Influence of New Development of Accounting Information Quality

Characteristics based on Hadoop on Enterprise Investment Efficiency

Xiaoqian Wang, Sixuan He and Yixi Zhang

*

Chongqing College of Architecture and Technology, Chongqing, China

Keywords: Big Data Technology, Accounting Information Quality, Enterprise Investment Efficiency.

Abstract: Based on big data analysis technology, Hadoop, MapReduce big data computing framework and HDFS

distributed file storage database are adopted to complete the construction of enterprise investment decision-

making system. With the help of big data technology and data processing characteristics, it provides necessary

technical support and theoretical basis for the secondary development of enterprises. Under the big data

technology, the enterprise investment decision-making system realizes the innovative development of the

quality characteristics of enterprise financial accounting information, so as to improve the enterprise

investment efficiency, and then have a certain positive significance to the enterprise's business performance,

and finally help the enterprise to develop more rapidly and comprehensively under the condition of

maintaining good operation.

1 INTRODUCTION

At present, the development of science and

technology is changing with each passing day, and

the development form of China's social economy is

also on the rise, especially the extensive application

of modern information technology, prompting

China's economic construction in all aspects have

made great achievements. At present, under the social

and economic system of our country, investment

behavior is one of the three core financial activities of

modern enterprises, which has an important impact

on the survival and development of enterprises.

Investment efficiency refers to the ratio between the

effective results achieved by an enterprise's

investment and the amount of input consumed or

occupied, that is, the proportional relationship

between the output and input of an enterprise's

investment activities (MBA think tank,

Encyclopedia, 2010). The change of enterprise

investment efficiency will be directly related to the

economic benefits of enterprises, but also will bring

great impact on the survival and development of

enterprises.

The research based on the theory of information

asymmetry and the principal-agent theory shows that

there is an inevitable connection between the quality

of enterprise accounting information and the

efficiency of enterprise investment. The enterprise

managers and decision makers decide the direction of

investment according to the content reflected in the

accounting information. At the same time, according

to the accounting information, the results of the

investment behavior are analyzed to determine

whether the investment is effective, and then make

decisions on the next investment. (

Ma, 2014

)

Therefore, the quality of enterprise accounting

information is the key to enterprise investment

behavior and an important factor affecting enterprise

investment efficiency. Enterprise accounting

information not only comes from the daily

production, operation, management and other

activities of the enterprise, but also contains the data

information related to external social environment,

policies and regulations. Under the traditional

enterprise operation mode, the acquisition of

enterprise accounting information only depends on

the analysis and processing of the data in the financial

statements, ignoring the impact of the external

environment and policies and regulations of the

enterprise. In addition, a lot of human work is needed

for data mining and processing of complex financial

data statements. Therefore, big data technology

innovation is applied to enterprise accounting

information processing to intuitively improve the

quality of accounting information, realize the

visualization of accounting information, so as to help

Wang, X., He, S. and Zhang, Y.

Influence of New Development of Accounting Information Quality Characteristics based on Hadoop on Enterprise Investment Efficiency.

DOI: 10.5220/0011356200003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 883-889

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

883

enterprise managers and decision makers make good

decisions on enterprise investment behavior, improve

the investment efficiency of enterprises, and finally

achieve the goal of long-term and healthy

development of enterprises.

2 ENTERPRISE INVESTMENT

EFFICIENCY AND

ACCOUNTING INFORMATION

QUALITY

2.1 Enterprise Investment Efficiency

The investment behavior of an enterprise can be

simply defined as an economic activity in which an

enterprise advances funds or other resources to a

business in order to obtain economic benefits. As a

key activity in the daily operation of enterprises,

investment activities aim to obtain more economic

benefits, and can effectively reduce the cost of

enterprises, and maintain the continuous progress and

development of enterprises. In the comprehensive

evaluation of investment activities, the standard of

investment efficiency is introduced to measure the

implementation effect of enterprise investment

activities, which also provides data support for

enterprise managers and decision makers to make

decisions.

There are external factors and internal factors that

affect the efficiency of enterprise investment. The

external factors include national system control and

government forced intervention. For example,

regional protection policies, preferential tax policies.

