The Impact of Exchange Rate on GDP: In Case of Tajikistan

Parviz Gafurov

a

, Firuz Kodirov

b

and Shahriyor Turakhonzoda

c

The Tajik state University of Finance and Economics, Nakhimov Str. 64/1, Dushanbe, 734067, Tajikistan

Keywords: Exchange Rate, GDP, Economic Growth, OLS, Real Exchange Rate, Real Effective Exchange Rate,

Investment.

Abstract: The purpose of the study is to identify and build a model of the impact of the exchange rate on GDP of the

Republic of Tajikistan. According to the goal, the model was developed based on the current situation in

Tajikistan by selecting the main influencing factors. To build the model, GDP was used as an endogenous

variable, and the real effective exchange rate and investment were used as exogenous variables. According to

estimates, the result of the model shows that the economic growth of the Republic of Tajikistan reaches 7%

on average, of which about 0.17% is due to the increase of the real effective exchange rate.

1 INTRODUCTION

In a market economy, the stability of monetary policy

is the most important indicator of the welfare of the

state and the population. In order to increase the

effectiveness of monetary policy and socio-economic

development of the Republic of Tajikistan, the

National Strategy and Development of the Republic

of Tajikistan (NDS) for the period up to 2030 defines

the main tasks related to monetary policy and presents

an analysis of the current state, as well as directions,

stages and terms of implementation of future reforms:

strengthening the role and capacity of the National

Bank of Tajikistan in the area of monetary policy

management; the implementation of a comprehensive

monetary operation and the creation of a stable state

of foreign exchange policy (NDS, 2016).

Regulation and supply of money supply in the

economy and maintenance of price stability are the

main objectives of the monetary policy of the

Government of the country. In theory, the national

regulator should implement acceptable policies to

activate sectors of the economy for sustainable

growth (Paun et al., 2019). Thus, exchange rate policy

is one of the main elements of monetary policy, which

regulates inflation, the interest rate, the exchange rate

of the national currency, the money supply, the level

a

https://orcid.org/0000-0002-8764-6394

b

https://orcid.org/0000-0003-4564-630X

c

https://orcid.org/0000-0002-0596-3231

of international reserves and the competitiveness of

domestic goods.

Currently, in the Republic of Tajikistan, the issues

of the impact of the exchange rate on the gross

domestic product (GDP) play an important role in the

real and monetary sectors. Economic issues related to

the dynamics of the exchange rate have become one

of the main problems that dominate in

macroeconomic studies of the last period. Some

scientists argue that the economic crisis in developing

countries is caused directly or indirectly by the

incorrect choice of exchange rate policy, which is one

of the key tasks for ensuring the stability of

production (Reinhart, 2002; Camba-Crespo, 2021;

Krugman, 2014).

Thus, it is relevant to study the impact of the

exchange rate and its volatility on the economic

growth rate of Tajikistan, depending on the country's

monetary policy.

2 REVIEWS OF LITERATURE

The impact of the exchange rate on GDP should be

studied based on the economic system of the country,

since the relationship of these indicators varies

depending on the economies of countries. Therefore,

240

Gafurov, P., Kodirov, F. and Turakhonzoda, S.

The Impact of Exchange Rate on GDP: In Case of Tajikistan.

DOI: 10.5220/0011348800003350

In Proceedings of the 5th International Scientific Congress Society of Ambient Intelligence (ISC SAI 2022) - Sustainable Development and Global Climate Change, pages 240-247

ISBN: 978-989-758-600-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reser ved

several theoretical analyzes of the impact of the

exchange rate on GDP have been considered.

According to the study Fofanah (2020), the impact

of exchange rate volatility on economic growth is

insignificant. It should be noted that the study was

based on data from WAMZ countries. But studies

have shown that there is a positive and significant

relationship between exports and economic growth.

According to this study, the relationship between

imports and GDP growth rates is also positive and

significant.

An increase in the real exchange rate reduces the

efficiency of exports, causes an increase in imports

and prices for imported goods, or negatively affects

the competitiveness of national goods in foreign and

domestic markets, and increases the production of

non-tradable goods (Davlyatov, 2011). This study

analyzes the purchasing power of the national

currency in a small open economy of the Republic of

Tajikistan. Based on this, the author has determined

the relationship between the internal and external

markets on the basis of the real effective exchange

rate (REER).

The relationship between exchange rates and FDI

in Vietnam for the period 2005–2019 based on the

vector autoregression (VAR) model, have been

studied by Huong et al. (2020) and three main results

have been obtained. First, there is a positive causal

relationship between FDI and Real Effective

Exchange Rate (REER). Second, trade openness has

a positive impact on FDI and REER. Third, economic

growth has an impact on REER but did not impact on

FDI.

