Research on Financial Quality Evaluation of New Energy Listed

Companies based on Factor Analysis and Cluster Analysis

Ziyu Huang

a

School of Economics and Management, Beijing Jiaotong University, Beijing, China

Keywords: Factor Analysis, Cluster Analysis, Financial Situation, New Energy Listed Companies.

Abstract: This paper will study the financial conditions of 118 listed companies in the energy industry in 2020, extract

four common factors reflecting four aspects of financial conditions from 12 indicators by factor analysis, and

rank the companies by calculating the scores of each factor and the total scores. According to the four factors

extracted, the clustering analysis is carried out on the companies, and the 118 companies are divided into three

types by means of multiple comparison of the mean value, namely, strong companies, ordinary companies

and problem companies, which provides certain basis for the managers to make business decisions and

investors to make investment decisions. Finally, countermeasures and suggestions are put forward to improve

the operating performance of listed companies in the energy industry, pointing out the direction for energy

enterprises to improve their performance and better development.

1 INTRODUCTION

Since the 21st century, the rapid development of

Tesla has stimulated the innovation of the new energy

industry and the overall quality improvement of

related industries, and the development is in the

ascendant. Under a series of complex backgrounds

such as global economic integration and sluggish

world economy, China's new energy listed companies

are facing a very severe situation and are under great

pressure at home and abroad.

2 LITERATURE REVIEW

Since the 20th century, foreign scholars have studied

many methods of financial quality evaluation,

including enterprise credit ability index, DuPont

financial analysis system, Balanced Scorecard, Z

scoring model. Later, with the popularity and

maturity of statistical software such as SAS, SPSS

and STATA, multivariate statistical analysis method

was also applied to various fields such as financial

quality analysis, including factor analysis.

Hornungova, Jana et al. (Jana, et al, 2016) used

correlation analysis and factor analysis to eliminate

a

https://orcid.org/0000-0003-2387-4020

information duplication, reduce dimensions, and

reduce the 13 financial indicators originally

concentrated in basic indicators into three categories.

Meanwhile, Pearson chi-square test shows that the

above indicators are correlated with the company size

to a certain extent, and the largest and most

significant indicator related to the company size is

"operation indicator". Yulin GE and Jing Y used

factor analysis method to study the financial quality

of listed retail companies and know the development

level of each company in the industry through

comparison, which provides a direction for

improving the financial quality of enterprises.

Santosh Kumar Yadav, M. Dharani (2019) examined

the financial quality of banks based on the financial

ratio study, obtained the final ranking of banks by

using the TOPSIS method from 2010 to obtain the

standard value by using the entropy method.

After the reform and opening up, domestic

scholars began to explore and study enterprise

financial quality and established a perfect enterprise

financial quality evaluation system from two research

perspectives. First of all, on the macro understanding,

such as professor Zhang Xinming (Zhang, 2013)

believes the financial quality terms from the book to

see the quality of the enterprise financial situation,

have the profit is the main business of the company

986

Huang, Z.

Research on Financial Quality Evaluation of New Energy Listed Companies based on Factor Analysis and Cluster Analysis.

DOI: 10.5220/0011361600003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 986-991

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

can rely on production of timely and efficient

distribution of dividends, bonuses, etc., should at

least include asset quality quality, quality of capital

structure, profits and cash flow quality. Other

scholars, starting from the micro aspect, evaluate the

financial quality through a variety of analysis

methods, the more common methods are factor

analysis, EVA evaluation method, balanced

scorecard method and entropy method. For

example, Based on the financial data of 13 listed

companies of Xinjiang Production and Construction

Corps, Wang Haixia and Guo Jiaxi (Guo, 2016)

found that the listed companies of Xinjiang

Production and Construction Corps had a low level of

proximity from the effectiveness analysis of DEA

model, and Malquist index was used for dynamic

analysis, suggesting that the relative performance

from 2010 to 2014 declined instead of rising. Li

Xiaoyan (Li, 2014) analyzed the index data of 16

commercial banks in 2011 with the entropy method

of objective weighting, and obtained the ranking of

16 commercial banks through comprehensive

evaluation. During the analysis, she found that

profitability and growth play an important role in

evaluating the financial quality of commercial banks.

