Is There a Momentum Effect in Chinese STAR MARKET? An

Empirical Analysis based on 223 Stocks in 2019-2021

Yiwen Liu

1,a

and Yuze Jiang

2,b

1

Guangdong University of Technology, Guangzhou, China

2

Monash University, Melbourne, Australia

Keywords: SSE STAR MARKET, Python, Turnover Rate, Momentum Effect.

Abstract: With the deepening of the reform and opening-up process, China's capital market has gradually become

mature. Established in 2019, the SSE STAR MARKET (written below as SSE) is a special board in China

specifically for high-tech enterprises to solve the problem of the high threshold for listing on the mainboard,

and to promote the development of innovative enterprises. The characteristics of the SSE are quite different

from those of the mainboard, so this paper use Python with weekly trading data for 223 Stocks in SSE to

investigate whether there is a momentum effect in the SSE by constructing a winner 's portfolio and a loser's

portfolio for the first time. What’s more, this paper investigates the relationship between the turnover rate and

the momentum effect. The study finds that there is no momentum effect in the SSE STAR MARKET in the

short term. However, there is a momentum effect within the long term and the extent of the momentum effect

deepens in the market with low monthly turnover rates.

1 INTRODUCTION

The momentum effect refers to the recent good

performance of monetary assets in the forthcoming

period will also maintain its better performance. In

some mature securities markets, investors have

started to buy and hold the financial assets of the

winning portfolio for a period of time, while selling

the financial assets of the losing portfolio to achieve

the momentum effect of investment strategy. In recent

years, domestic investors have also begun to look for

traces of the momentum effect in China's stock

market.

SSE, one of the components of China's stock

market, was established in July 2019, and it promotes

the process of technology-based and innovative

enterprises, and solves their concentration of

financing problems. As a place of innovation and

reform in the progress of China's capital market, the

SSE has promoted the development of Chinese

innovation into a golden age and brought historic

development opportunities for relevant high-tech

enterprises. At the same time, most of the listed

companies in the SSE have characteristics of high

potential, high return and high risk, and more and

more investors are focusing their attention on this

area and naturally thinking about whether they can

construct momentum effect strategies in the SSE to

gain the excess returns. The existing literature mainly

focuses on the analysis of the A-share market as a

whole, mostly using monthly and annual frequency

data, while the findings would not be the same if the

results were directly covered for the whole A-share

market due to the different sample subjects and

periods. Moreover, there are just a few papers that

refine the Chinese stock market and study the

momentum effect of a particular sector separately.

Considering that the price elasticity of the board is

greater than that of the mainboard, this paper adopts

the weekly data related to listed companies in the SSE

during 2019-2021 for empirical analysis to examine

the existence of the momentum effect and explore the

influencing factors for the first time, providing

investment strategy suggestions and references for

relevant investors.

2 LITERATURE REVIEW

2.1 Existence of Momentum Effects in

The Stock Market

The momentum effect has been examined and

analyzed by scholars around the world in both

66

Liu, Y. and Jiang, Y.

Is There a Momentum Effect in Chinese STAR MARKET? An Empirical Analysis based on 223 Stocks in 2019-2021.

DOI: 10.5220/0011723400003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 66-71

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

established and emerging stock markets to provide

evidence for its existence. In foreign research,

Jegadeesh & Titman (Jegadeesh, 1993), the

originators of the momentum effect study, concluded

that stock returns are short-run persistent by studying

daily frequency data of individual stocks in the U.S.

stock market from 1965 to 1989. Later Fama &

French (Fama, 2012) on stock markets in the Asia-

Pacific region confirmed the existence of the

momentum effect to be different.

On the domestic side, the researches on the

momentum effect have been considered in different

directions due to the complexity of the A-share

market. Firstly, in terms of whether there is a short-

term momentum effect in the A-share market, the

conclusions of domestic scholars are more uniform,

led by Gao Qiuming, Hu Conghui, and Yan Xiang

(Gao, 2014), and Song Guanghui, Dong Yongqi, and

Chen Yang Yang (Song, 2017), who use weekly

frequency data and conduct a study based on the

overlap method, conclude that there is a significant

short-term (within 1 month) momentum effect in the

A-share market.

