An Empirical Study of Volatility Spillover Effects between

International Crude Oil Futures and Russian and Chinese Stock

Markets: A Multivariate BEKK-GARCH Model based on

Wavelet Multi-Resolution Analysis

Chengchen Hu and Wenhao Ai

*

SILC Business School, Shanghai University, China

Keywords: International Crude Oil Futures, Russian and Chinese Stock Markets, Volatility Spillover Effects, Wavelet

Multi-Resolution Analysis, Multivariate BEKK-GARCH Model.

Abstract: The strategic position of oil determines the high impact of crude oil on the macro economy. The volatility of

crude oil futures prices affects the stock market, and China and Russia are typical representatives of crude oil

importers and exporters respectively. This paper focuses on empirically studying the volatility spillover

effects of international crude oil futures and the Chinese and Russian stock markets. This paper selects data

on international crude oil futures prices, China-Russia stock market composite index and sectoral stock

indices for the period from 24 April 2015 to 20 April 2018. The empirical results show that all industry stock

indices are cointegrated with international crude oil futures prices, and the adjustment coefficients of

international crude oil futures prices on the volatility of other industry stock indices are insignificant, except

for CSI Industrial and Russian Energy.

1 INTRODUCTION

China is extremely dependent on imported crude oil

and Russia is currently the world's largest crude oil

reserve, which means that fluctuations in

international crude oil prices will have a significant

impact on the Chinese and Russian economies. Crude

oil futures, which reflect the spot price, to some

extent influence the stock market, which reflects the

economic situation. Currently, there is a very limited

literature that examines the impact of international

crude oil futures prices on both composite and

sectoral stock indices. This paper investigates the

volatility spillover effects of international crude oil

futures prices on Chinese and Russian composite and

sectoral stock indices, and examines the linkage

between crude oil and stock markets by comparing

the effects of international crude oil futures prices on

Chinese and Russian stock markets.

In this paper, different empirical models are used

for further analysis according to the characteristics

exhibited by the variable groups in the test to ensure

the reliability of the results. In this paper, the

international crude oil futures price is selected as the

explanatory variable, and the Chinese and Russian

stock market composite indexes and sector indices

are selected as the explanatory variables to establish

the corresponding variable groups. The test finds that

all the data are not smooth, so this paper proposes two

options: (1) to make first-order difference on the

original data, establish VAR model and GARCH

model, after that, the international crude oil futures

price is wavelet transformed and multi-resolution

processed, establish BEKK-GARCH model, and

judge whether there is volatility spillover effect

according to the Wald test results; (2) to make

cointegration test on the original data and on the basis

of this, Granger causality test results are used to

divide the variable groups and establish VECM and

ECM models respectively.

2 LITERATURE REVIEW

Most of the studies on the linkage between

international crude oil futures and stock market in the

established literature are based on stock pricing

models. Huang, Masulis and Stoll (1996) suggest that

changes in international crude oil futures prices have

an impact on discount rates and firms' future cash

flows. Leblanc and Chinn (2004) argue that the effect

of international crude oil futures prices on inflation is

choppy. Early studies on the linkage between

438

Hu, C. and Ai, W.

An Empirical Study of Volatility Spillover Effects Between International Crude Oil Futures and Russian and Chinese Stock Markets - A Multivariate BEKK-GARCH Model Based on Wavelet

Multi-Resolution Analysis.

DOI: 10.5220/0011739500003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 438-444

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

international crude oil futures prices and stock

markets did not test for significant results. the multi-

factor model used by Chen, Roll, and Ross (1986)

was a sample of early studies on the impact of

international crude oil futures prices on stock

markets. Since then, Hamao (1990) and Ferson and

Havey (1994) extended the model, but none of the

studies on the U.S. and Japanese stock markets found

a significant effect of international crude oil futures

prices on the stock market. However, Jones and Kaul

(1996) find significant effects of international crude

oil futures prices on the Canadian and U.S. stock

markets. Qian-Min Qi and Hong-Liang Zhu et al.

