Will Government Subsidies Increase Investor Confidence in Listed

Agricultural Companies?

Linlin Guo

a

and Panpan Yang

b

Zhengzhou University of Aeronautics, Zhengzhou, Henan Province, China

Keywords: Government Subsidies, Big Data, Investor Confidence, Web Text.

Abstract: Financial fraud cases of agricultural listed companies have occurred frequently, adversely affecting investor

confidence. By using the big data method, this paper develops the agricultural IC index and analyzes the

impact of different types of government subsidies and tax refunds on the IC of agricultural listed companies

from the perspective of behavioral finance.

1 INTRODUCTION

Agricultural listed companies are at high risk of

financial infidelity and fraud. According to the

Choice of Orient Wealth, from January 2010 to

December 2020, a total of 312 listed companies in

China’s A-share market were subject to public

sanctions or regulatory investigations for disclosing

false information, including 54 agricultural

enterprises (agriculture, forestry, animal husbandry,

fishery, and agricultural product processing),

accounting for about 17% of the A-share market in

China. Poor quality disclosure of information of

agricultural listed companies will cause investors to

worry about possible losses, which seriously

undermines investor confidence (IC) and creates a

risk of a decline in the valuation of agricultural listed

companies or an increase in financing capital. On this

basis, this paper develops an agricultural IC index

with the big data method, and studies whether the

subsidies and supports of the government have a

supportive effect on the investors of agricultural

listed companies from the perspective of behavioral

finance, and further examines the possibility of

increasing IC in the information disclosure of

agricultural enterprises and government supports

easily affecting IC.

a

https://orcid.org/0000-0002-9189-9554

b

https://orcid.org/ 0000-0001-5874-7885

2 LITERATURE REVIEW

In order to study whether government subsidies have

a supportive effect on the agricultural IC, it is

important to first obtain the agricultural IC. The

traditional method is to obtain IC through

investigation. Today, Internet data records the micro-

psychological information and concerns in searching

of investors and provides massive data for research.

Web text data mining and its application in the

economic and financial fields were developed in

foreign countries early on. Ettridge et al. (Ettridge, et

al, 2005) were the first to propose that web search

data have an important value in economic statistical

research. In studying assets pricing. Iresberger

(Iresberger, 2015) used the search engine Google to

collect network data representing the crisis

psychology of investors. Zongyue et al. (Zongyue, et

al., 2017) conducted an emotion analysis based on the

received domestic financial news comments,

expanded the emotion dictionary by using the

clustering method for the news comments, combined

with the time characteristics of the text, and decided

to assess the emotional tendency of the text with the

help of machine learning. Zhang. Zongxin et al.

(Zhang, 2021) conducted an emotion analysis of the

media reporting corpus of individual stocks in Baidu

News, used machine learning to classify text

emotions and develop the emotion value, and studied

the influence of the emotion value of media on the

346

Guo, L. and Yang, P.

Will Government Subsidies Increase Investor Confidence in Listed Agricultural Companies?.

DOI: 10.5220/0011178000003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 346-350

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

securities market. In this paper, it is believed that IC

is highly flexible and diverse. Compared with the

traditional questionnaire interview method, the IC

collection method based on big data technology is

more timely and complete.

3 RESEARCH DESIGN

3.1 Variable Design

1) Investor confidence. The level of investor

confidence (IC) can reflect the optimism of the

market towards agricultural enterprises. This paper

uses web crawler technology to obtain web text data

of investor exchanges on the Stock Bar Forum of

Orient Wealth (China’s first financial website with an

average daily visitors of over 30 million users),

extract the subjects of the text data using the LDA

model, and use machine learning algorithms to

classify investors’ bearish and bullish expectations.

Finally, this paper uses the classified emotion value

and the quantified feature word weights to develop

the Stock Bar investors’ bearish and bullish

expectation index, of which, combined with Baidu

search confidence index and stock turnover rate, will

be used to construct the final IC index using principal

component analysis. The specific methods are as

follows.

First of all, the Python crawler software was used,

and the hot post page of Orient Wealth Finance and

Economics Review Bar (Stock Bar) was considered

as the entry page. The basic information crawled

includes page information, post title, publication

time, number of comments, page views, and

comment contents, and the crawled information was

stored by date to form the web text database of the

Stock Bar with a certain scale.

