Quality of Cryptocurrency Mining on Previous Generation

NVIDIA GTX GPUs

Jerzy Demkowicz

a

, Maciej Rutkowski and Przemysław Falkowski-Gilski

b

Faculty of Electronics, Telecommunications and Informatics, Gdansk University of Technology,

Narutowicza 11/12, Gdansk, Poland

Keywords: Cryptocurrency Mining, Blockchain Technology, GPU, NVIDIA GTX, P2P, Quality Evaluation.

Abstract: Currently, there is a lot of previous generation NVIDIA GTX graphical processing units (GPUs) available on

the market, which were ousted from by next-gen RTX units. Due to this fact, numerous fully-operational

devices remain underused, which are available at an affordable price. First, this paper presents an analysis of

the cryptocurrency market. Next, in this context, the results of research on the performance of NVIDIA

graphics cards with dedicated software as a cryptocurrency mining platform. The research included three

hardware platforms: GTX 480 x1, GTX 480 x2 and GTX 760 x1, tested under four cryptocurrencies, namely:

Bitcoin, Litecoin, Monero and Ethereum. The custom-build test bench included power consumption as well

as the efficiency of mining various digital currencies. Obtained results can aid any investigator interested in

designing his own stand as well as configuring the environment.

1 INTRODUCTION

Cryptocurrencies are one of the biggest technological

phenomena in recent years. Few of the other

information technologies have spread so quickly and

made similar rapid changes in their field.

Cryptocurrencies are based on blockchain

technology, which is an innovative application of

previously existing algorithms and data structures

(Mukhopadhyay et al., 2016; Szostek, 2018).

Blockchain technology opened the way for fast,

cheap and global money transfer between users,

without the need for the participation of the institution

that performs the bank activities. The currency is

completely virtual, but despite this, it cannot be

duplicated in any way, and with a sufficiently large

network size, any attempt to manipulate the data is

practically impossible (Fang et al., 2022; Wątorek et

al., 2021).

a

https://orcid.org/0000-0003-3362-5325

b

https://orcid.org/0000-0001-8920-6969

2 BLOCKCHAIN TECHNOLOGY

Blockchain is a distributed chain of records with a

strictly defined structure, stored by a number of

equivalent nodes and using peer to peer (P2P)

communicating protocols (Di Pierro, 2017; Nofer,

2017).

Individual records, called blocks, contain

information about transactions carried out between

network participants with the use of cryptocurrency.

Each network node has a pair of keys: public and

private. They allow network operations, that is

transactions.

The keys are used to generate unique addresses

(wallets) on which the virtual currency is stored. Each

transaction consists of: input address (or addresses),

output address (or addresses), amount of transferred

currency, and a single block consists of: a certain

number of transactions, the previous block hash and

the so-called nonce, which stands for number only

used once.

The nonce is a very important element of the

system because it uses asymmetric cryptography to

stabilize and systematize the creation of new blocks.

Finding a matching nonce is very complicated

466

Demkowicz, J., Rutkowski, M. and Falkowski-Gilski, P.

Quality of Cryptocurrency Mining on Previous Generation NVIDIA GTX GPUs.

DOI: 10.5220/0011567400003318

In Proceedings of the 18th International Conference on Web Information Systems and Technologies (WEBIST 2022), pages 466-474

ISBN: 978-989-758-613-2; ISSN: 2184-3252

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

computationally, and it is easy to verify the already

found one.

Due to the fact that the creation of new units

involves real costs, like electronic equipment,

electricity, it is necessary to reward for participation

in the system. The reward is cryptocurrency units

delivered to the node’s wallet when it mines a new

block. They have two sources: one is a completely

new unit introduced into the network in the amount

defined by a given algorithm, and the other is the

so-called transaction fee.

Over time, the use of blockchain by other network

participants causes a constant increase in the length

of the chain, and thus increasing requirements for

both RAM and non-volatile memory. So to record

transactions, Merkle trees (hash trees) are used,

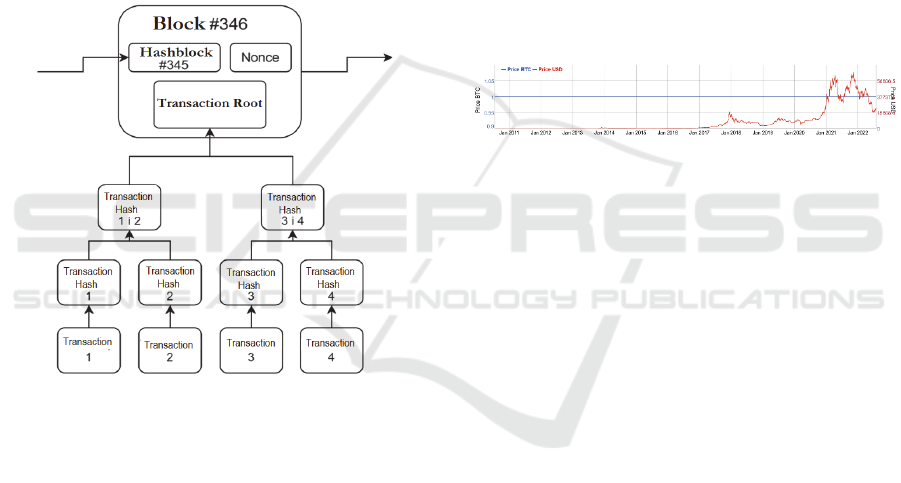

as shown in Figure 1.