The economic literature notes that the

depreciation of the real exchange rate plays an

important role in increasing the competitiveness of

international prices, but this indicator will not be able

to determine the volume of production. The function

of the real exchange rate is the measurement of

domestic prices in relation to foreign ones. It also

shows a decrease or increase in the competitiveness

of tradable goods, for example, a decrease in the real

exchange rate in the short term contributes to an

increase in the export of domestic goods. Indeed,

improving competitiveness is an important part of the

money transmission mechanism.

In the long term, changes in real exchange rates

are driven by fundamental factors such as shifts in

productivity and the terms of trade: they are

endogenous and independent of monetary policy.

This does not mean that government policy cannot

indirectly influence the real exchange rate. However,

only government policies aimed at changing the real

economy will sustainability affect the real exchange

rate. Therefore, efficiency gains that increase the

tradable sector's ability to attract resources from

competing sectors (domestic and foreign) will drive

an appreciation of the real exchange rate, however

defined.

For the development of the economy of

Tajikistan, export is the main source of foreign

exchange (Tursunov, 2017). This suggests that in the

socio-economic policy of the Republic of Tajikistan,

much attention is paid to the development of the

export sector by creating a favorable environment for

the development of industrial production, considering

the choice of monetary policy.

It should be noted that Evans and Saibu (2017) in

their studies in case of Nigeria assess the impact of

monetary and exchange rate policies on the

diversification of the economy using the ARDL

(Autoregressive Distributed Lag) approach. His

results show that the relationship between the

exchange rate and economic diversification is

statistically significant. In addition, monetary policy

instruments, in terms of money supply and credit,

have a significant impact on the diversification of the

economy. Thus, they recommend that it is possible to

maintain the value of the national currency, to ensure

the internal and external balance without prejudice to

the overall goal of diversifying the economy.

Enu and Opoku (2013), having studied the

relationship between GDP growth and the exchange

rate in the case of Ghana for the period from 1980 to

2012, estimated linear regression using OLS

(Ordinary least squares method). They used statistical

methods of autocorrelation, heteroscedasticity, and

multicollinearity, and, as a result, they obtained a

positive linear relationship between the GDP growth

rate and the exchange rate. This confirms the theory

that high exchange rate depreciation stimulates

economic growth in the short term. Their results are

also consistent with the conclusions of Tarawalie

(2010) and Chen (2012). They propose that

politicians should ensure long-term stability of

monetary and fiscal policy, and should also continue

to engage in productive activities in order to increase

a country's exports more than its imports.

Rizokulov and Azizbayev (2018) in their works

propose that “after legislative amendments and

measures taken to stabilize the foreign exchange

market, the volume of dollarization decreased only

due to the fact that it moved from official sources,

such as credit institutions, to the unofficial sphere,

namely, to the shadow economy. They note that in

order to achieve import substitution, it is necessary to

take into account the factor as a result of which, due

to the outflow of capital, domestic production will

The Impact of Exchange Rate on GDP: In Case of Tajikistan

241

develop”. Based on this, it can be argued that today

the exchange rate is one of the important factors in the

development of the real sector of the economy.

The results obtained by Huong (2019) showed

that the real exchange rate can lead to a positive effect

on real GDP. Empirical studies (Conrad, et al., 2018)

for the Trinidad and Tobago economy over the period

1960 to 2016 have shown that undervalued exchange

rates have a positive impact on economic growth and

overvaluations have a long-term negative impact.

According to the Krekó and Oblath (2020) research,

the relationship between economic growth and RER

misalignments within the EU during the period of

1995–2016 has been identified.

Thus, there are many studies that suggest a

correlation between the real exchange rate and GDP

growth (Alidzhanov, 2016; Ashurov and Safarov,

2019). As long as productivity in the tradable sector

is higher, countries have an incentive to keep the

relative price of tradable goods high enough to make

it attractive to move resources into their production.

Consequently, a low real exchange rate is required to

support the production of tradable goods.

It should be noted that the impact of the real

exchange rate on economic growth per capita in the

medium term is still unresolved.

3 DATA AND METHODOLOGY

Currently, in conditions of economic instability, the

exchange rate is a key indicator of economic

development, especially in the external sector of the

economy, and managing it is one of the main goals of

the country's monetary and foreign exchange policy.

In this context, the effective management of the

national currency is timely, which affects the growth

of inflation, trade balance, capital, financial stability

and the country's economy as a whole. Despite being

unstable due to external economic and financial

shocks, the structure of the economy of the Republic

of Tajikistan is mainly focused on import

substitution, since the traded goods of domestic

producers are closely related to the purchasing power

of the national currency.

To achieve the NDS goals until 2030, it is

necessary to determine the impact of exchange rate

dynamics on economic growth, which is one of the

main tasks of the state and creates favorable

conditions for the development of domestic

production, which can help create sustainable

employment and the development of the country's

economic sector.

Therefore, given the use of the real effective

exchange rate indicator, the NBT can ensure efficient

and optimal allocation of foreign exchange to the

private sector.