(2011) and Xi Zhang and Jian-Yu Wang (2013)

found that the fluctuations in international crude oil

prices have a strong and long-lasting impact on the

stock markets of the United Kingdom and the United

States, but a smaller impact on the stock markets of

China and India. Hui Zhang (2013), Shangqi Zhuge

and Xiangchao Hao (2009) find a long-run

cointegration relationship between Chinese stock

market volatility and international crude oil futures

price volatility between 2002 and 2010. Chunying

Zhu (2015) establishes an asymmetric BEKK model

and Wald test to find a two-way volatility spillover

effect between the international crude oil futures

market and the stock market. However, there are

relatively few studies on the impact of international

crude oil futures prices on various sectors of the stock

market. Sadorsky (2001) finds that stock returns of

oil companies are positively correlated with oil

prices, while natural gas companies are negatively

correlated with them. Jie-Nan Lao (2008) finds a

significant positive effect of international crude oil

futures prices on all primary sector indices. However,

Hongfei Jin and Eminent Jin (2010) found that

international crude oil futures prices have a

significant negative effect on the automotive,

construction, and financial sectors, while they have a

significant positive effect on the crude oil and natural

gas sectors by building a GED-GARCH (1,1)-M

model. Using an ARMA-EGARCH-M model for the

period 2009 to 2013, Dandan Dai (2014) finds that an

increase in international crude oil futures prices has a

positive impact on the extractive industries and a

negative impact on the chemical industries, among

others.

Most of the early literature assumed a stable linear

relationship between macroeconomics and

international crude oil futures prices, but studies have

shown that the relationship is nonlinear and

asymmetric. In addition, some literature selects the

composite index as the explanatory variable without

considering the possible correlation between it and

international crude oil futures prices, and when

studying the impact of international crude oil futures

prices on industry stock indices, most of the literature

uses a uniform model to analyze all data without

considering the variability among data, and the

results obtained are prone to bias. At the same time,

many studies only analyze the linkage between

international crude oil futures prices and a country's

stock market. In contrast, this paper studies the

linkage between international crude oil futures prices

and the stock markets of China and Russia, and

investigates the impact of international crude oil

futures prices on the stock indices of both industries.

3 THE IMPACT OF CRUDE OIL

ON THE STOCK

This paper focuses on the macroeconomic and

industry-specific effects on the stock market

respectively, namely how the discount rate changes

and how the future cash flows of firms change when

oil prices fluctuate.

3.1 Impact of Crude Oil Futures Prices

on The Stock Market as A Whole

Crude oil price fluctuations act on the stock market

by trading currencies and influencing the

macroeconomy. The interaction of national monetary

policies affects the trading of crude oil. As the

number of net crude oil importers exceeds the

number of net crude oil exporters, crude oil prices

rise, consumption levels in net importing countries

decrease, the purchasing power of currencies falls,

inflationary pressures rise and the global economy

generally declines.

3.2 Impact of Crude Oil Prices on

Related Industries

In this paper, five industries that are closely linked to

crude oil are selected to analyse the impact of higher

crude oil prices on specific industries. When crude oil

prices rise, it will be good news for crude oil miners

and coal miners in the extractive industry and

negative news for other resource miners; it will have

a negative effect on the manufacturing industry; the

electricity, heat, gas and water production and supply

industry will see an increase in supply costs and a

decrease in corporate profits; companies in the

construction industry will see a decrease in future

cash flows; the transport, storage and postal industry

An Empirical Study of Volatility Spillover Effects Between International Crude Oil Futures and Russian and Chinese Stock Markets - A

Multivariate BEKK-GARCH Model Based on Wavelet Multi-Resolution Analysis

439

will see an increase in operating costs, resulting in

overall profits in the transport industry decline.

