛽

𝐹𝑇𝑅 + 𝛽

𝑂𝐼𝑆𝑅 +

𝛽

𝐼𝐶 + 𝛽

𝐸𝑃𝑆 + 𝛽

𝑌𝑒𝑎𝑟𝑠 (1)

𝐼𝑈𝑅 = 𝛽

+𝛽

𝑃𝐼 + 𝛽

𝑙𝑛𝑇𝐴 + 𝛽

𝐿𝐸𝑉 +

𝛽

𝑅𝑂𝐸 + 𝛽

𝑇𝑂𝑃𝐼 + 𝛽

𝐼𝑃𝐸 + 𝛽

𝐹𝑇𝑅 + 𝛽

𝑂𝐼𝑆𝑅 +

𝛽

𝐼𝐶 + 𝛽

𝐸𝑃𝑆 + 𝛽

𝑌𝑒𝑎𝑟𝑠

(2)

Among them, the explanatory variables of model

(1) are the book value of intellectual property (IBPV)

and the explanatory variable of model (2) is the

Research on the Impact of Innovation Output on IPO Underpricing Rate based on Multiple Linear Regression Model

339

intensity of intellectual property (PI). Referring to the

study of Jianghong Zeng and Xiaoxia Li et al. the IPO

underpricing rate is also affected by total assets

(lnTA), gearing ratio (LEV), return on net assets

(ROE), years of establishment (Years), percentage of

shares held by the largest shareholder (TOPI), price-

to-earnings ratio of the industry to which it belongs

(IPE), First-day turnover ratio (FTR), Online

Offering Winning rate (OISR), IPO offering expense

ratio (IC), and earnings per share (EPS). In addition,

the model controls for the company's duration of

establishment (Years), which is calculated by

calculating the number of days between the

company's establishment date and listing date divided

by 365 days, rounded to single digits, and the result

is recorded as the company's duration of

establishment (Years). The specific variables are

defined in Table 1.

Table 1.

Variable definition table

Variable

Type

Variable

Name

Variable

symbol

Variable

definition

Explaine

d

variables

IPO

Underprici

ng Rate

IUR

Moderat

ed

explanat

ory

variables

Adjusted

IPO

Underprici

ng Rate

AIUR

Explanat

ory

variables

Book

Value of

Intellectual

Property

IPBV

(Intangible assets -

land use

rights)/intangible

assets*100

Intensity of

Patent

PI

Total number of

patents

invented/intangible

assets

Control

variables

Total

assets

lnTA

The total assets of

the firm as of the

day before the

sample cut-off date

are taken as the

natural logarithm

Debt to

Asset ratio

LEV

Gearing of the

company as of the

day before the

sample cut-off date

Return on

Equity

ROE

Net return on

equity of the

company on the

day before the

sample cut-off date

The First

Big

Proportion

of

Shareholdi

ng

TOPI

The percentage of

shares held by the

company's largest

shareholder on the

day before the

sample cut-off date

Industry

Price

Earning

Ratio

IPE

P/E ratio of the

company's industry

on the day before

the sample cut-off

date

First-day

Turnover

Rate

FTR

First-day turnover

rate of the

company's initial

listing

Online

Issue

Winning

Rate

(Online

demand-

to-offer

ratio)

OISR

The winning

percentage of the

online offering of

the company's

initial listing

Issuance

Cost

IC

Issue expense ratio

for the company's

initial public

offering

Earnings

per Share

EPS

Earnings per share

for the company's

initial public

offering

Number of

years of

establishm

ent

Years

Logarithm value of

Number of years of

incorporation at the

time of the IPO

4.4 Descriptive Statistics

To preliminarily analyze the relationship between the

book value of IPRs, the intensity of invention patents

and the degree of IPO depression for companies listed

on the KSE since 2019, this paper presents

descriptive statistics on the variables of the sample.

Table 2 shows the results of descriptive statistics

for all variables. The statistics of IPO price

suppression level (IUR, AIUR) show that the high

price suppression phenomenon is serious in China's

science and technology board, with the average price

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

340

suppression rate as high as 156.26%, and the degree

of price suppression on the first day of listing varies

greatly among different companies in the science and

technology board, with a standard deviation as high

as 124.90.The maximum value of intellectual

property book value (IPBV) is 100.00% and the mean

value is 37.13% with a standard deviation as high as

40.56. The ownership of IPBV of KCI companies in

the sample pool is generally high, but the results from

the cross-sectional comparison show that the

ownership varies greatly from company to company.

