Application of Artificial Intelligence in Tax Risk Management

Yiran Tao

Chongqing College Of Architecture And Technology, 401331, China

Keywords: Artificial Intelligence, Tax Risk Management, Application Scenarios.

Abstract: The application of artificial intelligence technology can provide more ideas and platforms for tax risk

management. In particular, the advantages of "artificial intelligence + tax risk management" in tax auditing

and screening are extremely obvious showing the inherent tax risk. This article summarizes the existing

problems in current tax risk management work based on previous work experience. The author discusses the

application of artificial intelligence in tax risk management from five aspects: upgrading management

concepts, optimizing risk management systems, innovating tax risk management methods, establishing new

artificial intelligence systems, and performing risk prediction operations.

1 INTRODUCTION

The implementation of actual tax risk management

can use artificial intelligence technology to provide

relevant enterprises with more creative ideas. This

technology can present a great advantage in

investigating tax risks. Relevant managers can also

incorporate various tax risk influencing factors

according to the characteristics of the artificial

intelligence model. Subsequently, relevant

management personnel can also perform effective

classification and calculations to accurately obtain

tax risk content. This can not only ensure the

integration of tax risk management and artificial

intelligence, but also strengthen the risk management

and control capabilities of this type of enterprise. This

is also the essence of its changing development trend.

2 THE NECESSITY OF

APPLICATION OF ARTIFICIAL

INTELLIGENCE IN TAX RISK

MANAGEMENT

2.1 Principles of Artificial Intelligence

Technology

Before the application of artificial intelligence,

technicians need to clarify the technical principles

used in the technology. In general, artificial

intelligence belongs to the category of AI technology,

which has cutting-edge technological characteristics.

Its application is mainly to combine artificial and

intelligent to create different forms of computer

algorithms, and use computer technology to imitate

various behaviors of the human brain. At this stage,

the objects of artificial intelligence technology are

mainly human brain neurons. It can simulate the

internal neurons of the human brain through the

interconnection between the network and the

neurons. More importantly, the system can also

complete related tasks through network and neuron

connections. Among them, there are two most

common ways of intelligent creation. First, the whole

process of brain thinking can be fully understood and

simulated by artificial means. Second, the system can

only simulate part of the brain function, and it is only

a pure imitation. It can be created by artificial

intelligence through related function display. In

addition, artificial intelligence technology can also

identify the internal data of the system and explore

the various information hidden behind the data. When

dealing with specific problems, humans rely on a lot

of knowledge and experience, but it is difficult to

achieve good handling of hidden information that is

not easy to be discovered. To this end, staff can use

artificial intelligence system applications to

demonstrate technical advantages and technical value

(Bian, 2020).

Tao, Y.

Application of Artificial Intelligence in Tax Risk Management.

DOI: 10.5220/0011179000003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 371-376

