Strategy Optimization and Simulation Analysis of Electricity-saling

Companies under Renewable Portfolio Standard

Weiqiang Huo

1 a

, Meiting Liu

1b

, Yang Tang

1 c

and Feng Zhou

2,* d

1

Hubei Power Exchange Center, HBPX, Wuhan, Hubei, China

2

School of Economics and Management, Wuhan University, Wuhan, Hubei, China

*

Corresponding author

Keywords: Renewable Energy Consumption Market System, Electricity Selling Company, Trading Strategy

Optimization, Simulation.

Abstract: In the context of energy supply constraint and ecological problems, governments have actively promoted the

development and utilization of renewable energy and released a series of incentive policies, one of which is

China's Renewable Energy Consumption Guarantee Scheme (RPS). Based on the RPS, this paper constructs

an optimization model for the annual portfolio purchase strategy of power sales companies with the objective

of studying how to optimize the portfolio purchase scheme and reduce the cost of power purchase. The

simulation results show that, as RPS keeps developing and maturing, the subjects who do not complete their

consumption responsibility will bear huge fines, so the optimal strategy is: when the price of renewable power

is lower than that of conventional power, the purchase of renewable power should be given priority; if the

consumption responsibility is still not fully satisfied at this time, the excess consumption of other subjects and

the lower price of green certificates should continue to be purchased until the consumption responsibility is

completed.