The maximum value of Invention Patent Intensity

(PI) is 8.61, the minimum value is 0.00, and the

standard deviation is 0.61. The ability of companies

per unit size in the sample pool to produce invention

patents does not vary much.

Table 2.

Descriptive statistics of variables

Vari

able

s

Number

of

samples

ave

rag

e

val

ue

(statistics)

standard

deviation

minimu

m value

maximu

m value

IUR 212

156

.26

124.90 -2.15 923.91

AIU

R

212

156

.09

124.36 -1.9 908.1

IPB

V

212

37.

13

40.56 0.00 100.00

PI 212

0.0

9

0.61 0.00 8.61

lnT

A

212

3.0

2

0.04 2.93 3.22

LEV 212

32.

99

16.73 83.84 83.84

RO

E

212

13.

28

13.74 -13.70 124.35

TOP

I

212

30.

77

13.86 9.35 81.88

IPE 212

41.

40

15.31 12.97 131.69

FTR 212

74.

53

5.65 57.57 98.96

OIS

R

212

4.0

8

1.57 2.72 22.54

IC 212

9.8

6

3.40 1.67 34.89

EPS 212

0.9

8

1.15 0.00 15.13

Year

s

212

14.

61

4.93 5.00 32.00

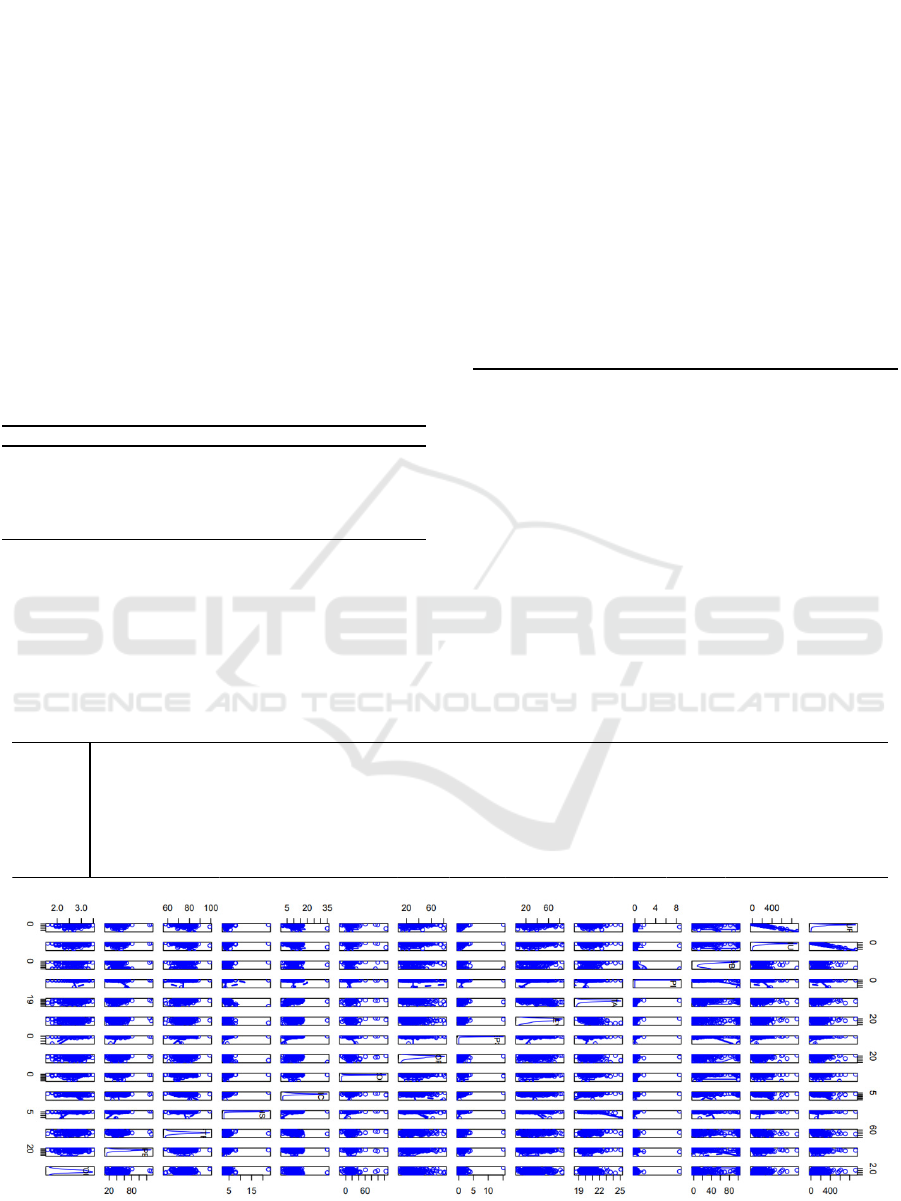

4.5 Correlation Analysis

First, this paper analyzes the correlation coefficients

of the explanatory variables, explanatory variables,

and control variables, and Table 3 shows the

correlation matrix encompassing all variables, and

Fig. 1 shows the correlation scatter plots of all

variables. As shown in Table 3, there is a positive

relationship between both IPR book value and

invention patent intensity and IPO price suppression

rate, sign this paper expects.

Table 3: Correlation matrix of variables.

.

Figure 1: Scatter plot of variable correlations.

Names of Variables IUR AIUR IPBV PI lnTA LEV EPS TOPI ROE IC OISR FTR IPE Years

IUR

1 0.999678359 0.093840934 0.114497913 -0.000676464 -0.070021416 -0.169244766 -0.084720052 0.098840555 0.28008789 -0.011714264 0.323672413 0.049335921 0.006696566

AIUR 0.999678359 1 0.093749693 0.116784662 0.000189331 -0.070372874 -0.172612836 -0.085129737 0.101083929 0.28101959 -0.009547488 0.324269707 0.04878373 0.006625652

IPBV 0.093840934 0.093749693 1 0.169573466 -0.141595019 -0.194365617 0.101946362 -0.126692632 -0.083165356 -0.064524001 0.019661625 -0.001071604 0.275435748 -0.147996434

