Simulation of Swiss Market Index (SMI) for the First 20 Years in the

21

st

Century and Weekly and Monthly Average from 1990 to 2010

with Random Walk

Shaomin Yan

a

and Guang Wu

b

National Engineering Research Center for Non-Food Biorefinery, State Key Laboratory of Non-Food Biomass and Enzyme

Technology, Guangxi Academy of Sciences, 98 Daling Road, Nanning, 530007, Guangxi, China

Keywords: Big Data Mining, SMI, Random Walk, Simulation, Stock Market.

Abstract: This is the continuation of our series of studies on use the random walk model to simulate stock indices in

order to provide evidence to verify the efficient market hypothesis (EMH). In this study, our simulation is

directed to the Swiss Market Index (SMI). However, we expand our approach not only to the SMI in the first

20 years in the 21

st

century, but also to the period from 1990 to 2010 by using daily, weekly and monthly

close prices because our previous experience shows the volatility is the obstacle to set the command in Monte

Carlo algorithm correctly. The results not only confirm what we found in our previous studies that the random

walk model can simulate the SMI, but also provide fresh evidence on simulation on the moving average.

1 INTRODUCTION

The Swiss Market Index (SMI) is an important and

useful benchmark, which is composed of 20 most

important companies in Switzerland. It attracts many

investors/institutions and funds, not only because it

includes some world famous and renowned

companies such as ABB, Credit Suisse, Nestlé,

Novartis, Roche, Swiss Life, and UBS, but also it

serves as a thermometer for the health of Swiss

economy and those companies. Fairly enough, the

SMI is not as important as the stock indices such as

CAC40 and DAX in major European economy, but

the SMI has still been studied since early days

(Ranaldo, 2001, Thorbecke, 2018, Kato, 2018).

As a matter of modeling, the SMI is subject to

many mathematical and statistical studies (Tenreiro

Machado, 2012, Fallahgoul, et al., 2019, Dudukovic,

2014), and online software analyses, for instance, V-

Lab Analyses (V-Lab Analyses, 2021). However, to

the best of our knowledge, the random walk model as

an important analytical tool has yet to apply to the

investigation on SMI.

Random walk was proposed to support the

efficient market hypothesis (EMH) (Boya, 2019,

Urquhart 2016, McGroarty 2016), which was mainly

a

https://orcid.org/0000-0001-7642-3972

b

https://orcid.org/0000-0003-0775-5759

verified using statistical tools, for example, variance

ratio test, unit root test, autocorrelation test, and run

test (Lo, 1988, MacKinlay, 1988, Liu, 1991, He,

1991, Deo, 2003, Richardson, 2003, Chow, 1993,

Denning, 1993, Aktan, et al., 2019). Over recent

years, our group attempted to verify this hypothesis

with the random walk simulations on stock indices

(Yan, 2011, Wu, 2011, 2020, 2021). Although our

studies in conjunction with other studies provide us

with new insights into this issue, a solid conclusion

still cannot be drawn. This is because many technical

details, which are absolutely unexpected, appear

during the studies. This nevertheless requires more

studies to increase our first-hand experience. Hence,

we employ the random walk model to simulate the

SMI for the first 20 years in the 21

st

century.

2 MATERIALS AND METHODS

2.1 SMI Data

In Yahoo Finance (Yahoo Finance, 2021), the SMI

includes daily open, high, low, close, adjusted close

prices, and volume for download. Two sets of data

were used in this study.

1018

Yan, S. and Wu, G.

Simulation of Swiss Market Index (SMI) for the First 20 Years in the 21st Century and Weekly and Monthly Average from 1990 to 2010 with Random Walk.

DOI: 10.5220/0011364600003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 1018-1022

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

(1) The first 20 years in the 21

st

century includes

5029 trading days. In consistent with our previous

studies (

Yan, Wu, 2011, 2020, 2021), we divide this

period of 20 years into five segments: (i) 5029 trading

days the segment from 2001 to 2020, (ii) 3767 trading

days for segment from 2006 to 2020, (iii) 2508

trading days for segment from 2011 to 2020, (iv)

1255 trading days for segment from 2016 to 2020,

and (v) 252 trading days for segment for 2020.

