Analysis on the Application of Statistical Analysis in Enterprise

Economic Management

Ling Wang

Chongqing Aerospace Polytechnic, Chongqing, China

Keywords: Statistical Analysis, Enterprise Economic Management, Big Data, Application.

Abstract: With the rapid development of society, statistical analysis technology is gradually maturing, and its role is

most obvious in the application of enterprise economic management. The related decisions of enterprises are

realized according to the data obtained after statistical analysis. In this paper, by using big data technology,

aiming at the problems existing in traditional enterprise economic management, the author constructs an

application system of statistical analysis in enterprise economic management, which accords with the current

economic development. This system not only makes up for the problems existing in enterprise economic

management, but also effectively manages the data involved in enterprise economic management. Because it

fully analyzes the data, the decision-making of enterprises is more efficient and accurate.

1 INTRODUCTION

Statistical analysis is the behavior of quantitative and

qualitative research on data by using statistical

methods. It is characterized by data nature, purpose

nature, and timeliness. After statistical analysis of

data information, it is beneficial to discover the value

of enterprise data information. Therefore, now many

business operators and managers pay more and more

attention to statistical analysis. The author thinks that

by using big data technology, the application system

of statistical analysis in enterprise economic

management can be constructed to solve the problems

existing in traditional enterprise economic

management, such as improper allocation of human

resources, inaccurate control of financial risks, lack

of evaluation of economic management system, so as

to improve enterprise management level and

statistical work quality, and then promote enterprises

to quickly form an efficient management mode and

achieve the goal of enterprise precise decision-

making.

2 OVERVIEW OF RELEVANT

THEORIES

2.1 Big Data

Big data are collection of massive data. Big data is

specialized processing of data to obtain valuable data.

The essence of big data is to process large quantities

of data by using computer clusters. Big data is

characterized by abundance, diversity, timeliness and

value. Abundance is the most essential feature of

data. Big data has a huge amount of data, and the data

unit is at least PB, EB or ZB. Diversity is the multi-

dimensional manifestation of data types, such as

videos, pictures. Timeliness and value mean that big

data can quickly obtain high-value data information.

