The Study based on Coordination of Revenue Sharing Contract in

Three-stage Port Supply Chain under Emergencies

Shihao Gong

a

and Zhangchi Sun

b

College of Transportation Engineering, Dalian Maritime University, Linghai Road, Dalian, China

Keywords:

Revenue Sharing Contract, Emergencies, Port Supply Chain, Supply Chain Coordination.

Abstract: On the basis of random market demand, establishing revenue sharing contract can achieve the coordination

of the three-stage port supply chain system. However, the drastic fluctuations of market demand caused by

emergencies will break the coordination of supply chain in stable market, which in turn affects the normal

operation of each node enterprise. This paper gives an emergency optimization strategy for the multimodal

transport service supply chain with the port as the integrator under the emergencies, which makes the

original contract has stronger robustness; and gives the relationship of the profit distribution coefficients

among the subjects when supply chain systems yield the most, and finally verifies the effectiveness of the

improved revenue sharing contract through case analysis.

1 INTRODUCTION

1

Since the global outbreak of COVID-19,

international trade has been hit. Along with the

gradual intensification of trade frictions between

countries, emergencies such as COVID-19 are

unpredictable, short-cycle and of huge influence,

which have led to frequent and dramatic fluctuations

in the market environment, resulting in a global

supply chain crisis. How to achieve coordination

among enterprises at all levels of the supply chain,

enhance their ability to cope with shocks and reduce

losses of supply chain enterprises under the impact of

emergencies has gradually become the focus of

scholars at home and abroad. The port supply chain

in shipping industry is gradually becoming a key link

in the global industrial chain and international trade

chain, providing transportation services for about

70% of global trade and having a major strategic

position in global supply chain network. In the port

supply chain, port enterprises play the role of

integrating multiple information and building a

trading platform. They play a vital role in connecting

road carriers, ocean carriers and port companies as a

whole, and are also responsible for distribution and

coordination of internal revenue within the supply

chain, while directly dealing with shippers externally.

a

https://orcid.org/0000-0002-4196-0687

b

https://orcid.org/0000-0003-3388-2444

Therefore, under the impact of emergencies, how to

coordinate the interest conflicts among the three-

stage port supply chain consisting of road carriers,

ocean carriers and port enterprises will become the

key to whether the port supply chain can withstand

risks, maintain efficient and stable operation.

Against the preceding background, this paper

analyzes the response measures of risk and revenue

sharing strategies of port supply chain under

centralized and decentralized decision by using

revenue sharing contract under the disturbance of

emergencies, and explores what response measures

of risk should be taken by the three-stage port supply

chain under different market fluctuations, aiming to

provide theoretical guarantee for port supply chain to

cope with emergencies and port supply

chain security.

2 LITERATURE REVIEW

First, the supply chain is a whole composed of multi-

level enterprises. Due to different interests among

enterprises at different levels, it is difficult to

coordinate the interests of the whole supply chain.

How to reasonably divide the interests of the supply

chain so as to maximize the revenue of the supply

chain has been the focus of academic research. For

the distribution of interests within the supply chain,

(Cachon, 2005) first proposed the role of revenue

contribution contract in supply chain coordination,

658

Gong, S. and Sun, Z.

The Study based on Coordination of Revenue Sharing Contract in Three-stage Port Supply Chain under Emergencies.

DOI: 10.5220/0011207700003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 658-668

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

and concluded that revenue sharing contract can give

the optimal revenue allocation proportion and

optimal order quantity for each link in the supply

chain system under a stable market environment,

which proves the effectiveness of revenue sharing

contract. And (Xu, 2010) improved the classical

revenue sharing contract by considering price

elasticity of demand, realized the coordination

between traditional distribution channels and

electronic distribution channels, explored the

conditions for the existence of perfect win-win

coordination between dual-channel supply chains,

and gave a solution method for the contract

parameters. (Niu, 2009) used Stackelberg game

theory to study the game process between retailers

and distributors and the equilibrium effect of revenue

sharing contract on supply chain revenue under

dominant supply chains. The above studies proved

the role of supply chain contract in supply chain

interest distribution, supply quantity optimization,

etc., and proposed various paths to coordinate the

supply chain.

It is worth noting that most of the above studies

are based on normal market models and ignore the

impact of unusual market fluctuations on the supply

chain. Especially under the impact of the COVID-19,

the instability of the supply chain has greatly

increased. In order to cope with the impact of

emergencies, many scholars have conducted research

on the coordination of supply chain based on the

background of abnormal perturbation of market

fluctuations, in order to enhance the ability of supply

chain to cope with risks and resist market

fluctuations, so as to reduce the losses of supply

chain enterprises under the market fluctuations. For

example, (Liu, Liu, 2020). analyzed the coordination

effect of quantity flexibility contract for supply chain

under emergencies based on a two-stage closed loop

supply chain model in the context of contingency

disturbances. (Chen, Liu, 2014) studied the effect of

revenue sharing contract on the coordination of

emergency contingencies based on the perspective of

a three-stage supply chain. (Liu, 2013) demonstrated

that revenue sharing contract can still coordinate the

revenue gap between supply chain links under

complex market fluctuations from a four-stage

supply chain consisting of suppliers, producers,

distributors and retailers, and demonstrated the

robustness of revenue contribution contract.