Secondly, the text data was processed by cleaning

and standardizing the initial Stock Bar comment text

data, which was then vectorized using the vector

space model. Assume the web text as Q

k

D

, k

D

…,k

D

, D

as the feature word of

Text Q, and k

as the weight of the feature word, the

feature value of each text was determined using the

information gain algorithm, and the cosine value of

the angle between vectors was used to indicate the

similarity between Text Q. Then, the LDA subject

extraction model was used to extract the subject

information representing the emotional intensity of

investors from the text data set, and it was represented

by simplified text. Finally, machine learning

classification technology was used to calculate the

emotional tendency value of the text data.

Thirdly, the development of the bearish and

bullish expectation index of investors of the Stock

Bar. The text emotion value was represented by the

product of the emotional tendency value of the

bearish and bullish of each subject and the sum of the

feature words weights, and then the expectation

values of all the texts were summed to obtain the

expectation values of investors of the Stock Bar for

that day. The expectation index was developed

according to the following formula.

Estock =

∑

sent

∑

Temperature

T

(1)

In which, M=

1,2, … ,M

represents the

number of daily text comment subjects of the Stock

Bar, sent

represents the bearish and bullish

expectation value of the M-th subject, and

∑

Temperature

T

represents the sum of

feature words weights in M subjects.

The TF-IDF model was used to calculate the

weight of each feature word. Assume TF

as the

frequency of Feature Word D

in Document Q

,

IDF

as the inverse text frequency of Feature Word

D

in Document Q

, and n

as the number of

training samples of D

, the calculation formula of the

weight of the feature value is as follows.

Temperature

T

= TF

× IDF

=

log

freq

+

1

× log

n n

⁄

(2)

In conclusion, the Stock Bar agricultural stock

investors’ bearish and bullish expectations index can

be expressed as:

Estock =

∑

sent

∑

log

freq

+1

×

log

n n

⁄

(3)

Fourthly, the development of the IC index. The

bearish and bullish expectation index of investors of

the Stock Bar (Estock), Baidu search index (BIX),

and stock turnover (STM) were fitted by principal

component analysis method to develop an IC index.

For the Baidu search index, the monthly Baidu search

volume of the stock code of agricultural listed

companies was used instead of the search volume of

the company name. Because the company name can

be divided into abbreviations and full name, it is

impossible to determine which name investors used.

In addition, the company name may be searched on

Baidu for different purposes. The investors may not

search the company name because they care about the

stock of the company, but the company’s stock code

is searched, and can directly indicate that investors

actively search and pay attention to the stock of the

company

In the principal component analysis, the following

standard was strictly complied with to select the

information which could ensure the explanation of

principal components and all the indexes. The

Will Government Subsidies Increase Investor Confidence in Listed Agricultural Companies?

347

cumulative variance contribution rate reaches over

85%, and therefore, the first two principal

components were selected, and the weighted average

was obtained according to the variance contribution

rate. The weight was the ratio of the variance

contribution rate of the principal component to the

sum of the variance contribution rates of the three

principal components, and the final result was as

follows.

IC=0.6928×Estock+0.6003×BIX+0.5221×STM (4)

2) Government subsidies and tax refunds. The

government will support the development of

agricultural enterprises through various supporting

policies (such as government subsidies, tax

incentives, and direct investment). Combined with

relevant data on agricultural listed companies, this

paper mainly considers two kinds of government

support, that is, government subsidies and tax

refunds. For government subsidies, according to the

provisions of Accounting Standards for Business

Enterprises No.16-Government Subsidies

promulgated in 2017, this paper sets GOVNOI, the

ratio of government subsidies included in non-

operating income to operating income, to measure the

government’s non-operational subsidies to

agricultural enterprises, and GOVOI, the ratio of

government subsidies included in other income to

operating income, to measure the government

operational subsidies to agricultural enterprises. As

for tax refunds, in order to support the development

of agricultural enterprises, the government will give

subsidies in the form of tax refunds. This paper sets

GOVTR, the ratio of tax refunds to operating income,

to measure the tax refunds received by agricultural

enterprises.

3) Moderating variables. From the perspective of

corporate governance, government support is

affected by internal governance and third party

supervision. this paper sets GOVEI as the moderating

variable to measure the shareholding ratio of state-

owned capital investment in agricultural enterprises.

