An Empirical Analysis of the Trade Effect of the Construction of the

Sino-Russian Free Trade Area Based on the Trade Gravity Model

Nan Yan

School of Economics, Harbin University of Commerce, Harbin, Heilongjiang, China

Keywords: China-Russia Free Trade Area, Trade Effect, Trade Gravity Model.

Abstract: Based on the trade scale, trade structure, and investment cooperation development between China and Russia

from 2010 to 2019, using the trade gravity model, empirical analysis of the trade effects of the establishment

of a free trade area between China and Russia. The regression results show that the GDP growth of China and

Russia has a significant boost to the bilateral trade volume; the changes in the exchange rate level between

the two countries will have a certain impact on the bilateral trade volume; the reduction and exemption of

tariffs between the two countries will have a positive effect on the growth of bilateral trade volume. Therefore,

with the in-depth development of economic and trade cooperation between the two countries, the

establishment of a free trade zone will have a more significant trade effect.

1 INTRODUCTION

The signing of the world’s largest free trade

agreement, RCEP, on November 15, 2020, indicates

that China’s strategy of “promoting the construction

of a global-oriented high-standard free trade zone

system” in 2019 is being implemented steadily.

Against the background of rising global trade

protectionism and the negative impact of the new

crown pneumonia epidemic on trade and investment,

China’s active participation in bilateral or multilateral

free trade areas not only helps reduce trade frictions

and stabilizes the foreign trade situation, but also

promotes the development of a dual cycle of domestic

and foreign trade.

There have been some related academic studies on

the construction of the Sino-Russian Free Trade Area.

Hao Yubiao (2013) used the trade gravity model to

measure the influencing factors between China and its

main trading partners, and analyzed the restrictive

factors of Sino-Russian trade development. (Hao,

2013) Liu Zhizhong (2017) used the revealed

competitive advantage index and trade

complementarity index to estimate the

competitiveness and complementarity of various

products in bilateral trade between China and Russia

under the “One Belt and One Road” strategy. (Liu,

2017) Ling Chen (2020) comprehensively analyzed

the constraints and complementary conditions for the

establishment of the Sino-Russian Free Trade Area

under the opportunities of the new era, and further

elaborated the specific promotion strategy. (Chen,

2020)

This article continues the above thoughts, on basis

of expounding the status quo of Sino-Russian trade

and investment, draws lessons from the Sino-

Australian Free Trade Area, which is similar to the

Sino-Russian trade structure, and uses the trade

gravity model to analyze the trade effects established

by the Sino-Russian Free Trade Area. Based on the

above research, suggestions are given for accelerating

the construction of a Sino-Russian free trade area

under the new situation.