1 INTRODUCTION

Since global industrialization , traditional fossil

energy sources have been heavily exploited and used,

leading to energy resource constraints and

environmental degradation. The key to addressing

these problems lies in adjusting the energy structure

and increasing the proportion of renewable energy

sources (RES). China is in a critical period of socio-

economic transformation and development, and

facing the dilemma of development and

environmental protection, the "decoupling" of

economic growth and environmental problems has

become a major issue in China's green development,

of which the key lies in how to achieve a sustainable

energy system transformation based on RES. At

present, China's energy system transformation has

indeed made substantial progress. In recent years,

a

https://orcid.org/0000-0002-7623-0350

b

https://orcid.org/0000-0003-4417-9420

c

https://orcid.org/0000-0001-5570-1451

d

https://orcid.org/0000-0002-3646-2907

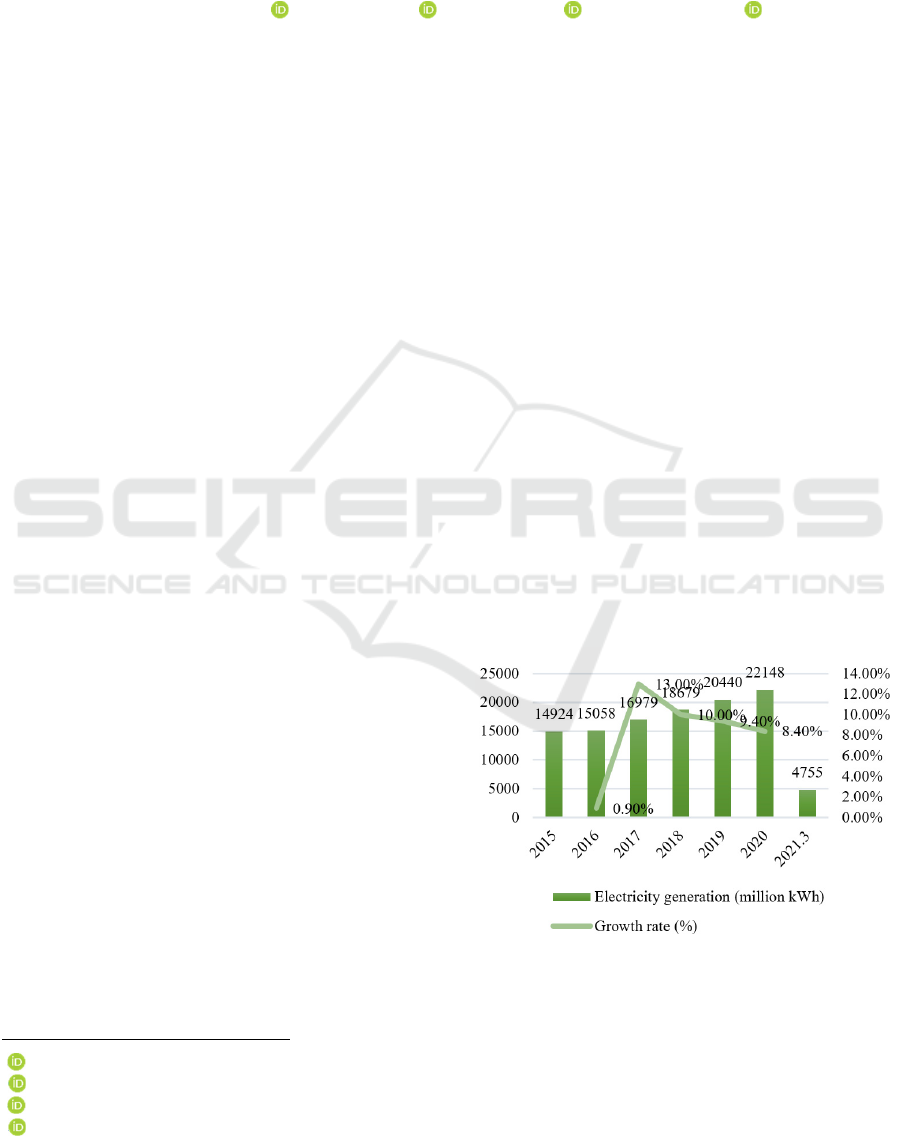

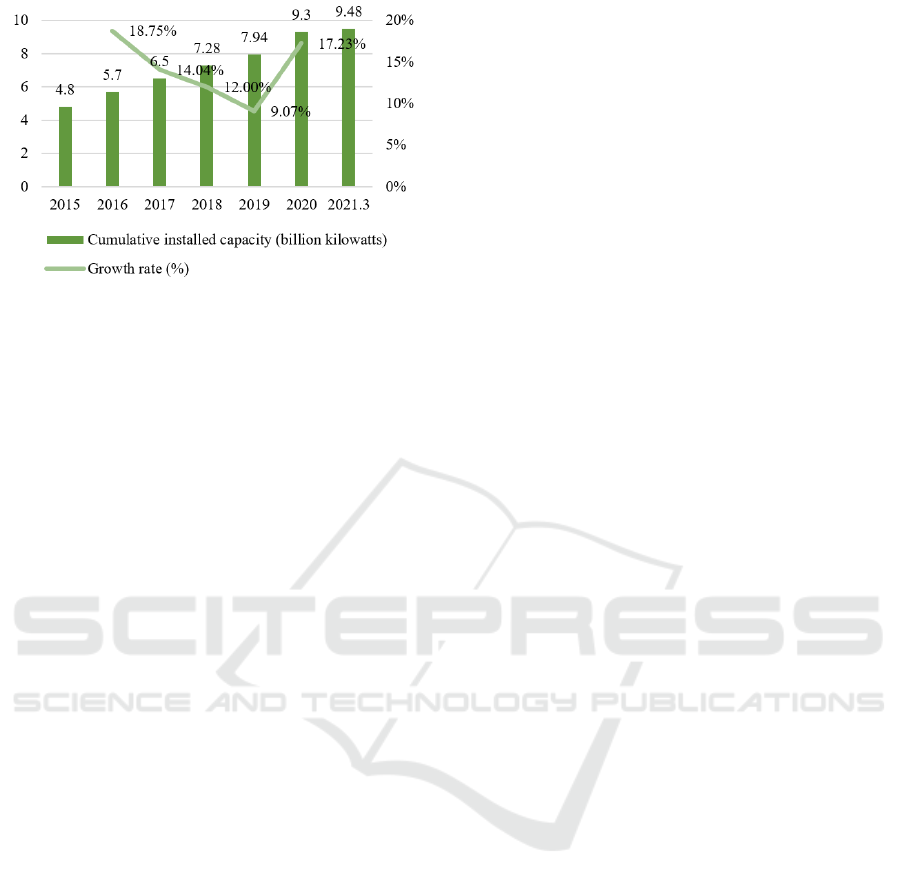

RES power generation and its installed capacity have

maintained a high level of growth (see Figure 1 and

Figure 2).

