Analysis of Regional Comparative Advantage and Its Driving Factors

of Manufacturing Industry:Based on the Panel Data of

Manufacturing Industry in Chongqing

Changlin Wang and Tong Mu

School of Business Administration, Chongqing University of Science & Technology, Chongqing, China

Keywords: Regional Comparative Advantage, Manufacturing Industry, Driving Factor, Chongqing.

Abstract: Based on the revealed comparative advantage index, this paper constructs the industrial regional comparative

advantage index, and constructs the econometric model of manufacturing industrial regional comparative

advantage including labor, capital, and technological factors, etc. Based on the panel data analysis of

Chongqing manufacturing industry and its sub-industry, it is concluded that labor factor contributes

significantly to the regional comparative advantage of Chongqing manufacturing industry, while technical

factor and capital factor have limited and insignificant effects. However, there are significant differences

among labor factor, technical factor and capital factor in the driving force of regional comparative advantage

in different industries. The difference of industries indicates that relying on labor factor to drive the regional

comparative advantage of Chongqing manufacturing industry has diminishing marginal effect, so the

improvement of regional comparative advantage must be realized by implementing innovation strategy based

on technological progress.

1 INTRODUCTION

The theory of comparative advantage originated from

international trade has been widely used in regional

economic analysis and industrial upgrading analysis

in recent years (Wang, Zhang, 2018, Chen, et al,

2018, Zhang, et al., 2018, Zhao, Chen, 2020). Earlier,

R. Hausman of Harvard University (2003) proposed

an evolution theory of comparative advantage based

on the theory of comparative advantage. According

to the theory, the upgrading of products from simple

to complex is the evolution and development process

of comparative advantage, and such upgrading path

is closely related to the initial industrial structure and

comparative advantage (Hausmann, Rodrik, 2003,

Hidalgo, et al., 2007, Wu, Zhang, 2012, Wang, 2013).

Some Chinese scholars also used the theory of

comparative advantage to conduct in-depth studies on

China's industrial transfer, industrial transformation

and upgrading. For example, Wang Tuzhan and

Zhang Yue (Wang, Zhang, 2018) analyzed the space-

time evolution of China's regional manufacturing

comparative advantage by establishing the

mechanism of explicit and potential comparative

advantage (Wang, Zhang 2018). Chen Guosheng et

al. (2018) analyzed the comprehensive effect of

comparative advantage and competitive advantage on

China's manufacturing industry transfer by using

panel data (Chen, et al., 2018).

China is in the process of transformation and

upgrading from a manufacturing giant into a

manufacturing power, but there are obvious

differences among different regions in the

development path of manufacturing industry

upgrading. Chongqing, an important manufacturing

city in western China, experienced an obvious decline

in economic growth around 2018, especially in the

growth of industrial added value of the manufacturing

industry. In order to solve this problem, this paper

will construct the industrial regional comparative

advantage index and the measurement model of

manufacturing regional comparative advantage,

combined with the panel data of Chongqing

manufacturing industry, analyzes the temporal and

spatial changes of Chongqing manufacturing industry

regional comparative advantage, and deeply analyzes

the driving factors of Chongqing manufacturing

industry and regional comparative advantage in

various industries.

Wang, C. and Mu, T.

Analysis of Regional Comparative Advantage and its Driving Factors of Manufacturing Industry: Based on the Panel Data of Manufacturing Industry in Chongqing.

DOI: 10.5220/0011231900003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 695-701

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

695

2 RESEARCH DESIGN

2.1 Industrial Regional Comparative

Advantage Index

Balassa, an American economist, put forward the

RCA index (Revealed Comparative Advantage Index)

in 1965. Reference the concept and connotation of

RCA index, and existing research results (Wang,

Zhang, 2018, Chen, et al., 2018, Zhang et al., 2018),

we constructed the industrial regional comparative

advantage index as follows:

DCAij=(Hij/Yi)/(Hj/Y) (1)

The above formula represents the ratio between

the share of industry j in region i in the regional total

output and the share of industry j in the national total

economic output. In the formula, DCAij Represents

the index of regional comparative advantage of

industry j in region i, Hij Represents the industrial

added value of industry j in region i, Hj Represents

industrial added value of China's J industry, Yi

Represents the gross domestic product of region i,

and Y represents the gross domestic product of China.

DCA and RCA have the same meaning, that is, when

DCA value is greater than 2.50, an industry has a

strong comparative advantage; when DCA value is

between 0.80 and 1.25, an industry has a medium

comparative advantage; when DCA value is below

0.8, it is at a comparative disadvantage.