(2) The daily, weekly and monthly close prices

from November 9, 1990 to July 30, 2010 include

4968 daily close prices, 1030 weekly close prices,

and 237 monthly close prices.

2.2 Classical Random Walk

The classical random walk (Feller, 1968) is quite

simple and straightforward. It is a path in x, y

coordinates, where the movement starts from the

origin and each step along the x-axis takes either 1/–1

along the y-axis. Historically, 1/–1 was generated by

tossing a fair coin, but nowadays 1/–1 is generated by

any computer program using the command to generate

a series of random numbers. If a random number is

larger or smaller than its previous one, then we round

the random number into 1/–1. Currently the most

popular algorithm to generate random numbers is the

Monte Carlo method.

2.3 SMI in Pattern of a Random Walk

In fact, we can let SMI mimic the classical random

walk by means of comparison between trading days,

that is, if an SMI close in a trading day is larger or

smaller that in its previous trading day, then we

consider it as 1/–1. With trading date as x-axis and

1/–1 as y-axis, we can pace an SMI in pattern of a

random walk. This SMI pathway in x, y coordinates

can compare with the random walk generated by the

Monte Carlo method, which can generate different

random walks with different seeds. Clearly, the best

simulation needs a seed which can generate a random

walk as approximate to the SMI in pattern of a

random walk as possible. Therefore the entire

becomes to search for such the best seed. Our

previous studies (

Yan and Wu, 2011, 2020, 2021a,b,c)

show that we need at least to search 100 000 seeds

ranged from 0 to 10 using SigmaPlot (

SPSS Inc.,

SigmaPlot, 2002)

in order to find a seed, which, though

not the best, is satisfactory.

Table 1: Procedure to compose a random walk simulation.

Date

SMI Close

Price

Compare

Previous

Close Price

Random

Walk in 1 or–

1 Pattern

Generated

Random

Number

Compare

Preceding

Random

Number

Random

Walk in 1 or–

1 Pattern

Generated

Random

Number

Random

Walk in

Decimal

Pattern

Jan 3, 2020 10699.82 0 –0.02686 0 84.8911 10699.82

Jan 6, 2020 10665.41 –1 –1 0.84546 1 1 –14.31492 10685.51

Jan 7, 2020 10686.8 1 0 –0.7544 –1 0 36.62705 10722.13

Jan 8, 2020 10652.16 –1 –1 0.9241 1 1 –96.3666 10625.76

Jan 9, 2020 10650.97 –1 –2 0.51223 –1 0 –34.41585 10591.35

Jan 10, 2020 10639.49 –1 –3 –0.15068 –1 –1 57.08906 10648.44

Jan 13, 2020 10622.41 –1 –4 0.39615 1 0 –76.11688 10572.32

Jan 14, 2020 10655.82 1 –3 0.75981 1 1 59.3287 10631.65

Jan 15, 2020 10670.74 1 –2 –0.82084 –1 0 20.01103 10651.66

2.4 Random Walk in Decimal Pattern

The limitation of classical random walk in simulation

is obvious because the SMI is the decimal data

although we can artificially change the SMI in a

pattern of 1/–1. Evidently, the classical random walk

needs to be decimally digitalized, that is, we can

directly use the generated random number to

compose a random walk in x, y coordinates: each

trading day goes along the x-axis and each generated

number goes along the y-axis.

3 RESULTS AND DISCUSSION

We explain how to compose the random walk

simulations in both 1/–1 and decimal patterns in

Table 1. Columns 1and 2 do not require an

explanation. Column 3 is the comparison of

sequential SMI closes in column 2 with 1/–1 for

larger or smaller than previous SMI close. Column 4

is the SMI in the 1/–1 pattern by means of the addition

of each value in column 3. Column 5 is the random

numbers generated by SigmaPlot. Column 6 is the

Simulation of Swiss Market Index (SMI) for the First 20 Years in the 21st Century and Weekly and Monthly Average from 1990 to 2010

with Random Walk

1019

comparison of sequential random numbers in column

5 with 1/–1 for larger or smaller than previous value.