Figure 1: Renewable Energy Generation in China, 2015-

March.2021.

Huo, W., Liu, M., Tang, Y. and Zhou, F.

Strategy Optimization and Simulation Analysis of Electricity-saling Companies under Renewable Portfolio Standard.

DOI: 10.5220/0011260600003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 725-730

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

725

Figure 2: Cumulative Installed Capacity of Renewable

Energy Generation in China, 2015-March.2021.

However, with the gradual expansion of the scale

of RES, its consumption problem is increasingly

prominent. 2018 the amount of China's annual "three

abandoned" power was more than 100 billion

kilowatt hours, equivalent to the annual power

generation of the Three Gorges Power Station.

Therefore, in order to improve the RES consumption

rate and change the increasingly serious situation of

the new energy subsidy gap, the National

Development and Reform Commission and the

Energy Bureau jointly issued the Notice on

Establishing a Sound Renewable Energy Power

Consumption Guarantee Mechanism (hereinafter

referred to as "the Notice") on May 10, 2019, which

set the RES power consumption responsibility weight

for each provincial administrative region. In this

context, power sales companies have been able to

make a significant contribution to the development of

the renewable energy market. In this context, it is

important to study the trading strategy of power sales

companies as the first type of market players who

bear the responsibility of RES consumption.

2 REVIEW OF THE

LITERATURE

2.1 Review of Renewable Energy

Consumption Mechanism in China

Renewable energy power consumption guarantee

mechanism, also known as renewable energy quota

system (RPS), refers to a country or region mandatory

requirement that a certain percentage (i.e., quota

standard) of the power supplied by the power system

must be RES. foreign research on RPS started earlier,

the literature (

Helgese 2018

) established the electricity

market and green certificate trading market

equilibrium model, the study founds that the

implementation of RPS not only improves production

technology, but also can further improve social

welfare. The feasibility of implementing RPS in

China and its institutional design has been a research

hotspot for scholars in China for many years:

literature (

Feng 2017) selected indicators such as

obligation subject, operation mode, form of quota

target, and degree of incentive, summarized and

analyzed the practical experience of countries

currently implementing RPS on the electricity sales

side, and analyzed the feasibility of implementing

RPS on the electricity sales side in China with our

national conditions, and also designed the

implementation of quota system on the electricity

sales side in China The framework of RPS in China

is designed.

The RPS is the product of a series of policy

promotion. the Notice issued in May 2019 clearly

decomposes the required RES power consumption to

regional power sales companies and power

consumers and assesses their completion; the Notice

on the Preparation Outline of the Implementation

Plan for Provincial Renewable Energy Power

Consumption Guarantee (hereinafter referred to as

the Outline) issued in March 2020 further clarifies the

management mechanism and task division of labor

(

Zhang 2019) . The literature (Zhong 2020) argues that

the RPS jointly established by the Notice and the

Outline contains two main aspects.

1) The bearer of the consumption

responsibility: There are two types of market

participants, namely: ① grid enterprises,

independent power sales companies, and power sales

companies with the right to operate distribution grids,

which supply (sell) electricity directly to power

consumers; and ② power consumers and

enterprises with self-provided power plants, which

purchase electricity through the wholesale power

market. The quota is to be borne by the electricity

sales side rather than the generation side.