A high shareholding ratio indicates that state-owned

capital has a strong motivation to participate, which

may increase the supervision of agricultural

enterprises and the supporting effect of government

support.

4) Control variables. Control variables mainly

include enterprise size (Size), enterprise profitability

(ROE), enterprise financial leverage (LEV), listing

age (Age), stock return (SR), dummy variable of the

year (Year), and dummy variable of the sector

(Sector). If it belongs to the Beijing Stock Exchange,

the value is 1, otherwise it is 0.

3.2 Model Design

In order to examine whether government subsidies

and tax refunds can increase IC in agricultural listed

companies, this paper sets up a double fixed-effect

model of individuals and time points based on the

data obtained.

IC

,

= β

GOVNOI

,

+ β

GOVOI

,

+ β

GOVTR

,

+

β

Size

,

+ β

ROE

,

+ β

Age

,

+ β

Age

,

+

β

SR

,

+ β

Sector

,

+ β

+ θ

+ε (5)

Where β

is the fixed effect of an individual, θ

is the fixed effect of a time point, and the other

variables have been introduced in the preceding part

of this paper. In addition, from the perspective of

corporate governance, we explored whether state-

owned capital shareholding and audit supervision

improved or worsened the relationship between

government subsidies and IC. In Model (2), the

moderating variables state-owned capital

shareholding ratio were added to test.

IC

,

= β

GOVNOI

,

+ β

GOVOI

,

+ β

GOVTR

,

+α

,

GOV

,

× GOVEI

,

+ β

Size

,

+ β

ROE

,

+ β

Age

,

+ β

Age

,

+ β

SR

,

+β

Sector

,

+ β

+ θ

+ε (6)

Where GOV_SUB

,

is the vector consisting of

government subsidies GOVNOI and GOVOI, and tax

refund GOVTR; β

is the fixed effect of an

individual; θ

is the fixed effect of a time point.

3.3 Data Sources

The data studied in this paper is from agricultural

enterprises listed on the Shanghai Stock Exchange,

Shenzhen Stock Exchange, and Beijing Stock

Exchange (the former National Equities Exchange

and Quotations selected layer and innovative layer)

from 2015 to 2020. A total of 1,432 agricultural listed

companies in the agriculture, forestry, animal

husbandry, and fishery industries were collected from

the Shanghai and Shenzhen Stock Exchanges,

excluding alcohol, ST, and samples with less than 3

years of listing. At the same time, a total of 226

agricultural companies of the Beijing Stock

Exchange were collected and classified based on the

management classification results of listed companies

in the National SME Share Transfer System.