Column 7 is the classical random walk by means of

the addition of each value in column 6. Column 8 is

the random numbers generated by SigmaPlot with the

upper/lower ranges of standard deviations of SMI

close in 2020. Column 9 is the random walk in the

decimal pattern by means of the addition of each

value in column 8. Comparisons can be made

between columns 4 and 6 for the 1/–1 pattern, and

between columns 2 and 9 for the decimal pattern.

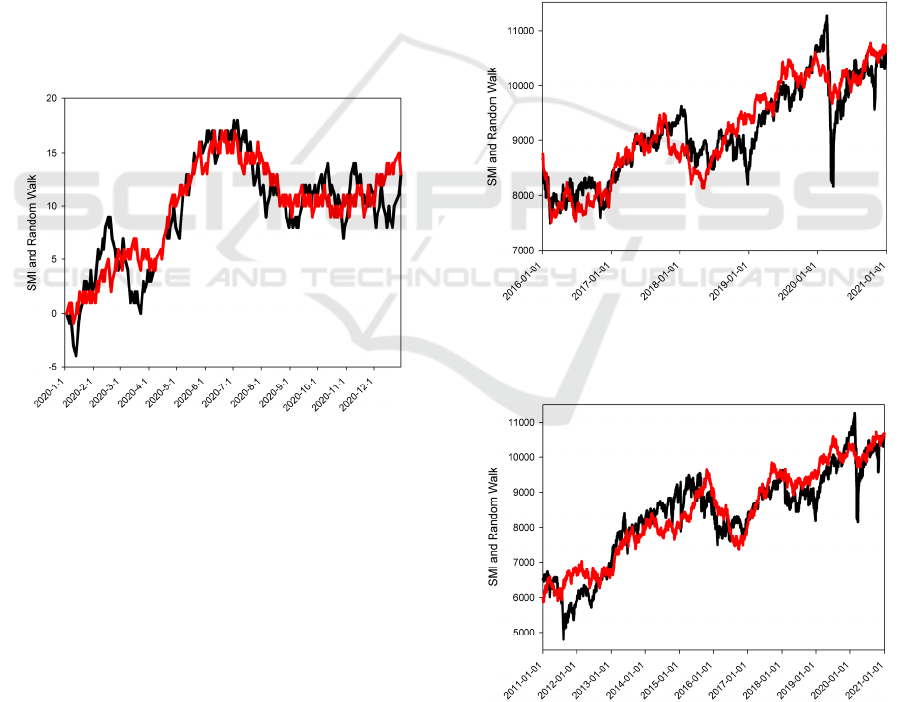

Figure 1 is the comparison between SMI close and

random walk simulation in the 1/–1 pattern for 2020.

Clearly, the simulation is very close to the SMI.

Figure 2 is the comparison between SMI close and

random walk simulation in the decimal pattern for

2020. Clearly, the simulation is not as good as that in

Fig. 1, but the simulation is reasonably fine. This

demonstrates the difficulty in the simulations in the

decimal pattern because of too many choices leading

too much computational time and the exhausting

seeds for Monte Carlo algorithm.

Figure 1: The SMI in 2020 in 1/–1 pattern (black line) and

its simulation (red line) generated by random walk in 1/–1

pattern using the seed of 3.15054.

In our previous studies (Yan, Wu, 2011, 2020,

2021)

, we used to detail the difference between

figures in order to indicate the impact of Covid-19

pandemic and financial crisis. However, we will not

repeat these details in this study because these events

not only affect the stock markets similarly but also

can be considered as random events due to their

unexpectedness. Therefore, importance is to simulate

the stock indices under these unexpected and

unpredictable random events rather than to detail

what occurs in figures.

Figures 3, 4, 5 and 6 are the comparison between

SMI close and random walk simulation in the decimal

pattern from 2016, from 2011, from 2006 and from

2001 to 2020. These figures as the figures in our

previous studies (Yan, Wu, 2011, 2020, 2021)

demonstrate the possibility to use a random walk

model to simulate the stock indices, but the suitability

is limited to short period of time because the

simulation for a short period of time is usually better

than the simulation for a long period of time.