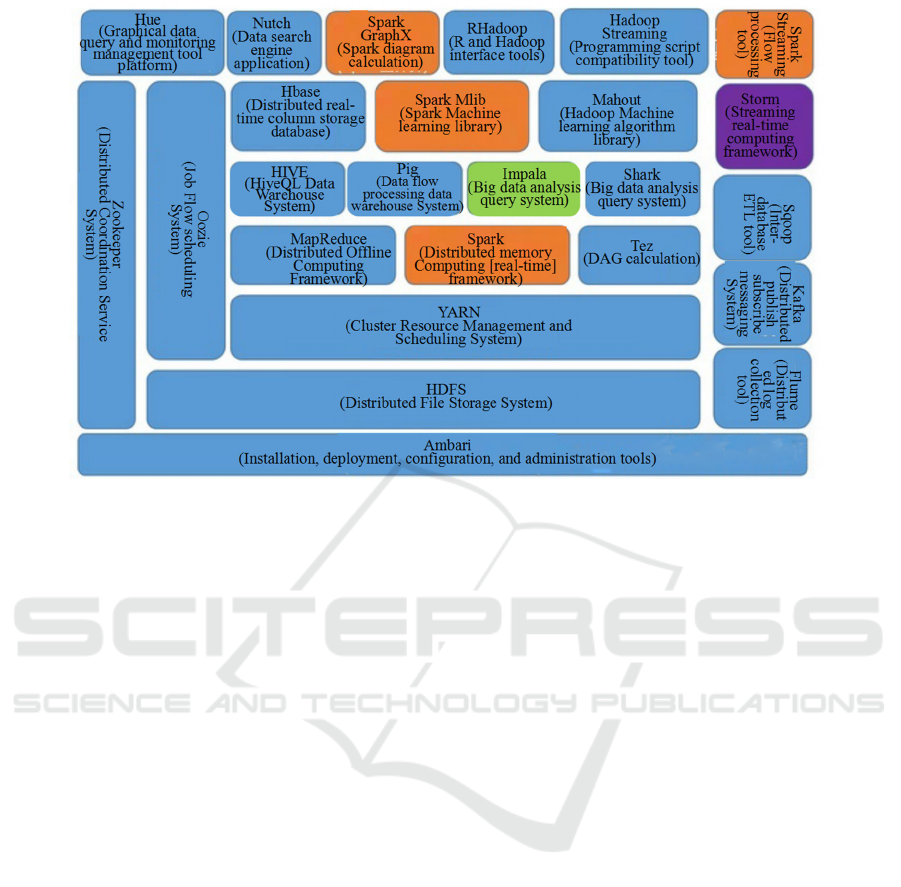

2.1.1 Overview of Big Data

Big data technology is realized through data

collection, data storage, data cleaning, data analysis,

data mining and data presentation. Its basic big data

processing technology framework is shown in Figure

1.

Wang, L.

Analysis on the Application of Statistical Analysis in Enterprise Economic Management.

DOI: 10.5220/0011190500003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 543-549

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

543

Figure 1: Basic technical framework of big data processing.

Data collection: Use Flume NG, NDC, Sqoop,

Zookeeper and other technologies to collect the

structured and unstructured scattered mass data in the

network into the data warehouse. Data collection

includes file logs, database logs, and access to

relational databases. Data is generally presented in

the form of text, graphics, images, and videos.

Data storage: Storage tools, such as HBase,

Phoenix, Redis, and Kudu, are used to efficiently and

quickly process data due to the large amount of data

involved in data storage. When the data table

involved is more complicated, the data can be flexibly

compressed by using Parquet and ORC, so as to

significantly reduce the occupation of storage space.

Data cleaning: Data cleaning is a process of

reviewing and verifying data to ensure data

consistency by adding, deleting, and modifying data.

The methods used include missing data value

processing and outlier processing, and technologies

such as MapReduce, Oozie, and Azkaban.

Data analysis and mining: Use data for shallow

analysis, using SPSS, SAS, etc., and then use Hive,

Impala, Nutch, Elasticsearch, Mahout, machine

learning algorithm, etc., for high-end analysis and

application.

Data display: Data display is data visualization,

which is to show the data results of data analysis and

mining, so as to guide managers to make decisions.

In the process of presentation, we need to use graphic

image processing, computer vision, modeling and

other methods to three-dimensional processing of

data results, such as Cufflinks, HoloViews,

Pyecharts, Bokeh.

2.1.2

Brief Introduction of Big Data

Technology

Flume: Flume is a tool for collecting data in big

data, and performs simple processing on data, such as

storage. Flume adopts a three-tier architecture, and

each tier can be extended horizontally. Flume

architecture collects the generated logs from the

external system (Web Server). By using the Source to

collect data sources into the channel, sink extracts

data from the channel and stores the data into the

HDFS file system. The extracted data can come from

multiple external systems.

HDFS: HDFS is the main storage engine of

Hadoop and the distributed file system of Hadoop. It

can be used for offline and massive data analysis. Its

characteristics are high fault tolerance, high

throughput and large file storage.

MapReduce: MapReduce is a query engine,

which is used for parallel computation of large-scale

data sets. The specific operation process is divided

into two steps. One is Map, which preprocesses the

original data, such as filtering the required data,

grouping it, and then distributing it to Reduce; the

second is Reduce, which summarizes the data. For

example, after receiving the distributed data, Reduce

starts to execute the custom calculation function or

logic, and finally gets the total data.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

544

Hive: Hive is mainly used to map structured data

into a database table, and has the function of query.

Its advantage is that users can query, summarize and

analyze data in HDFS without writing MapReduce

program, only with standard SQL syntax.

Echarts: Echarts is the most basic tool for big data

visualization. It has the advantages of making maps:

first, it can be dynamic, for example, the sales of

various products in various places can be displayed in

one map; Second, it can not only make basic charts in

Word, but also make maps, heat maps, instrument

panels and so on.

