Does the Export Promotion Improve the Chinese Comparative

Advantage in the Energy Products?

Yu Hong

1

, Chaojie Chen

1

, Dong Yan

1

and Ting Liu

2*

1

College of International Economics and Trade, Jilin University of Economy and Finance, Changchun, China

2

Changchun Humanities and Sciences College, Changchun, China

Keywords: China, Energy Products, Trade, Granger Causality.

Abstract: This research employed the Chinese and the world trade data in energy products during the period of 1985-

2019 to obtain of the weighted index of trade competitiveness (TC) and the indicators symmetric

comparative advantage for Chinese export in the energy products (RX), and then used the differences

between TC and RX to capture China's export promotion in energy products (HX). After preliminary

analyses on the time paths of the indicators, this study made econometric modeling on RX and HX to

empirically examine the short-run and the long-run Granger causal relationship across the two time series.

We concluded that 1) China has adopted export promotion in her energy products; 2) in the short-run, there

is no Granger causal relationship of any direction between the export promotion and the comparative

advantage in Chinese energy export; 3) the long-run equilibrium relationship Granger cause both RX and

HX, while there is no evidence that export promotion Granger causes the Chinese comparative advantage in

the energy products in the long-run. This study documented that the Chinese export policy intervention has

maintained continuity, and the short-run and long-run effects have been much different from the

protectionist predictions of comparative advantage improving.

1 INTRODUCTION

The controversies between protectionist theories and

the free trade theories have lasted for centuries. Trade

protectionist theories represented by the mercantilism

have argued that government should adopt import

restriction or export promotion policies to ensure the

trade surplus and the inflow of gold and silver, which

is a nation's real wealth that can make the country

stronger. Trade policy interventions have been also

advocated by List (1841) (List, 2011), the dynamic

comparative advantage theories (Grossman, 1991)

and Keynesian economics (Keynes, 1997).

Adam Smith proposed the free trade theory of

"absolute advantage" and called for rebellion against

the mercantilist policy interventions (Smith, 1998).

David Ricardo developed the free trade theory by

elaborating the "comparative advantage" or the

"comparative cost". As long as there are differences

in the production costs, every country, even a country

with the "absolute disadvantage" in any product, may

obtain "trade benefits" in the international

specialization and trade if she defers to the principles

of comparative advantage (Ricardo, 2015). To the

free trade theorists, government interventions in both

export promotion and import restriction are

protectionism (Salvatore, 2013), which the school of

free trade has been fighting against.

There is another protectionist policy intervention

in the form of import promotion. This research also

reckons the "import promotion" as trade protectionist

policy intervention, because a government may adopt

the trade policies in this form for various reasons.

This may be true for the Chinese trade in energy

products because China has been a country with

booming domestic energy demand in her fast

economic development during the past decades,

which may have encouraged the Chinese government

to promote the energy import instead of restricting it.

2 METHODOLOGIES AND DATA

2.1 Data Acuration

This research obtained the 3-digit import and export

annual data for the world in the energy products on

168

Hong, Y., Chen, C., Yan, D. and Liu, T.

Does the Export Promotion Improve the Chinese Comparative Advantage in the Energy Products?.

DOI: 10.5220/0011732300003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 168-173

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

September 31

st

, 2020, for the period of 1985-2019,

under the classification of SITC Rev.1 from United

Nation Comtrade database (available from:

https://comtrade.un.org/data/). There are six 3-digit

energy products involved which includes "coal, coke

and briquettes" (code 321), "petroleum, crude and

partly refined" (code 331), "petroleum products"

(code 332), "gas, natural and manufactured" (341),

"electric current" (code 351) and "mineral tar" (code

521) (Chen, 2020). Some countries’ delayed data

reporting to UN Statistics Division makes the data

for 2019 and for the recent years only partially

available. As a result, later accession may generate

slightly different data.