PI 0.114497913 0.116784662 0.169573466 1 -0.072490426 -0.096253892 -0.011129475 -0.002760072 -0.007234123 -0.003622992 -0.044575152 -0.004576718 0.146752875 0.035270101

lnTA -0.000676464 0.000189331 -0.141595019 -0.072490426 1 0.461292227 -0.045142354 0.104621933 -0.081572606 -0.367298739 0.501849641 -0.186094999 -0.174952777 0.004067442

LEV

-0.070021416 -0.070372874 -0.194365617 -0.096253892 0.461292227 1 -0.060762256 0.030269679 -0.009169496 -0.002936206 0.092745503 -0.100470881 -0.1187251 0.027862398

EPS -0.169244766 -0.172612836 0.101946362 -0.011129475 -0.045142354 -0.060762256 1 -0.001354362 0.100987781 -0.244857231 -0.108447175 -0.130830282 -0.044763145 -0.12318908

TOP I

-0.084720052 -0.085129737 -0.126692632 -0.002760072 0.104621933 0.030269679 -0.001354362 1 0.094023322 0.0360487 0.142421646 -0.100391624 -0.086533193 0.112199987

ROE 0.098840555 0.101083929 -0.083165356 -0.007234123 -0.081572606 -0.009169496 0.100987781 0.094023322 1 -0.027090386 -0.111236175 -0.09490774 0.019091321 0.011057491

IC

0.28008789 0.28101959 -0.064524001 -0.003622992 -0.367298739 -0.002936206 -0.244857231 0.0360487 -0.027090386 1 -0.254894591 0.323964966 0.046566388 0.135881387

OISR -0.011714264 -0.009547488 0.019661625 -0.044575152 0.501849641 0.092745503 -0.108447175 0.142421646 -0.111236175 -0.254894591 1 0.033516719 -0.161156709 -0.124907702

FTR 0.323672413 0.324269707 -0.001071604 -0.004576718 -0.186094999 -0.100470881 -0.130830282 -0.100391624 -0.09490774 0.323964966 0.033516719 1 0.035717084 -0.112488673

IPE 0.049335921 0.04878373 0.275435748 0.146752875 -0.174952777 -0.1187251 -0.044763145 -0.086533193 0.019091321 0.046566388 -0.161156709 0.035717084 1 -0.033740989

Years 0.006696566 0.006625652 -0.147996434 0.035270101 0.004067442 0.027862398 -0.12318908 0.112199987 0.011057491 0.135881387 -0.124907702 -0.112488673 -0.033740989 1

Research on the Impact of Innovation Output on IPO Underpricing Rate based on Multiple Linear Regression Model

341

Secondly, this paper also performs variance

inflation factor tests on the variables to exclude

multicollinearity, and Tables 4 and 5 use the book

value of intellectual property and patent intensity of

invention as explanatory variables, respectively.

