Renewal of Land Transfer Fee and Real Estate Tax in the Silver Age

of Real Estate: Potential Estimation, Functional Substitution and

Policy Design

Xinqiang Song

1

, Jiajia Ke

2

, Huami Yi

3

and Peng Zhang

4

1

Headmaster’s office, Guangdong University of Finance and Economics, Guangzhou, Guangdong, China

2

School of Humanities and communication, Guangdong University of Finance and Economics, Guangzhou, Guangdong,

China

3

School of Culture Tourism and Geography, Guangdong University of Finance and Economics, Guangzhou, Guangdong,

China

4

School of Public Administration, Guangdong University of Finance and Economics, Guangzhou, Guangdong, China

Keywords: Land Transfer Fee, Real Estate Tax, Potential Estimation, Functional Substitution, Policy Design.

Abstract: Focusing on the current hot discussion on the collection of real estate tax and how to renew the land use term,

this paper discusses how to deal with the relationship between real estate tax and land transfer in the future.

Taking Guangzhou land market as the research object, by establishing an alternative analysis framework for

Guangzhou real estate tax and transfer fee, the total amount of existing urban residential buildings in

Guangzhou is estimated based on GIS technology, the effect of real estate tax and land transfer fee is

empirically analysed, and finally the process of government collecting real estate tax is simulated. Providing

theoretical analysis and policy design for the functional substitution between Guangzhou's future real estate

tax collection policy and transfer fee renewal policy.

1 INTRODUCTION

The golden age of real estate has passed which is

becoming the basic consensus of professionals. In

order to promote high-quality economic

development, we have to improve the ability to

prevent and resolve major risks. Therefore, the future

land financial transformation and the resolution of

local government debt risks urgently need the reform

of the national financial and tax system and

management system (Yang, et al, 2021, Zhang, et al,

2016). The legislation of real estate tax is imminent.

Can the real estate tax gradually replace the land

transfer fee? Can ordinary people no longer pay the

due land transfer fee under the condition of paying

real estate tax? These are hot topics at present, and

they are also hot issues related to the basic livelihood

and well-being of the people (An, 2015).

In recent years, real estate tax legislation is a hot

topic in the two sessions every year, and it is also a

hot spot in China's tax system reform, but there is no

specific timetable for its collection. At present, the

development trend of China's real estate is very

complex. On the one hand, the expiration and renewal

of commercial housing not only brings confusion to

residents, but also affects the real estate market; On

the other hand, the real estate tax to be introduced by

the state is also like a fog. How to deal with the

expiration and renewal of residential land use right

has always been a widely concerned problem by the

government and academia (Yi, et al, 2017, Zhang,

2021). At the same time, the real estate tax, which is

closely related to the real estate market and people's

life, has also attracted extensive social attention. On

the issue of land renewal upon expiration, although

the property law states "automatic renewal", there are

no specific legal provisions on the details such as how

long the renewal period is and whether the transfer

fee needs to be paid. Since the tax system reform in

1994, the land transfer fee has been placed under local

management, which has improved the land utilization

rate, but due to the unreasonable structure of local

fiscal revenue, the mode of relying on land sales to

obtain income to fill local fiscal revenue is

unsustainable. Therefore, the current institutional

problem is how to deal with the relationship between

1010

Song, X., Ke, J., Yi, H. and Zhang, P.

Renewal of Land Transfer Fee and Real Estate Tax in the Silver Age of Real Estate: Potential Estimation, Functional Substitution and Policy Design.

DOI: 10.5220/0011363000003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 1010-1017

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

real estate tax and land transfer fee, which is an urgent

problem to be discussed and solved.

2 GUANGZHOU REAL ESTATE

TAX POTENTIAL

ESTIMATION AND FUNCTION

SUBSTITUTION

2.1 Alternative Analysis Framework of

Real Estate Tax and Transfer Fee

The collection of real estate tax can not only maintain

the financial revenue of local governments, but also

take into account people's acceptance ability. This

study takes Guangzhou land market as the research

object to estimate the renewal land transfer fee under

the background of Guangzhou real estate tax in the

future. This study assumes that the transfer fee to be

paid for new land (including renewed land) in the

future will be reduced, and the reduction of land

transfer fee will reduce the financial revenue of local

government. In order to maintain the source of

government revenue, the total amount of land transfer

fee reduction and renewal add up to the total amount

of real estate tax collection every year (

Chen, et al,

2016

).