2 DEVELOPMENT STATUS OF

SINO-RUSSIAN BILATERAL

TRADE

2.1 The Scale of Bilateral Trade

Continues to Expand, and the

Growth Rate Is Relatively Slow

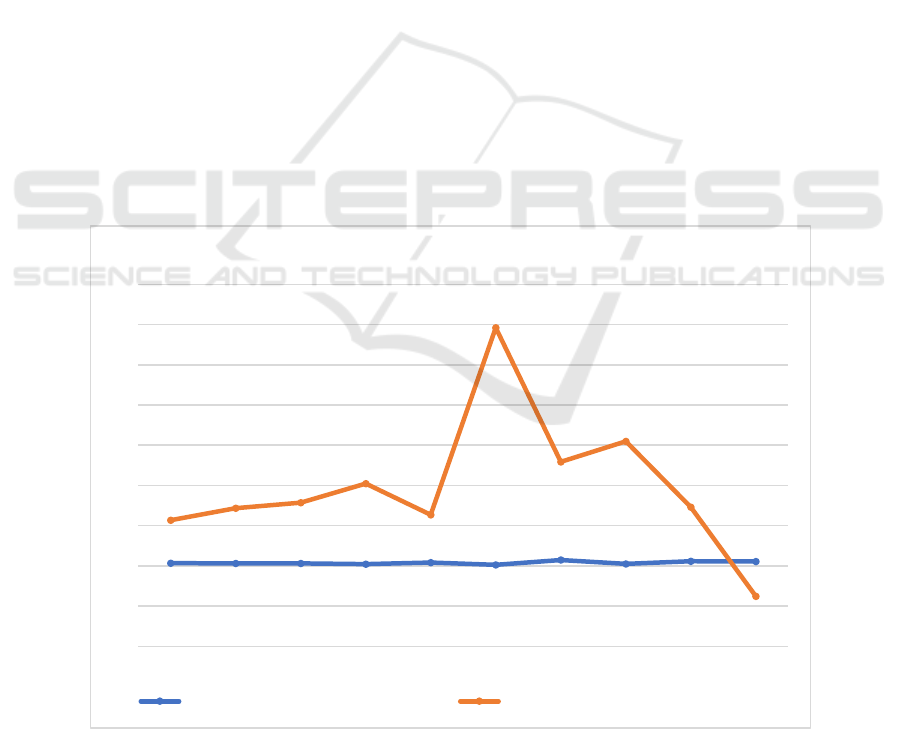

As shown in Figure 1, from 2010 to 2019, the bilateral

trade volume rose from 55.53 billion U.S. dollars to

110.94 billion U.S. dollars, an overall increase of

99.78%. In 2019, the total bilateral trade between

China and Russia increased by 3.58% year-on-year, of.

264

Yan, N.

An Empirical Analysis of the Trade Effect of the Construction of the Sino-Russian Free Trade Area Based on the Trade Gravity Model.

DOI: 10.5220/0011734500003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 264-270

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

Figure 1: 2010-2019 China’s trade value with Russia.

which China’s exports to Russia were US$49.75

billion, a year-on-year increase of 3.71%, and imports

from Russia were US$61.19 billion, a year-on-year

increase of 3.47%. In terms of trade balance, the trade

surplus and deficit have fluctuated. From 2013 to

2017, China was in a trade surplus position, but after

2014, the trade surplus position declined. In 2018 and

2019, China’s trade deficit was 1.17 billion U.S.

dollars and 11.44 billion U.S. dollars. The steady

growth of trade volume in the past ten years has laid a

solid economic foundation and stable cooperative

relations for the construction of the China-Russia Free

Trade Area. However, the scale of bilateral trade is

still relatively small and the growth rate is relatively

slow. It can be seen there is great room for bilateral

trade to development.

2.2 The Level of Bilateral Trade Is Low

and The Trade Structure Is Highly

Complementary

Free trade zones are easier to establish between

economies that dominate intra-industry trade. For

example, the China-Korea Free Trade Zone focuses on

intra-industry trade of mechanical and electrical

products. According to the country-by-country trade

report of the Ministry of Commerce of China, in 2019,

mechanical and electrical products accounted for more

than 50% of the total import and export volume of

China and South Korea. The trade structure between

China and Russia is similar to that of China and

Australia, with inter-industry trade dominated. China

mainly exports labor-intensive manufactured products

such as machinery and electronics and textiles, and

imports primary energy products such as mineral

products. In 2019, mechanical and electrical products,

base metals and products, textiles and raw materials

were the top three commodities in Russia’s imports

from China. These three categories of commodities

together accounted for more than 60% of Russia’s

total imports from China. Mineral products, wood

products, and mechanical and electrical products are

the top three commodities in Russia’s exports to

China. These three types of commodities together

accounted for 85.8% of Russia’s total exports to

China, of which mineral exports accounted for the

highest proportion, reaching 75.2 %. It can be seen the

low level of Sino-Russian trade and the single trade

structure are not conducive to the increase of the added

value of bilateral trade and the further expansion of

trade scale.