2.2 Indicators for the Trade Patterns

This study employed the indicators of "trade

competitiveness" (TC) and then used the indicator of

export promotion (HX) which is derived from TC

and the indicators of "revealed symmetric

comparative advantage for export" (RX), to examine

the Chinese trade patterns in energy export.

• Trade Competitiveness. The indicator is a

county's trade balance in proportion to the total

import and export value in product k:

TC

ck

= (X

ck

- M

ck

)/ (X

ck

+ M

ck

) (1)

where X stands for export value and M is for the

value of import. The subscript of c indicate that the

reporting country is China and the subscript of k

represents each specific 3-digit energy product. The

value range of TC

ck

is [-1, 1] with a mean of zero.

• Revealed comparative advantage. Balassa

(1965) designed the indicator to measure one

comparative advantage that revealed in the trade of

product k (Balassa, 1965).

RCA

ck

= (X

ck

/ X

wk

)/ (X

c

/ X

w

) (2)

where X

c

is the total trade value of country c and the

subscript of w is for the world. The indicator of

RCA

ck

compares product k's share in country c to

that in the world total export (X

w

). RCA

ck

ranges

from 0 to X

w

/X

c

without a certain upper bound and a

certain mean, preventing the comparing across

different countries, products and other indicators of

trade patterns.

• Revealed symmetric comparative advantage.

Dalum, Laursen and Villumsen (1998) proposed the

indicator of "revealed symmetric comparative

advantage" (RSCA) to address RCA's problems of

uncertain value range and definite mean (Dalum,

1998) by

RX

ck

=RSCA

ck

= (RCA

ck

- 1)/ (RCA

ck

+ 1) (3)

which has the range of [-1, 1] with a mean of zero,

being identical to that of TC

ck

(Hong, 2018; Hong,

2010; Shi, 2019). This study added X to indicate the

"revealed symmetric comparative advantage" is for

the energy export.

• Policy intervention in export. In Ricardian

comparative advantage theory, a country should

specialize in and export the products in which she has

comparative advantage, and import the products in

which the country is dis-comparative advantaged.

The higher degree of comparative advantage in

product k implies country c's more export in the

product and vice versa. Under perfect free trade

environment where there is no any government

policy intervention, the equilibrium of

TC

ck

=RX

ck

(4)

must hold. This deduction facilitates the measuring

of policy intervention in the trade by

HX

ck

=TC

ck

- RX

ck

(5)

where HX

ck

is country c's policy intervention in

product k's export with the value range of [-2, 2].

HX

ck

>0 implies that country c promotes the export

in product k, making the indicator of TC

ck

higher

than the export comparative advantage; HX

ck

<0

means export restriction (Pang, 2010).

• Weighting approaches. Because there are six

3-digit specific energy products, weighting is

necessary to obtain the indicators of the trade

patterns for the product category j. We used the

proportion of country c in the world total export

value of product k, or

w

1

=X

ck

/ X

wk

(6)

to weight RX

ck

because only export is involved here.

The weight for the HX

ck

is

w

2

=(X

ck

+ M

ck

)

/ (X

wk

+ M

wk

) (7)

because both the export and the import are necessary

to obtain the indicator of HX

cj

.

2.3 Econometric Analyses

Different approaches should be employed according

to the generating process of the time series of RX

ck

and HX

ck

in order to avoid any conjecture. This

research performed augmented Dicky-Fuller (ADF)

unit root tests to examine the stationarity of the time

series; we employed the least information criteria of

the vector auto-regression (VAR) models to select

between the linear or non-linear model assumptions

as well as the VAR lag interval; this research made

vector error correction (VEC) models select the

Does the Export Promotion Improve the Chinese Comparative Advantage in the Energy Products?

169

optimal VEC specification and therefore performed

Johansen co-integration test; this research finally

conducted short-run and long-run Granger causality

tests with specific short-run and long-run effects

reported along with the directions of Granger causal

relationship.

