Private Equity Investment and Mergers and Acquisitions: Empirical

Research on Big Data Based on Small and Medium Enterprise Board

and Growth Enterprise Market

Zaixin Ji and Xuedong Chen*

School of Economics and Management, Beijing Jiaotong University, No.3, Shangyuancun, Haidian District, China

Keywords: Private Equity Investment, M & a and Restructuring, M & a Performance, M & a Payment Method.

Abstract: It has become easy and common to introduce private equity investment when Chinese listed companies con-

duct mergers and acquisitions. Private equity investment can help listed companies better understand and

apply mergers and acquisitions. This paper selects 387 M&A transactions of all listed companies on China's

SME board and GEM in 2017-2021 as the big data samples for empirical research. This research uses the

ordinal logistic regression model as the main analysis tool, using CITC analysis algorithm α The coefficient

algorithm was used to test the reliability and validity of the measurement scale, and the joint significance test

was used to verify the effect of each variable. The study found that when companies introduce private equity

investment institutions as shareholders, they will have a positive response to the performance of mergers and

acquisitions. At the same time, the increase in the shareholding ratio of private equity investment in mergers

and acquisitions also has a positive response to the performance of mergers and acquisitions. When private

equity accounts for a large proportion in the acquirer's enterprises, the response of M&A performance is

positive, which will promote the improvement of the company's excess return rate. When private equity in-

vestment is introduced into the acquirer company, the priority of payment methods is mixed payment, cash

payment and stock payment.

1 INTRODUCTION

1.1 Background

According to China's M&A market data released by

the my country Investment Research Institute in

2021, a total of 2,782 M&A transactions were con-

cluded in the Chinese M&A market, a year-on-year

increase of 5.26%. Among them, only 2,322 disclosed

the transaction value, but the total amount of mergers

and acquisitions of 252.1 billion US dollars was

reached last year. Although private equity investment

has participated in a large number of mergers and ac-

quisitions by the acquirer, the role of PE in corporate

mergers and acquisitions is not clear. This paper in-

tends to carry out research on this, taking GEM and

SME board listed companies as the research object,

and examining the impact of PE as the major share-

holder of the acquirer on M&A behavior, market val-

uation and business performance, including the

choice of M&A payment methods, and the causes of

M&A events. market response and changes in com-

pany performance before and after mergers and ac-

quisitions, so as to make judgments about the role of

PE in company mergers and acquisitions.

1.2 The Research Status

The definition of private equity investment is not pub-

licly traded on stock exchanges to raise and trade

funds (Barber, Brad M, Yasuda, et al, 2017). Foreign

studies have concluded that private equity investment

is characterized by high investment risk, but with high

income potential. [2]. According to the definition re-

port of the Federal Reserve Board, the private equity

investment market is compared with others, and its

high professional quality and professional manage-

ment ability are obtained, and its main investment ob-

jects are some unlisted companies for financing activ-

ities (BoneWinkel, Pfeffer, 2006), the specialization

specifically referred to here has gradually adapted to

the market and even promoted the market after the

practical test of long-term capital market economic

Ji, Z. and Chen, X.

Private Equity Investment and Mergers and Acquisitions: Empirical Research on Big Data Based on Small and Medium Enterprise Board and Growth Enterprise Market.

DOI: 10.5220/0011742000003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 485-490

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

485

activities. Shi 's point of view is that private equity

investment mainly has the following effects on the

merger and acquisition of the acquirer, which are sup-

ported by sufficient cash flow, attracting individual

investors with high returns, and significantly reducing

the merger and acquisition risk of the acquirer's en-

terprise. Reduce (Osuri, 2010). Luo 's point of view is

that with the increase in the shareholding ratio of pri-

vate equity in the acquirer, the M&A performance

will also increase, but it will not affect the business

performance of the company. (Boone, Broughman,

Macias, 2018) The article published by Broughman

and Fried first mentioned that private equity invest-

ment institutions promote the successful completion

of mergers and acquisitions mainly through positive

incentives, and share their own benefits in mergers

and acquisitions; Repurchase, thus affecting the daily

cash flow of the company, and the forced merger was

successfully completed (Yu, Luo, 2016). Thompson

and Richard believe that private equity investment

can also introduce advanced management experience

and technology to further promote the integration of

acquirer companies (Shi, 2007). Stephan, Torsten and

Harald believe that the involvement of private equity

investment can not only improve the quality of cash

flow but also improve the quality of company man-

agement (Stephen, 1998). Wright and Gilligan found

that private equity investment will further participate

in the daily operation and management of the com-

pany, improve the company's overall governance

level, improve the company's daily turnover effi-

ciency and comprehensive competitiveness.

