Research on the Reform of Enterprise Financial Analysis in the Era

of Great Wisdom Propelling Clouds

Xinyue Peng

1

and Zhiwei Zhang

2

1

Southwest Petroleum University, Nanchong, Sichuan, China

2

Intelligent Financial Technology and System Key Laboratory of Nanchong City, Southwest Petroleum University,

Nanchong, Sichuan, China

Keywords: Great Wisdom Propelling Clouds, Change Analysis, Path Research.

Abstract: Along with the further development of our social economy and science and technology, "Big Data",

"Intelligence", "Mobile Internet" and "Cloud Computing" (hereinafter referred to as "Great Wisdom

Propelling Clouds ") has become the main theme of today's era. The birth of these technologies provides a

breeding ground for new development concepts, the cradle of incubating new reform strategies. This paper

first explains the definition of Great Wisdom Propelling Clouds, and then through the study of the

limitations of the current enterprise financial analysis, so as to find out the opportunities and challenges

brought to the enterprise financial analysis in the era of Great Wisdom Propelling Clouds. Based on this, the

direction of the reform path is put forward for the financial analysis of the enterprise. Finally, specific

results the enterprise reform are expounded. This paper makes an in-depth analysis of the content and form

of financial management of enterprises, which provide a theoretical reference for enterprises to implement

financial analysis of big data enterprises and have certain practical significance.

1 INTRODUCTION

"Great Wisdom Propelling Clouds ", as the name

suggests, refers to the era of "big data",

"intelligence", "mobile Internet" and "cloud

computing". With the progress of national science

and technology and the development of social

productivity, the concept of "Great Wisdom

Propelling Clouds" was first proposed at the China

Internet Conference in August 2013. (Cao 2017)

Then at the 2014 China Internet Conference, Wu

Hequan said that with the arrival of the era of "Great

Wisdom Propelling Clouds," social economy will

face new challenges and create a new trend of

integration. Under a series of documents issued by

the central government to promote China 's financial

informatization, enterprises around the country have

adopted ' big data ', ' intelligent ', ' cloud computing '

and other technologies to carry out financial

management of enterprises, which has accelerated

the pace of the era of ' Great Wisdom Propelling

Clouds ' and also produced new challenges to

traditional financial management.

Big datum refers to a collection of nouns that are

far more complex than conventional data in terms of

capture, storage, and analysis. It has five

characteristics: large scale, high-speed circulation,

diverse value types, low value density, and

authenticity. Intelligentization also includes the

combination of the Internet and the Internet of

Things to meet all kinds of human needs. Mobile

Internet integrates communication and Internet to

realize communication anytime and anywhere.

Cloud computing refers to splitting the huge data

into small parts and reprocessing through the system

to achieve the final purpose of calculation.

Through the research on the current situation of

enterprise financial analysis, it is found that

enterprises face many challenges in financial

analysis, such as difficult to use existing technology

to analyze and process massive data, insufficient

data sources, single analysis method, one-sided

analysis and so on. In the era of great intelligence

and cloud shift, traditional financial analysis is

bound to be innovated to conform to the

development of the time. The establishment of big

data financial analysis platform for enterprises can

not only realize data sharing in domestic and foreign

industries, timely access to macro and micro policy

information, but also realize real-time

decision-making and future trend analysis, improve

Peng, X. and Zhang, Z.

Research on the Reform of Enterprise Financial Analysis in the Era of Great Wisdom Propelling Clouds.

DOI: 10.5220/0011350500003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 831-839

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

831

the efficiency and influence of financial analysis,

and then provide strong support for managers to

make scientific decisions.

2 IMPACT ON ENTERPRISE

FINANCIAL ANALYSIS IN THE

ERA OF GREAT WISDOM

PROPELLING CLOUDS

2.1 Limitations of Current Enterprise

Financial Analysis

2.1.1

Limitations of Data Sources

Enterprise financial analysis is based on enterprise

financial report information, internal accounting

report information and other related information.

This kind of information has three specific forms.

The first is the most original paper file data. The

second is the data recorded by accountants in

Internet memory, and the third is the logical

structure that can be inferred between these data,

which are also a special type of data. (Hu 2018) The

above three types of data are all structured data.

Although they come from a high degree of

reliability within the enterprise, the number of data

is very small, and most of these data are historical

data, which is of little reference value to the present.

In this case, the first step of financial analysis cannot

effectively obtain the source of data, so it is difficult

to continue the effective evaluation and reasoning.

Moreover, based on the asymmetry of information,

enterprises will appear adverse selection and moral

hazard. It is difficult for enterprises to master the

data information of other competitors in the same

industry, and it is difficult to obtain valuable

resources for enterprises themselves in public

limited data. Therefore, the limitation of data

sources has become one of the obstacles to financial

analysis.

