Digitalization and Forecasting of the Iron Ore Business

Stanislav Popov

1,2 a

, Denys Kolosovskyi

1b

, Michael Radin

2c

, Liudmyla Shokotko

3d

and Oleksandr Astafiev

3e

1,2

Kryvyi Rih National University, V. Matusevych Str., 11, Kryvyi Rih, Ukraine

2

Rochester Institute of Technology, USA

3

State University of Economics and Technology, Medychna Str., 16, Kryvyi Rih, Ukraine

Keywords: Economics, Forecasting, Iron Ores, Model, Stoping.

Abstract:

Ukraine’s iron ore mining industry is among the most powerful ones in the world, which account for 90% of

the volume of iron ore products. All iron ore mining enterprises of Ukraine are private. Current conditions of

their operation and prospects for its development bring up the problem of the most accurate forecasting of

economic results of mining by implementation of its key process – ore stoping. This determines profitability

of the business, its competitiveness and possibility of reasonable planning. To solve this problem, the authors

developed a methodology, a system of technical and economic indicators and a computer program to provide

multifactor economic analysis of competitive solutions on stoping and selection of optimal one according to

the forecast economic results of its application. Use of ore value indicators, the value of ore reserves and the

degree of use of the value as a result of stoping makes the basis of this methodology and the system of

indicators. Further development of this work implies creation of systems for modeling the entire process of

underground iron ore mining the key element of which is stoping with forecasting profitability of the business

based on analysis of iron ore market conditions.

1 INTRODUCTION

Currently, Ukraine is in the group of 7 countries with

the most developed iron ore mining industry out of 52

countries carrying out activities. Business structures

that operate in this area in Ukraine are among the

largest. Iron ore enterprises of these structures

account for about 9% of the country’s GDP. In

Ukraine, there are 8 large private iron ore enterprises

which produce up to 87.0 Mt of commercial iron ore

products (concentrate, pellets, sinter ore, blast furnace

and raw ore). About 60% of this volume is consumed

by national private metallurgical enterprises, 40% is

sold in foreign markets (Kindzerskyi, 2013). Business

in the field of iron ore mining is one of the most

profitable and forms a powerful source of the

country’s budget revenues in national and foreign

currencies.

a

https://orcid.org

/0000-0003-4874-997X

b

https://orcid.org/0000-0002-0550-2021

c

https://orcid.org/0000-0001-9951-7955

d

https://orcid.org/0000-0001-7294-2003

e

https://orcid.org/0000-0002-2929-3076

Application of the underground method of mining

iron ore deposits is one of important and promising

directions in production performance and

development. This is due to the fact that the specific

technology of this mining method provides the

possibility of economically effective iron ore

extraction at great depths (over 1000 m). At such

depths, the open pit method of mining, which is

currently the main one, is economically inefficient.

In Ukraine, application of the underground

mining method accounts for 15-20% of the volume of

commercial iron ore products. In the near future, their

volumes will grow as the main reserves of iron ore

extend to great depths. Iron ores are already proved to

occur at the depth of 2750 m, and the forecast depths

are 5.0-7.0 km.

Along with this, it should be noted that in order to

achieve the highest economic efficiency of mining

these reserves at great depths, mining enterprises

Popov, S., Kolosovskyi, D., Radin, M., Shokotko, L. and Astafiev, O.

Digitalization and Forecasting of the Iron Ore Business.

DOI: 10.5220/0011348400003350

In Proceedings of the 5th International Scientific Congress Society of Ambient Intelligence (ISC SAI 2022) - Sustainable Development and Global Climate Change, pages 219-229

ISBN: 978-989-758-600-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

219

need to solve a number of complex problems. The

most relevant among them is the need for accurate

forecasting of technical and economic results of iron

ore development according to mining engineering

and economic conditions of its implementation.

(Kaplenko, 2003) (Kaplenko, 2013). These conditions

are very difficult in terms of ore occurrence

characteristics, the situation in the markets of iron ore

products and the markets of production resources.

The need for such forecasting is determined by the

needs for reasonable forecasting of business

profitability, its competitiveness, and justified

planning of business processes (

Kosenko, 2017)

(Popov, 2016).

One of the most important tasks in the field of

such forecasting is determination of technical and

economic results of implementing one of the key

processes of underground mining, namely Stoping.

This is one of the most large-scale, technologically

complex, costly and extremely dangerous processes.

The implementation of this very process provides the

mining enterprise with an ore resource with

characteristics necessary for production of

commercial iron ore products. The volume of

financial costs for its implementation reaches 40-60%

of the cost of extracted ore mass, with an increase in

the mining depth of development, they increase as

well. At the same time, in stoping, significant

technological losses of ore occur, up to 9-15% of the

reserve, and increased dilution of the extracted ore

mass with waste rocks makes up to 10-20% of its

volume. All this negatively affects the economic

results of mining.

This problem can be solved by applying such

technological, technical, parametrical solutions for

implementation of stoping which are optimal, i.e.

ensure achievement of the highest profitability of

mining in specific conditions of its implementation.

This problem can be solved only on the basis of

digitalization of the business in the field of iron ore

mining, i.e. development and use of application-

oriented software means modeling of production and,

in particular, the process of ore stoping and

optimization of its design solutions based on

forecasting the results of mining ore reserves. The

degree of compliance of these solutions with the

target function of optimality directly determines the

profitability of mining, performance of a mining

enterprise, (a business structure can include several

enterprises of this kind), and this is the basis for

formation of economic results and business

efficiency.