External factors also include the degree of market

perfection, such as the marketization and legalization

of social economy. The internal factors are more

complex than the external factors, because the

internal factors not only directly affect the investment

efficiency of enterprises, but also indirectly affect the

investment efficiency through the mutual influence of

different internal factors. Such as enterprise internal

control level, accounting information quality,

management characteristics. Among them, the

quality of accounting information directly reflects the

key information such as investment cash flow status,

enterprise debt ratio, and is related to the smooth

implementation of enterprise investment behavior.

And then affect the efficiency of enterprise

investment.

2.2 Enterprise Accounting Information

Quality

Accounting information quality is the sum of

characteristics of accounting information's ability to

meet explicit and implicit needs (

Wang, 2016

), and

its main role is to provide information needed for

decision-making for enterprise managers and

decision makers. Accounting information is an

important part of enterprise financial information.

Due to the complexity of its source and the

importance of its role, enterprise accounting

information shows many different quality

characteristics, such as relevance, authenticity,

timeliness, usefulness. These enterprise accounting

information quality characteristics are an important

standard to measure accounting information. In the

investment activities of enterprises, high-quality

accounting information can help enterprises

eliminate the information asymmetry between the

two sides of the investment, and help enterprises in

the distribution of cash flow and liabilities and other

aspects of unified management and planning, that is,

to provide help and suggestions for the investment

activities of enterprises. Thus, the investment

efficiency of enterprises can be improved, and the

investment elasticity and overall vitality of

enterprises can be stimulated.

2.3 The Impact of Enterprise

Accounting Information Quality on

Enterprise Investment Efficiency

Under the theory of information asymmetry,

information asymmetry is mainly manifested in the

asymmetry of content and time, both of which are

important factors directly related to the normal

operation of enterprises and rational allocation of

resources. In the investment direction of enterprises,

the quality of accounting information can reduce the

problem of information asymmetry between

investors and invested enterprises. High-quality

accounting information helps to identify high-quality

enterprises or projects, and also helps to obtain the

internal actual operation information of invested

enterprises or projects, thus reducing investment

risks. Under the principal-agent theory, the quality of

accounting information measured by accounting

conservatism can ensure that the contract participants

work according to the agreed content, adjust the

conflicts of interest, reduce investment risks and

opportunistic behaviors, and thus alleviate the agency

problems among the investment contract parties.

(

Qin 2020

)

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

884

2.4 The Impact of Enterprise

Accounting Information Quality on

Enterprise Investment Efficiency

2.4.1 The Judgment of Enterprise

Accounting Information Quality on

Enterprise Investment Risk

In the enterprise investment activities, the forecast of

the investment project income and the forecast of the

enterprise's own economic strength is the key to

determine the direction of the enterprise investment,

but also the enterprise managers and decision makers

to judge an investment project risk of an important

basis. The above two kinds of estimation are

inseparable from the analysis and application of the

quality characteristics of enterprise accounting

information. For example, as one of the

characteristics of correlation, the two major signs of

the correlation of enterprise accounting are the

predictive value and feedback value of accounting

information, (

Wu, 2017

) both of which can help

enterprise investment risk judgment, thus affecting

the investment efficiency of enterprises.

2.4.2 The Impact of Enterprise Accounting

Information Quality on Enterprise

Investment Amount

The development of enterprise investment activities

cannot be separated from the allocation and

utilization of the enterprise's own capital, and the

amount of enterprise's own capital also determines

the amount of enterprise investment, which is directly

related to the trend of enterprise investment

efficiency. The direct source of enterprise funds is the

main business income of the enterprise itself, and the

authenticity of the quality of enterprise accounting

information is the most real and intuitive embodiment

of the business conditions of the enterprise.

Therefore, enterprise managers and decision makers

can determine the amount of enterprise investment

according to the enterprise capital surplus reflected in

the accounting information. Therefore, the quality of

accounting information can directly affect the

accuracy of enterprise financial statements, and then

affect the efficiency of enterprise investment.

2.4.3 The Impact of Enterprise Accounting

Information Quality on Enterprise

Investment Effect

The timeliness of enterprise accounting information

quality means that the production of enterprise

accounting information takes precedence over the

production of enterprise investment decisions. The

usefulness of enterprise accounting information

quality refers to that the enterprise accounting

information can directly affect the enterprise's

investment activities. (

Guo, 2016, Ke, 2016

)

Generally speaking, the relevance, authenticity,

timeliness, usefulness and other characteristics of

enterprise accounting information quality will affect

the judgment and evaluation of enterprise managers

and decision makers on the investment effect. If the

quality of enterprise accounting information is not

high and the characteristics are not clear, it will lead

to a large deviation in the judgment of the investment

effect.