Maintaining the growth of production, the choice

of the exchange rate regime, is an important issue of

monetary policy. Consequently, according to the IMF

methodology for managing the foreign exchange

market of the Republic of Tajikistan, the exchange

rate classification system was implemented in order

to regulate the exchange rate.

The choice of the exchange rate regime and

foreign exchange transactions in the country also has

implications for the economic growth of the Republic

of Tajikistan (Khikmatov and Sayfullozoda, 2019).

As noted, the impact of monetary policy in the

real sector of the economy occurs through the money

supply. To assess the velocity of money circulation,

the theory of the amount of money was used

(Keynes, 2018).

Monetary policy cannot directly control prices,

and its impact is associated with increased volatility

in interest rates, which lead to increased demand for

money, and a lack of money supply. The mechanism

of influence of monetary policy is associated with the

growth rate of the money supply and the activation of

the interest rate. As a result, it affects the equilibrium

of the real effective exchange rate. The money that is

not in the banking system can cause inflation to rise.

Therefore, the real effective exchange rate is a key

relative price in the economy, which gives economic

agents signals on how to optimally use factors of

production between goods and the provision of

services. In addition, the real effective exchange rate

shows how the structure of the economy should adapt

to the external environment in the medium term.

Unlike bilateral nominal exchange rates, the real

effective exchange rate is not directly observable,

highlighting the need for valuation techniques to

calculate it.

In this analysis, the estimated REER was used as

an exogenous variable. It should be noted that the

methodology for calculating this indicator is given in

more detail in the work of Turakhonzoda et al. (2017).

According to theoretical analysis, the impact of

the exchange rate on GDP should be significant, but

in the case of Tajikistan, the impact of the exchange

rate on GDP is insignificant. Therefore, the real

effective exchange rate was used as an influencing

factor due to its high impact on GDP.

Consequently, in addition to the REER, the

economy of Tajikistan is highly dependent on

investment, which has a significant impact on GDP

growth.

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

242

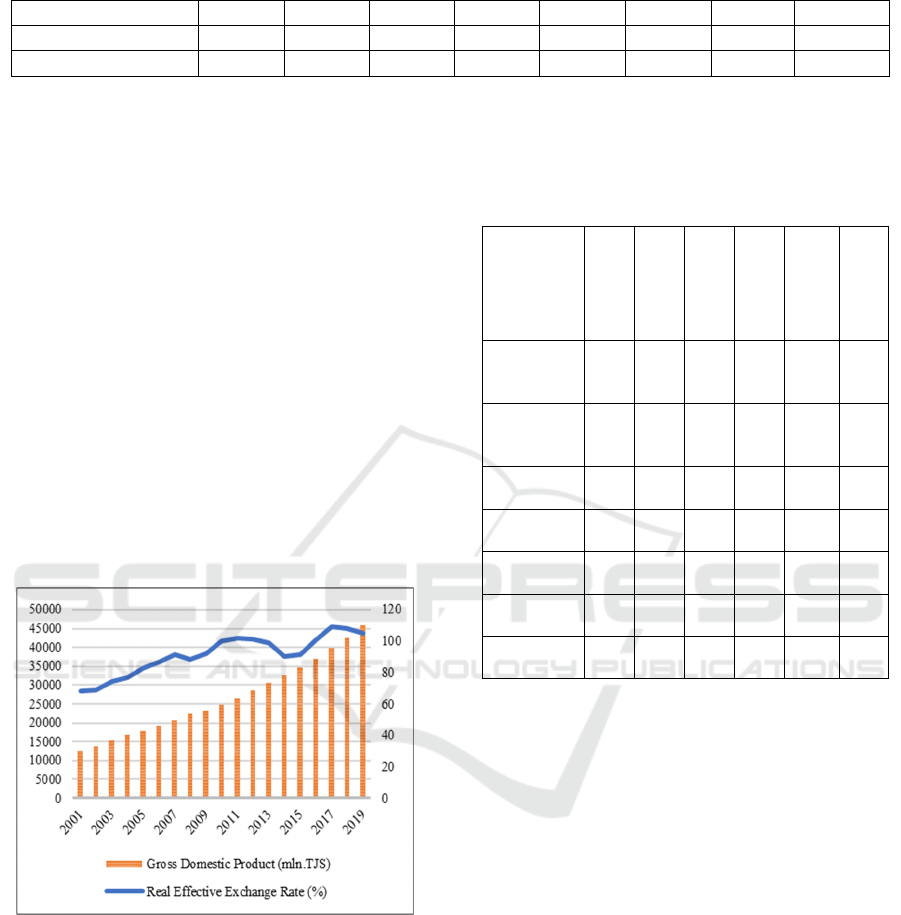

Table 1: Statistics of Macroeconomic Indicators.