2.2 Statistical Analysis

Statistical analysis is to prove a theory or predict the

future development trend by collecting, sorting,

summarizing and analyzing data. Statistical analysis

can reflect not only the current situation of an

enterprise at a certain point, but also the dynamic

situation of a certain period, such as production and

operation. (

Wang, 2018

) It not only provides

information consulting services for decision makers,

but also provides quantitative boundaries between

economic phenomena for enterprises. The application

of statistical analysis knowledge is reflected in the

field of big data analysis. The analysis of big data

needs to be supported by statistical analysis

knowledge, and the two promote and develop

mutually.

In the process of statistical analysis need to use

statistical analysis tools, such as statistical index

method, dynamic analysis, ratio analysis,

comparative analysis. The function of statistical

analysis method can be divided into three aspects:

one is to show the law of objective things; the other

is to determine the quantitative limit of qualitative

change of things according to the law of quantitative

change; the third is to reveal the new law that has not

been discovered. It is characterized by quantity and

precision.

3 DEMAND ANALYSIS

3.1 System Requirements

Economic management belongs to the most

important part of enterprise management, economic

management level will directly affect the enterprise

profit, and then extended to the enterprise

development strategy formulation, (

Dong, 2015

) and

now exists in the economic management of

enterprises human resource values, lack of financial

risk control is not comprehensive and economic

management system evaluation. This will seriously

affect the improvement of comprehensive strength of

enterprises, and even hinder the sustainable

development of enterprises. Therefore, enterprise

economic management needs human resource

module, financial risk control module and evaluation

system as the guarantee in the process of enterprise

economic management. Specific analysis is as

follows:

First, the human resources department. The

human resources module needs to increase the input

of human resources, such as increasing the staff of the

human resources department and setting up an

independent human resources department;

Reasonable allocation of human resources, such as

the position and staff ability and technology

matching; In view of employees' sense of collective

achievement and superiority, measures such as

performance evaluation and reward and punishment

system should be set up to improve employees'

enthusiasm for work. (

Hou, 2015, Yang, 2015, Cao,

2015, Li, 2014

) Second, finance Department. The

finance department to strictly control the enterprises

in the operating activities, financing activities,

investing activities such as risks, such as enterprise in

the process of operation, without fully considering

the cash flow, capital allocation and other problems,

can appear the phenomenon such as shortage of

funds, unable to pay his debts, letting the

phenomenon development, will affect the normal

operation of the capital chain, even the results of the

enterprise bankruptcy. (

Chen, 2019, Wu, 2018

)

Third, enterprise economic management. Enterprise

economic management needs to set up economic

management system evaluation, in order to avoid the

enterprise because of excessive pursuit of economic

interests and blindly make decisions, resulting in

economic losses, customer loss and other

phenomena.

Now we need big data technology and statistical

analysis to solve these demand problems, so as to

promote the informatization process of enterprise

economic management, improve the decision-

making level of enterprises, and achieve the purpose

of efficient management and efficient income of

enterprises.