Although the Sino-Russian trade structure

dominated by inter-industry trade will restrict the

construction of the free trade zone to a certain extent,

the strong complementarity of the industrial structure

and its import and export commodity structure is also

the advantage of the construction of the Sino-Russian

free trade zone. Russia’s industrial structure is

dominated by heavy industries, and it relies heavily on

the export of crude oil and other energy sources to

generate income. In the process of rapid economic

development, China’s external demand for energy

resources has continued to grow. In addition, the

development of Russia’s agriculture and light industry

is relatively lagging, and China, as a world

manufacturing country, has advantages in scale, cost,

and price, and can effectively meet Russia’s domestic

market demand. In 2019, Russia’s first import from

-150

-100

-50

0

50

100

150

0

200

400

600

800

1000

1200

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

unit:100 million U.S. dollars

import and export value export value import value trade gap

An Empirical Analysis of the Trade Effect of the Construction of the Sino-Russian Free Trade Area Based on the Trade Gravity Model

265

China was mechanical and electrical products, which

accounted for nearly half of Russia’s total imports

from China. It shows that China’s mechanical and

electrical products have market competitive

advantages in Russia’s import trade of such products.

In addition, China’s light industrial products such as

base metals and products, textiles and raw materials,

furniture, toys, miscellaneous products, plastics,

rubber, shoes and umbrellas still occupy a major share

of Russia’s import trade. Among them, light industrial

products such as furniture, toys, miscellaneous

products, shoes and umbrellas account for more than

half of the total imports of similar commodities in

Russia’s foreign trade.

2.3 The Scale of Investment Is Small,

and the Areas of Cooperation Tend

to Be Diversified

As shown in Figure 2, although China’s direct

investment in Russia fluctuated greatly from 2010 to

2019, it averaged US$987.2 million per year.

Russia’s direct investment in China is relatively

small, but the overall trend is increasing, with an

annual average of US$380.1 million. In 2019,

China’s investment flow to Russia was negative 379

million U.S. dollars, mainly due to the negative flow

of 1.13 billion U.S. dollars in the mining industry.

From the perspective of investment fields, China’s

investment in Russia is mainly concentrated in

mining, agriculture, forestry, animal husbandry and

fishery, manufacturing, wholesale and retail

industries, while Russian investment in China mainly

includes technology, construction, transportation and

other fields. From the perspective of investment

regions, due to the geographical proximity, Chinese

investment in Russia is mainly distributed in Siberia

and the Far East, while Russian investment in China

is also mainly concentrated in China’s northeastern

region. From the perspective of investment entities,

most of the investment enterprises are small and

medium-sized enterprises. Factors affecting mutual

investment between China and Russia include: the per

capita GDP of the two countries, relevant policies and

regulations, the state of infrastructure such as

transportation and communications between the two

countries, and historical factors. These factors will

also restrict the level and level of the construction of

the Sino-Russian free trade zone. It can be seen Sino-

Russian bilateral investment cooperation has yet to be

deepened, and there is great potential for

development.

Figure 2: 2010-2019 China’s direct investment in Russia and China attracts Russian direct investment flows.

0,34

0,31 0,3

0,22

0,41

0,13

0,73

0,24

0,57

0,54

5,68

7,16

7,85

10,22

6,34

29,61

12,93

15,48

7,3

-3,79

-10

-5

0

5

10

15

20

25

30

35

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

unit: 100 million U.S. dollars

Russian direct investment flows to China China's direct investment flows to Russia

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

266

3 EMPIRICAL ANALYSIS OF

TRADE EFFECT BASED ON

TRADE GRAVITY MODEL

3.1 Construction of Trade Gravity

Model and Variable Selections

This article selects the data from 2003 to 2019, and

uses the trade gravity model to empirically

demonstrate the influencing factors of Sino-Russian

bilateral trade, which focuses on the analysis of the

impact of tariffs on trade effects.

