Research on Incremental Distribution Network Investment Strategy

Considering Uncertainty of Income

Youzhong Miao

1

, Feng Zhao

1

, Hui Li

2a*

, Guangbiao Wang

2

, Xinjian Chen

2

and Ning Wang

2

1

State Grid Jibei Electric Power Company Limited, 100054, Beijing, China

2

Tianjin Tianda Qiushi Electric Power High Technology Co.,Ltd., 300392, Tianjin, China

Keywords: Incremental Distribution Network, Profit, Uncertainty, Investment Decision.

Abstract: In the market-oriented environment, the investment and operation of incremental distribution network faces

multiple uncertainties. By analyzing the typical operation mode of incremental distribution network in China,

this paper summarizes that the sources of income uncertainty of incremental distribution network mainly

include power growth volatility, construction scheme, power grid investment, multi energy complementary,

energy Internet construction. Finally, based on the real option theory, the investment decision-making

elements of incremental distribution network under uncertain environment are proposed. This study can

provide support for operators' investment decision-making.

1 INTRODUCTION

Since the notice on standardizing the pilot reform of

incremental distribution business was issued in 2016.

As of August 2020, five batches of 483 incremental

distribution pilot projects have been approved (F, S

2018). With the investment and operation of a large

number of incremental distribution network pilot

projects, the investment and operation mode of

incremental distribution network is gradually clear,

and the relevant policies and construction

specifications are more clear. However, the gradual

deepening of China's power market-oriented reform

has further intensified the competition in the

incremental distribution market, and the uncertainty

of operating income has led to the withdrawal of a

large number of incremental distribution operators

who get up early and enter the market (H, B, T, E

2020).

In the existing research, by referring to the

relevant methods of power grid planning in China, the

investment strategy of incremental distribution

network is analyzed based on load forecasting,

investment planning and benefit evaluation (Z, Y, W

et al. 2020). In terms of load forecasting, regional

saturated load forecasting considering load density is

an important research method. This is due to the lack

of historical data in the incremental distribution

network Park, resulting in the poor applicability of

the traditional prediction algorithm based on

historical data (T, P, W, et al. 2019). In terms of

investment planning, the investment decision-making

methods, principles and strategies are given mainly

combined with the investment income model of

incremental distribution network. Some literature

have also constructed constant capacity optimization

methods such as distributed generation and energy

storage under incremental distribution network for

specific scenarios. In terms of benefit evaluation,

based on the existing project technical and economic

analysis methods, the influencing factors of

incremental distribution network investment benefit

are analyzed by introducing DEA, VaR and other

methods (Q, W, Y et al. 2021). This paper analyzes

the uncertain factors in the market-oriented

environment to adapt to the incremental distribution

network operation scenario with great uncertainty

and provide guidance for the investment decision-

making of incremental distribution network

operators.

956

Miao, Y., Zhao, F., Li, H., Wang, G., Chen, X. and Wang, N.

Research on Incremental Distribution Network Investment Strategy Considering Uncertainty of Income.

DOI: 10.5220/0011359900003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 956-960

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 OPERATION MODE OF

INCREMENTAL

DISTRIBUTION NETWORK IN

POWER MARKET

ENVIRONMENT

The service scope of incremental distribution

network mainly includes two aspects: first, for

distribution network, some basic services must be

provided, including distribution network dispatching,

operation, construction, transformation and providing

power supply services to users. Second, special

policy services under the background of power

market reform can be carried out, which are defined

here as value-added services, such as comprehensive

energy services of cooling, heating and power, agent

users to participate in market-oriented transactions,

etc. the specific transaction types include power

purchase and sale, auxiliary services, carbon trading,

etc.

In terms of basic business, the distribution service

fee will be the main revenue source of the power

supply service of the incremental distribution

network company. At the same time, the

administrative measures for orderly liberalization of

distribution network business points out that the

distribution price of the incremental distribution area

shall be formulated by the provincial (District,

municipal) price competent department in

accordance with the relevant provisions of the

national transmission and distribution price reform

and reported to the national development and Reform

Commission for the record. Before the distribution

price is approved, the transmission and distribution

price of the provincial power grid shared network

corresponding to the access voltage level of the

power selling company or power users shall be

deducted from the transmission and distribution price

of the provincial power grid shared network

corresponding to the access voltage level of the

distribution network.