2.1.2 Limitations of Professional

Thinking

For the managers of most enterprises, it is their

vision to maximize shareholder wealth. Therefore,

most of them only pay attention to the indicators of

operating income and operating profit, while

ignoring the importance of financial analysis for

enterprise development. For small-scale or growing

enterprise financial workers, Financial analysis of

the enterprise is carried out by relying solely on a

few financial statements and limited internal data,

and the conclusions are reported to managers. Thus,

the analysis made when the enterprise financial

personnel do not fully grasp the specific financial

situation of the enterprise may have relatively large

errors with the actual situation. Such financial

analysis has no reference value for enterprises. With

the further development of enterprises and the

gradual maturity, the market has higher and higher

requirements for enterprises, and the requirements of

enterprises for internal financial analysts should also

be improved. For the traditional financial personnel,

it is difficult to continue to carry out effective

financial analysis and put forward constructive

suggestions or solutions for enterprises if they only

master the basic knowledge they have

learned before,

so they are self-contained and no longer further

study and improve. Therefore, breaking the

limitation of professional thinking is also an

important means for the survival and development

of enterprises in the era of Great Wisdom Propelling

Clouds.

2.2 Opportunities and Challenges

Brought to the Financial Analysis

of Enterprises in the Era of Great

Wisdom Propelling Clouds

2.2.1 The Arrival of the Era of Great

Wisdom Propelling Clouds Can

Bring New Opportunities for

Enterprise Financial Analysis

As mentioned above, the traditional financial

analysis of enterprises is mostly based on internal

data such as financial statements. These data are

mostly static structural historical data, which have

low reference value for financial analysis of

enterprises. Therefore, the limitations of data

sources are a major constraint for financial analysis

of enterprises. However, with the advent of the era

of Great Wisdom Propelling Clouds, the use of big

data, the Internet, the Internet of Things, cloud

computing and other means can accurately and

quickly mine and capture more effective dynamic

data, which greatly improves the accuracy and

availability of data, and has more reference

significance and use value for evaluating various

financial indicators of enterprises. Of course, for the

operation of intelligent cloud computing, the

requirements for financial workers are also

increasing. Therefore, the status of financial analysis

in the financial management of enterprises is also

increasing, and financial workers are increasingly

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

832

favored by managers. This has laid a good

foundation for enterprises to establish specific

analysis departments or analysts, and played a

certain role in improving the management

organizational structure and optimizing the

allocation of resources. (Wang 2017)

2.2.2 The Arrival of the Era of Great

Wisdom Propelling Clouds Can

Bring New Challenges to Corporate

Financial Analysis

In order to make full use of the Internet, big data,

cloud computing and other tools to contribute to the

financial analysis of enterprises, the corresponding

supporting hardware facilities of enterprises also

need to be further followed up. However, the R & D

expenditure and cost of hardware facilities are a

large amount of expenses that enterprises need to

consider. Moreover, the software for data processing

and processing that meet the needs of enterprises is

not yet mature, which cannot be adapted to local

conditions and used in accordance with the time.

Secondly, financial analysis in the era of Great

Wisdom Propelling Clouds has certain professional

requirements for operators. Firstly, the gap of

professional and technical talents cannot be

compensated. Financial analysis talents are still the

major colleges and universities should focus on

training. For the financial workers who have been

employed, they are faced with the dual test of

strengthening their professional knowledge and

constantly learning big data intelligent financial

technology. Therefore, it brings new opportunities in

the era of Great Wisdom Propelling Clouds, but also

brings new challenges to enterprises.