2.2 Empirical Calculation of Real

Estate Tax Collection

2.2.1 Using GIS Technology to Estimate the

Total Value of Existing Urban Housing

in Guangzhou.

The tax base of real estate tax is the value of

residential taxable area. To study the impact of

Guangzhou real estate tax on local finance, we should

consider the total value of urban housing in

Guangzhou. Since the housing information is not

disclosed to the public, the area of urban housing in

2021 is unknown. The total amount of urban housing

in 2021 is estimated by GIS technology. The

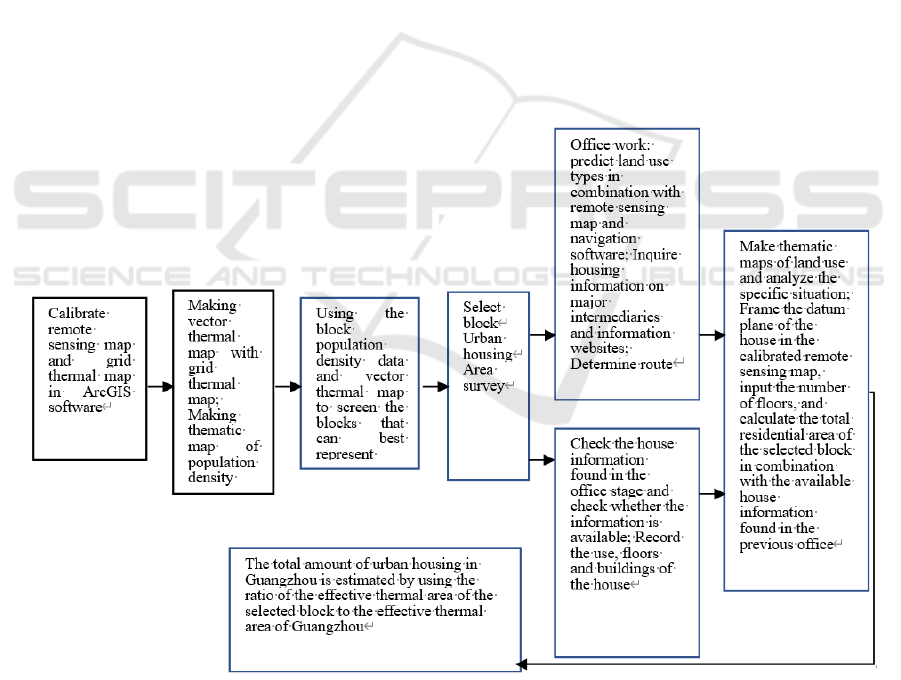

estimation process is shown in Figure 1.

Source: the author made his own according to the research results

Figure 1: Technical roadmap of GIS estimation.

Renewal of Land Transfer Fee and Real Estate Tax in the Silver Age of Real Estate: Potential Estimation, Functional Substitution and Policy

Design

1011

a) Selection of representative blocks

In order to estimate the total amount of urban

housing in Guangzhou more scientifically, block

population density data are selected. The blocks close

to the average population density are used as the

survey object, by comparing the block thermal scale

map with the thermal map of Guangzhou to ensure

that the selected blocks are more representative by

observing the availability (

Luo, et al, 2007).

