Adaptive Transformation of Ukraine's Economy in the Context of

Covid-2019 Pandemic

Kateryna Holikova

1a

, Svitlana Matsyura

1b

, Viktoriia Radko

1c

, Kobuljon Kurolov

2d

,

Nina Rudenko

3

and Daryna Zhukova

3

1

State University of Economics and Technology, Kryvyi Rih, Ukraine

2

Tashkent state technical University Named after Islam Karimov, Tashkent, Uzbekistan

3

Kryvyi Rih Technical College of the National Metallurgicall Academy of Ukraine, Krivyi Rih, Ukraine

Keywords: Adaptive Transformation, COVID-2019, Pandemic, Economic Crisis, Gross Domestic Product, Forecast,

World Economy.

Abstract: The predictions of analysts and scientists are analyzed and the preconditions of the global economic crisis

caused by Covid-2019 are determined. Scenarios for the development of the economic crisis and stages of

forecasting economic development for Ukraine are considered. The program measures of the state authorities

of some countries of the world and measures on overcoming of consequences of crisis situation in Ukraine

are considered and the estimation of consequences of their realization with development of the corresponding

offers is carried out.

1 INTRODUCTION

Not only have our daily lives been affected by the

pandemic induced by the spread of the coronavirus

infection, but also a number of global processes.

Along with the shift in methodology, the instruments

that defined the product's worth, produced profit,

established trends, and set the pace for the economy's

development shifted as well. Digitalization is one of

the new tools that have undoubtedly made our lives

easier during the lockdown.

Evidently, any modifications to the system result

in changes to the functioning of its effective

mechanisms. Demand is the most important

mechanism in economics. Obsolete tools became less

useful during the pandemic, and in some fields, they

were found to be useless. They were replaced by

digital tools that are quickly changing demand

development.

Regardless of the contentious concerns, one thing

is certain: the global market has changed as a result

of the pandemic and will never revert to its pre-

pandemic state. Profitability will be achieved only by

a

https://orcid.org/0000-0002-6303-3833

b

https://orcid.org/0000-0002-3243-7683

c

https://orcid.org/0000-0003-0351-2573

d

https://orcid.org/0000-0003-1703-0161

adaptation to new conditions. The coronavirus

outbreak had a negative influence on world trade, but

it also created new chances and places for

development, bringing to mankind's attention

previously unmentioned challenges. Supply networks

are reopening, commerce is resuming, and

technology is evolving at a quicker rate than ever

before. Without a doubt, the crisis has pushed forward

important changes and will keep doing so

(Samuelson, 1993).

The external environment's dynamism and variety

compel governments to react instantly - to adapt.

Adaptation is defined as "the process of modifying

the properties of a system to achieve the best or at

least acceptable effectiveness under changing

conditions" or "the process of modifying the

parameters and structure of a system, as well as

possibly controlling actions based on current data, to

achieve a certain, usually optimal, state of the system

under initial uncertainty and changing operating

conditions".

As demonstrated in the scientific works of Y.

Zavadsky, T. Osovska, O. Yushkevich, V.

Holikova, K., Matsyura, S., Radko, V., Kurolov, K., Rudenko, N. and Zhukova, D.

Adaptive Transformation of Ukraine’s Economy in the Context of Covid-2019 Pandemic.

DOI: 10.5220/0011363300003350

In Proceedings of the 5th International Scientific Congress Society of Ambient Intelligence (ISC SAI 2022) - Sustainable Development and Global Climate Change, pages 401-409

ISBN: 978-989-758-600-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

401

Kaznacheev, V. Lozovoy, E. Chizhenkov, N.

Shevchuk, K. Zaika, D. Soltys, and G. Khanaliev, the

scientific and practical phenomenon of adaptation has

a fairly broad range of scientific and methodological

applications. These studies enable the identification

of characteristics such as an object's or subject's

adaptability to shifting situations or circumstances,

including changing functions, structure,

relationships, or parameters, in order to facilitate

adaptation.

According to Meskon M. (Mescon, Albert and

Hedouri, 1997) the basis of modern management is

adaptation, as frequent changes in the external

environment and internal environment of functioning

socioeconomic systems consistently lead to crisis

situations.

According to the neoclassical theory of adaptation

proposed by A. Marshall, S. Brew, P. Samuelson

(Samuelson, 1993) etc., the economic system's

subjects' behaviour is governed by the following

categories of constraints:

- resources (lack and depletion of resources);

- technical (achieved level of technological

development and innovation);

- conjuncture (characteristics of the markets).