4 EMPIRICAL ANALYSIS AND

RESULTS

This paper focuses on the linkages between

international crude oil futures prices and the Russian

and Chinese stock markets, specifically the impact of

international crude oil futures prices on the stock

market composite stock index as well as the stock

market sector stock index, and therefore the

corresponding indicators are selected for the study

respectively. Daily frequency data from April 24,

2015 to April 20, 2018 are used in this paper.

Brent Crude Oil Futures Price is used as the

international crude oil futures price, with data from

wind database, and SHA and RTS are used as the

broad indices of Chinese and Russian stock markets

respectively, data from Bloomberg database.

As for ZZCP, ZZFZ, ZZGY. ZZJZ, ZZJT, ZZNY,

ZZRL, RCP, RFZ, RGY, RJZ, RYS, RNY and RRL,

these specific indexes are gathered from Wind and

Bloomberg.

Firstly, the Jarque-Bera test was performed on the

17 variables mentioned above, and the correlation

statistics showed that the subjects were characterised

by "spikes and thick tails", which did not follow a

normal distribution and had a wide range of

fluctuations. Secondly, the smoothness test shows

that the 17 variables are non-stationary at 1%

significance level. In view of this, this paper proposes

two options for further research: 1. first-order

differencing of the original data; 2. cointegration test

of the original data.

4.1 First-Order Differential

After first-order differencing of the raw data, the

original hypothesis of a unit root was rejected at the

1% significance level for all 17 variables selected.

The results of the Granger causality test after first

order differencing of the data show that there is a two-

way Granger causality between Brent crude oil

futures price and Russian RTS; Brent crude oil

futures price is the Granger cause of CSI energy

(ZZNY), CSI fuel (ZZRL), Russian car allocation

(RCP) and Russian energy (RNY); while Russian

textile (RFZ), Russian Fuel (RRL) are Granger

causes of Brent crude oil futures prices; there is no

Granger causality between Brent crude oil futures

prices and the remaining nine variables.

The results of the VAR regression of Brent crude

oil futures price and Russian RTS index with two-

way Granger causality show that: 1. Brent crude oil

futures price has a significant negative effect on itself

at the first and second lags. 2. Russian RTS index has

an opposite effect on itself at the first and second lags,

with the effect at the first lag being larger and more

significant; 3. RTS index lagged first and lagged

second have comparable influence on Brent crude oil

futures price, while the coefficient of lagged second

is more significant; 4. Brent crude oil futures price

lagged first and lagged second have great influence

on RTS index and have opposite effects.

The impulse response results show that the RTS

Index has a two-period lag to the Brent crude oil

futures price; the Brent crude oil futures price has no

lag to the RTS Index, has an immediate impact and

lasts for about four periods; in the long run, both the

RTS Index and the Brent crude oil futures price are

in a stable state and the impact effect is largely

unchanged. The results of the variance

decomposition are consistent with these findings.

In this paper, Breusch-Godfrey Serial Correlation

LM Test is chosen to test for serial correlation, and

the results show that the variable groups dSHA &

dBrent, dZZCP & dBrent, dZZFZ & dBrent, dZZJZ

& dBrent and dZZJT & dBrent have serial

correlation.

This paper performs an ARCH effect test on the

regression equations, and the results show that

ARCH effects exist for all variable groups except CSI

Textiles and Brent Crude Oil futures prices. For CSI

Textiles and Brent Crude Oil futures prices, direct

OLS regressions are done and Wald tests show that

there is no significant relationship between the two.

For the variable groups with ARCH effect, the ARCH

effect was eliminated for each variable group after

the GARCH model was built.