To successfully solve this problem, it is necessary

to have, first of all, the method of economic and

mathematical modeling of the stoping process,

considering a wide range of mining and economic

conditions for stoping. In addition, it is necessary to

have a system of indicators that allow correct

assessment of its economic results (

Veduta, 2017).

At present, there is no generally recognized

modeling methodology and system of indicators

available. Developments that exist in this area are

based only on determined values of the integrated

indicator of efficiency – profit from implementation

of the result of the Extracted ore mass stoping.

However, they do not solve the important economic

problem that arises in this process, namely,

determining how fully the economic potential (i.e. an

ore reserve with its engineering and economic

characteristics) is used as a result of mining, and this

directly concerns profitability of mining.

According to the above mentioned, the work is

aimed at developing a mathematical model, a set of

indicators and a computer system for modeling the

process of iron ore stoping to predict its results at the

level of the economic activity of the mining enterprise

support. The theoretical basis for their development

is described below.

2 RELATED WORK

The process of ore stoping is carried out at the main

production objects of underground mining enterprises

- Mining blocks. Stoping includes implementation of

a number of so-called Technological processes of

stoping. Specific solutions on the technology of

performing each of them, means of labour

mechanization, parameters of their implementation

determine technical-economic efficiency of stoping

(

Ray, 2016).

In previous years, the urgent need to increase this

efficiency in difficult underground conditions

required development of a whole range of

technological and technical solutions to extract ore,

aimed to improve stoping and eliminate its

shortcomings. These solutions are summarized in a

special document Typical passports of underground

mining systems. Currently, 50 variants of such

systems have been developed in Ukraine. In general,

over 2,500 patterns have been developed for various

conditions of ore in the world.

The passports of mining systems present:

• designs of mining blocks based on different

variants of mining systems;

• expected technical and economic results of

mining their reserves (productivity of a stope,

labour efficiency, specific length of technological

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

220

workings, expected technological losses of ore,

technological dilution, cost of extracted ore

mass).

• criteria for selecting variants of mining systems

(mining depth, ore body thickness and dip,

physical and mechanical properties of ore and

country rocks);

From these passports, based on comparison of the

criteria for mining systems selection and actual

conditions at mining sites of the deposit, variants of

systems for specific blocks are selected. It should be

noted that in practice these conditions are unique and

are not repeated at other mining sites.

On the basis of the selected mining systems,

mining blocks are designed.

However, designing implies certain complexity

consisting in the fact that the right choice of the

mining system does not guarantee its highest

economic results. This situation is due to the fact that

in typical passports there are only fundamental

solutions for block designs and the technology of

stoping treatment for certain simplified forms of ore

bodies, elements of their occurrence. Yet, in practice,

real characteristics of ore bodies have significant

deviations from average values, and this leads to

specific economic results of mining which will

naturally differ from the values indicated in the

passports of the systems. Therefore, in order to obtain

the highest economic efficiency of stoping, the

selected variant of the mining system still needs to be

parametrically adapted to conditions of a particular

block, and there may be several competitive variants

of systems.

At the mining enterprise, there can be from 4 to

20 mining blocks at the same time and it is necessary

to design more and more new blocks as already

exhausted blocks are decommissioned. Designing of

the kind is a constant and continuous process. These

projects are prepared according to a special

instruction, in which unfortunately there is no method

of detailed economic analysis of decisions made

during designing (

Barry, 2006).

Parametrical adaptation of mining systems is

performed through selecting geometrical parameters

of structural elements of the block without violating

the principle design of the system chosen for it. In

addition, when adapting, the parameters of the

stoping technology are calculated, the general scheme

of which is regulated by the passport. Naturally, the

obtained technical and economic results of ore

extraction and its profitability depend on the level of

constructive, technological and parametrical

adaptability of the entire production and

technological complex of a mining unit to specific

geological and mining conditions of its design and

mining of its reserve.

Such adaptation represents a complex, time-

consuming and responsible process in which many

options of different solutions are considered. Its

implementation requires highly qualified designers

with practical experience in technological design and

mining economics. At the same time, each of their

solutions should be not only due to mining factors,

but also economically justified and optimized

according to the criteria for obtaining the highest

economic efficiency. That is why it is necessary to

have an economic and mathematical model of an

appropriate nature and a system of estimated

economic indicators.

The authors have developed a relevant model and

system of indicators. This model is developed on the

basis of formalization of three important

characteristics of the subject of labour: the Value

represented by the ore reserve; the Value of the ore

reserve; the Degree of the value use when mining.

For this purpose, business structures acquire the right

to mine the reserve. This approach to evaluate the

efficiency of stoping is applied for the first time.

Specificity of application of the above

characteristics consists in the following. The purpose

of stoping is to obtain the industrial reserve of ore

from the monolithic ore massif, the required volume

of ore mass which, in its physical condition (crushed

material with a given granulometric composition),

quality (metal content) and economic characteristics

(cost), allows economically efficient processing it

into commercial iron ore products that meet the

requirements of the consumer (a metallurgical

enterprise). At the same time, the closer to these

requirements the characteristics of the mined ore

mass are, the more cost-effectively ore mass is

processed. Up to 40% of ore mined at mining

enterprises, even without detailed optimization of

mining immediately after extraction, meets these

requirements. But that is not sufficient. To achieve

the highest degree of such conformity, it is necessary

to choose the most optimal technological, technical

and parametrical solutions for implementing each

technological process, which make up the structure of

stoping. However, this is currently not performed,

and designers are guided only by common solutions

without their detailed economic analysis.

