Effect of E-Service Quality on E-Satisfaction in using Mobile Banking

through User Experience at Bank Sumut

Muhammad Arief Valendra Ginting

Department of Management, University of North Sumatra, Jl. Prof. TM Hanafiah, SH, USU Campus, Medan, Indonesia

Keywords: E-Service Quality, User Experience, E-Satisfaction

Abstract: Today's banks face a big challenge where they must provide the best quality of service (e-service quality) and

offer experience for customers to create customer satisfaction (e-satisfaction) in the era of digital banking.

The analysis approach is qualitative and quantitative with descriptive. The results of the questionnaire given

to 81 people were collected. The results of the study provide empirical evidence that there is a significant

effect between e-service quality and user experience has a significant effect on e-satisfaction, e-service quality

has a significant effect on user experience and e-service quality has a significant effect on e-satisfaction

through user experience.

1 INTRODUCTION

Currently, banking transformation is taking place.

How the best banks in the world are responding to

these changes, and how the core principles of

competitors are forcing us to think about banking in a

different way. One of them is that transactions with

smartphones have surpassed branch transactions but

banks are still centered on branches both in

organization and design (King, 2020).

Service quality is one of the important issues

discussed by the company to maintain its business

existence during existing competition. In today's

digital era, information technology plays a very

important role in aspects of human life because it

makes it easier to carry out various activities,

including business activities (Adzania, 2015).

A complaint contains a lot of information about

customers and products and can be used as a

foundation for the formation of product strengths

(Fanny, et al 2020). Bank SUMUT has received data

on customer complaints where the complaints are

feedback from customers addressed to Bank

SUMUT. The customer complains because he is not

satisfied, he is dissatisfied because his expectations

are not met.

In this context, Dipa et al. (2020) emphasizes

that most of the Mobile Banking satisfied with

internet accessibility, ease of use, usability, and

trustworthiness. As a result, positive (or negative)

consumer perceptions of quality on various e-service

attributes will result in satisfaction (or dissatisfaction)

with e-services provided through websites (Arcand et

al., 2017).

Previous research on the effect of e-service

quality on e-satisfaction was conducted by San and

Von (2020) who found a positive relationship

between service quality dimensions and customer

satisfaction in the context of Islamic banking culture

in Malaysia. Another study conducted by Ahmad et

al. (2017) stated that there was a relationship between

e-service quality and e-satisfaction among internet

users in India. Alikhan (2019) found that there was an

influence between e-service quality on e-satisfaction

on online shopping in Pakistan.

This study adds user experience as an

intervening variable, user experience is a new

technology finding in the digital era that strongly

supports economic activities, in this case banking

activities will be discussed. Digital modernization

requires banks to reinvent their core businesses in

lending, retail banking and payments. This will

replace branch investment with cheaper digital

channels which will allow banks to build economies

of scale with much lower capital investment (Mbama

et al., 2018).

Service is a differentiation as well as a

determinant of the success or failure of banks in

maintaining existing customers and attracting new

prospective customers. One of the services provided

by banking in the digital era is Mobile Banking. The

Ginting, M.

Effect of E-Service Quality on E-Satisfaction in Using Mobile Banking Through User Experience at Bank Sumut.

DOI: 10.5220/0011518600003460

In Proceedings of the 4th International Conference on Social and Political Development (ICOSOP 2022) - Human Security and Agile Government, pages 85-90

ISBN: 978-989-758-618-7; ISSN: 2975-8300

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

85

emergence Mobile Banking as an innovation that

makes banking activities easier because it eliminates

space and time limits (Komulainen and Saraniemi,

2018).

Through the existence of mobile phones and

M-Banking, banking transactions which are usually

done manually, meaning that activities previously

carried out by customers by visiting the bank, can

now be done without having to visit bank outlets,

only by using the cellphonecan save time and costs,

in addition to saving time. Mobile banking also aims

so that customers are not outdated in using modern

and can also take advantage of cellphone which are

usually used to communicate but can also be used

for business or transactions (Hapsara, 2015).

2 LITERATURE REVIEW

2.1 E-Satisfaction

In the online context, Amin (2016) conceptualizes e-

satisfaction as consumers' assessment of their internet

experience compared to their experience with the

traditional way of dealing with customers satisfaction

as customer satisfaction in connection with previous

purchase or use experiences with product and service

companies.