3 SAMPLE SELECTION AND

DATA SOURCES

All financial data in this paper are from the CSMAR

database. According to the definition of the new

energy industry, 118 a-share new energy listed

companies in Shanghai and Shenzhen are selected in

this paper, including Kaier New Materials, Yueng

Holdings... Gigaweft lithium energy, etc. In order

to comprehensively analyze the financial quality of

the new energy industry, *ST company is retained

and the following companies are excluded :(1)

companies that have just been listed for less than two

years, which are not conducive to empirical research;

(2) companies with incomplete financial data and

obvious errors in some information are excluded from

the sample.

Based on the relevant theory of financial capacity,

this paper selected twelve variable indicators,

including current ratio, cash ratio, asset-liability ratio,

growth rate of total assets and net profit growth rate,

operating income growth, accounts receivable

turnover, inventory turnover, total assets turnover

ratio, total assets net profit margin, net interest rate of

the return on net assets and business, this paper

selects indicators in 2020.

4 THE RESEARCH PROCESS

4.1 Factor Analysis

4.1.1 KMO and Bartlett's Test

The closer KMO value is to 1, the stronger the

correlation between variables is, and the more

suitable the original variables are for factor analysis.

Bartlett is used to test whether the correlation matrix

is a unit matrix, that is, whether each variable is

independent. In factor analysis, if the null hypothesis

is rejected, factor analysis can be done; if the null

hypothesis is not rejected, it means that these

variables may provide some information

independently and are not suitable for factor analysis

(Wang 2018).

KMO and Bartlett sphericity tests were carried

out on the data, and the results were shown in Table

4.1. The KMO value was 0.681, over 0.5 and close to

0.7, and the P value was 0.000<0.05. It can be seen

that the original data is suitable for factor analysis.

Table 1: KMO and Bartlett's Test.

Kaiser-Meyer-Olkin Measure of Sampling

Ade

q

uac

y

.