(Bencivenni, Simone, Murtas, et al., 2002) Metrick

and Ayako found that firms backed by private equity

investments promote more reasonable ownership

structures.( Ghezzi, Mocci, 2012)

1.3 Research Hypothesis

(1) The impact of mergers and acquisitions supported

by private equity investment on the improvement of

merger and acquisition performance The advantages

brought by the shareholding of private equity invest-

ment institutions not only bring various benefits to the

acquisition of equity, but the influencing factors are

also related to the withdrawal of private equity invest-

ment. Strategies are closely related, so they have good

reasons for active, effective and rigorous oversight of

the board (Cotter and Peck, 2001). As a result, Hy-

pothesis 1 is proposed:

H1: Compared with the mergers and acquisitions

carried out by the mergers and acquisitions of the

mergers and acquisitions without private equity in-

vestment shares, the mergers and acquisitions of the

mergers and acquisitions of the mergers and acquisi-

tions of the private equity investment shares will

bring better merger and acquisition performance.

(2) Differences in the impact of private equity ra-

tio on M&A performance Bottazzi and Hellmann

(2008) concluded through empirical research that the

larger the shareholding ratio of private equity invest-

ment institutions in the acquirer’s company, the more

likely the acquirer’s company will be in the process

of M&A and reorganization. The influence of the

company also increases, and then it can participate in

the daily operation and high-level management activ-

ities of the invested company to a greater extent, so as

to add more value to its equity during mergers and

acquisitions. Therefore, Hypothesis 2 is proposed:

H2: The larger the shareholding ratio of private

equity investment in the merger and acquisition of the

acquirer, the better the effect of M&A and reorgani-

zation.

(3) Differences in the impact of private equity on

M&A payment methods The article published by An-

driosopoulos and Yang mentioned that the large sam-

ple analysis concluded that the acquirer will use stock

and cash to meet the needs of M&A and reorganiza-

tion transactions when conditions permit. Therefore,

in most cases, private equity investment will be more

inclined to mixed payment than cash payment under

the ownership of the acquirer's enterprise. Therefore,

Hypothesis 3 is proposed:

H3: Private equity investment institutions are

most inclined to mixed payment in terms of M&A

payment methods of the acquirer, and are the least in-

terested in stock payment, and cash payment is mod-

erate.

2 STUDY DESIGN

2.1 Data Sources

This paper takes the mergers and acquisitions events

initiated by companies on the GEM and SME boards

from 2017 to 2021 as a sample, and chooses the GEM

as the research object because: On the one hand, the

GEM companies are smaller in scale than the main

board, and they often face financing difficulties be-

fore listing. , the capital demand for PE is higher; on

the other hand, GEM companies are more high-tech-

intensive, and more need PE to cultivate professional

managers related to the company's business, so GEM

companies are more inclined to introduce PE in the

growth process , and is more likely to be affected by

it. The screening criteria for M&A events are as fol-

lows: (1) The types of mergers and acquisitions are

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

486

asset acquisition, tender offer and merger by absorp-

tion; (2) If the company has multiple mergers and ac-

quisitions in a quarter, only the first one is taken as a

research sample; (3) The transaction is successful; (4)

The first announcement date, payment method, trans-

action scale and other information are complete, and

finally 387 M&A events were obtained. The data of

PE is collected manually by referring to the method

of Wang et al. The prospectus is checked to determine

whether there are private equity investors holding

shares in the company. Information about sharehold-

ers can be obtained from the "Basic Information of

the Issuer" in the prospectus. This part introduces the

shareholders' information. The share capital compo-

sition determines whether there is PE involvement be-

fore the company's merger. All other data are from the

CSMAR database.