Figure 1: Blockchain as a Merkle tree.

Individual blocks with transactions are hashed,

and the resulting values are then paired with each

other and hashed again. This process continues until

the so-called transaction root, a single hash value that

is associated with all transactions in a given block.

So nodes do not have to keep copies of all transactions

that took place in the history of the blockchain and

can limit themselves to the latest transactions related

to a given amount of currency (Nakamoto, 2009).

In such a situation, the node still has the certainty that

there has been no manipulation and that the current

owner of the currency is its rightful owner, thanks to

the fact that the transaction is rooted in the block.

Asymmetry in creating and verifying new blocks

is very important, because one cannot introduce

crafted blocks into the network. Their creation is

associated with the need to sacrifice computing

power, and the algorithms for selecting the right block

in the event of a conflict make it necessary for forgery

to have more computing power than the entire

network (Bastiaan, 2015). Carrying out such an

attack, although demanding, is possible.

3 FIDUCIARY CURRENCY AND

CRYPTOCURRENCY

There are both similarities and differences between

the characteristics of cryptocurrencies and fiduciary

currency, which are not covered by material goods.

Similar to currencies issued today by governmental

organizations such as the US Dollar or Euro, the value

of cryptocurrencies is not sustained by any real

commodities. In the event of a sudden drop in

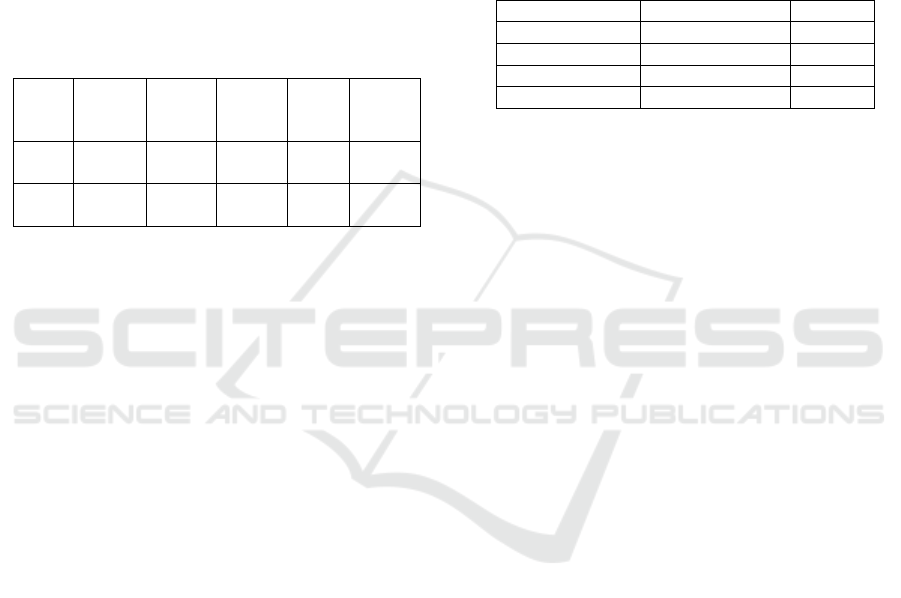

demand, as shown in Figure 2, cryptocurrency owners

have no way of using them other than for transactions

with other users.

Figure 2: The price of one Bitcoin (BitInfoCharts, 2020).

This means that the price of cryptocurrencies is

highly volatile and completely depends on the current

demand (Liu, 2021; Gandal and Hałaburda, 2014).

The main difference is how new units of currency

are produced. In traditional currencies, it is the central

bank that takes decisions based on many factors about

reprinting the currency in a certain quantity. In most

cases, this means that they are characterized by

variable, but always present, level of inflation,

i.e., the decline in the value of money associated

with increasing its supply.

Cryptocurrencies do not have a central “emitter”

of the currency, and the number of its units and supply

are strictly defined by the algorithm, without the

possibility of manipulation based on, e.g., market

conditions. Typically, new cryptocurrency units are

delivered to the network nodes involved in the

creation of new blocks, which involves sacrificing

computing power, which in turn requires investments

in equipment and electricity (Li et al., 2019; Náñez

Alonso, 2021).

Due to the fact that the supply of a new

cryptocurrency is associated with a certain cost,

inflation is significantly limited, and it is “profitable”

to store it for users of the currency. The amount of

currency in the blockchain is limited, and the supply

of new units slows down over time, to stop

Quality of Cryptocurrency Mining on Previous Generation NVIDIA GTX GPUs

467

completely in the rather far future (Xu et al., 2009;

Risius and Spohrer, 2017, Ahram et al., 2017).

4 TESTED

CRYPTOCURRENCIES

4.1 Bitcoin

Bitcoin was the first system to implement blockchain

in cryptocurrency. On October 31, 2008, a person or

group of people using the pseudonym Satoshi

Nakamoto published an article describing his

assumptions. Then, on January 3, 2009, the Bitcoin

network was initiated, mining it for the first time.

The network does not take into account any

central authority, and all decisions regarding the

future of the system (adding more blocks) are made

by consensus among all network users. The lack of a

“bank” prevents institutional manipulation of the

currency, such as its “reprint”, it is not possible to

grant loans, and the fragmented nature of the system

in practice prevents from taking control by any

financial organization or political.

4.2 Litecoin

Litecoin was founded in October 2011 by Charles Lee

(Bitcoin Forum, 2011), based on the Bitcoin

blockchain software, with a number of differences.

Its creator has drawn conclusions from the first

cryptocurrency, as well as several alternatives that

have come and gone unnoticed in the meantime.