According to Budiman, et al (2020) the

dimensions of e-satisfaction are:

1. Convenience is

the level of comfort felt by customers from using a

mobile banking including ease of use and

convenience in using the system. With mobile

banking, customers do not need to leave their homes

or travel to perform banking transactions.

2. Merchandising

positive perception of merchandising online e-

satisfaction. Merchandising’s defined here as factors

related to online sales and offerings. This includes

product offerings and banking product information

available online.

3. Serviceability customer

Feedback on application design, availability of

banking service products, and service are factors that

affect e-satisfaction.

2.2 E-Service Quality

According to Zeithaml (2017) E-service quality is

defined as the extent to which a website facilitates

efficient and effective shopping, purchasing, and

delivery of products and services. Service in this case

is defined as a service or service delivered by the

service owner in the form of convenience, speed,

relationship, ability, and hospitality aimed at the

attitude and nature of providing services for E-

satisfaction.

According to Zavareh et.al (2012) the

dimensions of e-service quality include:

1. Efficient and reliable services

a. Services provided through the Mobile

Banking Quick

b. The Mobile Banking of the website or

application is always available for business

c. Mobile Banking can always make

transactions anytime

d. Complete transactions quickly via the 's

website bank

2. Fulfillment

a. The organization and structure of the

Mobile Banking is easy to follow

b. Accurate promises about services provided

c. The Mobile Banking of the application is

easy to use and immediately operational

d. transactions Mobile Banking are always

accurate.

3. Security/trust

a. No Misuse of Customer's Personal

Information

b. Transactions Mobile Banking

c. Confidence in Mobile Banking services.

4. Site aesthetic

a. application Mobile Banking Attractive

b. app page Mobile Banking is visually

pleasing.

5. Responsiveness/contact

a. Quick response to customer requests

b. transaction problems online Quickly

c. customer service Mobile Banking is easily

accessible by telephone / other means.

2.3 User Experience

User Experience is a person's perception and response

resulting from the use and or anticipation of using a

product, system, or service. More simply, user

experience is how someone feels about every

interaction you are having with what is in front of you

when you use it (Winter and Thomaschewski, 2015).

Perspective customer-centric, the customer

plays a key role in creating value because the

customer's personal and individual living

environment shapes the environment for creating

value and customer experience. Therefore, the

customer decides where, when and how value is

created. For banks, this means it is important to

understand how their customers integrate m-banking

ICOSOP 2022 - International Conference on Social and Political Development 4

86

into their daily value creation processes and how their

experiences and associated value are shaped in this

context (Komulainen and Saraniemi, 2018).

Digital Experience Transformation is a holistic

and intuitive approach to reaching and re-engaging

your current and potential customers. Doing it right

requires a strategic understanding of customers in

every channel in which customers interact with them.

In user experience according to Dube and Helkkula

(2015) there are 4 dimensions:

1) Reach

2) Personalization

3) Simplicity and ease of use

4) Channel flexibility

3 RESEARCH METHOD

This type of research uses associative research.

According to Sugiyono (2017) the notion of

associative is research that aims to determine the

relationship between two or more variables. This

research was carried out in a structured research stage

through certain research stages. The population in this

study were 445 customers who use Mobile banking

Bank SUMUT

. Sampling technique in this study is to

use a sampling technique with the probability

sampling the technique used is purposive sampling.

Purposive sampling according to Maholtra et al.,

(2017) is taking sample members from the population

according to predetermined strata or criteria. With the

Slovin formula, it is found that the sample is 81

people who are actively using Mobile Banking Bank

SUMUT

Research Hypothesis

H1: E-service quality effect on E-satisfaction

H2: User Experience has a positive and significant

effect on E-satisfaction

H3: E-service quality has a positive and significant

effect on User Experience

H4: E-service quality has a positive and significant

effect on E -satisfaction through User

Experience.