Due to the fundamental difference between the

service supply chain represented by the port supply

chain and the traditional product supply chain, the

above-mentioned papers still focus on the traditional

product supply chain and lack in-depth exploration of

the service supply chain. At present, in the field of

port supply chain, (Zhang, 2009) analyzed the profit

distribution of port service supply chain by using the

improved Shapley method and proposed a new profit

distribution model from the perspective of

cooperative game. (Wang, 2021) studied the optimal

business strategy under two different decision

scenarios: centralized decision and decentralized

decision, for the port supply chain model under

demand disturbance, and proposed different

transportation strategies for goods with different

characteristics, such as cost-sensitive and time-

sensitive. (Zhao, 2007) studied the longitudinal

alliance structure of the port supply chain and

analyzed the potential benefits from the cooperation

between upstream and downstream port enterprises.

(Lv, 2020) considered the optimization effect of

introducing fourth party logistics on the port supply

chain, and analyzed the competition and coordination

between port integrators and port and shipping

enterprises. He found that the whole supply chain

could achieve the highest yields under centralized

decision, but the members of each link might need to

sacrifice some of their own interests to achieve the

goal of global optimum.

In the above studies on port supply chain,

although they all propose corresponding coordination

mechanisms for the port supply chain model to

ensure the long-term stable operation of the port

supply chain. However, most of the scholars in the

current research are based on the simplified two-

stage supply chain model for supply chain contract

design, ignoring the three-stage supply chain

consisting of road carriers, port enterprises and ocean

carriers in the port supply chain. With the gradual

development of port integration and the increasing

flexibility of transportation services, the “door-to-

door” transportation form represented by multimodal

transport is gradually receiving more and more

attention. Therefore, it is worthwhile to further study

the three-stage port supply chain in the context of

multimodal transport. Meanwhile, most scholars

have focused on traditional product supply chain

research in the study of supply chain coordination for

emergencies, but not on the optimization and

coordination of service supply chain such as logistics

transportation. Currently, the occurrence of frequent

disruptions such as COVID-19 and trade frictions,

the study of service supply chain such as logistics

services has become the focus of global attention.

To sum up, based on the three-stage port supply

chain consisting of road carriers, ports and ocean

carriers and considering both market random

fluctuations and contingency disturbances, this paper

The Study based on Coordination of Revenue Sharing Contract in Three-stage Port Supply Chain under Emergencies

659

constructs a revenue model for each party in the

supply chain and the whole supply chain , and

constructs a revenue sharing contract based on this

model to explore the response strategies of the port

supply chain under contingency disturbances and

uses cases to demonstrate the general application of

the contract.

3 PROBLEM DESCRIPTION AND

CONDITION ASSUMPTIONS

In recent years, with the outbreak of the COVID-19

and the intensification of world trade frictions,

outages and production shutdowns have occurred

from time to time, leading to widespread market

fluctuations, and these emergencies have posed

challenges to the stable operation of the supply chain.

Large fluctuations in market demand can lead to

significant changes in demand for specific

commodities. For example, after the outbreak of

COVID-19, the market demand for medical supplies

such as masks and vaccines increased significantly;

after the China-Australia trade friction intensified,

the volume of coal trade between China and

Australia decreased greatly. At this time, the shipping

industry, as the main carrier of world trade, needs to

adjust to market fluctuations. In the event of demand

expansion and capacity shortage caused by

emergencies, enterprises at all levels of the supply

chain need to improve transportation efficiency,

expand transportation scale and bear the cost of

exigently production increase. And in the case of

sharp decline of market demand caused by

emergencies, there will inevitably be a large amount

of idle capacity in supply chain, resulting in waste

and bringing losses to the supply chain enterprises.

To this end, this paper establishes a three-stage

supply chain consisting of port operators, ocean

carriers and road carriers in the context of sea-land

combined transport. Compared with the traditional

supply chain model, the port supply chain of sea-land

combined transport has the following characteristics:

The information between road carrier and ocean

carrier is symmetrical and independent. Logistics

service as a intangible product without residual

value. The ideal state of the whole supply chain is

that the agreed volume of port operators is equal to

the agreed volume of road carriers and ocean carriers.

In view of the above problems and characteristics,

the following assumptions are proposed in this paper:

Assumption 1: The cost of stocking and retail

price of each service provider do not change, and the

distribution function which market demand subject to

in a stable environment is continuous, differentiable

and derivable.

Assumption 2: The services provided by the port

supply chain are multimodal transport of containers.

Assumption 3: Port service providers, road

carriers, and ocean carriers are risk-neutral and

entirely rational, i.e., each makes decisions according

to the net benefit maximization principle.

Assumption 4: All parties in the supply chain

can accurately predict the demand distribution

function of customers.