2) Market transaction mechanism for quota

assessment: The quota system is designed with two

sets of mechanisms to meet the weight of

consumption responsibility through market-based

transactions: (i) purchase the "excess" from market

players who have exceeded the annual consumption

volume, and both parties independently determine the

transfer (or transaction) price; (ii) voluntarily

subscribe to the "green certificate", and the RES

power corresponding to the green certificate is

recorded as the consumption volume.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

726

2.2 Review of the Trading Strategies of

Electricity-saling Companies

Foreign market-based reforms are earlier, and

literature (

Nojavan 2017

) combines multiple power

purchase paths such as RES and distributed power

sources to propose a variety of pricing schemes for

power sales companies for electricity contracts. In the

domestic literature (

Dai 2021

), in order to analyze the

impact of renewable energy consumption

responsibility assessment on power sales companies,

a power purchase portfolio investment model is

established; the penalty mechanism of consumption

responsibility assessment is introduced to realize the

evaluation of the role of assessment strength. The

literature (

Zhou 2020

) established a power purchase

portfolio investment model in order to analyze the

impact of renewable energy consumption

responsibility assessment on power sales companies.

3 PROBLEM DESCRIPTION AND

MODELING

3.1 Problem Description

1) Trading of Excess Consumption

After the electricity selling company and the

customer have completed the corresponding

consumption in the renewable energy trading market,

the consumption beyond the quota obligation can be

sold in the excess consumption trading market to gain

revenue, and the shortage can also be bought in the

market to realize the substitution of consumption

between responsible entities.

2) Trading of Green Certificates

Green certificates themselves do not have any

value, but under the quota system, their own price

reflects the environmental value of RES generation -

RES generators can sell their green certificate

holdings in the green certificate trading market and

receive additional green certificate proceeds, thus

compensating for the portion of RES generation costs

that exceed conventional energy generation,

effectively reducing the government's financial

burden.

3) Optimization problem of trading strategy for

Electricity-Saling companies

The power seller needs to make decisions in the

traditional spot market for electricity, the spot market

for renewable energy, the spot market for excess

capacity, and the spot market for green certificates, so

as to minimize the cost of power purchase under the

condition that the load demand and the minimum

consumption weight of renewable energy are met

(and bear the corresponding penalty when they are

not met).

In this paper, we take the optimal purchase

problem in the long-term phase (one year) as an

example, and study how the power seller allocates the

appropriate purchase ratio in the above markets to

meet the electric energy demand and renewable

energy quota requirements to maximize profit (with a

fixed sales tariff, the minimum cost of power

purchase can be used as an equivalent substitute for

the maximum profit).

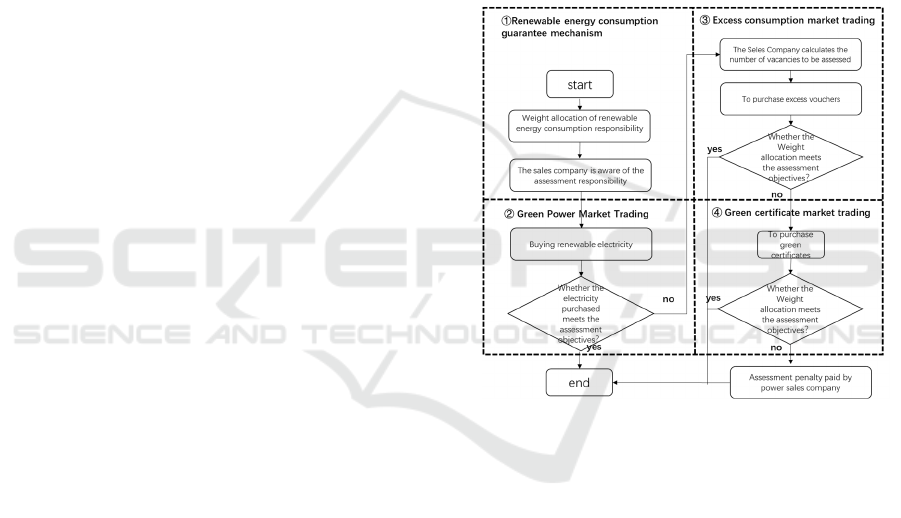

3.2 Problem Modelling

Figure 3: Renewable energy consumption market system

framework.