2.1 The Structure of Stoping

As mentioned above, stoping involves a number of

technological processes that are strictly sequenced

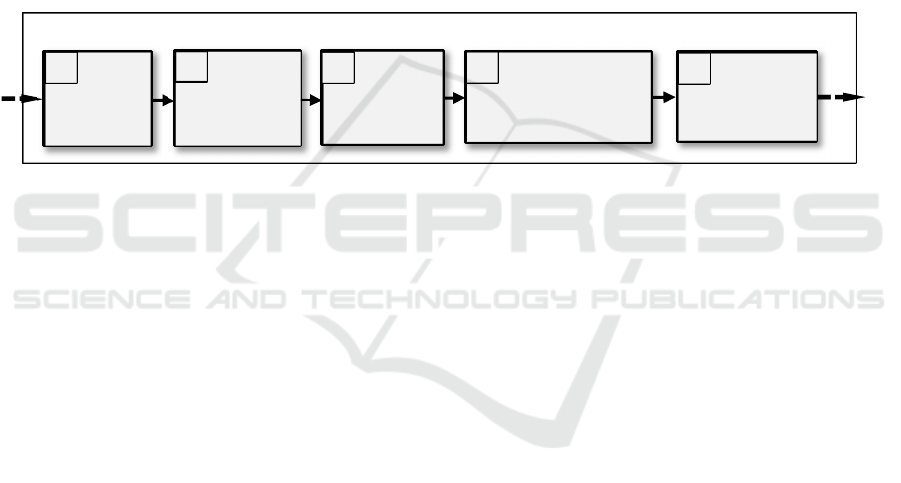

and rigidly related. This sequence is given in Fig. 1.

Digitalization and Forecasting of the Iron Ore Business

221

It is the specifics of execution of these processes

according to the selected solutions that determines the

economic result of stoping in general (

Tradin

Ecjnomics) (Popov, (2020)

(

Martynov,

2010).

Drilling consists in forming systems of blast holes

within the stoping space of the mining block. The

holes are located according to a certain pattern and

have defined length and diameter parameters. To

mine the reserve of one block, 10.0 - 30.0 km of

boreholes are drilled. It should be noted that while

parametrical adaptation of development systems, the

total length of holes can vary significantly in different

variants of drilling operations, and this significantly

affects the economic results of stoping due to the fact

that this process is one of the most costly.

Blasting consists in charging holes with explosives

and forming explosive charges of special structures,

the blasting circuit switching, initiating detonation of

the charges in a certain sequence. Currently, ore is

broken by mass blasting when up to 50.0-100.0 t of

explosives are detonated in one cycle and up to 200.0-

400.0 and sometimes up to 900.0 kt of ore is broken.

Depending on mining conditions, costs for blasting

reach 40-70% of the total cost of stoping.

Ventilation of the block is removal of explosive

gases from the block after detonation of charges in the

stoping space. Ventilation is executed, as a rule, due

to general depression, sometimes by force applying

special ventilation equipment. The need to ventilate

the block requires a significant amount of ventilation

workings that distribute air flows in the block

between different objects. The length of ventilation

workings can make up to 40% of the length of all

types of mine workings in the block.

Figure 1: The schematic diagram of stoping.

Broken ore mass drawing consists in removing

the broken ore mass from the stoping space. Ore mass

drawing can be executed by the gravitational method

or applying special vibration equipment. Productivity

of the ore mass drawing from the block amounts to

800.0-6000.0 t per working shift.

Ore mass transportation consists in moving the

broken ore mass from the stoping space in the block

to the place where it can be hauled to the hoisting

complex of the mine. To perform this process, a

system of technological workings and machines

(scrapers, conveyors, vibro-equipment) operates in

the block.

Dashed arrows in Fig. 1. show that the process of

stoping is an element of a larger production and

technological system of an iron ore mining enterprise

and executed after implementation of a complex of

various processes before and after it. However, in this

scheme stoping is a key process. Each of the

technological processes of stoping makes its

contribution to the formation of its technical and

economic results.

2.2 The Main Factors of Forming

Economic Characteristics of

Stoping

Implementation of all technological processes of

stoping requires appropriate financial investments,

the specific value of which is determined by the

following factors:

• characteristics of the raw material resource,

namely ore and its industrial reserve (grade, volume);

• mining conditions of ore reserve occurence

(geological, geomechanical, mining-geometric,

hydrogeological);

• the nature of technological, technical,

parametrical and organizational solutions for

implementation of stoping;

• economic conditions in which a mining

enterprise operates (prices for resources, volume of

costs during construction of the block and mining of

itst reserve, volumes of works).

To determine the expected economic results of

stoping at the stage of preparation of the project for

its implementation, these factors, or rather, their

influence on the economic results of stoping, should

be mathematically formalized and analyzed when

solving economic problems.

The process of iron ore stoping

Drilling

1

Broken ore mass

drawing from

stoping space

Ore mass

transportation

Blasting

2

4

5

entilation

3

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

222

2.3 Theoretical Bases of Development

of Economic and Mathematical

Model of Stoping

According to the above, we will proceed directly to

development of the economic and mathematical

model which describes formation of economic results

of stoping and indicators by which it is possible to

assess the economic efficiency of stoping. This model

and the indicators are a tool for selecting optimal

design solutions for implementing each component of

the technological process of stoping in preparing

designs of mining blocks.