The most important change was the reduction of

the average extraction time for a new block from

10 to 2.5 minutes. This has greatly increased the

convenience of using cryptocurrency as a payment

method for goods, reducing the need for long waiting

for transaction confirmation. The second advantage

was a significant reduction in transaction fees, thanks

to which Litecoin could have a much higher financial

liquidity than its predecessor. Additionally, this

currency uses the Scrypt hashing algorithm, which

has much higher memory requirements than SHA256.

4.3 Ethereum

Ethereum was created in 2015 by a group of people

led by Vitalik Buterine. It is an innovative

development of the previous blockchain

implementation. Each contract added to the Ethereum

blockchain can be simply treated as a class in the

Speaking program, denoting a given state and

transition points so that this state can be changed,

assigning it using argument methods. One can also

download some blockchain data, such as the current

time block and, above all, information about

incoming payments.

Currently, it is the second cryptocurrency after

Bitcoin, having approx. 12% market share

(Coinmarketcap, 2022). Its additional advantages are

even easier transactional activities and further

activities, namely several seconds instead of

10 minutes, thanks to which various tasks can be

performed in near real-time.

4.4 Monero

Monero was founded in April 2014, and introduced

several new cryptographic solutions. The most

important of which are: stealth addresses and ring

signatures, increasing the privacy of the recipient and

sender, respectively. It is not possible to review the

blockchain for this user’s activity.

5 MINING PLATFORMS

New units of individual cryptocurrencies are

automatically delivered to users who provide the

computing power of their devices. The process is

called cryptocurrency mining. There have been many

changes to the way since the first cryptocurrencies

appeared. The most used graphics cards were

constantly being replaced by new models, in many

cases also by devices of a completely different

category. However, over the years the most popular

type of device used for this purpose have been

dedicated graphics cards.

There are three categories of devices capable of

mining cryptocurrencies (Ghimire and Selvaraj,

2018):

CPUs (Central Processing Units),

GPUs (Graphics Processing Units),

ASICs (Application Specific Integrated

Circuits).

CPUs are rarely used for this purpose, due to the

specificity of calculations performed in most

blockchain algorithms. The search for a nonce in

order to obtain a specific checksum is an action to

promote the maximum possible number of threads,

with the simultaneous relative simplicity of the

actions performed. This works definitely to the

advantage of the second type of chips mentioned,

because graphics rendering has similar requirements

to the GPU as cryptocurrency mining. There are cases

where the use of CPUs can be profitable, but they

QQSS 2022 - Special Session on Quality of Service and Quality of Experience in Systems and Services

468

make up a very small percentage of the overall

cryptocurrency market. In the case of ASIC

installations, they are completely self-contained when

mining cryptocurrencies.

6 MATERIALS AND METHODS

Tests were carried out using graphic cards from older

generations of NVIDIA GTX, and included two

models, that is: NVIDIA GeForce GTX 480 and MSI

GeForce GTX 760. The technical specifications of

these GPUs is described in Table 1.

Table 1: Technical specification of tested GPUs.

GPU CUDA

cores

CPU

clock

[MHz]

Mem.

clock

[MHz]

RAM

[MB]

T-put

[GB/s]

GTX

480

480 700 1848 1536 177.4

GTX

760

1152 1150 6008 2048 192.3

Particular attention is paid to the power supply

and its quality. It must be able to deliver the

maximum amount of power that a single or multiple

GPUs can draw from the mains. Of course, a stable

Internet connection is also required.

The main criterion for selecting a cryptocurrency

was its popularity, assessed on the basis of their

market cap, provided by price tracking services.

In addition, the technologies, on which the

blockchains of individual currencies were built, were

taken into account. They have a very large impact on

the efficiency of mining, and in combination with the

price of a given cryptocurrency, on the profitability of

the entire process (Bouri et al., 2019; Caporale et al.,

2018).

One of the most important parts of the blockchain

is the hashing algorithm. While Bitcoin uses

SHA256, the next emerging cryptocurrencies have

often made significant changes in this area,

introducing their own solutions. Newer algorithms

are most often aimed at preventing or at least

hindering the creation of ASIC devices specializing

in mining a given cryptocurrency. Such activities had

a large impact on the frequency of finding new blocks

by blockchain participants, which makes the

profitability of mining individual cryptocurrencies on

different devices unalike. For this reason,

the cryptocurrency mining process had to be tested

with various hashing algorithms (or families of

algorithms), so that in the future, when new

cryptocurrencies using these algorithms are released,

it will be possible to assess the profitability of using

older GPUs from the NVIDIA GTX family.

6.1 Operating System

Kubuntu 20.04 LTS was selected as the operating

system (OS) for cryptocurrency mining. This was the

latest version of this system at the time of our studies,

additionally having long time support (LTS).

The configuration is described in Table 2.

Table 2: Mining software used during tests.

Cr

yp

tocurrenc

y

Minin

g

software Version

Bitcoin CGMine

r

3.7.2

Litecoin CGMine

r

3.7.2

Ethereu

m

Ethmine

r

0.18.0

Monero XMRig 5.11.4

Kubuntu is a variation of Ubuntu, one of the most

popular desktop Linux distributions. This OS offers

good support from cryptocurrency mining programs

and easy ability to execute all necessary commands

as well as monitoring via the terminal, using the

Secure Shell Protocol (SSH).