0.681

Bartlett's Test of

Sphericity

Approx. Chi-Square 789.652

df 66

Sig. 0.000

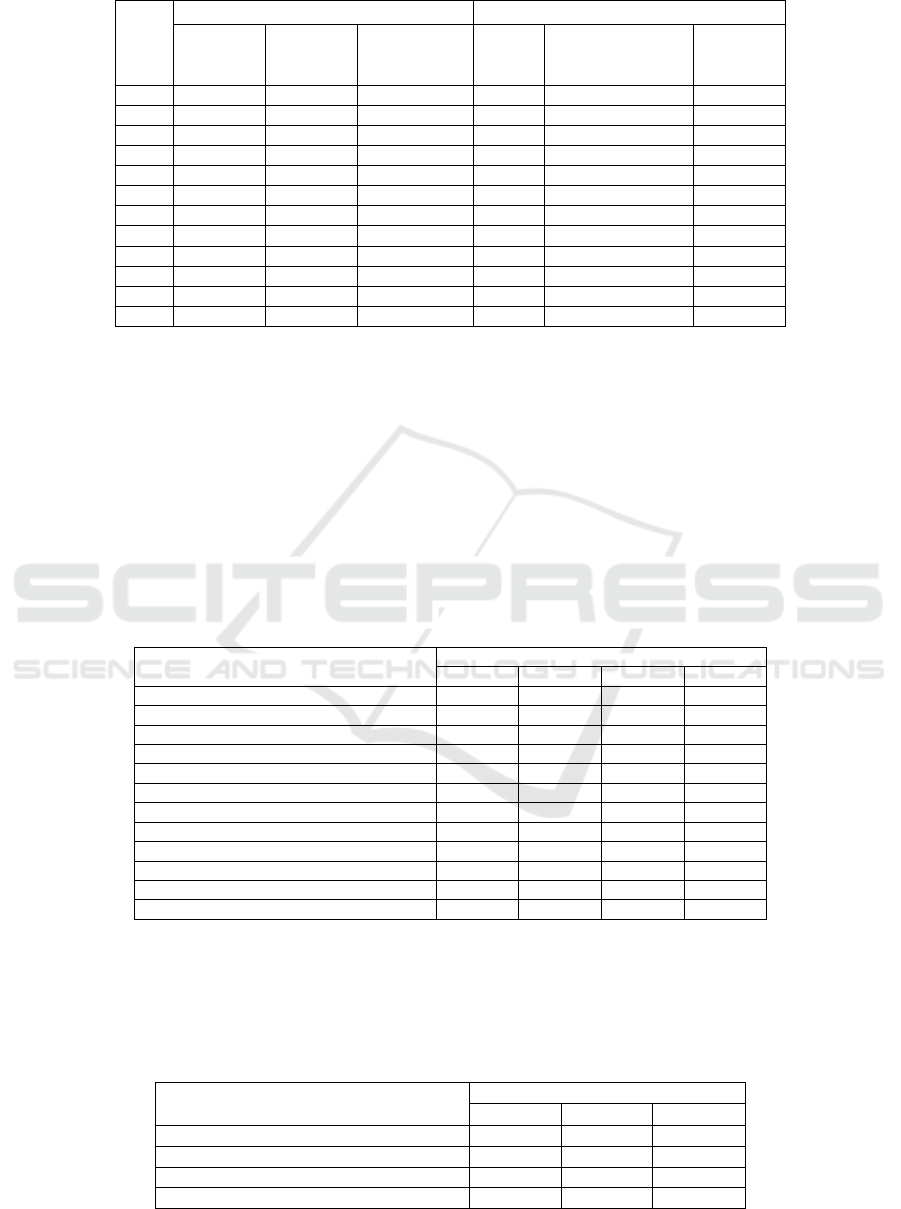

4.1.2 Factor Out

As the selected indicators are different, the

measurement units and orders of magnitude of data

indicators are different, so the original data are

standardized first. SPSS software was used for factor

naming and rotation of standardized data, and the

total variance of interpretation was shown in Table2.

Four common factors are extracted from the ten

factors, and the contribution rates of the four principal

components are 28.185%, 19.117%, 10.023% and

9.322% respectively (as can be seen from the

percentage of variance). The cumulative variance

contribution rate of the four common factors is

66.647%, that is, the combined influence of all

common factors on the dependent variable is

66.647%. It can accurately describe the financial

quality of listed new energy companies.

Research on Financial Quality Evaluation of New Energy Listed Companies based on Factor Analysis and Cluster Analysis

987

Table 2: Total Variance Explained

Compon

en

t

Initial Eigenvalues Sum of squares of rotational loads

Total

% of

Variance

Cumulative % Total

Sum of squares of

rotational loads

% of

Variance

1 3.633 30.275 30.275

3.382 28.185 28.185

2 2.083 17.358 47.633

2.294 19.117 47.302

3 1.189 9.911 57.544

1.203 10.023 57.326

4 1.092 9.103 66.647

1.119 9.322 66.647

5 0.958 7.981 74.628

6 0.876 7.304 81.932

7 0.846 7.047 88.979

8 0.558 4.653 93.632

9 0.389 3.239 96.870

10 0.217 1.807 98.677

11 0.140 1.164 99.841

12 0.019 0.159 100.000

4.1.3 Define Factor Variable

Since the typical representative variables of each

main factor in the unrotated load value are not very

prominent, in order to more accurately describe the

inherent economic significance of each factor and to

better describe the obtained factor with realistic

language, SPSS is used to rotate the factor load

matrix and the rotation component matrix is obtained

in Table3. It can be seen from the figure that net

interest rate on total assets, return on net assets and

net operating interest rate reflect the profitability of

the enterprise, while liquidity ratio, cash ratio and

asset-liability ratio reflect the solvency, receivables

turnover, inventory turnover and total assets turnover

reflect the operating capacity of the enterprise. The

growth rate of total assets, net profit and operating

income reflects the development ability of

enterprises. These four factors just confirm the four

representative indicators reflecting the financial

ability of enterprises.