The variables used in this paper are shown in

Table 1:

Table 1: Definition of Parameters

,,,

t por

ππ ππ

Profit for the whole supply chain, port

operators, ocean carriers and road

carriers

,,,

tpor

QQ QQ

Optimal transportation volume for the

whole supply chain, port operators,

ocean carriers, and road carriers

,,

p

or

ccc

Unit cost for port operators, ocean

carriers and road carriers

(), ()Fx Gx

Market demand distribution function

after emergencies in a stable market

,

or

θθ

Unit price of ocean carriers and road

carriers

,

or

kk

Benefit coefficient of ocean carriers

and road carriers

,,

p

or

λλλ

Unit opportunity cost for port

operators, ocean carriers and road

carriers following a reduction in

market demand due to emergencies

,,

p

or

μμμ

Unit cost of exigent production

increment for port operators, ocean

carriers and road carriers following an

increase in market demand due to

emergencies

,

tp

pp

Shipper purchase price under

centralized decision and decentralized

decision

Based on the above assumptions, we first develop

a benchmark revenue sharing contract model of

three-stage service supply chain under a stable

market, and further consider how the improved

revenue sharing contract coordinates the entire

system in the event of a sudden increase/decrease in

market demand due to emergencies.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

660

4 THE BENCHMARK REVENUE

SHARING CONTRACT MODEL

OF THREE-STAGE SERVICE

SUPPLY CHAIN

4.1 Model Overview

The port supply chain in the context of multimodal

transport can provide customers with “door-to-door”

entire transport services. Since the whole system has

several independent subjects, the participants in the

supply chain are usually set to make self-interested

and rational decisions, and the goal of their decisions

is often to maximize their own interests. Therefore,

in general, the service volume when the individual

achieves the optimum is often not the optimal

service volume of the whole supply chain.

The supply chain contract model represented by

revenue sharing contract can provide appropriate

incentives for all parties in supply chain to optimize

sales channels to ensure supply chain coordination.

However, the occurrence of emergencies can lead to

changes in contract parameters as well as market

demand, which can result in lower overall revenue

and further lead to supply chain incongruity.

Therefore, we construct the supply chain revenue

sharing contract models respectively under

centralized and decentralized decision to coordinate

the whole supply chain. Further, we consider the

parameter optimization of the revenue sharing

contract model to cope with such perturbations under

the influence of emergencies, and finally, we verify

the effectiveness of our model through case analysis.

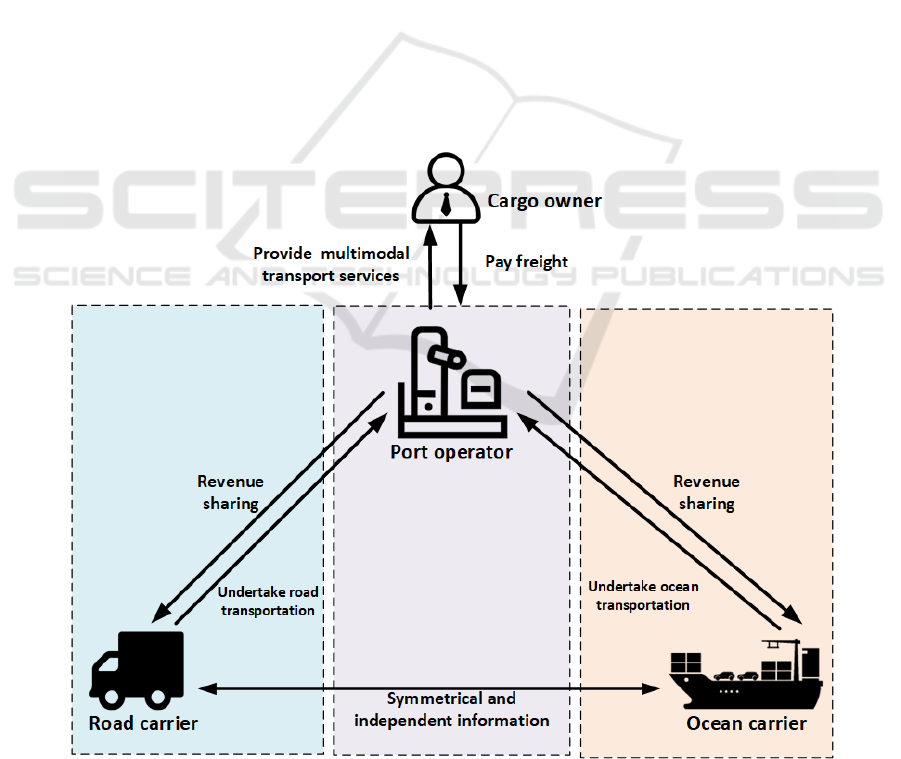

The model in this paper considers a three-stage

service supply chain consisting of port operators,

road carriers, and ocean carriers, whose structure is

shown in Figure1. Under the coordination of revenue

sharing contract, port operators purchase

transportation resources from road and ocean carriers

respectively at below cost to provide multimodal

transport services to customers, and sign carriage

contracts with shippers outside the system as supply

chain integrators, and finally share part of the

revenue to road and ocean carriers through the

earning yields agreed in advance.

Figure 1: The framework of port three-level service supply chain.

The Study based on Coordination of Revenue Sharing Contract in Three-stage Port Supply Chain under Emergencies

661

To establish a benchmark three-stage service

supply chain, we let the demand of shippers in the

market D be an obeying random variable of F(x), and

the unit stocking cost of the three parties, namely,

port operators, road carriers and ocean carriers, be

,,

p

ro

ccc

.

4.2 The Revenue Sharing Contract

Model under Centralized Decision

Under centralized decision, the supply chain parties

jointly aim at maximizing the profit of the system,

and let the overall profit of the supply chain be

t

π

,

the agreed volume jointly decided by supply chain

participants under the centralized decision be

t

Q

and

the unit charge to shippers be

t

p

. When the market

volume is D, the final actual volume of the port

supply chain is

{

}

min ,

t

D

Q

.