6.2 Mining Pool Payout Model

There are several payout models offered by

cryptocurrencies. PayPerShare (PPS) is a model that

accrues a reward for pool share upon receipt of each

properly completed user unit of work (share).

However, there are more favorable variants where,

in addition to the block mining rewards, they also

receive some transaction fees (Farell, 2015; Liu et al.,

2022):

Full Pay Per Share (FPPS) – profit from

transaction fees is calculated on the same basis

as the block reward.

Payer Share Plus (PPS+) – transaction fees are

distributed to users on the basis of the Pay Per

Last N Shares (PPLNS). Receiving a portion of

the transaction fees is especially important with

Bitcoin, where the rewards per block are

relatively small.

Pay Per Last N Shares (PPLNS) – the pool

operator shifts the risk to the users. Instead of

rewarding them on receipt of each unit of work,

payment is made only after the pool has

actually extracted the block.

When selecting a pool, the PPS payout models

were preferred, because they better meet the

requirements of this study. High randomness,

characteristic to PPLNS, may adversely affect the

reliability of research results, and in order to

Quality of Cryptocurrency Mining on Previous Generation NVIDIA GTX GPUs

469

minimize its impact, very long tests should be run,

which, with the expected low performance of the

cards used, could result in unnecessary losses. Then,

attempts were made to select the best offers among

the available ones, i.e., those with low fees to the pool

and those requiring no additional verification, such as

providing a telephone number. The list of utilized

model pools is described in Table 3.

Table 3: Cryptocurrency pools used during test.

Cryptocurrenc

y

Mining pool Model

Bitcoin SlushPool.com FPPS

Litecoin LitecoinPool.or

g

PPS

Ethereum S

p

arkPool.com PPS+

Monero MinerGate.com PPS

6.3 Test Bench

The test stand could consist of a maximum of

13 GPUs. First, it was planned to start with a version

of a single graphics card. The implementation of any

of the other variants depended entirely on the results

of the profitability tests, due to the additional costs of

purchasing other necessary components, including:

power supplies, motherboard, CPU, etc.).

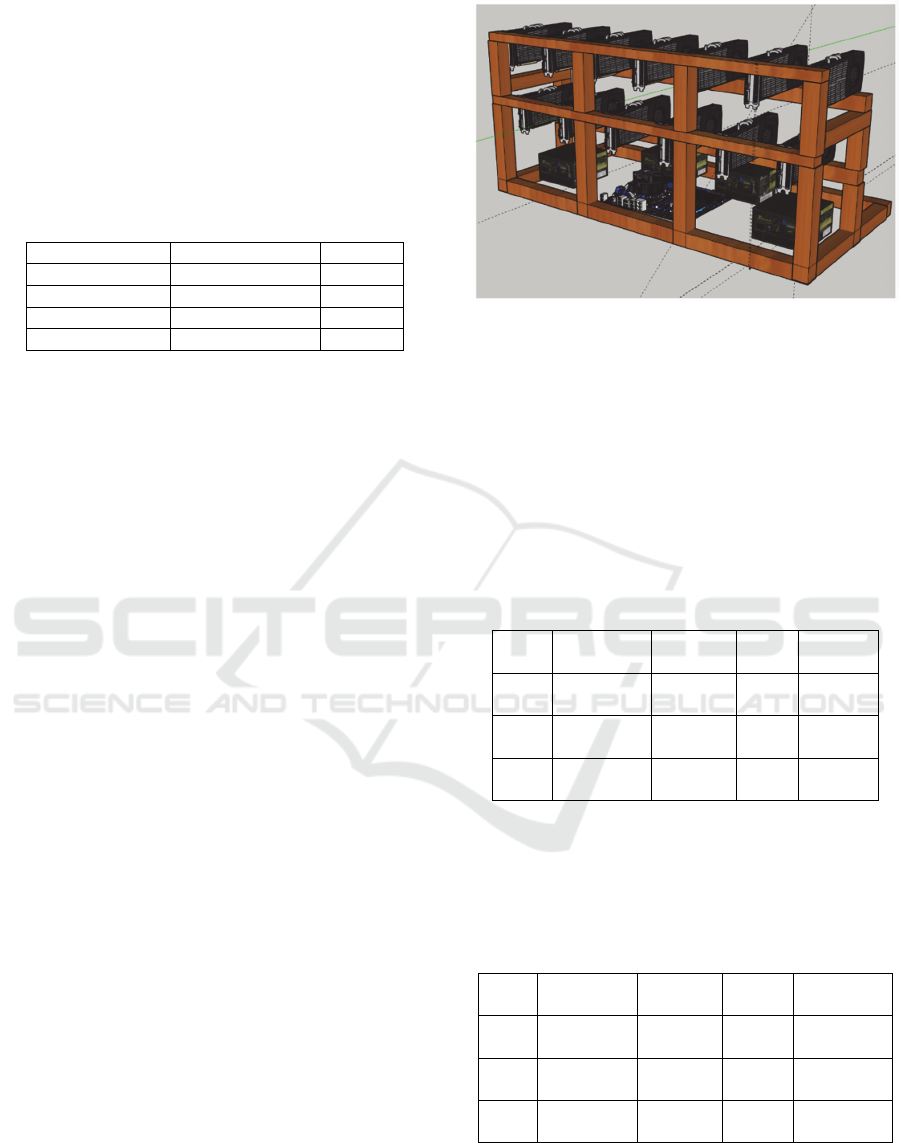

At an early stage of work, 3D models of the test

environment were made using SketchUp for Web,

as shown in Figure 3. Each model assumed the use of

the number of cards being a power of 2, except for the

last one, reaching the limit of 13.