Ore is the subject of stoping. This resource has an

economic characteristic of the Gross Value G

1

(

Subject of labor, 2001) (The concept of value, 2005). By

definition, G

1

represents the market value of a useful

component (in this case Iron) which is contained in

1.0 t of the industrial ore reserve. The value of this

indicator is determined at the stage of geological and

economic evaluation of the ore reserve by the formula

=

=

N

n

m

C

N

P

G

1

1

01,0

(1)

Where

• P is the metal price, UAH/t;

• C

m

is concentration of metal in ore at geological

sampling sites, %;

• N is the number of sampling sites on the deposit,

pcs.

In the process of mining by stages of its

implementation, the industrial reserve of ore moves

from the state of a monolithic rock massif to the state

of extracted ore mass and changes one of its most

important characteristics, namely the content of metal

С

m

.

As a result, the extracted ore mass also acquires a

certain value which is determined by the Extracted

Value indicator G

2

. This indicator determines the cost

of metal which is contained in 1.0 of the mined ore

resource at concentration of metal in it С

mr

and is

calculated by the formula

mr

PСG 01,0

2

=

(2)

The G

2

value is in a certain dependence on the G

1

indicator, but this dependence is not functional,

although it is not accidental. Their relationship

depends on many factors of a natural and man-made

nature.

In G

2

, the initial part is G

1

,, because formation of

G

2

begins with G

1

,. Their relationship can be

described as follows

21

GХG →∈

(3)

This expression suggests that the parameter G

1

is

an element of the set of parameters X that form value

of the parameter G

2

, as the final characteristic of the

development by changing the value of the object of

labor.

The G

1

and G

2

, indicators are important for

assessing changes in the economic nature of ore after

its extraction depending on the value the G

2

parameter differs from the G

2

value, taking into

account in what way the G

2

value is formed and what

factors influence the parameters of this formation. In

practice, their values can be relative to each other as

G

2

< G

1

; G

2

= G

1

; G

2

> G

1

and each of these options

has its own economic meaning that depends on

specific mining conditions.

It should be noted that G

1

and G

2

characterize

only the ore itself and the ore mass extracted from the

subsoil as raw materials, but they do not consider the

fact that in addition to the difference in value there is

a difference in volume of these materials. These

volumes characterize the scale of mining and between

them there is already a clearer dependence Q

2

=f(Q

1

)

(Mossakovskyi, 2004).

To describe it, one can use the following

indicators: the total value of the industrial ore reserve

G

ir

=Q

1

G

1

that is the one that characterizes its

economic potential; the total value of the iron ore

product G

p

= Q

2

G

2

. In this case, G

p

is a general

economic characteristic of the entire volume of ore

extracted.

To what extent a mining enterprise will be able

to use the potential of G

p

in mining depends on the

following factors:

1. Factors that are determined by objective

conditions and do not depend on the mining

enterprise, namely: geographical conditions of

deposit location (distance, nature of the area,

climate); geological conditions (composition of

rocks, morphology of subsoil, hydrogeological

conditions); geochemical characteristics (chemical

composition of ore, content of useful components and

harmful impurities); mining conditions (subsoil

geomechanics, seismics, physical properties of

rocks); administrative and social conditions

(development of the mining area, population that will

be influenced by production activities of the

enterprise). The same group includes factors of

economic nature according to the economic policy of

Digitalization and Forecasting of the Iron Ore Business

223

the state regarding the use of subsoil and business

activities of mining enterprises (subsoil fees, taxes,

mandatory payments).

These factors determine the amount of funds that

should be invested in production to settle technical,

environmental, social issues that will arise before the

mining enterprise under the specified conditions

because each of them imposes certain restrictions on

mining the ore reserve.

2. Factors that depend on the enterprise, i.e. how

it solves the following tasks:

• correct assessment of the potential of the enterprise:

its technical, technological, labour, financial

resources;

• rational planning and organization of the

production process (stoping and all preparation

processes for it);

• selection and adaptation to specific conditions of

the stoping technology;

• selection and efficient use of labour

mechanization and equipment;

• motivation of workers to productive and high-

quality work;

• provision of production with necessary resources

including the relevant transportation mode and

their efficient use;

• organization of control over implementation of

the production process at all its stages;

• organization of an appropriate level of analysis

and evaluation of economic efficiency of

production which should provide the most

accurate results.

It is quite difficult to do all this, but without this

it is almost impossible to obtain necessary production

results using the economic potential of the ore reserve

to the full extent and get such profitability of the

business, the value of which will be the maximum

possible in these conditions. In order to properly

assess this completeness, we formalize the process of

mining the ore reserve of the mining block and

obtaining a commercial iron ore product where the

key role is played by stoping.