3 CONSTRUCTION OF

ENTERPRISE FINANCIAL

ANALYSIS PLATFORM

STRUCTURAL SYSTEM IN

THE ERA OF GREAT WISDOM

PROPELLING CLOUDS

3.1 Platform Function Settings

3.1.1 Financial Index Analysis

The purpose of building a financial analysis

platform is to analyze financial indicators more

effectively, which requires that the platform

structure system can comprehensively cover the four

basic financial indicators, and can focus on

reflecting different financial conditions, providing

information related to decision-making for internal

information users such as enterprise managers and

external information users such as investors and

creditors. In the traditional financial analysis,

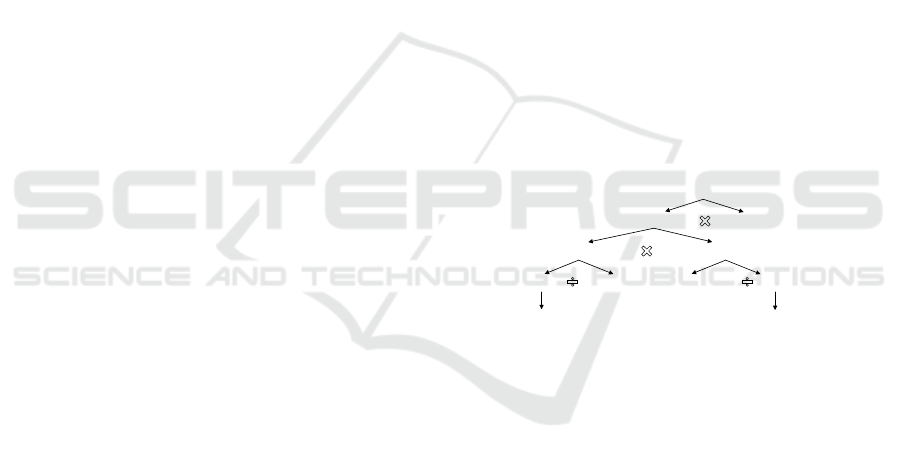

enterprises often use the DuPont analysis system

method (Figure 1). In this method, enterprises

decompose the equity net interest rate into the

product of sales net interest rate, asset turnover rate

and equity multiplier, so that the complex indicators

can be decomposed into specific and feasible

indicators. It provides a valuable reference for

investment and financing decisions of enterprises

from two aspects of business leverage and financial

leverage. However, the DuPont analysis system

method also has some shortcomings. Firstly, this

method focuses on the analysis of financial

information and ignores the impact of non-financial

information on enterprises, such as consumers and

suppliers. Secondly, this method is applicable to

short-term business decisions, but not to long-term

strategic decisions. In addition, DuPont analysis

system is based on the analysis of historical data,

which cannot meet the needs of future

decision-making for growing enterprises.

net interest rate

net interest rate equity multiplier

n

et profit on net sale Asset turnover rate

profit Sales revenue Sales revenue Total assets

Sales revenue-all costs + other

profits-income tax

Long-term assets +

current assets

Figure 1: Diagram of DuPont Financial Analysis System.

In the era of Great Wisdom Propelling Clouds,

intelligent enterprises based on big data can break

through the blind spots and omissions in the past

methods one by one on the basis of the existing

financial analysis methods, increase the

management of non-financial information such as

consumers and suppliers, and adjust the financial

analysis system in time in combination with the

constantly updated data in the development of

enterprises, so as to continuously improve and

progress the financial analysis system. Based

on this,

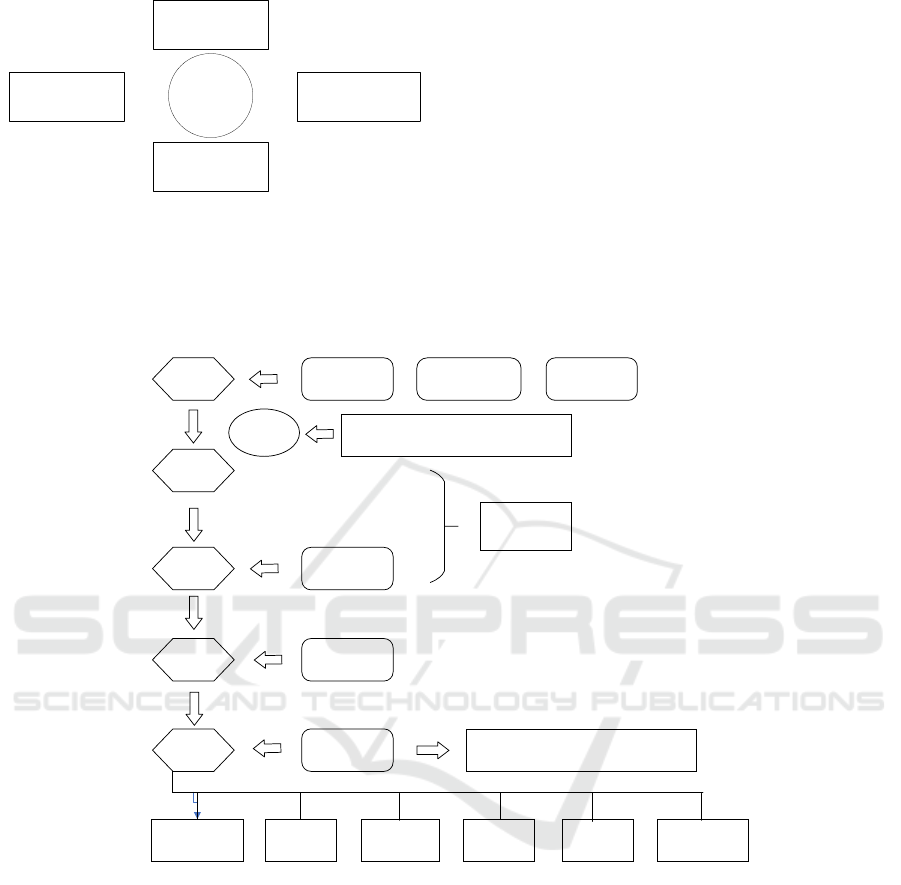

enterprises can consider combining with the

balanced scorecard in corporate strategy (Figure 2)

to grasp the overall financial analysis of enterprises

from four aspects: finance, customers, internal

business processes, learning and growth. (Wang

2017)