Through the observation of block remote sensing

map and comparing the uniformity of land use type,

building density and residential distribution, we

found that the residential distribution of Tianyuan

street is relatively uniform, the area of urban villages

is small, and the average population density of

Guangzhou block is the smallest in the representative

area. Combined with the difficulty of field

investigation, Tianyuan street is preliminarily

selected as a representative block.

b) Estimation of urban residential area in

Tianyuan Street

In the internal business stage, the residential area

is counted from the existing data, and the availability

needs to be checked in the external business stage. To

estimate the residential area using GIS technology, it

is necessary to collect the number of

residential floors,

housing structure, supporting commercial building

floors and structures in the field stage, and give

corresponding symbols in the calculation process for

accumulation or elimination. To estimate the

residential area using GIS technology, it is necessary

to accurately deduct the building datum from the

remote sensing surface after calibration, and then

input the number of floors to calculate the calculation

results (see Table 1).

Table 1: Urban residential area of Tianyuan Street.

project Area (M2)

Calculate the urban residential area obtained from

Tianyuan street with ArcGIS (excluding the

statistical part of existing data)

1730355.057766

Statistics of urban residential area available 5725111.38

Estimated total urban housing area of Tianyuan

Street

7,455,466.437766

Source: the author calculated according to the research results

c) Estimation of total value of existing urban

housing in Guangzhou

The income method is adopted for the appraisal.

With reference to the rent data of China real estate

intermediary association, the annual net income =

monthly rent (yuan / month / ㎡) × 12. The rate of

return is determined by the rent level and selling

price. Since China only reformed welfare housing

distribution into monetary housing distribution in

1998, the service life of commercial housing land in

China is generally 70 years. In order to estimate the

house price in Guangzhou, the income life is set as 60

years in 2021, and so on in other years. The following

data and calculation results are obtained (see Table 2

and table 3).

Table 2: Estimation of the total value of existing urban housing in Guangzhou.

partic

ular

year

Annual rent

per square

meter in year

(yuan)

House price

(yuan / m2)

Rate of

return

Growth rate

of net income

over the

previous year

Years of

income

Annual

growth rate

of net

income

Appraisal

price (yuan /

m2)

2014 400.56

14762

2.71% 19.68% 67

5.55

10628

2015 411.36

16555

2.48% 2.7% 66 11919

2016 444.24

19208

2.31% 7.99% 65 13829

2017 486.24

18564

2.62% 9.45% 64 13366

2018 520.92

20016

2.6% 7.13% 63 14411

2019 616.56

22926

2.67% 18.35% 62 16506

2020 629.4

28578

2.2% 2.08% 61 20576

2021 645.24

32413

1.99% 2.51% 60 23454

Source: the author calculated according to the research results

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

1012

Table 3: Estimation of total population and housing.

particular

year

Proportion

of urban

population

(%)

Permanent

resident

population

(10000)

Per capita housing

area (M2)

Total urban residential

area (M2)

Appraisal

price (yuan /

m2)

2014 84.78 1275.96 21.89 234830509.2298 10628

2015 85.02 1283.39 22.46 245069634.7788 11919

2016 85.27 1292.68 22.73 250545570.0428 13829

2017 85.43 1308.05 23.32 260593331.218 13366

2018 85.53 1350.11 24 277139779.92 14411

2019 86.06 1404.35 25.42 307221953.662 16506

2020 86.14 1449.84 29.86 (latest

published sampling

data)

372919202.7536 20576

2021

(

estimated

)

86.6 1500 30 389734362.612 23454

Source: the author calculated according to the research results

2.2.2 Empirical Analysis on the Effect of

Real Estate Tax and Land Transfer

Fee

a) Empirical calculation of real estate tax levy

This paper uses the following formula to simulate

and calculate the real estate tax revenue of

Guangzhou after the collection of real estate tax:

𝑅

=𝑃

∗𝑇

∗𝑆

−𝑆

∗𝑁

∗4+𝑁

In essence, the above formula shows that the real

estate tax income is the difference between the total

urban residential value in Guangzhou and the

deductible residential value after the real estate tax is

levied. Among them, in order to evaluate the average

house price, it is calculated according to 72% of the

current price; For the real estate tax rate, this paper

selects 0.4%, 0.5% and 0.6% to study; It is the tax-free

area per capita. In the specific analysis, we divide it

into 20m²/ Person, 25m²/ Person, 30m²/ Three

scenarios are discussed. For the number of primary

and secondary school degrees in Guangzhou,

assuming that the student family of each degree is a

family of four, the total number of families with

houses in Guangzhou can be inferred through the

number of degrees 4 and the aging population, so as

to calculate the total reduced or exempted housing

value in Guangzhou. For the real estate tax rate,

referring to the real estate tax rate background

formulated by Chongqing and Shanghai, this paper

studies the real estate tax rate in three cases: 0.4%,

0.5% and 0.6%, and simulates the calculation results

(see Table 4).