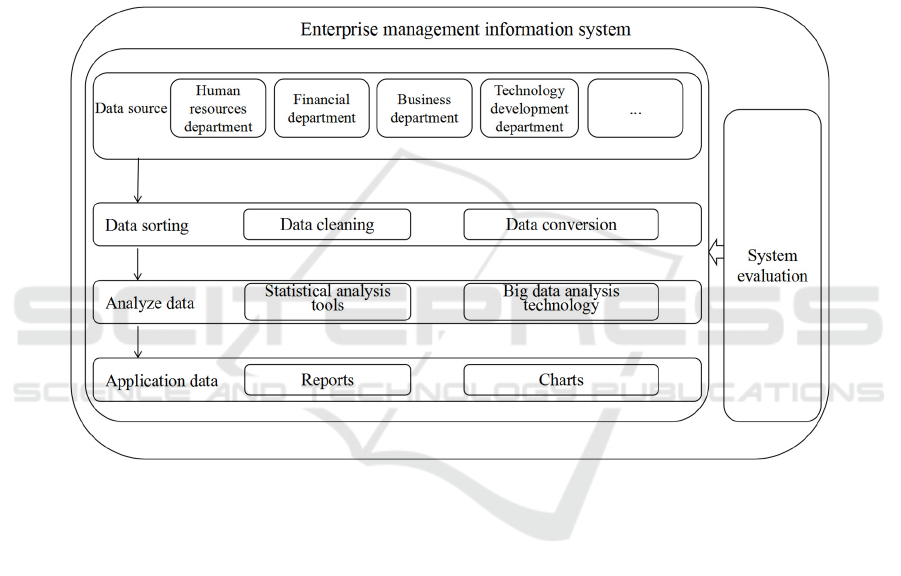

3.2 Overall Design

In view of the above enterprise economic

management involved in the demand, now design a

statistical analysis in the enterprise economic

management application system, using the system to

Analysis on the Application of Statistical Analysis in Enterprise Economic Management

545

solve the above demand problems. The application of

statistical analysis in enterprise economic

management is realized through the management

information system, as shown in Figure 2. The

management information system is built by using

Web technology, statistical analysis tools and big

data technology. Users enter the management

information system through the website, view reports

and charts, and make relevant decisions. The system

consists of five parts: data source, data sorting, data

analysis, application data and system evaluation.

Among them, the data source is the data information

of human resources department, finance department,

business department, technology development

department and other departments; data sorting is to

clean and convert the data source and organize it into

a format that is conducive to data analysis; analysis

data analyze the collated data by using statistical

analysis tools and big data analysis technology;

application data is to visualize the results of analysis

data in the form of reports and charts. System

evaluation is to evaluate the application process of

statistical analysis in enterprise economic

management, which is beneficial for enterprises to

reflect and adjust themselves.

Figure 2: Management Information System.