4 RESULTS AND DISCUSSION

Based on the data processing that has been carried

out, the r square as follows:

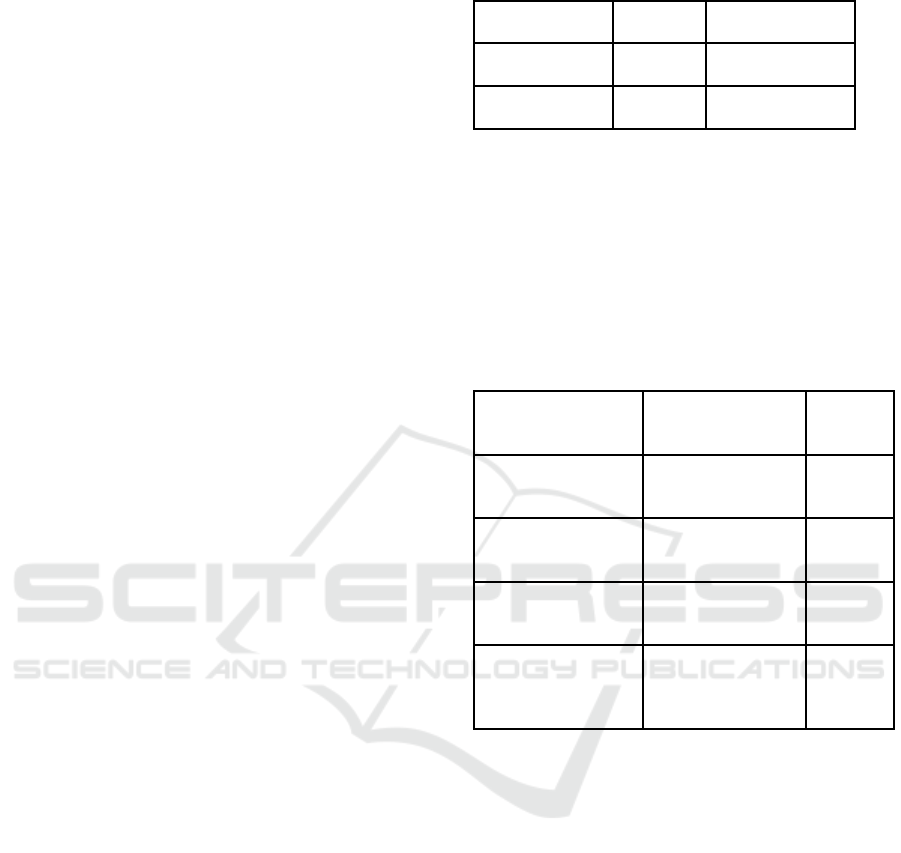

Table 1: r Square

Indicator R S

q

uare Ad

j

ust R S

q

uare

E-satisfaction 0.608 0.598

User Experience 0.523 0.517

Based on the data presented in Table 1 above,

the R Square forvariable e-satisfaction is 0.608 and

user experienceis 0.623. Obtaining this value explains

that the percentage of e-satisfaction can be explained

by e-service quality and user experience of 60.8%,

while the score that explains that the percentage of

user experience can be explained by e-service quality

is 52.3%.

Table 2: T Statistics and P Value

T Statistics

(

|

O/STDEV

|

)

P Values

E-service quality ->

E-satisfaction

2.075 0.039

User experience ->

E-satisfaction

13,961 0.000

E-service quality ->

User ex

p

erience

5,860 0.000

E-service quality ->

User experience - >

E-satisfaction

5,200 0.000

4.1 Effect of E-Service on

E-Satisfaction

The effect of e-service quality on e-satisfaction of

Bank SUMUT Medan Ngumban Surbakti Branch

Office shows the t

statistic

of 2.075 with p value 0.039

smaller than 0.05. Based on these results, it can be

interpreted that e-service quality has a positive and

significant effect on e-satisfaction at Bank SUMUT

Medan Branch Office Ngumban Surbakti.

In the research of Sheng and Liu (2010) which

examined the level of satisfaction and loyalty of e-

commerce in China, with the independent variable e-

service quality. Overall satisfaction and loyalty of e-

commerce in China is influenced by e-service quality

in a positive and significant direction. Kim's (2010)

research results also state that internet user

satisfaction in America and South Korea is influenced

by the e-service quality consisting of the dimensions

of privacy, efficiency, system availability and

Effect of E-Service Quality on E-Satisfaction in Using Mobile Banking Through User Experience at Bank Sumut

87

fulfillment, the directions are the same, namely

positive, and significant.