Table 4: Income simulation calculation of real estate tax in Guangzhou.

particular

year

Number

of degrees

Aging population

Total urban

residential area

Assess average

house price

𝑇

=0.5%, 𝑆

=30

Real estate tax income at

2015 1381389 1184000 234830509.2 14762

17.82519084

2016 1373263 1264000 245069634.8 16555

25.24329468

2017 1406204 1330000 250545570.0 19208

28.97250868

2018 1432942 1406499 260593331.2 18564

31.03940816

2019 1453098 1475260 277139779.9 20016

42.15953895

2020 1474216 1546091 307221953.7 22926

69.27015554

2021 1234400 1618500 372919202.8 28578

181.3118054

Source: the author calculated according to the research results

Due to space constraints, only the tax rate is 0.5%

and the per capita tax-free area is 30m ²/ Real estate

tax income calculated by person time. In this paper,

based on the reduction area per capita, it is proposed

to be 20m² respectively, 25m², 30m² analysis on the

substitution effect of real estate income in Guangzhou

on land transfer fee in Guangzhou (see Table 5).

Renewal of Land Transfer Fee and Real Estate Tax in the Silver Age of Real Estate: Potential Estimation, Functional Substitution and Policy

Design

1013

Table 5: Estimation of substitution effect of real estate tax on land transfer fee under 0.5% real estate tax rate.

partic

ular

year

Land

transfer fee

(100 million

yuan)

Income from real estate tax (100 million yuan)

Reduced

area 20m ²

Substitution

effect (%)

Reduced

area 25m ²

Substitution

effect (%)

Reduced area

30m ²

Substitutio

n effect

(

%

)

2015 307.4 53.48 17.40% 35.65 11.60% 17.83 5.80%

2016 412.0 65.51 15.90% 45.38 11.01% 25.24 6.13%

2017 762.0 77.06 10.11% 53.02 6.96% 28.97 3.80%

2018 841.0 78.74 9.36% 54.89 6.53% 31.04 3.69%

2019 907.1 94.67 10.44% 68.42 7.54% 42.16 4.65%

2020 282.0 130.70 46.35% 99.98 35.46% 69.27 24.56%

2021 1173.0 248.76 21.21% 215.04 18.33% 181.31 15.46%

Source: the author calculated according to the research results

According to the statistical yearbook of land and

resources, the land transfer fee shows an increasing

trend as a whole. In 2016, due to the influence of

policy regulation, the land transfer fee in Guangzhou

was depressed. If it is included in the analysis, which

will affect the analysis effect, so it is excluded from

the analysis. See Table 6 for the average replacement

rate of different tax rates and different reduced areas

in 2016-2021.

Table 6: Estimation of average substitution rate of different tax rates and different reduced areas in 2016-2021.

Substitution effect (%)

Tax rate

(

%

)

0.40% 0.50% 0.60%

Reduced

area m ²

Reduced

area

20m ²

Reduced

area

25m²

Reduced

area

30m²

Reduced

area

20m²

Reduced

area

25m²

Reduced

area

30m²

Reduced

area

20m²

Reduced

area

25m²

Reduced

area

30m²

Average

substitution

effect

11.26 8.26 5.27 14.07 10.33 6.59 16.88 12.39 7.90

Source: the author calculated according to the research results

As can be seen from table 6, when the tax rate is

0.4%, the reduction area is 30m², the real estate tax

can averagely replace 5.27% of the land transfer fee;

When the tax rate is 0.6%, the reduced area is 20m²,

the real estate tax can averagely replace 16.88% of

the land transfer fee. The above analysis shows that

there are two extreme collection methods, while the

more moderate collection tax rate is 0.5% and the

reduction area is 25m². At this time, the average

replacement rate of real estate tax on land transfer fee

is 10.33%, and the effect is also more appropriate.