The unit cost of the port supply chain consists of

the unit cost of each party together, i.e.

tpro

cccc=++

.After the supply chain participants

reach an agreed volume, each participant prepares

resources for stocking according to the determined

agreed volume, and the overall stocking cost is

()

++

p

rot

cccQ

. Thus, the profit of the port supply

chain under centralized decision is shown as follows:

{

}

()

min ,

tt t prot

pDQcccQ

π

=−++

(1)

The expected profit function is:

()

()

0

() ()

t

t

Q

tt t prot

Q

E

pxfxdxQfxdxcccQ

π

∞

=+−++

(2)

.. 0

t

stQ >

The first derivative of the expected profit for the

whole supply chain with respect to the agreed

volume

t

Q

is:

[]

()

()

1()

t

ttpro

t

E

p

FQ c c c

Q

π

∂

=− −++

∂

The second derivative of the expected

profit

()

t

E

π

with respect to the agreed volume

t

Q

is:

()

()

2

2

t

tt

t

E

pf Q

Q

π

∂

=−

∂

Because of

()

2

2

0

t

t

E

Q

π

∂

<

∂

,

()

t

E

π

is convex function,

and the agreed volume of the whole port supply

chain is determined by

()

t

t

E

Q

π

∂

∂

.

Let

()

0

t

t

E

Q

π

∂

=

∂

,then

()

*

1

p

ro

t

t

ccc

FQ

p

++

=−

, i.e.:

*1

1

p

ro

t

t

ccc

QF

p

−

++

=−

Therefore, under the centralized decision, the

optimal agreed volume of the whole supply chain is

shown in the above equation.

4.3 The Revenue Sharing Contract

Model under Decentralized

Decision

Since port operators, as the integrators of the supply

chain, dominate the game process in the port supply

chain, in order to match the agreed volumes of each

party under the decentralized decision with the

agreed volumes under the centralized decision, i.e., to

achieve supply chain coordination, we adopt a

revenue sharing contract to allocate the revenue of

each party in the supply chain. The road carrier and

ocean carrier determine the respective optimal agreed

volumes

**

,

ro

QQ under a given revenue sharing

contract

(,),(, )

rr oo

kk

θθ

,

,

ro

θθ

are the unit

prices of transport services purchased by the port

from the road carrier and ocean carrier, and

,

ro

kk

are the proportion of revenue allocated by the port to

two parties. Further, the port operator determines his

own optimal agreed volume

*

p

Q based on his

expected revenue function and

(,),(, )

rr oo

kk

θθ

.

Under the revenue sharing contract, the revenue

functions of the road and ocean carriers are as

follows:

()

{

}

() {}

min ,

min ,

rrrrrp r

ooooop o

cQ kp DQ

cQ kp DQ

πθ

πθ

=− +

=− +

(3)

Expected profit function is:

()

()

0

0

( ) () ()

() () ()

r

r

o

o

Q

rrrrrp r

Q

Q

ooooop o

Q

E

cQ kp xfxdx Qfxdx

E

cQ kp xfxdx Qfxdx

πθ

πθ

∞

∞

=− + +

=− + +

(4)

.. , 0

ro

stQ Q >

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

662

Calculate the first derivative and the second

derivative of

()

r

E

π

, and results are as follows:

()

[]

2

2

()

1()

()

()

r

rr rp r

r

r

rp r

r

E

ckp FQ

Q

E

kp f Q

Q

π

θ

π

∂

=−+ −

∂

∂

=−

∂

Because of

2

2

()

0

r

r

E

Q

π

∂

<

∂

, and

()

r

E

π

is

convex function, its optimal agreed volume

*

r

Q can

be determined by

()

r

r

E

Q

π

∂

∂

.

Let

()

0

r

r

E

Q

π

∂

=

∂

, then

()1

rr

r

rp

c

FQ

kp

θ

−

=+

, i.e.:

*1

(1 )

rr

r

rp

c

QF

kp

θ

−

−

=+

Calculate the first derivative and the second

derivative of

()

o

E

π

, and results are as follows:

()

[]

2

2

()

1()

()

()

o

oo op o

o

o

op o

o

E

ckp FQ

Q

E

kp fQ

Q

π

θ

π

∂

=−+ −

∂

∂

=−

∂

Because of

2

2

()

0

o

o

E

Q

π

∂

<

∂

, and

()

r

E

π

is

convex function, its optimal agreed volume

*

r

Q can

be determined by

()

o

o

E

Q

π

∂

∂

.

Let

()

0

o

o

E

Q

π

∂

=

∂

, then

()1

oo

o

op

c

FQ

kp

θ

−

=+

, i.e.:

*1

(1 )

oo

o

op

c

QF

kp

θ

−

−

=+

The port operator, as the supply chain integrator,

is the actual leader of this service supply chain. The

port operator purchases transportation services from

road carriers and ocean carriers respectively and then

allocates the profits received from the customer to

the carriers for supply chain coordination, so its

profit function can be expressed as:

()

{

}

()

1min,

p

rop p prop

kkp DQ c Q

πθθ

=−− − ++

(5)

Its expected profit function is:

()

()

0

() 1 () ()

p

p

Q

prop p prop

Q

E

kkp xfxdx Qfxdx c Q

πθθ

∞

=−− + − + +

.. 0

p

stQ >

(6)

Calculate the first derivative and the second

derivative of

p

Q with respect to ()

p

E

π

, and the

results are as follows:

()

()

()

2

2

()

11()

()

1()

π

θθ

π

∂

=−− − − ++

∂

∂

=− − −

∂

p

rop p pro

p

p

rop p

p

E

kkp FQ c

Q

E

kkpfQ

Q

Because of

2

2

()

0

p

p

E

Q

π

∂

<

∂

, and ()

p

E

π

is

convex function, its optimal agreed volume

*

p

Q can

be determined by

()

p

p

E

Q

π

∂

∂

.