2.2 Econometric Model of Industrial

Regional Comparative Advantage

There have been analysis and research on the

measurement of industrial comparative advantage,

most of which are based on Cobb-Douglas production

function to construct an econometric model to

analyze the influence of various factors such as labor

factors and capital factors on industrial comparative

advantage. For example, Liu Wei and Liu Guozhen

(2015) used Cobb-Douglas production function to

construct an econometric model of regional industrial

comparative advantage of labor, capital, foreign

capital and technological factors (Liu, Liu, 2015).

Zhang Yue et al. (2018) constructed an econometric

model of comparative advantage based on traditional

international trade theories such as Heckschel-Ohlin

(HO) theory and Porter's competitive advantage

theory (Zhang, et al., 2018).Wang Tuzhan and Zhang

Yue (2018) pointed out that technological level,

factor endowment, economies of scale,

agglomeration effect and institutional factors are all

important sources of explicit comparative advantage

of regional manufacturing (Wang, Zhang, 2018).

Based on Cobb-Douglas production function and

traditional international trade theories such as

Heckschel-Ohlin (HO) theory, and based on existing

research results, this paper establishes an econometric

model of industrial regional comparative advantage

based on the sources of traditional comparative

advantage including capital, labor and technological

progress, as follows:

DCAit =a +αLit+βKit+γTEit +ξi (2)

The model represents the driving factors of the

regional comparative advantage of i industry in period

t, and ξ represents other disturbances. The model

mainly investigates the influence of each driving

factor on the change of industrial location comparative

advantage, Kit is the index of capital factor, indicating

the capital input of i industry in period t. Lit is the

labor factor index, indicating the annual labor input of

industry i in period t. Technical factor index TEit is

the change of the technological level of i industry in

period t. This paper uses the method of total labor

productivity for technical factor to comprehensively

reflect the relative level of the regional manufacturing

industry and the production technology, operation and

management, technical proficiency and labor

enthusiasm of the employees in all local industries

(Wang and Zhang 2018, Zhang et al. 2018, Liu and

Liu 2015).

3 DATA DESCRIPTION

The sample data is from the "China Statistical

Yearbook", "China Industrial Economic Statistical

Yearbook" and "Chongqing Statistical Yearbook"

over the years. The selected manufacturing sub

industries are selected according to the national

economic industry classification standard of the

National Bureau of Statistics of China, and 25

manufacturing sub industries are selected according to

the availability of data. The statistical data of each

manufacturing sub industry is from the statistical data

of industrial enterprises above designated size from

2008 to 2018. From the collected data of

manufacturing sub industries in Chongqing, there is

only statistical data of transportation equipment

manufacturing industry from 2008 to 2011, while

from 2012 to 2018, it is divided into two industries,

namely automobile manufacturing industry and

railway, ship aerospace and other transportation

equipment manufacturing industry, in order to unify

data analysis, the data from 2012 to 2018 is integrated

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

696

into the data of transportation equipment

manufacturing industry for analysis and processing.

Through the comparative analysis of the statistical

data caliber of Chongqing in different periods, we can

find the industrial added value of manufacturing sub

industries from 2008 to 2011. There is a lack of

statistical data on the industrial added value of

manufacturing sub industries from 2012 to 2018.

Therefore, for some years it’s calculated from the

industrial added value of manufacturing sub industries

in the previous year, as well as the annual price index

and growth rate of industrial added value of

manufacturing sub industries. For the years from 2012

to 2018 when there is no data on the growth rate of

industrial added value of manufacturing sub

industries, the industrial added value production

method is used for estimation, that is, from the

perspective of the formation of the value of products

and labor services in the process of industrial

production, the value of intermediate inputs in the

production process is excluded, so as to we obtain the

industrial added value of each industry in the current

year. The labor factor index collects the average

number of employees in each industry in that year.

The capital factor index collects the paid-in capital of

each industry in the current year. For technical factors,

the total labor productivity of each industry in the

current year is collected. For the lack of data of the

total labor productivity of each industry in Chongqing

in some years from 2008 to 2018, the industrial added

value of each industry in the current year was divided

by the average number of employees in each industry

in the current year. In the model, all explanatory

variables are logarithmic processed with the original

data, namely:

Kit=LN (paid-in capital of i industry in period t)

Lit=LN (average annual labor input to industry i in

period t)

TEit=LN (Total labor productivity of industry i in

period t)