However, in the short term, when choosing the

appropriate collection rate, we also need to take into

account the actual situation of Guangzhou residents'

tax burden, tax collection technical conditions and

taxpayers' psychological expectations. Limited by

objective factors, the collection rate is generally less

than 100%. If the collection rate is too low, the effect

of real estate retention tax will be affected. Rural real

estate is not considered in the estimation of the

substitution effect of land transfer fee by real estate

tax. If rural real estate is included in the calculation

scope, the substitution effect is estimated to make up

for the lack of collection rate. Therefore, it is feasible

for real estate tax to replace land transfer fee.

b) Simulating the impact of real estate tax on local

fiscal revenue

Based on Guangzhou housing data, this paper

simulates and predicts the expected income of

Guangzhou personal housing real estate tax, and then

analyzes the impact of real estate tax on Guangzhou's

fiscal revenue.

Firstly, considering the sustainability of

government revenue and the acceptability of public

opinion, selecting the real estate tax rate is 0.5% and

the per capita tax-free area is 30m² to explore the

impact of real estate tax on Guangzhou’s fiscal

revenue. Based on the analysis of the substitution

effect of the former real estate tax on the land transfer

fee, the substitution effect is 6.59%; Secondly, select

the fiscal and tax data of Guangzhou from 2015 to

2021, and use the time series analysis method to make

an empirical analysis with the general budget revenue

(Y) as the explanatory variable and the real estate tax

revenue ( 𝑅

) as the explanatory variable. By

analyzing the impact of real estate tax reform on

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

1014

government revenue effect, a regression model is

constructed. The regression model is as follows:

LnY = β

+β

∗LnR

+ε

Among them, Y represents the general budget

revenue of Guangzhou, R

represents the real estate

tax revenue, β

represents the constant term,

β

represents the influence coefficient, and ε is the

residual term of the equation. In order to eliminate the

influence of heteroscedasticity on the regression

equation, logarithms are taken on both sides of the

regression equation of the model for linear regression

analysis.