In accordance with T. Grinko's study (Grinko,

2012), where adaptation is defined as a change in the

current state of an object as a result of changing

environmental conditions necessary for its existence,

we would further consider the following

classification of various types of adaptation:

1) private (linear) adaptation - adaptation targeted

at selecting individual factors independently of their

agreement and without needing a fundamental

reorganization of the object's existing functional

system;

2) systemic (multilevel) adaptation - adaptation

that requires a change in management, a

reinterpretation of priorities, a formation of new

connections, and a systematic reorganization of

operations;

3) problematic adaptation-adaptation aiming at

resolving the "cause" of the requirement for

adaptation;

4) complicated adaptation-adaptation aimed at

altering the object of adaptation and necessitating

system rearrangement;

5) product (effective) adaptation-adaptation that

occurs when the product of production must be

changed, when changes to the internal environment

are required to achieve the expected level of results at

the output of the production system;

6) "classical" adaptation-adaptation is required

when the external environment influences the

adapting object. As a result, the response is the

traditional approach associated with a change in the

organization's internal environment;

7) programme adaptation-adaptation in which the

external environment's impact is balanced by the

object of adaptation's internal activity, which enables

it to approach the desired state through the utilization

of known and currently available environmental

factors;

8) tolerant adaptation - occurs when an item,

having everything necessary and at its disposal, can

also serve as a subject of control, allowing it to apply

an approach based on event prediction and future

situation.

Therefore, adaptation is "a response to changing

conditions that mitigates the risk of a system's

behaviour degrading in efficiency".

The authors prepared the article using a

methodological approach that is based on the results

of their previous scientific works. The authors used

system analysis and synthesis methods, specifically

causal and historical analysis, to establish the essence

and types of adaptation; induction and deduction to

determine the favourable trends of a sustainable

economy in the context of mitigating the impact of

challenges and threats; modelling and analogy to

adapt a dynamic model of the economic development

management system under the influence of the

COVID-19 pandemic; simulation modelling - in the

process of developing different scenarios for

Ukraine's future.

2 BACKGROUND

The extraordinary nature of the crisis caused by the

spread of the SARS-CoV-2 coronavirus is that it

manifests not so much as a break in the development

trajectory as a significant shift in development on

both macro and micro levels, against the backdrop of

fundamental changes in society's way of life. The

changes impacted every facet of existence

(communication/ mode of work/ training, etc.). And

the forced implementation of permanent quarantine

restrictions in most of the world's countries and

Ukraine, which varied in scope and timing throughout

the year, resulted in an unprecedented shift in the

behaviour of economic entities at both the

consumption and production levels, as precaution

against the possibility of permanent restrictions

became the dominant motivational principle. In many

countries around the world, economic growth slowed

down because of the pandemic and unusual

quarantine rules. This includes the EU and Ukraine.

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

402

By and large, the decline in the state of Ukraine in

2020 is rather minor in comparison to many other

countries. Therefore, when comparing Ukraine's

economic performance in 2020 to that of the EU (27)