4 DATA ANALYSIS

4.1 Industrial Regional Comparative

Advantage

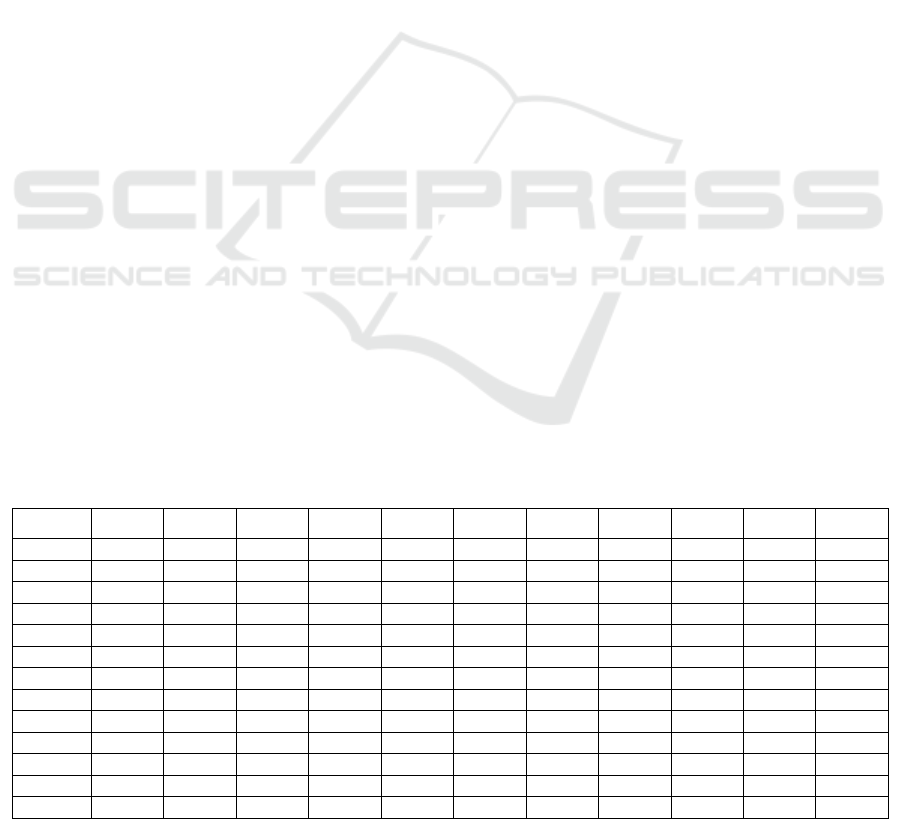

This paper uses the concept and connotation of the

explicit comparative advantage index to construct the

industrial regional comparative advantage index. The

industrial regional comparative advantage index

represents the ratio of the share of an industry in the

regional total output to the share of the industry in the

national total economic output. Through data

collection and analysis, the typical industrial regional

comparative advantage of Chongqing's manufacturing

industry and its sub sectors is shown in Table 1. The

analysis results show that the overall regional

comparative advantage of Chongqing's manufacturing

industry in each year from 2008 to 2018 is less than 1,

reaching the highest value of 0.8542 in 2015, showing

a weak trend of manufacturing regional comparative

advantage. The overall regional comparative

advantage of manufacturing industry increased from

0.6005 in 2008 to 0.657 in 2018, indicating that the

regional comparative advantage of manufacturing

industry has improved somewhat. In terms of the

development trend of Chongqing's manufacturing

regional comparative advantage, the manufacturing

regional comparative advantage increased from

0.6005 in 2008 to 0.8542 in 2016, but declined to

0.6826 in 2017 and 0.6570 in 2018, showing an

inverted "U" structure to a certain extent (as shown in

Figure 1).Specific to manufacturing sub industries, the

development trend of regional comparative advantage

is also different.

Table 1: Manufacturing industry regional comparative advantage in Chongqing.

industry 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

HY0 0.6005 0.6598 0.6784 0.6767 0.6604 0.7015 0.7560 0.8241 0.8542 0.6826 0.6570

HY1 0.4515 0.4767 0.5249 0.5130 0.4952 0.5043 0.5404 0.5885 0.6404 0.5068 0.4593

HY2 0.4100 0.4502 0.4655 0.4329 0.3778 0.4218 0.4302 0.4610 0.4543 0.4055 0.3538

HY3 0.9238 0.9001 0.8843 0.8382 0.8348 0.8279 0.8015 0.7062 0.6104 0.6533 0.9536

HY4 0.2437 0.3118 0.3075 0.2606 0.2478 0.2396 0.2173 0.2097 0.2029 0.1009 0.0556

HY5 0.1316 0.1221 0.1569 0.2138 0.2126 0.2232 0.2419 0.2369 0.2130 0.1458 0.1108

HY6 0.3307 0.3296 0.3678 0.4953 0.4909 0.5304 0.5331 0.5367 0.5790 0.4904 0.4701

HY7 0.0801 0.0959 0.1211 0.1361 0.1169 0.1349 0.1947 0.2651 0.2818 0.3238 0.3424

HY8 0.4406 0.5639 0.5132 0.5894 0.5297 0.5887 0.5359 0.3767 0.4144 0.3829 0.4158

HY9 0.3784 0.5396 0.6814 0.5223 0.6348 0.7171 0.7938 0.8196 0.8249 0.6964 0.7989

HY10 0.6795 0.7819 0.8047 0.7833 0.7317 0.7958 0.9052 1.0055 0.8860 0.6972 0.7348

HY11 0.0717 0.1035 0.0773 0.0659 0.0696 0.0581 0.0706 0.0858 0.0818 0.0553 0.0671

HY12 0.5561 0.5623 0.5757 0.5858 0.4940 0.4519 0.4432 0.4595 0.4480 0.3488 0.3553

Analysis of Regional Comparative Advantage and its Driving Factors of Manufacturing Industry: Based on the Panel Data of Manufacturing

