Risk Assessment in Global Energy

M. I. Kudusova

Chechen State University, Grozny, Russia

Keywords: International energy security, energy, risk, global risk, risk map, commodity risks, investment risks, nuclear

energy technologies.

Abstract: The article is devoted to the problems of risk assessment in the global energy sector in the world and in Russia.

A register of risks in this energy sector has been compiled, which shows internal and external risks. A risk

map is provided.

1 INTRODUCTION

The new financial chronicle showed that, despite the

importance of the energy market, for the world

economy, it is quite receptive to a single set of

interrelated factors, the range of which is quite

extensive - from scientific and technical to

geopolitical.

As a result, the problem of energy security (ES) is

becoming more and more acute, providing a

successful distribution of completed energy resources

among consumers.

Undoubtedly, the result of the global ES is

impossible without considering the functioning, as

well as possible dangers that hinder the establishment

of a balance in the energy market.

This, in turn, means identifying internal and

external aspects of influence, modernizing scenarios

for the future development of incidents, assessing the

randomness of the occurrence of incidents and

potential damage.

As a result of the above analysis, the main

postulates of risk minimization tactics and their

impact on the global energy market will be outlined.

Thus, the understanding of possible dangers and the

formation of a proper risk management system can be

considered as one of the significant elements of the

supply of international energy security (Egorova,

2013).

2 MATERIALS AND METHODS

International energy security has usually been viewed

primarily from the point of view of buyers, the

leading energy importing countries, from the

standpoint of providing them with energy resources

on a stable concept and at fairly reasonable prices.

At the same time, net exporting countries

(producers) were required to maintain a significant

the level of reserve capacities, which, among other

things, would allow them to compensate for the time

from time to time emerging in the market shortage of

energy resources.

Meanwhile, the energy industry itself, like other

industries of the economy, is subject to a list of risks

arising in the process of manufacturing and exporting

products. In addition, energy production has a number

of typical features.

First of all, this is the use of the final product

(energy) by all segments of the national economy,

which emphasizes the importance of the energy

industry in the formation of a general trend of

economic development.

The risks of the primary energy markets create

uncertainty in the pricing of final products. And

finally, the basic type of raw material for energy

today is non-renewable hydrocarbon resources, of

course, over time, the risk of their depletion and the

emergence of an energy shortage increases. Some of

the risks can be mitigated by redistributing

investment flows in certain areas of development of

the energy industry (Ralph, 2011; Egorova, 2015).

However, at present, in the context of high

uncertainty in the prospects for economic

development and the situation in energy markets, the

Kudusova, M.

Risk Assessment in Global Energy.

DOI: 10.5220/0011572100003524

In Proceedings of the 1st International Conference on Methods, Models, Technologies for Sustainable Development (MMTGE 2022) - Agroclimatic Projects and Carbon Neutrality, pages

369-373

ISBN: 978-989-758-608-8

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

369

risks associated with investing in long-term energy

projects are also on the rise. And the transition to new

technologies is complicated uncertainty of possible

outcomes of innovations.

In addition to economic risks, the importance of

political risks is increasing, including transit. In the

absence of an alternative replacement for

hydrocarbons, the risks of conflicts over the

possession of raw materials will only increase with

growing shortage of traditional types of energy

resources.

Thus, even a brief overview of potential threats in

the energy market shows that risks are of a different

nature: from negative trends in the global economy to

technological accidents in individual industries.