In the above process, because the power sales

company needs to ensure that the proportion of

purchased RES power is not less than k (consumption

weight), its transaction costs in carrying out power

trading business can be specifically divided into

power purchase costs and certificate costs: power

purchase costs include both traditional power and

green power, certificate costs include over-

consumption voucher expenses and green certificate

expenses (if the assessment target is not completed,

the shortage part pays the corresponding penalties ).

The mathematical expressions are as follows.

𝑚𝑖𝑛 𝐶

+𝐶

+

𝐶

+𝐶

+

𝑀⋅𝑚𝑎𝑥

𝑘𝑄 𝑄

𝑄

𝑄

,0

(1)

Strategy Optimization and Simulation Analysis of Electricity-saling Companies under Renewable Portfolio Standard

727

In the above equation, 𝐶

and 𝐶

denote the

power purchase cost for power sales companies to

purchase conventional power and renewable energy

power in the medium and long-term power market,

respectively, 𝐶

and 𝐶

denote the power

purchase cost for power sales companies to purchase

excess consumption vouchers and green certificates

in the excess consumption trading market and green

certificate trading market, respectively, and the last

term is the penalty cost, M is the penalty for the

assessed unit of electricity.

𝐶

=𝑝

⋅𝑄

(2)

𝐶

=𝑝

⋅𝑄

(3)

𝐶

=𝑝

⋅𝑄

(4)

𝐶

=𝑝

⋅𝑄

(5)

𝑄

、𝑄

、𝑄

、𝑄

indicate the purchase of

traditional power, renewable power, excess

consumption, and green certificates, respectively. In

the actual trading process of excess consumption and

green certificates, the subject of the transaction is the

voucher, but a voucher is equivalent to 1MWh of

renewable energy consumption, and in this paper, for

the purpose of unifying the quantum of a variable, all

of them are converted into units of electricity to

express.

𝑝

denotes the price of thermal power purchased

by the power selling company in the medium and

long-term power market. Thermal power is basically

stable in the current stage of the power market price,

so this price is set in this paper as a value that

fluctuates randomly within a small range, and

considering the environmental cost of its generation,

its price is bound to be higher than the market price

of renewable power 𝑝

; 𝑝

is the transaction price

of the power selling company in the RET market

transaction; 𝑝

and 𝑝

denote the license

purchase price of the power selling company in the

excess capacity market and the green license market,

respectively.

Constraints of power purchase and consumption

assessment for power sales companies:

𝑄=𝑄

+𝑄

(6)

𝑘⋅𝑄≤𝑄

+𝑄

+𝑄

≤𝑄

(7)