In the China-Australia FTA, Australia’s tax cut

transition period is 5 years, and there are three ways to

cancel tariffs: one is the 0 category, that is, when the

agreement comes into force, the tariffs on products

originating in China are reduced to 0; the second is the

3 category, which means that the tariffs on products

originating in China will be divided three times and

reduced to zero every year when the agreement comes

into force; The third is the 5 category, that is, when the

agreement comes into force, the tariffs on products

originating in China will be divided into five times and

will be reduced to zero in equal proportions every

year. According to relevant simulation analysis and

prediction, the China-Australia FTA will increase

China’s GDP by 0.33%, exports by 0.53%, and

imports by 0.51% within 5 years from the entry into

force of the agreement. (Zhao, 2019) Therefore, it is

expected that during the construction and subsequent

development of the China-Russia Free Trade Area, the

gradual reduction of tariffs will promote the

continuous growth of Sino-Russian bilateral trade.

In this paper, based on the trade gravity model, the

expression of the trade effect between China and

Russia is as follows:

ln (Y

)=α

+ α

ln (GDP

)+α

ln (T

)+α

ln (R

)+

α

ln (FDI

)+ξ

(1)

Among them, the dependent variable is the total

bilateral trade Y

between China and Russia, and t

represents the year. The independent variables are the

sum of GDP

of China and Russia, the average import

tariff T

of the two countries, the average exchange

rate of RMB to ruble R

, and the sum of the two-way

direct investment FDI

between China and Russia. ξ

is the random error term.

In order to ensure the validity of the estimated

value and regression, after the unit root test of the

variables, they are all stable time series, so the

phenomenon of “false regression” in the model can be

avoided. The following uses Stata 14 measurement

tool to perform least squares regression calculation. In

the first regression, the explanatory variable ln (FDI

)

is expected to have the same sign, but the significance

is not high, so it is deleted. (Huang, 2020) The results

of the second regression are shown in Table 4.

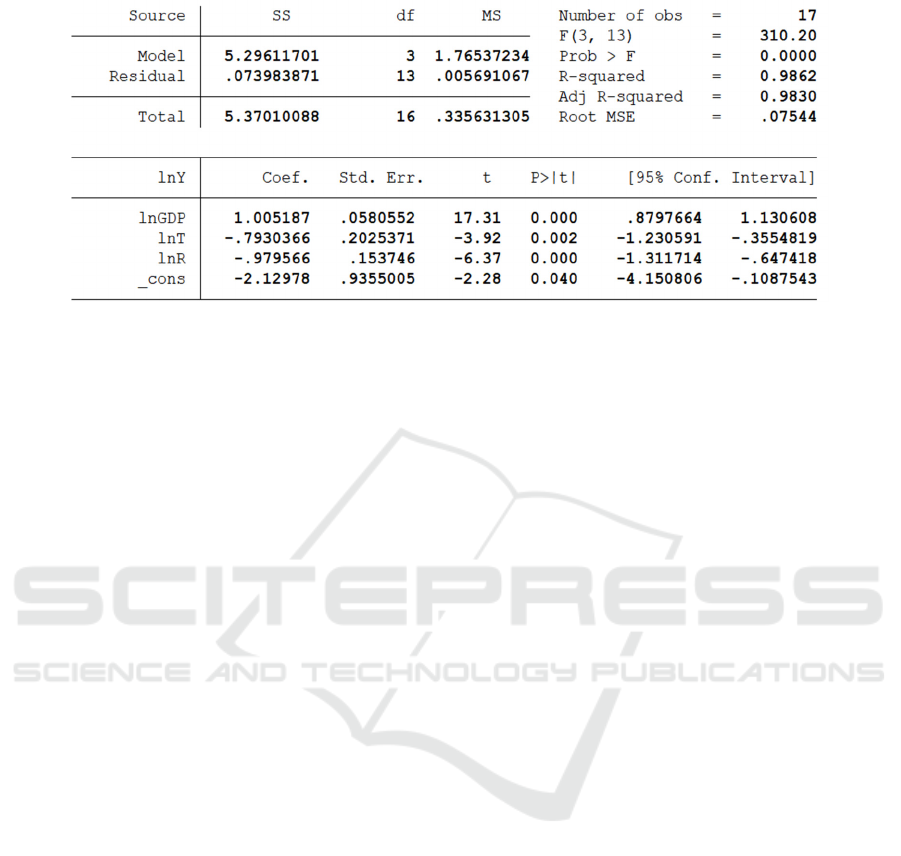

The regression equation obtained from Table 4 is:

ln(Y

)=−2.13 + 1.01ln (GDP

) − 0.79ln(T

) −

0.98ln(R

) (2)