• Augmented Dicky-Fuller (ADF) unit root

tests. OLS using non-stationary time series may

cause the problem of spurious regression. This

research conducted ADF unit root tests to determine

the further econometric approaches. The test types of

exogenous assumptions are as follows: 1) "constant

and linear trend"; 2) "constant"; and 3) "none"

according to the principle of decreasing restriction

conditions. The maximum lags are automatically

selected by Schwarz information criterion. The test

proceeded until the ADF statistic is significant at

0.05 level. If none of the tests for the level series

satisfy this condition, the study took first differences

of the series and repeated the above mentioned

procedures. Because the relationship across the

variables may be non-linear, this study took natural

logarithms on the time series plus one to avoid taking

logarithms on negative values (Ma, 2020).

• Fundamental modelling. This research

assumed that when the relationship across the time

series is linear, the fundamental model or the co-

integrating equation is

RX

cj,t

= a

0

+ a

1

HX

cj,t

+ a

2

T + u (8)

where a

0

is the constant, a

1

and a

2

are the coefficients

to be estimated, T is a deterministic time trend, and u

is the disturbing error. When the relationship is non-

linear, the model is assumed to be

ln(RX

cj,t

+ 1)= b

0

+ b

1

ln(HX

cj,t

+ 1) + b

2

T + v (9)

where b

0

is the constant, b

1

and b

2

are the coefficients

to be estimated and v is the disturbing error. The

specific co-integrating equation was determined by

Johansen co-integration tests.

• Selection for the linear or non-linear

assumptions. This research made linear and non-

linear VAR models and selected the VAR lag

interval 1 to "L" by the information criteria of FPE

(Final prediction error), AIC (Akaike information

criterion), SC (Schwarz information criterion) and

HQ (Hannan-Quinn information criterion). The

criteria for linear and non-linear assumptions are

compared at the same time to select the optimal

model assumption.

• Specification for the vector error correction

(VEC) models and Johansen co-integration tests.

This study made VEC models and summarized

Johansen co-integration test results of all the possible

five specifications with the optimal VEC lag interval

of 1 to L-1, and selected the optimal VEC

specification by the five information criteria of FPE,

AIC, SC and HQ.

• Short-run Granger causality tests. Granger

(1963) assumed that the cause precedes the effect and

the future does not cause the past. This study

employed block exogeneity Wald tests based on the

optimal VEC models to examine the short-run

Granger causal causality between RX

cj

and HX

cj

if

the assumption is linear, and between ln(RX

cj,t

+1)

and ln(HX

cj,t

+1) if it is non-linear. The specific

values for short-run effect(s) were measured by

aggregating the coefficients of the corresponding

VAR lags.

• Long-run Granger causality tests. This study

used Wald F tests to explore long-run Granger

causality for the error correction term of VEC models

as well as the individual independent variables. The

specific value(s) of the long-run effect of the separate

independent series upon the dependent series is (are)

captured by the convergence value(s) of the

corresponding generalized impulse-response

functions if the Granger causality is statistically

significant (Hong, 2014).