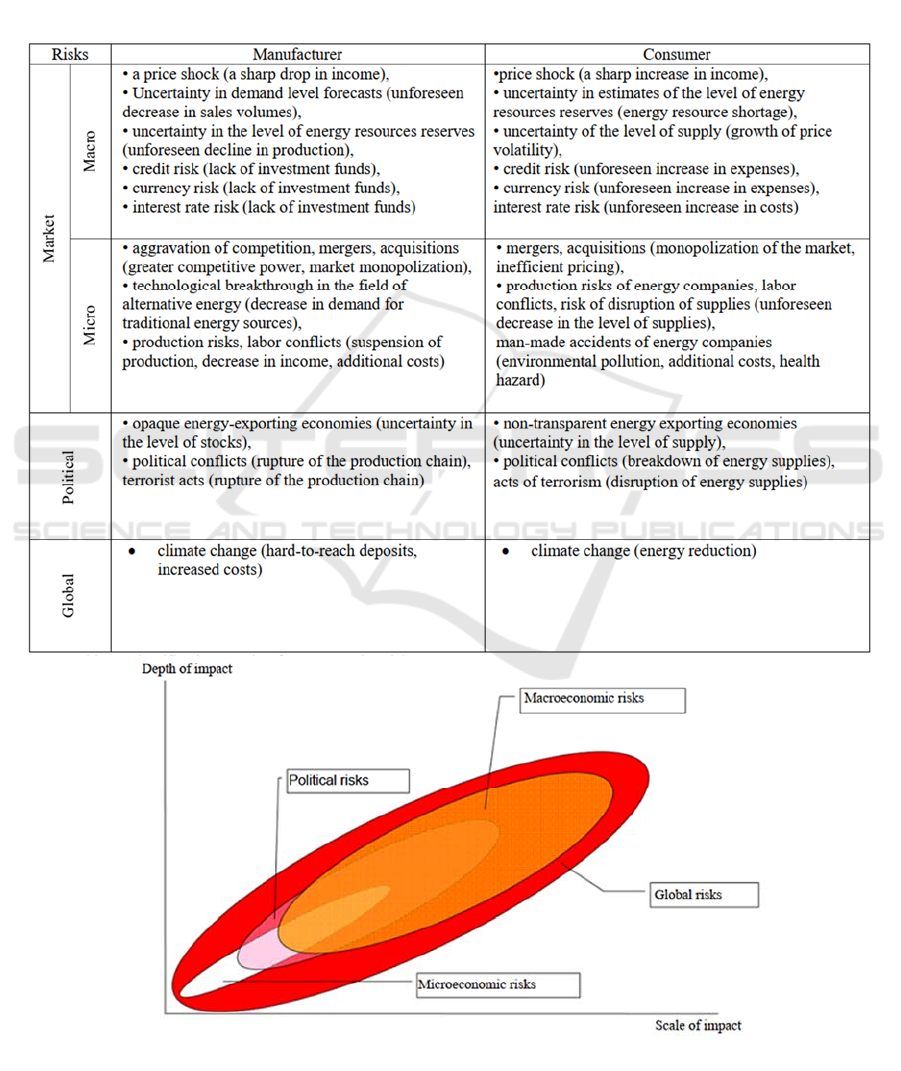

A more detailed analysis of the main risk groups

in the energy market allows us to assess the degree of

influence of one or another unfavorable scenario and

identify ways to reduce the negative consequences in

as a result of potential threats. Below is the

classification risk matrix (see Table 1) and ranking of

the main risk groups according to the degree of their

influence to the energy market (see Figure 2).

The rise in oil prices revived investment processes

in the global energy sector. The rise in hydrocarbon

prices reflects the interests not only of oil and raw

material producers, but also of the global financial

community, which was hardly interested in

maintaining the situation, which threatened, among

other things, with large expenses to stop the

consequences of bankruptcies of shale companies.

This is a fundamental difference between the

current situation and the 1980s: at that time, the world

capitalist system was strong enough to withstand two

decades of low oil prices and, accordingly, a meager

flow of petrodollars.

Figure 1: Map of global risks.

MMTGE 2022 - I International Conference "Methods, models, technologies for sustainable development: agroclimatic projects and carbon

neutrality", Kadyrov Chechen State University Chechen Republic, Grozny, st. Sher

370

The modern global financial system, despite the

huge difference in the formal volumes of financial

resources, began to experience difficulties after 2

years, when the first talk began about the return of

prices to the “average global profitability horizon”.