2.2 Model and Variable Design

1. The explanatory variable of private equity invest-

ment research on M&A performance: The explana-

tory variable of model 1 and model 2 is M&A perfor-

mance, which is represented by the cumulative excess

return CAR. The window period selected here is

around the date of the first M&A announcement. 30

days, as a surrogate variable to test the research ques-

tion of this paper. Explanatory variables: Whether

there is a dummy variable of private equity invest-

ment and the shareholding ratio of private equity are

selected as explanatory variables. Control variables:

the total proportion of shares held by the largest

shareholder in the year before the acquirer company

participated in the M&A and reorganization (TOP1),

the acquirer company participated in the M&A and

reorganization in the previous year’s return on equity

(ROE), and the acquirer company participated in the

M&A and reorganization in the previous year. One-

year asset-liability ratio (FinLev), the acquirer's free

cash flow (FCF) in the previous year, the acquirer's

main business revenue growth rate (Mincmgrrt) and

company size in the year before the acquirer's partic-

ipation in the M&A, and the company's scale is se-

lected here. The logarithm of total assets (SIZE) and

the type of merger and acquisition of the company in

the previous year before participating in the merger

and acquisition. Here, whether the two sides of the

merger and acquisition are in the same industry is

used to represent (SAME) horizontal merger is 1, oth-

erwise it is 0, and the payment method (Y) is used as

a control variable. and the payment method (Y) cho-

sen by the M&A as a control variable, with numbers

1, 2 and 3 representing stock, cash and hybrid pay-

ments, respectively. Model (1) Regarding the re-

search on the impact of private equity participation on

M&A performance, model 1 is established as follows:

CAR [-30, 30]=β

0

+β

1

PE +β

2

ROE +β

3

FinLev

+β

4

TOP1+β

5

FCF +β

6

Mincmgrrt +β

7

SIZE +β

8

SAME

+β

9

Y+ε (1)

Model (2) Research on the impact of private eq-

uity ratio on M&A performance. On the basis of

model 1, the dummy variables of private equity in-

vestment are replaced with equity ratio variables, and

model 2 is established as follows:

CAR [-30, 30]=β

0

+β

1

PRO +β

2

ROE +β

3

FinLev

+β

4

TOP1+β

5

FCF +β

6

Mincmgrrt +β

7

SIZE +β

8

SAME

+β

9

Y+ε (2)

2. The research on the influence of private equity

investment on the payment method of M&A is ex-

plained variable: the explanatory variable of model 3

is the payment method of the acquirer participating in

the merger and acquisition, using Y is an unobserva-

ble latent variable, x represents the explanatory vari-

able, and β is the corresponding. The coefficient to be

estimated, e is the error term. The observed value of

Y has the following three values: y = 1 (stock pay-

ment), y = 2 (cash payment), y = 3 (mixed payment).

Explanatory variable: In model three, choose private

equity The presence or absence of investment is used

as an explanatory variable to explain the model. Con-

trol variables: the total proportion of shares held by

the largest shareholder in the year before the acquirer

company participated in the M&A and reorganization

(TOP1), the acquirer company participated in the

M&A and reorganization in the previous year’s return

on equity (ROE), and the acquirer company partici-

pated in the M&A and reorganization in the previous

year. One-year asset-liability ratio (FinLev), the ac-

quirer's free cash flow (FCF) in the previous year, the

acquirer's main business revenue growth rate (Minc-

mgrrt) and company size in the year before the acquir-

er's participation in the M&A, and the company's

scale is selected here. The logarithm of total assets

(SIZE) and the type of merger and acquisition in the

year before the party company participated in the

merger and acquisition. Model (3) In order to explore

the impact of private equity investment on M&A pay-

ment methods, the research line of this model is to

study the preference degree that private equity invest-

ment should select for three payment methods under

the ownership of the acquirer. The third model is es-

tablished as follows:

y= xβ+ e, e | x ~ logit (0, 1) (3)

Private Equity Investment and Mergers and Acquisitions: Empirical Research on Big Data Based on Small and Medium Enterprise Board

and Growth Enterprise Market

487

3 EMPIRICAL ANALYSIS

3.1 Descriptive Statistics

Figure 1: Descriptive Statistics(owner-draw).