To further investigate the volatility spillover

effect of Brent crude oil futures price fluctuations on

the stock indices of China and Russia, a BEKK-

GARCH model is chosen for this paper, with the

following expressions:

𝑌

= 𝜑

+ 𝜑

𝑌

+ ⋯+ 𝜑

𝑌

+ 𝜑

𝑋

+ 𝜀

, 𝑝 >0

𝐻

= 𝐶𝐶

+ 𝐵

𝐻

𝐵+ 𝐴

𝜀

𝜀

𝐴 (1)

where 𝑌

is the stock price index, 𝑋

is the crude oil

futures price, 𝐻

=

ℎ

,

ℎ

,

ℎ

,

ℎ

,

is the conditional

covariance matrix, A and B are both 2*2 order

parameter matrices, A reflects the ARCH effect of

volatility, B reflects the GARCH effect of volatility,

and C is a 2*2 order upper triangular matrix.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

440

The conditional covariance matrix can be

expanded as follows.

ℎ

,

= 𝐶

+ 𝛽

ℎ

,

+2𝛽

𝛽

ℎ

,

+ 𝛽

ℎ

,

+ 𝛼

𝛼

𝜀

,

𝜀

,

+ 𝛼

𝜀

,

+2𝛼

𝛼

ℎ

,

ℎ

,

= 𝐶

+ 𝐶

+ 𝛽

ℎ

,

+2𝛽

𝛽

ℎ

,

+ 𝛽

ℎ

,

+ 𝛼

𝜀

,

+2𝛼

𝛼

𝜀

,

𝜀

,

+ 𝛼

𝜀

,

ℎ

,

= 𝐶

𝐶

+ 𝛽

𝛽

ℎ

,

+

𝛽

𝛽

+

𝛽

𝛽

ℎ

,

+ 𝛽

𝛽

ℎ

,

+ 𝛼

𝛼

𝜀

,

+

𝛼

𝛼

+ 𝛼

𝛼

𝜀

,

𝜀

,

+ 𝛼

𝛼

𝜀

,

(2)

where ℎ

,

denotes the conditional variance of the

stock price index at moment 𝑡, ℎ

,

denotes the

conditional variance of the crude oil futures price at

moment 𝑡, and ℎ

,

denotes the conditional

covariance between the stock price index and the

crude oil futures price.

The BEKK-GARCH model finds the coefficients

of A (1,2) and B (1,2) are significant, indicating that

there are volatility spillovers between the Brent crude

oil futures price and the China and Russia composite

stock indices as well as the sector stock indices.

Comparing B (1,1) with B (2,2), we find that B (1,1)

> B (2,2) for the combinations of SSE, CSI Auto,

Russian Textile, Russian Construction, Brent Crude

Oil futures prices. Indicating that equity indices react

faster and with shorter periods than Brent Crude Oil

futures prices to shocks. In the other combinations, B

(1,1) < B (2,2) indicates that the stock index is more

volatile than the Brent crude oil futures price and has

a longer reaction period to information shocks.

Wavelet transform and multi-resolution can

transform the time and frequency of a time series and

study the morphology of a subspace series satisfying

the multi-resolution condition on different subspaces.

In this paper, the discrete wavelet transform is used

to stratify and process the raw data, and the binary

orthogonal wavelet multi-resolution analysis method

is used to wavelet decompose the raw data into short-

, medium- and long-term data. The time scales for the

short-term data (high frequency signals) are 2 days 4

days. For the medium term are 8 days and 16 days

and for the long term is 32 days.