2.2 Influencing Factors of Momentum

Effects in The Domestic Stock

Market

Most of the analyses of the factors influencing the

momentum effect in Chinese stock markets have

mainly focused on two points. Firstly, the impact of

the domestic short selling mechanism: Qiuming Gao,

Conghui Hu, and Xiang Yan (Gao, 2014)

find that

restrictions on short selling promote short-term

momentum effects; Tianhui Zheng (Zheng, 2017)

distinguishes whether the underlying can be financed

and financed and finds that the underlying stocks that

can be financed and financed have more significant

momentum effects than those that cannot be financed

and financed. Secondly, the effect of turnover rate: Li,

Jiangping (Li, 2020) first used daily frequency data

of Land Stock Exchange from 2017 to 2019 and

concluded that Land Stock Exchange still has

significant momentum effect in the case of low

turnover rate.

3 RESEARCH HYPOTHESIS

It has been practically two years since the start-up of

the SSE, experiencing impacts such as the epidemic

and changes in the international political environment

on the way. The SSE showed an overall trend of high

growth and achieve dazzling results. This

undoubtedly reflects the huge potential and upside of

SSE and attracts a large number of investors to buy

into it, causing the share prices of these listed

companies to rise in a longer time, thus easily leading

to the momentum effect in a long-term perspective.

However, the investor structure of SSE is special,

mainly institutional investors and investors with

superior professional levels. The long holding time of

such investors solves to a certain extent the problem

of massive selling when encountering a bear market,

which leads to a sharp fall in stock prices and

stabilizes the market price, making it difficult to form

a momentum effect in the short term. In the actual

market environment, there is also the same herding

effect that retail investors are prone to form at the

initial stage of buying in the SSE, i.e., the stock price

climbs up one after another. Based on the above

analysis, the first hypothesis of this paper is proposed.

Hypothesis 1: There is no short-term momentum

effect but a long-term momentum effect for SSE

stocks.

As mentioned earlier in this paper, most domestic

scholars revolve around the mechanism of our stock

(difficult to short) and turnover rate. As a measure of

stock liquidity, low turnover rate responds to low

liquidity, and according to the explanation for the

creation of momentum effect in behavioral finance:

the lack of response from investors causes, which

means that the information dissemination in the

market is slower, easily causing information bias and

asymmetry, resulting in stock price deviation from its

own true value. Therefore, based on the finding of

scholar Li Jiangping (Li, 2020) that Land Stock

Exchange long position stocks have momentum

effect despite low turnover rate, this paper explores

whether the turnover rate affects the existence of

momentum effect in SSE and proposes the second

hypothesis of this paper.

Hypothesis 2: With the low turnover rate, stocks

in the SSE still have a significant medium-term

momentum effect.

Is There a Momentum Effect in Chinese STAR MARKET? An Empirical Analysis based on 223 Stocks in 2019-2021