2017.1.1-2021.12.31 A total of 387 companies on the

SME board and ChiNext participated in mergers and

acquisitions as acquirers, including 57 companies

backed by private equity and 330 companies without

private equity support. The descriptive test results of

listed companies on the SME board are shown in the

table above. Table 4-2 lists the relevant variables

adopted in this merger. In the research sample of this

paper, there are 21 pure stock payment, 60 mixed pay-

ment, and 306 pure cash payment; the average value

of PE is about 0.14, which reflects the introduction of

private equity investment by the acquirer in all M&A

events. The overall proportion is about 15%; for the

selection of control variables, the average size of en-

terprises is about 21.34, of which the extreme differ-

ence is large; in the M&A transaction market of the

small and medium-sized board and the ChiNext, the

average asset-liability ratio Finlev is about 0.37, The

average ROE of the return on equity is about 0.09,

and the average free cash flow FCF is negative, indi-

cating that most of the GEM and companies are in

good financial condition but the degree of free cash

flow is poor; the shareholding ratio of the largest

shareholder is 0.41, indicating that in the sample The

management rights of the largest shareholder in the

company are relatively concentrated; the maximum

growth rate of the main business income is 82.70%.

The growth vitality of the entire small and medium-

sized board and the ChiNext board is relatively high,

and the development potential of the company is rel-

atively large. When private equity institutions invest

More screening and judgments are needed; at the

same time, the average number of payment methods

chosen by the acquirer companies is close to 2 and the

variance is small, so they still choose a large number

of cash payments; the proportion of horizontal mer-

gers and acquisitions in the entire sample reached

53%, indicating that companies have more choices

Horizontal mergers and acquisitions expand their

market share and accumulate energy for the next step

of development and growth.

3.2 Empirical Analysis

1) Regression analysis for model one

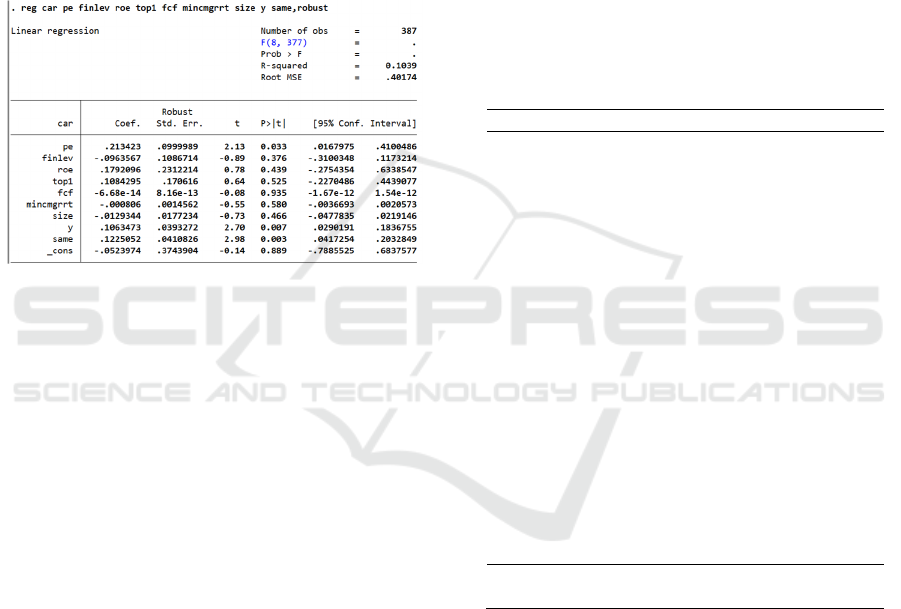

Figure 2: Model-One Logistic Regression(owner-draw).