To sum up, the quality of enterprise accounting

information can directly affect the development,

operation and effect evaluation of enterprise

investment activities, and then change the efficiency

of enterprise investment. Therefore, in order to

improve the efficiency of enterprises in investment,

expand the development scale and comprehensive

strength of enterprises, it is urgent to put forward the

corresponding improvement and improvement in the

quality of enterprise accounting information. The

innovative integration of big data technology and

enterprise accounting business will give new

development from the measurement, timeliness,

usefulness and other characteristics of accounting

information. Help enterprises to reduce the cost of

investment activities, avoid the risk of investment

activities, improve the efficiency of investment

activities.

3 BIG DATA TECHNOLOGY AND

ENTERPRISE ACCOUNTING

INFORMATION QUALITY

3.1 Big Data Technology

Big data is the inevitable result of the development of

information technology in today's society. Under the

development law of technology itself, information

technology has been applied to work production to

improve efficiency and gradually moved to a more

advanced stage of intelligence. Today, massive

information data has become the basis of the whole

social operation and development, and we have also

become the producers and users of data in the current

information data society. The birth of big data

technology is inseparable from the development and

maturity of modern information technology and

Influence of New Development of Accounting Information Quality Characteristics based on Hadoop on Enterprise Investment Efficiency

885

communication technology. In the actual application

process, big data technology combines the

advantages of modern information technology and

communication technology, and can be widely used

in all industries and fields of the whole society. Big

data technology not only promotes and changes the

overall social development in the technical level, but

also provides a new method and new thinking mode

for us to look at and deal with work. That is, decision-

making behavior will increasingly be made based on

data analysis, rather than relying on experience and

intuition as in the past.

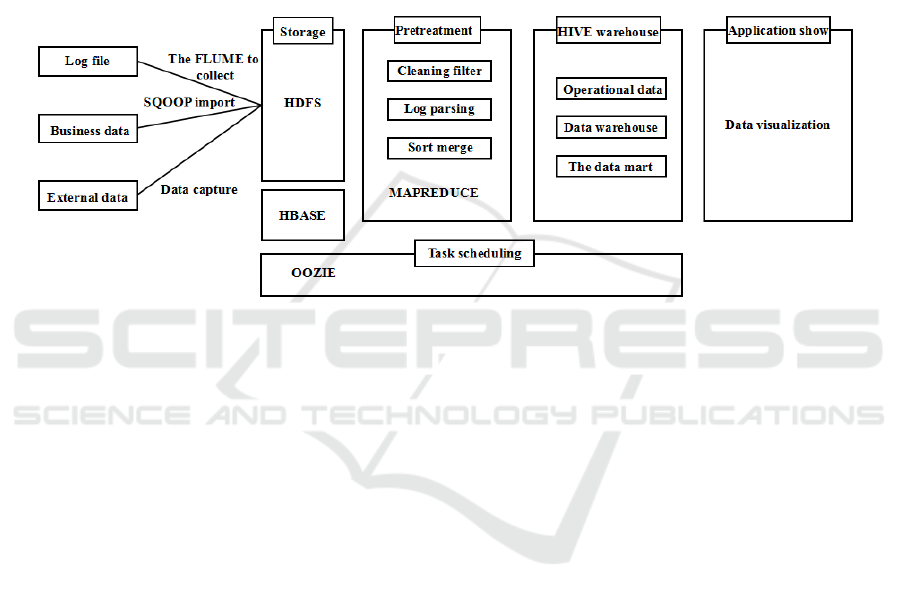

The system of big data technology is huge and

complex. The basic framework and technical

categories include data collection, distributed

storage, NoSQL database, data warehouse, parallel

computing, visualization. The common big data

processing processes are: data collection, data

preprocessing, data storage, data cleaning, data

query, analysis and visualization. (Core Technologies

that Must be Mastered in Learning Big Data.

Computer & Network) The specific process is shown

in Figure 1.

Figure 1: Big data project processing process.