Observing the test results, the VIF values of all

factors are low and stable, and no large values or

significant outliers are found. Therefore, the

multicollinearity is negligible and there are no factors

that need to be excluded.

Table 4.

VIF test (Explanatory Variable 1 IPBV)

IPBV 1.190295224

lnTA 1.995935436

LEV 1.386475373

EPS 1.14023079

TOPI 1.084941262

ROE 1.055505566

IC 1.494960568

OISR 1.500969826

FTR 1.217930872

IPE 1.135804759

Years 1.106044695

Table 5.

VIF Test (Explanatory Variable 2 PI)

PI 1.031047698

lnTA 1.979954064

LEV 1.375743561

EPS 1.128830362

TOPI 1.074703973

ROE 1.045573152

IC 1.494749516

OISR 1.483353476

FTR 1.215232249

IPE 1.074787317

Years 1.09509684

4.6 Multiple Regression Analysis

Table 6 shows the regression results of IPBV and IPO

price suppression of science and innovation firms. the

coefficient of IPBV is positive, which is consistent

with H1, i.e., higher IPBV increases the likelihood of

IPO price suppression of firms. The regression results

in Table 6 show that IPBV has a significant positive

effect on IPO price suppression of innovative firms,

which is in line with the conjecture of H1. The

regression result has a statistic of 5.439 and a p-value

of 1.48e-7, the overall regression is more significant

and the explanatory variable book value of IPR has

some degree of explanation on IPO price suppression

rate.

Table 6.

Regression results of the effect of IPBV on IUR

Variable

s

Estimat

e

Std.

Error

t

value

Pr(>|t|

)

(Intercep

t)

-

1145.73

283.06 -4.05 0.00

**

*

IPBV 0.41

*

0.21

*

1.98

*

0.05

*

*

lnTA 38.58 12.13 3.18 0.00 **

LEV -1.01 0.54 -1.85 0.07

EPS -10.66 7.18 -1.49 0.14

TOPI -0.77 0.58 -1.33 0.19

ROE 1.62 0.58 2.81 0.01 **

IC 9.97 2.76 3.61 0.00

**

*

OISR -4.67 6.11 -0.76 0.45

FTR 6.11 1.51 4.05 0.00

**

*

IPE -0.11 0.54 -0.20 0.84

Years 3.31 23.27 0.14 0.89

Signif. codes: 0‘***’0.001‘**’0.01‘*’0.05‘.’0.1‘ ’1

Multiple R-squared:0.2312, Adjusted R-squared: 0.1887

F-statistic: 5.439 on 11 and 199 DF, p value: 1.48e-07

Table 7 shows the regression results of invention

patent intensity on IPO price suppression for COST

companies. The positive coefficient of PI supports the

positive correlation expected by H2, i.e., higher

invention patent intensity exacerbates the degree of

IPO price suppression for COST companies. From

the regression results in Table 7, it can be seen that

invention patent intensity has a less significant

positive effect on IPO depression of innovative

companies. With a statistic of 4.986 and a p-value of

7.682e-7, the overall regression is more significant,

but the explanatory variable invention patent

intensity has a lower degree of explanation for the

IPO price suppression rate.

Table 7.

Regression results of the effect of PI on IUR

Variable

s

Estimat

e

Std.

Error

t

value

Pr(>|t|

)

(Interce

pt)

-

1068.80

283.

77

-

3.77

0.