and that of neighbouring countries such as Hungary

and Slovakia, Ukraine has negative interest rates and

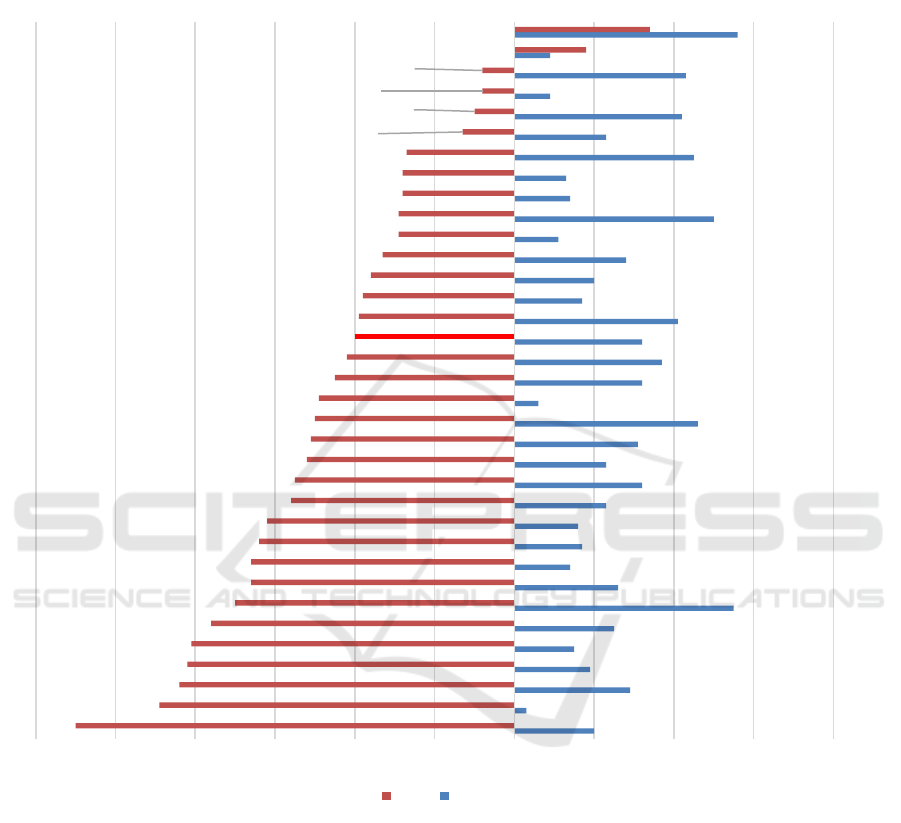

stronger GDP dynamics in 2020 (Figure 1).

Figure 1: Change in GDP in Ukraine and EU countries, compared to the corresponding period of the previous year, %

(Ministry of Economic Development, 2021).

The reason for this accomplishment is primarily

due to our economy's transformational nature. Weak

participation in global value-added production

chains, a sizable share of shadow businesses and

income, underdeveloped tourism, a significant share

of agriculture (which ensured food security), a sizable

share of large-scale production that continued to

operate even during peak periods, and the capacity of

Ukrainians to survive and adapt to a variety of

difficult circumstances all contributed to this.

To establish a national strategy for economic

development in Ukraine, as in any other European

country, international ratings are utilized as indicators

of the country's internal and external environment

(Table 1).

Ukraine's place in the world rankings is in a state

of flux. It is worth noting that, between 2014 and

2020, Ukraine increased its position in the

international arena in terms of the world's strongest

militaries, the world's happiness rating, economic

freedom, ease of doing business (its conduct), and

democracy.

2

0,3

2,9

1,9

1,5

2,5

5,5

2,6

1,4

1,7

1,6

2,3

3,2

2,3

3,1

4,6

0,6

3,2

3,7

3,2

4,1

1,7

2

2,8

1,1

5

1,4

1,3

4,5

2,3

4,2

0,9

4,3

0,9

5,6

-11

-8,9

-8,4

-8,2

-8,1

-7,6

-7

-6,6

-6,6

-6,4

-6,2

-5,6

-5,5

-5,2

-5,1

-5

-4,9

-4,5

-4,2

-4

-3,9

-3,8

-3,6

-3,3

-2,9

-2,9

-2,8

-2,8

-2,7

-1,3

-1

-0,8

-0,8

1,8

3,4

-12-10-8-6-4-202468

Spain

Italy

Croatia

Greece

France

Portugal

Malta

Iceland

Austria

Belgium

EU (27 countries)

Czech Republic

Slovenia

Slovakia

Cyprus

Hungary

Germany

Northern Macedonia

Bulgaria

Ukraine

Romania

Netherlands

Latvia

Denmark

Switzerland

Estonia

Sweden

Finland

Poland

Luxembourg

Serbia

Norway

Lithuania

Turkey

Ireland

2020 2019

Adaptive Transformation of Ukraine’s Economy in the Context of Covid-2019 Pandemic

403

However, it was in 2020 that the state's position

was marginally weakened in terms of countries'

competitiveness ratings and perceptions of

corruption. Ukraine is a relative outsider in the

world's ranking of innovative economies, having

dropped from 41st to 56th place since 2016.

Table 1: Indicators for assessing the effectiveness of public policy in Ukraine: the international dimension.

№ Indicator

Place in the rankin

g

2014 2015 2016 2017 2018 2019 2020

1 Press Freedom Index 127 129 107 102 101 102 96

2 Global Fire

p

owe

r

21 21 25 25 30 29 27

3 World Ha

pp

iness Re

p

ort 111 123 132 133 138 133 123

4 The Global

Competitiveness Index

49 60 59 60 59 54 55

5 The Index of Economic

Freedo

m

155 162 162 166 150 147 134

6 Ease of Doing Business

Index

112 96 83 80 76 71 64

7 Corruption perception

index

144 142 130 131 130 120 126

8 Democrac

y

Index 928886868483 78

9 Worlds most innovative

economies

49 33 41 42 46 53 56

There are solely economic reasons for the

Ukrainian economy's slight deterioration. Among

them, the government and the NBU have

implemented measures aimed at mitigating the

negative effects of the COVID-19 pandemic by

assisting the population and businesses, rapidly

adapting certain sectors of the economy to work

under social restrictions, and, unlike in previous

crises, maintaining financial sector stability. Given

the limited demand, the government and the NBU

expect inflation to reach 5% at the end of the year,

which corresponds to the inflation target. All of these

things add up to create a positive level of domestic

consumer demand.