3.2 Big Data Technology Improves the

Quality Characteristics of

Enterprise Accounting Information

3.2.1 Big Data Technology Changes the

Relevance of Accounting Information

Enterprise accounting information in the traditional

mode of operation, only a simple access to the

internal enterprise generated by a variety of

structured data, due to the initial balance, accounts

receivable and so on. However, for the external

enterprise, especially for the highly interconnected

and closely related unstructured data in the current

society, such as user evaluation, user satisfaction,

regional policy, valuable data information cannot be

obtained. In turn, it will affect the degree of

information integrity and comprehensiveness of the

subsequent enterprise investment decision. And big

data technology can easily realize the enterprise

external data fetching, and through a series of

processing process and realizes the enterprise

external data information and enterprise internal data

information used in combination, greatly eliminate

the unequal sex investment decision-making

information, namely the implementation of enterprise

accounting information quality correlation of

ascension, Thus, the accuracy and controllability of

enterprise investment decisions can be further

improved, investment risks can be reduced and

investment efficiency can be improved.

3.2.2 Big Data Technology Changes the

Timeliness of Accounting Information

The application of big data technology can change the

timeliness of current enterprise accounting

information transmission. Based on big data

technology, enterprise financial management

software will adopt data distributed computing and

storage, which can greatly improve the speed of data

storage, calculation, invocation and other operations.

So as to improve the timeliness of enterprise

accounting information quality.(

Yang. 2018

) What's

more, the data analysis and mining technology in the

accounting information accounting has filled the gap

on the function of the traditional accounting software

system, and big data technology support for data

visualization, vast amounts of data by classification,

component form different data sets, and when the

user calls, and in a dynamic and multiple forms of

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

886

data chart display, Make accounting information

accounting more fast, more transparent and intuitive,

in order to improve the usefulness of enterprise

accounting information quality, but also more

convenient for enterprise managers, decision-makers

quickly on this basis, make decisions on enterprise

investment activities, improve enterprise investment

efficiency.(

Long. 2015

)

To sum up, the application of big data technology

in the enterprise financial management system can

achieve innovative development and qualitative

improvement of the quality characteristics of

enterprise accounting information. The application of

big data technology helps to improve the accounting

information data management ability of enterprises,

and is also the key to achieve the success of

intelligent business decision.

4 ENTERPRISE INVESTMENT

DECISION SYSTEM BASED ON

BIG DATA

4.1 System Overview

The enterprise investment decision system based on

big data can expand the input aperture of enterprise

accounting information, alleviate the difficulty of

enterprise accounting information exchange and

accounting, and realize the comprehensive utilization

of accounting information data coordination,

intelligent analysis and decision-making aid. That is,

big data technology comprehensively improves and

develops the quality characteristics of enterprise

accounting information, provides due support for

enterprise investment activities, and ultimately

improves the investment efficiency of enterprises.

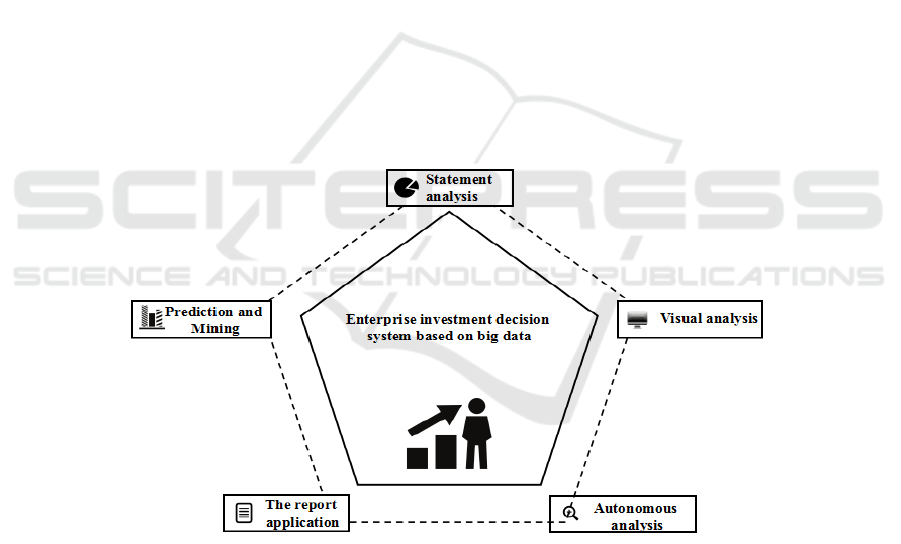

The system construction model is shown in Figure 2.

The system can provide analysis methods such as

financial statement analysis, data result visualization,

self-service data analysis, data prediction and data

mining, to accurately support enterprise managers to

make decisions on enterprise investment activities.