Indicators 2001 2005 2010 2015 2016 2017 2018 2019

GDP (mln. TJS) 12601.8 17938.7 24704.7 34650 37057.9 39670.8 42447.7 45900.5

Investment (mln. TJS) 155.2 623.4 5891.6 13973.9 16944.1 20398.4 24200 25783.9

Therefore, an equation was created to show the

functional relationship of real GDP (base year 2010)

with REER and investment (base year 2010) based on

historical data (Table 1).

Real GDP was used as an endogenous variable,

and REER and investment were used as exogenous

variables (equation 1).

𝑌𝛼𝛽

𝑅𝐸𝐸𝑅 𝛽

𝐼𝑒, (1)

where, Y- real GDP, REER- real effective

exchange rate, I-investment.

For the period 2008, 2013-2014 and 2016

weighted relative prices declined relative to foreign

prices, stimulating domestic producers. Therefore,

between 2009 and 2012 there is an increase in REER

at the level of 101.64%. After this period, since 2013,

the volatility of this indicator of ±10% has been

observed (Figure 1). It should be noted that the main

influencing factors that lead to the volatility of the

REER are the global financial crises.

*

Source: author's calculation according to the official data of

the Statistical of the Republic of Tajikistan

Figure 1: GDP in constant prices and REER for the period

2001-2019.

The REER trend shows that for the periods 2002-

2007, 2008-2009. and 2015-2017 weighted relative

prices were strengthened against foreign currencies,

so it can be argued that domestic producers were

uncompetitive in the domestic and foreign markets

(Figure 1).

Since 2015, the structure of exports has changed

significantly and has led to an increase in exports. The

reason for the increase in exports is the positive

change in tradable commodities such as minerals,

electricity and cement (Table 2).

Table 2: Structure of Exports by commodity (2001 to 2019).

Export

structure

2010

2015

2016

2017

2018

2019

Aluminum

primary,

%

62 24 23 17 18.6 15

Ore

concentrat

es, %

- 17 27 33 37.3 25

Cotton

fibe

r

, %

17 16 14 10 15.4 12

Electricity,

%

- 6 6 5 7.2 8

Cement, % - 0.0

1

2 4 6.1 5.8

Other

goods, %

21 37 28 31 15.5 34

Total, % 100 100 100 100 100 100

Table 2 shows that aluminum production

decreased from 398.4 million USD in 2001 to 173.2

million USD in 2019, and in recent years there has

been an increase in ore concentrates, reaching up to

296.9 million USD in 2019, and cement production

increased to 68.1 million USD in 2019.

In order to assess the reason for the change in the

structure of exports and the impact of the exchange

rate on economic growth, the real effective exchange

rate can be used as an influencing factor.

The change in the volume of exports over the past

5 years has reached an average of 7.3%. It should be

emphasized that in 2018, compared to 2017, it

decreased by 10%, and compared to 2015, it

increased by 21%, and the change in the volume of

imports increased from 2,564.9 million somoni in

2002 to 14,004.9 million somoni in 2008 and 26676.2

million somoni in 2014.