Research on the Reform of Enterprise Financial Analysis in the Era of Great Wisdom Propelling Clouds

833

Learning and

growth

customer

finance

Internal

business process

Vision

and

strategy

Figure 2: Balanced Scorecard.

3.1.2 Financial Decision Analysis

Traditional financial decision-making analysis is

generally carried out in qualitative and quantitative

aspects by financial staff based on the above various

indicators and parameters, combined with their own

experience accumulated in many years of work.

Today, in the era of Great Wisdom Propelling

Clouds, enterprises can obtain various data from

mobile Internet, Internet of Things and other

channels, including structured data, semi-structured

data, unstructured data, and upload the collected

data to the data center of cloud computing platform

for big data processing, and then analyze data. It

provides feasible reference data for enterprises to

make a series of financial decisions such as

enterprise budget management, financing decision,

investment decision, production decision, pricing

decision and cost decision. (Figure 3)

Data

Sources

data

center

data

processing

Structured

data

Semi-structured

data

Unstructured

data

Big data

processing

Analysis

support

policy support

channel

Mobile Internet, Internet of Things,

Social Network

data

analysis

Financial

decision

Cloud

computing

platform

Text analysis and search, smart

business, etc.

Budget

management

Financing

decision

Investment

decision

Production

decision

Pricing

decision

Cost decision

Figure 3: Flow chart of enterprise financial decision analysis.