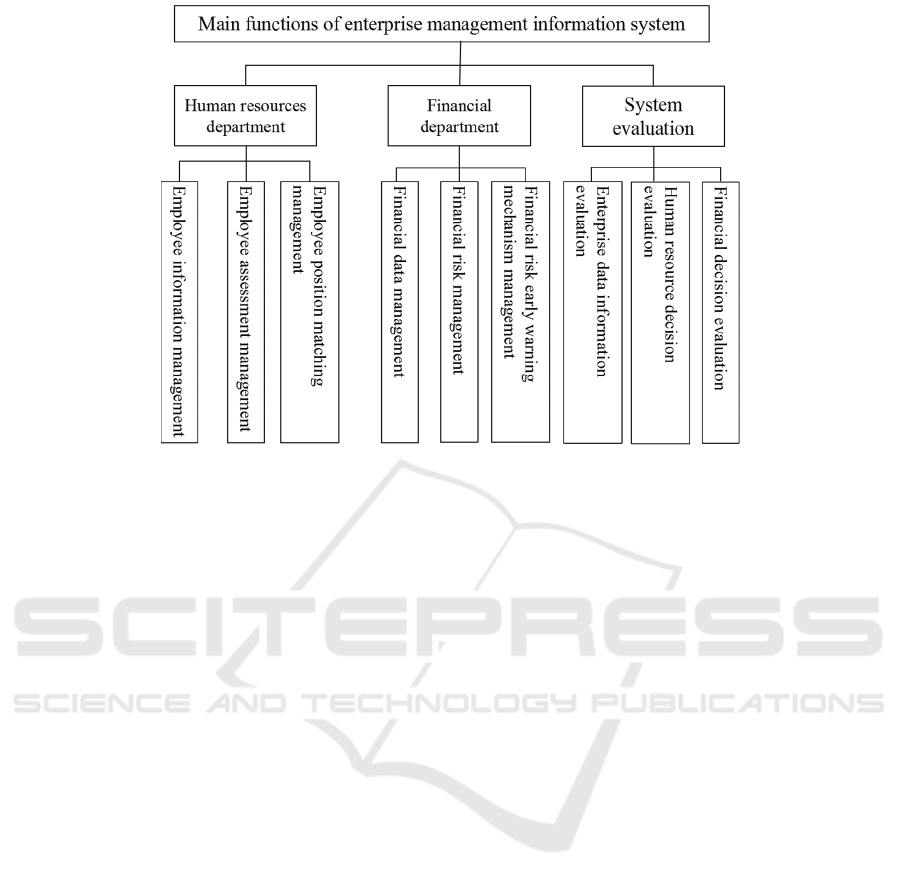

4 DESIGN AND

IMPLEMENTATION

This part focuses on the introduction of human

resources department, finance department and system

evaluation, and the specific functional modules are

shown in Figure 3. The specific functional modules

of Human Resources Department include employee

information management, employee assessment

management and employee position matching

management; the specific functional modules of the

financial department include financial data

management, financial risk management and

financial risk early warning mechanism management;

the specific functional modules of the evaluation

system include enterprise data information

evaluation, human resource decision evaluation and

financial decision evaluation. Through the

construction of the evaluation functions of human

resources department, finance department and

system, it makes up for the defect that the human

resources department does not pay attention to it,

comprehensively controls the occurrence of financial

risks, and improves the evaluation system of

enterprise economic management, thus making

enterprise economic management more intelligent,

systematic, informational and efficient, which not

only improves the decision-making level of

enterprises, but also makes the development direction

of enterprises clear.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

546

Figure 3: Specific function module.

The following is a detailed introduction to the

functions.

4.1 Human Resource Department

Employee information management. Employee

information management is to use Flume to collect

the data information of the data source human

resources department, store it with the help of HDFS,

clean and convert the data with MapReduce and

spark, and send the unqualified data information such

as outliers and duplicate values to the manager. The

manager decides whether to filter or correct these

data information. In this process, it ensures the

intelligence, comprehensiveness and precision of the

data information management used by the

enterprises, improves the utilization rate of data and

information by the department, avoids the loss of data

and information, and saves human and material

resources.

Employee assessment and management. It is

necessary to establish an assessment system in

employee assessment management. The system

needs to analyze and query the cleaned and converted

employee information by using Hive in big data

technology, and then use the visualization tool

Echarts to obtain reports or charts related to employee

information. By viewing reports and charts,

formulate a system to motivate employees to work

efficiently through rewards and punishments.

Employee position matching management. By

viewing and analyzing the report or chart of

employee information, we can transfer the employees

who are not suitable for the current position or whose

position is insufficient to give full play to the

employees' value. It is not only conducive to the

employees' efficient work, but also conducive to the

employees' sense of satisfaction, accomplishment and

superiority. (

Jia, 2016

)

4.2 Financial Department

Financial data management. Data collection, storage,

cleaning and conversion in financial data

management are the same processes and tools as

employee information management in human

resources. Through this process, financial data can be

more accurate and comprehensive, and error data

caused by manual data entry, collation and review can

be avoided.

Financial risk management. To analyze and query

the processed data in the financial data management

module, we need to use Hive in big data technology

and statistical analysis tools, such as comparative

analysis, ratio analysis and statistical index analysis.

By looking at the results of data analysis, managers

can not only know the source and destination of

internal financial data, but also optimize the capital

structure and allocate funds reasonably. It is not only

conducive to the current management of enterprises,

but also conducive to planning the future

development of enterprises.

Financial risk early warning mechanism

management. The financial risk early warning

Analysis on the Application of Statistical Analysis in Enterprise Economic Management

547

mechanism is to monitor the potential risks generated

in the business management activities in real time. It

is based on the financial data and business plan of the

enterprise, and uses statistical analysis tools and

modeling methods to inform the enterprise of the

crisis that the enterprise has faced and will face in

advance and take corresponding preventive

measures. In this way, enterprises can avoid financial

crisis caused by decision-making mistakes or existing

problems of enterprises themselves, and minimize

financial risks.