In terms of value-added business, by signing

energy-saving service contracts with customers, we

provide customers with a complete set of energy-

saving services, including energy audit, project

design, project financing, equipment procurement,

engineering construction, equipment installation and

commissioning, personnel training, energy-saving

confirmation and guarantee, It is a business operation

mode to recover investment and profit from the

energy-saving benefits obtained by customers after

energy-saving transformation. The operation modes

of contract energy management mainly include:

equipment leasing type, energy-saving benefit

payment type, energy-saving quantity (rate)

guarantee type, energy-saving benefit sharing type

and long-term trust type of energy cost.

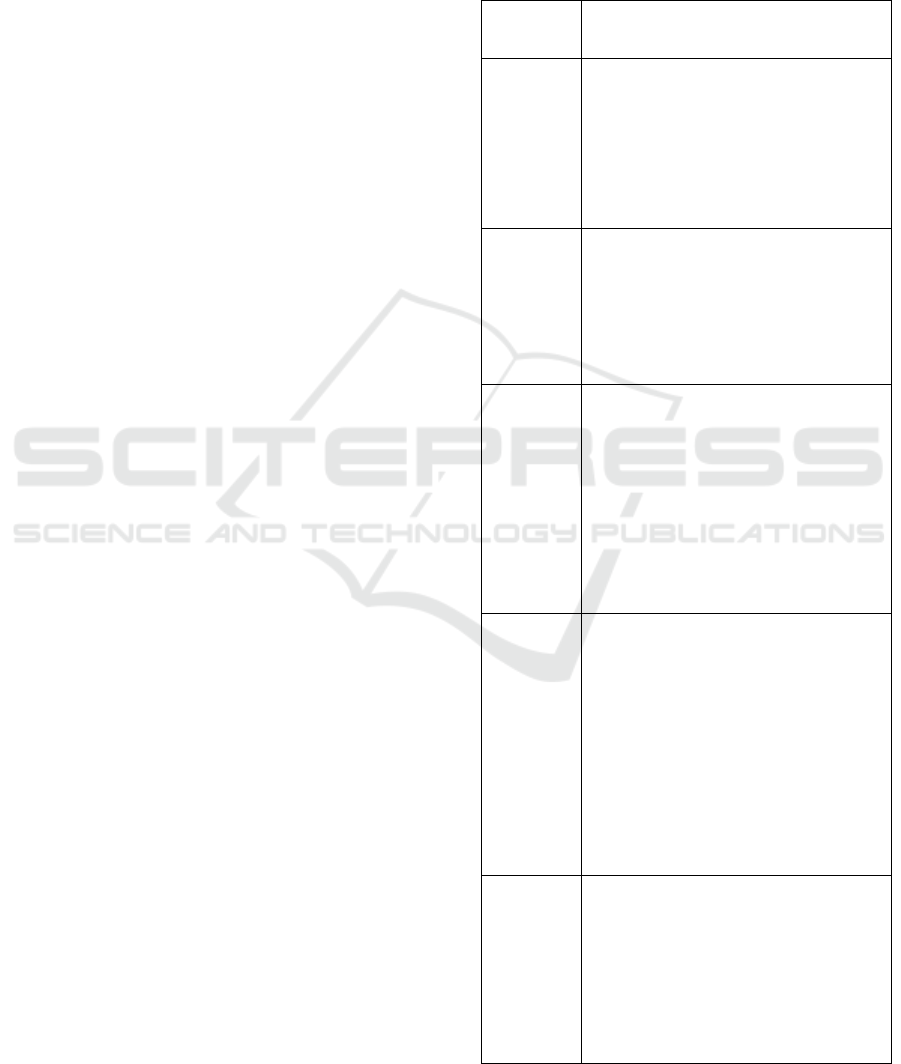

Table 1: Basic operation mode of contract energy

management.

Basic

mode

Concrete content

Equipment

rental type

The customer leases energy-saving

equipment from the service company.

After the lease expires, the equipment is

transferred to the customer free of

charge. The customer pays the

equipment rent to the service company

on a monthly or quarterly basis.

Energy

saving

benefit

payment

type

When the customer entrusts the service

company to carry out energy-saving

transformation, a certain proportion of

advance payment shall be paid first, and

the balance shall be paid with energy-

saving benefits.

Energy

saving

(rate)

guaranteed

All investment in energy-saving

projects shall be provided by the service

company, and the whole process service

shall be provided to ensure the energy-

saving effect. The customer shall pay

the cost of energy-saving transformation

projects; If the promised benefits are not

achieved, it shall bear the

responsibilities and losses in accordance

with the contract.