However, if we dive into the depth of simulation, we

found that the random walk is not time-dependent,

but rather than volatility-dependent. The unexpected

and unpredictable events essentially sharply increase

the volatility of stock. This makes difficulty in

random walk simulation because the random walk is

based on the generated random numbers, whose

command sets four parameters, number to generate,

upper/lower ranges and seeds. How to the

upper/lower ranges is crucial.

Figure 3: The SMI from 2016 to 2020 (black line) and its

simulation (red line) generated by random walk in decimal

pattern using any of three seeds from 3.75113 to 3.75115.

Figure 4: The SMI from 2011 to 2020 (black line) and its

simulation (red line) generated by random walk in decimal

pattern using the seed of 3.76679.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

1020

With increasing our experience in this type of

simulations, we consider that the minimization of the

volatility is perhaps a way to go around the difficulty

in choice of upper/lower ranges. Another possible

approach could use different seeds for different

periods of time. However, this type of simulations

seems to contradict to our understanding on

simulation.

In order to minimize the volatility, we consider

the approach of moving average, which can smooth

the fluctuations of the SMI in our study.

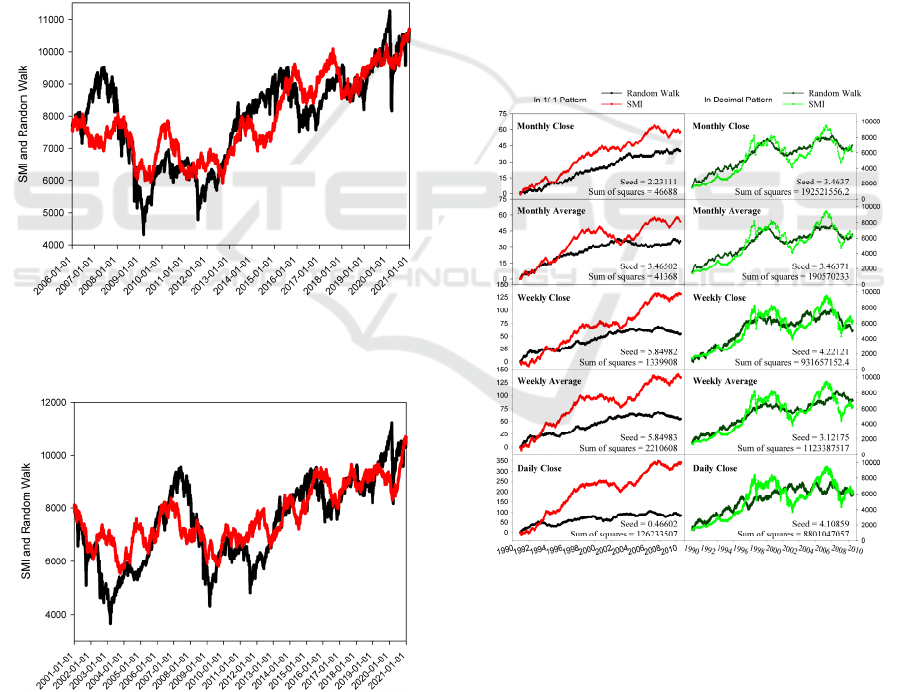

Figure 7 shows the comparison of simulations on

SMI daily, weekly and monthly average from 1990 to

2010. As can be seen, the simulations based on the

1/–1 pattern are worse than the decimal pattern in

general. This shortage could be attributed to the

extreme small probability for such a long period of

time.

Figure 5: The SMI from 2006 to 2020 (black line) and its

simulation (red line) generated by random walk in decimal

pattern using the seed of 1.25267.

Figure 6: The SMI from 2001 to 2020 (black line) and its

simulation (red line) generated by random walk in decimal

pattern using the seeds of 1.45015.

As we know that the probability for a perfect fit

for the 1/–1 pattern is ½n (

Yan, Wu, 2011, 2020, 2021),

where n is the number of points along the x-axis in x,

y coordinates. In such cases, the probabilities for

2020 is ½252, for the daily close from 1990 to 2010

is ½4968, for weekly close prices from 1990 to 2010

is ½1030, for monthly close prices is ½237. Clearly

these probabilities are very difficult to achieve.