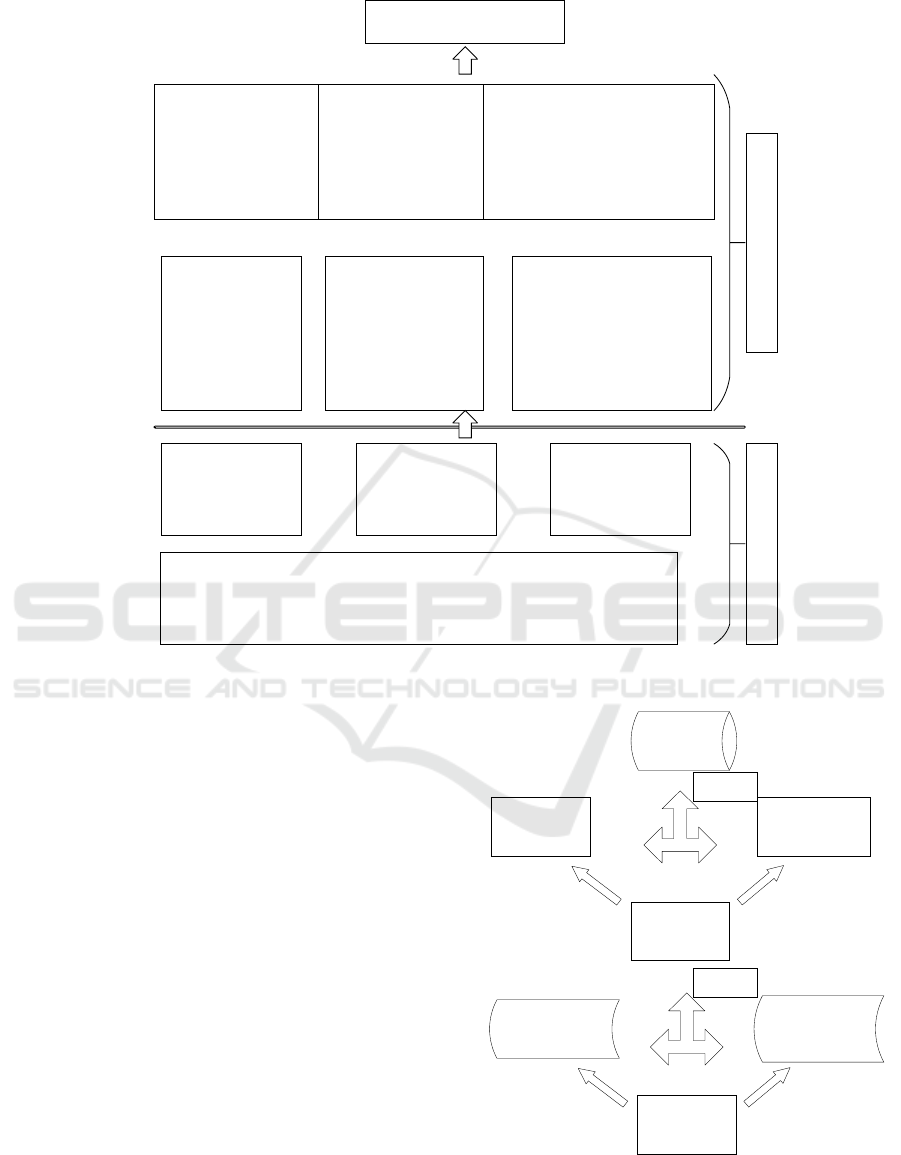

3.1.3 Financial Forecast Analysis

Financial forecast is the premise for enterprises to

prepare financial budgets. The traditional financial

forecast mostly combines certain methods and

principles, and uses cost behavior analysis,

cost-volume-profit analysis model and other

methods to predict the future of enterprises,

including sales forecast, cost forecast, profit forecast

and capital demand forecast. In the era of Great

Wisdom Propelling Clouds, enterprises can combine

financial indicators such as liquidity, profitability,

solvency and market value with non-financial

indicators such as ownership structure and the

composition of board of directors and board of

supervisors on the basis of mastering their own

financial status, operating ability, corporate

governance and other original information, so as to

realize the transformation of enterprise financial

analysis from static analysis to dynamic analysis.

(Figure 4)

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

834

Early warning analysis of

enterprise financial dynamics

Liquidity status

Current ratio

Quick ratio

Inventory turnover

Accounts Receivable

Turnover Rate

Liquid assets turnover rate

Turnover rate of fixed assets

Profitability status

Roe

Net profit rate

Net assets growth rate

Operating income growth

rate

Operating profit growth rate

After-tax profit growth rate

Ownership structure

Types of actual shareholders of listed companies

The largest shareholder's shareholding ratio

The sum of the shareholding ratios of the top five

major shareholders of the company

The ratio of the company's largest shareholder to

the second largest shareholder

Solvency status

Assets and liabilities

Inventory current

debt ratio

Cash flow debt ratio

Cash debt ratio

Debt-to-capital ratio

Composition of the Board

of Directors and the Board

of Supervisors

Board size

Supervisory board size

Shareholding ratio of the

board of directors

Shareholding ratio of the

board of supervisors

Market value analysis

Earnings per share

Net assets per share

Operating income per share

P/E ratio P/B ratio P/S ratio

Capital adequacy ratio

Financial and non-financial indicators

Financial status

income

cost

Profit etc.

Operating conditions

Production and sales

Procurement,

research and

development, etc.

Corporate Governance

Ownership structure

Board composition

Governance

mechanism, etc.

environment

Macro (politics, law, economy, technology, culture, nature, etc.)

Micro (materials, energy, capital, labor, consumption preferences, etc.)

Original information

Figure 4: Flow chart of financial forecast dynamic analysis.

3.2 Platform Structure System Design

3.2.1 Data Collection Layer

Traditional financial analysis only takes financial

information into the scope of data collection, but

ignores non-financial information. On the basis of

the data in the data collection layer designed by the

structural system of the financial analysis platform,

the collection of non-financial information is added,

and the structured data and unstructured data are

collected together. The original vouchers, books,

sales contracts, shipping orders and other data

information are uploaded through the internal

network of the enterprise. At the same time, the data

information related to the enterprise is collected and

stored in the data warehouse in the external social

network, and the traditional data collection scope is

expanded to make the data collection more

comprehensive. (Figure 5)

database

Intranet

Corporate

external

network

Original

documents

Structured

data

Unstructured

data

storage

Obtain

Original

documents

Figure 5: Flow chart of business data collection.

Research on the Reform of Enterprise Financial Analysis in the Era of Great Wisdom Propelling Clouds

835

3.2.2 Data Storage Processing Layer

After storing the collected data in the data

warehouse, large amounts of data need to be

processed effectively. The data processing

technologies adopted by different data types are also

different. Firstly, for structured data, using Shared

Nothing architecture, the data are divided into high

value density data and low value density data,

combined with the Massively Parallel Processor

(MPP) system for large-scale parallel processing,

which has the characteristics of non-sharing

resources. Secondly, for unstructured data,

HADOOP technology is used to store massive data

with HDFS, and calculates on MapReduce. In this

way, we can combine HADOOP technology (Ma

2019) with the new database to process different

types of data. (Figure 6)