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

371

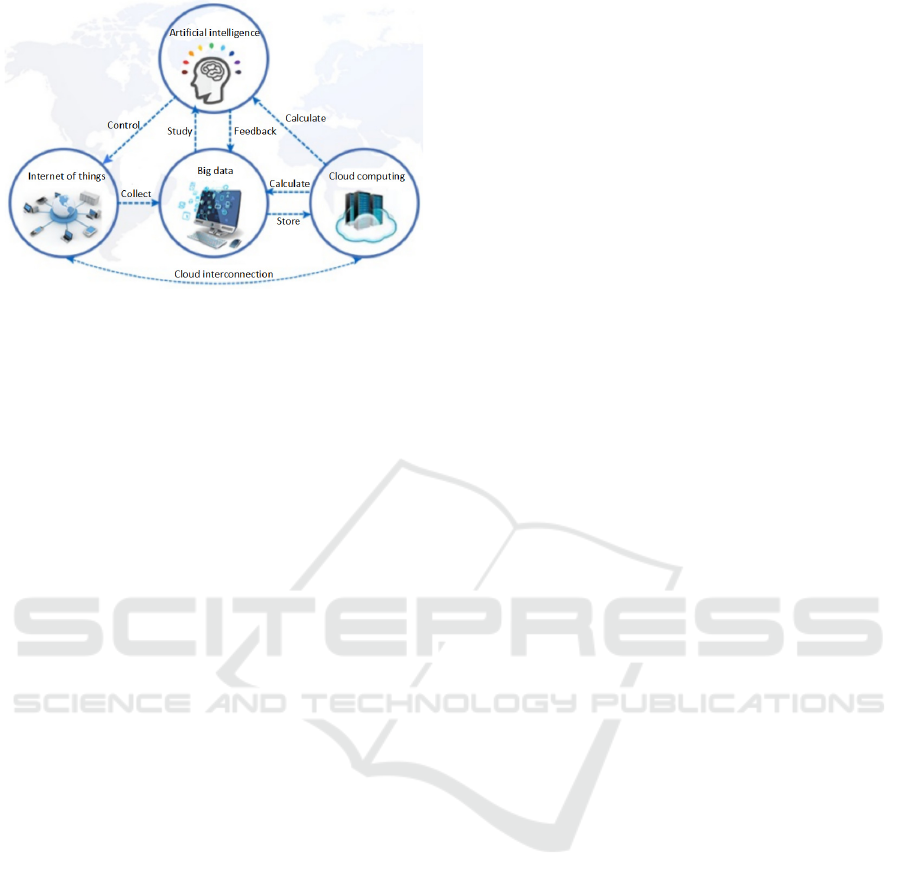

Figure 1: Schematic diagram of artificial intelligence

technology principle.

2.2 Artificial Intelligence Affects Social

Development

The development of actual information

technology d promotes the application of artificial

intelligence in many fields, and this type of

technology can show strong advanced features. The

main reason lies in the application of many new

software tools, making it easier to build complete

network applications. It can also be seen from the

application of the actual artificial intelligence system

that it can not only use multiple programming

languages, but also complete the target recognition

work. Even if it is offline, it can also train the neural

network. When the actual development and training

work is over, the system can also be transferred to the

network platform. It can be through cloud capabilities

or a PC, and more hardware and software platforms

can be integrated into it. In actual development, some

industries have ushered in more development

opportunities through artificial intelligence

applications, allowing intelligent machines to replace

manual operations. This has also led to significant

changes in China's overall labor structure, and the

impact on traditional industries is also very obvious,

and many new management models have been

extended. Currently, many corporate tax risk

management are in a state of transition. Through the

application of artificial intelligence system, the

reform work can be carried out more quickly and

effectively, and the overall risk management level of

the enterprise can be strengthened.

3 PROBLEMS IN CURRENT TAX

RISK MANAGEMENT

3.1 Traditional Tax Risk Management

Concepts

In the previous implementation of the account

management system, the measures adopted for tax

management operations were "person-to-person".

With the continuous reform of the commercial

system, more taxpayers have appeared, which has

also increased the work pressure of tax

administrators. First of all, the traditional account

management model is likely to affect the

effectiveness of tax risk management. For taxpayers'

hierarchical and classified risk management, many

managers continue to use traditional inertial thinking.

This traditional method cannot clearly distinguish tax

source management matters from professional risk

management matters. Many managers continue to use

methods such as making phone calls and going to the

venue, ignoring the mining of tax-related data and

failing to accurately locate and monitor various risk

suspects. Second, tax risk management cannot run

through the entire process of tax management.

Generally speaking, tax risk management belongs to

the content of system engineering, which runs

through the work of tax collection and management.

It mainly includes pre-warning, prevention and

control during the event, and post-event evaluation. It

also includes some specific job responsibility systems

and information systems. However, it can be seen

from specific practice that risk management can

easily be used as a collection and management tool or

as a substitute for tax assessment, and cannot achieve

a good risk control effect (Yu 2020).

3.2 Tax Risk Management and

Analysis Methods Are Not

Scientific

First of all, it is difficult to accurately grasp tax risk

points in the process of manual analysis. It can be seen

from the actual tax risk analysis work practice that the

risk doubts mainly come from the following aspects.

Firstly, the personal work and life experience of the

analyst. Second, the results of policy analysis. Due to

the limited sources of risk doubts, subjective judgment

does not have an effective scientific basis, and

ultimately cannot show the integrated effect of tax-

related data. Secondly, the mathematical model is

simple and the guiding role is limited. Currently, the

most commonly used tax risk analysis method is the

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

372

index method. The system can establish a single index

or a comprehensive index through the relationship

between the indicators, and carry out corresponding

risk scans. However, affected by artificial thinking

and the limitations of data operation, the index method

can often only construct function rules for a single risk

feature. This is also where the comprehensive index

lies, and the description logic of the risk

characteristics involved is not complicated.

Meanwhile, the selection of indicator thresholds

mainly relies on simple classification and aggregation.

It can only be applied to the data table layer, relying

too much on the subjective judgment of the modeler.

It can also be seen from this that it is very difficult to

establish comprehensive risk identification indicators

using traditional indicator methods. Finally, tax risk

management classification and classification

standards cannot be unified. In actual work

development, relevant risk analysts will generally

rank according to risk attribute information and the

resulting consequences, and then the risk task

coordinator will adjust its level. In the judgment of

specific inherent attributes, it is often based on

previous work experience, which is likely to cause risk

issues. In this way, there is no clear standardization

and standardized sorting method, and its subjectivity

is strong.

