Early Warning Analysis of Company's Financial Risk based on Fuzzy

Evaluation Method

Yang Long

a

Business School, China West Normal University, Nanchong, China

Keywords: Financial Risk, Financial Early Warning, Hierarchical Analysis Method, Fuzzy Evaluation.

Abstract: With the rapid development of the automotive industry, there are more and more uncertainties in the

production and operation process, which makes the possibility of financial risks increasing day by day.

Therefore, risk identification and prevention are particularly important for enterprises, especially in the rapidly

developing and promising automotive industry. Taking Company A as an example, this paper firstly analyzes

the nature and characteristics of the industry, the company's production and operation, financial data and other

information to extract financial risk assessment indicators and establish a financial early warning indicator

system. Secondly, the financial risk early warning model is constructed by combining the hierarchical analysis

method (AHP) and fuzzy evaluation method, and finally, the established financial risk early warning model

is analyzed based on the financial data of Company A in recent years. The study aims to improve the financial

risk early warning capability of the enterprise, which is a contribution to the field.

1 INTRODUCTION

With the rapid development of China's economy and

the influence of world economic integration, China's

auto industry has risen at a very impressive pace.

According to the China Association of Automobile

Manufacturers (CAAM), after sixteen years of

development, China's automobile production and

sales volume has changed from 2.07 million units in

2000 to 25.02 million units in 2016 (Hou, Peng,

2019). Undeniably, with the rapid development of the

automobile industry, there are more and more

uncertainties in its production and operation process,

and these uncertainties make the possibility of

financial risks increasing day by day. The auto

industry itself is characterized by rapid product

replacement, numerous enterprises and strong

competition, which are also increasing financial risks

in a subtle way (Hou 2019). Forty-seven percent of

Chinese companies fail because of financial

problems, and the failure is not due to the lack of

profitability, but to the lack of risk prevention and

control ability, which leads to cash flow breakage.

Therefore, the identification and prevention of risks

is particularly important for the automotive industry,

a

https://orcid.org/0000-0001-7145-2547

which is growing rapidly and has great potential for

development (Hou 2019). Among the financial risk

early warning methods, the fuzzy comprehensive

evaluation method is suitable for financial risk early

warning by converting the qualitative into

quantitative and giving a definite conclusion to the

uncertain and complex environment. This paper takes

Company A as an example to use fuzzy

comprehensive evaluation method for financial risk

early warning management research has certain

theoretical significance and practical significance.

2 THEORIES RELATED TO

FINANCIAL RISK EARLY

WA RN IN G

2.1 The Concept of Financial Risk

Early Warning

"Early warning" refers to the calculation of the

likelihood of risk occurrence based on actual data and

certain research methods, and the provision of alerts

or signals before the occurrence of risk, in order to

Long, Y.

Early Warning Analysis of Company’s Financial Risk based on Fuzzy Evaluation Method.

DOI: 10.5220/0011207900003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 669-674

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

669

prevent the occurrence of risk when conditions are

available and reduce the losses caused by risk. Early

warning of enterprise financial risk refers to the use

of theories of financial management and business

management to analyze and judge the business

activities of the enterprise based on financial and non-

financial data, so as to find out the potential risks of

the enterprise, calculate the level of risks, analyze the

reasons for the risks and give an early warning signal

to the enterprise. It enables business operators to take

appropriate preventive measures to avoid the

occurrence of dangers and reduce the losses caused

by the occurrence of risks in the enterprise (Xiong,

Zhang, 2019). To escort the production and

management decisions and the survival and

development of the enterprise.

2.2 The Function of Financial Risk

Warning

Monitoring function: The financial risk early warning

system predicts the risks that may occur in the

operation of the enterprise, based on the financial data

in the operation of the enterprise and the national

standard value of the same industry, and issues an

alarm whenever the risk reaches a certain level, so

that the enterprise decision makers can feel the

existence of risk and play a monitoring role for the

enterprise (Huang, Li, 2018).