00

*

**

PI

3.25 53.84 0.06 0.95

lnTA

36.38 12.32 2.95 0.00

**

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

342

LEV

-1.12 0.55 -2.04 0.04

*

EPS

-9.25 7.21 -1.28 0.20

TOPI

-0.88 0.58 -1.51 0.13

ROE

1.51 0.58 2.60 0.01

**

IC

9.81 2.79 3.51 0.00

***

OISR

-3.31 6.14 -0.54 0.59

FTR

5.95 1.52 3.90 0.00

***

IPE

0.16 0.53 0.31 0.76

Years

-1.59 23.52 -0.07 0.95

Signif. codes: 0‘***’0.001‘**’0.01‘*’0.05‘.’0.1‘ ’1

Multiple R-squared:0.216, Adjusted R-squared: 0.1727

F-statistic: 4.986 on 11 and 199 DF, p value: 7.682e-07

4.7 Robustness Tests

To make the empirical results more reliable, this

paper uses the adjusted IPO underpricing rate

(AIUR), replacing the IPO underpricing rate (IUR) as

the explanatory variable, to conduct the robustness

test of this regression model. The regression results

in Tables 8 and 9 remain largely consistent with those

in Tables 6 and 7, and the empirical results are more

robust. According to the regression results shown in

Tables 8 and 9, the coefficients of the book value of

intellectual property and the intensity of invention

patents are both positive, and both have a positive

effect on the degree of IPO depression of innovative

companies. Among them, the former's has a

significant positive effect on the IPO price

suppression rate of KIC companies. The overall

regression of the model is more significant, but the

explanatory variables are not well explained.

Table 8.

Robust regression results on the effect of IPBV on AIUR

Variable

s

Estimat

e

Std.

Error

t

value

Pr(>|t|

)

(Intercep

t)

-

1142.65

281.21 -4.06 0 **

*

IPBV

0.41 0.21 1.99 0.05

*

lnTA

38.53 12.05 3.2 0

**

LEV

-1.01 0.54 -1.87 0.06

EPS

-10.96 7.13 -1.54 0.13

TOPI

-0.78 0.58 -1.35 0.18

ROE

1.64 0.57 2.86 0

**

IC

9.97 2.74 3.63 0 **

*

OISR

-4.48 6.07 -0.74 0.46

FTR

6.08 1.5 4.06 0 **

*

IPE

-0.11 0.53 -0.21 0.83

Years

3.19 23.12 0.14 0.89

Signif. codes: 0‘***’0.001‘**’0.01‘*’0.05‘.’0.1‘ ’1

Multiple R-squared:0.234, Adjusted R-squared: 0.1917

F-statistic: 5.527 on 11 and 199 DF, p value: 1.078e-07

Table 9.

Robust Regression Results on the Effect of Invention

Patent Intensity on IPO Price Suppression Rate

Variables

Estima

te

Std.

Error

t

value

Pr(>|t|)

(Intercept)

-

1065.9

6

281.94 -3.78 0.00 *

*

*

PI

3.36 53.49 0.06 0.95

lnTA

36.33 12.24 2.97 0.00 *

*

LEV

-1.12 0.54 -2.06 0.04

*

EPS

-9.56 7.17 -1.33 0.18

TOPI

-0.89 0.58 -1.53 0.13

ROE

1.53 0.58 2.66 0.01 *

*

IC

9.81 2.77 3.54 0.00 *

*

*

OISR

-3.12 6.10 -0.51 0.61

FTR

5.92 1.51 3.91 0.00 *

*

*

IPE

0.15 0.53 0.29 0.77

Years

-1.70 23.37 -0.07 0.94

Signif. codes: 0‘***’0.001‘**’0.01‘*’0.05‘.’0.1‘ ’1

Multiple R-squared:0.2188, Adjusted R-squared: 0.1756

F-statistic: 5.068 on 11 and 199 DF, p value: 5.697e-07

5 CONCLUSIONS AND

RECOMMENDATIONS OF THE

STUDY

5.1 Conclusion

IPO price suppression in China receives multiple

factors, and the price that exists between the IPO

issue price and the first-day closing price of the IPO

is simultaneously undervalued by the primary market

and overvalued by the secondary market. The actual

innovation capability of a company is increasingly

valued in IPO valuation pricing, and this paper

explores the impact of innovation output capability of

Research on the Impact of Innovation Output on IPO Underpricing Rate based on Multiple Linear Regression Model

343

science and technology companies on IPO valuation

pricing by using a sample of IPO listed companies in

China's A-share science and technology board from

2019/7/22-2021/2/10. It is found that both the book

value of intellectual property and the intensity of

invention patents have positive effects on the degree

of IPO price suppression of innovative firms, with the

positive correlation of the book value of intellectual

property being more significant. It is concluded that

the higher the book value of intellectual property

rights or the higher the intensity of invention patents,

the stronger the innovative output capability of the

STB companies, the higher the confidence of

secondary market investors in the competitiveness

and sustainable profitability of the listed companies,

the recognition of the innovative R&D capability and

the actual value of the companies, and the higher the

cumulative excess return after the first IPO of the

companies, the more severe the IPO price

suppression.