4.3 System Evaluation

Enterprise data information evaluation. Enterprise

data information evaluation is to evaluate the reports

and charts related to human resources and financial

departments. It evaluates the integrity, timeliness,

legitimacy, uniqueness, consistency, accuracy and

timeliness of data information. The evaluation results

are graded by the frequency of data information

quality problems (frequency of data information

quality problems = times of data information quality

problems/total data stored). According to the

frequency greater than equal to 1, less than 0.5 and

intermediate value is divided into three levels,

respectively, grade one is poor quality, need to be key

monitoring; grade three is good quality, continue to

maintain; grade two quality is general, need to find

the source of the problem. Through data and

information evaluation, we can understand the

current status of the enterprise and determine the

future development direction of the enterprise.

Human resource decision evaluation. According

to the decision-making of human resources

department, it can be judged whether it is beneficial

to the development of enterprises, such as increasing

investment in human resources department, making

decisions to improve job matching degree, and

making employee appraisal system, etc. The score

reduction system needs to be used in the

determination process. The score reduction system is

based on the performance appraisal of the

department, and the performance appraisal is aimed

at employees' work efficiency, mastery of theoretical

knowledge and attitude towards work, with a total of

10-point system, the work attitude is 4 points, and the

other is 3 points each. When the score drops to 3

points, it is judged that there is something wrong with

the decision-making and adjustment is needed.

Through the evaluation of human resources decision-

making, it is beneficial to timely adjust the decision-

making of enterprises to departments, so as not to

cause more problems.(

Zhang, 2017

)

Financial decision evaluation. It is to evaluate the

economic decisions made by enterprises, such as

meeting the daily business activities of enterprises

and ensuring the normal operation of enterprises as a

whole; when arranging the reasonable funds in fund-

raising activities, we should consider that the

enterprise has the ability to pay off debts; implement

real-time tracking of investment projects, and feed

back the profit and loss of investment projects in

time, so as to decide whether to make additional

investment or divestment. The evaluation also

implements the score reduction system, aiming at the

situation that the loss and profit amount of the

enterprise are small, the enterprise adjusts the

decision. Through this evaluation, it is conducive to

timely stop loss, thus improving the profitability of

enterprises. (

Lei, 2020, Cui, 2020, Pan, 2020

)

5 CONCLUSION

The application of statistical analysis in enterprise

economic management is built through centralized

management of enterprise human resources

department and financial department, which not only

shows that enterprises attach importance to human

resources department, but also comprehensively

controls the occurrence of financial risks. The

construction of this system is conducive to promoting

the information management of enterprise data and

improving the efficiency of enterprise decision-

making. After replacing departments and data, the

system can also be applied to other departments of the

enterprise, so as to realize the clarity of data in each

link of the enterprise and further make the enterprise

develop better. Similarly, modern enterprises also

need to build this system to achieve the goal of

maximizing the economic benefits of enterprises.

REFERENCES

Chen Fangfang. (2019) Application of financial analysis in

enterprise risk control. Accounting audit.

Cui Qianyue, Pan Yang. (2020) On the application of

statistical analysis in economic management leading

city [J] China market.

Dong Meiyou. (2015) Current situation and

Countermeasures of modern enterprise economic

management. Journal of Hubei correspondence

university.

Hou Dawei, Yang Wenjing, Cao Shuai. (2015) Problems

and Countermeasures of enterprise economic

management. Enterprise management.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

548

Jia Li. (2016) On the application of statistical analysis

method in enterprise human resource management.

Shopping mall modernization.

Lei Yunchi. (2020) Application of statistical analysis in the

field of economic management. Marketing.

Li Jun. (2014) Research on the role development of

enterprise human resource management. Nankai

University.

Wang Renjie. (2018) Analysis on the method of statistical

analysis and its application in enterprise economic

management. Operation and management.

Wu Qianyi. (2018) Development trend of economic

management in the era of big data. Economic Forum.

Zhang Shiwei. (2017) Analysis on the application of

statistical analysis method in enterprise human resource

management. Economy.

Analysis on the Application of Statistical Analysis in Enterprise Economic Management

549