Pulse-taking function: Based on the results of risk

analysis and evaluation, financial risk warning

identifies risk factors, finds out the reasons for the

occurrence of risk factors, and furthermore finds out

the problems against the actual situation of the

enterprise, gives the pulse of the enterprise, and

provides decision support to managers.

Treatment function: Based on the risk forecast

results, the financial risk warning identifies the risk

factors affecting the enterprise through the pulse

function, finds out the problems existing in the

enterprise operation, further proposes improvement

measures to the enterprise, and provides treatment

solutions to the managers.

Protection function: Through regular financial

risk warning, the company continuously finds out the

financial risks faced by the company, takes the pulse

of the company, provides treatment plans for the

operators, prevents and controls the occurrence of

risks in the operation, and protects the company.

3 EARLY WARNING MODEL

FOR CORPORATE FINANCIAL

RISK

3.1 Background Analysis

Company A was founded in 1984, and since the first

pickup truck was produced in 1996, the sales volume

has been growing year by year, and the market share

is in the leading position in China. And starting from

the Middle East market, it has gradually expanded

into foreign markets. Company A was listed on the

Hong Kong H-share and domestic A-share markets in

2003 and 2011, respectively.

From the analysis of Company A's production and

operation in 2016, the return on net assets in 2016 was

significantly lower. When analyzing the risk profile

in 2016, more attention needs to be paid to the reasons

for the decrease in the return on net assets and the

resulting impact on the survival and development of

the company (Yan, Wang, 2018). Identify control

measures and prevent them so that the enterprise can

gain more profits and develop more stably. Company

A has a generally high market share of each product

and the company's overall financial situation is good

(Zhang, Chen, Wang, 2017). At present, China's

automobile industry is developing rapidly and the

competition is fierce. To make the enterprise

invincible in the long run, it is not enough to manage

afterwards by analyzing the previous financial reports

alone, but to manage beforehand by combining with

regular financial risk warning.

3.2 Determination of Financial Risk

Early Warning Indicator System

Current Ratio: Current ratio is the percentage of

current assets to current liabilities. Current assets are

assets that can be realized or applied in the short term,

and current liabilities are debts that need to be repaid

in the short term, and the short term generally refers

to a business cycle. The definition shows that the

current ratio is a measure of a company's ability to

liquidate its current assets to repay its debts.

Gearing ratio: Gearing ratio is the percentage of

total liabilities to total assets. With this indicator, the

importance of capital provided by creditors can be

measured and the interests of creditors can be

protected in this way.

Total Asset Turnover: Total Asset Turnover is the

net operating income as a percentage of average total

assets. The higher the total asset turnover ratio, the

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

670

stronger the company's sales capacity and reflects the

efficiency of the company's asset operations.

Accounts Receivable Turnover Ratio: Accounts

Receivable Turnover Ratio is the percentage of net

credit sales revenue to the average accounts

receivable balance. It indicates the speed of collection

of accounts receivable, that is, the speed of

conversion to cash. It also indicates how well

accounts receivable support sales revenue. A higher

accounts receivable turnover ratio indicates that

accounts receivable are recovered quickly and that

the funds used for operations are turned over more

quickly.

Inventory Turnover: Inventory turnover is the cost

of goods sold as a percentage of average inventory

balance. Inventory turnover ratio indicates the speed

of inventory turnover, that is, how quickly inventory

is converted into cash or accounts receivable within a

certain period of time. The higher the inventory

turnover rate, the lower the average inventory

balance. That is, the stronger the inventory realization

ability, signifying the stronger the short-term debt

servicing ability.

Operating Profit Margin: Operating profit margin

is the percentage of operating profit to total business

revenue. The higher the operating profit margin, the

more profit the enterprise makes from sales in the

course of operation, indicating stronger profitability.

Return on total assets: Return on total assets is the

percentage of net profit to the average total assets.

The return on total assets reflects the relationship

between the effectiveness of asset utilization and

capital utilization. The higher the return on total

assets, the higher the business management level and

the stronger the competitive strength of the

enterprise.