Let

()

0

p

p

E

Q

π

∂

=

∂

, then

()

()1

1

pro

p

rop

c

FQ

kkp

θθ

++

=−

−−

, i.e.:

()

*1

1

1

pro

p

rop

c

QF

kkp

θθ

−

++

=−

−−

In summary, the respective optimal agreed

volumes for road carriers, ocean carriers and port

operators under decentralized decision are shown

above.

4.4 Coordination of Centralized

Decision and Decentralized

Decision

For the three-level port supply chain who provides

the service of transport, the key to achieve overall

coordinating is that the decided volume of each party

should be equal, the same as the optimal volume of

the centralized decision.

Proposition 1. When the market remains stable,

the revenue sharing contract enables the supply chain

to be coordinated, which means that the optimal

volume of each party of the decentralized decision

should equal with that of the centralized decision.

The proof as follows:

The Study based on Coordination of Revenue Sharing Contract in Three-stage Port Supply Chain under Emergencies

663

let

**

p

t

QQ=

,

then

()

1

pro pro

rop t

cccc

kkp p

θθ

++ ++

=

−−

.Considering

that the port, as an integrator, receives the quotation

of the cargo owner in our model, so

p

t

pp=

, the

constraints on the port in our overall coordination are

as follows:

1

pro

ro

pro

c

kk

ccc

θθ

++

−−=

++

(7)

let

****

,

rtot

QQQQ==

,then

()

rrrrop

ckccc

θ

=− ++

(8)

()

ooorop

ckccc

θ

=− ++

(9)

put the above three equations into the profit

function of port operator, road carrier and marine

carrier respectively:

()

{

}

()

()

1min,1

prot t roprot

kkp DQ kkcccQ

π

=− − −− − ++

(10)

{

}

()

min ,

rrt t rprot

kp DQ k c c c Q

π

=−++

(11)

{

}

()

min ,

oot t oprot

kp DQ k c c c Q

π

=−++

(12)

Compare the result with the overall profit

function of the supply chain of centralized

decision

p

π

, and we can find:

()

1

prot

kk

ππ

=−−

(13)

rrt

k

ππ

= (14)

oot

k

ππ

= (15)

In this case, we can figure out that the profit

function of each part of decentralized decision and

the overall profit function of centralized decision are

affine. Therefore, when the market reaches a plateau,

the revenue sharing coefficient can maintain its

coordination by adjusting the supply chain.

Proposition 2. The road carriers and ocean

carriers are the independent information-sharing

carriers in the supply chain, and their revenue

contract coefficients satisfy the following

relationship when the supply chain is coordinated:

()()

or r ro o

kckc

θθ

−= − (16)

Let

**

ro

QQ= , then

11

oo

rr

rp op

c

c

kp kp

θ

θ

−

−

+=+

.

The above equation can be obtained after

simplification. At this time, the optimal volume of

the three parties in the three-stage chain of the port is

equal to the optimal volume of the system, from

which it can be obtained that under the coordination

of the revenue sharing contract, the optimal volume

of the participating parties are the same, and their

profit functions are affine to the overall income

function of the supply chain, and the supply chain

reaches coordination.

Proposition 3. The pricing of ocean carriers and

road carriers are negatively correlated with their

revenue sharing coefficients respectively when the

decentralized decision parties adopt the optimal

volume under a centralized agreement, as evidenced

by the following:

According to Proposition 1, if supply chain

coordination is to be achieved under the revenue

sharing contract, the optimal agreed volume for road

carriers and ocean carriers is:

()

*1

1

1

pro

p

rop

c

QF

kkp

θθ

−

++

=−

−−

(17)

As can be seen from the equation, under the

decentralized decision, if the supply chain is required

to achieve coordination, both road carriers and ocean

carriers should use this optimal agreed volume, at

this time,

** *

por

QQQ== , the optimal supply of

transportation services for the road carrier under

decentralized decision is:

*1

(1 )

rr

r

rp

c

QF

kp

θ

−

−

=+

(18)

If the road carrier is still required to maintain the

original optimal volume at this time, i.e.

**

rp

QQ= .

The relationship between its revenue sharing

coefficient

r

k

and the price of transport services

provided to the port operator

r

θ

can be obtained as:

1

orro

rr

or p por

kcck

k

cc c c

θ

θθ

−−

=+

++ ++

(19)

.. 1

o

st k <

It can be obtained from the above formula, there

is a negative correlation between

r

k

and

r

θ

, which

demonstrates that when the port operator increases

the revenue-sharing coefficient, the carrier will

correspondingly reduce the unit price of its transport

services in order to increase the freight volume to

gain more revenue. As a result, when supply chain

reaches equilibrium, the revenue-sharing contract can

regulate the overall pricing of the supply chain.