3.3 Missing Closed Loop of Tax Risk

Management

First of all, in the implementation of actual risk

management work, it mainly relies on post-event

prevention and control. It is precisely because tax risk

management places too much emphasis on

prevention and control after the event, it is unable to

identify relevant risk content in a timely manner, let

alone monitor the whole process, which affects the

security of tax management. Secondly, the effect of

risk response feedback is not obvious enough. At this

stage, there is often no risk response link in tax risk

management. For those risks that have been

identified, it is impossible to make a comprehensive

summary and generalization. In the actual commonly

used index method, the feedback of the response

results to the index is often limited to narrowing or

widening the screening criteria, and it is impossible

to achieve model iteration. As a result, the effect of

this method on risk feedback is not obvious.

Generally speaking, the above-mentioned problems

are mainly due to the relatively short research time on

tax management risks in China, the lack of complete

regulations and procedures, and the insufficient risk

prevention and control system in China. In addition,

the tax authorities have not paid more attention to

informatization support. Although various tax

authorities have accumulated a lot of tax-related data,

the quality of the data is poor and its dispersion

characteristics are extremely obvious. In addition,

various information systems are also "independently"

in use, and it is difficult to clarify those complex risks

(Wang, 2020, Zhu, 2020).

4 ARTIFICIAL INTELLIGENCE

BRINGS OPPORTUNITIES FOR

TAX RISK MANAGEMENT

INNOVATION

4.1 Promote the Transformation of

Traditional Tax Risk Management

Concepts

The prerequisite for artificial intelligence to play a

role is the application of big data. Only by ensuring

the full application of related algorithms can the full

training of big data be realized and the applicable

similar data can be summarized. As a result, people

can apply artificial intelligence to the field of tax risk

management in depth, and use existing empirical

analysis as the leading factor to change the traditional

tax risk management concept. People can establish a

big data tax risk management concept with data as the

core and correlation analysis as the leading factor. In

this way, “everything can be quantified” can be

achieved under the influence of big data, and then

with the help of artificial intelligence, the perspective

of tax risk management can be broadened. Regardless

of the application of traditional data methods to

record various information, or the application of

unstructured data such as behavior trajectories,

artificial intelligence can summarize the connections

and laws between the data. As long as there is enough

data and abundant data connection points, the tax risk

management process and links will be more perfect.

In the actual artificial intelligence algorithm

scanning, the relevant staff should also use data as the

basis to comprehensively describe and evaluate the

risk distribution, so that classification and

classification management can be truly achieved.

4.2 Drive the Optimization of the

Traditional Tax Risk Management

System

First, realize the overall optimization of the tax

Application of Artificial Intelligence in Tax Risk Management

373

information system. With the application of modern

information technologies such as big data and

artificial intelligence in tax management, people have

put forward very high requirements on the amount of

specific tax-related data. Generally speaking, after

reaching the PB level, it can be called big data. In

consequence, if you want to truly collect tax-related

data, artificial intelligence applications are very

important. Besides, artificial intelligence also puts

forward some requirements for data sharing. It uses

specific data sources and cross-checking operations

to ensure that artificial intelligence can find hidden

value from the content of fuzzy data. This is also the

basic process of data deep mining. In general, with

the continuous application of artificial intelligence,

the construction of tax information systems will be

based on big data architecture. In this way, it can

transition from the traditional form to the new form,

and it can also achieve compatibility with various

application scenarios. In addition to the above

content, the application of artificial intelligence in tax

risk management can also ensure that the data of each

link is fully mined. In the meantime, it can also clarify

the core collection and management links, strengthen

the efficiency of collection and management, and

build a complete full-process closed-loop structure

system (Chen, 2019).

5 APPLICATION CONTENT OF

ARTIFICIAL INTELLIGENCE

IN TAX RISK MANAGEMENT

5.1 Upgrade Management Concept

At this stage, due to the relatively backward

management concepts, some companies have many

problems in tax risk management and control. The

application of artificial intelligence technology can

solve this type of dilemma, and it can truly achieve a

comprehensive upgrade of management concepts.

First of all, with the help of artificial intelligence, big

data can be regarded as the focus of management, and

the quantitative attributes of big data are used as the

basis to ensure that the tax risk management process

and indicators are more clear. In addition, the staff can

also use the network system to record personnel

information, invoice information, etc., and reflect the

specific behavior trajectory through images and

videos. Simultaneously, the application of artificial

intelligence technology can reflect the laws in internal

information and data, and then provide a basis for the

effective division of subsequent functions. Secondly,

the application of artificial intelligence can also ensure

that the thinking mode of managers is changed. The

application of traditional artificial thinking mode will

consume a lot of manpower and material resources.