Thus, home consumer demand lost the least

during the crisis and was the only source of GDP

growth in 2020.

Two factors contributed to the demand's positive

dynamics.

First, the government's social policy. The

minimum wage was increased (from UAH 4,723 to

UAH 5,000 on January 1, 2020), labour rights for

employees and internally displaced persons were

guaranteed, and temporary disability benefits equal to

50% of the average salary were paid in the fight

against COVID-19. Additionally, it assists employers

from small and medium-sized businesses with partial

unemployment throughout the quarantine time

(Ministry of Economic Development, 2021).

Despite the difficulties encountered in developing

labour market conditions during Ukraine's and the

world's lockdowns, the unemployment rate in

Ukraine remained within the projected ranges for the

year. Thus, the PES estimates that 1,674.2 thousand

individuals became unemployed in 2020, the

unemployment rate for the population aged 15–70 in

2020 was 9.5 % of the labour force of the

corresponding age, taking into account the 4.0 %

decline in the number of working people aged 15–70

in 2019.

The second factor contributing to demand growth

was the overall positive dynamics of nominal wages

as a result of the continued growth of certain sectors

of the economy (wholesale and retail trade, financial

and IT sectors, chemical and pharmaceutical

industries) in the context of increased demand for

data services and products of foreign trade activity

(FTA).

In general, the nominal average monthly wage of

full-time employees increased by 10.4 % to UAH

11 591 in 2020 (from UAH 10,497 in 2019), and real

wages increased by 7.4 %, which enabled the

government to maintain a positive level of household

demand even after accounting for the compensation

social payments imposed by the government.

Unfortunately, despite a considerable rise in

public capital spending, it was nearly impossible to

offset the decline in investment demand. The

investment standstill has become one of the primary

symptoms of the COVID-19 pandemic, against a

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

404

backdrop of significant uncertainty. By and large,

gross fixed capital formation (GFCF) constituted the

largest demand component to decrease, at 24.4% in

2020 (against an increase of 11.7% in 2019) (Report

coronavirus cases).

Investments decreased across practically all

sectors of the economy, except for postal and courier

services and telecommunications (wireless

communications), which are directly tied to activities

subject to quarantine regulations. Among the FTA

that experienced the greatest decline in master capital

investments were air transport, art, sports,

entertainment, and recreation, all of which were

included in the list of activities subject to quarantine.

External demand is quite low, and protectionism

from some trading partners has aggravated existing

production challenges in several nations, given that

economic and social activity in the majority of

countries has been focused on fighting the COVID-

19 pandemic. The above resulted in negative effects

on foreign economic activity, given the Ukrainian

economy's export focus. Additionally, a lower

agricultural output and a deteriorating external

economic situation for some types of Ukrainian

export goods were factors (in particular, ferrous

metals, corn, and fertilizers). Thus, according to

preliminary data from the National Bank, exports of

goods and services declined by 4.6 % in value terms

in 2020. Simultaneously, imports faced bigger losses

than exports in the absence of significant exchange

rate variations. Imports of goods and services

declined by 17.9 % in value terms compared to 2019.

In 2020, the balance of trade in goods and services

was “minus” $1,813 million (Ministry of Economic

Development, 2021).

Globally, the exceptional economic situation and

periodic limits on the activities of businesses and

organizations aimed at preventing the spread of

infection have had an effect on both the dynamics of

the major components of demand and, consequently,

on production activity. Furthermore, it is worth noting

that production responded not just to demand

dynamics, but also to direct quarantine restrictions

and temporary difficulty getting sufficient imported

raw materials.

Thus, in a sectoral context, the most tangible

impact was felt primarily by industries that require

the concentration of numerous people in a single

room or their long-term communication and work at

a dangerously close distance from an infectious

standpoint. As a result, the services sector incurred

huge losses, including passenger transportation

(53.9% decline in passenger turnover), catering

facilities, hotels, restaurants, etc. And this is despite

the fact that household demand has remained

constant. These are primarily small and medium-

sized businesses whose operations are restricted by a

variety of prohibitions and quarantine regulations.