The relationship between G

ir

and G

p

can be

formalized by the following function

1122

GQKGQGKG

irр

ϕϕ

===

(4)

The coefficient K

φ

in this formula characterizes

the degree of change of the product QtpGvil relative

to the value of the product Q

s

(salary)G

g

(gross), that is

obtained as a result of development. In the case of

different solutions for development will be different

value Q

tp

G

rv

. You can calculate the value of K

φ

as

follows:

11

22

GQ

GQ

K =

ϕ

(5)

Note that this formula for calculating Kφ shows

only the final result of ore mining by completeness of

the value use, but it does not reflect the fact that this

result is not instantaneous, but is the result of a long

time of a number of processes (geological

exploration, geological economic evaluation of the

stock, design of development, opening of the stock,

drainage of the extraction site, preparation of the

stock, its cutting, implementation of a set of

technological processes of purification of ore, rolling

of extracted ore mass, its rise to the earth's surface,

processing ore mass at the crushing and sorting plant

products). The implementation of each of these

processes requires the investment of certain financial

resources. The magnitude of these investments

depends on geological, mining, geomechanical,

hydrogeological conditions at each extraction site and

the nature of the decisions on which these processes

will be performed. Therefore, the distribution of these

investments in different processes in different

extractive countries and their total amount will be

different. And, most importantly, will be different and

economic characteristics of the process of ore

extraction and its economic results.

An important aspect is that the financial costs of

all development processes and the distribution of

these costs form certain financial constraints on the

implementation of the removal extraction and its

components of technological processes. This means

that when designing the development of the

production unit stock in specific conditions, not all

options of technological, technical and parametric

solutions can be used, even when they are technically

acceptable, but the financial costs of their

implementation in these conditions will exceed

acceptable limits.

These limitations must be predicted as accurately

as possible during project preparation - because they

are the basis for choosing the best design solutions for

different development conditions.

Industrial ore reserves Q

1

with gross value G

1

,

forms a certain common value G

ir

=Q

1

G

1

. Ideally,

this stock could be sold at a price equal to the value

of this value. However, in the development of each

completed process over the stock, from the above,

and the money invested in it reduces its value for the

mining company, because its sale at the market price

of the metal will no longer be so profitable for each

work performed. If the total value of a certain process

is equal to the amount of money invested in

development, the profitability of such development

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

224

will be equal to R = 0 and formally perform all other

processes will be economically unprofitable.

However, if at a certain level of the process

sequence to optimize solutions for each of them, it is

possible to optimize the entire production process,

including not only reducing the financial costs of each

process, but also their optimal distribution between

different processes. Such optimization can be

performed only with the use of economic and

mathematical modeling of the entire development

process, in which the basis is the modeling of the

cleaning extraction.

The basis for such optimization is this approach.

Based on the expression (5), the calculation of K

φ

by

stages of development can be done as follows

11

1

22

11

1

11

22

GQ

SGQ

GQ

S

GQ

GQ

К

N

i

і

N

i

і

==

−

=−=

ϕ

(6)

In this formula the expression ΣS

і

/Q

1

G

1

determines

the specific value of financial investments in

processes in the sequence of their implementation

1, 2, 3,…, і. This is the relationship between the

values Q

2

G

2

і Q

1

G

1

taking into account the financial

costs of receipt Q

2

з Q

1

can be formalized as follows

,

1

44131122

=

−+−=

N

i

і

SGQGQGQGQ

(7)

Where

• Q

3

volume of ore of industrial stock, which is

lost during treatment, thousand tons;

• Q

4

the volume of rock that clogs the ore during

removal, thousand tons;

• G

4

value contained in the ore mass in the form

of ore material that meets the requirements

for the iron ore product, UAH.

At each stage of development the value K

φ

will

change as the values change Q

2і

, G

2і

, S

і

.

Indicator K

φ

, in the given form we will name the

Indicator of efficiency of use of economic potential

of an industrial stock of ore. This indicator determines

the degree of use of the economic potential of the

stock, which is formed by the value of the ore G

1

і the

volume of its stock Q

1

, G

ir

=Q

1

G

1

upon receipt of an

iron ore product, on any сstages of the production

process.

In turn, the iron ore product at each stage of

development is characterized by total value G

p

=Q

2

G

2

,

which differs from the value G

ir

due to certain losses

of ore and its clogging with empty floors and financial

costs ΣS to carry out development. This changes the

value of the stock to values G

p

as the sequence of

development work.

In this formula, the values of the parameters are

known G

1

,

G

2

they are determined by the content and

price of the metal in the ore of the industrial stock and

in the iron ore product. The value is known ΣS, it is

determined by economic and mathematical modeling

of the development process, or according to practice.

The value is also known Q

1

, it is provided by the

geological service of the enterprise.

Only the value remains uncertain Q

2

. At the stage

of project development for the development of the

production unit stock, it can be determined by the

nature of design decisions for development and based

on the value of the indicator Q

1

, by such expression

()

()

11

2

1

2

100

100

QКQ

k

k

Q

v

=

−

−

=

(8)

Where

• k

1

the coefficient of industrial stock ore during its

extraction, %;

• k

2

the coefficient of clogging of the extracted ore

mass during mining, %;

• К

v

the coefficient of visible extraction of ore

during mining, USD

Indicator k

1

represents the ratio of the volume of ore

Q

3

, which was lost during the development of a

certain amount of ore Q

1

, k

1

=100Q

3

/Q

1

, %. Indicator

k

2

- the ratio of the volume of waste rock Q

4

, which is

contained in the extracted ore mass Q

2

, which got into

it in the process of stock development Q

1

,

k

2

=100Q

4

/Q

2

.

Thus, from function (8) formula (6) can be written

as follows.

Taking into account these aspects of the approach

to the economic evaluation of the efficiency of the

removal process that are used in this work in the final

version, this formula is as follows

()

()

321

1

1

2

21

1

100

100

1

KKK

Q

S

k

Gk

G

К

N

i

і

−

−

−

=

=

ϕ

( 9 )

К

1

, К

2

, К

3

coefficients that take into account different

types of taxes К

1

, payments К

2

, repayment of

receivables, etc. from each unit of profit received

from the sale of a unit of iron ore product.