Industry in Chongqing

697

HY13 0.9482 0.9299 0.7902 0.7107 0.6859 0.7038 0.7243 0.8824 0.8981 0.6828 0.6521

HY14 0.0623 0.0742 0.0730 0.0533 0.0166 0.0327 0.0354 0.0632 0.0928 0.1313 0.1217

HY15 0.3089 0.3762 0.4174 0.5112 0.5865 0.6476 0.6462 0.6671 0.7237 0.6340 0.5102

HY16 0.7023 0.6909 0.7462 0.7299 0.7028 0.7203 0.7605 0.8100 0.8244 0.6250 0.6789

HY17 0.3770 0.3764 0.4923 0.5517 0.4542 0.4698 0.4692 0.4893 0.4043 0.2602 0.3317

HY18 0.8648 0.7896 0.7405 0.6484 0.5852 0.5920 0.6475 0.6887 0.6875 0.5453 0.4600

HY19 0.3063 0.3562 0.4144 0.5794 0.4995 0.5073 0.5670 0.6680 0.6914 0.4392 0.4590

HY20 0.5224 0.6561 0.6411 0.5235 0.4967 0.5063 0.5537 0.6093 0.6816 0.5871 0.5822

HY21 0.4167 0.5158 0.5128 0.3729 0.3085 0.3859 0.4166 0.4707 0.5380 0.3850 0.3879

HY22 3.0335 2.9579 2.7291 2.6890 2.6366 2.7617 2.8292 2.9108 2.9000 2.1655 1.8328

HY23 0.5010 0.5391 0.5993 0.6418 0.6500 0.5923 0.6359 0.6826 0.6497 0.4988 0.4553

HY24 0.0888 0.1232 0.2060 0.6282 0.9848 1.2458 1.4991 1.5501 1.6992 1.5796 1.6440

HY25 0.7606 0.7879 0.9185 0.7256 0.9233 0.8263 0.8424 0.8055 0.7424 0.6324 0.5555

Data source: According to the original data collation calculation. Industry Code Description : HY0: Manufacturing industry;HY1:

Agricultural and sideline food processing industry; HY2: Food manufacturing; HY3: Tobacco products industry; HY4: Textile industry; HY5:

Textile clothing, shoes and hats manufacturing; HY6: Leather, fur, feather (feather) and its products; HY7: Wood processing and wood,

bamboo, rattan, palm and grass products; HY8: Furniture manufacturing; HY9: Paper and paper products industry; HY10: printing and

recording media; HY11: Petroleum processing, coking and nuclear fuel processing industry; HY12: Manufacturing of chemical raw materials

and chemical products; HY13: Pharmaceutical manufacturing; HY14: Chemical fiber manufacturing; HY15: Rubber products industry;

HY16: Non-metallic mineral products industry; HY17: Ferrous metal smelting and rolling processing industry; HY18: Non-ferrous metal

smelting and rolling processing industry; HY19: Metal products industry; HY20: General equipment manufacturing; HY21: Manufacturing

of special equipment; HY22: Manufacturing of transportation equipment; HY23: Electrical machinery and Equipment manufacturing; HY24:

Communication equipment, computer and other electronic equipment manufacturing; HY25: Instrument and cultural and office machinery

manufacturing.(HY1-HY25 are for manufacturing sub industries).

4.1.1 Manufacturing Sub Industry Analysis

with Strong Regional Comparative

Advantage

From 2008 to 2018, the manufacturing sub industries

with strong regional comparative advantage in

Chongqing are transportation equipment

manufacturing and communication equipment,

computer and other electronic equipment

manufacturing. From the perspective of development

trend, the regional comparative advantage of

transportation equipment manufacturing decreased

year by year, and its DCA decreased from 3.0335 in

2008 to 1.8328 in 2018.The manufacturing industry

of communication equipment, computer and other

electronic equipment showed a trend of increasing

regional comparative advantage year by year, and

showed a rapid growth during 2008-2012. DCA

increased from 0.0888 in 2008 to 0.9848 in 2012, and

even increased to 1.644 in 2018.