As a result, industries that are primarily focused

on their home market and are capable of rapidly

adapting their operations to changing conditions

experienced significantly fewer losses as a result of

their use of digital technology. For instance, the

pharmaceutical industry (which is expected to grow

by 3% in 2020) and chemical production (which is

expected to grow by 5.1%), the food industry (which

is expected to decrease by only 0.8%), the IT-sector,

the financial sector, and, of course, the health security

sector, which bears the brunt of the fight against the

coronavirus (Kuznetsova, 2020).

Additionally, investment cycle industries' output

was severely reduced (in particular, mechanical

engineering's by 17.6%), except for building, which

grow by 5.6%. Furthermore, it indicated a

considerable decline in the amount of export-oriented

manufacturing (especially metallurgy— by 8.7%).

However, the decline in GDP is less than the

decline in other indices of the economy's major

sectors, most notably industry (decrease by 4.5%) and

agriculture (decrease by 11.5%). The reason for this

is that some types of economic activity, which were

historically determined to be the main drivers of GDP

growth, were compensated for by an increase or a

negligible decrease in the performance of others,

which proved to be less vulnerable, more adaptable to

realities, or even benefited from the growth in

demand for their products.

The fact that Ukraine avoided financial

destabilisation during the crisis and maintained

uninterrupted banking activity allowed for the active

use of financial mechanisms to assist society and the

economy in combating the crisis. The government's

assistance was critical in general, particularly the

prioritisation of budgetary money to fulfil medical

demands and repair transportation and social

infrastructure, as well as to assist the populace and

businesses in stimulating demand.

In turn, the mobile movement of enterprises to

new modes of work process organization (remote/

home-based work and training) boosted demand for

new digital services and the provision of existing

digital services, including conducting trade and

business.

UNCTAD suggests temporarily abandoning

austerity and pursuing balanced macroeconomic

expansion until the private sector begins to expand its

spendings. This policy assumes an acceleration of

wage growth for low-income employees while

Adaptive Transformation of Ukraine’s Economy in the Context of Covid-2019 Pandemic

405

simultaneously lowering real interest rates to negative

levels. This effectively means that a part of the

primary balance of the debt would be written off,

which would encourage businesses, the populace, and

the government to spend the loan funds. Additionally,

the COVID-19 crisis may be an appropriate time to

establish a wealth tax, as even a minor increase in the

taxes of high-income individuals and businesses

would have a substantial effect.

More ambitious steps are required to ensure a

global recovery following the global crisis. Firstly, it

is discussing a large-scale extra distribution of special

drawing rights (SDR)—a type of international reserve

asset issued by the International Monetary Fund and

convertible into hard cash. By 2020, over $204 billion

in special drawing rights will have been issued,

equating to approximately $288 billion. USA.

Around 90% of all SDRs were distributed during the

2009 global financial crisis. UNCTAD wants to

multiply this figure by 2.5 trillion and distribute new

SDRs in US dollars. Developing countries would

receive the equivalent of $1 trillion in this case to

cover current liquidity requirements. This would cost

Ukraine 50 billion dollars (Trade and development

report, 2020).

Secondly, the idea entails a Marshall Plan-style

approach to global health recovery. This is not just

about medicine; it is also about access to safe drinking

water and sanitation, as well as food security and

working and housing situations. UNCTAD estimates

that global donors may commit up to 600 billion

dollars to similar causes over the next year and a half

via grant assistance or interest-free loans.

Simultaneously, UNCTAD recommends

establishing a new state-controlled credit rating

agency to compete with the private sector, as well as

a worldwide sovereign debt authority that is

independent of the private sector. It must avoid the

escalation of liquidity crises into recurrent sovereign

defaults. Its responsibilities could include the creation

of a publicly available register of countries' loans and

obligations. Additionally, such a worldwide

organization might establish an international legal

framework for automatic debt suspension during

times of crisis and a method for resolving such debts

in a fair, efficient, and transparent manner.

Thus, UNCTAD provides scenarios for economic

growth following the pandemic's resolution and

emphasizes the importance of integrating driver

growth, outcomes, and budgetary requirements into a

“growth recovery” scenario (Table 2).

Table 2: A ‘growth revival’ scenario compared with the baseline, 2022–2030 (per cent).