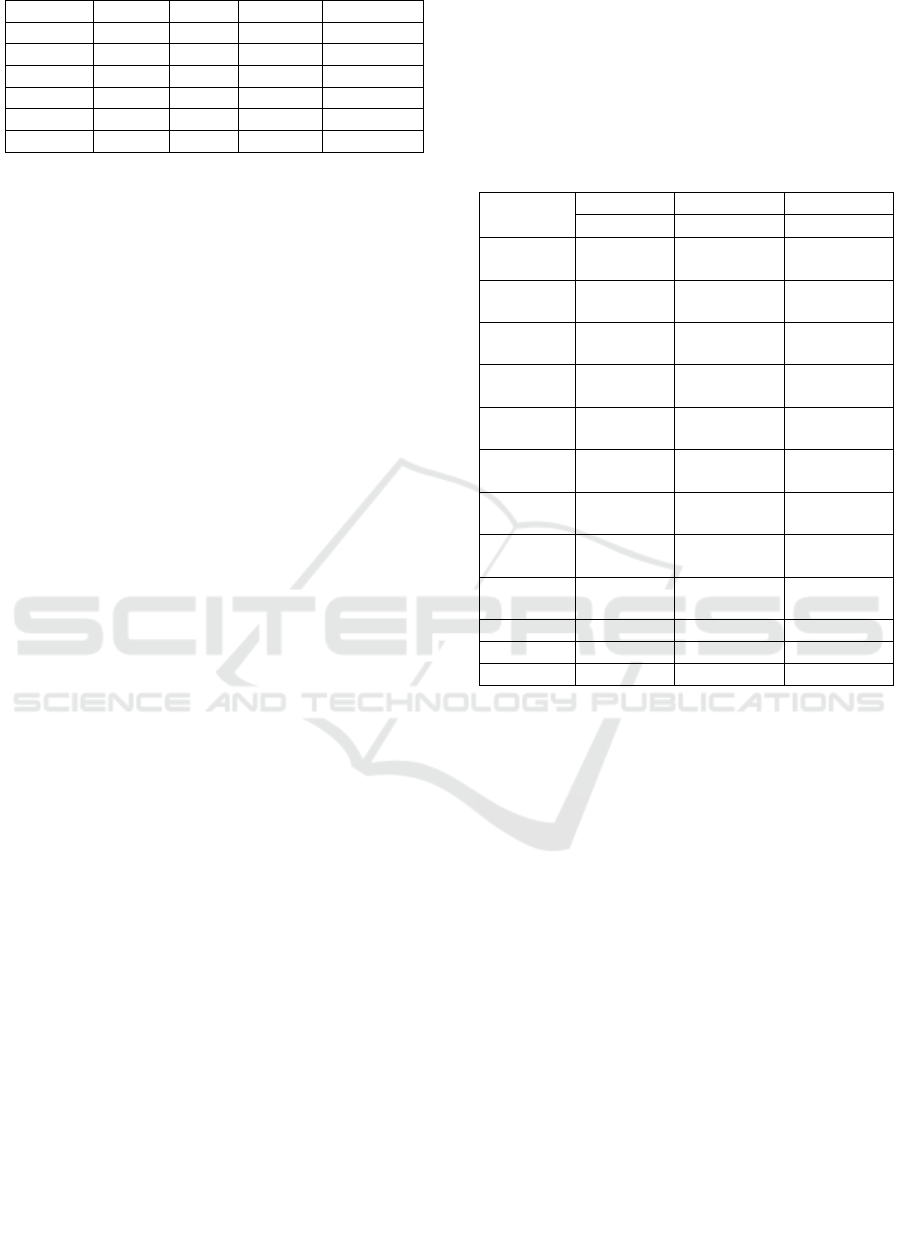

Table 1: Descriptive statistics of variables.

Variable mean SD

minimu

m

maximum

IC -0.181 1.783 -3.110 3.459

GOVNO

I

0.015 0.037 0 0.790

GOVOI 0.009 0.255 0 0.457

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

348

GOVTR 0.007 0.378 0 0.101

GOVEI 0.017 0.047 0 0.845

Size 22.30 0.891 0 45.680

ROE 0.011 0.045 -1.00 0.671

LEV 0.49 0.300 0.072 0.920

A

g

e 11.45 5.261 4 17

SR 0.039 0.155 -1.231 1.458

4 EMPIRICAL TEST

4.1 Test of the Effect of Government

Subsidies and Tax Refund on IC

According to the test results in Table 2, the full

samples of government subsidies included in “non-

operational income” unrelated to daily operation does

not have a significant effect on IC, while government

subsidies and tax refunds included in “other income”

related to daily operation have a positive effect on IC.

Compared with Shanghai and Shenzhen stocks, the

effect on the IC of agricultural enterprises listed on

the Beijing Stock Exchange is relatively big, perhaps

because most companies listed on the Beijing Stock

Exchange are small and medium-sized companies

whose corporate governance and corporate operation

should be improved. In addition, the information

disclosure requirements of enterprises listed on the

Beijing Stock Exchange are different from those of

enterprises listed on the main board. Therefore,

investors do not trust agricultural enterprises listed on

the Beijing Stock Exchange, which affects the IC.

However, the results show that government subsidies

can positively increase the IC in agricultural

enterprises of the Beijing Stock Exchange, with a

greater supporting effect. Secondly, the test results

also show that government subsidies unrelated to the

operation may not have a supporting effect on

investors. Compared with government subsidies

unrelated to daily operation, tax refunds and

government subsidies related to daily operation

included in “other income” have a greater positive

effect on IC, that is, to increase IC. Domestic scholars

have also found that different classifications of

government subsidies have different influences on

R&D expenditures, innovation ability, and other

aspects of enterprises. Seen from control variables,

the profitability, financial leverage, and other aspects

of agricultural enterprises have no statistically

significant impact, whereas the enterprise size and

listing age have a positive impact on IC. Finally, we

can see from the test results that the effect of tax

refund (with an impact coefficient of 0.0318) is

greater than that of the government subsidies

included in “other income” related to daily operation

(with an impact coefficient of 0.0245), perhaps

because agricultural enterprises have certain

conditions to meet the requirements for tax refunds

with a stronger supporting effect.