4.1.2 Manufacturing Sub Industry Analysis

with Inferior Regional Comparative

Advantage

In addition to transportation equipment

manufacturing and communication equipment,

computer and other electronic equipment

manufacturing, the regional comparative advantage

of other manufacturing industry in Chongqing is at

disadvantage. From 2008 to 2018, Chongqing

regional comparative advantage in manufacturing

improved industry of leather, fur, and feathers (fine

hair) and its products, wood processing and wood,

bamboo, cane, palm, grass products, chemical fiber

industry, paper and paper products, rubber products,

printing and recording media industry, fabricated

metal products. Among them, the DCA of paper and

paper products industry, printing industry and

recording media industry is close to 1, while the DCA

of other industries is less than 0.5, indicating that the

regional comparative advantage of other industries is

weak.

From 2008 to 2018, Chongqing regional

comparative advantage to degradation in the

manufacturing industry: textiles, pharmaceutical

manufacturing industry, non-ferrous metal smelting

and rolling processing industry, instruments and

meters, and culture, office machinery manufacturing

industry. Among them, non-ferrous metal smelting

and rolling processing industry and instrument is a

traditional industry in Chongqing, but showed a trend

of decline in the regional comparative advantage.

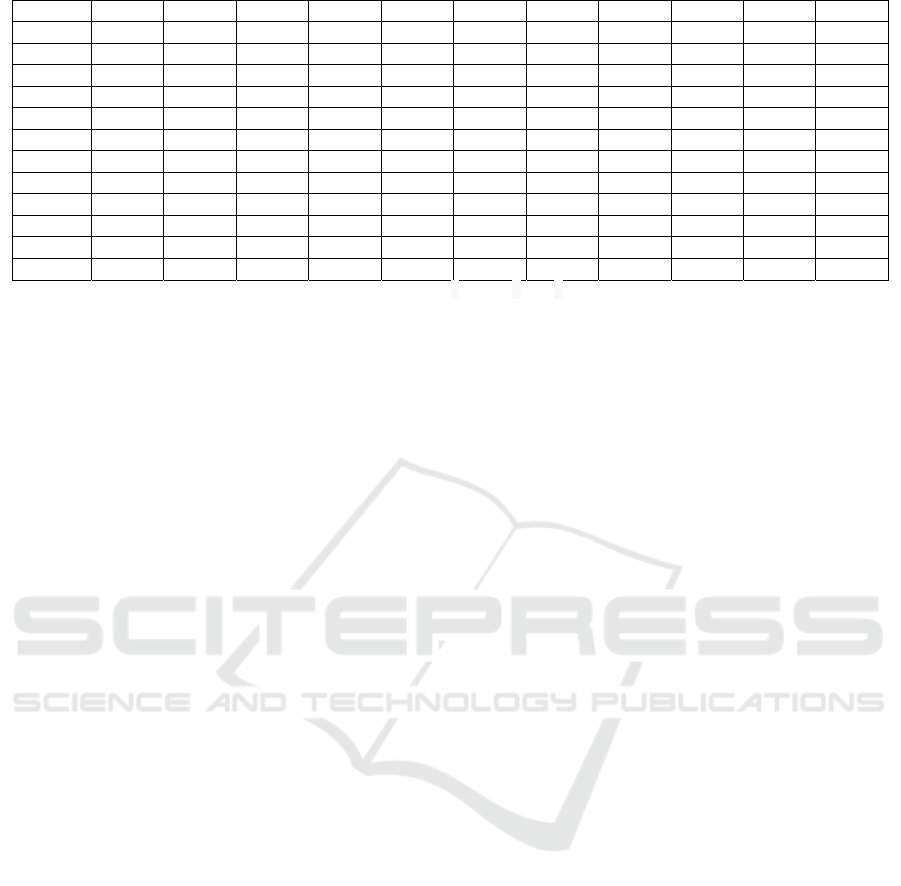

From 2008 to 2018, the regional comparative

advantage of most manufacturing sub industries in

Chongqing presents an inverted "U" shaped structure

to a certain extent (as shown in Figure 1). The

regional comparative advantage

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

698

Figure 1: Comparative advantage of Manufacturing

industry and some industries in Chongqing.

shows a significant peak in 2015 or 2016, but a

significant downward trend after 2016.This is

consistent with the changing trend of Chongqing's

industrial added value in recent years.

4.2 Analysis of Driving Factors of

Regional Comparative Advantage

Combined with Cobb-Douglas production function

and Heckschel-Ohling(HO) traditional international

trade theory, the econometric model based on the

traditional sources of comparative advantage

including capital, labor and technological progress is

established(see section 2 model settings above).In the

analysis process, model 1 is set as the general

situation of Chongqing manufacturing industry for

data inspection and analysis, and model 2 is the data

analysis of Chongqing manufacturing sub industries.

The model mainly studies the influence of driving

factors on the change of manufacturing industry and

regional comparative advantage of each

manufacturing sub industry.