This shows that in the regression results, the

coefficient signs of the explanatory variables are

consistent with the expected results. In addition, R

_

2

=

0.9830, indicating that the goodness of fit of the

equation is high, F = 310.20, and the P value of the F

statistic is 0.0000 <0.01, indicating that the overall

effect of the equation is significant. In summary, this

regression is generally established and effective.

Table 1: Explanatory variables expected symbols, theoretical analysis and data sources.

Independent

variable

Expected

s

y

mbol

Theoretical analysis Data Sources

GDP +

GDP reflects the supply and demand capacity of both sides.

The higher the GDP, the greater the bilateral trade volume.

World Bank

T -

The high level of tariffs will restrict the development of trade,

and the reduction or exemption of tariffs will promote the

growth of bilateral trade.

World bank WITS

atabase

R -

Changes in the exchange rate level between the two countries

have a certain impact on the volume of bilateral trade.

China Statistical

Yearbook

FDI +

Foreign direct investment promotes the development of

bilateral trade. The greater the investment, the greater the

bilateral trade.

Statistical Bulletin

of China’s Outward

Direct Investment

An Empirical Analysis of the Trade Effect of the Construction of the Sino-Russian Free Trade Area Based on the Trade Gravity Model

267

Table 2: The Regression Results of the Total Volume of Sino-Russian Bilateral Trade and Its Influencing Factors.

3.2 Empirical Regression Analysis

First, the GDP growth of China and Russia has a

significant boost to the bilateral trade volume. When

the total gross domestic product of the two countries

increases by 1%, the bilateral trade volume will

increase by 1.01%. Second, changes in the exchange

rate level between the two countries will have a certain

impact on the volume of bilateral trade. When the

average exchange rate of RMB to ruble increases by

1%, the bilateral trade volume will decrease by 0.98%.

Third, the reduction or exemption of tariffs between

the two countries will have a positive effect on the

growth of bilateral trade. When the average import

tariff level of the two countries is reduced by 1%, the

bilateral trade volume will increase by 0.79%. On the

whole, with the in-depth development of economic

and trade cooperation between the two countries, the

positive effects of the establishment of a free trade

zone will be further expanded.

4 CONCLUSION AND

SUGGESTION

Factors affecting Sino-Russian economic and trade

cooperation include: the level of economic

development of both sides, exchange rates, tariff

levels, relevant policies and regulations,

infrastructure, and historical factors. However, the

continued growth of trade and investment between the

two countries, and the complementary advantages of

natural resources, human resources, industrial

structure, and commodity trade structure have shown

a good foundation for cooperation, making the

construction of a free trade zone highly feasible. At the

same time, the establishment of the China-Russia Free

Trade Area will further promote the in-depth

development of bilateral economic and trade

cooperation. The construction of the China-Russia

Free Trade Area can refer to the China-Korea Free

Trade Area and the China-Australia Free Trade Area,

formulate a reasonable transition period for tax

reduction, optimize the trade structure, and then

increase the level of trade and develop the trade

potential between the two countries. The relevant

countermeasures are as follows:

4.1 Optimize The Sino-Russian

Bilateral Trade Structure

Products with low value-added dominate the trade

structure between China and Russia, such as labor-

intensive manufactured products and energy primary

products. These products have low technological

content and lack of core competitiveness, thus forming

a single trade structure and a lower level of trade,

restricting the in-depth development of bilateral trade

cooperation. Therefore, the two countries should

strengthen cooperation in science and technology, use

technology transfer, technology licensing and other

forms to promote the flow of factors such as

technology, management, and talents, and increase the

added value of commodities in bilateral trade, so as to

achieve greater benefits. Russia has a good scientific

and technological foundation in the fields of

aerospace, metallurgy, and chemical industry. After

the reform and opening up, China has made significant

progress in technological innovation and research and

development capabilities, and has great potential for

cooperation with Russia in the fields of

communications, aerospace, electromechanical

manufacturing, and building materials. The two

countries can expand new cooperation space in the

fields of infrastructure construction and aerospace.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

268

China can strengthen cooperation in production

capacity through contracted projects and labor export,

and at the same time strengthen cooperation in science

and technology through technology trade and R&D

cooperation. This can accelerate the transformation

and upgrading of Sino-Russian trade, improve quality

and efficiency, and optimize the bilateral trade

structure, thereby improving the level and level of the

construction of the Sino-Russian free trade area.

4.2 Promote the Growth of Sino-

Russian Two-Way Investment

The small scale of mutual direct investment between

China and Russia limits the breadth and depth of

bilateral economic and trade cooperation. Under the

strategic opportunity of docking cooperation between

the “Silk Road Economic Belt” and the “Eurasian

Economic Union”, the two countries should increase

two-way investment, promote the development of

large projects, expand investment areas, and carry out

deeper cooperation. In particular, it is necessary to

strengthen investment in the field of service trade. At

present, the level of service trade between China and

Russia lags far behind the goods trade between the two

countries, and service trade not only has the

advantages of environmental protection and high

added value, but also serves the goods trade and can

improve trade efficiency and facilitation.

In terms of transportation, facing the pressure of

poor infrastructure and interconnection between the

two countries and the increasing volume of Sino-

Russian cargo transactions, the two sides should

vigorously develop bilateral cooperation in the

logistics industry, shorten the time of cargo

transportation, and improve transportation efficiency.

In terms of transportation, facing the pressure of poor

infrastructure and interconnection between the two

countries and the increasing volume of Sino-Russian

cargo transactions, the two sides should vigorously

develop bilateral cooperation in the logistics industry,

shorten the time of cargo transportation, and improve

transportation efficiency. In terms of payment

settlement, the two parties should deepen cooperation

in finance, insurance, consulting and other industries,

further standardize bank settlement, and reduce the

import and export risks of bilateral enterprises. In

terms of investment consulting, there are situations in

which Chinese and Russian companies have

incomplete and inadequate understanding of each

other’s market information. Intermediary agencies

with high authority are needed to provide investors

with information on the other party’s investment

environment and government policies.

4.3 Extend the Transition Period for

Tax Cuts

In the China-Russia FTA tariff reduction plan

officially implemented in July 2017, the two countries

implemented tariff reduction plans for approximately

7,000 tax items, laying a good foundation for further

tax reduction arrangements between the two countries.

Judging from the current trade structure between the

two countries, among China’s exports to Russia, food,

ceramics, mechanical and electrical products, and

transportation equipment have obvious market

competitive advantages. However, among Russia’s

exports to China, the competitiveness of Russia’s

exports is relatively weak, and Russia’s status in

China’s import trading partners continues to decline.

The overall and rapid reduction of tariff rates will

reduce the income effect brought by Russia to Russia

more than the reduction brought to China, which

shows that China-Russia negotiations on tariff

concessions are still facing inevitable resistance.

Therefore, both parties need to appropriately extend

the transition period of tax reduction, which can refer

to the tax reduction arrangements of China-Australia

and China-Korea FTA.

Based on the comparison of the strengths and

weaknesses of their own products between China and

Russia, trade commodities are divided into general

commodities, sensitive commodities and highly

sensitive commodities to determine different tariff

rates. For general goods, tariffs can be reduced

significantly in a relatively short period of time; for

sensitive goods, tariffs can be reduced in equal

proportions every year within 5 years; for highly

sensitive goods, the existing tariff rates can be

maintained, and then tariffs can be reduced in a timely

manner by dynamic classification. In this process,

China can appropriately relax tariff restrictions on

superior products and reach a list of tariff concessions

within the scope of commodities acceptable to Russia.