Granger causality tests were conducted on the

short-, medium- and long-term Brent crude oil

futures price data and the raw data with the composite

and sectoral indices of both China and Russia stock

markets, and found that only the three variable groups

of RTS index and Brent crude oil futures price, RTS

index and Brent crude oil futures price short term,

and SHA index and Brent crude oil futures price had

bivariate Granger The regression results of the

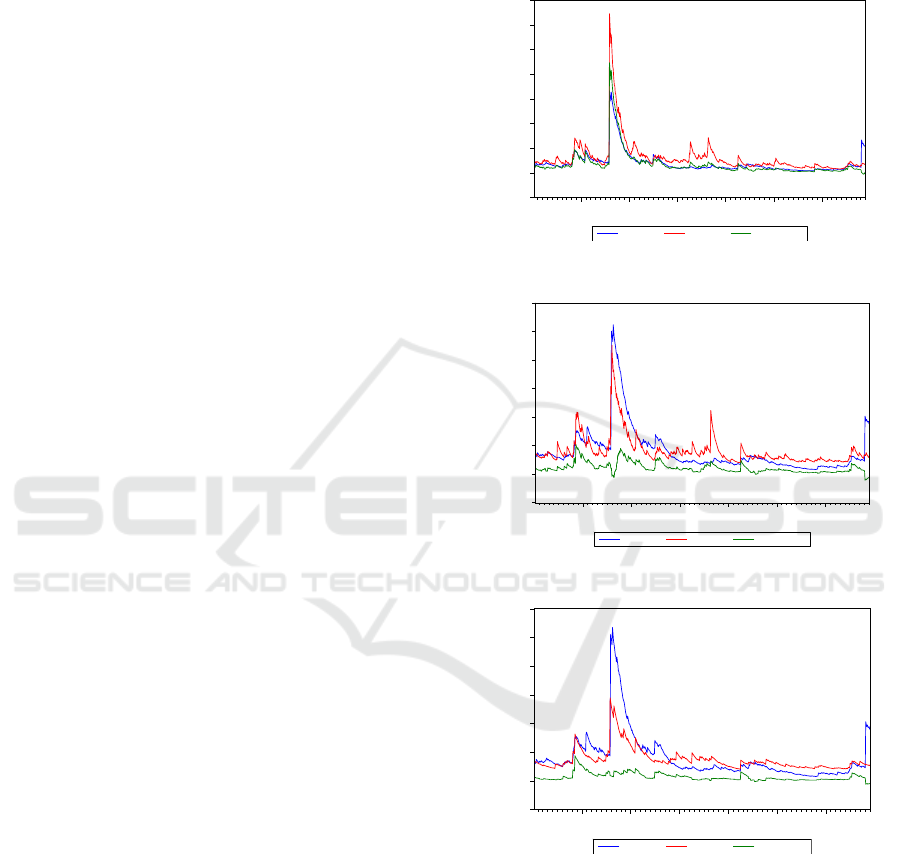

BEEK-GARCH model are shown in the figure

below.

Figure 1: RTS & BRENT.

Figure 2: RTS & BRENT short-term.

Figure 3: SHA & BRENT.