Integrators can adjust the overall price by adjusting

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

664

the revenue-sharing coefficient in order to adapt to

the normal fluctuations and changes of the market.

5 OPTIMIZATION OF REVENUE

SHARING CONTRACT

COORDINATION FOR THE

THREE-STAGE PORT SUPPLY

CHAIN UNDER THE

DISTURBANCE OF

EMERGENCIES

5.1 The Effect of Emergencies to

Three-stage Port Supply Chain

Now considering the effect of benchmark revenue

sharing contract on supply chain coordination when

emergencies lead to drastic fluctuations in market

demand, causing the distribution function of market

demand subject to change from

()Fx

to

()Gx

.

Proposition 4. Supply chain coordination cannot

be achieved if the benchmark revenue sharing

contract is still adopted in the presence of large

fluctuations in market demand under emergencies, as

evidenced by the following:

When

*

QQ>

, due to emergencies resulting in a

sharp increase in demand for cargo transportation of

the shipper, the supply chain parties need to provide

the exigent transportation capacity, the amount is

()

*

QQ− ,the unit incremental cost of exigent

production increment of port operators, road carriers

and ocean carriers are

,,

pro

μμμ

. At this time the

profit function of three parties becomes as:

()

()

()

**

1

proppro p

kkpQc Q QQ

πθθμ

=−− − ++ − −

(20)

()

()

**

rrr rp r

cQ kpQ QQ

πθ μ

=− + − −

(21)

()

()

**

ooo op o

cQ kpQ QQ

πθ μ

=− + − −

(22)

Taking the road carrier as an example, at this

point, substituting the revenue sharing ratio of the

road carrier in a stable market state into its profit

function, we can get

()

**

1

rr r

rt

rr r

c

QpQ QQ

kk k

θ

μ

π

−

=+−−

. Now

the profit function of the road carrier is not affine to

the whole supply chain’s profit function

t

π

, so the

supply chain cannot be coordinated according to the

original revenue sharing coefficient.

When

*

QQ<

,as a result of emergencies that

lead to a sharp drop in the transportation demand for

the cargo of the shipper, all parties in the supply

chain still prepare their goods in accordance with the

optimal volume

*

Q in a stable market, therefore

there will be surplus capacity

()

*

QQ− cannot be

sold, the respective increased unit opportunity cost

for port operators, road carriers and ocean carriers are

,,

pro

λλλ

. At this point the profit functions of the

three parties become as:

()

()

()

**

1

propprop

kkpQc Q QQ

πθθλ

=−− − + + − −

(23)

()

()

**

rrr rp r

cQ kpQ Q Q

πθ λ

=− + − −

(24)

()

()

**

ooo op o

cQ kpQ Q Q

πθ λ

=− + − −

(25)

By the same token, the profit function of each

party in the supply chain is not affine to the profit

function of the whole supply chain, and the supply

chain cannot be coordinated as well.

5.2 Optimizing Revenue Sharing

Contract Coordination

In order to enable the three-stage port service supply

chain to coordinate by using the revenue sharing

contract even under the disturbance of emergencies,

we improve the original revenue

sharing contract, i.e.,

the cost of exigent production increment borne by

each supply chain entity is allocated according to its

benefit coefficient in the whole.

Proposition 5. In the case of emergencies

perturbation resulting in an increase in market size,

the cost of exigent production increment is allocated

according to the benchmark revenue sharing

coefficient, at which point the adjusted revenue

sharing contract still can make supply chain back to

the coordinated situation, as evidenced by the

following:

Assuming that the emergencies make the market

demand expectations increased to

Q

, let the optimal

volume obtained by adopting revenue sharing

contract coordination under the stable operation of

the market is

*

Q

, then the revenue functions for

each of the decision parties are shown as:

()

()

()

()

()

'*

*

1

1

proppro

ro p r o

kkpQc Q

kk QQ

πθθ

μμμ

=−− − ++

−− − + + −

(26)

The Study based on Coordination of Revenue Sharing Contract in Three-stage Port Supply Chain under Emergencies

665

()

()

()

'* *

rrr rp rpro

cQ kpQk QQ

πθ μμμ

=− + − ++ −

(27)

()

()

()

'* *

ooo op opro

cQ kpQk QQ

πθ μμμ

=− + − ++ −

(28)

Now respectively substitute the revenue sharing

ratio between each subject and the whole

()

1,,

roro

kkkk−− into

'''

,,

p

ro

πππ

, we can find

that the profit functions of road carriers, ocean

carriers and port operators are still affine to the

revenue function of the whole supply chain, i.e. the

port supply chain is re-coordinated. In the three-stage

port service supply chain, the company that receives

more shared revenue also needs to bear greater costs

accordingly to achieve the overall coordination of

supply chain.

Similarly, when the market demand is reduced by

emergencies, the newly increased opportunity costs

of all parties in the supply chain are distributed

according to the benchmark revenue sharing

coefficient. The adjusted revenue sharing contract

can also make the income function of all parties

involved in decision-making form an affine

relationship with the overall income function, that is,

the supply chain can achieve coordination again.

In that case, the current market demand is the

optimal transportation service provision for the

whole supply chain. Thus, through revenue sharing

contract, it is possible to optimize and adapt to

specific volumes. This enables enterprises in the

supply chain to have a strong risk response

capability, which greatly enhances the overall

earnings of the supply chain and realizes the risk

sharing of the supply chain.