Energy

saving

benefit

sharing

The initial investment of the project

shall be paid by the energy conservation

company. During the contract period,

the energy conservation service

company shall share the consumption

reduction benefits brought by energy

conservation transformation with

customers. Upon the expiration of the

contract, all energy-saving equipment

and long-term income shall belong to

the customer.

Energy

cost long-

term

trusteeship

On the premise of ensuring the reduction

of customers' energy costs, all

customers' energy costs are managed by

the energy conservation service

company. The long-term operation,

maintenance, renovation and re

investment of energy-saving equipment

are undertaken by the energy-saving

service com

p

an

y

.

Research on Incremental Distribution Network Investment Strategy Considering Uncertainty of Income

957

3 UNCERTAINTY ANALYSIS OF

INCREMENTAL

DISTRIBUTION NETWORK

INVESTMENT INCOME

The uncertainty of investment return comes from

macro environment and micro environment.

Specifically include:

(1) Growth fluctuation of load and electricity

Most of the revenue of incremental distribution

network operation comes from power supply. On the

one hand, this part of revenue depends on the

transmission and distribution price, on the other hand,

it is related to load and electricity. In the coming

period of time, the transmission and distribution price

will basically remain stable under the control of the

government and will not fluctuate greatly. The

fluctuation of electricity will affect the operation

income of incremental distribution network, then

affect its investment value, and determine the option

value of incremental distribution network. There are

many factors affecting power consumption, mainly

including economic development, industrial

structure, industry prospect, climate, energy

substitution, etc.

(2) Investment uncertainty caused by different

construction schemes

In the process of power grid planning, different

power grid construction schemes can meet the future

user load. Different construction schemes will have

great differences in line structure and substation

quantity. At the same time, the cost of materials and

equipment used for different types of users is also

different. Therefore, different construction schemes

have differences in project investment cost. The

project investment cost is uncertain, which leads to

the uncertainty of incremental distribution network

income. At the same time, technological progress will

also affect the power grid construction scheme, thus

affecting the investment cost.

(3) Uncertainty caused by the stimulation of

power grid investment projects

Power grid investment and construction, on the

one hand, is used to meet the needs of existing power

users, and will have a positive stimulating effect at

the same time. Especially for the industrial park,

industrial enterprises have high requirements for the

guarantee of power supply quality and safety. The

complete power grid facilities in the park will

facilitate investment attraction, so as to attract

enterprises to settle in the park. The quality of

distribution network and the length of construction

cycle play an important role in this process.

(4) Uncertainty caused by multi energy

complementary

The future power system will no longer be

independent. Especially for enterprises with multiple

energy needs, integrated energy services will better

meet the needs of users. Therefore, the meaning of

future incremental distribution network is not only

the power grid, but also the pipelines for cooling and

heating. In this context, the coordinated supply of

multiple energy sources in incremental distribution

network is very necessary, and the way of

complementary, coordinated and optimal scheduling

of multiple energy sources makes the income of

incremental distribution network uncertain.

(5) Uncertainty caused by energy Internet related

investment

In the context of energy Internet, the power grid

will realize island operation in the form of micro-grid

in the future, and the large power grid will be used as

the auxiliary of micro-grid to maintain the stability of

power grid. For specific projects, the investment in

energy supply and consumption equipment such as

distributed generation, energy storage and charging

vehicle charging pile in incremental distribution

network will not only increase the investment cost,

but also bring additional benefits, which is uncertain.

4 INCREMENTAL

DISTRIBUTION NETWORK

INVESTMENT STRATEGY

CONSIDERING UNCERTAINTY

Among many traditional evaluation methods, net

present value method is the most commonly used

method. However, considering that the power grid

project has the characteristics of high cost, high

technology, long construction cycle, large time span

and many uncertain factors, at the same time, the

materials for power grid construction are special, and

it is very difficult to sell and realize power grid assets.

Next, combined with the characteristics of the above

power grid project construction, the traditional net

present value method and real option method are

compared in the economic evaluation of power grid

investment.

The decision-making suggestions obtained by

traditional methods are limited to investing now or

not. The option method can provide a variety of

investment strategy suggestions, including when to

invest, the choice of investment scale, when to exit,

whether to invest step by step and so on. Under the

traditional method, investment decision-making only

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

958

makes unilateral consideration, that is, according to

whether the net present value is greater than zero, it

appears in the decision-making suggestions of

investment and no investment at present, but

entrepreneurs or managers rarely make such a simple

conclusion, so such a quantitative method is difficult

to meet the needs of investment decision-making.

