Research on Optimization Technology of Cost Management and

Control of Power Grid Enterprises under the Background of Smart

Grid Application

Jing Yu and Yaru Han

Power Economic Technology Research Institute of State Grid Fujian Electric Power Co., Ltd., Fujian, Fuzhou, 350012,

China

Keywords: Factor Analysis, Photovoltaic Energy, Listed Companies, Financial Analysis.

Abstract: With the continuous advancement of power science and technology, strengthening the intelligent

construction of power grids has become one of the key development strategies of power grid enterprises.

The invoice terminal in the business hall of a power grid enterprise is an important link between the power

grid and power customers, and it is also an important indicator of the intelligent level of the power grid. For

this reason, the grid enterprise has invested a lot of money in the investment and construction of the invoice

terminal and technology upgrade. However, the lack of in-depth cost-effective analysis of the input of the

invoice terminal by the power grid enterprises has caused problems of low capital input efficiency of the

invoice terminal from time to time. Therefore, this paper selects F provincial-level grid enterprise business

hall invoice terminal as the research object, combines the DEA theory to carry out the input cost

effectiveness evaluation, and analyzes the main factors affecting the output effect of the invoice terminal, in

order to further promote the intelligent development of the power grid. Provide reference and reference for

the effect of enterprise capital input and output.

1 INTRODUCTION

At present, as social and economic development

enters a new normal, external supervision and

inspection have become stricter, electricity prices and

the complexity of the operating environment have

increased, and the implementation of the deepening

of the strategic system of power grid companies and

the continuous improvement of high-quality

development requirements. In this context, power

grid companies must attach great importance to cost

input and output effects and improve cost

management efficiency.

Literature (

Jin, 2021) analyzed the current status

and problems of cost accounting management of

power grid companies, and based on the perspective

of comprehensive budget management, proposed a

cost accounting optimization strategy for power grid

companies. Literature (

Wang, 2020) starts from the

situation faced by power grid enterprises and the

status quo of cost management, and proposes

measures to strengthen lean cost management of

enterprises, which provides a reference for

enterprises to improve their cost management level.

From the perspective of supply chain, the literature

(

Wu, 2021) takes T Grid Company as the specific

research object, conducts in-depth research on T Grid

Company’s infrastructure projects, finds the

shortcomings of T Grid Company’s cost

management, and proposes corresponding

optimization suggestions. Literature (

Xu, Ling, Cheng,

Wang, 2019

) analyzed the impact path of the power

transmission and distribution price reform on the cost

management, fixed asset management, investment

management and budget management of power grid

enterprises, and proposed a "one foundation, three

grasps" financial management strategy. Literature

(

Zou, Zhang, Wu, Chen, 2020) based on the traditional

weighted average cost of capital calculation method,

introduced the risk adjustment coefficient of power

grid projects, proposed a weighted cost of capital

(WACC) model suitable for power grid companies’

overseas investments, and obtained key international

regions through empirical analysis. Based on the

WACC calculation results, a regression fitting

analysis was carried out through WACC and credit

risk rating quantitative indicators, and a credit rating

risk adjustment model was proposed.

Yu, J. and Han, Y.

Research on Optimization Technology of Cost Management and Control of Power Grid Enterprises under the Background of Smart Grid Application.

DOI: 10.5220/0011360200003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 967-972

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

967

It can be seen from the above that the relevant

research on the cost input-output effect of power grid

enterprises is still blank. Therefore, it is necessary for

this article to select the typical business types of

power grid companies to carry out cost input

effectiveness analysis and research.

2 INVOICE TERMINAL

BUSINESS INTRODUCTION

2.1 Business Background

With the popularization of the mobile Internet, the

public has put forward higher requirements for

service quality while the demand for electricity

continues to increase. On this basis, the invoice

terminal has gradually become an important part of

the business hall of the power grid company. From

the experience point of view, high-quality service

means friendliness and convenience, which is

conducive to improving the business environment.