4 EXAMPLE ANALYSIS

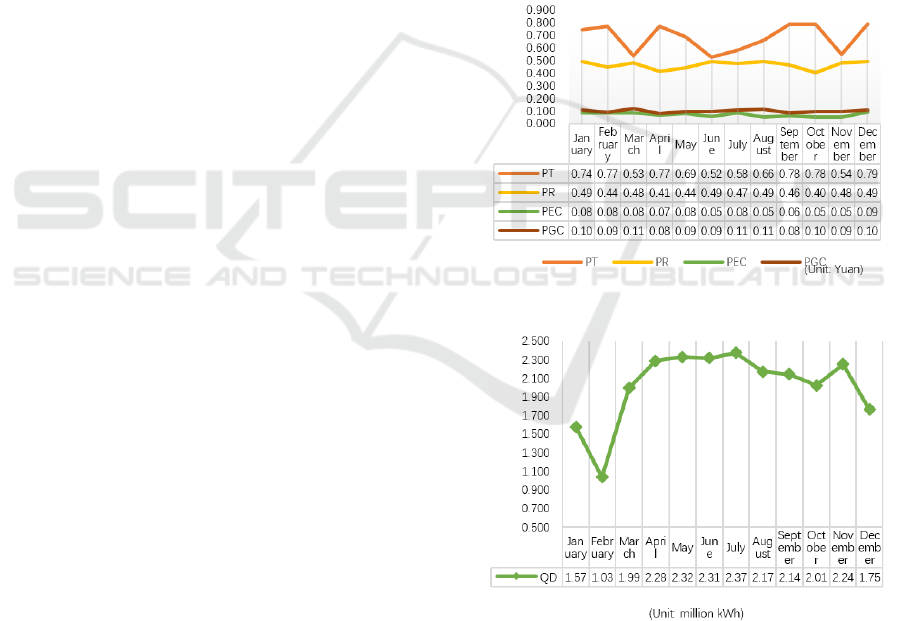

Electricity price fluctuations and market demand

fluctuations are the risks that electricity sellers are

bound to face when participating in monthly and

annual centralized market bidding transactions.

Therefore, in the setting of the relevant parameter

values of this model, all kinds of electricity price

fluctuations and electricity consumption fluctuations

are considered, and the annual contracted electricity

and renewable energy consumption are decomposed

into each month, and the final combination forms an

annual optimal power purchase strategy.

4.1 Setting of Parameter Values

Consider the elimination weight k=0.3250 (constant)

and the unit penalty M=$10/unit (constant).

1

)

Fluctuations in electricity prices and electricity

market demand by category

The fluctuation of various types of electricity

prices with the market over the 12-month period is

shown in Figure 4, and the QD (electricity market

demand) also fluctuates with the market conditions,

which is shown in Figure 5.

Figure 4: Monthly average transaction price chart.

Figure 5: Electricity demand chart by month for power

sales companies.