CAR[-30,30]=-0.052+0.213PE+0.179ROE-

0.963FinLev+0.108TOP1-6.68e-14FCF-

0.001MINCMGRRT-

0.013SIZE+0.106Y+0.123SAME+ε (4)

According to the results of the table, through the re-

search on all domestic SME board and GEM M&A

events in the past five years, model 1 is used. When

the explanatory variable of whether there is private

equity investment in the acquirer's enterprise, the re-

gression analysis shows that the R2 value is 0.1039,

It shows that the overall fitting degree of model 1 is

good, and the experimental results have reference

value. Checking the T value shows that at the 5% sig-

nificance level, the cumulative excess return CAR is

significantly correlated with the acquirer's return on

equity in the previous year, and the asset-liability ra-

tio in the previous year is negatively correlated, espe-

cially the type of merger and payment method The

relationship is obvious, and the company's profitabil-

ity and M&A performance have no obvious relation-

ship with other control variables. The reason for the

control variable is that a reasonable payment method

can avoid the crisis of the company's daily operating

cash flow, and a successful horizontal merger can

save the production cost of the company and improve

the performance of mergers and acquisitions. Finally,

the conclusion drawn from Model 1 is that private eq-

uity investment in SME and GEM acquirers will

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

488

bring about better M&A performance. The main rea-

son is that private equity investment institutions par-

ticipate as acquirers. After mergers and acquisitions,

the company usually has a target company integration

period of about one year. Even if the private invest-

ment institution has no long-term investment in the

acquirer’s company, it is only for the pursuit of short-

term interests, but in order to maximize the invest-

ment income of private equity investment. , during

the period of integrating the target company, there

will still be participation in the operation and manage-

ment of the acquirer's company.

2) Regression Analysis for Model Two.

Figure 3: regression analysis of model 2(owner-draw).

From the test results, the equation of model 2 is as

follows:

car[-30,30]=-0.223+4.437pro+0.232roe-

0.082finlev +0.102top1+1.70e-13fcf-

0.001mincgrrt-0.004size+0.094y+0.128same+ε (5)

It can be seen from the table that, through the re-

search on all sme board and chinext m&a events in

the past five years, the equation of model 2 is used.

When the private equity investment shareholding ra-

tio in the acquirer's enterprise is used as the explana-

tory variable, the regression analysis shows that the

value of r2 shows it is 0.1624. At the 5% significance

level, the return on net assets and the asset-liability

ratio of the acquirer in the year before participating in

the m&a and reorganization are significantly related

to the cumulative excess return car of participating in

the m&a and reorganization, but the asset-liability ra-

tio in the previous year showed a significant correla-

tion. Negative correlation, but these two variables do

not significantly affect the m&a performance of the

smes and chinext listed companies. Among them, the

proportion of private equity holdings is large to a cer-

tain extent, which can significantly improve the m&a

performance of listed companies. The main reason for

the above phenomenon is that the increase in the pro-

portion of shares held by private equity institutions in

the acquirer's enterprise has a negative impact on the

company's profitability. Said to be a major positive,

the greater the proportion of private equity investment

in the acquirer's enterprise, the stronger the ability to

dominate and influence the management. Combined

with the conclusions of model 1, it can be concluded

that private equity investment has a positive incentive

effect on the m&a performance of listed companies

on the sme board and the chinext board, and the ac-

quiring company is affected by private equity invest-

ment. Moreover, the larger the shareholding ratio of

private equity investment in the acquirer companies

in the sample, the better the m&a performance of the

m&a and reorganization of the sme board and the

chinext board.

3) logistic Analysis of Model Three

Table 1: Logistic analysis of model three(owner-draw).

(1) (2) (3)

PE 0.1328*** 0.1295** 0.1502**

(2.33) (2.29) (2.21)

FinLev

0.9169** 0.9935**

(2.27) (2.27)

ROE

-2.9795*** -3.0382***

(-3.09) (-3.14)

FCF

1.1206 1.3092

(1.19) (1.32)

TOP1

-0.0203

(-1.19)

Mincmgrrt

0.8692

(1.22)

SIZE 0.1129 0.0573 0.0711

(0.86) (0.36) (0.42)

SAME 0.1422 0.1032 0.0826

(1.02) (0.79) (0.81)

Pseudo R-

square

d

0.1106 0.1192 0.1248

LR statistics -246.13 -242.46 -240.23

N 387 387 387

Z values in parentheses, * * and * * * indicate signifi-

cant at 5% and 1% significance levels respectively

Through the logistic analysis of Model 3, we ex-

plore how the intervention of private equity invest-

ment affects the acquisition method selection prefer-

ence of the acquirer company. In Table 5-3, through

the regression analysis of model 3, in the results of

regression 1, only the variable private equity invest-

ment and the other two M&A characteristics are in-

troduced, and it is found that private equity invest-

ment is significant at the 1% level. Then introduce the

relevant corporate governance structure and financial

indicators respectively, and construct regressions 2

and 3. The regression results show that the influence

of private equity investment on the choice of payment

method is significant at a significance level of 5%.