4.2.1 Formal Test of Model Setting

According to the set econometric model of regional

comparative advantage, this paper analyzes the

driving factors of regional comparative advantage of

Chongqing manufacturing industry and 25

manufacturing sub industries by using regional

comparative advantage, capital factor, labor factor

and technology factor. The explained variable DCA

in the model represents the comparative advantage of

manufacturing industry and various sub-industries.

The explained variables are labor factor variable L,

capital factor variable K and technology factor

variable TE. The variables are annual data, and the

sample range is from 2008 to 2018.In this paper,

software EVIEWS10.0 was used, and analysis

showed that R

2

=0.9317, F=11.4249 in model 1,

indicating that 93.17% of the variation of

manufacturing regional comparative advantage can

be explained by their respective variables, and the

significance probability reaches 0.000, indicating

significant regression. For model 2, according to the

test method of model setting provided by Gaotiemei

(2006)(N=25, k=3, T=11), F1=180.284, F2=151.743,

F1 and F2 are greater than the corresponding critical

value, so the variable coefficient model is selected for

analysis(Gao 2006).The variable coefficient panel

model can be divided into random effect and fixed

effect according to different individual effects of

intercept items. Hausman test is used to process

variables. The results of Hausman test show that the

P value of this model is 0, less than 0.05, which

rejects the null hypothesis. The null hypothesis of

Hausman test believes that the random effect model

should be established. Based on the above tests, the

regression model adopted in this paper is fixed effect

variable coefficient panel model. Model 2 tests

R

2

=0.9904, and the significance probability reaches

0.000, which indicates that the change of regional

comparative advantage can be explained by 99.04%

of independent variables, and the fitting effect of the

model is very good.