67

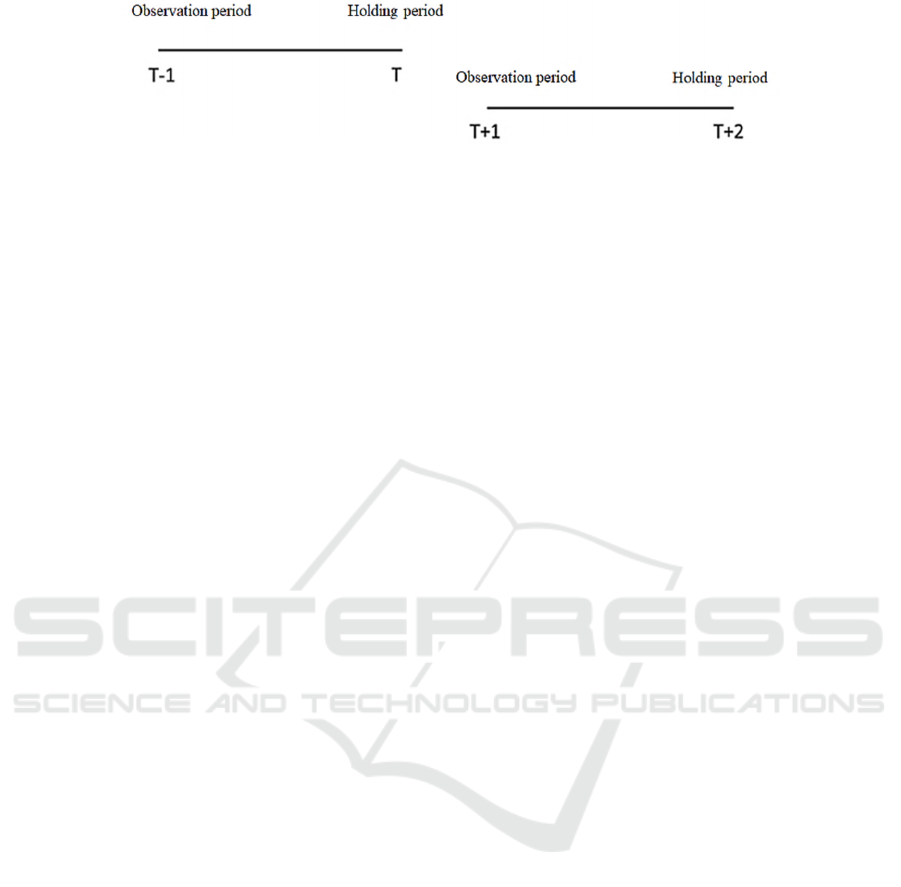

Figure 1: Momentum effect strategy construction method.

4 RESEARCH METHODOLOGY

AND DATA SOURCES

4.1

Research Methodology

The model used throughout this paper is the

overlapping sampling method used by Jegadeesh &

Titman (Jegadeesh, 1993), finding whether there is a

momentum effect in the SSE. In this paper, the period

is divided into two periods, the first period A is the

observation period and the second period B is the

holding period. The holding period of 1-2 weeks is

defined as short term, 4 weeks as medium term, and

8 weeks as long term. Also, the time lengths of A and

B are taken as 1 week, 2 weeks, 4 weeks and 8 weeks

respectively, i.e., 16 different groups of portfolios are

paired, and the stocks with the top 10% returns in the

observation period are recorded as winners'

portfolios, while the bottom 10% stocks are recorded

as losers' portfolios. The stocks in each group are

bought according to the same weight, and then the

average return of the winner portfolio and the loser

portfolio are calculated separately during the holding

period, and finally, the difference between the winner

portfolio and the loser portfolio (W-L) is calculated.

Also, a one-week space between the observation

period and the holding period is used to prevent the

occurrence of the overrun-lag effect, which becomes

the form of (A, 1, B) strategy.

In addition, in order to study the effect of turnover

rate on the emergence of momentum effect of SSE

stocks, this paper mimics the overlapping sampling

method model by this following: First, the turnover

rate period C, i.e. (C, A, B), is set before the

observation period and the position period,

considering the short length of SSE establishment,

which will result in too small a study sample, so no

space-time is set here. The first 30% of stocks are the

high turnover rate portfolio, and the last 30% are the

low turnover rate portfolio. Then in the low turnover

portfolio in the observation period for the returned

ranking from the largest to the smallest, take the top

10% return stock portfolio as the winner portfolio, on

the contrary, the lowest 10% return stock portfolio as

the loser portfolio. Finally, the difference in return

between winner and loser portfolio in the holding

period is measured. In this paper, the value of C is

fixed for one month, and A and B are taken for 1

week, 2 weeks and 4 weeks, respectively, to construct

9 groups of strategies to judge the impact of turnover

rate.

4.2 Data Sources

This paper uses the Choice financial data platform of

Oriental Wealth to obtain the return and monthly

turnover data of the stocks of the CoC, with the

sample time range from October 2019 to May 2021,

i.e., starting from the second month of the inception

of the CoC. In this paper, we analyze the existence of

the momentum effect of the Cochrane Board in terms

of weekly time. Each strategy has a fixed observation

period and holding period. There are 16 portfolio

strategies, stocks with missing data and historical

returns of less than 1 month removed. Depending on

the above data criteria, a total of 223 stocks of SSE is

derived for research and analysis in this paper.

In this paper, the return calculation of the winner

portfolio, the loser portfolio and the difference

between the two are done through the WindQuant

platform by introducing the WindPy for python

quantitative back testing, and calculating the return of

the stock portfolio under different parameter settings

respectively. Using a strategy with a 1-week

observation period and a 1-week holding period (1, 1,

1) as an example, Figure 2 shows the average yield of

the winner's portfolio, the loser's portfolio and the

difference between the two over different periods. (If

you need the code of this paper, please feel free to

contact the author by email).