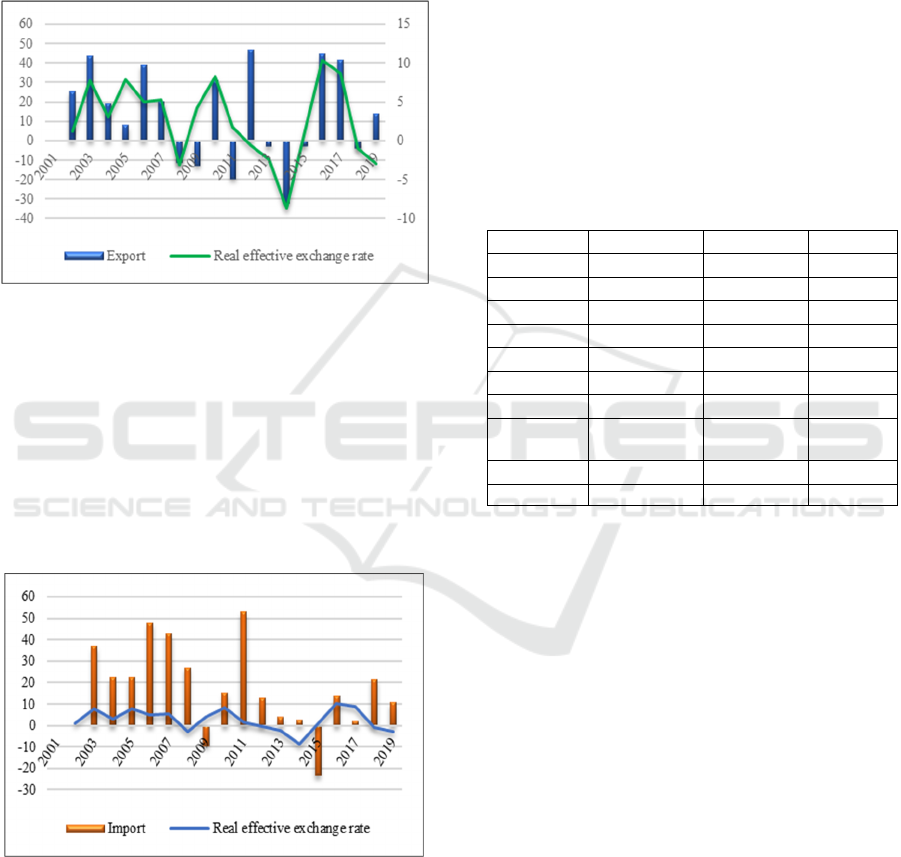

According to the REER and export trends for the

period 2016-2019. it can be argued that the real

effective exchange rate stimulated the turnover of

The Impact of Exchange Rate on GDP: In Case of Tajikistan

243

domestic producers and led to an increase in exports

(Figure 2).

The appreciation of the real exchange rate in cases

of high inflation has a negative impact on the current

account, as real effective exchange rate indices are

weighted averages of exchange rates that show

fluctuations in the bilateral nominal or real exchange

rate.

*

Source: author's calculation according to the official data of

the Statistical of the Republic of Tajikistan

Figure 2: Export growth rate (million TJS) and REER

growth rate (2002-2019).

Figure 2 shows that changes in exports and REER

in 2008, 2013, 2014 and 2018 are negative, while in

other years these indicators are positive. This means

that changes in export growth rates are closely related

to REER growth rates. Thus, it was revealed that the

rate of change of the real effective exchange rate

reaches ±10%.

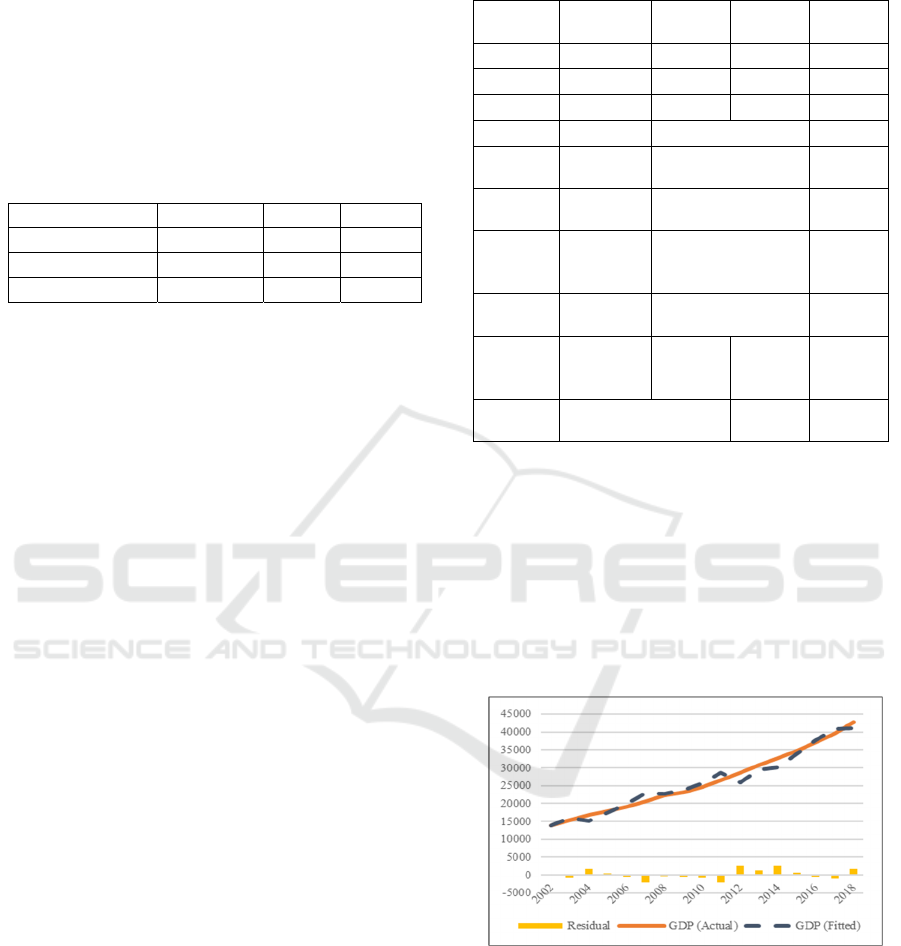

*

Source: author's calculation according to the official data of

the Statistical of the Republic of Tajikistan

Figure 3: Import growth rate (million TJS) and REER

growth rate (2002-2019).

And also, the change in the REER has a

significant impact on the rate of change in imports.

Figure 3 shows that the dynamics of changes in

imports is gradually declining. It should be noted that

the trend of changes in exports and imports in 2009

and 2015 is opposite to the change in REER. It

follows that there are two main factors influencing the

growth of imports, these are the growth of domestic

demand and changes in relative prices. In this case,

the part of imports that depends on changes in relative

prices is considered through the REER. However, the

other part of the change in imports depends on

aggregate demand. Depending on the trend in imports

and REER, it can be argued that these indicators are

closely related.