Digitalization and Forecasting of the Iron Ore Business

225

From the expression for determining Kφ it is seen

that in the case of equalization of values

()

()

1

1

2

1

100

100

Q

S

k

Gk

N

i

і

вил

=

=

−

−

(10)

the value of this indicator will be equal to 0, where

the ratio ∑S/Q

1

determines the specific financial costs

of development to a certain stage, and the ratio

()

()

,

100

100

2

21

k

Gk

−

−

(11)

determines the magnitude of the change in value G

1

taking into account its reduction as a result of

technological losses k

1

and ore clogging k

2

.

Thus from this expression it is possible to predict

at what sizes of parameters k

1

k

2

, Q

1

, S

і

, G

2

development will reach the limit of profitability,

when the income from the sale of products only

compensates for the costs of development without

making a profit.

Therefore, in order to prevent unprofitable

development, it is necessary to determine the limit of

the value of ΣS, which cannot be exceeded when

making design decisions. This limit (limΣS) can be

determined on the basis of the value indicator

()

2

221

1

100

100

lim

k

GQk

S

N

i

і

−

−

<

=

(12)

Let us consider how this limitation applies to the

second mining. The amount of financial costs that

forms the value ΣS includes the second mining costs

and is as follows:

,

1413121110

987654321

1

SSSSS

SSSSSSSSSЗ

N

i

i

++++++

+++++++++=

=

(13)

Where

• S

1

is the amount of financial costs for geological

prospecting works, UAH;

• S

2

is for the construction of a surface system,

UAH;

• S

3

is for the stock preparation, UAH;

• S

4

is for the stock division, UAH;

• S

5

is for the drilling and blasting works, UAH;

• S

6

is for the ventilation of the mining space, UAH;

• S

7

is for the restoration of dislocated objects,

UAH;

• S

8

is for the performance of works on the drawing

of ore mass, UAH;

• S

9

is for the delivery of ore mass, UAH;

• S

10

is for the ore mass hauling, UAH;

• S

11

is for the hoisting of ore mass on the earth's

surface, UAH;

• S

12

is the costs for processing of ore mass at the

grinding-sorting factory or the enrichment,

UAH;

• S

13

is the financial costs for capital mining

operations (it is calculated as % of the total

amount of weight-to-volume ratio), UAH;

• S

14

is the costs, which were not taken into

account at the performance of actual mining

(defined as% of the total amount of weight-

to-volume ratio), UAH;

• S

15

is the amount of unaccounted financial costs

(defined as % of the total amount of weight-

to-volume ratio), UAH.

In this formula, the parameters S

6

+S

7

+S

8

+S

9

+S

10

are determined by the financial costs for the process

of second mining of ore З

ios

, and the other ones – by

the general mine costs З

gm

Thus, the formula (9) will

appear as:

()

()

.

100

100

1

12

1

1

+

−

−

−

=

Q

SS

k

Gk

G

К

iosgm

вил

ϕ

(14)

Based on the equation (12), the maximum

allowable value З

ios

can be calculated as follows

()

gmios

З

k

GQk

З −

−

−

<

2

111

100

100

(15)

The obtained ratio allows to determine what

should be the values of all basic technological

features of the process of second mining Q

p

, k

1

, k

2

and

especially S

ios

, which is the part of a series of items of

financial costs for development, in order to ensure the

economic feasibility of its making in each mining unit

in economic conditions of operation of a particular

mining enterprise.

As mentioned above, the limit of the financial

costs for the performance of each of the development

processes is affected not only by the maximum

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

226

allowable value of the prime cost of iron ore products,

but also by the fact of correlation of the values of

financial costs for all development processes. This

determines the opportunities and limitations of

investing in each process. These ratios must be

determined in the project of second mining, for cost-

effective decisions on projects, for these development

conditions, for example, when the financial losses,

outsized due to objective reasons, on one process can

be compensated by certain technological, parametric

solutions of performance of another process, so that

the total costs of its implementation do not exceed the

maximum value lim∑S, and their technical results

were acceptable for the enterprise.

This situation requires the detailed organization

of work throughout the production cycle, taking into

account the relationships and dependencies between

individual processes and works.

All this applies to the technological processes of

second mining, which have a lot of options for

technology, mechanization means, parameterization

and all of them provide different economic results in

the specific conditions.

To implement this approach, it is proposed to use

a number of indexes that reflect the efficiency of the

economic potential of the ore stock in the

implementation of each technological process of

second mining, which are the target optimization

functions of these processes:

min100

11

→

⋅

=

GQ

S

К

d

d

ϕ

(16)

min100

11

→

⋅

=

GQ

S

К

b

b

ϕ

min100

11

→

⋅

=

GQ

S

К

v

v

ϕ

mi

n

100

11

→

⋅

=

GQ

S

К

br

br

ϕ

min100

11

→

⋅

=

GQ

S

К

ot

ot

ϕ

Where

• K

φd

is for the drilling works, %;

• K

φb

is for the blasting works, %;

• K

φv

is for the ventilation, %;

• K

φbr

is for the works on ore mass drawing, %;

• K

φot

is for the works on delivery of ore mass, %;

The amount of financial costs for implementation,

respectively

• S

d

is for the drilling works, UAH;

• S

b

is for the blasting works, UAH,

• S

v

is for the ventilation, UAH,

• S

br

is the work on the drawing of ore mass from

the mining space, UAH,

• S

ot

is the work on delivery of ore mass, UAH;

The comparison of the values of these indexes on

their respective groups makes it possible to determine

how effectively each of the components of the second

mining process was implemented, as well as provides

an opportunity to identify the problems in the

distribution of financial costs for their performance.