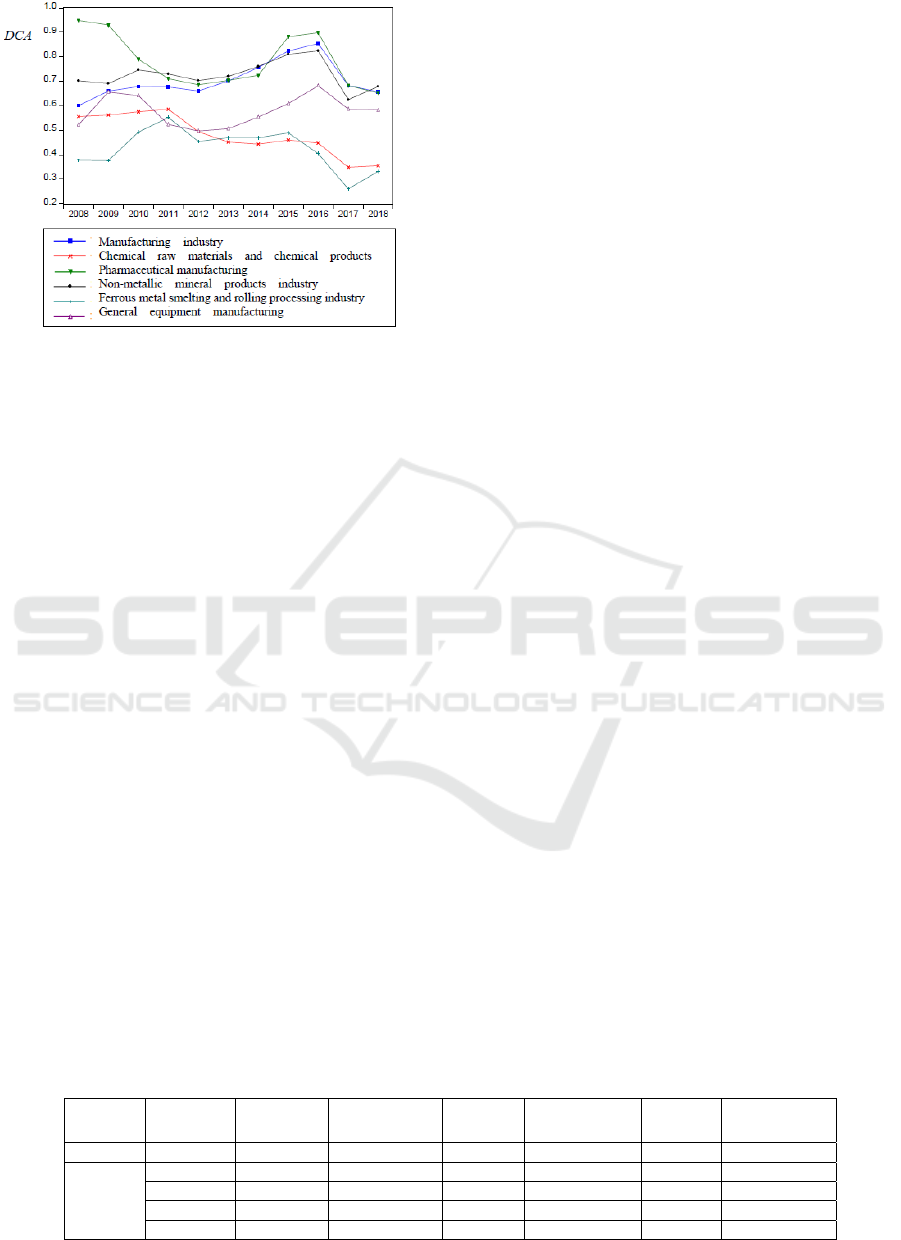

4.2.2 Model Estimation

For model 2, a panel model with fixed effects and

variable coefficients was used to perform regression

analysis on all variables, using the method of cross-

sectional weighting. As for the estimation method,

panel correction standard error (PCSE) method is

adopted, and the results are shown in Table 2.

Table 2: Econometric model analysis results (Unit: None).

industry α T statistic of α β T statistic of β γ T statistic of γ

Model 1 HY0 0.779 3.437 0.011 0.073 0.176 -0.467

HY1 0.384 2.674 -0.255 -1.301 -0.022 0.610

HY2 0.254 1.459 -0.151 -0.871 0.057 -0.468

HY3 0.594 2.368 0.015 0.280 0.051 1.107

HY4 0.179 0.647 -0.010 1.036 -0.003 0.243

Analysis of Regional Comparative Advantage and its Driving Factors of Manufacturing Industry: Based on the Panel Data of Manufacturing

Industry in Chongqing

699

Model 2

HY5 0.176 2.480 -0.011 -0.099 0.122 -0.112

HY6 0.283 3.284 -0.185 -1.048 0.130 1.429

HY7 0.160 0.988 -0.099 -0.295 -0.227 1.098

HY8 0.508 2.363 -0.308 -4.378 0.291 -0.889

HY9 0.509 2.641 -0.143 -1.812 -0.090 4.131

HY10 0.046 -0.211 0.176 1.054 0.007 -0.553

HY11 0.020 0.251 0.005 -0.156 0.099 0.196

HY12 0.292 0.562 -0.261 -0.538 -0.322 -0.270

HY13 0.075 0.547 0.139 1.757 0.056 -2.847

HY14 0.057 0.615 -0.007 -0.107 0.230 0.763

HY15 0.387 3.499 -0.128 -1.947 0.274 2.807

HY16 0.617 2.288 -0.432 -0.910 0.134 0.610

HY17 0.256 3.808 -0.072 -1.622 -0.066 1.488

HY18 0.351 2.049 -0.220 -1.641 0.127 -0.742

HY19 0.746 3.615 -0.307 -2.401 -0.169 1.100

HY20 0.609 2.575 0.096 0.480 0.028 -0.938

HY21 0.378 2.731 -0.063 -0.666 2.008 0.482

HY22 1.023 -0.517 -2.233 -19.385 0.319 6.876

HY23 0.482 2.187 -0.370 -2.567 -0.318 1.216

HY24 0.654 7.725 0.095 -4.494 -0.174 2.988

HY25 0.793 4.606 -0.017 -0.285 0.176 -1.188

4.2.3 Analysis of Model Results

The regression coefficient analysis results of driving

factors show that DCA of manufacturing industry in

Chongqing is positively correlated with labor input,

capital input and technological progress, but only

labor input has a significant impact on DCA of

manufacturing industry, while technological progress

and capital input have a limited and insignificant

effect on manufacturing regional comparative

advantage. At the same time, the contribution of labor

input to manufacturing regional comparative

advantage is far more than the impact of capital input

and technological progress. This conclusion is

consistent with the labor population transfer in

Chongqing from 2008 to 2018. The transfer of rural

labor to the secondary industry and the return of

migrant labor from the east are the main driving

factors for the formation of comparative advantages

of Chongqing manufacturing industry in this period.

But on the whole, the marginal effect of labor input

on manufacturing regional comparative advantage

shows a downward trend, which is reflected in the

inverted "U" shaped structure of Chongqing

manufacturing regional comparative advantage (as

shown in Figure 1).This indicates that the driving

factors which promoted the improvement of

Chongqing's manufacturing regional comparative

advantage from 2008 to 2016 decreased after 2016,

while the manufacturing industry in Chongqing did

not form new driving factors after 2016, resulting in

the decline of manufacturing regional comparative

advantage.