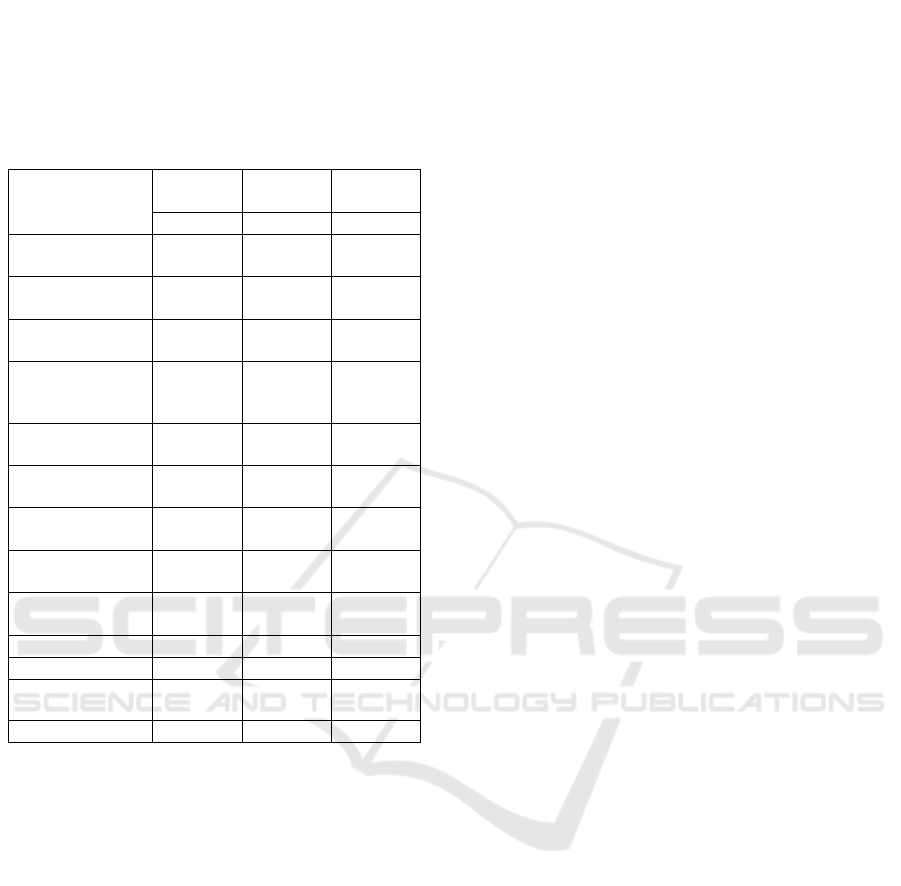

Table 2: Regression results of the effect of government

subsidies on IC.

Var ia bl e

IC IC IC

full HS BJ

GOVNOI

0.0031

(0.129)

0.0024

(0.170)

0.0036

(0.137)

GOVOI

0.0276

*

(0.062)

0.0117

**

(0.041)

0.0210

*

(0.077)

GOVTR

0.0325

*

(

0.078

)

0.0206

*

(

0.063

)

0.0389

*

(

0.066

)

Size

0.0012

*

(0.039)

0.0010

*

(0.044)

0.0018

(0.109)

ROE

0.0036

(0.901)

0.0054

(0.862)

0.0051

(0.151)

LEV

-0.9290

(

0.890

)

-1.4456

(

1.237

)

-1.3786

(

0.972

)

Age

0.0010

*

(0.048)

0.0007

*

(0.044)

0.0020

*

(0.021)

SR

0.0335

*

(0.072)

0.0298

**

(0.083)

0.0451

*

(0.027)

Individual

and Yea

r

Controlled Controlled Controlled

Adj.