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

68

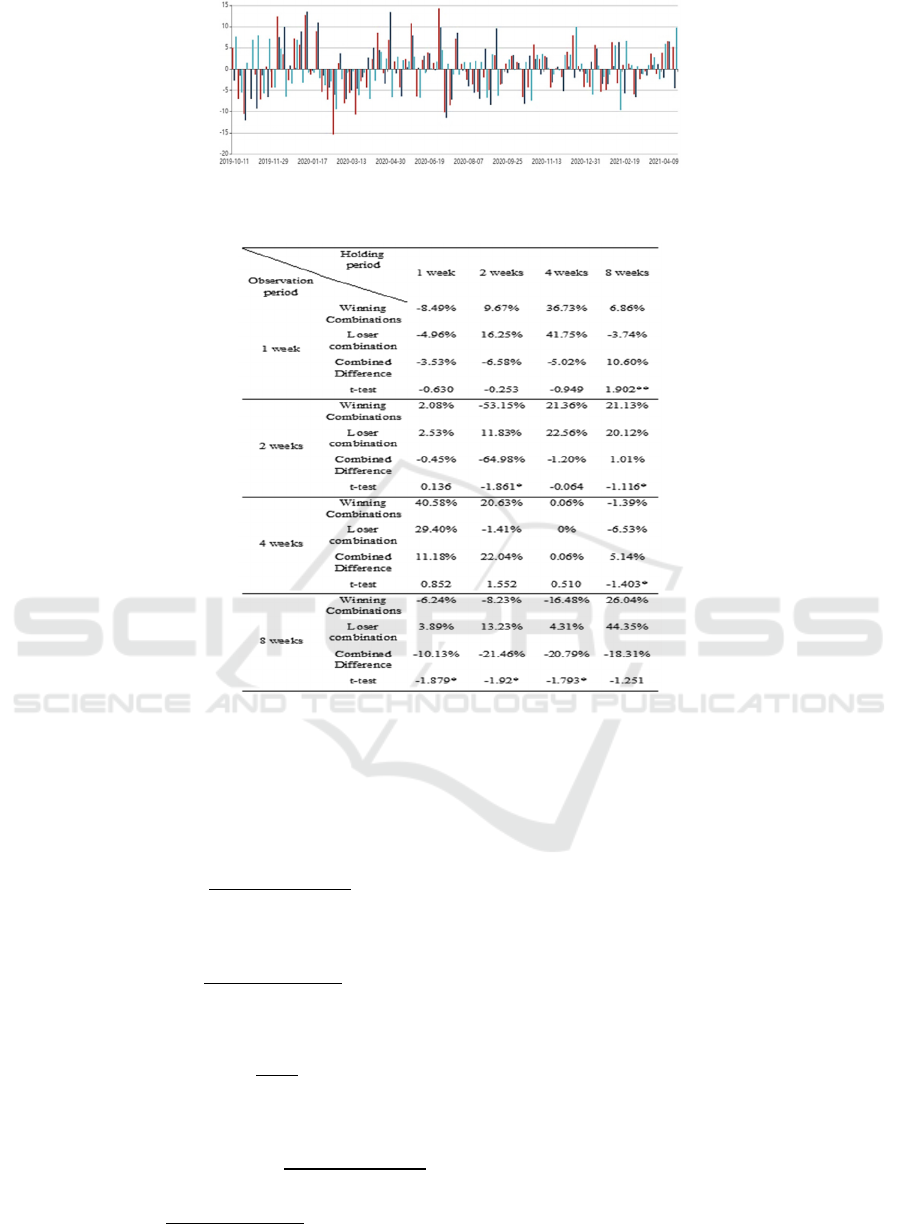

Figure 2: (1, 1, 1) Strategy grouping returns.

Table 1: Returns of different strategy combinations of SSE.

4.3

Description of Variables and

Definition of Indicators

The average return of the winner's portfolio over each

holding period is:

𝑅

Σ

.

𝛱

1 r

1

0.1xN

1

The average return of the loser portfolio over each

holding period is

𝑅

Σ

.

𝛱

1 r

1

0.1xN

2

The cumulative average return of the portfolio

over the sample time period is:

𝐶𝑅

/

Σ

𝑅

/

Y

3

Difference between winner's and loser's

portfolios:

𝑆𝑝𝑟𝑒𝑎𝑑

∑∑

𝛱

1 𝑟

1

0.1𝑥𝑁

𝛱

1 𝑟

1

0.1𝑥𝑁

4

5 EMPIRICAL RESULTS AND

ANALYSIS

5.1 Exploring the Existence of

Momentum Effects under Different

Strategies in the SSE Market

In Table 1 below, the average return results of the

winning portfolio, the losing portfolio, and the

portfolio difference under 16 different observation

and holding periods are presented, and a one-sample

t-test is conducted on the portfolio difference, i.e., the

zero-cost momentum portfolio, for each set of

strategies, with the original hypothesis that the mean

value of the return on the difference portfolio is zero,

as a test of whether the momentum effect is

significant. A positive return means that the

momentum effect exists, while the opposite is not

true. The following information can be consulted on

the table.