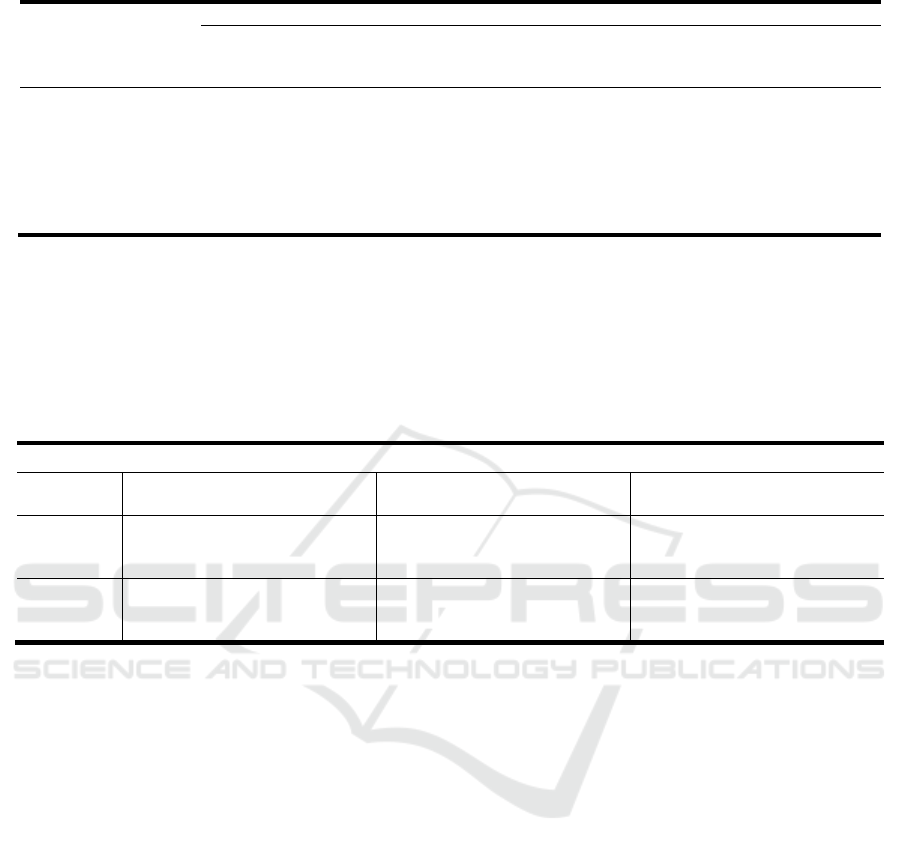

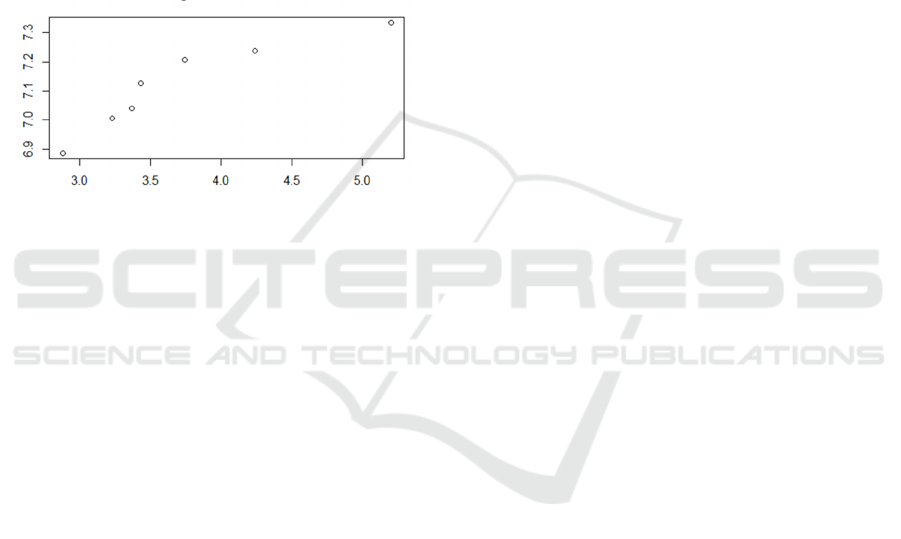

① The scatter diagram of the relationship

between real estate tax income and general budget

income is shown in Figure 2

(Abscissa: Real estate income, Ordinate: General budget

income)

Figure 2: scatter diagram of real estate tax income and

general budget income.

Source: the author calculated according to the research

results

According to figure 2, the logarithmic sample data

points fall near an approximate straight line,

indicating that there is a significant linear relationship

between real estate tax revenue and general budget

revenue. Because the sample points are not all on a

straight line, it shows that the relationship between

𝑅

andY is not completely linear, and there is an

interference term.

② Statistical analysis

Through Pearson correlation analysis (the

analysis process is omitted), the correlation

coefficient is 0.9225249 and the p value is 0.003077.

When the significance level is 0.01, the original

hypothesis is rejected and it is considered that there is

a significant linear correlation between real estate tax

income and general budget income after the

introduction of real estate tax. The determination

coefficient R

2

= 0.8511, the fitting degree of the

regression equation is good, which can explain the

variance of 85.11% of the dependent variable, and the

constant term and regression coefficient are

significant at the level of 0.01. The residual diagram

shows that all points are within 3 and there are no

abnormal values. It can be considered that the sample

data of this example is basically normal, and the

research assumptions of the theoretical model are

reasonable.

