Data Analysis of Economic Policy Uncertainty and the Number of

Enterprise Employees based on Panel Regression Model -Taking

China's A-share Listed Companies as an Example

Yifan Zhou

*

School of Mathematics and Statistics, Jiangsu Normal University, Shanghai Road, Xuzhou, China

Keywords: Economic Policy Uncertainty, Number of Employees, Panel Regression Model, Text Analysis.

Abstract: To make a systematic analysis of the uncertainty of economic policy and then to propose effective

countermeasures has been an important subject of business management for many years. This paper selects

the asset data of China’s A-share listed companies from 2011 to 2020 and the economic policy uncertainty

index EPU formulated by Baker to create a panel regression model, focusing on studying the impact of

economic policy uncertainty on the number of employees, and trying to find out the factors that inhibit the

impacts of economic policy uncertainty on employment. EPU is an uncertainty index constructed by Baker

based on keywords in the South China Evening News, using technical means such as big data crawlers and

text analysis. The data results show that economic policy uncertainty is negatively correlated with the number

of employees. It is further found that enterprises with large financing constraints and non-state-owned

enterprises are more affected by economic policy uncertainty. Finally, based on this conclusion, suggestions

and countermeasures are made to relevant policy makers.

1 INTRODUCTION

Since the development of the Economic Policy

Uncertainty Index, scholars worldwide have

conducted research on the index and multiple aspects

of economic performance, especially on the

correlation between the index and the aspects of

macroeconomic growth. The Economic Policy

Uncertainty Index was developed by three

researchers including Scott R. Baker of Stanford

University, and is mainly used to measure the

economic conditions and policy uncertainty of major

economies in the world (Hao Xiaoyan, 2018). Their

research results point out that there is a clear

correlation between the EPU index and macro

indicators such as China's macroeconomic growth

rate and employment rate.

The analysis of the correlation between economic

policy uncertainty and investment has always been a

hot topic in economic research and study. The

research mainly focuses on the impact of economic

policy uncertainty on corporate fixed asset

investment (Li Fengyu, 2015) (Han Guogao, 2016),

innovation and R&D investment (Chen Juanjuan,

2021). Meanwhile, lots of research focuses on the

moderating effect of other variables such as

investment efficiency (Rao Pingui, 2017),

entrepreneurial subjective factors (Han Guogao,

2016), cash holdings (Wang Yizhong, 2017). The

impact of economic policy uncertainty on enterprise

investment and business environment will inevitably

lead to an impact on the ability of enterprises to

absorb employment. Qian Xueya (2018) found that

economic policy uncertainty has a significant

negative impact on the employment rate. Xin Daleng

(2018) found that when economic policy uncertainty

increases, manufacturing jobs will decrease

significantly. Foreign scholars Saud Asaad Al-

Thaqeb et al. (2019) found that the economic policy

uncertainty of their country is negatively correlated

with the productive investment of enterprises and

employment.

It is the common goal of China and all world

economies to maintain sustainable economic

development, improve the external business

environment of enterprises, and allow employees as

the main body of enterprises to receive decent wages

to improve well-being. Existing studies on economic

policy uncertainty pay more attentions to its impact

on corporate investment behavior, and most studies

406

Zhou, Y.

Data Analysis of Economic Policy Uncertainty and the Number of Enterprise Employees based on Panel Regression Model -Taking China’s A-share Listed Companies as an Example.

DOI: 10.5220/0011738600003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 406-412

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

on the relationship between policy uncertainty and

employment are conducted at the national macro

level. This paper attempts to explore the substantial

impact of economic policy uncertainty on

employment in a bottom-up method by analyzing the

changes in the scale of employees in China's A-share

listed companies. At the same time, it also aims to put

forward constructive suggestions on maintaining job

security, which is one of the most important factors

for people’s well-being.