Indicators

World

economy

Developed:

current

account

deficit

economies

Developed:

current

account

surplus

economies

Emerging:

current

account

deficit

economies

Emerging:

net energy

exporting

economies

Emerging

: current

account

surplus

economie

s

GDP growth:

average 2022–2030

[baseline]

['growth revival'

scenario]

2.0

3.8

1.0

2.8

0.9

2.6

2.3

5.0

1.9

4.7

4.3

5.3

Private investment

growth:

average 2022–2030

[baseline]

['growth revival'

scenario]

3.8

6.0

2.0

5.6

2.1

6.4

2.3

6.6

2.8

7.8

5.9

5.1

Government spending

growth: average

2022–2030 [baseline]

['growth revival'

scenario]

1.2

3.1

-0.1

2.4

-0.2

2.1

2.1

4.1

1.5

3.8

2.3

3.4

Government spending

(percent of GDP):

average 2022–2030

[baseline]

['growth revival'

scenario]

19.8

19.9

18.6

19.1

22.6

23.4

18.1

17.1

22.2

21.8

18.3

18.9

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

406

Government debt

ratio [per cent of

GDP]:

at year 2021

at year 2030

[baseline]

['growth revival'

scenario]

89.6

91.8

76.3

119.7

139.6

113.7

123.4

128.7

115.5

84.5

105.2

70.7

56.8

67.8

43.9

65.8

48.1

53.6

Share of labour

income:

average 2022–2030

[baseline]

['growth revival'

scenario]

49.8

54.0

51.1

56.5

51.5

55.9

45.0

49.7

44.4

48.7

54.2

57.3

According to UNCTAD research, austerity

measures stifle economic growth and do not ensure

public debt sustainability. On the contrary, and

particularly in countries with weaker economies,

budget deficits are frequently the result of the

government squeezing out the private sector,

resulting in decreased tax revenues and increased

unemployment. As a result, reverting prematurely to

a policy of high deficits following the recent crisis

could be perilous and result in a slowdown in

economic growth. According to the organization, this

equates to approximately one percentage point per

year for the next decade. The consequences can be

particularly severe for developing countries, where

fiscal space is constrained by high debt levels,

monetary policy is under external pressure, and the

informal economy cannot grow on its modest

resources alone.

The authors attempt to estimate the prospects for

the development of the Ukrainian economy in the

aftermath of the global COVID-19 pandemic, taking

into consideration scientific, technological,

information-psychological, and social elements.