③ Analysis on the impact of levying real estate

tax on local fiscal revenue

Through modeling analysis, the regression

equation between general budget income and real

estate tax income is:

LnY = 6.43821 + 0.18293 ∗ LnR

As shown in the formula, there is a significant

positive correlation between the real estate tax

revenue and the general budget revenue, the

coefficient is 0.18293, and the elasticity is less than

1, indicating that the general budget revenue will

increase by less than the real estate tax revenue, that

is, for every 1% increase in the real estate tax revenue

after the introduction of the real estate tax, the general

budget revenue will increase by 0.18%, After the

introduction of real estate tax, the real estate tax

revenue plays an obvious role in stimulating the

financial revenue of Guangzhou.

3 RENEWAL OF LAND

TRANSFER FEE UNDER THE

BACKGROUND OF FUTURE

GUANGZHOU REAL ESTATE

TAX: POLICY SIMULATION

3.1 Policy Mix

In order to comply with the public opinion and make

the government revenue grow continuously and

steadily, according to the survey data and modeling

analysis, it is suggested to adopt the following policy

combination.

For the general population, 25m more than the per

capita tax-free housing² (refers to the housing

construction area, the same below) shall be calculated

according to the tax rate of 0.5% of the average

transaction price of new houses in the administrative

region in December of the previous year, and the tax

system of the current year shall be paid at the

beginning of the year, with no upper limit. Tax

payable = taxable area * average transaction price of

new houses in the administrative region where the

house is located in December of the previous year *

tax rate.

For retirees, set the age threshold. For example,

those who exceed the retirement age (generally 60

years old) only have one set of housing, which is tax-

Renewal of Land Transfer Fee and Real Estate Tax in the Silver Age of Real Estate: Potential Estimation, Functional Substitution and Policy

Design

1015

free no matter how large; If there is more than one set,

tax shall be paid from the second set. If more than one

suite is not self occupied and has income, it can bear

the tax and prevent others from attaching the house to

the tax-free quota for tax avoidance.

For retirees, set the age threshold. For example,

those who exceed the retirement age (generally 60

years old) only have one set of housing, which is tax-

free no matter how large; If there is more than one set,

tax shall be paid from the second set. If more than one

suite is not self occupied and has income, it can bear

the tax and prevent others from attaching the house to

the tax-free quota for tax avoidance. For the

unmarried young house buyers whose children of

Guangzhou families buy houses for the first time in

adulthood, if the house purchase area exceeds 100m²,

Considering the large area of tax payable, the

implementation of the registered residence

registration fee reduction 50m² for such people, non

registered residence registration can enjoy 35m² fee

reduction; If the area is less than 100m²/ The

registered residence of the city can enjoy 40m² fee

reduction. Non registered residence registration can

enjoy 25m² fee reduction. The registered residence of

singletons has more than 100m². The reduced area is

50m ². The area of tax exemption for those who hold

the residence permit for talent introduction in

Guangzhou is 50m². The self owned houses built by

farmers on the homestead are temporarily exempted

from real estate tax.

3.2 Using GIS Technology to Simulate

the Expropriation Process

Based on the above analysis, GIS technology is used

to simulate the process of government collecting real

estate tax. Based on the survey results, some

Tianyuan streets are selected as tax areas. The

housing types in this area include class I residence

(Villa) and class II residence, and have many factors

affecting house prices, such as location, greening,

education, commerce and so on. After learning the

housing location information, the corresponding

record carrier is established through GIS system to

realize the visualization of spatial relationship. The

10 housing information is assumed and the ownership

is Guangzhou registered residence. The income

method is adopted for the appraisal. GIS assisted

appraisal predefines and calculates the mathematical

model according to the selected appraisal method to

provide the reference price of real estate. The free

area is only for the first house of the owner, and the

free area is not allowed from the second house.

The tax rate policy of five grades of excess

accumulation system is implemented for the taxable

area. The tax rate of 0.7% is adopted for the taxable

area of class I residence of 50m² - 100m², and 1.1%

is adopted for the taxable area of class II residence of

more than 90m² and less than 120 m².

4 RESEARCH CONCLUSION

Taking GIS as the main research tool, this study

selects representative blocks by using the data of

block population density, economic development

level and income level. At the same time, the

replacement rate of real estate tax on land transfer fee

is calculated by different tax rates and exempted areas

based on the data of permanent population and the

number of primary and secondary school degrees.