2

RESEARCH HYPOTHESES

2.1 Economic Policy Uncertainty and

Scale of Enterprise Employees

Many studies have shown that economic policy

uncertainty will increase the difficulty of business

operations. The bigger the uncertainty is, the more

difficulties to obtain funds from outside and the less

internal willingness to actively invest. Enterprises

often adopt defensive strategies to reduce

expenditures and control costs. As big part of the

operation cost, headcounts are in high likelihood to be

cut or frozen. Based on this, this paper proposes the

first research hypothesis:

H1: Economic policy uncertainty is negatively

related to the number of corporate employees.

2.2 The Moderating Effect of

Financing Constraints

Financing ability varies significantly with the scale of

the enterprise, the nature of the ownership of the

enterprise and the level of financial development in

the region where it is located. In China, private

enterprises, especially small and medium-sized

enterprises, are with much more difficulties to obtain

financing support than large state-owned enterprises

(Zou Yao, 2015). From a risk perspective, companies

with financing difficulties often choose to downsize

their business or cancel investment when facing the

challenges. Therefore, the total employment is

downsized or frozen accordingly. Based on this, this

paper proposes the second research hypothesis:

H2: The higher the degree of corporate financing

constraints is, the higher the negative correlation is

between economic policy uncertainty and the number

of corporate employees.

2.3 Moderating Effect of Ownership

Concentration

Research shows that sufficient voting rights can

ensure the company's shareholder’s high participation

in company's operations. The higher level they are

involved in the business, the more the company stick

to the value, mission and vision which are in large

degree aligned to owner’s individual pursuit.

When companies can more consider and follow

long-term goals, companies tend to pay more

attentions to sustainable development, establish more

people-oriented values, and increase their own

investment in human development costs. The

importance of stability on human resources are

usually given high weight by those enterprises on

business long term strategy. Based on this, this paper

proposes the third research hypothesis:

H3: The higher level the ownership concentration

is, the smaller the negative correlation is between

economic policy uncertainty and employee size.

2.4 The Effect of Equity Nature

In this paper, listed companies are divided into state-

owned enterprises and non-state-owned enterprises

according to the nature of equity. The existing state-

owned enterprises in China have relatively large scale

of assets and number of employees. The state-owned

enterprises are one of the fundamental forces to the

national economy and people's livelihood. Under the

circumstance of high economic policy uncertainty,

state-owned enterprises have the higher ability and

responsibility of achieving the goals not only on

economy and but also on social employment stability.

Comparing to the other type of enterprise, state-

owned enterprises are in general with good conditions

on financing. Based on this, this paper proposes the

fourth hypothesis:

H4: Compared with non-state-owned enterprises,

the number of employees in state-owned enterprises

is less affected by economic policy uncertainty.

3 RESEARCH DESIGN

3.1 Sample Selection and Data Sources

This paper selects the data of listed companies in

Shanghai and Shenzhen A-share companies from

2011 to 2020, and draws on other research (Xu

Yekun, 2020) to process the selected data as follows:

(1) exclude ST and ST* companies; (2) exclude

Data Analysis of Economic Policy Uncertainty and the Number of Enterprise Employees based on Panel Regression Model -Taking China’s

A-share Listed Companies as an Example

407

financial enterprises; (3) eliminate corporate data

with missing or obviously wrong main variable

information, and perform 1% abbreviated processing

for all continuous variables. This method refers to the

practice of Chen Juanjuan et al. (2021) and reduces

the impact of extreme values on the regression results

by shortening the tail.

It ends up with 13760 sample observations by

using this methodology. The above enterprise data all

come from the CSMAR database. The economic

policy uncertainty index selects the EPU index

formulated and published by Baker et al. The index

data is downloaded from the PU website

(http://www.policyuncertainty.com).

3.2 Definition and Measurement of

Variables

3.2.1 Explained Variables

Number of employees of the enterprise (STAFF).

Because the number of employees of listed

companies in China varies greatly, this paper adopts

the method of calculating the natural logarithm of the

number of employees to measure the number of

employees in the enterprise.