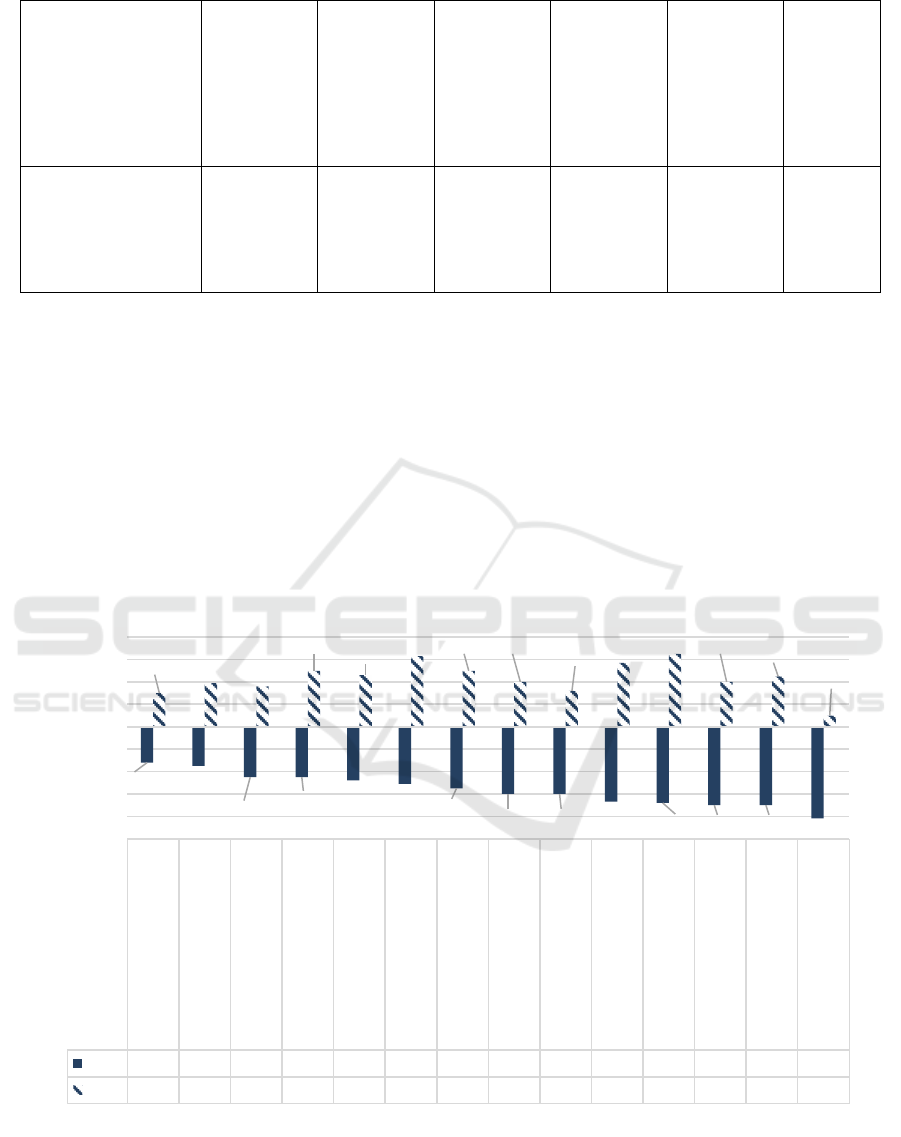

Considering the forecasts generated by several

analytic structures is below (Figure 2).

Figure 2: Forecast estimates of Ukraine's GDP dynamics made by various expert-analytical organizations (Kuznetsova, 2020).

Thus, the International Monetary Fund has the

lowest expectations, which is explained by the low

savings stock of Ukrainian households and the

economy's minimal government assistance. The

World Bank and the EBRD both make optimistic

estimates.

The primary challenges and directions for

economic adaptation in Ukraine as a result of the

World

Bank

Аpha

Bank

Mood

ys

Europ

ean

Bank

for

Recon

structi

on and

Devel

opmen

t

Minist

ry of

Econo

my of

Ukrai

ne

J.P.

Morga

n

S&P

Nation

al

Bank

Conse

nsus

foreca

st of

Ukrai

nian

analys

ts

ICU

Bank

of

Ameri

ca

Drago

n

Capita

l

Capita

l

Timea

The

Intern

ational

Monet

ary

Fund

2020

-3,2 -3,5 -4,5 -4,5 -4,8 -5,1 -5,5 -6 -6 -6,7 -6,8 -7 -7 -8,2

2021

3 3,9 3,6 5 4,6 6,3 5 4 3,2 5,7 6,5 4 4,5 1

-3,2

-3,5

-4,5

-4,5

-4,8

-5,1

-5,5

-6 -6

-6,7

-6,8

-7 -7

-8,2

3

3,9

3,6

5

4,6

6,3

54

3,2

5,7

6,5

4

4,5

1

-10

-8

-6

-4

-2

0

2

4

6

8

%

Adaptive Transformation of Ukraine’s Economy in the Context of Covid-2019 Pandemic

407

COVID-19 pandemic are:

1. Medicine has proved an inability to deal

with severe obstacles. The discovery of new viruses

and the subsequent fight against them proceed at a

slower rate. If the virus becomes more aggressive,

human civilization may suffer a substantial decline,

wreaking havoc on the economy.

2. All bureaucratic bodies must be shifted

entirely online, so that the state is not reliant on

people's capacity to come to work or the necessary

institutions in the case of new pandemics.

3. It is critical to shift the majority of training

to an online format, which would serve as a backup

in the case of natural disasters, but also as an

additional opportunity to learn.

4. It has become evident that infrastructure is

crucial in the event of unforeseeable events. Hence,

the growth of the Internet, as well as the availability

of stable energy and water, ensure the country's

survival in the event of a crisis. Clearly,

advancements in this field would have an effect on

the automation of distribution systems, which is

critical during a crisis.

Thus, the end of the pandemic and the economic

crisis should result in the formation of a new country

with a slightly different economic structure, but one

that is more prepared for natural disasters (Stavytsky,

2020).

The primary trend is an endeavour by individuals

to establish a sense of self-worth in this profoundly

altered reality. This may be the most essential lesson

for Ukrainian businesses: there is still a market for

many of them; they simply need to look for it,

discover it, and understand how you can be useful in

this situation. From an economic theory perspective,

this situation represents J. Keynes' decisive win over

the Austrian school of economics, demonstrating that

the state's intervention in a crisis is crucial and that

leaving everything to market forces is obviously a

wrong path that would not result in optimal solutions.

Given the extent to which the state controls the

financial industry and banks in Ukraine, it gives a

reason to anticipate a relatively speedy exit from the

crisis, subject to other favourable conditions

(Radchuk, 2022).

3 CONCLUSIONS

Ukraine passed the COVID-19 pandemic's effect test.