Referring to the implementation methods of the

current two pilot cities of real estate tax, simulate the

policy rules and policy combination, and finally

simulate the real estate tax collection process (Fan, et

al, 2010).

In addition to legal principles and respecting

historical traditions, the renewal and supplementary

payment of land use right also needs to be based on

economic principles, the concept of social equity and

the specific practice of land system (Huang, 2018).

Based on the land price theory, from the perspective

of land policy and public policy, land taxation and

social equity, and from the perspective of realizing

social fairness and justice, reducing management

costs and conforming to economic laws, China

should abandon the policy orientation of continuing

to pay the transfer fee according to the real-time

market rent when the land expires, and amend

relevant laws in time to make the use right of

residential land long-term or even permanent, and

adopt appropriate land tax policies to return the land

value-added income to the state (Chen, et al, 2007,

Zhu, 2016). The recovery of land appreciation should

become the main value orientation of China's land

policy in the future. Therefore, the three policies of

differentiated low standard collection, consolidated

real estate tax and land appreciation are more

reasonable, especially land appreciation (Zhu, Fang,

2019).

No matter when the land use right expires, in the

real estate transaction link, the evaluation institution

entrusted by the government will calculate the land

appreciation and recover 30% - 60% of the

appreciation. If the appreciation is not increased,

there is no need to make up the payment. The

supplementary payment of similar land value-added

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

1016

tax is only collected when the property right is

transferred and expires. This method is different from

the function of real estate tax. It should reflect the

basic system of state ownership, and the price rise

should be returned to the public. The land value-

added tax paid during the period can be included in

the historical cost accounting and deducted when

making up the payment (Peng, 2016). In short, there

is no value-added tax (transfer fee).

REFERENCES

An Tifu., 2015. Legal basis and relevant policy suggestions

for real estate tax legislation. Research on local finance.

Chen Ping, Li Jianying, Zhuang Hailing., 2018. Prediction

of the impact of real estate tax reform on local fiscal

revenue -- simulation calculation based on Guangzhou

data. Tax research.

Chen Yulu, Zhao Ziwei, Guo Dongjun, Zou Dahai, Chen

Zhilong., 2021. Study on the correlation between urban

underground space and population distribution. Journal

of underground space and engineering.

Fan Zhongjun., 2010. Bayesian vector autoregressive

analysis method and its application. Mathematical

statistics and management.

Huang Xiaofang., 2018. The automatic renewal of house

property rights after 70 years lays the foundation for the

collection of real estate tax. Economic daily.

Luo Gang Hui, Wu Ci Fang, Zheng juan'er., 2007.

Influence of parcel area on residential land price. China

land science.

Peng Pei., 2016. Land development right and distribution

of land value-added income. Chinese issues and British

experience. Chinese and foreign law.

Yang Yuanyuan, Jia Pengfei, Gao jiechao., 2021. Choice of

long-term regulation paradigm of China's real estate:

real estate tax policy or macro Prudential policy.

Finance, trade and economy:

Yi Liqi, Zhou Ruiping., 2017. Analysis of settlement

change characteristics and influencing factors from the

perspective of Urban New Area Construction in recent

10 years. Journal of Inner Mongolia Normal University

(PHILOSOPHY AND SOCIAL SCIENCES

EDITION).

Zhang Ping, Ren Qiang, Hou Yilin., 2016. China's real

estate tax and the transformation of local public

finance. Journal of public management.

Zhang su., 2021. Research progress of tax base batch

evaluation in real estate tax reform. Special economic

zone.

Zhu Haifeng, Fang Xu., 2019. Research on land income

balance calculation method supported by GIS.

Computer and digital engineering.

Zhu Liyu., 2016. Analysis on the substitution effect of real

estate tax on land transfer fee in the "post land finance"

period--Taking Sichuan Province as an example.

Journal of Henan College of Finance and taxation.

Renewal of Land Transfer Fee and Real Estate Tax in the Silver Age of Real Estate: Potential Estimation, Functional Substitution and Policy

Design

1017