4 CONCLUSIONS

In this study, we continue our efforts to verify the

EMH with simulation on the SMI. Moreover, we

attempt to simulate the SMI in its weekly and

monthly average in order to reduce the volatility,

which is due to unexpected random events. The

results not only confirm what we found in our

previous studies, but also shed lights on the

simulation based on the moving average. Thus, it

opens a new frontier for the simulations in the future.

Figure 7: Comparison of simulations on SMI daily, weekly

and monthly average from 1990 to 2010.

ACKNOWLEDGEMENTS

The authors are thankful to the Scientific

Development Fund of Guangxi Academy of Sciences

(2021YFJ1203).

Simulation of Swiss Market Index (SMI) for the First 20 Years in the 21st Century and Weekly and Monthly Average from 1990 to 2010

with Random Walk

1021

REFERENCES

Aktan, C., Iren, P. & T. Omay. (2019) Market development

and market efficiency: evidence based on nonlinear

panel unit root tests. Euro J Finan 25, 979–993.

Boya, C. M. (2019) From efficient markets to adaptive

markets: Evidence from the French stock exchange.

Res. Int. Bus. Finan. 49, 156–165, 2019.

Chow, K. V. & K. C. Denning. (1993) A simple multiple

variance ratio test. J. Econometrics 58, 385–401.

Deo, R. S. & M. Richardson. (2003) On the asymptotic

power of the variance ratio test. Econometric Theory

19, 231–239.

Dudukovic, S. (2014) A Cumulant-based stock market

volatility modeling – Evidence from the international

stock markets. J. Finan. Account. 17, 1–15.

Fallahgoul, H. A., Kim, Y. S., Fabozzi, F. J. & J. Park.

(2019) Quanto option pricing with Lévy models.

Comput. Economics 53, 1279–1308.

Feller, W. 1968. An introduction to probability theory and

its applications. John Wiley, New York, 3

rd

edition.

Liu, C.Y. & J. He. (1991) A variance ratio tests of random

walks in foreign exchange rates. J. Finan. 46, 773–785.

Lo, A. W. & A. C. MacKinlay. (1988) Stock market prices

do not follow random walks: Evidence from a simple

specification test. Rev. Finan. Studies 1, 41–66.

Ranaldo, A. (2001). Intraday market liquidity on the Swiss

Stock Exchange. Finan. Markets Portfolio Manage. 15,

309–327.

SPSS Inc., SigmaPlot 2002 for Windows Version 8.02.

(1986–2001).

Tenreiro Machado, J. (2012) Analysis of stock market

indices with multidimensional scaling and wavelets.

Math. Problems Engin. 2012, 819503.

Thorbecke, W. & A. Kato. (2018). Exchange rates and the

Swiss economy. J. Policy Modeling 40, 1182–1199.

Urquhart, A. & F. McGroarty (2016) Are stock markets

really efficient? Evidence of the adaptive market

hypothesis. Int. Rev. Finan. Anal. 47, 39–49.

V-Lab Analyses - Swiss Market Index AGARCH Volatility

Analysis. (2021)

https://vlab.stern.nyu.edu/volatility/VOL.SMI%3AIN

D-R.AGARCH

Yahoo Finance (2021) https://de.finance.yahoo.com/

Yan, S. & G. Wu. (2011) Fitting of SSEC index (Shanghai

composite) from January 2000 to July 2010 using

random walk model. Guangxi Sci. 18, 92–96.

Yan, S. & G. Wu. (2020) Fitting of impact of COVID-19

pandemic on S&P 500 Index using random walk.

Conference Publishing Services: ICEMME 4, 1007–

1011.

Yan, S. & G. Wu. (2021a) Fit Hang Seng index for 21

st

century with random walk model. Conference

Publication Series: CBFD 66–69.

Yan, S. & G. Wu. (2021b) Simulation of impact of COVID-

19 pandemic on Dow Jones index using random walk.

Proceedings in the 2nd International Conference on

Computing and Data Science (CONFCDS) 2021; 59–

64.

Yan, S. & G. Wu. (2021c) Simulation of NIKKEI 225 index

for 21

st

century using random walk. 2021 2nd

International Conference on Big Data and

Informatization Education (ICBDIE) 330–333.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

1022