Relying on technical advantages and understanding

of customers' own needs, the invoice self-service

terminal provides customers with a strategy of

efficient experience. Adding self-service can

alleviate the problem of excessive traffic in

traditional business halls, make up for the lack of

original business hours, and provide customers with

better service. Come for easy, convenient and

considerate service. As an extension and supplement

of

the service of the business hall, the self-service

Figure 1: Wall-mounted multi-function self-service

terminal.

Figure 2: Through-the-wall multi-function self-service

terminal.

invoice terminal has gradually become an

indispensable strategic means and tool.

2.2 Necessity Analysis

As a self-service payment channel for customers, the

invoice terminal can effectively divert the payment

business in the physical business hall, shorten the

time for customers to pay in the business hall, and

reduce the overall service and marketing costs of the

enterprise. It is an effective part of the physical

business hall. Compared with the traditional service

mode, self-service terminals have obvious

advantages: First, self-service terminals adopt

human-computer interaction, which avoids problems

such as customer dissatisfaction caused by service

attitude and service quality. Second, labor costs are

getting higher and higher, and the advantages of self-

service terminals in saving labor and reducing

operating costs will become increasingly prominent.

The third is that the self-service terminals put in

place extend the service hours of the business halls,

provide customers with more convenient services,

and improve the cost-effectiveness of business

outlets. Fourth, self-service terminals, as modern and

automated advanced equipment, have established a

good public image for power grid companies.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

968

2.3 Service Objects and Objectives

Service object: electricity customers with various

needs such as business application, list printing,

invoice printing, scanning code payment, etc.

Invoice terminal

service content

Electricity business

application

List printing

Invoice printing

......

Scan code to pay

Figure 3: Invoice terminal service content.

Service objectives: First, to effectively relieve the

pressure of queuing in the business hall and improve

the efficiency of business settlement. The second is

to save human resources, reduce labor costs and the

total operating costs of business halls. The third is to

improve the work efficiency and quality of the staff

in the business hall, and reduce the workload of the

staff.

Function

Relieve business

pressure

Save human

resources

Reduce labor costs

Reduce employee

workload

Improve employee

productivity

Figure 4:Invoice terminal function.

3 RESEARCH ON THE

EFFECTIVENESS ANALYSIS

SYSTEM OF INVOICE

TERMINAL COST INPUT

BASED ON DEA THEORY

3.1 Basic Ale of DEA Theory

There are many types of DEA models, among which

the theory of the

RC

2

model is relatively complete.

Competing power companies are the decision-

making units. There are a total of

n

power

companies. Each power company has

m

types of

input (X) and

s

types of output (Y),

j

DWU

's input

and output

12

(, ,..., )

T

jjjmj

xxx x=

,

12

( , ,..., )

T

jjjsj

yyy y=

,

nLj ,,2,1=

.

0

0

max

.. 1

0, 0

T

T

T

j

T

j

uy

vx

uy

st

vx

uv

≤

≥≥

(1)

Among them,

12

(, , , )

T

m

vvv v=

and

12

(, , , )

T

s

uuu u=

respectively represent the

weight coefficients of

m

types of input and

s

types

of output. The Charnes-Cooper transformation of the

above formula can be transformed into an equivalent

linear programming model:

0

1

0

1

1

min

..

0, 1, 2, ,

n

j

j

n

jj

j

j

st x x

yv

jnE

θ

λθ

λ

λθ

=

=

+

≤

≥

≥= ∈

(2)

The model after being processed by non-

Archimedes infinitesimal (

ε

):

Research on Optimization Technology of Cost Management and Control of Power Grid Enterprises under the Background of Smart Grid

Application

969

0

1

0

1

1

min[ ]

..

0, 1, 2, , , 0

TT

n

j

j

n

jj

j

j

SS

st x S x

ySy

jnES

ee

θ

λθ

λ

λθ

∧∧

−+

−

=

+

=

+−

−+

+=

−=

≥= ∈ ≥

(3)

Among them,

TT

Le )1,,1,1(

ˆ

= , if 1

0

=

θ

,

0=

−

S

,

0=

+

S

are satisfied, then

0j

DWU

is

called DEA.