It should be noted that these indicators in the

complex characterize the efficiency of a single

process of ore stoping. In this case, the values of the

parameters S

d

, S

b

, S

br

, S

ot

substantially different from

each other. Their integral contribution to the use of

the value of industrial ore reserves and evaluation of

the efficiency of its use can be carried out applying

the following formula

mi

n

100 →

⋅

++++

=

пз

зп

валпз

otbrvbd

Q

Q

GQ

SSSSS

К

ϕ

(17)

This expression is the target function of the

stoping process optimization on the entire range of

works that must be performed during its

implementation. Such optimization is performed

through economic and mathematical modeling of the

stoping when considering different options for the

technological and technical competitive solutions for

the implementation of the components of the stoping

processes according to the variational approach to its

design.

The technique described above formed the basis

for computer program, that was developed by the

authors, for modeling of the stoping process,

determining its optimal parameters and evaluating its

economic efficiency.

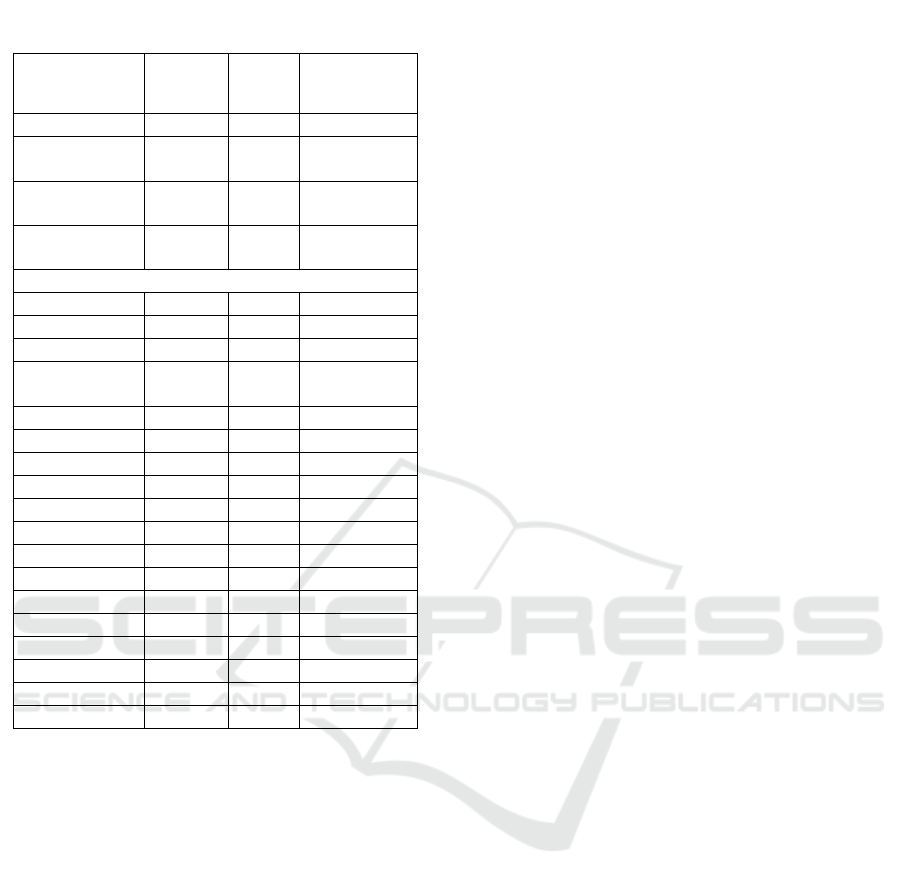

An example of the results of modeling with this

system is given in Table 1, which presents its results

for one of the mining units at the “Yuvileyna” mine of

the Private Joint Stock Company "Sukha Balka of

Kryvyi Rih Iron Ore Basin.

Digitalization and Forecasting of the Iron Ore Business

227

Table 1: Results of economic and mathematical modeling

of the stoping process.

The indicators Marking

Unit of

meas

Value

Reserve Q

1

t 260000,0

The content of

metal

С

m

% 62,0

Gross Value

G

1

UAH / t 50000,0

The total value

Q

1

G

1

UAH / t 8060000000,0

Results of modelling

Losses of ore k

1

% 9,0

Clogging k

2

% 12,0

Ore mass Q

2

t 268863,6

The content of

metal

Cm % 58,0

The total value Q

2

G

2

UAH 7797045454,5

Driling S

6

UAH 87360000,0

Blasting S

7

UAH 145600000,0

Ventilation S

8

UAH 2912000,0

Drawing S

9

UAH 37856000,0

Transportation S

10

UAH 20384000,0

Amount S

io

UAH 294112000,0

The indicators: Kφd % 1,08387

Kφb % 1,80645

Kφv % 0,03613

Kφbr % 0,46968

Kφot % 0,25290

Total Kφ % 3,52998

Cost UAH/t 1131,2

The above table shows that relative to the total

value of the industrial ore reserve Q1G1 in this block,

the finantional costs for the stoping is 3.52%. That is,

by this amount there will be an extracted value

decline relative to the stock value in the

implementation of the stoping. At the same time, with

the calculated projections of this process, the

profitability of the mining itself will be quite high

because when the cost of extracted ore mass is

11301.2 UAH / t for the main development process -

stoping, the selling price of iron ore in the current

market conditions of different consumers ranges from

2259.0 to 6213.0 UAH/t, that is 1.99-5.49 times

higher than the production cost according to this

process.