Return on net assets: Return on net assets is the

percentage of net profit to average shareholders'

equity. The higher the return on net assets, the more

effective the utilization of assets.

Operating growth rate: Operating growth rate is

the percentage of the growth of operating revenue this

year to the total operating revenue of the previous

year. Operating growth rate reflects the growth status

and development ability of the enterprise's operating

income.

Operating profit growth rate: The operating profit

growth rate is the percentage of the total operating

profit of the previous year. The growth rate of

operating profit reflects the growth of operating profit

and development ability of this year.

Growth rate of total assets: The growth rate of

total assets is the percentage of the growth of total

assets of this year to the total assets of the beginning

of the year. The growth rate of total assets reflects the

growth and development capability of total assets.

4 EARLY WARNING ANALYSIS

OF FINANCIAL RISK OF

COMPANY A

4.1 Calculation of Financial Risk Early

Warning Indicators

After establishing the financial risk early warning

index system and early warning model of Company

A, the financial data of the company from 2012 to

2016 were applied to the financial risk early warning

to analyze the financial risk of the company.

According to the balance sheet data in Company A's

accounting annual report, the financial data from

2012 to 2016 were sorted and selected against the

financial risk early warning model, and the financial

data were organized in the table, and then the values

of each evaluation index of Company A's financial

risk were obtained as shown in Table 1.

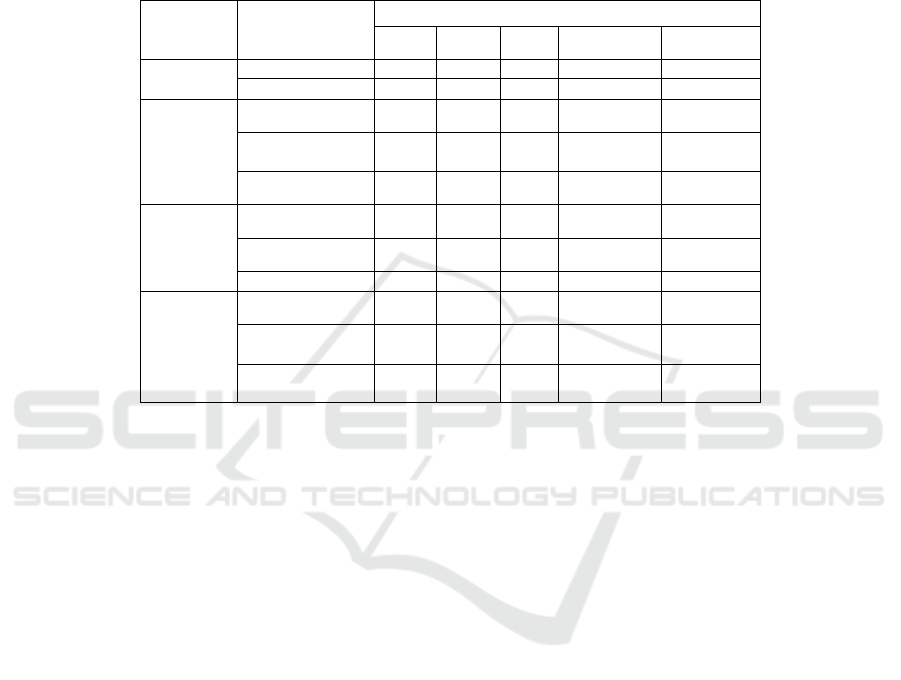

Table 1: Table of evaluation index values.

Tier 1

Indicator

s

Secondary

indicators

Early warning indicator

values

2016 2015 2014

Debt

Service

Risk

Current ratio

(%)

128.4 127 135

Gearing ratio

(%)

41.0 46.6 45.4

Operatio

nal Risk

Total assets

turnover (times)

1.23 1.06 1.02

Accounts

receivable

turnover ratio

(times)

122.31

101.