3 RESULTS AND DISCUSSION

The modern economy has become clearly more

capital-dependent while maintaining the same

sources of rent (Ivonin, 2009).

Expert assessments made on the eve of the World

Economic Forum in Davos testify to the preparation

Table 1: Classification matrix of energy market risks.

Figure 2. The degree of impact of the main risk groups on the energy market.

Risk Assessment in Global Energy

371

of the investment community for a new cycle of

investing petrodollars in global energy.

None of the major world players in the modern

world economy is interested in the implementation of

reindustrialization projects announced in oil-

producing countries (in Saudi Arabia, Iran, and partly

in Russia), which can at least make it difficult to

collect traditional raw material rent. The surplus of

petrodollars formed as a result of rising prices should

either be “eaten away” (within the framework of

“social programs”, for example) or spent on various

large investment projects, some of them fictitious. At

the same time, it is impossible to allow the

strengthening of the influence of new players in the

global "digital economy", where a difficult

competitive situation is already developing.

It is fundamentally important for Russia to ensure,

at the present stage of development of the world

economy, if not dominant, then at least a leading

position precisely in the energy sector. And for this it

would be extremely expedient to lead, at least at the

level of conceptual understanding and

comprehension of the problem, a new investment

cycle in the global energy sector, avoiding both the

“eating up” of additional funds received, and their

“dispersed”, “portfolio” investment (Polyakova,

2011).

If we consider potential investment "vectors" in

the global energy sector, the picture for Russia is not

very favorable:

The topic of biofuels, which was the most

important investment vector at the beginning of the

2000s, can be considered almost completely “burnt

out”. It is unlikely that investment interest in it will

resume in the near future, although "laboratory"

research will continue.

Renewable energy sources and in general, i.e.

"alternative energy" as an object of investment are

contradictory: these technologies have already been

practically tested and "promoted". But this type of

energy has turned out to be economically discredited

to the greatest extent.

Nuclear energy technologies remain investment

attractive. But it is premature to talk about the

existence of any fundamentally new technological

platform for the development of nuclear energy.

However, the development of investment processes in

this area may also have the character of competitive

pressure on Russia in the promising nuclear energy

markets.

Energy-saving technologies will remain a

significant investment vector. But it carries

significant risks for Russia associated with a decrease

in energy consumption in developed countries.

Serious contradictions of a social nature are also

emerging within Russia, where energy consumers are

interested in reducing consumption, and energy

companies in increasing sales.

Risky projects in the field of classical

hydrocarbons. As a principle direction of investment

in the energy sector, they are acceptable for Russia,

although earlier investments have largely depreciated

due to falling hydrocarbon prices. And most

importantly, their volume cannot be restored, even in

a minimal form, given the current and prospective

level of oil prices in the coming years.

Thus, none of the conditional vectors in the world

energy industry that existed before the collapse of oil

prices can now be the basis for an economically

meaningful investment cycle. For Russia, in the

current investment cycle in the energy sector, if it

really becomes a reality, there are practically no risk-

free vectors.

It is possible that we will face the next edition of

the "green revolution", i.e. with some kind of

propaganda campaign, within the framework of

which investment will be carried out in too wide a

range of energy technologies, moreover, on the basis

of some “ideological” considerations in essence and

without a clearly defined prospect of further

monetization. There is a risk of "chaotization" of

investment processes in the energy sector and

manipulation of investment projects.

There is a danger of a global fictitious investment

process emerging in the world energy industry,

probably based on the topic of “alternative” energy

sources. It is important for Russia to avoid being

drawn into such fictitious investment processes both

at the state level and at the level of companies, while

at the same time increasing the level of “greening” of

the economy and reducing its energy intensity.