3.2.2 Explanatory Variables

(1) Economic Policy Uncertainty (EPU). This index

(EPU) is constructed by Baker et al. based on the

news index of two major newspapers in China. This

paper refers to Qi Jianhong et al. (2020) to calculate

the arithmetic mean of the monthly EPU index to

obtain the annual EPU index and adopts the one-

period lag EPU index as an indicator of economic

uncertainty for robustness testing.

(2) Financing constraints (SA). This variable (SA)

is the corporate financing constraint index, which is

collected from the Cathay Pacific database. The

higher the SA index, the greater the corporate

financing constraint.

(3) Equity concentration (H). This variable (H) is

the sum of the squares of the shareholding ratios of

the top 5 major shareholders of the company. The

larger the h index, the higher the ownership

concentration.

3.2.3 Control Variables

This paper refers to previous studies to determine

macro-level control variables and enterprise-level

control variables respectively. The macro control

variable is the per capita GDP of the province where

each enterprise is located; the enterprise control

variable includes enterprise scale (SIZE), enterprise

leverage ratio (LEV), enterprise return on assets

(ROA), and enterprise scale is measured by the

logarithm of the total enterprise assets. Corporate

leverage is measured by the ratio of total liabilities to

total assets and return on assets is measured by the

ratio of after-tax net profit to total assets.

3.3 Empirical Model

In order to study the impact of economic policy

uncertainty on the number of corporate employees,

this paper uses the following model to test the

assumptions proposed above.

STAFF

i,t

=α

0

+α

1

EPU

t

+α

2

Z

i,t

+μ

i

+γ

i

+ε

i,t

(1)

Model (1) is the basic model to test the research

focus of this paper: the correlation test between

economic policy uncertainty and the number of

corporate employees, where i represents an

individual, namely a listed company, t represents the

year, α

0

represents a constant term, and μ

i

represents

a fixed term effect, γ

i

stands for time effect, ε

i,t

stands

for random error, and Z

i,t

stands for a series of control

variables, namely firm size, leverage ratio, financing

constraints, and per capita GDP. According to H1,

this paper expects the model (1) variable EPU

coefficient to be negative, that is, there is a negative

correlation between economic policy uncertainty and

the number of corporate employees.

And according to H2 and H3 respectively, namely

examining the moderating effects of corporate

financing constraints and equity concentration on the

number of employees from economic policy

uncertainty, the model is further adjusted to obtain:

STAFF

i,t

=

α

0

+β

1

EPU

t

+β

2

SA

i,t

+β

3

SA

i,t

*EPU

t

+β

4

Z

i,t

+μ

i

+γ

i

+ε

i,t

(2)

STAFF

i,t

=

α

0

+𝜂

1

EPU

t

+𝜂

2

H

i,t

+𝜂

3

H

i,t

*EPU

t

+𝜂

4

Z

i,t

+μ

i

+γ

i

+ε

i,t

(3)

In model (2), SA

i,t

*EPU

t

represents the interaction

term between economic policy uncertainty and

corporate financing constraints.

In model (3), H

i, t

*EPU

t

represents the interaction

term between economic policy uncertainty and

corporate ownership concentration.

Referring to the practice of Jiang Teng et al.

(2018), when the interaction term is significant, the

higher the coefficient of the interaction term, the

stronger the moderating effect.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