6 CASE ANALYSIS

Assuming that the market demand

D

satisfies the

uniform distribution of

[

]

30,60 ,

5, 6, 4, 5

2, 0.2, 0.3, 48

pro r

or o p

ccc

kk p

θ

θ

====

== = =

Under the above conditions, coordination

between carriers is achieved when satisfying

**

ro

QQ= , the relationship between the revenue

sharing contract coefficients

()

, k

θ

for road and

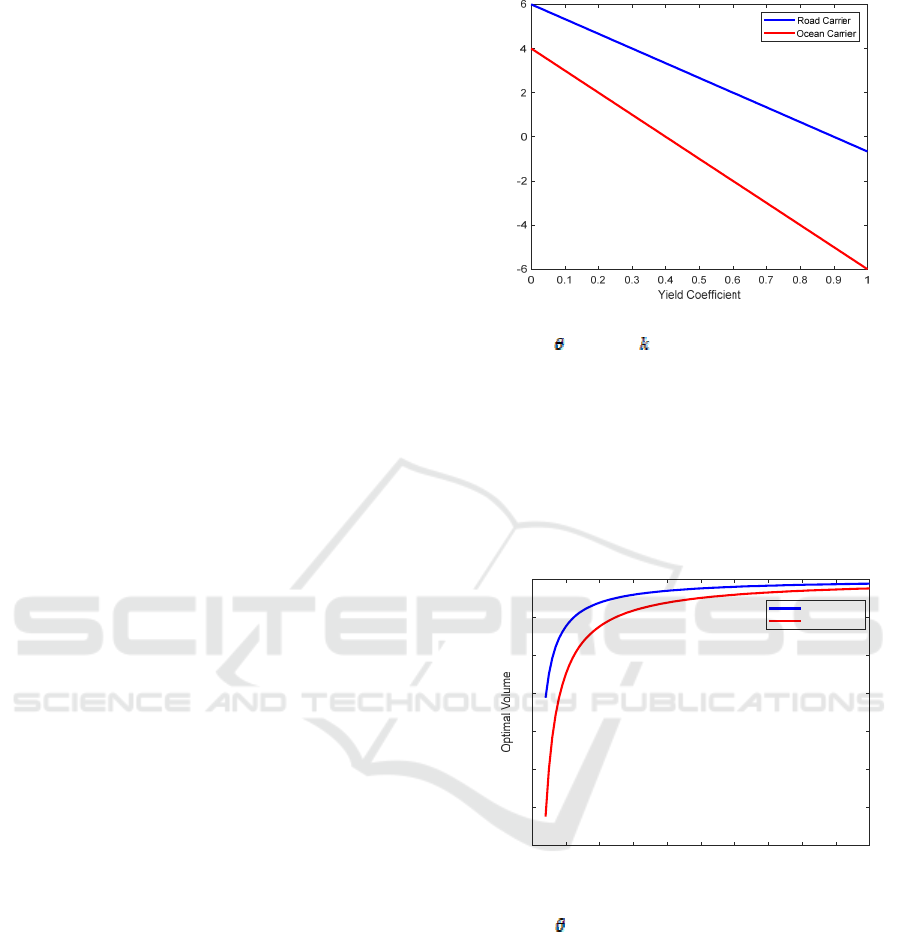

ocean carriers is shown in Figure 2:

Carrier Price

Figure 2: Relationship between carrier yield sharing

coefficient

and price .

It can also be seen from the figure that there is a

negative correlation between the price of each carrier

and its yield coefficient.

Under decentralized decision, when the revenue

sharing coefficient, unit cost and unit price of each

carrier and port operator are respectively unknown,

the relationship between the optimal agreed volume

of carriers and each coefficient is shown as:

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1

Yield Coefficient

-5

0

5

10

15

20

25

30

Road Carrier

Ocean Carrier

Figure 3: Relationship between carrier yield sharing

coefficient

and optimal volume.

The figure shows that the optimal agreed volume

of road carriers and ocean carriers are positively

related to their respective yield sharing coefficient.

Through the case analysis, we compare the yield

sharing coefficient of road carriers and ocean carriers

separately with the optimal agreed volumes and their

own selling prices, and visualize how the revenue

sharing coefficient coordinate the whole

supply chain.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

666

7 CONCLUSION

In this paper, we only considered the contingency

response of the three-stage port service supply chain

when the market price is stable. We first propose the

use of revenue sharing contract for the stable market

to achieve coordination among the participants of

the three-stage port supply chain so as to maximize

the overall revenue of the supply chain. Further, we

consider the impact of emergencies on the

transportation demand of cargo owners in

the market,

where the disturbance of such emergencies can make

the originally coordinated supply chain no longer

coordinated. For this reason, we adjust the existing

revenue sharing contract model so that each entity

shares the cost of the whole supply chain in

proportion to the revenue coefficient, and in this

case, the improved revenue sharing contract can

restore the system to coordination after the

perturbation.

The study concludes that when the disturbance of

transportation cost and market demand caused by

emergencies is small, the transportation plan does not

need to be adjusted and the supply chain system has

the ability to recover itself; however, when the

disturbance of emergencies is large enough to

influence the transportation cost, the original revenue

sharing contract cannot achieve the purpose of risk

sharing and the revenue sharing coefficient of each

entity need to be adjusted in time. The improved

revenue sharing contract can enable the supply chain

companies to share the risk to cope with emergencies

and maximize the overall revenue.