Suppose the optimal solution of the model is

0

θ

,

0

λ

,

−0

S

,

+0

S

, if

1

0

=

θ

, and

0

0

=

−

S

,

0

0

=

+

S

, then DMU is called DEA

effective; if

1

0

=

θ

, and

0

0

≠

−

S

,

0

0

≠

+

S

,

then DMU is called weak DEA effective; if

1

0

<

θ

,

the DMU is said to be non-DEA valid.

Its economic significance is: if a decision-making

unit is DEA effective, from the perspective of the

production function, it is both technically effective

and scale-effective, that is to say, for these decision-

making units, the input

X

and the output obtained

Y has reached the optimum.

3.2 Construction of Cost-effectiveness

Analysis Index System

Based on the invoice terminal cost input

characteristics and output effect, the analysis index

system is shown in the table below:

Table 1. Cost benefit analysis index system.

Investment index

Number of invoice

terminal configuration

Number of employees

Investment costs

Effectiveness and output

effect index

Frequency of bill

printing

4 EMPIRICAL ANALYSIS

This paper takes the cost input of F provincial power

grid enterprise Z and N as the cost effectiveness

analysis.

4.1 Analysis of the Cost and Input

Situation

Z company invested a total of 80 invoice terminals,

with a total cost of 2,178,400 yuan. Among them: 26

receipt printing terminals were funded by the

provincial company, and M company leased in by

means of financial leasing, with a total cost of

278,200 yuan. 54 units were funded by M company,

of which 14 QR code scanners were purchased

through low-value consumables at a total cost of

70,000 yuan, and 40 integrated business handling

terminals were leased in the form of operating leases,

with a total cost of 1,830,200 yuan. The usage of

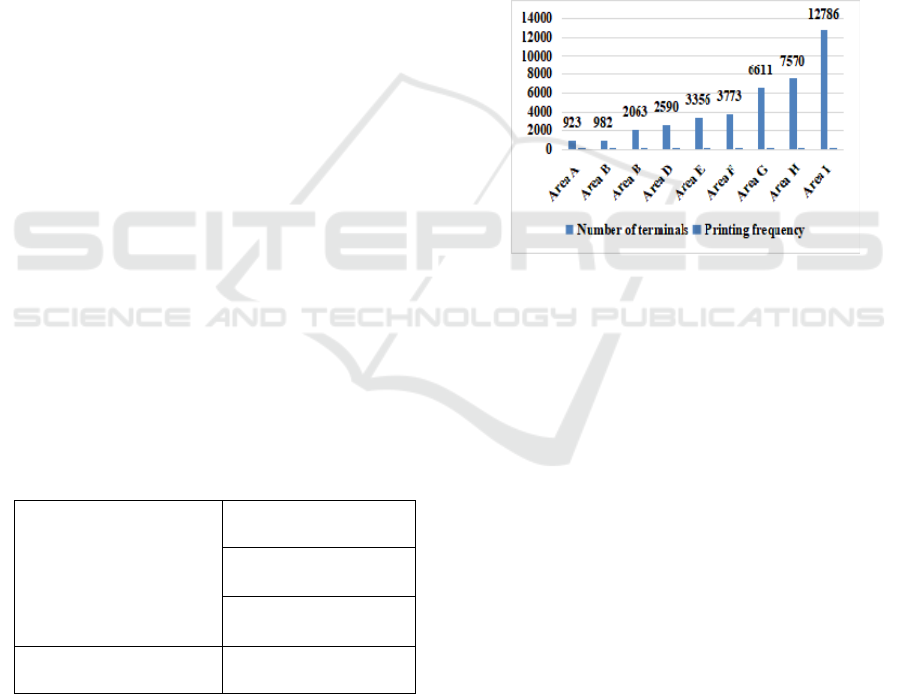

invoice terminals in 9 regions of Z company is

shown in the figure below:

Figure 5: Comparison of invoice terminals in different

regions of Z company.

It can be seen from the above figure that the use

frequency of invoice terminals in Z company is

uneven, with great differences.