408

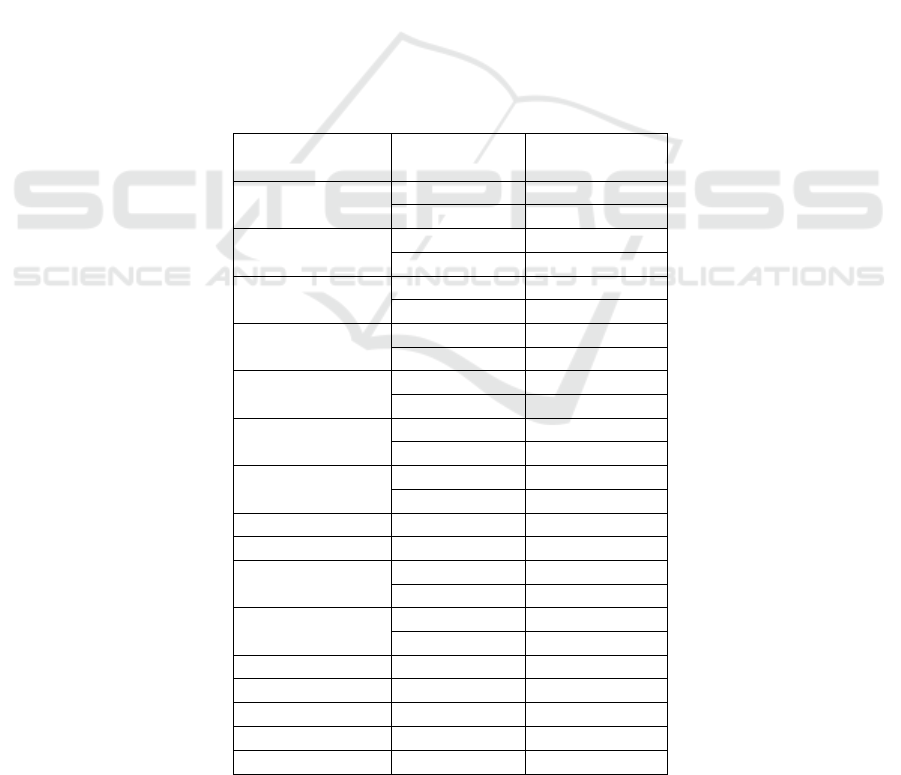

Table 1: Benchmark regression results.

(1) (2) (3) (4)

lnY lnY lnY lnY

EPU -0.025

***

-0.021

***

-0.038

***

-0.038

***

(-18.513) (-11.136) (-9.387) (-4.710)

SIZE 0.423

***

0.432

***

0.447

***

0.447

***

(78.638) (72.198) (71.024) (26.911)

LEV 0.224

***

0.214

***

0.186

***

0.186

**

(6.957) (6.621) (5.708) (2.513)

ROA -0.165

**

-0.190

***

-0.182

**

-0.182

(-2.335) (-2.677) (-2.551) (-1.516)

lnK -0.075

***

0.095

***

0.095

(-3.274) (2.676) (1.381)

_cons -5.827

***

-5.282

***

-7.595

***

-7.595

***

(-34.868) (-22.397) (-18.057) (-8.197)

N 13760 13760 13760 13760

r2 0.439 0.439 0.445 0.445

F 2418.405 1938.385 763.371 126.413

model selection FE FE FE FE

time fixed effects NO NO YES YES

firm fixed effects NO NO NO YES

*** 1% ** 5% * 10%

4 EMPIRICAL ANALYSIS

4.1 Results of Regression Analysis

4.1.1 Economic Policy Uncertainty and

Number of Employees

Using the model (1) formulated in Section 3.3 to test,

the regression results of the impact of economic

policy uncertainty on the number of employees of

enterprises are shown in Table 1. The basic model of

per capita GDP, the data results show that the

economic policy uncertainty is negatively correlated

with the number of employees, the preliminary

verification H1, columns (2) (3) (4) are all added to

the macro control variables, columns (3) (4) is added

to the time fixed effect, and column (4) is added to the

firm fixed effect. As can be seen from the figure, after

adding control variables and fixed effects in turn,

economic policy uncertainty is still negatively

correlated with the number of employees, so

hypothesis 1 can be tested.