In terms of specific sub industries, technological

progress has a great positive effect on the regional

comparative advantage of transportation equipment

manufacturing, metal products manufacturing,

electrical machinery and equipment manufacturing,

communication equipment computer and other

electronic equipment manufacturing, etc. In textile

industry, printing industry and pharmaceutical

manufacturing industry, capital input has a large

positive effect on the formation of industrial regional

comparative advantage, but in most other industries,

capital input has a very limited effect on the

formation of industrial regional comparative

advantage. Agricultural and sideline food processing,

food manufacturing, tobacco products industry,

textile and garment, shoes, caps, leather, fur, and

feathers and its products, furniture

manufacturing,

paper and paper products, rubber products, non-

metallic mineral products, ferrous metal smelting and

rolling processing industry, non-ferrous metal

smelting and rolling processing industry, fabricated

metal products, general equipment manufacturing

industry, special equipment, communications

equipment manufacturing, electric machinery and

equipment manufacturing industry of computer and

other electronic equipment manufacturing,

instrumentation and cultural office machinery

manufacturing and other industries, labor input has a

great positive effect on the formation of the regional

comparative advantage of these industries.

Textile industry, pharmaceutical manufacturing

industry, non-ferrous metal smelting and calendering

industry, instrument and instrument and culture

industry, office machinery manufacturing industry,

all showed a declining trend of regional comparative

advantage, except pharmaceutical industry, the

driving factor of regional comparative advantage is

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

700

labor input. For most industries, their regional

comparative advantage mainly depends on labor

input, but these industries do not have strong regional

comparative advantage in the whole country. In

Chongqing, the industries with strong regional

comparative advantage, such as transportation

equipment manufacturing (automobile

manufacturing and other transportation equipment)

and communication equipment, computer and other

electronic equipment manufacturing, are mainly

driven by technological factors rather than capital

factors or labor factors. This shows that the strong

regional comparative advantage of manufacturing

industry must rely on technological innovation and

technological progress.

5 CONCLUSIONS

The analysis above shows that there is a marginal

diminishing effect in the regional comparative

advantage of Chongqing manufacturing industry

driven by labor factors, while the new competitive

advantage has not yet formed, which led to a decline

in the development of Chongqing manufacturing

industry after 2016.The analysis of this paper shows

that only technological innovation and technological

progress can establish the competitive advantage and

enhance the regional comparative advantage of

manufacturing industry in Chongqing. Therefore, the

development of Chongqing manufacturing industry

needs to implement innovation-driven strategy to

realize the promotion and development of industrial

comparative advantage, so as to enhance the core

competitiveness of Chongqing manufacturing

industry, therefore, promote the transformation and

upgrading of industrial structure, and promote the

high-end development of Chongqing manufacturing

value chain.

ACKNOWLEDGMENT

This paper is sponsored by the The Social Science

Research Major Project of Chongqing Education

Commission (20SKGH229).

REFERENCES

C. A. Hidalgo, B. Klinger, A. -L.Braasi, R. Hausmann. The

Product Space Conditions and Development of Nations

Science,2007, 317(5837), pp.482-487.

Chen Guosheng, Zhang Hengyi, Zhao Liping, Wei Xiaobo,

Luo Jiaoxia. Influence of Comparative Advantage and

Competitive Advantage on Regional Manufacturing

Transfer. Economic Geography,2018,38(9), pp.168-

175.

Gao Tiemei. Econometric Analysis and Modeling --

Application and Examples of EViews. Tsinghua

University Press, 2016, pp.386-418Wang Tuzhan,

Zhang Yue. A study of multi-sources of comparative

advantages of regional manufacturing industries.

Science Research Management,2018,39(8), pp.43-52.

Hausmann R, and Rodrik d. Economic Development as

self-discovery. Journal of Development Economics,

2003,72(2), pp.603-633.

Liu Wei, Liu Guozhen. Research on Comparative

Advantage, Industrial Correlation and Transformation

and Upgrading of Dongguan Manufacturing Industry.

People's Publishing House, 2015, pp.69-75.

Wang Changlin. Evolution and upgrading path of China's

offshore service outsourcing comparative Advantage.

Reform of Economic System, 2013, (3), pp.30-33.

Wang Tuzhan, Zhang Yue. A study of multi-sources of

comparative advantages of regional manufacturing

industries. Science Research Management,2018,39(8),

pp.43-52.

Wu Yejun, Zhang Qizai. Evolution of comparative

advantage and economic growth: An empirical analysis

based on Argentina. China Industrial Economics, 2012,

(2), pp. 37-46.

Zhang Yue, Wang Tuzhan, Liu Li. Comparative advantage,

competitive advantage and regional manufacturing

transfer. Modern Economic Science, 2018, 40(6),

pp.107-119.

Zhao Ting, Chen Zhao. Comparative Advantage and

Industrial Policy Effect: Regional Differences and

Institution Cause. China Economic Quarterly, 2020,

19(3), pp.777-796.

Analysis of Regional Comparative Advantage and its Driving Factors of Manufacturing Industry: Based on the Panel Data of Manufacturing

Industry in Chongqing

701