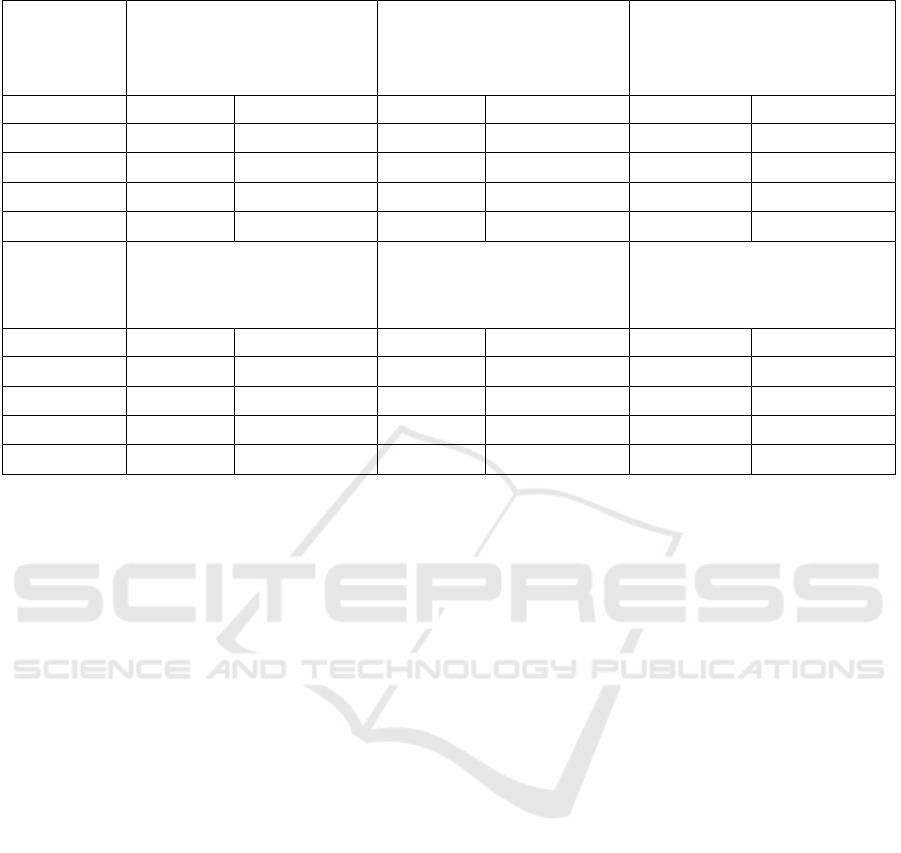

Wald tests were conducted on two variable

groups, RTS index and Brent crude oil futures price

and SHA index and Brent crude oil futures price, to

determine the direction of the volatility spillover

effect, and the results are shown in Table 1.

-.001

.000

.001

.002

.003

.004

.005

.006

.007

100 200 300 400 500 600

VAR_Y1 VAR_Y2 C OV _ Y1 Y2

-.0005

.0000

.0005

.0010

.0015

.0020

.0025

.0030

100 20 0 300 400 500 600

VAR_Y1 VAR_Y2 COV_Y1Y2

-.0005

.0000

.0005

.0010

.0015

.0020

.0025

.0030

100 200 30 0 400 500 60 0

VAR_Y1 VAR_Y2 C O V _ Y1 Y2

An Empirical Study of Volatility Spillover Effects Between International Crude Oil Futures and Russian and Chinese Stock Markets - A

Multivariate BEKK-GARCH Model Based on Wavelet Multi-Resolution Analysis

441

Table 1: Wald test results.

Original

hypothesis

No two-way volatility spillover

between Brent crude oil futures

prices and the RTS Index

𝐻

: 𝛼

= 𝛼

= 𝛽

= 𝛽

=0

No unidirectional volatility

spillover effect of the RTS Index

on Brent crude oil futures prices

𝐻

: 𝛼

= 𝛽

=0

No unidirectional volatility spillover

effect of Brent crude oil futures

prices on the RTS Index

𝐻

: 𝛼

= 𝛽

=0

F-value Significance level F-value Significance level F-value Significance level

S 749.0268 0.0000 282146.2 0.000 941138.14 0.0000

𝑑1

2526.654 0.0000 1761374 0.0000 34865.67 0.0000

𝑑2

7973.026 0.0000 1848848 0.0000 296475.1 0.0000

𝑑3

0.2450 0.9128 0.3120 0.7319 7.42e-009 0.9999

Original

hypothesis

No two-way volatility spillover

between Brent crude oil futures

prices and the RTS Index

𝐻

: 𝛼

= 𝛼

= 𝛽

= 𝛽

=0

No one-way volatility spillover

from SSE Composite to Brent

crude oil futures prices

𝐻

: 𝛼

= 𝛽

=0

No unidirectional volatility

spillover

effect of Brent crude oil futures

prices on the RTS Index

𝐻

: 𝛼

= 𝛽

=0

F-value Significance level F-value Significance level F-value Significance level

S 6551.491 0.0000 401.2298 0.000 973683.0 0.0000

𝑑1

1.026588 0.3268 2.568956 0.4456 1.50792 0.5566

𝑑2

0.8561 0.5029 0.6122 0.6250 0.2567 0.7736

𝑑3

0.2380 0.9356 0.4569 0.7259 8.602e-011 0.9999

The results show that there is a two-way volatility

spillover effect between the raw series of Brent crude

oil futures prices and the data at 𝑑1 and 𝑑2 levels and

the RTS Index, while there is no two-way volatility

spillover effect between the data at the remaining

levels of Brent crude oil futures prices and the RTS

Index; while only the raw series of Brent crude oil

futures prices has a two-way volatility spillover effect

with the Shanghai Composite Index.