4.1.2 The Moderating Effect of Financing

Constraints

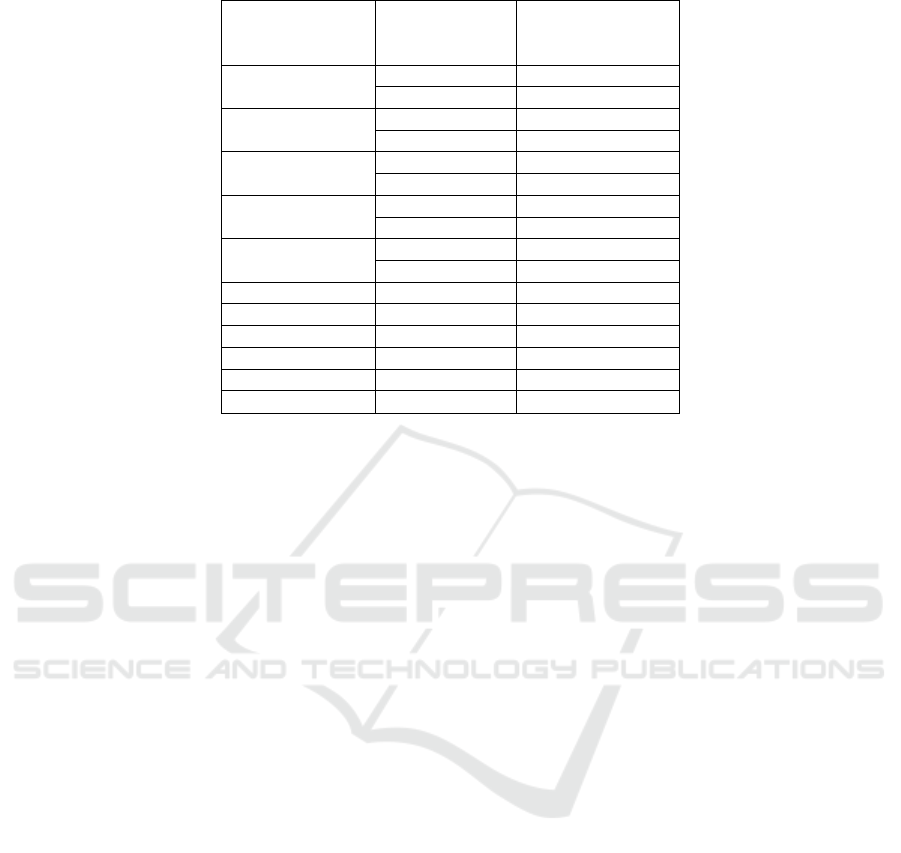

According to the model (2), the moderating effect of

financing constraints on the correlation between

economic policy uncertainty and the number of

employees is tested, and the SA index is used as a

measure of corporate financing constraints. In the

case that SA is negative, the closer SA is to 0, the

greater the financing constraints faced by enterprises

can be considered. Therefore, in order to test the

moderating effect of financing constraints, the

interaction term between financing constraints and

economic policy uncertainty index is added to the

model. The larger the coefficient of the interaction

term, the greater the moderating effect (Jiang Teng,

2018). The index in column (1) of Table 2 shows that

the coefficient of EPU is -0.038, which is

significantly negative at the 1% level. Meanwhile, the

interaction term of economic policy uncertainty and

corporate financing constraint (SA index) (SA*EPU)

coefficient is 0.016, which is significantly positive at

the 10% level, indicating that with the increase of

corporate financing constraints, economic policy

Data Analysis of Economic Policy Uncertainty and the Number of Enterprise Employees based on Panel Regression Model -Taking China’s

A-share Listed Companies as an Example

409

uncertainty has a greater negative effect on the

number of companies. So, hypothesis 2 can be tested.

4.1.3 The Moderating Effect of Ownership

Concentration

According to the model (3), the moderating effect of

ownership concentration on the correlation between

economic policy uncertainty and the number of

employees is tested. The moderating effect of

ownership concentration is shown in the second

column of Table 2. The coefficient of EPU is -0.036,

which is significantly negative at the level of 1%, but

the coefficient of interaction between ownership

concentration and economic policy uncertainty index

is -0.01, which is not significant, indicating that

ownership concentration has no moderating effect on

the correlation between economic policy uncertainty

and number of corporate employees, so hypothesis 3

cannot be tested.