Table 3: Rotated Component Matrix

Componen

t

1 2 3 4

Zscore (curren

t

ratio) -0.005 0.919 0.039 -0.115

Zscore (cash ratio ) 0.085 0.826 0.060 0.136

Zscore (lev) -0.183 -0.834 -0.034 -0.017

Zscore (growth rate of total assets) 0.449 -0.075 -0.012 -0.323

Zscore (net profi

t

growth rate) 0.727 0.118 -0.018 0.070

Zscore (growth rate of revenue) -0.037 -0.037 0.415 -0.521

Zscore (accoun

t

receivable turnove

r

) 0.025 -0.022 0.223 0.820

Zscore (inventory turnover) 0.057 0.006 -0.715 0.052

Zscore (total assets turnover) 0.114 0.134 0.670 0.168

Zscore(rate of return on total assets) 0.956 0.144 0.076 0.037

Zscore(return on equity) 0.958 0.075 0.075 0.030

Zscore(Ne

t

operating interes

t

rate) 0.873 0.069 -0.050 0.006

4.1.4 Calculated Factor Score

Variables are coded for the factors, and expressions

between 12 indicators and 4 factors are constructed.

F

1

is defined as profitability factor, F

2

as debt paying

ability factor, F

3

as operating ability factor and F

4

as

development ability factor. The scoring coefficient

matrix based on factor analysis is shown in Table 4.

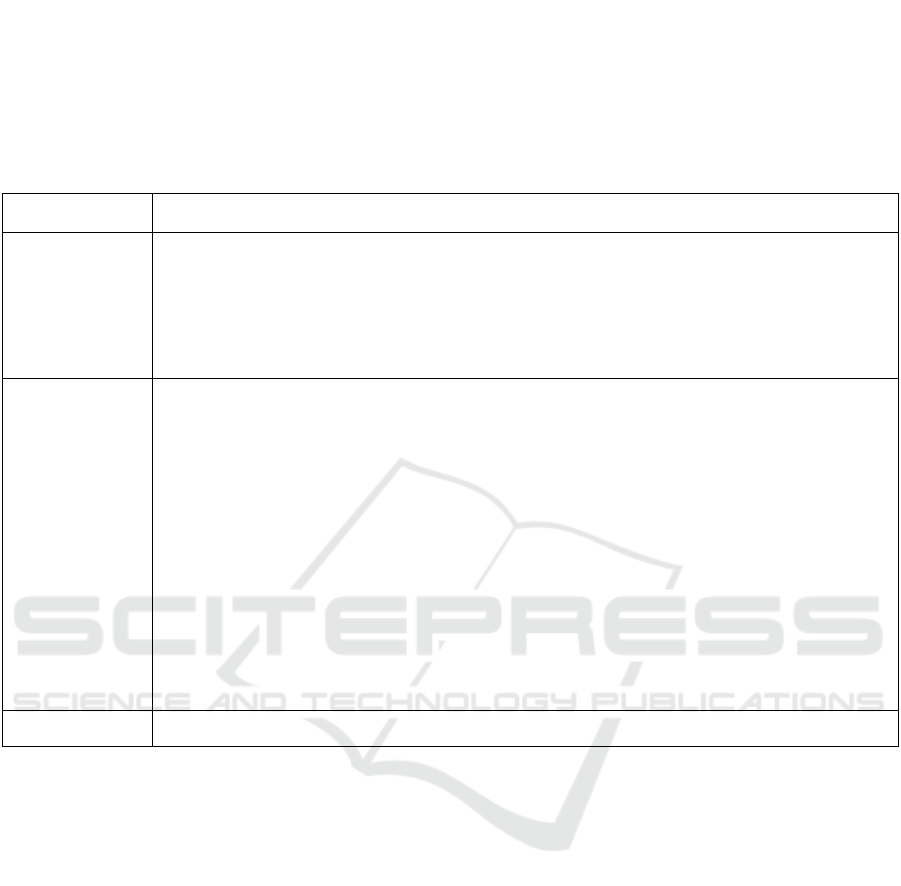

Table 4: Component Score Coefficient Matrix

Componen

t

1 2 3

Zscore(current ratio)