The miner platform used for the tests, apart from

one of the above-mentioned GPUs, consisted of:

Intel i5-750 CPU,

Hynix DDR3 16 GB RAM,

Asus P7P55D Deluxe motherboard,

Hitachi 500 GB hard drive,

XFX 750W power supply.

Each research scenario lasted 12 hours. This

length was chosen because it allows easy

extrapolation of results to larger time units (days,

months, etc.), while remaining long enough to

observe any fluctuations.

Figure 3: Test bench used during test.

7 RESULTS

The research was carried out for several sites,

described as no. 1, no. 2, etc. After finding the optimal

parameters for all stations, the main research

scenarios were started. The configuration for Bitcoin

is described in Table 4, where the number of treads

was equal to 2.

Table 4: Optimal parameters for Bitcoin.

Suite

no.

GPU Intensity Hash

index

Job

unit

1 GTX 480

x1

16 132.7

Mh/s

2.1/min

2 GTX 480

x2

16 266.5

Mh/s

4/min

3 GTX 760

x1

14 162.5

Mh/s

2.5/min

Whereas, the configuration for Litecoin is

described in Table 5. In case of all suits, the number

of threads was equal to 1, and the intensity was set to

11.

Table 5: Optimal parameters for Litecoin.

Suite

no.

GPU Shaders Hash

index

Job

unit

1 GTX 480

x1

530 60.1

kh/s

56.7/min

2 GTX 480

x2

1060 121.3

kh/s

142.5/min

3 GTX 760

x1

1266 70.1

kh/s

71.3/min

The following parameters were measured: GPU

hash rate, total network hash rate, number of shares

accepted, number of shares rejected, number of

hardware errors, GPU memory allocated, GPU load,

QQSS 2022 - Special Session on Quality of Service and Quality of Experience in Systems and Services

470

GPU temperature, fan speed, cryptocurrency units

generated and power consumption.

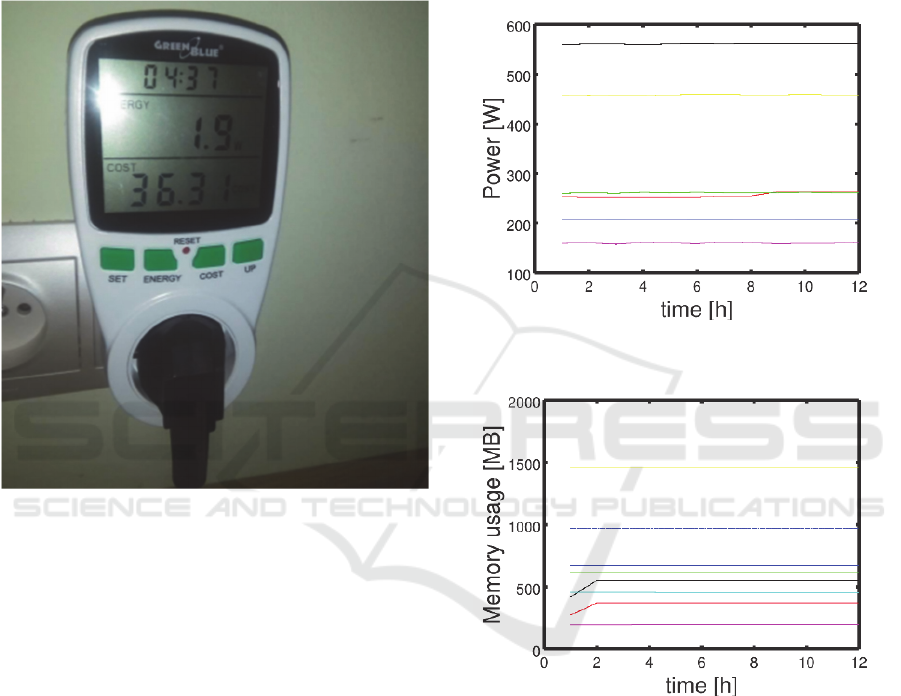

The above data, with the exception of power

consumption, was read from individual miner

programs or from utilities supplied with the graphics

card drivers. Whereas, power consumption

measurements were carried out using the GreenBlue

GB202 power meter, as shown in Figure 4.

Figure 4: GreenBlue GB202 power meter.

Each research scenario lasted 12 hours, because it

allows easy extrapolation of results to larger time

units. After collecting all the data, calculations were

started to check the overall profitability of the

process.

Using data on cryptocurrency prices as well as

online exchanges and equipment on auction websites,

a summary of the following data was prepared:

The value of the generated cryptocurrency

units in PLN.

Value of the equipment used in the research.

Cost of consumed electricity.

Total profit or loss.