4.1.4 The Effect of Equity Nature

According to the different nature of equity, this paper

divides the enterprise samples into two groups of

6350 state-owned enterprises and 7030 non-state-

owned enterprises. According to H4, this paper

assumes that the different nature of the company's

equity will affect the company's business strategy

when facing increasing economic policy uncertainty

and consequently enterprise take varies of approaches

on employment. From the regression data in Table 3,

it can be seen that among state-owned enterprises and

non-state-owned enterprises, the coefficients of EPU

are -0.030 and -0.051 respectively, and they are

significantly negatively correlated at the 1% level.

Therefore, economic policy uncertainty has an

inhibitory effect on the number of employees in both

types of enterprises, however non-state-owned

enterprises are more affected by economic policy

uncertainty. So, hypothesis 4 can be tested.

Table 2: Moderating effect test.

(1) (2)

lnY lnY

EPU -0.038

***

-0.036

***

(-3.282) (-4.221)

SA index -0.084

(-0.574)

EPU*SA 0.016

*

(1.809)

EPU*H -0.010

(-0.488)

H 0.078

(0.474)

SIZE 0.445

***

0.447

***

(26.745) (26.941)

LEV 0.171

**

0.184

**

(2.280) (2.490)

ROA -0.179 -0.182

(-1.488) (-1.534)

lnK 0.092 0.095

(1.332) (1.387)

_cons -7.495

***

-7.614

***

(-8.082) (-8.276)

N 13760 13760

r2 0.446 0.445

F 109.685 110.316

time fixed effects YES YES

firm fixed effects YES YES

*** 1% ** 5% * 10%

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

410

Table 3: The effect of equity nature.

state-owne

d

non-state-owne

d

enter

p

rise enter

p

rise

lnY lnY

EPU -0.030

***

-0.051

***

(-3.020) (-3.665)

SIZE 0.429

***

0.464

***

(

15.072

)

(

21.731

)

LEV 0.054 0.212

**

(

0.437

)

(

2.034

)

ROA -0.273 -0.168

(-1.146) (-1.263)

ln

K

0.001 0.219

*

(

0.015

)

(

1.785

)

_

cons -5.952

***

-9.464

***

N 6350 7030

r2 0.349 0.501

F 35.431 88.647

time fixed effects YES YES

firm fixed effects YES YES

*** 1% ** 5% * 10%

4.2 Robustness Check

This paper refers to previous studies to solve the

endogeneity problem by using lagged variables.

Using the variable of economic policy uncertainty

with a lag of one period, and using the method of

negative binomial regression data, the results show

that after excluding the endogeneity problem, the

economic policy uncertainty and the number of

employees still show a significant negative

correlation. Secondly, this paper uses the method of

expanding the sample size to test the robustness of the

overall regression results. The sample in this paper

comes from the data of listed companies in China’s

A-shares from 2011 to 2020. In order to expand the

sample size, this paper adds the data of B-share listed

companies in China. It shows that even if the sample

size is expanded, economic policy uncertainty is still

significantly negatively correlated with the number of

employees, so the basic hypothesis of H1 is tested

again.

5 CONCLUSIONS

The analysis above draws the following conclusions:

Firstly, economic policy uncertainty has a significant

negative correlation with the number of corporate

employees i.e., the higher the EPU is, the lower the

scale of enterprise employment goes. Secondly, the

bigger the financings are constrained, the more

negative correlation goes between the number of

employees and the uncertainty of economic policy.

Thirdly, the level of ownership concentration has no

significant effect on the negative correlation between

the uncertainty of economic policy and the number of

enterprise employees. Fourthly, differences in equity

ownership can also effectively moderate the negative

correlation between economic policy uncertainty and

the number of employees. The state-owned

enterprises are less affected by economic policy

uncertainty than non-state-owned enterprises.

Based on the above analysis, in order to minimize

impact of the economic policy uncertainty on

employments, this study propose to the policy makers

the followings

1. Strengthen the communication mechanism

between the government and enterprises in order to

reduce the uncertainty of economic policies. Establish

green channels for effective and efficient

communication. Dynamically track the uncertainty of

economic policies and set up warning mechanisms.