In the banking sector, another study by Charles

(2016) confirms that the relationship of e-service

quality to satisfaction and loyalty of e-banking in

general in Nigeria has a positive and significant

direction. Al Hawari (2014) who also conducted

research in the banking sector but in the United Arab

Emirates, confirmed the research which stated that the

quality of service in the e-banking has a positive and

significant effect on the satisfaction felt by its users.

4.2 Effect User Experience on

E-Satisfaction

The effect user experience on e-satisfaction of Bank

SUMUT Medan Ngumban Surbakti Branch Office

shows a t

-satistical

of 13,961 with a p value of 0.000 less

than 0.05. Based on these results, it can be interpreted

that user experience has a positive and significant

effect on e-satisfaction of Bank SUMUT customers at

the Medan Ngumban Surbakti Branch Office.

User experience (User Experience, UX) is often

associated with human interaction relations (users)

with computerized application systems (Siebenhandl

et al, 2013). Customers who have positive

experiences will also give positive reviews to the

company so that this can affect other customers who

have not used the company's products or services.

Research by Suandana (2016) found that the

experience of buying fashion online. has a positive

and significant influence on customer satisfaction.

Thus, the better the experience the customer has, the

customer satisfaction will also increase. Research

conducted by Aditya (2015) found that the better the

experience felt by consumers, the greater the

possibility of repurchasing.

The importance of customer experience for

improving business performance means that

companies must understand how to ensure an online

optimally, so as to increase customer satisfaction

(Rose et al., 2012). This is in line with research

conducted by Yulianti (2017) which found that user

experience has a positive and significant effect on e-

satsfaction among cellular operator users in Indonesia.

Another study was conducted by Dewi, et al (2018)

who found that user experience had a positive and

significant effect on consumer satisfaction on the use

of the PayTren application in Jabodetabek.

Purnomo and Ardiansyah's research (2018)

mentions user experience to meet user needs with the

simplicity and elegance of a product that is pleasant to

own and pleasant to use development User experience

application iBeautythat has been developed has

proven to be helpful in accordance with the usability

that has been carried out through post task and SUS

testing so that it can be developed into a real. In a

study conducted by Yulianti (2017) the effect of user

experience on customer satisfaction on cellular

operators in Indonesia shows that the dimensions of

user experience simultaneously have a significant

influence on customer satisfaction.

Another study conducted by Intanny et. al (2018)

that user experience affects e-satisfaction on the use

of Jogyaplaza.id. This is supported by measuring the

user experience. The pragmatic quality aspect has a

tendency on a positive evaluation measurement scale.

This means that users experience the ease of learning

and using, the speed in completing activities, and the

practicality that is supported by a well-organized

system. This is also in line with research conducted by

Aziati (2020) who found that user experience had a

significant effect on e-satisfaction on e-commerce

mobile application Syarif Hidayatullah State Islamic

University students in Jakarta.

4.3 Effect of E-Service Quality on User

Experience

The effect of e-service quality on user experience of

Bank SUMUT Medan customers Ngumban Surbakti

Branch shows the t

statistic

of 5,860 with p values 0.000

smaller than 0.05. Based on these results, it can be

interpreted that e-service quality has a positive and

significant effect on the user experience of Bank

SUMUT customers at the Medan Ngumban Surbakti

Branch Office.

In the last decade, the number of electronic

services provided to the public through information

and communication technology has increased, and it

was found that the quality of digital services greatly

affects the actual access to electronic services by the

public. Different aspects of service quality have been

addressed by many studies over the last two decades.

Research has shown that good service quality can

increase the retention of current customers, increasing

the attractiveness of new customers gained from the

experience of using the service product.

Research conducted by Putri (2020) states that

e-service quality has a positive and significant effect

on the user experience Bank Syariah Mandiri KC

Medan Petisah customers.

ICOSOP 2022 - International Conference on Social and Political Development 4

88

4.4 Effect of E-Service Quality on

E-Satisfaction Through User

Experience

The effect of e-service quality on e-satisfaction

through user experience of Bank SUMUT Medan

customers The Ngumban Surbakti Branch Office

shows a t

statistic

of 5.200 with a p- value 0.000. Based on

these results, it can be interpreted that e-service

quality has a positive and significant effect on e-

satisfaction through user experience of Bank Sumut

customers, Medan Ngumban Surbakti Branch Office.