-0.068 0.424 -0.022

Zscore(cash ratio )

-0.036 0.366 -0.009

Zscore(lev)

0.005 -0.368 0.029

Zscore(growth rate of total assets)

0.147 -0.057 -0.003

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

988

Zscore(net profit growth rate)

0.215 0.001 -0.039

Zscore(growth rate of revenue)

-0.012 -0.026 0.372

Zscore(account receivable turnover)

-0.001 -0.050 0.161

Zscore(inventory turnover)

0.030 0.043 -0.607

Zscore(total assets turnover)

0.011 0.006 0.550

Zscore(rate of return on total assets)

0.283 -0.010 0.036

Zscore(return on equity)

Zscore(Ne

t

operating interes

t

rate)

0.288

0.265

-0.041

-0.029

0.040

-0.063

According to the component scoring coefficient

matrix in Table 4, the factor scoring function can be

obtained as follows:

F

1

=-0.068X

1

-

0.036X

2

+0.005X

3

+0.147X

4

+0.215X

5

-0.012X

6

-

0.001X

7

+0.030X

8

+0.011X

9

+0.283X

10

+0.288X

11

+0.2

65X

12

F

2

=0.424X

1

+0.366X

2

-0.368X

3

-

0.057X

4

+0.001X

5

-0.026X

6

-

0.050X

7

+0.043X

8

+0.006X

9

-0.010X

10

-0.041X

11

-

0.029X

12

F

3

=-0.022X

1

-0.009X

2

+0.029X

3

-0.003X

4

-

0.039X

5

+0.372X

6

+0.161X

7

-

0.607X

8

+0.550X

9

+0.036X

10

+0.040X

11

-0.063X

12

F

4

=-0.131X

1

+0.096X

2

+0.011X

3

-

0.291X

4

+0.055X

5

-

0.481X

6

+0.729X

7

+0.071X

8

+0.123X

9

+0.019X

10

+0.0

14X

11

-0.002X

12

According to the calculation result of factor

analysis, to new energy of the listed company profit

ability factor, debt paying ability factor, development

capacity factor and operation ability factor score

values as independent variables, explanation as

dependent variable, namely to Y represent new

energy listed companies financial quality score, build

multivariate linear regression model (Shen 2012),

formula is:

Y=(0.30275F

1

+0.17358F

2

+0.09911F

3

+0.09103F

4

)/0.66647

4.1.5 Ranking

The score of factor analysis is summarized and the 118

enterprises are ranked according to the score. The

paper only lists the top six and the bottom three listed

new energy enterprises.

Table 5: New energy enterprise score and ranking

Company name F

1

F

2

F

3

F

4

Y Ranking

Star power -0.005 1.150 0.969 6.051 1.27 1

Yuxing real stake -0.222 4.240 -0.332 0.157 0.98 2

Suzhou solid

technetiu

m

-0.050 3.198 0.306 0.329 0.90 3

Wanli shares -0.526 4.279 0.222 -0.365 0.86 4

Donghua energy 0.255 -0.437 2.376 2.343 0.68 5

Aoke shares 0.180 0.371 1.733 1.394 0.63 6

…… …… …… …… …… …… ……

Jiaru co -0.775 -1.027 0.506 -0.353 -0.59 113

Eicon Tec -1.222 -0.613 -0.207 0.174 -0.72 114

Jia new can 0.5256 0.175 -7.478 0.397 -0.77 115

Million lida -2.795 -0.549 0.581 -0.696 -1.42 116

*ST Huayi -6.315 -0.505 -0.606 -0.179 -3.11 117

ST King Kong -7.347 -0.487 -0.560 -0.211 -3.58 118

Comprehensive analysis: In terms of

comprehensive scores, 64 companies, including Star

Power, Yuxing, Suzhou Guzuo, Wanli, Donghua

Energy and Oke, have positive comprehensive scores

and their financial quality is higher than the average

level. The remaining 54 companies scored negative,

with only one company with a score greater than 1,

and eight companies with a score greater than 0.5,

indicating that some enterprises in China's energy

industry have insufficient financial resources, and

there is a large difference among enterprises, with the

overall financial level being average. From the point

of view of individual enterprises, star power, Yuxing

shares and Suzhou Gootechnetium and other listed

companies total score is high, the financial level is

significant, while Yi Lida, *ST Huayi and ST King

Research on Financial Quality Evaluation of New Energy Listed Companies based on Factor Analysis and Cluster Analysis