Policy makers can take countermeasures before the

policy uncertainty index reaches the specified limit

and thus to reduce the EPU

2. Strengthen the balance of the financial market

development. In China there is still a big gap on the

degree of financial market development between the

coastal areas and the central & western regions.

Provide more support to the less developed regions

and small-medium sized enterprises. Consequently,

the national economic development gets more

balanced and employment gets more stabilized.

3. Strengthen the research at the macro level on

the impact of enterprise ownership difference on

Data Analysis of Economic Policy Uncertainty and the Number of Enterprise Employees based on Panel Regression Model -Taking China’s

A-share Listed Companies as an Example

411

employment and economic development. With the

rapid changes of the world, the uncertainties will

continue to bring challenges to enterprises. The

government should examine and redefine the role of

state-owned enterprises in safeguarding the country's

core interests, stabilizing the economic foundation,

and maintaining employment.

REFERENCES

Al‐Thaqeb S A, Algharabali B G, Alabdulghafour K T. The

pandemic and economic policy uncertainty. IntJ Fin

Econ. 2020;1–11.

Chen Juanjuan, Zhao Hongyan, Yang Xiaoli. Economic

Policy Uncertainty, Financing Constraints and

Enterprise Innovation [J]. Forecast, 2021, 40(02): 55-60.

Hao Xiaoyan, Han Yijun, Shi Zizhong. Analysis of the

Impact of Economic Policy Uncertainty on China's Grain

Trade [J]. Economic Issues Exploration, 2018(3):10.

Han Guogao, Hu Wenming. Macroeconomic Uncertainty,

Entrepreneur Confidence and Fixed Asset Investment: A

Systematic GMM Method Based on my country's Inter-

provincial Dynamic Panel Data [J]. Finance and

Economics, 2016(03): 79-89.

Jiang Teng, Zhang Yongji, Zhao Xiaoli. Economic Policy

Uncertainty and Corporate Debt Financing [J].

Management Review, 2018, 30(3):11.

Li Fengyu, Yang Mozhu. Will Economic Policy

Uncertainty Constrain Corporate Investment? An

Empirical Study Based on China's Economic Policy

Uncertainty Index [J]. Financial Research, 2015(04):

115-129.

Qian Xueya, Jiang Zhuoyu, Hu Qiong. Research on the

Influence of Social Insurance Contributions on

Enterprise Employment Wages and Scale [J]. Statistical

Research, 2018, 35(12): 68-79. DOI: 10.19343/j.cnki.

11-1302/c.2018.12.006.

Qi Jianhong, Yin Da, Liu Hui. How Does Economic Policy

Uncertainty Affect Enterprise Export Decisions? --

Based on the Perspective of Export Frequency [J].

Financial Research, 2020(5):19.

Rao Pingui, Yue Heng, Jiang Guohua. Research on

Economic Policy Uncertainty and Enterprise

Investment Behavior [J]. World Economy, 2017,

40(02): 27-51.

Wang Yizhong, Yuan Jun. The mechanism and effect of

macroeconomic risks affecting the company's cash

holdings [J]. Finance and Economics, 2017(09): 56-64.

DOI: 10.13762/j.cnki.cjlc.2017.09. 005.

Xin Daleng. Economic Policy Uncertainty and

Employment of Industrial Enterprises [J]. Industrial

Economics Research, 2018(05): 89-100.DOI:

10.13269/j.cnki.ier.2018.05.008.

Xu Yekun, Wang Yuanfang, An Suxia. Replacement of

Local Officials and Staff Allocation in Enterprises [J].

Comparison of Economic and Social Systems,

2020(2):11.

Zou Yao. Research on the Transformation and Upgrading

of Small and Medium Private Enterprises——Taking

Wenzhou Rongde Valve Co., Ltd. as an example [D].

Zhejiang University of Technology, 2015.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

412