Quite surprisingly, only in case of the Litecoin it

was possible to obtain a non-zero amount of

cryptocurrency from all assembled suits. As it turned

out, the Ethereum was not compatible with the tested

equipment, due to insufficient size of the GPUs

memory, therefore eventually it was omitted from the

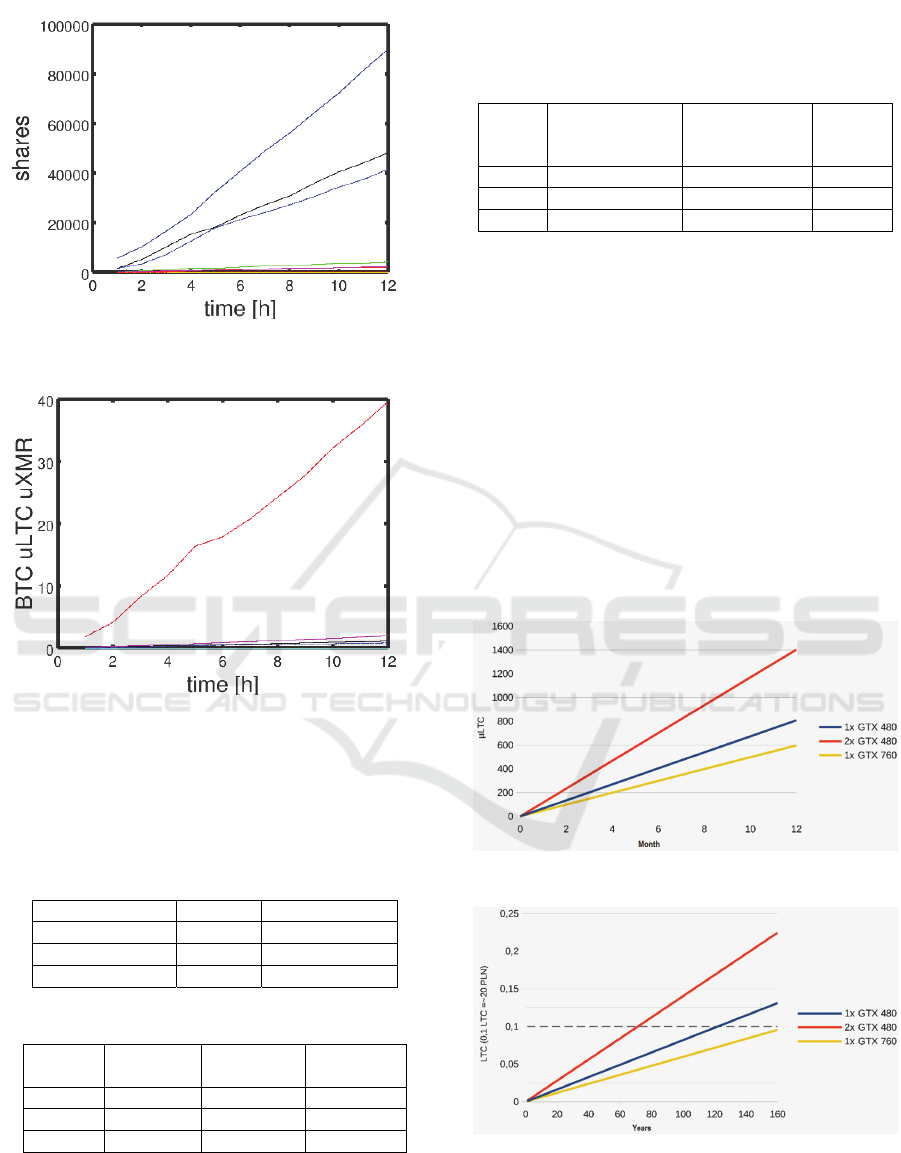

study. Obtained results are shown in Figure 5-8,

where respective lines represent:

Red – Bitcoin currency suite no. 1,

Black – Litecoin currency suite no. 1,

Yellow – Monreo currency suite no. 1,

Green – Bitcoin currency suite no. 2,

Blue – Litecoin currency suite no. 2,

Magenta – Bitoin currency suite no. 3,

Cyan – Liteoin currency suite no. 3,

Dotted Red – Monero currency suite no. 3.

Figure 5: Power consumption for different suites.

Figure 6: Memory usage for different suites.

Suite no. 2 gives slightly different results as

compared to suite no. 1, but the most important

parameter, i.e., the amount of cryptocurrency, is still

equal to zero (except for Litecoin). This suite had

additional minor custom software modifications,

e.g., changing the version of XMRig Miner to 5.11.0

from version 4.6.2. Suite no. 3 obtained slightly

different results, but the amount of cryptocurrency

was still equal to zero (except for Litecoin once

again). In this case, a software update was necessary

in order to test the Monero cryptocurrency

(GPU driver 440.33.01, CUDA 10.2, XMRig v6.3.2,

xmrig-cuda v6.3.2).

Quality of Cryptocurrency Mining on Previous Generation NVIDIA GTX GPUs

471

Figure 7: Shares for different suites.

Figure 8: Mined cryptocurrency for different suites.

Table 6 summarizes the cryptocurrency price per

unit at the time of performing the tests. Whereas,

Table 7 and 8 sums up the earnings and profitability

(loss) in Polish Zloty [PLN].

Table 6: Cryptocurrency price per unit.

Cr

yp

tocurrenc

y

Unit Price

Bitcoin 1 BTC 38875.72 PLN

Litecoin 1 LTC 183.78 PLN

Monero 1 MXR 324.88 PLN

Table 7: Cryptocurrency mining earnings.

Suite

no.

Bitcoin

[PLN]

Litecoin

[PLN]

Monero

[PLN]

1 0 0.000206 0

2 0 0.000358 0

3 0 0.000152 0.012865

As shown, there is a great disproportion between

respective cryptocurrencies, ranging even up to a

couple of hundreds of percent, with Bitcoin being the

priciest one.

Table 8: Cryptocurrency mining profitability.

Suite

no.