989

Kong and other enterprises total score is significantly

lower than the average. Sort by composite scores, the

top five companies have good financial quality

because of their four or most common factor score in

a hierarchical levels, explain the company's financial

quality not only see one aspect, such as low solvency

is not a good use of financial leverage a performance,

and to see whether the comprehensive factors.

4.2 Cluster Analysis and Results

Table 6: Cluster analysis.

category company name

1(34)

Star Power, Yuxing Co., LTD., Suzhou Gootechnetium Co., LTD., Wanli Co., LTD., Donghua

Energy Co., LTD., Oke Co., LTD., Chuantou Energy, Chengfei Integration, Zhongtian Technology,

Yicheng Xinneng, Yingluohua, Kuanda Technology, Dangsheng Technology, Shengyang Shares,

Cairn Co., LTD., Kesida Co., LTD., Longji Co., LTD., Beiba Media Co., LTD., Yunnan Energy

Investment Co., LTD., Hengdian Dongci Co., LTD., Shougang Co., LTD., Igor, Longma Sanitation,

Bowei Alloy, Camel Stock, Kaier New Material, Sheneng Stock, China Power, Daming city, New

Zhou Bang, Yutong Bus, Baoxin Energy, Yiwei Lithium energy, Leading Intelligence

2(82)

Linyang Energy, Fosu Technology, Aerospace Rainbow, Dongcai Technology, Jiangsu Xineng,

Jingsheng Electromechanical, Nanbo A, Zhuhai Port, Shenseg, Disen Shares, Putai Lai, Ganfeng

Lithium, North International, Longstar Chemical, Hengtong Optoelectronics, Daijin Heavy Industry,

Shangwei Shares, China Power Xingfa, Xinwangda, Jiangnan Chemical, Taisheng Wind Energy,

Naura Chuang, Changjiang Power, Woer Nuclear Materials, Ganeng Shares, Chengzhi Shares,

Zhonglai shares, Yinghe Technology, Nandu Power Supply, Fengyuan shares, Sunshine Power

Supply, Tianshun Wind Energy, Jixin Technology, Sinomaterial Technology, Dunan environment,

Dongfang Electric, Dongfang Risheng, Huawu Shares, Tianeng Heavy Industry, Gaolan Shares,

Shanshan Shares, Yonker Environmental Protection, Shao Shares, dongshan precision, hubei energy,

environmental protection, division of manufacturing, in the group, since the ranks, crystal

photoelectric, investment power, byd, large groups, core technology, vibration, jiang in electric,

electric, gansu hin tech center, its the big, huadian power international, Beijing can power, turbine in

China, the amalekites, Beijing express, Shenzhen Energy, Yueng Holding, Guodian Electric Power,

Tuori Xineng, Teride, Huaneng International, Ediqi Environment, Datang Power Generation,

Baochange Electric, Shanghai Electric Power, Duofudo, Huayin Power, JDIAN Shares, King Kong

Glass, Jia Yu Shares, Ikang Technology, Jia Ze Xineng, Yi Lida

3(2) *ST Huayi, ST King Kong

In this paper, k-means clustering method is adopted

to classify listed companies in the new energy

industry based on financial quality (Zhao 2019),

namely score Y, on the basis of factor analysis and

factor and comprehensive score, in order to identify

problems and draw conclusions more easily. The

results are shown in Table6.

The first Gradient company has the best business

performance, with 34 companies, accounting for

nearly one-third, indicating that there are many high-

quality companies in China's energy industry, and

such companies have strong strength, and investors

can get better returns if they invest in such companies.