But in the era of big data, managers can use audio,

video and other forms to transfer actual information to

the system platform. Managers can clarify the tax risk

points based on scientific data analysis. This kind of

thinking mode appears to be more rational and the

management efficiency brought by it is also very high.

Finally, the application of actual big data technology

can make tax risk forecasts more reasonable. It can

also reduce the transfer of multiple data to the

platform, clarify the law of risk occurrence, and

strengthen the controllability of tax risks, thereby

avoiding more economic losses for enterprises.

5.2 Optimize the Risk Management

System

In the implementation of actual tax risk management,

if artificial intelligence, cloud computing and other

technologies are applied, it will also place high

requirements on the technical capabilities of relevant

staff. For example, relevant staff can collect and

integrate data before applying big data. This can

provide corresponding support for artificial

intelligence system applications. In order to better

realize data sharing, people need to put forward more

requirements on artificial intelligence, and do a good

job of data inspection operations in different channels.

Only in this way can the role and value of data be truly

presented. More importantly, managers must also

make appropriate improvements to the risk

management process, and maintain the precise

attributes of artificial intelligence based on actual

conditions. This can make the data more reliable and

accurate. To achieve the above goals, relevant staff

should ensure that the management process is

transparent. For example, after tax data enters the

system platform, centralized precipitation and

conversion operations should be implemented. After

that, people need to apply and analyze again to ensure

the maximum value of the data. The application of

actual artificial intelligence in tax risk management

can apply the management method to the entire

management process to ensure that the risk is

effectively controlled (Xiang, 2019).

5.3 Innovative Tax Risk Management

Methods

First of all, technicians need to comprehensively

expand the risk analysis methods. After the artificial

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

374

intelligence completes the entire tax risk identification

task, the technical staff will also develop a scientific

analysis system based on the taxpayer's behavior

pattern. This ensures that both structured and

unstructured data are covered. For the enhancement of

the risk supervision process, it is also necessary to

focus on machines and staff to perform auxiliary

operations. More importantly, the staff should also

appropriately increase the frequency of use of

artificial intelligence technologies such as random

forests and decision trees based on actual conditions.

At the same time, the staff can also establish a

complete risk model, including all tax risk

characteristics and risk levels. Otherwise, in the actual

tax risk response, the artificial intelligence system can

improve the correlation characteristics of the risk

results and characteristics. Compared with the

traditional causal connection, this model needs further

improvement. Specific to a certain job, the relevant

technical personnel can establish a corresponding risk

model to achieve a comprehensive correction of the

data, and achieve a comprehensive exploration of the

risk data. What’smore, the application of this model

puts forward high requirements on technical

personnel. Enterprises should use various training

methods to strengthen the personal capabilities of

management and staff. Secondly, people have to

update the tax risk model in a timely manner. This is

mainly due to the high requirements of artificial

intelligence on the accuracy of the internal data of the

system. After the actual risk assessment operation is

over, the management personnel must also clarify the

specific improvement of the current situation of

management and control to achieve the improvement

and revision of the main model, and then perform in-

depth risk analysis.

5.4 Build a New Artificial Intelligence

System

All tax risk managers should clarify the role and value

of the artificial intelligence system in their daily work,

and strengthen the integrity of the ecosystem. The core

of the system is big data technology, which can ensure

the comprehensive collection of tax-related data and

establish a corresponding correction system. This can

also ensure that the management system can form a

closed-loop structure, that is, data collection,

processing and application, and so on. Meanwhile, the

application of the actual learning algorithm of the

network platform can strengthen the extensibility and

expansibility of the model, and meet various risk

requirements. In addition, the technical capabilities

that need to be applied in the construction of artificial

intelligence systems are very demanding. To this end,

the relevant management departments need to

establish a corresponding professional talent team.

This also includes risk analysts, model builders, etc.

Only by guaranteeing the improvement of technical

level and management ability can the tax risk

management procedures be more and more perfect

(Li, 2018, Li, 2018).

5.5 Perform Risk Prediction

Operations

Under normal circumstances, tax risk management

mainly comes from post-mortem analysis, which can

increase the probability of risk problems. In order to

improve this situation, people can use artificial

intelligence system design to make risk prediction

more accurate. In turn, we can avoid risks beforehand

and maintain the stable development of the company.