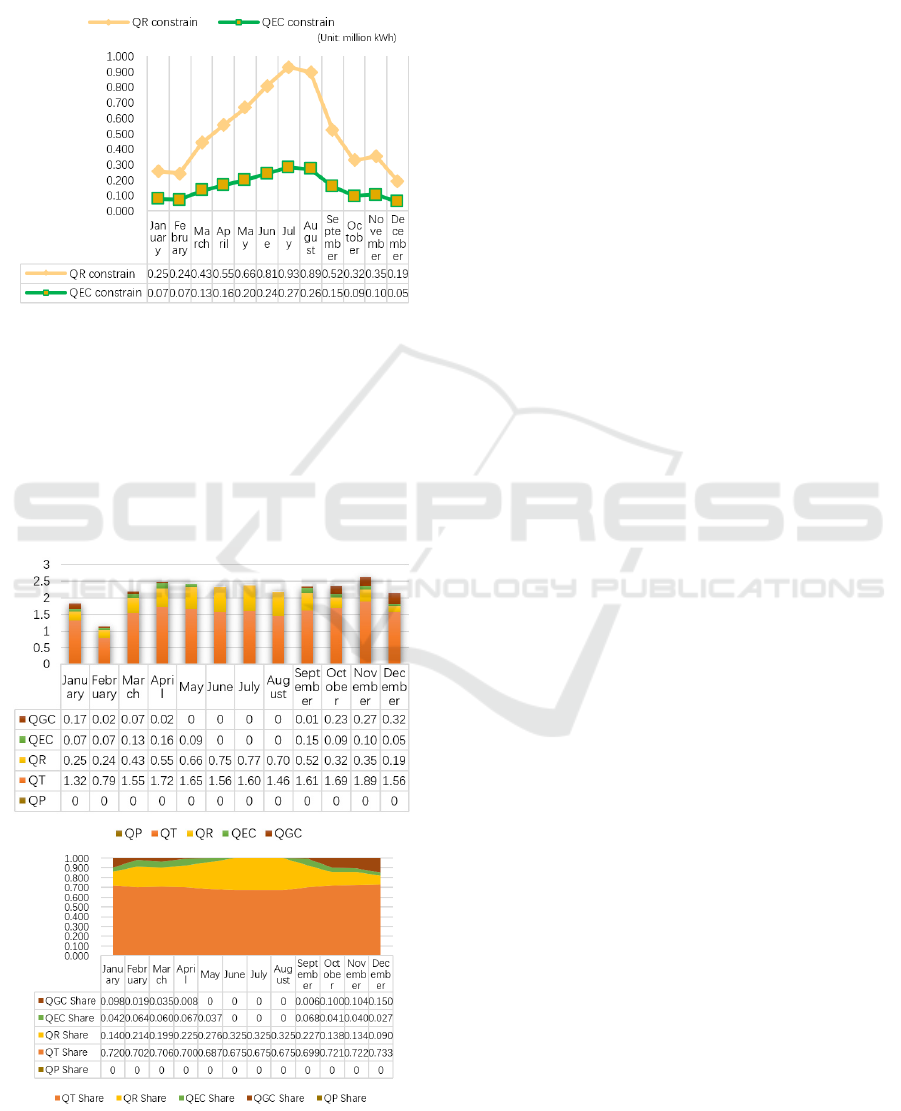

2)Monthly QR, QEC Caps

There is almost no oversupply in the thermal

power market, so there is no cap constraint on QT

(purchased conventional power). However, the RES

market has lower prices due to the presence of

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

728

government subsidies and lower excess market prices

relative to green certificates, so there are constraints

on QR (purchased RES electricity power) and QEC

(purchased excess). Their limits that fluctuate with

the market are shown in Figure6.

Figure 6: QR and QEC constrains..

4.2 Simulation Analysis

Using matlab to simulate and analyze the case, we get

the purchase amount of each type of electricity and

the percentage of each type of electricity to the total

monthly electricity in 12 months under the optimal

decision as shown below, and the minimum total cost

under the optimal decision is RMB 15415676.76.

Figure 7: The chart of transaction results.

4.3 Analysis of Algorithm Results

1) Analysis of QP values

The annual QP is constantly 0. This is due to the

fact that with the implementation of the national

policy, the RPS is gradually maturing, so the penalty

for the responsible body to complete the consumption

volume is stronger, as shown by the unit penalty M of

10 yuan/unit - much higher than the unit price of other

types of electricity.

2) Analysis of QR values

Throughout the year, QR reached the upper limit

of the renewable energy limit constraint for

the month.

This is due to the existence of government financial

subsidies, resulting in much lower RES electricity

prices compared to conventional electricity prices,

rational power sellers will prefer RES electricity, so

in the premise that the demand for electricity on the

sales side of the market is greater than the supply of

RES electricity, RES electricity will be "snapped up".

3) Analysis of QEC values

From the simulation results, it can be seen that the

QEC reaches the upper limit of the excess constraint

for the month from January to April and from

September to December. This is due to the fact that

the price of "excess" is lower in this simulation

compared to "green certificates", so a rational

generator will give priority to purchasing excess to

fulfill the consumption responsibility if the market

demand is met and the consumption responsibility is

not met. In May, because the unfulfilled consumption

responsibility did not need to be satisfied by

purchasing all the "excess", and the price of "excess"

was still higher than that of "green certificates", only

"Since the RES consumption responsibility has been

fulfilled by QR from June to August, there is no

longer a need for the "excess" or "green certificates".

4) Typical Month Analysis

a) December: QT and QGC both takes the

largest share of electricity.

The QD (electricity market demand) in December

is small, but the QR cap is also small, so in order to

meet the QD, the remainder after all QRs are

purchased has to be provided by QT, which results in

the largest QT share in the 12 months; the small QR

cap also results in the QR alone not being able to meet

the consumption responsibility, so the excess or green

certificates have to be purchased; unfortunately, the

excess in December is exactly the smallest in the year,

and all the excess It is also impossible to meet the

remaining consumption responsibility. This results in

the remaining part of the surplus needing to rely on

"green certificates", and the remaining part is

Strategy Optimization and Simulation Analysis of Electricity-saling Companies under Renewable Portfolio Standard

729

relatively large, which explains why QGC accounts

for the largest percentage of the year.

b) February: When QD is minimal, purchase

decisions for all types of electricity are

considered.

February QD is the smallest of the year, when the

price of RES power is still lower than that of

conventional power, so priority is still given to

meeting market demand with all the RES power

available for purchase, and the remaining unsatisfied

portion is supplemented by conventional power.