And now, the economy's predicament is largely

determined by the dynamics and scope of the

pandemic's spread, as well as by the prevailing factors

of constrained demand and a high degree of

uncertainty about the near future. Consequently,

recovering in the coming years would be contingent

on the government's ability to apply restrictive

measures under the auspices of “adaptive quarantine”

and whether they would revert to a harsh lockdown.

In any case, it would be necessary to alter government

and business strategies, particularly in terms of

approaches to recession management, international

production chains and long-term investments,

domestic economic management, and international

reserves management, and measures to strengthen

Ukraine's economy and society's resilience to future

crises would need to be developed and implemented

more responsibly.

REFERENCES

Borzenko, O., & Burlay, T. (2020). Overcoming

Divergence under the Conditions of Sustainable

Development: European Experience and Its Adaptation

in Ukraine. Zeszyty Naukowe Politechniki

Częstochowskiej Research Reviews of Czestochowa

University of Technology, 7.

Genkin A.S. (2020). Coronaeconomics: a New World After

the Pandemic. Information and Innovations. 15(2):37-

44. URL:https://doi.org/10.31432/1994-2443-2020-15-

2-37-44

Grigorash, OV, Grigorash, TF, & Chentsov, VV (2020).

World economy in the conditions of COVID-19.

Economics and the State, (4), 104-10

Grinko T. (2012) Adaptive innovation management

mechanism development of industrial enterprises:

author's ref. dis .Dr. econ. Science: special. 08.00.04

"Economics and Management enterprises "/ T. Grinko;

NAS of Ukraine, Institute of Economics prom-sti.

Donetsk, 32.

Impact of COVID-19 on the country's economy and

society: the results of 2020 and the challenges and

threats of post-pandemic development №53 (2021,

Apr). Ministry of Economic Development URL:

https://me.gov.ua/old/Documents/List?lang=uk-

UA&id=767c9944-87c0-4e5a-81ea-

848bc0a7f470&tag=Konsensus-prognoz

Kuznetsova, N. B. (2020). Current state and prospects of

development of creative industries in the conditions of

the COVID-19 pandemic. Strategy of Economic

Development of Ukraine, 46, 169-180.

Macroeconomic forecast for Ukraine 2020- 2023 (2020).

Capital Times. URL: https://www.capital-

times.com/insights/macro-forecast-2020

Mescon, M., Albert, M., & Hedouri, F. (1997).

Fundamentals of management. Publishing house

"DELO"

Pettigrew A.M. Competitiveness and the management

process / A.M. Pettigrew. – Oxford Oxford [u.a.] :

Blackwell, 1988. – 256 p.

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

408

Radchuk O. Three scenarios of economic development in

2022: crisis, breakthrough or stagnation URL:

https://www.slovoidilo.ua/2021/12/17/kolonka/aleksan

dr-radchuk/ekonomika/try-scenariyi-rozvytku-

ekonomiky-2022-roczi-kryza-proryv-chy-stahnacziya

Report coronavirus cases

URL:https://www.worldometers.info/coronavirus/#co

untries

Samuelson, P. (1993). Economics: a textbook. Lviv: Svit,

495

Shevchuk, NV, Zaika, KV, & Soltis, DS (2018). Features

of determining and evaluating the adaptation of the

enterprise. Strategy of Economic Development of

Ukraine, (43), 170-182. URL:

http://ir.kneu.edu.ua/bitstream/handle/2010/26805/sed

u_43_16. pdf?sequence=1&isAllowed=y

Stavytsky A. (2020) Economic scenarios of the pandemic: how

to transform Ukraine URL:

https://www.epravda.com.ua/columns/2020/04/7/6590

85/

Strilets V., Prokopenko O. and Orlov V. (2020). Impact of

Covid19 on the budget security of the national

economy: a forecast for Ukraine. Public and Municipal

Finance, 9(1), 25-33. doi:10.21511/pmf.09(1).2020.03

Trade and development report 2020. From global pandemic

to prosperity for all: avoiding another lost decade URL:

https://unctad.org/webflyer/trade-and-development-

report-2020

Ukraine in the rankings: how the country's position has

changed in six years

URL:https://ru.slovoіdіlo.ua/2020/06/25/іnfografіka/polіt

іka/ukraіna-rejtіngax-kak-menyalіs-pozіcіі-strany-shest-

let

Zavadsky, JS, Osovskaya, TV, & Yushkevich, OO (2006).

Economic dictionary. Kyiv: Condor, 356

Adaptive Transformation of Ukraine’s Economy in the Context of Covid-2019 Pandemic

409