The second gradient company has the middle and

lower business performance level, accounting for

nearly three-quarters of the total sample. This kind of

company is characterized by the overall performance

is generally lower, has its own advantages, but also

has certain problems, investors should hold a wait-

and-see attitude to this kind of company. There are

only two third gradient companies, poor business

performance, factor score and comprehensive score

are unsatisfactory, for *ST Huayi and ST King Kong

managers, want to reverse the situation is very high

pressure.

5 CONCLUSIONS

The new energy industry is in the stage of rapid

growth, with the support of national policies, is an

important part of the national strategy, and attracts the

attention of a large number of investors. New energy

listed companies are the "leader" of the new energy

industry, so the conclusion based on new energy listed

companies is more typical for the new energy

industry. The main research and innovation of this

paper are as follows:

With the method of factor analysis and cluster

analysis of 118 new energy to evaluate the financial

quality of listed companies and the company is

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

990

divided into three categories, the profitability as the

main factor is obtained and the quality of new energy

industry as a whole financial general conclusions, on

the basis of other scholars to further verify the

effectiveness of the factor analysis and

cluster analysis.

In view of the large gap between enterprises, the

lack of financial capacity of some enterprises and the

weakness of some enterprises in a certain aspect, the

government should allocate support resources

reasonably and effectively according to the r&d and

innovation capacity of enterprises in the new energy

industry. For enterprise managers, we should find out

the company's competitive advantages and

disadvantages, always seek innovation and upgrading,

encourage all staff to participate in enterprise cost

management.

REFERENCES

Hornungová, Jana, Milichovský, František. Financial

Performance Evaluation of the Czech Agricultural

Companies with Factor Analysis[J]. Scientific Papers

of the University of Pardubice, Series D, 2016, 23(37).

Hu Peng, Bai Bai, Wang Zhilin. Research on the

application of ahp-dea method in hospital financial risk

evaluation [J]. China health economics, 2018,37 (12):

104-107.

Li Xiaoyan. Performance evaluation analysis of listed

commercial banks based on entropy method [J].

Finance and Accounting Communications, 2014(17):

21-22.

Liang Mengxue. Comprehensive financial evaluation of

listed biomedical companies based on factor analysis

[J]. Hebei Enterprises, 2017(08):52-53.

Ma Shuzhong, Chen Li, ZHANG Hongsheng. International

business research, 2018, 39 (02):48-66.

Santosh Kumar Yadav and M. Dharani. Prioritising of

Banking Firms in India Using Entropy-TOPSIS

Method [J]. International Journal of Business

Innovation and Research, 2019, 20(4)

Shen Youdi, Shen Wang. Technology economics, 2012,

31 (7):66-72.]

Wang Haixia, Guo Jiaxi. Performance evaluation of listed

companies in Xinjiang Production and Construction

Corps based on DEA Model and Malmquist Index [J].

Finance and Accounting Communications, 2016 (29):

38-42.

Wang Jianhua, LI Ruting. New energy listed companies

performance evaluation system construction and

application [J]. Friends of Accounting, 2018(08).

Wang Lei, LIU Huiping. Performance evaluation of

Chinese agricultural listed companies based on factor

analysis [J]. Economic Research Reference, 2016(56).

Yulin GE,Jing YE. Empirical Analysis of Financial

Performance of Listed Company in Retail Based on

Factor Analysis Method [J]. International Business and

Management, 2018, 16(1).

Zhang Xinmin, Wang Xiuli. The quality characteristics of

enterprise financial Position [J]. Accounting Research,

2003 (09): 35-38.

Zhao Teng, Yang Shizhong. Application of Entropy weight

TOPSIS method in enterprise financial risk evaluation:

A Case study of Jiujiu Liquor Company [J]. Finance

and Accounting Monthly, 2019(3):9-16.

Zhao Xiangzhong, ZHANG Ying. Comprehensive

evaluation of financial risk of Listed companies in

Guangxi based on factor Analysis [J]. Finance and

Accounting Communications, 2016(14): 32-35.

Research on Financial Quality Evaluation of New Energy Listed Companies based on Factor Analysis and Cluster Analysis

991