However, the QR cap in February cannot meet the

consumption responsibility, so QEC and QGC still

need to be purchased; at this time, the price of

"excess" is still lower than that of "green certificates",

so priority is given to the purchase of "excess ".

However, the "Excess" cap in February is still unable

to meet the remaining consumption responsibility, so

finally, we still need to purchase 1.95% of the total

monthly power QGC.

c) July: When QD is at its maximum, purchase

decisions for all types of electricity are considered.

July QD is the largest of the year, and the RES

power available for purchase is also the largest of the

year, while the price of RES power is still lower than

that of conventional power, so priority is still given to

meeting the market demand with all the RES power

available for purchase, and the remaining unsatisfied

portion is supplemented by conventional power.

5 CONCLUSIONS

As the retail side of the grid continues to be

liberalized and the RPS continues to be improved, it

is critical that electricity sellers, as the obligated

bearers of consumption responsibility, adopt an

appropriate power purchase strategy to balance the

cost and risk of power purchase. In this paper, we

examine the combination of traditional, RES,

"overage" and "green certificates" strategies of

electricity sellers under the RPS on a monthly basis

with minimum annual purchase costs.

(1) Since the existence of government

subsidies keeps the price of renewable energy at a

lower level than the price of conventional energy,

electricity sellers should give priority to the purchase

of renewable electricity to meet their consumption

responsibilities.

(2) As the renewable energy quota system

continues to develop and mature, the ability of power

sales companies to meet their quotas will gradually

increase, and they will no longer have to rely on the

renewable energy contract market to meet their quota

needs, as they did in the early stages of development.

For fixed quota targets, purchases in the over-

consumption and green certificate spot markets will

also continue to increase as their prices fall.

(3) With the increase of renewable energy

quota target, the purchase volume of power sales

companies in renewable energy contract market,

excess consumption and green certificate spot market

will increase. The government can improve China's

power supply structure by increasing the quota target,

which will lead to a larger scale of renewable energy

consumption, but it cannot be increased indefinitely,

otherwise it will affect the operating efficiency of

power sales companies, and the quota target should

be reasonably set in accordance with the actual

situation of each region.

REFERENCES

Feng, QH Liu, Y Liu, S Wang. Exploring the Design of

Renewable Energy Quota System in China's Power

Sales Side (J). Automation of Electric Power System,

2017,41(24):137-141+158.

Helgesen, P.I. and A. Tomasgard, An equilibrium market

power model for power markets and tradable green

certificates, including Kirchhoff's Laws and Nash-

Cournot competition. Energy Economics, 2018. 70: p.

270-288.

Nojavan, S., K. Zare and B. Mohammadi-Ivatloo,

Application of fuel cell and electrolyzer as hydrogen

energy storage system in energy management of

electricity energy retailer in the presence of the

renewable energy sources and plug-in electric vehicles.

Energy Conversion and Management, 2017. 136: p.

404-417.

S Zhong, ZX Zhang, YH Guo, ZF Liang, L Ai, X Yan, Y

Li. Research on the pricing mechanism of renewable

energy power excess consumption transaction (J). Price

Theory and Practice, 2020(06):52-55+128.

SW Dai, L Zhang, NN Liu, M Yang, C Liu, SN Cao.

Analysis of Power Purchase Decisions of Electricity

Sales Companies Considering Renewable Energy

Consumption Responsibilities(J). Electric Power,

2021,54(09):156-164.

X Zhang, Z Chen, ZM Ma, Q Xia, XJ Dai, DX Lu, R Zhao.

Research on Electricity Market Trading System

Adapted to Renewable Energy Quota System (J).

Power Grid Technology, 2019,43(08):2682-2690.

XJ Zhou, Q Peng, R Yang, ZY Han, M Wang. Research on

E-commerce Bidding Strategies for Comprehensive

Energy Sale Considering the Impact of Transmission

Congestion under the Influence of Green Power

Certificate Transactions (J). Power Grid Technology,

2020,44(04):1317-1324.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

730