As shown in Table 1 (*** p<0.01, ** p<0.05, *

Is There a Momentum Effect in Chinese STAR MARKET? An Empirical Analysis based on 223 Stocks in 2019-2021

69

p<0.1), the maximum return on portfolio spread is

22.04% for the (4,2) strategy and the minimum return

is -64.98% for the (2,2) strategy. In these 16

strategies, the (1-1), (1-8), (2-8), (4-1), (4-2), (4-4),

and (4-8) spreads perform positively, most of which

are concentrated in the medium to long-term holding

period and the observation period of 4 weeks. To

address the issue of significance, the T-statistics of the

above portfolios with positive returns on difference is

significant at the 90% confidence level for strategies

(2, 8) and (4, 8), and at the 95% confidence level for

strategies (1, 8), while strategies (2, 2), (8, 1), (8, 2)

and (8, 4) show insignificant momentum effects.

When the observation period is 1 to 2 weeks, only the

(1, 1) portfolio shows a momentum effect and both

the winner portfolio and the loser portfolio have

negative average returns, i.e., the momentum effect

arises from the lower returns of the loser portfolio;

when the observation period is 4 weeks, the reason

comes from the high returns of the winner portfolio

and the low returns of the loser portfolio, indicating

that the stock rally in the SSE has some sustainability.

It is worth noting that when the observation period is

8 weeks, the portfolio spreads are all negative, and

after a longer period of better performance, there is a

significant pullback during the holding period,

indicating a probability of "momentum collapse" in

the SSE market.

The findings of this paper on whether there is a

momentum effect in the SSE market are different

from those of other scholars on China's A-share

market but are more consistent with the findings of

scholars on SECOND BOARD. In summary,

hypothesis 1 is correct that there is no momentum

effect for stocks in the SSE in the short term (1-2

weeks holding period) and medium term (4 weeks

holding period), but there is a momentum effect for

the long term (8 weeks holding period).

5.2

Exploring the Effect of Monthly

Turnover rate on the Momentum

Effect in the SSE Market

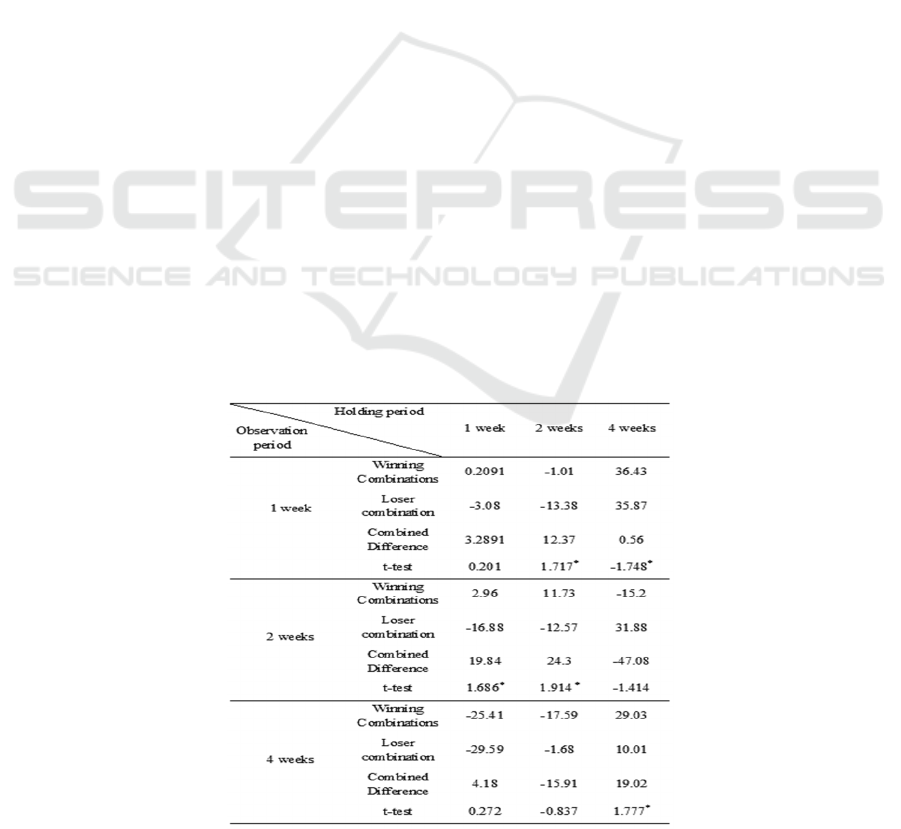

In order to investigate whether there is an effect of

turnover rate on the momentum effect in the SSE

market, this paper presents the average return results

of winning portfolios, losing portfolios, and portfolio

spreads under the influence of monthly turnover rate

for nine different observation and holding periods in

Table 2 below, and performs a one-sample t-test on

the portfolio spreads for each group of strategies with

the following results.