In conclusion, we note that the authors are

currently working on the wider implementation of

this modeling system in the design departments of

iron ore mining companies in Ukraine.

The methodology described above is the basis of

a computer program developed by the authors for the

modeling of the process of second mining,

determination of its optimal parameters and

assessment of the economic efficiency. Currently, the

work is underway to implement it in the project

departments of iron ore mining enterprises in

Ukraine.

3 СONCLUSION AND FURTHER

WORK

As a result of the research on the topic of this

publication, the following conclusions can be made:

1. The iron ore mining industry of Ukraine is one

of the most powerful in the world, producing 90% of

iron ore products. An important direction in its

functioning and development is the use of the

underground method of development of iron ore

deposits. This can be explained by the fact that the

specifics of its technology provides the possibility of

cost-effective mining of iron ore at great depths

(greater than 1000 m), which have the main stock of

these ores in the bowels of Ukraine.

2. All iron ore mining enterprises of Ukraine are

private and part of large business structures. The

conditions in which they currently carry out the

underground development and prospects for its

development raise the problem of accurate and

reliable forecasting of economic results of the

development, because it directly determines the

profitability of the business, its competitiveness in the

iron ore market, and provides reasonable business

planning.

3. Such results can be achieved by ensuring the

cost-effective implementation of the key process of

development, which is the second mining of ore. The

financial costs for its implementation reach 60-70%

of the prime cost of extracted ore mass.

4. To solve this problem, it is necessary to have a

method of modeling and calculating the parameters of

the second mining, which would determine the

optimal solutions for its performance in specific

mining and economic conditions based on accurate

forecasting of economic results, which is currently

missing. The authors have developed the following

methodology and system of technical and economic

indexes, which provide the possibility of multifactor

economic analysis of competitive solutions for the

performance of second mining and selection of the

optimal one.

5. The basis of this methodology and system of

indexes of second mining efficiency is the use of

indexes of the value of ore, the value of its stock and

the degree of use of value as a result of this process

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

228

on the final result of development.

6. This methodology also provides a method of

determining the financial limitations, which function

in specific economic conditions of operation of

mining enterprises, and which determine the amount

of allowable financial costs for the performance of

second mining. This limitation is one of the basic

factors that provide the optimization of the

parameters of the second mining.

7. Based on this methodology, the authors

developed a computer program for modeling and

determining the optimal parameters of the second

mining in the development of iron ore at great depths.

The need for this program is due to the great

complexity of solving the problem of optimization of

mining solutions.

8. Further development of this work will be the

creation of systems for modeling the entire process of

the underground iron ore production, a key element

of which is second mining of ore, as well as the

implementation of this system at mining enterprises

to prepare projects for mining units and determination

of the planning parameters for the process of

development of iron ore deposits and the support of

business planning.

REFERENCES

Kindzerskyi Yu.V. (2013) Industry of Ukraine: strategy and

policy of structural and technological modernization.

NAS of Ukraine, SI Institute for economics and

forecasting. NAS of Ukraine. 536 p.

Kaplenko Yu., Fedko M, and Bezverkhyi S. (2003)

Possibilities of increasing the efficiency of

underground mining and processing of magnetite

quartzites in the Kryvyi Rih basin. Collection of

scientific papers.../National Mining University. -

Dnipropetrovsk, 2003. 17(2): 196-198.

Kaplenko Yu.P. (2003) Prime cost of iron ore: the problem

of reduction as a determining factor of competitiveness.

Metallurgical and mining industry: technology,

economics, machine science, computer science,

ecology, 2: 101-104.

Veduta E.N., Dzhakubova T.N. (2017) Economic science

and economic-mathematical modeli. Mathematical

modeling in economy/ 3-4 (9):23-27.

Ray C., Sina N. (2016) Mine and Mineral Economics.

Prentice hall.

Barry A. (2006) Mineral Processing Technology An

Introduction to the Practical Aspects of Ore Treatment

and Mineral Recovery. Elsevier Science & Technology

Books.

Tradin Ecjnomics. IronOre. https://tradingeconomics.

com/commodity/iron-ore/.

Popov S.O, Ishchenko M.O., Ishchenko L.F., Kolosovskyi

D. (2020) Modelling and design of technological

schemes of underground development of iron ore

deposits at the increase of the dificulty of tecondition

of their funtioning. Resource-saving technologies of

raw-material base development in mineral mining and

processing. Multi-authored monograph. Petroani,

Romania. UNIVERSIT AS Publishing. 467-48 pages.

Martynov, V. and Fedko M. (2010) Calculations of basic

production operations, processes and systems of ore

deposits development, KTU:76 -115

Sazhyn, M., Chibrikov, G. (2001) Subject of labor. In the

book - Economic theoryEdition. NORMA P. 456.

The concept of value (2005) In the book - Menger K.

Collected works. Publishing House “Territory of the

Future”. 496 p.

Mossakovskyi Ya.V. (2004) Economics of the mining

industry. MGGU. 525 p.

Digitalization and Forecasting of the Iron Ore Business

229