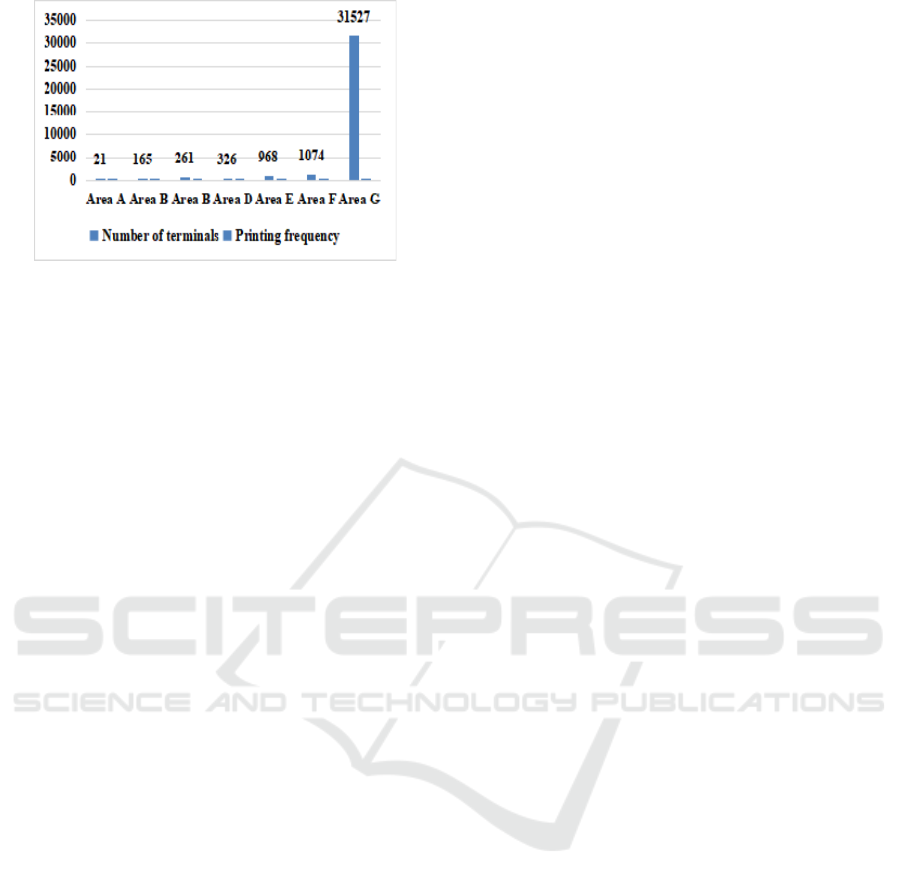

N Company N’s 90 invoice terminals, with a

total cost of 2,610,200 yuan, were all purchased by

Ningde Company. Among them: 28 three-in-one

smart self-service payment terminals and 9 QR code

scanning printers were rented in operating leases at a

cost of 1,995,600 yuan; 14 self-service invoice

printers were rented in by financial leasing at a cost

of 447 million yuan; 39 Two QR code scanners were

purchased as low-value consumables at a cost of

167,600 yuan and a total cost of 2,610,200 yuan.

The usage of invoice terminals in 7 regions of

company n is shown in the figure below:

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

970

Figure 6: Comparison of invoice terminals in different

regions of N company.

It can be seen from Figure 6 that the use

efficiency of invoice terminal of company n is much

lower than that of company Z.

4.2 Conclusion of Cost-effectiveness

Analysis based on DEA Theory

Combined with the DEA analysis and conclusions,

combined with the actual use of the invoice terminal,

the problems with the cost input of the invoice

terminal of the F provincial grid enterprise are as

follows:

1) Lack of standards for terminal launch At

present, there is no unified standard for terminal

release. Terminal release control is extensive.

Business halls declare purchases according to their

needs, and then allocate them to business halls

according to business volume and passenger flow.

There is a large discretionary power and no unified

release standard has been formed. Unified

management and control.

2) The terminal utilization rate is uneven Z

company and N company's invoice terminal use

frequency is uneven, there is a large deviation in

input-output effect, it is necessary to

comprehensively consider factors such as regional

economy, business hall traffic, business volume and

other factors to rationally optimize the number of

terminal inputs.