R

0.3002 0.3461 0.2217

F 107.15

***

110.28

***

100.22

***

N 1647 1421 226

***, ** and * denote statistical significance at the 1%, 5%, and 10% level.

4.2 Test of the Moderating Effect of

State-owned Capital Shareholding

Based on the above test results, we further explored

whether state-owned capital shareholding could

enhance the supporting effect of government

subsidies and tax refunds. The results in Table 3 show

that the regression coefficient of GOVNOI×GOVEI

is not significant, that of GOVOI×GOVEI is 0.0572

(𝜌 <0.1), and that of GOVTR×GOVEI is 0.0656

(𝜌 <0.1) when the interaction terms of state-owned

capital shareholding ratio, government subsidies, and

tax refund are added in Models 5, 6, and 7. Consistent

with the test results in Table 2, the state-owned capital

shareholding cannot enhance the influence of non-

operational government subsidies . The regression

coefficient of the interaction terms of state-owned

capital shareholding, government subsidies, and tax

refunds related to daily operation is significantly

positive, which indicates that a higher proportion of

state-owned capital shareholding can enhance the

influence of government subsidies and tax refunds

related to daily operation on IC. The above-

Will Government Subsidies Increase Investor Confidence in Listed Agricultural Companies?

349

mentioned results show that state-owned capital

shareholding can enhance the supervision of the

governance environment of agricultural enterprises,

thereby further increasing IC.

Table 3: Test results of the moderating effect of state-

owned capital shareholdings.

Va ri ab le

Model

(

5

)

Model

(

6

)

Model

(

7

)

IC IC IC

GOVNOI

0.0008

(0.134)

GOVEI

0.0302

*

(0.077)

GOVNOI×GOVEI

0.0405

(

0.184

)

GOVOI

0.0334

***

(0.004)

GOVEI

0.0355

**

(0.085)

GOVOI×GOVEI

0.0572

*

(

0.090

)

GOVTR

0.0201

*

(

0.089

)

GOVEI

0.0142

*

(0.092)

GOVTR×GOVEI

0.0656

*

(0.097)

control variable

Yes Yes Yes

Adj. R

0.3711 0.3223 0.3039

F

27.021

***

28.119

***

27.458

***

N

1647 1647 1647

***, ** and * denote statistical significance at the 1%, 5%, and 10% level.

Some control variables that will affect IC in

agricultural enterprises may be omitted in this paper.

In order to solve the possible endogeneity problem of

the model and perform the robustness test, in this

paper, the following methods were used. Firstly, by

adjusting the characteristic variables of agricultural

enterprises, the debt-to-assets ratio (Debt) and

operating profit margin (Margins) were added. Then,

the IC index (ICQ) was transformed, and Tobin Q

value, turnover rate, and Baidu search index were

used for re-fitting. Following that, the dynamic GMM

model was used for estimation test. The test results

are almost the same to the main research conclusions

of this paper.

5 CONCLUSIONS

From the perspective of behavioral finance, this paper

develops the IC index by combining big data and

traditional indexes. The bearish and bullish

expectation index of investors of the Stock Bar, Baidu

search index, and stock turnover (STM) were fitted

by principal component analysis to extract the

common components of IC. Compared with the

existing method, this method can measure the IC

more timely and comprehensively.

According to the research results, government

non-operational subsidies cannot increase IC.

Therefore, in order to increase the IC in listed

agricultural companies of the market, when giving

subsidies to agriculture, the government should make

more customized subsidy policies related to daily

operation according to the characteristics of

agricultural operation. In addition, compared with

government subsidies, agricultural listed companies

may need to truly operate to receive the tax refunds.

Therefore, we can also consider decreasing direct

fund subsidies and supporting agricultural enterprises

from taxes and dues.

ACKNOWLEDGEMENTS

We are grateful to the editor for their comments that

helped improve the paper. This paper is supported by

the Henan Province Soft Science Research

(192400410384).

REFERENCES

Ettredge, M., J. Gerdes & G. Karuga. (2005). Using web-

based search data to predict macroeconomic statistics.

J. Communications of the ACM. 48, 87–92.

Irresberger, F. (2015). Explaining bank stock performance

with crisis sentiment. J. 59, 311-329.

Zhang. Z. X. (2021). Media's Emotional Contagion and

Analyst Optimistic Bias:Evidence Based on the

Technique of Machine Learning. J. 37, 170-185.

Zongyue, W. & Q. Sujuan. (2017). A Sentiment Analysis

Method of Chinese Specialized Field Short

Commentary. IEEE International Conference on

Computer and Communications.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

350