The real option method should not only consider the

traditional net present value, but also consider the

increase or decrease of enterprise options caused by

investment. Therefore, a variety of decision-making

suggestions can be obtained.

NPV

Investment nowNo investment now

Investment critical point

Figure 1: Discounted cash flow investment decision.

NPV

Option value

Maybe invest

in the future

Investment now

Possible future

investment

Never invest

Figure 2: Real option model investment decision.

Using the real option method, we can also get

more specific and meaningful decision-making

suggestions. For example, according to the

company's resources, changes in investment and

operating costs, technological progress, demand

change forecast, competitor investment strategy, etc.,

consider the "best" investment opportunity,

investment order, investment "best" scale, whether to

make (forward or backward) integrated investment,

whether to diversify (invest in original business or

new business), Whether to make international

investment.

The investment and operation of incremental

distribution network is multi-stage, which can be

divided into the stage of obtaining investment right

and each stage of power grid investment.According

to the policy requirements of incremental distribution

network, the investor of incremental distribution

network investment and operation needs to be

determined through public bidding. Therefore, in the

initial stage of incremental distribution network

investment and operation, the investment right needs

to be obtained through bidding and other means, so

as to generate the option of investment in the first

stage. When obtaining the operation right, the

investment expenditure to be borne by the investor is

the net fixed asset value of the stock assets of the

distribution network in the park. This part of assets

can be accounted into the incremental distribution

network assets by purchase or price as shares.

Different investment strategies will affect the

investment amount and income distribution of the

distribution network.

The investment income of distribution network in

typical parks is affected by many factors. From the

perspective of income source, its investment income

is determined by the transmission and distribution

power and transmission and distribution power price.

Under the condition that the transmission and

distribution power price of each voltage level is

approved, the investment income of distribution

network comes from the price difference between the

transmission and distribution power prices of

different voltage levels. When calculating the

income, it is necessary to predict the power

consumption of users in the park. This result is the

transmission and distribution power. Therefore, from

this point of view, the uncertainty of distribution

network investment income in typical parks mainly

comes from the price difference of transmission and

distribution price and user power consumption.

Under the control of the government, it is difficult to

adjust the price difference of transmission and

distribution price significantly. Therefore, the

fluctuation of distribution network investment

income in typical parks is mainly affected by the

accuracy of power consumption prediction. From the

perspective of power grid investment, under the

condition of energy Internet, power grid companies

gradually change to comprehensive energy service

providers. In this situation, power grid companies

become more flexible in the investment process.

Research on Incremental Distribution Network Investment Strategy Considering Uncertainty of Income

959

5 CONCLUSION

Under the market environment of the liberalization of

incremental distribution network and the gradual

introduction of competition in the distribution

market, the incremental distribution network

investment faces great uncertainty and the investment

income is at risk. Considering the defects of the

traditional net present value method under the new

situation, the venture capital theory is used to

reasonably evaluate the risk value caused by various

uncertainties based on the real option model, so as to

estimate the investment value more comprehensively.

At the same time, it should be pointed out that with

the gradual deepening of market-oriented reform, the

applicability of real option theory and model will be

greatly increased, which also needs further research.

ACKNOWLEDGMENTS

This work was financially supported by the Science

and technology project of State Grid Jibei Electric

Power Co., Ltd (Research on the strategy of mixed

ownership participating in incremental distribution

investment business).

REFERENCES

Jiaxin Q., Jiahui W., Lei Y., et al. (2021) Comprehensive

performance evaluation of a CCHP-PV-Wind system

based on energy analysis and a multi-objective decision

method, Power System Protection and Control, 49(2):

130-139(in Chinese).

Ming Z., Zhuangzhuang Y., Yuqing W., et al. (2020)

Optimal Model of distribution network investment

scale based on transmission and distribution price

constraints, Smart Power, 48(11): 1-8.

Roberto H., Pratheeba V., Nancy B., Frank T., Elisabeth E.

(2020) Integrating intellectual property and sustainable

business models: The SBM-IP canvas, Sustainability,

12(21): 78-107.

Yongsheng F., Dan S. (2018) Incremental distribution

reform and power system reform, Energy of China,

40(12): 25-32.

Zhongfu T., Lei P., Jing W., et al. (2019) Optimal model of

time-of-use transmission and distribution price based

on load rate differential pricing, Systems Engineering-

Theory & Practice, 39(11): 2945-2952.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

960