Classification

application

Structured

data

Unstructured

data

New

database

HADOOP

Structured

data

Unstructured

data

High-value

density data

Low-value density

data

Figure 6: Core technology of big data processing

3.2.3 Security Architecture

In the era of Great Wisdom Propelling Clouds, it is

more convenient to obtain information, but also

brings a series of problems in data security. When

constructing the system of enterprise financial

analysis platform, the security architecture of

information should be included, which can be

constructed from six aspects: physical security,

system security, network security, application

security, data security and management security. For

example, in the design of data security, the access to

data can be controlled by means of fingerprint or

facial unlocking, and graphic password input. In

addition, verification code or password input can be

carried out in data transmission to prevent data from

being stolen and lost, which makes the data control

the data security to a certain extent in the links of

storage, access and transmission.

4 THE TRANSFORMATION

PATH OF ENTERPRISE

FINANCIAL ANALYSIS IN THE

ERA OF GREAT WISDOM

PROPELLING CLOUDS

4.1 Ideological Level

In the era of Great Wisdom Propelling Clouds, both

managers and financial workers of enterprises

should change their way of thinking and cultivate

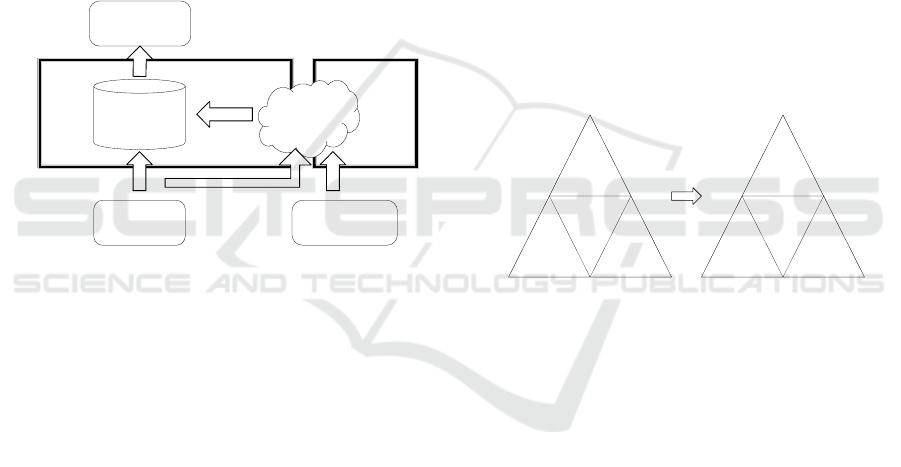

new ideas. Porter has proposed three competitive

strategies, including cost leadership, centralization

and differentiation. In the era of big intelligence and

cloud shifting, big data strategy has become the

fourth means of enterprise competition, and has an

impact on the other three competitive strategies to a

certain extent (Figure 7). Both business managers

and financial staff should be keen to detect market

dynamics, and make timely adjustments in their

respective areas for further strategic decisions.

Competitive

strategy

Centralized

Differentiation

Cost

leadership

Big Data

strategy

Centralized

Differentiation

Cost

leadership

Figure 7: Four new types of competitive strategies.

First of all, for business managers, they are the

helmsman of the enterprise, is the enterprise strategic

decision makers, business managers must first

establish the concept of enterprise big data intelligent

thinking, in the face of the emergence of new things,

timely reflect, quickly adjust the layout, analysis of

existing opportunities and threats, formulate the next

step of the development of the enterprise, take

advantage of the trend to lead the enterprise to a

higher level. If managers are satisfied with the status

qua and stagnate, they will lag behind the

development of society and eventually be eliminated

in the increasingly fierce market competition.

Secondly, for financial analysts, with the advent

of the era of Great Wisdom Propelling Clouds, the

further development of society has brought new

development space for enterprises and their own

development. At this time, we should be keen to

detect the changes in the wind direction of the

market, adjust and change the way of thinking, pay

attention to the use of big data intelligence in data

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

836

processing, and consciously cultivate their ability to

use the Internet for operation. This not only

improves their own business ability, but also

provides further protection for the accuracy of

corporate financial analysis.

4.2 Data Plane

4.2.1 Build a Data Warehouse

Traditional accounting records are in the process of

manually copying the current data to the original

vouchers and other paper documents and registering

books in accordance with the time sequence of the

brokerage business. If you want to view the original

data of a certain data, you must look up and look up

from all the accounting books in the warehouse in

turn. The difficulty and complexity of the process

can be imagined, the workload is large, the time is

long, and the search is difficult. Today, in the era of

Great Wisdom Propelling Clouds, this problem has

been solved optimally. Financial personnel

electronically all paper documents through financial

software such as Kingdee and Yongyou, which not

only makes the records of documents simple and

rapid, but also facilitates the collation, induction and

viewing of original data. Enterprises can also share

the data of electronic documents in real time,

reprocess the data horizontally and vertically, and

maximize the utilization of data according to the

needs of enterprises.