The conditional covariance plot of the Brent

crude oil futures price and the RTS Index shows that

the covariance curve is extremely similar to the trend

of the variance curves of the Brent crude oil futures

price and the RTS Index, indicating that the volatility

spillover effect is strong, especially in the short term,

and the volatility spillover effect is more obvious.

The volatility spillover effect of Brent crude oil

futures price on the SSE Composite Index is less than

that of the RTS Index, although there is a relationship

between the two. The correlation coefficients

between Brent crude oil futures prices and the RTS

Index and SSE Composite Index are largely positive,

implying that volatility in international crude oil

futures prices is likely to increase the volatility of the

Russian and Chinese stock indices.

4.2 Co-Integration

In order to prevent the loss of long-run relationships

between the data due to first-order differences, this

paper uses a cointegration approach to investigate

whether there is a long-run relationship between the

variables. This paper uses the two-step E-G method

to conduct co-integration tests and regressions. The

results show that all coefficients are significant and

positive, except for the coefficients between the SSE

Index, CSI Textile and Brent Crude Oil Futures Price,

which are not significant, indicating that in the long

run, the stock indices and international crude oil

futures prices show a positive relationship.

Granger causality tests were conducted on the

groups of variables with long-term relationships, and

it was found that RTS Index, SSE Composite Index

and Brent crude oil futures price have Granger bi-

directional causality; while Brent crude oil futures

price is the Granger cause of CSI Energy and CSI

Fuel; CSI Textile, CSI Industry, Russian Industry,

Russian Construction, Russian Energy and Russian

Transportation are the Granger causes of Brent crude

oil futures The price of Brent crude oil futures is the

Granger cause of VECM models were developed for

the groups of variables with Granger two-way

causality: Brent crude oil futures price and RTS

index, and Brent crude oil futures price and SSE

Composite Index. Both the impulse response and

variance decomposition results show that the

international crude oil futures price explains the

volatility of the Russian RTS Composite Index and

most of the sectoral indices quite strongly, but

explains the volatility of the SSE Index less strongly.

The part of the volatility of CSI Industrial, CSI

Transportation and CSI Textile that can be explained

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

442

by crude oil futures prices is similarly small, while

crude oil futures prices explain more strongly the

volatility of CSI Auto Allocation and CSI

Transportation, indicating that crude oil futures

prices have a stronger impact on the Auto Allocation

and Transportation sectors. Conversely, the volatility

of international crude oil futures prices was less

strongly explained by the Chinese stock market

composite index and industry indices.

After testing the existence of a long-run

equilibrium relationship between the variables, in

order to investigate the speed of adjustment of the

variables when they deviate from the stochastic trend,

this paper constructs an error correction model

through a first-order linear autoregressive

distribution lag model. The ECM model based on

cointegration theory is built according to the E-G

two-step method for the group of variables that do not

have Granger two-way causality. In the ECM model,

all error correction coefficients are negative,

indicating that the stock market has a reverse

correction function. The results obtained for each

variable group are relatively similar, with the

absolute values of the error correction coefficients

being small, implying that the backward adjustment

of the error correction term is limited if the current

period's volatility deviates from the long-term

equilibrium, i.e. the error in crude oil futures prices

has a small and weak adjustment to the volatility of

the current period's explanatory variables. The results

of the parametric tests show that the adjustment

coefficients of crude oil futures prices on the

volatility of other industry indices are insignificant,

except for China Industry and Russian Energy,

indicating that China Industry and Russian Energy

are correlated with international crude oil futures

prices in the long run.