Descriptive statistics were calculated for the

selected indicators, which have the following

properties (Table 3).

Table 3: Descriptive Statistics.

RGDP_2010 REER I

Mean 27695.44 92.11610 7117.791

Median 25618.75 91.86352 6264.306

Maximum 49113.52 109.4057 16371.93

Minimum 12601.80 68.21631 762.9205

Std. Dev. 11005.29 12.66114 4944.509

Skewness 0.434314 -0.507209 0.435215

Kurtosis 2.070750 2.189427 2.023606

Jarque-

Bera

1.348351 1.405062 1.425829

Probability 0.509577 0.495330 0.490213

Sum 553908.8 1842.322 142355.8

*

Source: author's calculation according to the official data of

the Statistical of the Republic of Tajikistan

Based on the descriptive statistics obtained, it can

be argued that Skewness (skewness coefficients) give

a measure of how symmetrical the observations are

around the mean. For a normal distribution, the

skewness is zero. In our case, the distribution of

RGDP_2010 and I has a positive skewness, i.e. the

distorted one is on the left, while the REER

distribution has negative skewness and the distorted

one is on the right.

Another indicator Kurtosis (coefficient of

kurtosis) shows that all the selected indicators in the

Table 3 have a flat-topped distribution.

To validate the tests of the normal distribution of

the time series, we need to take into account the

Jarque-Bera test and its Probability. These statistical

tests in our case indicate the possibility of a normal

distribution.

As a result, after checking the descriptive

statistics, we can use this data for analysis.

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

244

4 EMPIRICAL RESULTS AND

DISCUSSIONS

It should be noted that before performing the

regression analysis, we will check the relationship

between the selected variables (Table 4).

Therefore, the correlation between REER and I is

0.86, which indicates the absence of multicollinearity.

Table 4: Correlation of the Selected Indicators.

RGDP_2010 REER I

RGDP

2010

1.000000

REER

0.858732 1.000000

I

0.988896 0.860068 1.000000

*

Source: author's calculation

Thus, we can use the selected indicators in the

equation. As a result of the regression analysis, we got

the following result (equation 3).

𝑅𝐺𝐷𝑃

172.5503 ∗ 𝑅𝐸𝐸𝑅 1.60226 ∗

𝐼 𝐴𝑅1 0.63486 (3)

where, RGDP_2010-GDP (in constant price,

2010) and I-Investment (in constant price, 2010).

The coefficients of equation (3) shows that if the

REER increases by 1%, then real GDP in national

currency will increase by 172.55 million TJS, and if

investments increase by 1 million somoni,

respectively, GDP will increase by 1.6 million TJS. It

can be expected that, other things being equal, in a

country with a positive rate of change in the real

effective exchange rate, the depreciation of the

national currency will lead to an increase in the rate

of economic growth. And the depreciation of the

exchange rates of a country with a negative rate of

change in the real effective exchange rate can

negatively affect the foreign trade balance, which

impedes GDP growth. In fact, exchange rate

fluctuations have an impact on growth effects,

especially when the national currency depreciates.

Although this is indeed what we found in this

regression, i.e. the real exchange rate ratio has a much

greater impact on economic growth than other

factors.

Table 5 indicates that based on exogenous

variables (real effective exchange rate, investment),

GDP is predicted in real terms. The coefficient of

determination R2 is 0.97, which describes the quality

(accuracy) of the constructed regression model, and

the higher this indicator, the better the model

describes the initial data.

Table 5: Model Results.

Dependent variable: RGDP_2010

Variable Coefficient Std.

Erro

r

t-

Statistic

Prob.

REER 172.5503 26.14827 6.598917 0.0000

I 1.602256 0.281287 5.696171 0.0001

AR (1) 0.634863 0.236063 2.689378 0.0176

R-squared 0.972526 Mean dependent var 26252.53

Adjusted

R-s

q

uare

d

0.968601 S.D. dependent var 8831.200

S.E. of

regression

1564.873 Akaike info

criterion

17.70778

Sum

squared

resi

d

34283593 Schwarz criterion 17.85482

Log

likelihoo

d

-147.5161 Hannan-Quinn

criter.

17.72240

Durbin-

Watson

stat

1.631790

Inverted

AR Roots

.63

*

Source: author's calculation

Other statistics, such as the t-statistic, state that the

coefficients of the equation are significant and reject

the null hypothesis. In general, based on the result of

equation (3), it is possible to predict the GDP of the

Republic of Tajikistan in the medium term.

The result of the evaluation test for equation (3)

for real GDP, real effective exchange rate, and

investment using the adjustment process is shown in

Figure 4.

*

Source: author's calculation according to the official data of

the Statistical of the Republic of Tajikistan

Figure 4: Result of the Model of the Impact of the Exchange

Rate on GDP growth in the Republic of Tajikistan (for the

period 2001-2018).