4.2.2 Revolutionizing Data Processing

Technology

Data processing is one of the most important links in

the financial analysis of enterprises. Data processing

provides a new direction of change and development

platform for data processing from the initial

handwritten books to the medium-term accounting

computerization, to the arrival of the era of Great

Wisdom Propelling Clouds. In the past, in the

traditional data processing, the enterprise financial

personnel needed to export the historical data

obtained from the financial software to Excel for

secondary processing. This method takes a long time

and a heavy workload, and the storage space is

limited, and the probability of error is also high.

With the help of big data, intelligent cloud

computing can help financial workers to quickly

process data, greatly accelerating the work

efficiency, and the accuracy and reliability of the

results are improved. It also saves time for financial

workers to carry out the next work and improves

work efficiency.

4.3 Knowledge Level

4.3.1 Train High-Quality Financial Staff

In the era of Great Wisdom Propelling Clouds, the

demand for enterprise financial workers is gradually

increasing, and the ability of financial workers is

gradually improving. Enterprises not only needs a

certain number of financial personnel, but also needs

to have solid professional skills, active thinking

mode, keen market insight, strong big data operation

level and specific analysis and problem solving

ability. At present, most of the enterprises in our

country have a huge gap in financial personnel, for

big data, intelligent financial analytical ability has

not yet been. This requires colleges and universities

to carry out certain reforms in the talent training

mode, set up as many accounting courses as

possible,

cultivate excellent financial analysts, and form an

intelligent financial analysis talented team in

enterprises.

4.3.2 Pay Attention to Dynamic Analysis

The traditional financial analysis of enterprises

mainly focuses on the static analysis of financial

indicators and structural data, while ignoring the

impact of non-financial indicators and non-structural

data on corporate financial management. In the era

of Great Wisdom Propelling Clouds, enterprises can

use big data to obtain non-structural data that cannot

be obtained before. The effective analysis of these

real-time updated data can realize the transformation

to dynamic analysis on the basis of static analysis,

so as to improve and supplement the shortcomings

and deficiencies in traditional financial analysis, lay

a good foundation for the intelligentization of

financial analysis, and realize the organic integration

of financial indicators and non-financial indicators,

structural data and non-structural data.

5 THE EFFECT OF CORPORATE

FINANCIAL ANALYSIS

REFORMS IN THE ERA OF

GREAT WISDOM

PROPELLING CLOUDS

5.1 Make It Possible to Analyze the

Impact of Macro and Micro

Factors

The analysis of enterprises from the perspective of

Research on the Reform of Enterprise Financial Analysis in the Era of Great Wisdom Propelling Clouds

837

corporate strategy includes the macro environment

and the micro environment. The macro environment

includes four factors: political and legal factors,

economic factors, social and cultural factors and

technical factors, also known as the “PEST analysis”

(Wang 2014) model. Porter believes that there are

five kinds of competitiveness in the industry from

the basic structure of the industry, namely: potential

entrants, buyers, substitutes, suppliers and

competitors in the existing industry, which is the

famous ' Porter ' s five forces analysis model. We

know that the traditional financial analysis is

difficult to effectively sort out and process the

factors of the macro environment and the micro

environment. In the era of Great Wisdom Propelling

Clouds, the collected factors are reprocessed through

the mobile Internet big data technology to further

analyze the financial situation of enterprises, so that

managers can more comprehensively understand the

internal and external environment of enterprises, so

as to make important strategic decisions conducive

to the development of enterprises. (Figure 8)

Enterprise

competitor

supplier

Potential

entrant

alternatives

Target

customers

Politics and

law factor

Economic

factors

Social and

cultural

factors

Technical

factors

Macro

environment

Micro-

environment

Figure 8: Macro and micro environments that affect the

development of enterprises.

5.2 Make In-depth Analysis Possible

The traditional financial analysis often occurs after

the event, while ignoring the beforehand and in the

event, which makes the financial analysis more use

of historical data as a reference, greatly reducing the

timeliness of financial analysis, making the analysis

only floating on the surface but not deep-seated

research. Based on big data is conducive to the

enterprise will be in-depth analysis, thorough, will

fully implement the financial analysis of business

management in advance, in and after the event, the

long-term analysis of the stage, the stage analysis of

real-time, and the long-term objectives of the

enterprise segmentation, including business

management activities, budget system, business

forecasting, strategic planning, these decomposition

goals are phased targeted one by one to complete,

add up to the company set the ultimate goal. (Figure

9)

long-term

3-5 years

Per year

Every season

every day

Company

goals

Strategic Planning

Business forecast

Budget system

Management activities

Figure 9: The relationship between corporate plans,

budgets, strategies, and goals.