5 CONCLUSIONS

The crude oil futures market could reflect the

economic situation. This paper finds that the Russian

composite stock index is more influenced by the

international crude oil futures prices and the

effectiveness of the Russian stock market is more

pronounced. The fluctuation of international crude

oil futures price explains more strongly the

fluctuation of RTS index. The empirical results show

that the sensitivity to information, reaction speed and

digestion cycle of the composite stock index and

sector index of the Chinese stock market are weaker

than those of the Russian stock market. Therefore, the

relevant regulators of China's stock market should

strengthen the monitoring of large capital flows to

eliminate malicious manipulation of stock prices. In

the short term, the rise in international crude oil

futures prices will increase the volatility of the

Shanghai Stock Exchange Index, the China Industrial

Sector Index and the Russian Energy Sector Index; in

the long term, all indices show a cointegration

relationship with international crude oil futures

prices. Thus, stabilizing international crude oil

futures prices has a positive effect on stabilizing

stock prices. The government needs more to prevent

speculative behaviour and sound financial regulatory

system.

REFERENCES

B. Meyer, Applying "Design by Contract", Computer

25(10) (1992) 40–51. DOI:

https://doi.org/10.1109/2.161279

Chen N. F., Roll R., Ross S. A. (1986). Economic Forces

and the Stock Market. Journal of Business, 1986,

59(3):383-403.

Dai D. D. (2014). Research on the impact of international

crude oil futures price changes on Chinese industry

stock index returns. Inner Mongolia University, 2014.

(in Chinese)

Ferson, Wayne E., Campbell R. (1994). Harvey, Sources of

Risk and Expected Returns in Global Equity Markets.

Journal of Banking and Finance, 1994, 18, 775-803

Hamao Y., Masulis R. W., Ng V. (1990). Correlations in

Price Changes and Volatility across International Stock

Markets. Review of Financial Studies, 1990, 3(2):281-

307.

Huang, R. D., Masulis, R. W., & Stoll, H. R. (2015).

Energy shocks and financial markets. Social Science

Electronic Publishing, 16(1), 1-27.

Jin H. F., Jin E. (2010). The impact of international oil

prices on the Chinese stock market - an empirical

analysis based on industry data. Financial Research,

2010(2):173-187. (in Chinese)

Jones C. M., Kaul G. (1996). Oil and the Stock Markets.

Journal of Finance, 1996, 51(2):463-491.

Lao, J. N. (2008). Does oil price have an impact on the SSE

Composite Index? --An empirical analysis based on

data from 2000-2007. World Economic Situation,

2008(5):71-76. (in Chinese)

Leblanc M., Chinn M. D. (2004). Do High Oil Prices

Presage Inflation? The Evidence From G-5 Countries.

Business Economics, 2004, 39(2):38-48.

Qi Q. M., Zhu H. L. (2011). An econometric analysis of the

relationship between international oil prices and the

impact of the US and Chinese stock markets. Financial

Theory and Practice, 2011(7):82-87. (in Chinese)

Sadorsky P. (2001). Risk factors in stock returns of

Canadian oil and gas companies. Energy Economics,

2001, 23(1):17-28. (in Chinese)

An Empirical Study of Volatility Spillover Effects Between International Crude Oil Futures and Russian and Chinese Stock Markets - A

Multivariate BEKK-GARCH Model Based on Wavelet Multi-Resolution Analysis

443

Zhang H. (2013). A comparative study on the impact of

crude oil price volatility on stock prices: different

industry and time perspective. Zhejiang University of

Technology, 2013. (in Chinese)

Zhang X., Wang J. Y. (2013). An international comparison

of the impact of crude oil prices on stock markets. Price

Theory and Practice, 2013(1):75-76. (in Chinese)

Zhu C. Y. (2015). Study on the spillover effects among

crude oil futures and spot markets, exchange rate

markets and stock markets. Ocean University of China,

2015. (in Chinese)

Zhuge S. Q., Hao X.C. (2009). Domestic and international

oil price shocks and the Chinese stock market. China

Price, 2009(6):41-44. (in Chinese)

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

444