Zhao and Zhang (2019) showed that the effect

of system quality and service quality on user

satisfaction was stronger for high experienced users

than low experienced users and was significantly

positive for high experience. However, very limited

research has so far investigated the moderating effect

of user experience between technology capabilities

and user satisfaction. Considering that users'

perceptions of object capabilities vary in their level of

experience with objects, and technological

capabilities that are useful for experienced users may

not be effective for users with less experience (Lin

2012), this study incorporates user experience as a

moderator in the research model operation of m-

banking real-time becomes concrete for users in the

form of push notifications that appear after the

purchase event, containing information about the

purchase. From research conducted by Komulainen

and Saraniemi (2018), it can be concluded that the

experience gained from using m-banking services in

banking has a relationship with each other in creating

satisfaction for banking customers.

In line with the research conducted by

Komulainen and Saraniemi (2018) shows that the

interaction between the service and the user - that is,

the customer experience process as experienced by the

user, creates value for the user. Based on data, value

is created through ease of use, real-time operation,

visuality, sense of control, trust, and social status.

Based on these data, ease of use is clearly a utilitarian

value because it provides practical benefits, such as

speed and time savings.

5 CONCLUSION

In this study it was found that E-service quality, User

experience directly affects e-satisfaction, as well as

E-service quality on User experience. E-service

quality has a positive and significant effect on e-

satisfaction in using mobile banking through user

experience at Bank SUMUT Ngumban Surbakti

Medan Branch.

REFRENCES

Aditya, D. J. 2015. Analisis pengaruh

Kepercayaan,Persepsi Manfaat Dan Harga Terhadap

Niat Beli Ulang Online Pada Produk Pakaian (Studi

KasusPengguna Facebook di Kota Pontianak). Jurnal

Manajemen Update, 4(3), hal. 1-11.

Adzania, Ilza Ajrin. 2015. Pengaruh Kualitas Harga dan

Kualitas Produk terhadap Kepuasan Pembelian pada

Produk Samsung Galaxy Young S 6310. Jurnal Eprints

UMS, 2015.

Ahmad, Asad, Obaidur Rahman, Mohammed Naved Khan.

2017. Exploring the Role of website quality and

Hedonism in the Formation of -satisfaction and e-

loyalty: Evidence from Internet users in India. Journal

of Research inInteractive Marketing Vol. 11 No. 3,

2017 pp. 246-267.

Al-Hawari, M. A. A. (2014). Does customer sociability

matter? Differences in equality, e-satisfaction, and e-

loyalty between introvert and extravert onlinebanking

users. Journal of Services Marketing, 28(7), 538–546.

AliKhan, Mukaram and Syed Sohaib Zubair. 2019. An

Assessment of E-Service Quality, E-Satisfaction and E-

Loyalty, Case of Online hopping in Pakistan. South

Asian Journal of Business Studies Vol. 8 No. 3, 2019

pp. 283-302.

Amin, Muslim. 2016. Internet Banking Service Quality and

its Implication on Customer Satisfaction and E-

Customer Loyalty. International Journal of Bank

Marketing Vol. 34 No. 3, 2016 pp. 280-306.

Arcand, Manon., Sandrine P, Isabelle B. and Lova R. 2017.

Mobile Banking E- Service Quality and Customer

Relationship. International Journal of Bank Marketing.

Vol.35 No.7.

Aziati, Yusrina. 2020. Analisis Pengaruh User Experience

Terhadap Kepuasan Pengguna Mobile Applicatione-

Commerce Shopee Menggunakan Model Delone &

Mclean. Universitas Islam Negeri Syarif Hidayatullah

Jakarta.

Budiman, Arief, Edy Yulianto, Muhammad Saifi. 2020.

Pengaruh E-Service Quality Terhadap E-Satisfaction

Dan E- Loyalty Nasabah Pengguna Mandiri Online.

Jurnal Profit Volume. 14 No. 1 2020.

Charles, K. (2016). E-banking users behaviour: e-service

quality. International Journal of Bank Marketing

Vol.14.

Dewi, Rizki., Sinta Siregar, Edward H. 2018. Analisis User

Experience Terhadap Kepuasan Konsumen pada

Penggunaan Aplikasi PAyTren di Jabodetabek. Library

IPB.