After that, gradually expand the range of goods

subject to tariff reduction. For sensitive areas in the

longer transition period, the two sides will gradually

release the agreement according to the effective time

of the agreement. Finally, the overall tariff level will

be reduced to 5% within 10 years.

4.4 Innovative Trade Policy System

In Due to the differences in economic scale and

industrial structure between China and Russia, the

negotiation process of the free trade agreement will be

relatively slow. However, the mutual political trust

between the two countries, the continuous growth of

An Empirical Analysis of the Trade Effect of the Construction of the Sino-Russian Free Trade Area Based on the Trade Gravity Model

269

bilateral trade and investment, and other

complementary advantages have laid a realistic

foundation for the construction of the free trade zone.

In the negotiation process, it is necessary to learn from

the experience of establishing a free trade area

between China and RCEP member states, but also to

conform to the specific conditions of the construction

of a Sino-Russian free trade area. The main topics of

the free trade agreement are related arrangements such

as trade in goods, trade in services, and investment

liberalization. In the free trade agreement negotiations

between China, Vietnam, Singapore and other

countries, trade in goods is the main topic. The

determination of the main topic is related to the trade

structure of the two countries. Therefore, in the

negotiation of the China-Russia Free Trade

Agreement, the subject of the agreement can be

determined as trade in goods, and the tariff concession

list will be included as an annex to the agreement. In

terms of service trade and investment, China and

Singapore negotiated separately after the conclusion

of the main agreement and made it a part of the free

trade agreement. Taking into account that the

development of service trade and investment between

China and Russia is not yet mature, the relevant

provisions of service trade and investment can be

stipulated in the free trade agreement first, and then

implemented when the time is ripe.

In addition, a settlement mechanism for Sino-

Russian trade disputes should be established in

advance. In recent years, there have been more and

more trade disputes between China and the United

States, ASEAN countries and other countries. For this

reason, it is necessary for the establishment of a Sino-

Russian free trade zone to formulate an effective plan

to prevent and resolve trade disputes in advance. In

addition, China should also establish a supervisory

mechanism and a preventive mechanism. On the one

hand, we should be familiar with Russian law and

have relevant information, fully understand the

situation of the other party, respond quickly and have

effective evidence when there is a trade dispute, and

strive for the initiative. On the other hand, we should

also establish risk awareness, strengthen self-

prevention, and combine the power of the government

with the power of enterprises to prevent problems

before they occur.

ACKNOWLEDGMENT

This work was supported by the 2020 Harbin

University of Commerce “Young Innovative Talents”

Support Program: Research on the construction of

Sino-Russian FTA based on the perspective of the

“Silk Road Economic Belt” and the “Eurasian

Economic Union” (2020CX34).

REFERENCES

Hao Yubiao. (2013) Analysis of the influencing factors of

the level of Sino-Russian trade cooperation-based on

the trade gravity model. Economic and Social System

Comparison, 05: 175-182.

Huang Siyi, Huang Jinggui, Fu Guohua. (2020)

Constructing the economic foundation and feasibility

analysis of Sino-Russian FTA. Journal of Hainan

University (Humanities and Social Sciences Edition),

02: 80-87.

Liu Zhizhong. (2017) The competitiveness,

complementarity and development potential of Sino-

Russian bilateral trade under the “Belt and Road”

strategy. Inquiry into Economic Issues,07:95-102+11.

Ling Chen. (2020) Constraints, complementary conditions

and promotion strategies for the establishment of

China-Russia Free Trade Area. Foreign Economic and

Trade Practices, 09: 19-22.

Zhao Jinlong, Zhao Jingyuan, Yang Fan. (2019) Research

on the impact of China-Australia and China-Korea FTA

on my country’s economy, trade and industry. Journal

of Shanghai University (Social Science Edition), 05:

78-92.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

270