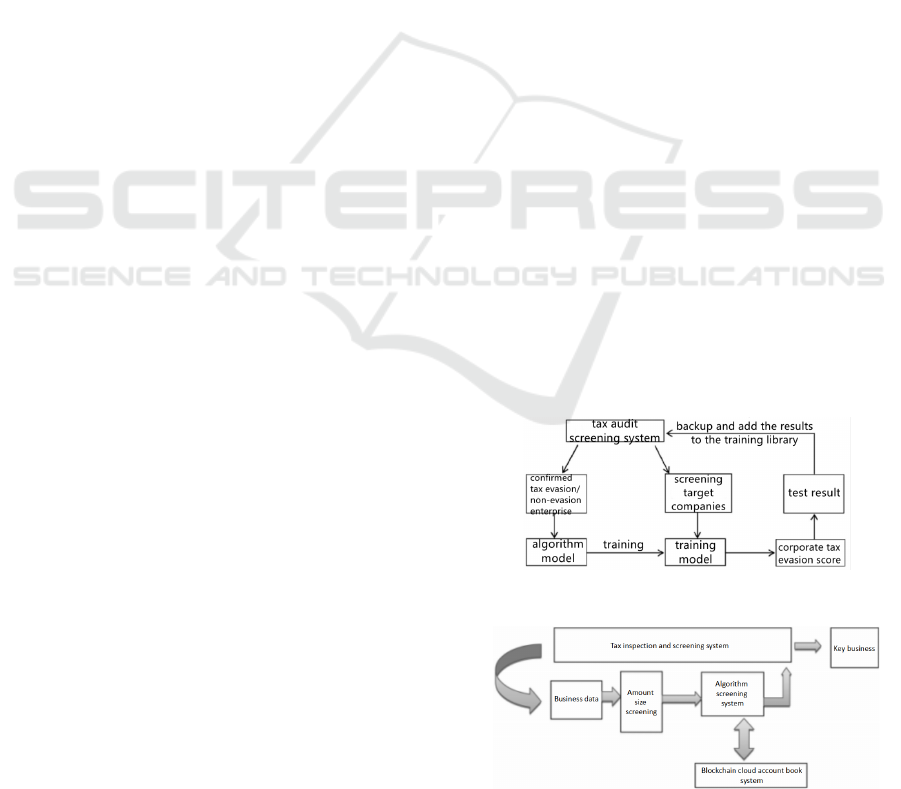

For example, in the development of tax risk

management of a company, relevant staff members

have established a tax inspection system based on

actual conditions. The specific procedure is shown in

Figure 2. It can learn about specific tax evasion

companies through big data applications. It can also

back up and retain the results and determine the target

company. It can also understand the company's own

tax registration. In the event of tax evasion, the system

will automatically add a corresponding score to arrive

at the final result, strengthening the accuracy of the tax

risk result. In addition, the company can establish a

key business screening system based on the tax

inspection system (Figure 3), and scientifically screen

the key businesses of the target enterprises according

to the weight of the tax bureau, which can provide

reliable financial evidence for the tax authorities.

Figure 2: Tax Inspection System.

Figure 3: Target enterprise key business screening system.

Application of Artificial Intelligence in Tax Risk Management

375

6 CONCLUSION

In summary, the development of tax risk management

is of positive significance for the development of

enterprises. In order to strengthen the scientific nature

of management concepts and methods, technicians

should understand the content of artificial

intelligence systems as much as possible. The system

is very reasonable in management ideas and

behaviors and can accurately predict specific tax

risks. Through the application of big data, all aspects

of the tax management system can be improved. This

can improve the quality of services and at the same

time make the tax risk management model develop

towards an intelligent direction.

ACKNOWLEDGEMENT

Humanities and Social Science Research Project of

Chongqing Education Committee.

Project No. 21SKGH390.

REFERENCES

Bian Shuaishuai. Application analysis of artificial

intelligence in tax risk management [J]. Economic

Management Abstracts, 2020(21): 51-52.

Chen Ning. Corporate tax planning to prevent corporate tax

risks and measures[J]. Taxation, 2019, 13(35): 46+49.

Li Weiren, Li Bin. Thoughts on introducing artificial

intelligence technology into tax risk analysis [J].

Taxation Research, 2018(06): 29-34.

Wang Aiqing, Zhu Kaida. Artificial intelligence technology

and tax risk management innovation [J]. Friends of

Accounting, 2020(07): 126-130.

Xiang Hongjin. Discussion on the feasibility of artificial

intelligence technology in tax risk analysis [J].

Commercial News, 2019(07): 109-110.

Yu Yiming. Research on taxation risk management based

on big data environment [J]. Modern Economic

Information, 2020(11): 123-124.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

376