Figure 2: Enterprise investment decision system construction model.

4.2 Specific Process and Functions

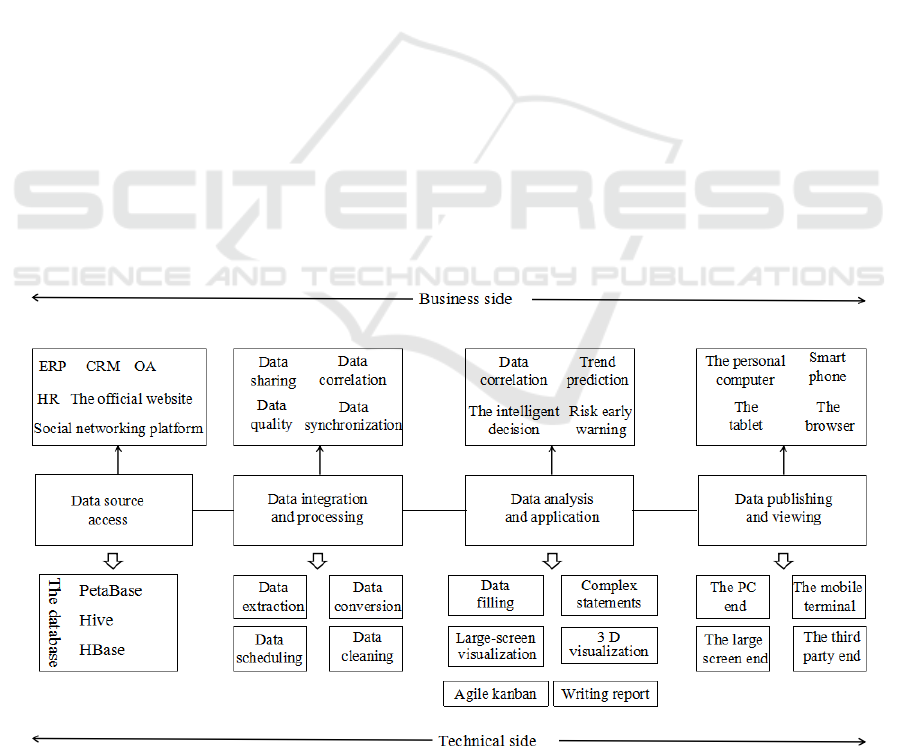

In the enterprise investment decision system, the

primary solution is the access of internal and external

accounting information. With the support of big data

technology, the system can not only process

traditional structured data information, but also

process unstructured information such as text and

pictures. Therefore, in the data source access module,

the system supports the acquisition of enterprise

internal production and operation data from

enterprise EPR management system, CRM

management system, OA transaction processing

system, HR management system and other aspects, as

the main body of accounting information. In addition,

it also supports the acquisition of external evaluation,

opinions and other data information from the

enterprise's independent social platform, official

Influence of New Development of Accounting Information Quality Characteristics based on Hadoop on Enterprise Investment Efficiency

887

website and other channels as a supplement to the

accounting information. The distributed storage

technology of big data is adopted to store data sets

formed by different data in different database servers

to improve the relevance of enterprise accounting

information.

After the accounting information data is stored,

the system will complete data extraction, data

cleaning, data conversion and other operations in the

data integration and processing function module, sort

out and refine a large number of disordered

accounting information data, retain valuable data

information, and improve the measurement of

accounting information quality. Through the

integration and processing of accounting information

data in the system, the data sharing and data

association of multiple systems of enterprises are

realized, the synchronization of accounting

information data of enterprises is enhanced, and the

quality of accounting information data is improved.

After data integration and processing, enterprise

accounting information data can be further analyzed

and applied. Through the system data analysis and

application module, accounting information can be

formed into various complex reports, agile data

kanban, data visual dynamic display, text reports and

other contents. And the comprehensive application of

these contents, the corresponding trend prediction,

income analysis, intelligent decision-making and risk

early warning for enterprise investment activities, so

as to assist enterprise managers and decision makers

to carry out comprehensive regulation and accurate

management of investment activities. Through the

powerful data analysis and computing ability of big

data technology, it realizes the data mining and data

insight that the traditional accounting system cannot

achieve, and improves the usefulness of the quality of

enterprise accounting information.