Mined

cryptocurrency

[PLN]

Energy

consumption

[kW/h]

Energy

price

[PLN]

1 0.000206 9.6 6.43

2 0.000358 12.2 8.19

3 0.013017 7.5 5.05

From all the cryptocurrencies tested during the

study, only Litecoin enabled to obtain a non-zero

amount of cryptocurrency from all 3 assembled

suites. Therefore, further calculations will focus

mostly on it.

8 DISCUSSION

Figure 9 and 10 shows the annual increase in the

amount of currency in the mining process and the

time required to withdraw the first income from the

pool. In in the case, the minimal pool is equal to

0.1 LTC, which currently corresponds to approx.

20 PLN.

Figure 9: Litecoin cryptocurrency mining performance.

Figure 10: Litecoin mining time to first payout.

Also for Litecoin, measurements of the hash index

and the amount of obtained cryptocurrency were

QQSS 2022 - Special Session on Quality of Service and Quality of Experience in Systems and Services

472

averaged in order to know the hash rate value at which

the process of mining this currency becomes

profitable. Linear dependence of both values was

assumed, because all fluctuations have already been

taken into account thanks to averaging. The result of

this analysis is shown in Figure 11.

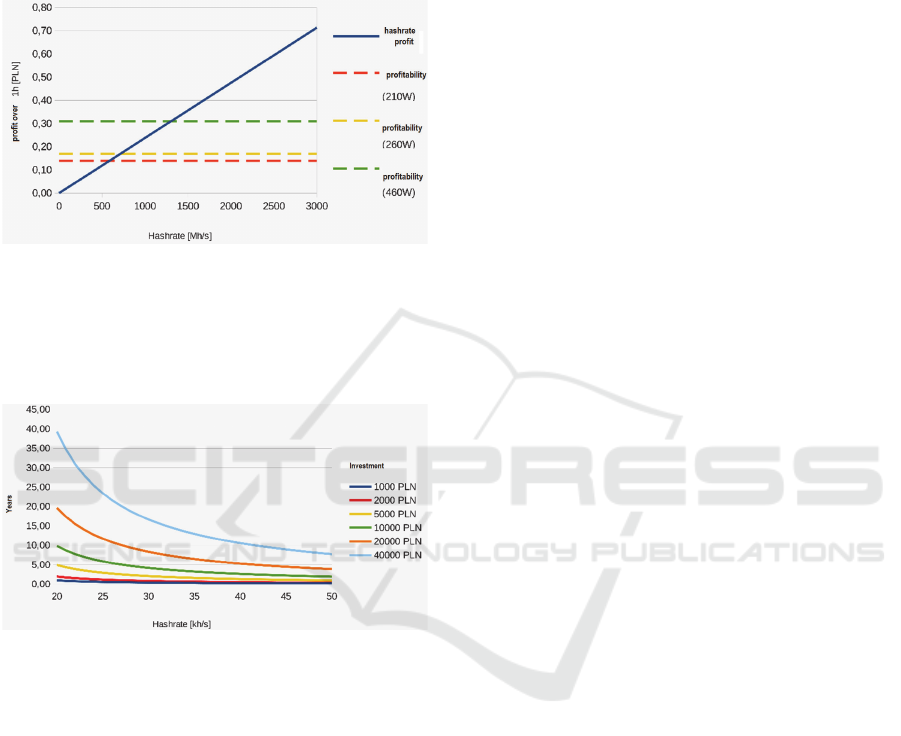

Figure 11: Hashrate vs profit in PLN for Litecoin.

Figure 12 shows the rate of return on investment

for a Monero cryptocurrency miner, expressed as the

number of years needed to fully cover the costs,

including electricity (250W power consumption).

Figure 12: Number of years required to cover the costs of

the miner platform.

9 SUMMARY

The aim of this work was to analyze the

cryptocurrency market and perform a series of tests

concerning the performance of previous generations

of NVIDIA GTX graphics cards used as miners.

After the software installation, tests were carried out

to find the optimal configuration for 3 hardware

configurations, including: NVIDIA GeForce GTX

480 x1, NVIDIA GeForce GTX 480 x2 and NVIDIA

GeForce GTX 760 x1. Initially, the investigation was

intended for 4 cryptocurrencies: Bitcoin, Litecoin,

Monero and Ethereum.

For the first three (Bitcoin, Litecoin, Monero),

a negligibly low or zero amount of cryptocurrency

was obtained, while the fourth one (Ethereum) could

not be evaluated due to insufficient graphics memory.

The collected data shows that older models of

graphics cards do not give any chance of profit in case

of any cryptocurrency.

In the optimal scenario (Monero), and the most

efficient platform (no. 3), the mining process would

have to last about 2 years to obtain the equivalent of

PLN 20, with electricity costs of approx. 1880 PLN.

Such bad results of the GPUs used in the tests are due

to the rapid development on the chip market and the

dominance of dedicated ASIC devices for the most

popular cryptocurrencies, which offer several times

better performance.

It should be also pointed out that owners of

cryptocurrency miners tend to operate in countries

with cheapest electricity, which provides a significant

advantage. As shown, previous generation GPUs

would surely prove to be still feasible when

processing rich multimedia content, i.e., audio-visual

content or 3D graphics editing, etc. Further source of

inspiration for future studies may be found in

(Jacob et al., 2021; Goodkind et al., 2020; Kumar,

2021; Fadeyi, 2019; Gundaboina et al., 2022;

Bastian-Pinto et al., 2021).

REFERENCES

Ahram, T., Sargolzaei, A., Sargolzaei, S., Daniels, J.,

Amaba, B. (2017). Blockchain technology innovations.