83

86.06

Inventory

turnover rate

(times)

17.47 15.0 14.5

Earnings

Risk

Operating profit

margin (%)

14.0 12.9 15.1

Return on total

assets (%)

11.5 12.1 14.1

Return on net

assets (%)

22.47 20.1 24.0

Develop

ment

Risk

Operating

growth rate (%)

12.1 21.4 10.2

Operating profit

growth rate (%)

3.56 0.40 (4.40)

Total assets

growth rate (%)

(0.28) 17.2 16.6

Early Warning Analysis of Company’s Financial Risk based on Fuzzy Evaluation Method

671

4.2 Results of Fuzzy Comprehensive

Evaluation

4.2.1 Results and Tests of Financial Risk

Early Warning Analysis in 2015.

Determining the affiliation matrix of each early

warning indicator: the standard values of enterprise

performance evaluation of the automotive vehicle

manufacturing industry in 2015 are chosen in this

paper. According to the results of Table 1, the index

affiliation matrix of 2015 year is obtained as shown

in Table 2.

Table 2: Company A's 2015 metric affiliation matrix.

Tier 1

Indicators

Secondary

indicators

Two-level fuzzy judgment matrix

Very

safe

Safer Fair Dangerous

Very

dan

g

erous

Debt Service

Risk

Current ratio 0.94 0.06

Gearing ratio 1

Operational

Risk

Total assets

turnover

0.94 0.06

Accounts receivable

turnover ratio

1

Inventory turnover

rate

0.02 0.98

Earnings

Risk

Operating profit

mar

g

in

0.40 0.60

Return on total

assets

0.11 0.89

Return on net assets 0.77 0.23

Development

Risk

Operating growth

rate

0.75 0.25

Operating profit

growth rate

0.30 0.70

Total assets growth

rate

0.87 0.13

The first-level fuzzy synthesis evaluation of the

company's financial risk: according to the above

calculation, the relative importance weight vector

Q1=(0333,0.6667) of each secondary indicator of

company A about debt service risk, using the fuzzy

synthesis operation formula A= Qi*Ri, we get the

first-level fuzzy synthesis evaluation matrix of the

company about debt service risk:

A1=(0.6667,03133,0.0200 The first-level fuzzy

integrated evaluation matrix of the company's

operational risk is calculated as follows:

A2=(0.2322,0.1198,0.6091,0.0389,0); the weight

vector of the relative importance of the second-level

indicators of operational risk is calculated as

Q2=(0.6480, 0.2298,0.1222); the weight vector of the

relative importance of the second-level indicators of

profitability risk is calculated as follows:

A2=(0.2322,0.1198,0.6091,0.0389,0); the weight

vector of the second-level indicators of profitability

risk is calculated as Q3=(0.7380,0.0944,0.1676), the

first-level fuzzy integrated evaluation matrix of the

company regarding the profitability risk is calculated:

A3=(0.1394,0.4178,0.4428,0,0); the weight vector of

the relative importance of the second-level indicators

regarding the development risk is calculated as Q4=

(0.66602220.1111), the first-level fuzzy integrated

evaluation matrix of the company regarding the

development risk is calculated as

A3=(0.1394,0.4178,0.4428,0,0); the weight vector of

the second-level indicators regarding the

development risk is calculated as

Q4=(0.66602220.1111). The first-level fuzzy

integrated evaluation matrix A4=

(0.0967,0.5145,0.1667, 0.0667.0.1555) is calculated.

It can be seen that Company A's solvency, operating

capacity, profitability and development capacity are

within the safe range.

Second-level fuzzy comprehensive evaluation:

According to the fuzzy synthesis formula: C=Q*A,

from the above calculation, the relative importance

vector Q= (0.0448,0.2674, 0.4627,0.2251) for each

first-level index of company A. The first-level fuzzy

comprehensive evaluation result A is formula (4-3),

and the second-level fuzzy comprehensive evaluation

result is C=(0.1782, 0.3552,0.4062,0.0254,0.0350).