5.2 Relevant Recommendations based

on the Findings of the Study

Based on the findings of this paper, the following

recommendations are made.

a) From the perspective of science and technology

companies, while continuously improving their

actual innovation capabilities, science and

technology companies should stand more from the

perspective of investors, and reasonably increase the

quality of information disclosure while ensuring that

key technology secrets are protected, so that the value

and competitiveness of the company is fully

recognized by investors, weakening the pricing bias

caused by information asymmetry in valuation

pricing, and making the company's R&D value

correctly reflected in IPO pricing The company's

R&D value is correctly reflected in the IPO pricing.

b) At the institutional level, the rules and

regulations governing information disclosure by

listed enterprises need to be further improved. It is

recommended to improve the relevant institutional

acts regulating the review of the assessment of

innovation capability of science and innovation

enterprises and the first-day excess return rate of

IPOs, so as to effectively promote the reasonable and

correct reflection of the actual innovation capability

of enterprises in the valuation and pricing process

from an institutional perspective. At the same time,

by limiting the cumulative excess return rate and

related incentives and penalties, the speculation of

stock prices by investment institutions and blind

follow-through investment by investors should be

combated.

c) At the regulatory level, it is recommended that

the relevant authorities should strengthen the

supervision of the rationality of the behavior of

secondary market investors in assessing the

innovation capability of science and innovation

enterprises, help investors to correctly understand the

actual value of enterprises, supervise the orderly

communication of information between enterprises

and the capital market, and build a bridge of

communication between enterprises, investment and

the capital market.

d) From the perspective of education and

publicity, education and guidance for individual

investors in the secondary market should be

strengthened, investors should be guided to

participate in market activities in an orderly manner,

and the threshold for investors to enter the securities

market should be raised moderately. Education and

dissemination of relevant knowledge to investors

should be enhanced to raise the risk awareness of

stockholders and reduce the emergence of speculative

behavior such as blind investment in a flurry of

activity and price hugging.

REFERENCES

Aboody, D., & Lev, B. (2000). Information Asymmetry,

R&D, and Insider Gains. The Journal of Finance,

55(6), 2747–2766.

Allen, F. and Faulhaber, G.R. (1989). Signaling by

Underpricjng in the IPO Market. Journal of Financial

Economics, 23, 303-324. - References - Scientific

Research Publishing. (n.d.).

Amihud, Y., Hauser, S., & Kirsh, A. (2003). Allocations,

adverse selection, and cascades in IPOs: Evidence from

the Tel Aviv Stock Exchange. Journal of Financial

Economics, 68(1), 137–158.

Baron, D. P., & Myerson, R. B. (1982). Regulating a

Monopolist with Unknown Costs. Econometrica,

50(4), 911–930.

Benveniste, L.M., & Spindt, P. (1989). How investment

bankers determine the offer price and allocation of new

issues. Journal of Financial Economics, 24, 343-361.

CHAMBERS, D., & DIMSON, E. (2009). IPO

Underpricing over the Very Long Run. The Journal of

Finance, 64(3), 1407–1443.

Chi, J. & Padgett, Carol. (2005). "Short-run underpricing

and its characteristics in Chinese initial public offering

(IPO) markets," Research in International Business and

Finance, Elsevier, vol. 19(1), pages 71-93, March.

Chi, J., & Padgett, C. (2005). Short-run underpricing and

its characteristics in Chinese initial public offering

(IPO) markets. Research in International Business and

Finance, 19, 71-93.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

344

Ellul, A., & Pagano, M. (2006). IPO Underpricing and

After-Market Liquidity. The Review of Financial

Studies, 19(2), 381–421.

Fabrizi, S., Lippert, S., Norbäck, P., & Persson, L. (2011).

Venture Capital, Patenting, and Usefulness of

Innovations. IO: Productivity.