A consequence of the analysis result for policy

formulation is that the government can provide access

to foreign exchange, especially for goods and services

that cannot be produced in the country.With the

establishment of an exchange rate, which is

The Impact of Exchange Rate on GDP: In Case of Tajikistan

245

exogenous, the inflation rate, the level of exports and

imports will be decided by the model as a target for

monetary policy. In addition, our economy is also

dependent on investment, and this factor was also

included in the model.

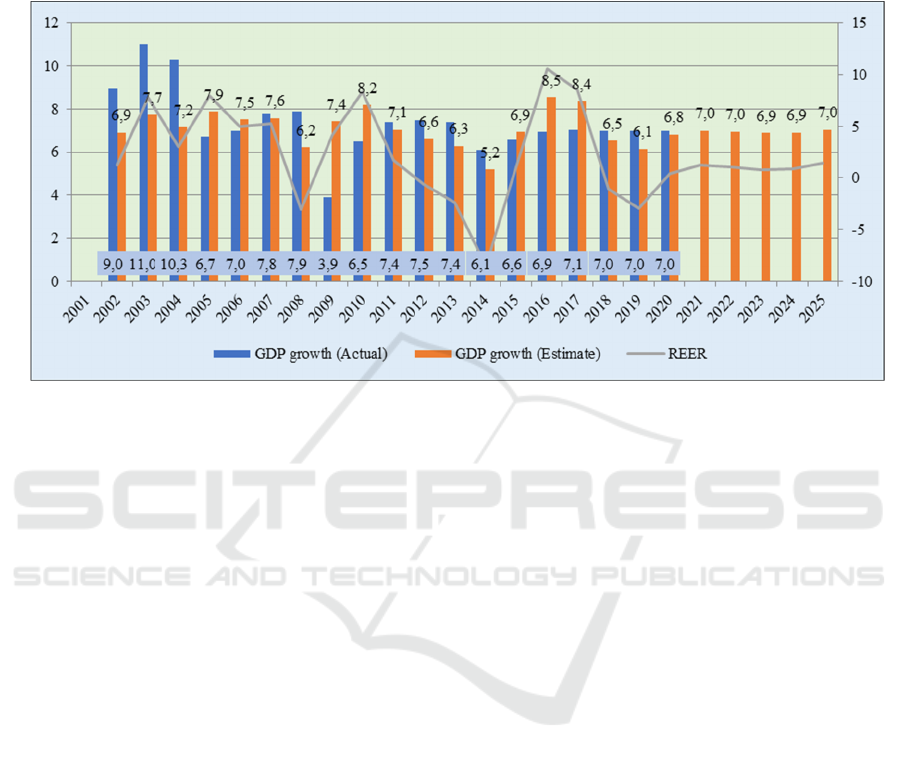

Accordingly, the forecast for real GDP growth

was obtained depending on the real effective

exchange rate and investment (Figure 5)

*

Source: author's calculations using annual statistics from the Agency for Statistics under the President of the Republic of

Tajikistan and the National Bank of Tajikistan.

Figure 5: GDP growth rates and Model Results (forecast for 2025).

5 CONCLUSIONS

Based on the analysis, it was revealed that there is a

positive relationship between the real exchange rate

and the growth of gross domestic product. In recent

years, due to the global financial crisis, managing

daily fluctuations in the exchange rate of the national

currency has made it difficult to apply the objective

of monetary policy. In this regard, the impact of the

monetary policy of the Republic of Tajikistan on the

real sector of the economy was determined by

choosing the exchange rate regime. Since the role of

monetary policy in sustainable growth is price

stability, monetary policy cannot directly control

prices and its influence occurs through increased

volatility of interest rates, which, as a result, lead to

an increase in the demand for money and a shortage

of money supply. It is known that in a developing

economy, the growth rate of money demand is faster

than the growth of gross domestic product and this

leads to an increase in the growth rate of money

supply and activates the growth of the interest rate.

Therefore, the Central Bank can achieve its goal in

the process of determining inflation through the effect

of the mechanisms of influence of monetary policy

The result of the analysis, using the real effective

exchange rate, which is periodically assessed by the

NBT, can ensure efficient and optimal allocation of

foreign exchange to the private sector. In addition,

this strategy can help create sustainable employment

and the development of a country's economic sector,

which can often serve as an engine of growth and

development.

Based on the obtained model results, it can be

argued that the proposed methods and approaches for

econometric modeling of the impact of the national

currency exchange rate on the dynamics of the gross

domestic product of the Republic of Tajikistan as a

whole ensure an increase in the efficiency of

monetary and foreign exchange policy, production,

trade, government revenues and ensuring economic

development. The result of the model shows that the

economic growth of the Republic of Tajikistan

reaches 7% on average, of which about 0.17% is due

to the increase of the real effective exchange rate.