The comprehensive evaluation score is calculated by

the formula Z =C*V, where V=(100,80,60,40,20),

and we get Z=72. 3, it can be seen that the financial

situation of Company A is in the range of mild risk

and is a normal operating enterprise. Among them,

the solvency reaches excellent indicators and the

financial risk is very small, but the

operating capacity,

profitability and development capacity still have

small risks, and a few indicators are not satisfactory,

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

672

especially the development capacity is slightly

poor.The early warning situation for Company A in

2015 basically matches with the actual operating

condition of the company, and the early warning

results are consistent with the current situation of the

enterprise, which can verify that the risk early

warning model constructed for Company A is

scientifically It can be verified that the risk warning

model constructed for Company A is scientific and

effective.

4.2.2 Early Warning Analysis of Financial

Risks in 2016.

Determine the subordination matrix of each early

warning indicator: based on the financial risk

evaluation index values calculated from the 2016

financial statements, the subordination matrix R is

obtained by referring to the 2016 enterprise

performance evaluation standard values of the

automotive vehicle manufacturing industry set by the

Bureau of Financial Supervision and Evaluation of

the State-owned Assets Supervision and

Administration Commission of the State Council,

corresponding to the judgment set V= {v1, v2,...

,vm}= (safe, mild, moderate, severe, serious} to find

out the affiliation matrix R. In this paper, we choose

the enterprise performance evaluation standard

values of the automotive vehicle manufacturing

industry in 2016, and finally get the index affiliation

matrix for 2016 as shown in Table 3.

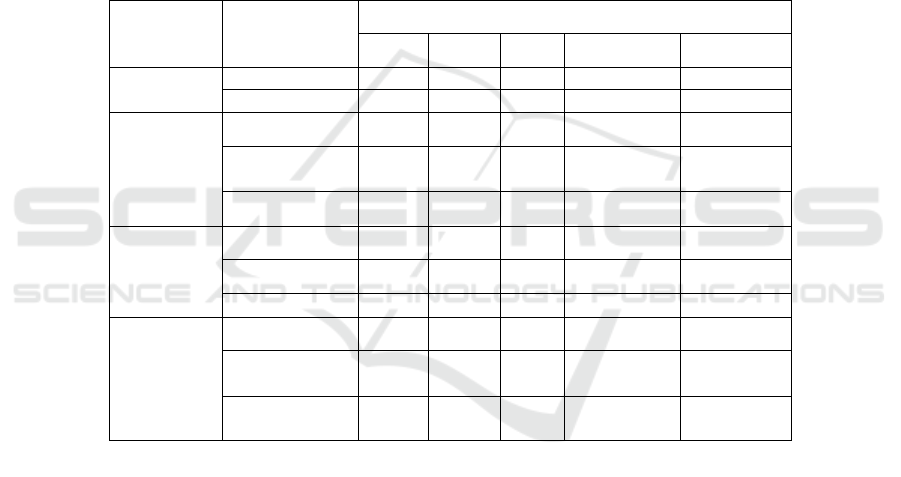

Table 3: Company A's 2015 metric affiliation matrix.

Tier 1

Indicators

Secondary

indicators

Two-level fuzzy judgment matrix

Very

safe

Safer Fair Dangerous Very dangerous

Debt Service

Risk

Current ratio 0.94 0.02

Gearing ratio 1

Operational

Risk

Total assets

turnover

0.23 0.77

Accounts receivable

turnover ratio

1

Inventory turnover

rate

0.36 0.64

Earnings Risk

Operating profit

mar

g

in

0.50 0.50

Return on total

assets

0.18 0.82

Return on net assets 1

Development

Risk

Operating growth

rate

1

Operating profit

growth rate

0.63 0.37

Total assets growth

rate

0.11 0.89

The first-level fuzzy comprehensive evaluation of

the company's financial risk: according to the above

calculation, it is known that the relative importance

weight vector of each secondary index of company A

about debt service risk: Q1=(03333,0.6667), using

the fuzzy synthetic operation formula A=Qi*Ri, the

first-level fuzzy comprehensive evaluation matrix of

the company about debt service risk is obtained:

A1=(0.6667,0.3266, 0.0067, 0, 0); the relative

importance weight vector of each secondary indicator

of operational risk: Q2=(0.6480, 0.2298, 0.1222), and

the first-level fuzzy integrated evaluation matrix of

operational risk: A2=(0.2738, 0.2272, 0.4990, 0,0);

the relative importance weight vector of each

secondary indicator of profitability risk: Q3=(0.6480,

0.2298, 0.1222). vector: Q3= (0.7380,0.0944,

0.1676), the first-level fuzzy integrated evaluation

matrix of the company on profitability risk:

A3=(0.1846,0.4464,0.3690,0,0); the weight vector of

the relative importance of the second-level indicators

on development risk: Q4=(0.66702222,01111), the

first-level fuzzy integrated evaluation matrix of the

company on development risk:

A3=(0.1846,0.4464,0.3690,0,0); the weight vector of

the second-level indicators on development risk:

Q4=(0.66702222,01111), the first-level fuzzy

integrated evaluation matrix of the company on

development risk The first-level fuzzy integrated

evaluation matrix of the company about development

risk: A4=(0.6667,0.1400.0944,0.0989,0). It can be

seen that the solvency, operating capacity,

Early Warning Analysis of Company’s Financial Risk based on Fuzzy Evaluation Method

673

profitability and development capacity of Great Wall

Company are within the safe range in 2016.

Secondary fuzzy comprehensive evaluation:

according to the fuzzy synthesis operation

formula:C=Q*A, the relative importance weight

vector Q=(0.0448,0.2674,0.4627,0.2251) for each

level of indicators of Company A, the secondary

fuzzy comprehensive evaluation result was obtained

as C= (0.3386, 0.3134,0.3257,0.0223,0) after fuzzy

synthesis operation. The comprehensive evaluation

score is calculated by the formula Z=C*V, where

V=(100,80,60,40,20) to get Z=79.4, which shows that

the financial situation of Company A in 2016 is in the

range of mild risk and is a normal operating

enterprise, which is better than the financial situation

in 2015. Among them, solvency and development

capacity reach excellent indicators with minimal

financial risk, but operating capacity and profitability

still have some risk and a few indicators are not good

enough.

5 EARLY WARNING ANALYSIS

OF FINANCIAL RISK OF

COMPANY A

In this paper, the improved fuzzy comprehensive

evaluation method is used to construct a financial risk

early warning model for Company A. The financial

statements and related data from 2012-2016 are used

to study the financial risk early warning analysis of

Company A. The financial risk early warning model

is established and empirical analysis is conducted.

The study has certain contribution to the subsequent

research in this field. Although some conclusions

were obtained and some results were achieved in the

research process of this paper, there are still

shortcomings and we hope to explore them more

deeply in the future research process.

REFERENCES

Hou X. H. Research on the construction and application of

financial risk early warning indicators of Internet

insurance companies. Hunan Forum,2019,32(03):89-

101.

Hou XH, Peng JJ. Research on financial risk early warning

of Internet insurance companies based on entropy value

method and efficacy coefficient method. Financial

Theory and Practice,2019,40(05):40-46.

Hou XH. Research on early warning of financial risk of

Internet insurance companies based on fuzzy

comprehensive evaluation method. Hunan social

science,2019(04):88-99.

Huang J,Li LQ.Study on the application and optimization

of financial risk early warning system of KY company.

Friends of Accounting, 2018(11):150-153.

Xiong Y,Zhang Yutang. Research on early warning of

financial risks of listed companies based on F-score.

Management Modernization,2019,39 (01):111-115.

Yan Chun,Wang Zeyi. Research on early warning model of

financial risk of life insurance companies based on Pls-

Logit model. Technology and Innovation

Management,2018, 39(01):102-110.

Zhang JG,Chen F,Wang B. Research on financial risk early

warning of manufacturing companies based on PSO

optimization SVM . Friends of Accounting,

2017(14):52-56.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

674