After data analysis and application, the system

supports enterprise managers and decision makers to

obtain corresponding data information and data

application content from different channels. The

system supports multiple terminal viewing modes,

such as PC, mobile device, large screen, and third-

party system integration. That is, enterprise managers

and decision makers can use mobile phones, tablet

computers, personal computers, anytime and

anywhere to log in the system to view and use the

system. The application of this big data technology

realizes the timeliness of the quality of enterprise

accounting information, makes the decision-making

of enterprise investment activities no longer rely on

the traditional complicated financial data statements,

and saves a lot of manpower and material costs.

The above is the introduction of the main

functional modules of the enterprise investment

decision system based on big data. As shown in

Figure 3, it is the functional architecture diagram of

the enterprise investment decision system.

Figure 3: Functional architecture diagram of an enterprise investment system.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

888

4.3 Technical Support

In terms of data collection of big data technology,

common database collection technologies include

MySQL and SQLSever, which are common database

servers in enterprises. For unstructured data under big

data technology, HDFS, HBase, NoSQL, etc. The

distributed database can design the corresponding

data sets according to the application characteristics

of different data, increase the throughput rate of data

on the server, so as to improve the efficiency of

system data operation.

In the process of data preprocessing, ETL tool is

often used for data extraction and data cleaning. Data

transformation is a process of processing the

inconsistencies in the extracted data. It also includes

the work of data cleaning, that is, according to the

business rules to clean the abnormal data to ensure

the accuracy of subsequent analysis results. (

Liu,

2020, Hu, 2020, Song, 2020

) Data scheduling refers

to the streamlining of data volume to obtain a smaller

data set while maintaining the original state of data to

the maximum extent.

In the link of data analysis and response, it mainly

realizes the visual design of data, and uses the results

to guide the enterprise investment decision service. In

this system, the mainstream technologies in Web-

based development are adopted, and the front-end

development framework of the system adopts vue. js

and ECharts visual tools for organic integration, so as

to quickly build a web-based front-end interactive

application interface. The overall architecture of the

enterprise investment decision system based on big

data is B\S architecture design, which enables users

to log in the system and complete the interactive

operation with the system at any time by using a

variety of devices through a web browser.

5 CONCLUSIONS

The enterprise investment decision-making system

based on big data is a practical application under the

innovative integration of big data technology and

enterprise accounting information management. By

improving the quality characteristics of accounting

information, the system helps enterprise managers

and decision-makers provide data support for the

decision-making of enterprise investment activities,

so as to more comprehensively and accurately realize

the regulation and management of enterprise

investment activities and improve enterprise

investment efficiency.

ACKNOWLEDGMENTS

Humanities and Social Science Research Project of

Chongqing Education Committee, Project No.

21SKGH390.

REFERENCES

Core Technologies that Must be Mastered in Learning Big

Data. Computer & Network.

Guo Xiumei, Ke Tengmin. (2016) Influence of Accounting

Information Quality on Investment Efficiency of

Enterprises. Journal of Fujian Agriculture and Forestry

University(Philosophy and Social Sciences).

Investment efficiency. MBA think tank Encyclopedia. See

https://wiki.mbalib.com/wiki/%E6%8A%95%E8%B5

%84%E6%95%88%E7%8E%87.

Liu Wenjun, Hu Xia, Song Xueyong. (2020) Big Data

Visualization Application Development Project

Tutorial. Beijing: China Railway Publishing House.

Long Yungeng. (2015) Research on the Influence of

Accounting Information Quality on Investors'

Emotional Effect. Southwestern University Of

Finance And Economics.

Ma Shuo. (2014) The Impact of Accounting Information

Quality on Enterprise Investment Efficiency. Modern

Marketing (next month).

Qin Xinmei. (2020) Basic Accounting (third Edition).

Liaoning: Dongbei University of Finance and

Economics Press.

Wang Aishan. (2016) Analysis on the Impact of

Accounting Information Quality on Enterprise

Investment Efficiency. Accounting Learning.

Wu Shuguo. (2017) Accounting Information Quality,

Management Overconfidence and Investment

Efficiency——Empirical Evidence Based on GEM

Market [D]. Southwestern University Of Finance And

Economics.

Yang Yinghua. (2018) Analysis on the Influence of Big

Data Era on the Quality of Enterprise Accounting

Information. Commercial Accounting.

Influence of New Development of Accounting Information Quality Characteristics based on Hadoop on Enterprise Investment Efficiency

889