3 RESULTS

3.1 ADF Unit Root Test Results

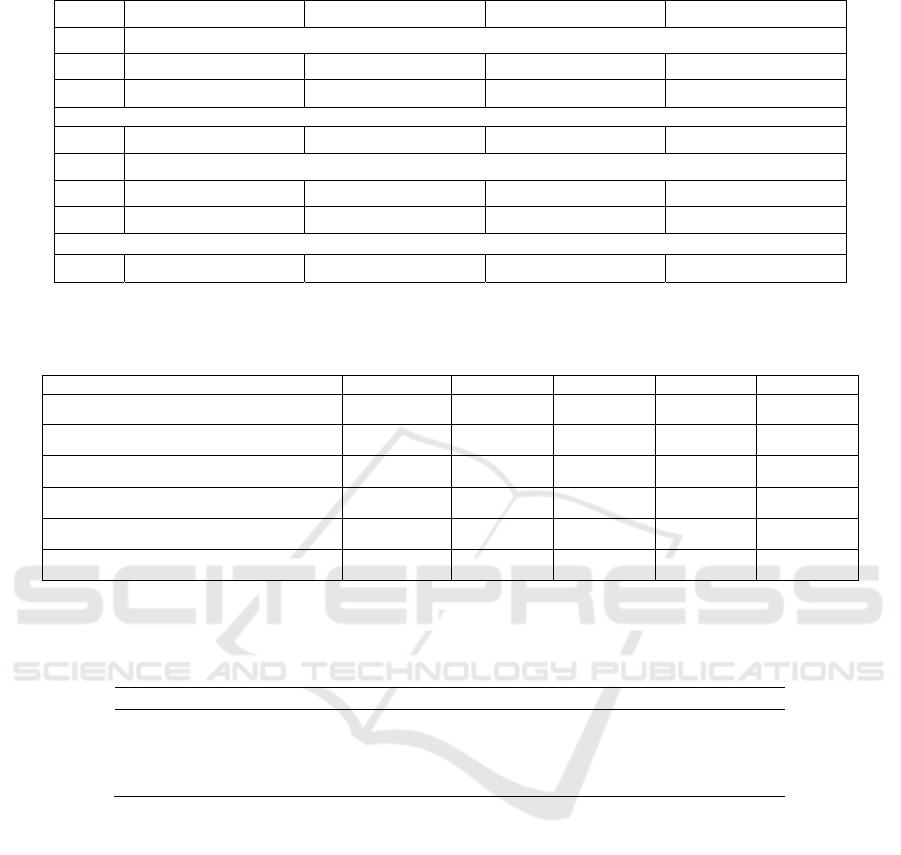

Table 1 reports the results for ADF unit root tests.

Only the time series of RX

cj

has a unit root, while the

first differences of all series are stationary. This facts

imply that we can make VEC models for further

econometric analyses.

Table 1: ADF unit test results.

Variable Test type ADF Prob. Variable Test type ADF Prob.

RX

c

j

,t

NN0 -0.383 0.539 ΔRX

c

j

,t

NN0 -5.562 0.000

HX

c

j

,

t

NN3 -4.829 0.000 ΔHX

c

j

,t

CN2 -6.427 0.000

ln (RX

c

j

,t

+1) CN7 -3.815 0.031 Δln (RX

c

j

,t

+1) NN0 -5.164 0.000

ln (HX

c

j

,t

+1) NN3 -4.423 0.000 Δln (HX

c

j

,t

+1) CN2 -6.613 0.000

a: "C, T, p" stands for "constant", "trend" and the "lag length".

b. The symbol of "N" is used when there is no a constant or a time trend.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

170

Table 2: Linear/non-linear model selection.

lag FPE AIC SC HQ

Linear Model Assumption

1 NA 0.000 -3.088 -2.993

2 56.215 0.000 -5.051 -4.766

*

……

5 22.750

*

1.49e-05

*

-5.484

*

-4.628

Non-linear Model Assumption

1 NA 0.000 -2.317 -2.222

2 59.624 0.000 -4.417 -4.131

*

……

5 22.602

*

2.89e-05

*

-4.824

*

-3.968

a. The maximum VAR lag is 7 that is about one fifth of the sample period.

b. * indicates lag order selected by the criterion.

Table 3: VEC model specification results.

Information Criteria Model 1 Model 2 Model 3 Model 4 Model 5

Determinant resid covariance (dof adj.) 0.000

*

0.000 0.000 0.000 0.000

Determinant resid covariance 0.000 0.000 0.000 0.000 0.000

*

Log likelihood 82.685

*

82.730 82.760 83.128 84.181

Akaike information criterion -4.179

*

-4.115 -4.051 -4.009 -4.012

Schwarz criterion -3.245

*

-3.135 -3.023 -2.934 -2.891

Number of coefficients 20 21 22 23 24

Model 1 assumes "no intercept or deterministic trend in CE (co-integrating equation)"; model 2 assumes "intercept (no deterministic

trend) in CE"; model 3 assumes "intercept (no deterministic trend) in CE"; model 4 assumes "intercept and trend in CE"; model 5

assumes "quadralic deterministic trend"; * indicates the model assumption selected by each individual information criterion

Table 4: Summary of The Johansen Co-Integration Test Results.