As shown in Table 2, among the three medium-

term strategy portfolios with a four-week holding

period, the return on the difference between the (1, 4)

and (4, 4) long-term portfolios is significantly

positive at the 90% confidence level, but unlike the

normal situation, the short-term strategy portfolios

also show a momentum effect under the low turnover

condition, with positive returns on the portfolios (1,

1), (1, 2), (2, 1), (2, 2), and (4, 1). And the t-statistics

of (1, 2), (2, 1), (2, 2) are significant at 90%

confidence level. This is a good indication that the

SSE market has a significant medium-term

momentum effect despite the low turnover rate and a

short-term momentum effect that do not exist in the

normal situation. The reason for this phenomenon

Table 2: Returns of different strategies in SSE under low turnover rate.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

70

maybe because the low turnover rate implies that the

information transmission rate in the SSE market is

slow, investors' response is insufficient, and stock

prices cannot return to their intrinsic value level

quickly enough to eliminate the noise problem in a

short period, thus leading to a short-term momentum

effect in the SSE market. In summary, hypothesis two

holds and stocks in the SSE still have significant

medium-term momentum effects in the presence of

low turnover rates.

6 CONCLUSIONS AND

RECOMMENDATIONS

In this paper, we study 233 stocks in the period from

October 2019 to May 2021 in the SSE, finding that

there is no momentum effect in the SSE market in the

short (1-2 weeks) and medium term (4 weeks), and a

significant momentum effect in the long term (8

weeks); using low turnover as a precondition, the SSE

market shows momentum effects in the short,

medium, and long term. The findings in this paper are

different from those of the mainboard of China,

which are related to the differences in the listed

companies, investor structure and policies of the

board. This paper also demonstrates that the market

is still not efficient in China. Therefore, this paper

suggests the following recommendations to both

regulators and the investors.

For the regulators, it is important to improve the

information disclosure system and increase the

transparency of trading in the SSE market. It is the

existence of asymmetric information and slow

delivery that leads to the momentum effect.

Therefore, regulators should supervise the timeliness

of information disclosure of listed companies and

establish mechanisms to ensure the authenticity and

validity of the information provided by listed

companies.

For the investors, to strengthen investment

learning, reduce excessive speculation and other

irrational behavior. China's retail investors are not

well educated in investment, easy to form a herd

effect and follow the herd behavior, affected by the

noise information. Investors should look at the

market volatility rationally, do not blindly select

stocks, while building a portfolio of momentum

strategies under different circumstances, such as the

results of the empirical analysis of this paper, in the

case of low turnover rate, good risk management, and

in line with their investment plan, constitute a

portfolio of momentum strategies to obtain a market

excess return.

REFERENCES

Fama E F, French K R. Size, value, and momentum in

international stock returns [J]. Journal of Financial

Economics, 2012, 105(3): 457 -472.

Gao Qiuming, Hu Conghui, Yan Xiang. On Characteristics

and Formation Mechanisms of Momentum Effect in

China’s A—share Market [J]. Journal of Finance and

Economics, 2014,40(02):97-107.

Jegadeesh, Narasimhan, and Sheridan Titman. Returns to

buying winners and selling losers: implications for

stock market efficiency [J]. Journal of Finance, 1993,

48: 65-91.

Li Jiangping. An empirical study on the momentum effect

of Shanghai-Hong Kong Stock Connect program long

position stocks [J]. Shanghai Finance, 2020(04):22-30.

Qiang Hong. Progress of research on momentum effects in

China [J]. Review of Economic Research, 2018(50):20-

30.

Song Guanghui, Dong Yongqi, Chen Yang Yang, and Xu

Lin, Liquidity and the Momentum Effect of China's

Stock Market: In -depth Study Based on Fama -French

Five Factors Model [J]. Financial Economics Research,

Vol. 1, 2017

Tianhui Zheng, Research on the effect of heterogeneous

beliefs on momentum effect under short selling

mechanism, Master's thesis, Harbin Institute of

Technology, 2017

Is There a Momentum Effect in Chinese STAR MARKET? An Empirical Analysis based on 223 Stocks in 2019-2021

71