Dipa Mulia, Hardius, Novia. 2020. The Role of Customer

Intimacy in Increasing Islamic Bank Customer Loyalty

in Using E-Banking and M-Banking. Journal of Islamic

Marketing Emerald Publishing Limited 1759-0833.

Effect of E-Service Quality on E-Satisfaction in Using Mobile Banking Through User Experience at Bank Sumut

89

Dube, A. and Helkkula, A. (2015), “Service experiences

beyond the direct use: indirect customer use

experiences of smartphone apps”, Journal of Service

Management, Vol. 26 No. 2, pp. 224-248.

Fanny, Oktha, Muslim dan Siregar, Mariana R.A. 2020.

Hubungan Kualitas Pelayanan Keluhan Dengan

Kepuasan Pelanggan. Jurnal Ilmu Komunikasi

FISIB Universitas Pakuan Bogor. Volume 2 No. 1

Tahun 2020 ISSN 26568306.

Hapsara, Radityo Febri. 2015. Pengaruh Kegunaan,

Kemudahan, Resiko Dan Kepercayaan Terhadap

Penggunaan Mobile Banking. Fakultas Ekonomi

Dan Bisnis Universitas Muhammadiyah Surakarta.

Intanny,Vieka Aprilya., Inasari Widiyastuti., Maria

Dolorosa Kusuma Perdani. 2018. Measuring Usability

and User Experience of The Marketplace of

Jogjaplaza.id Using UEQ and USE Questionnaire.

Jurnal Pekommas, Vol. 3 No. 2.

King, Brett. 2020. Bank 4.0, Perbankan dimana saja dan

kapan saja, tidak perlu bank. Mahaka publishing

(inprint Republika Penerbit). Jakarta: Indonesia.

Komulainen, Hanna and Saila Saraniemi. 2018. Customer

Centricity in Mobile Banking: A Customer Experience

Perspective. International Journal of Bank Marketing

Vol. 37 No. 5, pp. 1082-1102.

Lin. 2012. An empirical investigation of mobile banking

adoption: the effect of innovation attributes and

knowledge-based trust, International Journal of

Information Management.

Malhotra, Naresh. K., D.F. Birks, and P. Wills. 2017.

Marketing research: An Applied Approach. 5th ed.

London: Pearson Education.

Mbama, Cajetan Ikechukwu et al., 2018. JRIM 12,4 Digital

Banking, Customer Experience and Financial

Performance: UK Bank Managers’ Perceptions.

Journal of Research in Interactive Marketing. Vol. 12

No. 4, 2018 pp. 432 451.

Purnomo, Anang., Ardiansyah. 2018. Pengembangan user

experience dan user Interface aplikasi ibeauty berbasis

android. Jurnal Teknik Informatika. 2018

Rose, S., Clark M., Samouel, P., and Hair, N. 2012. Online

Customers Experience in e-Retailing: An Empirical

Model of Antecendent and Outcomes. Journal of

Retailing,88 (2), pp. 308-322.

San,W.H, Von W.Y and Qureshi M.I. 2020. The Impact of

E-Service Quality on Customer Satsfaction in

Malaysia. Journal of Marketing Vol. 3, 2020.

Sheng, Tianxiang dan Chunlin Liu, 2010, ‘An empirical

study on the effect ofeservice quality on online customer

satisfaction and loyalty’, Nankai Business Review

International, Vol. 1 No. 3, 2010, hal. 273-283.

Siebenhandl, K., Schreder, G., Smuc, M., Mayr, E., & Nagl,

M. 2013. A usercentered design approach to self-

service ticket vending machines. IEEE, 56(2).

Suandana, N. P. W., Rahyuda, K., & Yasa, N. N. K. (2016).

Pengaruh Pengalaman Membeli Produk Fashion

Terhadap Niat Membeli Kembali Melalui Kepuasan

dan Kepercayaan Pelanggan. Jurnal Manajemen,

Strategi Bisnis Dan Kewirausahaan, 10(1), 85–97.

Winter D., Schrepp M., Thomaschewski J. 2015. Faktoren

der User Experience - systematische Übersicht über

produktrelevante UX-

ICOSOP 2022 - International Conference on Social and Political Development 4

90