5.3 Make It Possible to Analyze Future

Development Trends

In today ' s era of Great Wisdom Propelling Clouds,

the level of science and technology is rising rapidly.

The data acquisition, information collection,

processing and method strategy of financial analysis

should be effectively reformed under the big data

technology and keep pace with the time. Taking

consumer analysis as an example, nowadays

Taobao, Jingdong, Vipshop, Pinduoduo and other

shopping software are widely used, so that consumer

information can be easily obtained on the Internet.

According to the browsing records of consumers,

enterprises can join the product characteristics of

shopping carts, collect browsing data such as

consumer preferences, price acceptance, and pay

attention to the substitutability of products. Through

targeted analysis, it is found that the law behind the

characteristics, and can obtain information

beneficial to the development of enterprises, which

provide a reference for the next business strategy of

enterprises.

The traditional financial analysis is based on the

research of enterprise financial personnel using

historical data and the work experience of managers

themselves. The accuracy and reliability of the

results are not high. Nowadays, enterprises can use

the structural system of the financial analysis

platform to understand consumers’ psychology more

comprehensively and achieve their expected goals,

so that enterprises can stand out in the competition

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

838

for the same industry and increase the market share

to a certain extent.

6 CONCLUSIONS

With the rapid development of social productivity in

China, the innovation of science and technology has

become the core symbol of the new era. The

emergence of ' big data ', ' intelligent ', ' mobile

Internet ' and ' cloud computing ' has laid a solid

foundation for enterprise development and laid a

good start for social progress. Everything has two

sides, which bring opportunities and challenges to

enterprises. Under this premise, enterprises need to

keep up with the pace of the times. From managers

to financial workers, they should innovate and

change from the aspects of thought, data and

knowledge, make full use of the obvious advantages

brought by the era of big intelligence and cloud

shifting. On the basis of analyzing the development

ability of enterprises, new ideas, new technologies

and new strategies are constantly established to seek

greater development space for enterprises.

ACKNOWLEDGEMENTS

This paper is the research results of the 2019

municipal science and technology strategic

cooperation project “Research on intelligent

financial system based on big data background”

(project number: 19SXHZ0003). The research

results of the 2021 municipal science and

technology strategic cooperation project ' Research

on the expenditure control and early warning of

Nanchong administrative institutions based on

machine learning ' ( project number: SXQHJH017);

research results of the 2021 Municipal Science and

Technology Strategic Cooperation Project'

Application Research on Resource and Environment

Audit Based on Big Data Visualization Technology '

(Project Number: SXQHJH018 ); the research

results of the project funded by the Innovation and

Entrepreneurship Research Fund of Southwest

Petroleum University “Research on the construction

of practical teaching system of financial

management major based on innovation and

entrepreneurship education” (project number:

2021RW025); the research results of the new

engineering research and practice project of the

Ministry of Education’s “exploration and practice of

talent innovation and entrepreneurship training in

industry (oil) universities under the background of

new engineering” (project number:

E-CXCYYR20200943); research results of the

first-class undergraduate course cultivation project

of Southwest Petroleum University in 2020 (course

name: basic accounting); research on the

Construction of Group Financial Management and

Control Curriculum System Based on Financial

Sharing (No. 202101197005), a collaborative

education project between industry and education of

the Ministry of Education in 2021; the research

results of the collaborative education project '

Research on the construction of financial big data

practice teaching center' (project number:

201902162056) of the Ministry of Education in

2019.

REFERENCES

Cao Cuizhen, Wang Fukun. Research on the construction

of enterprise financial informatization under the

background of big intelligence shifting cloud [J]. Time

Finance, 2017 (26): 218 – 219.

Hu Shumin. Analysis of innovative ways of enterprise

financial management in big data environment [J].

Financial accounting learning, 2018 (09): 69.

Ma Lina. Problems and Countermeasures of Enterprise

Financial Management in Big Data Era [J]. Marketing,

2019 (43): 164-165.

Wang Bo. Challenge analysis and reform of enterprise

financial management under the background of big

data [J]. Accounting learning, 2017 (22) :7-8.

Wang Qianghong. The application analysis of enterprise

financial management information system in the big

data environment [J]. Bohai Rim Economic Outlook,

2017 (08): 16.

Wang Zhiquan. Big data era and enterprise financial

management transformation [J]. Financial and

accounting, 2014 (06 ): 74-75.

Research on the Reform of Enterprise Financial Analysis in the Era of Great Wisdom Propelling Clouds

839