Data Trend: None None Linea

r

Linea

r

Quadratic

Test Type No Intercept Intercept Intercept Intercept Intercept

No Trend No Trend No Trend Trend Trend

Trace 1 0 0 0 0

Max-Eig 1 0 0 0 0

3.2 Linear or Non-Linear Model

Selection Results

Table 2 provides the results of the VAR lag intervals

for linear/non-linear model assumptions.

Both assumptions have the VAR lag interval of 1-

5, and the optimal linear VEC lag interval is 1-4.

3.3 VEC Model Specification Results

Table 3 reports the statistics for the information

criteria for all the five possible linear VEC models.

Both SC and AIC criterion selected "model 1".

Only "determinant resid covariance" selected "model

5" but the "determinant resid covariance (dof adj.)"

also selected "model 5". This research determined

that "model 1" is the optimal VEC model

specification, which has no exogenous variable.

3.4 Johansen Co-Integration Test

Results

Table 4 summarizes all 5 sets of assumptions a 0.05

level.

3.5 Short-Run Granger Causality Test

Results

Table 5 reports the short-run Granger causality test or

block exogeneity Wald test results. No statistically

significant Granger causal relationship of any

direction was found.

Does the Export Promotion Improve the Chinese Comparative Advantage in the Energy Products?

171

Table 5: Short-Run Granger Causality Test Results

Variable

ΔHX

c

j

ΔRXcj

Chi-sq Prob. SE Chi-sq Prob. SE

ΔHX

c

j

,t

——

——

——

3.243 0.519

——

ΔRX

c

j

,t

3.609 0.462

——

——

——

——

Note: In the brackets are the probabilities of Chi-sq statistics of short-run Granger causality tests; SE refers to short-run effect which is (are) provided only when the Chi-sq statistics are

statistically significant at 0.1 level.

Table 6: Long-Run Granger Causality Test Results.

Variable

ΔHX

c

j

,t

ΔRX

c

j

,t

F-stat df Prob. LE F-stat df Prob. LE

ECT

t

-1

6.142 (1, 21) 0.022

——

6.142 (1, 21) 0.022

——

ECT

t

-1

, ΔHX

c

j

,t

-1

, ΔHX

c

j

,t

-2

, ΔHX

c

j

,t

-3

, ΔHX

c

j

,t

-4

7.541 (5, 21) 0.000 0.011 1.036 (5, 21) 0.422

——

ECT

t

-1

, ΔRX

c

j

,t

-1

, ΔRX

c

j

,t

-2

, ΔRX

c

j

,t

-3

, ΔRX

c

j

,t

-4

2.037 (5, 21) 0.115

——

1.765 (5, 21) 0.164

——

Note: LE refers to long-run effect which is (are) provided only when the F-statistics are statistically significant at 0.1 level.

3.6 Long-Run Granger Causality Test

Results

Long-run Granger causality results are reported in

Table 6.

The error correction term (ECT

t-1

) Granger causes

ΔHX

cj

and ΔRX

cj

significantly (p=0.022). This result,

however, can not satisfy the curiosity of how the

change in an independent variable has the impact on

the dependent variables. Only the lags of ΔHX

cj,t

Granger cause ΔHX

cj

itself significantly (p=0.000)

with positive long-run effect (LE=0.011) jointly with

the long-run equilibrium relationship (ETC

t-1

),

implying that the Chinese energy export promotion

has maintained continuity. This research found no

evidence that ΔHX

cj,t

or ΔRX

cj,t

Granger causes each

other in any direction in the long-run.