Private Equity Investment and Mergers and Acquisitions: Empirical Research on Big Data Based on Small and Medium Enterprise Board

and Growth Enterprise Market

489

From this, it can be concluded that the overall prefer-

ence for the selection of the dependent variable Y is

1<2<3, that is, the method of mixed payment is the

most preferred, and stock payment is rarely selected,

and the payment in cash is more moderate and com-

mon. . The main reason for the above results is that in

order to maximize their own interests, private equity

investment institutions will actively intervene in the

M&A decision-making activities of the acquirer's

company to ensure the company's daily operating

cash flow while preventing its own equity from being

diluted. Choose a hybrid payment that is relatively

compromised in terms of method.

4 CONCLUSIONS

Through the above empirical test and analysis, we can

find that private equity investment has a positive and

positive role in promoting the M&A performance of

the invested companies after the merger. M&A per-

formance will also show a better level; the M&A per-

formance of companies invested by private equity

capital after M&A is significantly better than that of

companies without private equity capital support, and

the proportion of private equity holdings is positively

correlated with M&A performance; private equity in-

vestment In order to improve their own investment

returns, institutions will improve by choosing pay-

ment methods. The reason for the above phenomenon

is that private equity investment institutions have ma-

tured after years of development, and companies on

the small and medium-sized board and the ChiNext

board are highly active. Because private equity in-

vestment is highly specialized in management and su-

pervision, it can effectively improve the merger and

reorganization activities of enterprises. , and provides

a series of value-added services to help enterprises

improve the effect of mergers and acquisitions. Com-

pared with other variables, private equity investment

has a significant impact on the improvement of M&A

performance and the choice of M&A payment

method, indicating that private equity investment has

a more obvious effect on the optimization of corpo-

rate governance structure and has a strong influence

on corporate decision-making. Therefore, we believe

that the capital market should welcome the entry of

private equity investment with a more open and inclu-

sive attitude, and the improvement of quality should

be paid more attention by all parties than the increase

of quantity. The degree of specialization and the fur-

ther improvement of the quality of private equity in-

vestment institutions will promote the healthy and

stable development of my country's capital market.

REFERENCES

Barber, Brad M, Yasuda, et al. Interim fund performance

and fundraising in private equity.[J]. Journal of Finan-

cial Economics, 2017.

Gilligan J , Wright M . Private Equity Demystified: An Ex-

planatory Guide - 3rd Edition [M], 2008.

BoneWinkel, Stephan, Pfeffer T. OPPORTUNISTIC

REAL ESTATE INVESTMENT - WHAT CAN

PROPERTY DEVELOPMENT DO[J]. Eres, 2006.

Osuri, Laura, Thompson. Reform's Silver Lining? [J]. U.S.

Banker, 2010, 120(8):39-39.

Boone A, Broughman B, Macias A J . Shareholder approval

thresholds in acquisitions: Evidence from tender offers

[J]. Journal of Corporate Finance, 2018, 53.

Yu Jinsong, Luo Xuezhu. Private Equity Investment and

Corporate Growth: An Empirical Study Based on Chi-

na's 2009-2013 Growth Enterprise Market Data [J].

Journal of Guizhou University of Finance and Econom-

ics, 2016(1):10. (in Chinses)

Shi Tao. Research on the relationship between the alloca-

tion of control rights and business performance of listed

companies in my country [D]. Southwestern University

of Finance and Economics, 2007. (in Chinses)

Stephen C.P.M.S.Weisbach. Actual Share Reacquisition in

Open-Market Repurchase Program [J]. Journa I of Fi-

nance 1998.53(1): 313-333.

Bencivenni G, Simone P D , Murtas F , et al. Performance

of a triple-GEM detector for high rate charged particle

triggering[J]. Nuclear Instruments & Methods in Phys-

ics Research, 2002, 494(1-3):156-162.

Ghezzi C, Mocci A . Behavioral validation of JFSL speci-

fications through model synthesis[C]// IEEE. IEEE,

2012.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

490