In TEMSCON’17, 2017 IEEE Technology &

Engineering Management Conference. IEEE.

Bastian-Pinto, C. L., Araujo, F. V. D. S., Brandão, L. E.,

Gomes, L. L. (2021). Hedging renewable energy

investments with Bitcoin mining. Renewable and

Sustainable Energy Reviews, 138, 110520.

Bastiaan, M. (2015). Preventing the 51 percent attack: a

stochastic analysis of two phase proof of work in

bitcoin. In TSC’15, 22nd Twente Student Conference on

IT. University of Twente.

Bitcoin Forum. (2011). Litecoin – a lite version of Bitcoin.

https://bitcointalk.org/index.php?topic=47417.0

(access: 30.07.2022).

BitInfoCharts. (2020). Bitcoin Avg. Transaction Fee chart.

https://bitinfocharts.com (access: 30.07.2020).

Bouri, E., Shahzad, S. J. H., Roubaud, D. (2019).

Co-explosivity in the cryptocurrency market. Finance

Research Letters, 29, 178-183.

Caporale, G. M., Gil-Alana, L., Plastun, A. (2018).

Persistence in the cryptocurrency market. Research in

International Business and Finance, 46, 141-148.

Coinmarketcap. (2022). Cryptocurrency market

capitalizations. https://coinmarketcap.com/ (access:

30.07.2022).

Di Pierro, M. (2017). What is the blockchain?. Computing

in Science & Engineering, 19(5), 92-95.

Quality of Cryptocurrency Mining on Previous Generation NVIDIA GTX GPUs

473

Fadeyi, O., Krejcar, O., Maresova, P., Kuca, K., Brida, P.,

Selamat, A. (2019). Opinions on sustainability of smart

cities in the context of energy challenges posed by

cryptocurrency mining. Sustainability, 12(1), 169.

Fang, F., Ventre, C., Basios, M., Kanthan, L., Martinez-

Rego, D., Wu, F., Li, L. (2022). Cryptocurrency

trading: a comprehensive survey. Financial Innovation,

8(1), 1-59.

Farell, R. (2015). An analysis of the cryptocurrency

industry, University of Pennsylvania. Philadelphia.

Gandal, N., Hałaburda, H. (2014). Competition in the

Cryptocurrency Market, Bank of Canada. Ottawa.

Ghimire, S., Selvaraj, H. (2018). A survey on bitcoin

cryptocurrency and its mining. In ICSEng’18, 26th

International Conference on Systems Engineering.

IEEE.

Goodkind, A. L., Jones, B. A., Berrens, R. P. (2020).

Cryptodamages: monetary value estimates of the air

pollution and human health impacts of cryptocurrency

mining. Energy Research & Social Science, 59,

101281.

Gundaboina, L., Badotra, S., Bhatia, T. K., Sharma, K.,

Mehmood, G., Fayaz, M., Khan, I. U. (2022). Mining

cryptocurrency-based security using renewable energy

as source. Security and Communication Networks,

2022, 4808703.

Jacob, I. J., Shanmugam, S. K., Piramuthu, S., Falkowski-

Gilski, P. (eds.). (2021). Data Intelligence and

Cognitive Informatics. Proceedings of ICDICI 2020,

Springer. Singapore.

Kumar, S. (2021). Review of geothermal energy as an

alternate energy source for Bitcoin mining. Journal of

Economics and Economic Education Research, 23(1),

1-12.

Li, J., Li, N., Peng, J., Cui, H., Wu, Z. (2019). Energy

consumption of cryptocurrency mining: a study of

electricity consumption in mining cryptocurrencies.

Energy, 168, 160-168.

Liu, Y., Tsyvinski, A. (2021). Risks and returns of

cryptocurrency. The Review of Financial Studies, 34(6),

2689-2727.

Liu, Y., Tsyvinski, A., Wu, X. (2022). Common risk factors

in cryptocurrency. The Journal of Finance, 77(2),

1133-1177.

Mukhopadhyay, U., Skjellum, A., Hambolu, O., Oakley, J.,

Yu, L., Brooks, R. (2016). A brief survey of

cryptocurrency systems. In PST’16, 14th Annual

Conference on Privacy, Security and Trust. IEEE.

Nakamoto, S. (2009). Bitcoin: a peer-to-peer electronic

cash system. http://www.bitcoin.org/bitcoin.pdf

(access: 30.07.2022).

Nofer, M., Gomber, P., Hinz, O., Schiereck, D. (2017).

Blockchain. Business & Information Systems

Engineering, 59(3), 183-187.

Náñez Alonso, S. L., Jorge-Vázquez, J., Echarte Fernández,

M. Á., Reier Forradellas, R. F. (2021). Cryptocurrency

mining from an economic and environmental

perspective. Analysis of the most and least sustainable

countries. Energies, 14(14), 4254.

Risius, M., Spohrer, K. (2017). A blockchain research

framework. Business & Information Systems

Engineering, 59(6), 385-409.

Szostek, D. (2018). Blockchain a prawo, Wydawnictwo CH

Beck. Warszawa.

Wątorek, M., Drożdż, S., Kwapień, J., Minati, L.,

Oświęcimka, P., Stanuszek, M. (2021). Multiscale

characteristics of the emerging global cryptocurrency

market. Physics Reports, 901, 1-82.

Xu, M., Chen, X., Kou, G. (2019). A systematic review of

blockchain. Financial Innovation, 5(1), 1-14.

QQSS 2022 - Special Session on Quality of Service and Quality of Experience in Systems and Services

474