6 POLICY IMPLICATIONS

In order to ensure the effectiveness of monetary and

exchange rate policies, it is recommended that:

- Introduction into practice of the model of gross

domestic product, depending on the real effective

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

246

exchange rate and investment for the choice of

monetary policy.

- implementation of the proposed model of the

influence of the exchange rate on the dynamics of the

gross domestic product in order to choose a monetary

policy, which makes it possible to substantiate the

influence of monetary policy on the exchange rate,

the external sector and the growth of gross domestic

product.

REFERENCES

Alidzhanov, D.A., 2016. Monetary mechanisms to

stimulate import-substituting economic growth in the

Republic of Tajikistan. Economic Journal. - M. No. 3

(43), 12-29.

Ashurov, N., Safarov, K., 2019. The role of Banks in

Macroeconomic Stabilization of Economy of Republic

of Tajikistan. Bulletin of the Tajik National University.

A series of socio-economic and social sciences. No. 2,

89-94.

Camba-Crespo, A., García-Solanes, J., Torrejón-Flores, F.,

2021. Current-account breaks and stability spells in a

global perspective. Applied Economic Analysis.

Chen, J., 2012. Real exchange rate and economic growth:

evidence from Chinese provincial data (1992-2008).

Paris –Jourdan Sciences Economiques, 48 BD Jourdan-

E.N.S-75014 Paris.

Conrad, D., Jagessar, J., 2018. Real exchange rate

misalignment and economic growth: The case of

Trinidad and Tobago. Economies, 6(4), 52.

Davlyatov, A.J., 2011. Mechanisms for the implementation

of monetary policy in ensuring macroeconomic

stabilization (on the example of the transitional

economy of the Republic of Tajikistan). PhD

dissertation. Dushanbe, 1-24.

Enu, P.A.O.P., Opoku, F.O.G.C., 2013. An econometric

analysis of the relationship between GDP growth rate

and exchange rate in Ghana. Journal of Economics and

Sustainable Development Vol.4, No.9.

Evans, O., Saibu, O., 2017. Quantifying the Impact of

Monetary and Exchange Rate Policies on Economic

Diversification in Nigeria. Nigerian Journal of

Economic and Social Studies, 59 (1), 131-152.

Fofanah, P., 2020. Effects of exchange rate volatility on

trade: Evidence from West Africa. Journal of

Economics and Behavioral Studies, 12(3 (J)), 32-52.

Huong, D.T.M., 2019. Real Exchange Rate and Economic

Growth: An Empirical Assessment for Vietnam. Asian

Economic and Financial Review, 9(6), 680–690.

Huong, T.T.X., Nguyen, M.L.T., Lien, N.T.K., 2020. An

empirical study of the real effective exchange rate and

foreign direct investment in Vietnam. Investment

Management & Financial Innovations, 17(4), 1.

Keynes, J.M., 2018. The general theory of employment,

interest, and money. Springer.

Khikmatov, U.S., Sayfullozoda, S., 2019. Theoretical

aspects of the essence of foreign exchange transactions

in commercial banks of Tajikistan. Labor and Social

Relations. No. 2, 136-149.

Krekó, J., Oblath, G., 2020. Economic growth and real

exchange rate misalignments in the European Union.

Acta Oeconomica, 70(3), 297-332.

Krugman, P., 2014. Currency regimes, capital flows, and

crises. IMF Economic Review, 62(4), 470-493.

National Development Strategy of the Republic of

Tajikistan for the period up to 2030, December 1, 2016,

No. 636. - Dushanbe, - 86 p.

Paun, C.V., Musetescu, R.C., Topan, V.M., Danuletiu,

D.C., 2019. The Impact of Financial Sector

Development and Sophistication on Sustainable

Economic Growth. Sustainability. 11(6): 1713.

Reinhart, C.M., 2002. Credit ratings, default, and financial

crises: evidence from emerging markets. World Bank

Economic Review, 16(2), 151-170.

Rizokulov, T.R., Azizbaev, R.A., 2018. Analytical look at

the factors of non-payment in the economy of the

Republic of Tajikistan. Bulletin of TSULBP. Khujand,

No. 3 (76), 15-27.

Tarawalie, A.B., 2010. Real exchange rate behaviour and

economic growth: evidence from Sierra Leone:

economics. South African Journal of Economic and

Management Sciences, 13(1), 8-25.

Turakhonzoda, Sh.N., Gafurov, P.D., Parviz, Kh., 2018.

The Nominal and Real Effective Exchange Rate

Development in Tajikistan. Journal of Center for

Strategic Research under the President of the Republic

of Tajikistan, No. 2(61), 172-181.

Tursunov, I.B., 2017. Development of the export potential

of the Republic of Tajikistan within the framework of

regional integration. Bulletin of the Tajik National

University. A series of socio-economic and social

sciences. No. 2/1, 143-147.

The Impact of Exchange Rate on GDP: In Case of Tajikistan

247