Gao T.T. (2020). A study on the impact of the registration

system of science and innovation board on the IPO

price suppression of enterprises[J]. China Price

(11):74-77.

Griliches, Z. (1990). Patent Statistics as Economic

Indicators: A Survey. Journal of Economic Literature,

28(4), 1661–1707.

Hall, B. H., Jaffe, A., & Trajtenberg, M. (2001). Market

Value and Patent Citations: A First Look.

Ideas.repec.org.

Han, I, and C.M. Chuang. (2001). The Impacts of R&D

Investment on Company Performance: US vs.

Taiwanese Technology- Intensive Industry [J]. Review

of Pacific Basin Financial Markets and Policies,

14(1):171~194.

Lerner, J. (1994). The Importance of Patent Scope: An

Empirical Analysis. RAND Journal of Economics,

25(2), 319–333.

Levis, M. (1993). The Long-Run Performance of Initial

Public Offerings: The UK Experience 1980-1988.

Financial Management, 22(1).

Li Q.Y., Li X.P. (2020). Changes in The New Share

Issuance Systemand A-share IPO Underpricing.

Journal of Management Research, 34(3): 66-85.

Li S., Hong T., Wu C.P. (2012). The impact of listed

companies' patents on firm value--based on the

perspective of intellectual property protection[J].

Nankai Management Review(06), 4-13+24.

doi:CNKI:SUN:LKGP.0.2012-06-001.

Li, X.X., Luo, D.L., Wang, B.T. (2019). Who is better at

identifying corporate innovation: the government or the

market? -- An empirical study based on A-share IPO

listed companies[J]. Accounting and Economic

Research, 33(06):3-18.

Li, Y.Y., Duan, J.J. (2020). A study on the impact of the

liberalization of up and down limit on the price

suppression of IPO on the science and technology

board[J]. Technology and Industry, 20(12):142-147.

Lu, C.Y. (2009). An empirical study on the relationship

between technological innovation and corporate value

of listed companies in China. Diss. South China

University of Technology.

Megna, P., & Klock, M. (1993). The Impact on Intangible

Capital on Tobin’s q in the Semiconductor Industry.

American Economic Review, 83(2), 265–269.

Qiu D.Y., Peng H., Yao Y. (2013). Accounting firm

reputation and IPO price suppression--an empirical

study based on the small and medium-sized board

market [J]. Fujian Forum Humanities and Social

Sciences (8): 36~43.

Reilly, F. and K. Hatfield. (1969), Investor experience with

new stock issues, Financial Analysts Journal, 73-80.

Rock, K. (1986). Why new issues are underpriced. Journal

of Financial Economics, 15(1-2), 187–212.

Roosenboom, P. (2007), How Do Underwriters Value

Initial Public Offerings? An Empirical Analysis of the

French IPO Market*. Contemporary Accounting

Research, 24: 1217-1243.

Schankerman, M., & Pakes, A. (1985, June 1). Estimates of

the Value of Patent Rights in European Countries

During thePost-1950 Period. National Bureau of

Economic Research.

Shao H.X., Fang J.X. (2006). A study on the relevance of

intangible assets value of listed companies in China - A

re-test based on detailed classification information of

intangible assets. Accounting Research (12), 25-32.

Song, S.L., Tang, S.Y. (2019). First-day price control and

IPO speculation: inhibiting or promoting? [J].

Management World, 35(01):211-224.

X.L. Dong, J.N. Liu, and S.Y. Xu. A study on the pricing

efficiency and influencing factors of China's science

and technology innovation board ipo. Mathematical

Statistics and Management, 40(3), 18.

Zeng J.H., Ma R.Z. (2021). The impact of R&D investment

on IPO price suppression of startups - A moderation of

information disclosure quality. Soft Science.

Zheng S.L., and Song M.S. (2012). What determines the

value of a patent? --An Integrative Framework Based

on Literature Review. Scientology Research 30.009:

1316-1323.

Zou G.F., Cheng Q.Y., Chen W.J. & J. Ginger Meng.

(2020). What causes the IPO underpricing? New

evidence from China's SME market, Applied

Economics, 52:23, 2493-2507, DOI:

10.1080/00036846.2019.1693017.

Research on the Impact of Innovation Output on IPO Underpricing Rate based on Multiple Linear Regression Model

345