4 CONCLUSIONS

1) China has had dis-comparative disadvantage in the

energy products since the year of 1990.

2) China has deliberately promoted the export in

the energy products, which is a form of trade

protectionism;

3) The Chinese export promotion effort, however,

has not significantly improved the comparative

advantage in the energy products in either short-run

or long-run;

4) Neither in short-run nor long-run, we found

evidence that the Chinese export policy intervention

has been Granger caused by her comparative

advantage in the energy exports. The trade

protectionist predictions do not hold for the Chinese

trade in energy products;

5) The Chinese energy export promotion has

maintained continuity. An increase in the degree of

the export promotion will cause more future policy

intervention in the form of export promotion.

ACKNOWLEDGEMENTS

This work was financially supported by Jilin

Provincial Social Science Fund (2020J58, 2020J60),

Changchun Social Science Fund (CSK2020ZYJ-

001) and the College Poverty Stricken Students

Supporting Programme funded by Jilin Provincial

Ecological Industry Company Limited.

REFERENCES

A. Smith, “An inquiry into the nature and causes of the

wealth of nations”, Oxford: Oxford World's Classics,

1998 (1776).

B. Balassa, “Trade liberalization and revealed comparative

advantage”, Manchester Sch. 33 (2) (1965) 99-123.

B. Dalum, K. Laursen, G. Villumsen, “Structural change

in OECD export specialisation patterns: de-

specialisation and 'stickiness'”, Int. Rev. Appl. Econ.

12 (3) (1998) 423-443.

C.J. Chen, K.X. Yu, A.J. Hu, Y. Hong, “How does the

import restriction Granger cause the comparative

advantage of the USA's energy imports”, Basic Clin.

Pharmacol. Toxicol. 126 (S4) (2020) 307.

D. Ricardo, “On the principles of political economy and

taxation”, Cambridge: Cambridge University Press,

2015 (1871).

D. Salvatore, “International Economics (11th edition)”,

Hoboken: NJ: John Wiley & Sons, Inc, 2013.

D.L. Pang, Y.Hong, “Measuring distortions of trade

patterns: an application to China”, Proc. 2010 IEEE

Int. Conf. Serv. Oper. Logi. Inform. (2010) 124-429.

F. List, “The National system of political economy”,

Hoboken, NJ: John Wiley & Sons, Inc, 2011 (1841).

G.M. Grossman and E. Helpman, “Quality ladders in the

theory of growth”, Rev. Econ. Stud. 58, (1991) 43-61.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

172

G. Shi, Y.M. Yang, A.J. Hu, Y. Hong, “Israel's export

promotion and comparative advantage in services

export: 2005-2018”, Basic Clin. Pharmacol. Toxicol.

126 (S4) (2019) 342.

J.M. Keynes, “The general theory of employment, interest,

and money”, Amherst, NY: Prometheus Books, 1997

(1936).

P. Ma, Y.M. Yang, K.X. Yu, A.J. Hu, Y Hong, “How

have the degree of import restriction impacted Japan's

revealed comparative advantage in the services

exports?”, Basic Clin. Pharmacol. Toxicol. 126 (S1)

(2020) 121.

Y. Hong, Y.M. Yang, X.W. Mu, “The import patterns of

the Korean agro-manufactures: exploring the short-run

and long-run Granger causal relationship”, Adv. Intel.

Syst. Res. 164 (2018) 109-112.

Y. Hong, H.W. Su, “A test of dynamic comparative

advantage hypothesis using panel data of the Chinese

trade in medium-technology products”, 2010 Int. Conf.

Manage. Sci. Eng. (2010) 1600-1605.

Y. Hong, J.Y. Wang, H.W. Su, X.W. Mu, “Panel

cointegration analysis of export facilitation and

comparative advantages: the case of Chinese low-

technology manufactures”, Biotech. Ind. J. 10 (12)

(2014) 6040-6048.

Does the Export Promotion Improve the Chinese Comparative Advantage in the Energy Products?

173