In this paper, we only consider the applying and

improving of revenue sharing contract and enable it

to effectively coordinate the supply chain system

under emergencies under the situation where the the

information is complete, the data such as cost

structure and profit function of each supply chain

node enterprise is available, and the demand

distribution faced by retailers can be predicted, and

the risk is neutral.

Further in-depth research is needed to address the

complex situation of incomplete information of the

supply chain system and different risk attitudes of the

node companies.

REFERENCES

Chen Wentao, Liu Lang. Revenue-sharing contracts for

three- stage supply chain coordination for

extraordinary emergencies, Journal of Catastrophology

2014, 29(04): 23-28.

Du Shaofu, Du Chan, Liang Liang, Liu Tianzhuo. Supply

chain contracts and coordination that considers equity

concerns, Journal of Management Science, 2010, 13

(11): 41-48.

Gérard P. Cachon,Martin A. Lariviere. Supply Chain

Coordination with Revenue-Sharing Contracts:

Strengths and Limitations. Management Science,

2005, 51(1)

Liu Chongguang, Liu Lang. Price stochastic closed-loop

supply chain under the condition of emergency

quantity flexibility contract. Journal of Beijing

institute of technology (social science edition), 2020,

22 (02): 50 -59, DOI: 10.15918 / j.j bitss1009-

3370.2020.7955.

Li Zhifang, Liu Wei, Cheng Guoping. Research on supply

chain profit distribution strategy based on stackelberg

game. Logistics Technology, 2008(05):91-92.

Lu Yongming. Port coordination mechanism of supply

chain benefit-sharing contract. Journal of Shanghai

maritime university, 2017, 38 (01): 52-56. DOI:

10.13340 / j.j smu 2017.01.011.

Liu Qiusheng, Hu Xiaoyue, Hou Yunzhang. Research on

four-stage supply chain coordination under emergency

based on revenue sharing contract. Science and

technology management research, 2013, 33(12): 228-

233.

Liu Chongguang, Liu Lang. An emergency quantitative

elastic contract for closed-loop supply chain under

stochastic price. Transactions of Beijing Institute of

Technology (Social Science Edition), 2020,22(02):50-

59.DOI:10.15918/j. jbitss1009-3370.2020.7955.

Lu Jing, Qiao Yu, Xu Peng.4PL Port Supply Chain

Enterprises competition and cooperation and interest

coordination strategy, Journal of Dalian Maritime

University, 2020, 46(02): 49-58.

DOI:10.16411/j.cnki.issn1006-7736.2020.02.007.

Niu Chunyang. Research on Emergency Management of

Supply Chain under Revenue Sharing Contract. Xidian

University,2009.

Pang Qinghua, Zhang Yue, Hu Yulu, Chen Huamin. A

demand - dependent price–sharing contract for three -

stage supply chain under emergency, Journal of

Systems Management. 2015, 24(06): 887-896.

Peng Haiyan, Chen Weijiong, Liang Chengji. Study on the

contingency strategy of three-stage supply chain under

joint contract. Journal of Central China Normal

University (Natural Science edition), 2017, 51(01):40

-46.DOI: 10.19603/j.cnki.1000-1190.2017.01.007.

Pang Qinghua. Study on coordination of three-stage

supply chain response to emergencies under revenue

sharing Contract, Chinese Management Science, 2010,

18(04): 101-106. DOI: 10.16381/j.cnki.issn1003-

207x.2010.04.009.

Wang Jiahao, Chen Zigen, Xin Congying, Yang Ang.

Coordination strategy of port logistics service supply

chain considering demand disturbance, Journal of

Dalian Maritime University .2021.1-9

Wang Yonglong, Fu Heng, Fang Xin, Jian Ming. Supply

chain coordination strategy under emergent output,

The Study based on Coordination of Revenue Sharing Contract in Three-stage Port Supply Chain under Emergencies

667

Chinese Management Science, 2019,27(07):137-

146.DOI: 10.16381/j.cnki.issn1003207x.2019.07.013.

Xu Guangye, Dan Bin, Xiao Jian. Research on Dual-

channel Supply Chain Coordination Based on

Improved Revenue Sharing Contract. Chinese

Management Science, 2010, 18(06): 59-64.

DOI:10.16381/j.cnki.issn1003-207x.2010.06.008.

Yang Bofeng. Research on port supply chain coordination

based on revenue Sharing contract under multimodal

transport, Southwest Jiaotong University.2018.

Ye Fei, Li Yina, Hu Xiaoling. A study on sharing revenue

contract of supply chain technology Innovation under

uncertain demand. Research on Science

andTechnology Management. 2005(03): 81-83.

Zhou Xianxian. Research on coordination of secondary

slogistics service supply chain based on joint contract.

Bohai University,2019.

Zhang Zhiyong, Zheng Chenghua, Song Xuefeng. Benefit

distribution analysis of port logistics service supply

chain based on improved Shapley value. Industrial

technical economy. 2009, 28(06):113-115.

Zhao Gang. Research on Rizhao Port Supply Chain

management based on vertical strategic alliance.

Hohai University, 2007

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

668