4.3 Improvement Suggestions

First, the unified and clear terminal delivery

standards. Formulate scientific and reasonable

terminal delivery standards, standardize the source

of funds, conduct unified control over the terminal

demand declaration, and then give delivery after

professional examination and approval, strengthen

lean control, to provide institutional guarantee for

the standardized operation of the terminal.

Second, to establish a terminal regular analysis

mechanism. Strengthen data acquisition, timely and

accurately obtain various business data of terminal

operation through application platform, improve

analysis efficiency, conduct multi-dimensional

comparative analysis of the terminal use efficiency

by collecting data, strengthen closed-loop control,

trace the root cause according to analysis results, and

reasonably allocate idle resources in the region to

ensure the overall use efficiency of the terminal.

Third, optimize the allocation of resources and

utilization efficiency. Comprehensive control the

demand of terminal use, and study measures

according to local conditions to improve the

efficiency of terminal use. Based on the problem of

low use efficiency of terminals in individual

business halls, consider the overall coordination,

allocation and revitalization within the region, so as

to improve the penetration rate and utilization rate of

terminals in the whole region. At the same time, the

promotion of online electronic invoice may bring

negative impact to the business hall terminal,

including whether terminal purchase scientific, cost

economy, reasonable additional input, use

efficiency, etc., it is necessary to analyze the

terminal utilization efficiency, the overall control

around the use of the terminal, provide support for

subsequent decisions.

The fourth is to strengthen the depth of

feasibility study and quality control. Further improve

the depth and quality of the feasibility study. In

response to the insufficient depth of the project

application materials, it is required to analyze and

evaluate the customer groups, main service targets,

type and scale of enterprises, business hall traffic,

business volume and other subdivisions during the

application, and fully demonstrate them. The

necessity, rationality and economy of the terminal

placement plan to avoid over-configuration,

advanced configuration and capital waste.

4.4 Factor Naming

Table 3 shows the factor load matrix after rotation,

the first common factor has a greater load on variable

quick ratio, current ratio, cash ratio, total asset

growth rate, asset liability rate, cost and expense

utilization rate, this shows that these six variables are

highly correlated and fall into one category, which is

called the solvency factor, and the second public

factor, which has a greater load on the Yield valve

and operating profit margin, puts the two variables

Research on Optimization Technology of Cost Management and Control of Power Grid Enterprises under the Background of Smart Grid

Application

971

into the same category, the third public factor has a

greater load on the turnover rate of accounts

receivable and the growth rate of net profit, and is

named as the development capacity factor, it’s called

the operational capability factor.

5 CONCLUSIONS

The investment in the construction of the invoice

terminal in the business hall of the power grid

enterprise has not only improved the intelligent

application level of the power grid, but also improved

the customer's intelligent power consumption

perception level. This article takes the business hall

invoice terminal, one of the smart grid application

technologies, as the research object, with the goal of

improving its input and output effects, and builds a

DEA theory-based business hall invoice terminal cost

effectiveness evaluation technology, which

effectively guides the funds of power grid enterprises

Invest in the improvement of lean management level

to help the continuous improvement of the intelligent

level of the power grid.

REFERENCES

Jin Wenai. Analysis on Cost Accounting Management of

Power Grid Enterprises from the Comprehensive

Budget [J]. Finance and accounting study, 2021 (23):

108-110.

Wang Qiong. Analysis of Cost Management and Lean

Management Measures [J]. Western Accounting, 2020

(11): 40-42.

Wu heying. Power Enterprise Cost Management Research

from the Supply Chain perspective —— takes T

Power Grid as an example [J].Business, 2021 (07):

110-111.

Xu Nan, Ling Yunpeng, Cheng Jialu, Wang Yongli.

Influence of power transmission and distribution price

reform on Financial Management of Power Grid

Enterprises [J]. Price Theory and Practice, 2019 (09):

38-41.

Zou Guilin, Zhang Jigang, Wu Liangzheng, Chen Wen.

Study on weighted average capital cost of overseas

investment of power grid enterprises [J]. Management

of China Electric Power Enterprises, 2020 (33): 76-78

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

972