There is a need to form some kind of joint system

of expert evaluation and organization of investment

processes in the energy sector. Which should - to a

certain extent - guarantee Russia both at the level of

state interests and at the level of interests of corporate

structures from serious financial losses during the

current investment cycle in global energy.

Investments in the "new energy" cannot stand out

from the competition between the largest Russian fuel

companies. But the situation on the market dictates

the need for centralization of efforts.

It is important that such centralization is not used

for cartelization in the domestic market. But Russian

companies, not only hydrocarbons, but also energy

and investment companies, would do well to cartelize

on external energy markets, given the very likely

increase in competition.

MMTGE 2022 - I International Conference "Methods, models, technologies for sustainable development: agroclimatic projects and carbon

neutrality", Kadyrov Chechen State University Chechen Republic, Grozny, st. Sher

372

We can name the following areas in which it is

already necessary to strengthen interaction between

Russian companies and the state:

Research and forecasting of processes,

identification of fake (in fact, misinformation)

investment areas in the energy sector.

Examination of new foreign energy investment

projects on a cooperative basis and on the basis of a

unified methodology and risk assessment system.

Organization of "investment pools" for energy

projects, including research projects (R&D),

formation of mechanisms for managing such

"portfolio" investments (Porfiriev, 2010). For

example, the problem of organizing portfolio

investment in the development of nuclear energy and

nuclear energy technologies needs serious study.

Despite all attempts to advance in this direction,

which is natural for a modern market economy,

fundamental "model" solutions have not yet been

developed.

Organization of joint research and investment

projects in the field of energy saving, small and non-

traditional energy.

Organization of a Russian investment fund for

investments in the "new energy" within the country

on the basis of a "competition of regions" for the most

attractive conditions.

Creation of an "insurance" pool in the field of new

investments in the energy sector for at least partial

hedging of investment risks, including risks of joint

and several environmental liability (Nikoláeva,

2018).

In fact, without reducing the “competition field”

for Russian companies in traditional energy sectors,

as well as maintaining the level of antimonopoly

competition within the country, such measures make

it possible to be more systematically prepared for a

new investment cycle on a global scale

4 CONCLUSIONS

The designation of tasks and mechanisms for

achieving global energy security is largely

determined by monitoring existing and hypothetical

risks in the energy market.

In this regard, it is important to come to a common

understanding of threats in the energy field, which

can be achieved through the detection of probable

adverse events and the assessment of their

consequences.

Systematization of risks according to their

importance for the energy market makes it possible to

form a sane and effective program of actions aimed at

reducing these risks.

In addition, an analysis of the mechanisms of the

impact of negative events on the energy market and,

as a result, on the economy as a whole, gives the

prospect of interpreting the final indicators of the

realization of risks under certain scenarios for the

development of the world energy market.

REFERENCES

Egorova, M. S., 2013. Russian strategy for the development

of ecological construction. Megapolis management:

Scientific-theoretical and analytical journal. №6(36).

Moscow: Publishing house of the NICKNAME

"Content – Press". 2013.

Ralph, F., 2011. The Green Revolution. Economic growth

without damage to the environment: Alpina Non-fiction

Publishing House. 2011.

Egorova, M. S., Tsubrovich, Ya. A., 2015. Analysis of the

demand for "green" technologies in Russia. Economic

Sciences.

Ivonin, V. M., 2009. Adaptive forest reclamation of steppe

agricultural landscapes.

Polyakova, G. A., Melancholin, P. N., Lysikov, A. B., 2011.

Dynamics of the composition and structure of complex

forests of the Moscow regionю Lesovedenie. Ecosystem

services // Forestry and hunting.

Porfiriev, B., 2010. Climate change: risks or development

factors Russia in global politics.

http://www.globalaffairs.ru/number/Atmosfera-i-

ekonomika-14886.

Nikoláeva, L. B., 2018. Latin American economy in the

face of climate changes. New priorities.

Risk Assessment in Global Energy

373