Can the Participation of Party Organizations in the Corporate

Governance of Chinese State-Owned Enterprises Restrain Inefficient

Investment? An Empirical Study Based on a Time-Varying DID Model

Yue Cao

a

College of Business and Tourism, Sichuan Agricultural University, Chengdu, 611800, China

Keywords: Party Organization, Corporate Governance, State-Owned Enterprise, Inefficient Investment, Time-Varying

Difference-In-Differences Model.

Abstract: This paper uses A-share state-owned listed enterprises as the research object from 2010 to 2020 and

develops a time-varying difference-in-differences (time-varying DID) model to test the relationship between

party organization participation in state-owned enterprise (SOE) corporate governance and inefficient

investment. The results show that party organization participation in SOE corporate governance

significantly inhibits inefficient investment behavior. A further analysis based on SOE heterogeneity reveals

that the inhibitory effect of party organization participation in corporate governance on inefficient

investment is more pronounced in commercial SOEs and local SOEs. The policy effect of party organization

participation in corporate governance is mainly achieved by reducing agency costs by increasing total asset

turnover, thus discouraging inefficient investment. This paper provides important policy implications for

China to further promote the participation of party organizations in the corporate governance of SOEs.

a

https://orcid.org/0000-0003-2080-8122

1 INTRODUCTION

According to the report of the 19th Party Congress,

"China's economy has shifted from a stage of

high-speed growth to a stage of high-quality

development." The digital economy assists the

country's economy in developing with high quality,

and SOE play a leading role in the high-quality

development of the digital economy, with the Party's

participation in SOEs' corporate governance being

an important pillar of their digital construction. The

modern SOE system with Chinese characteristics,

according to General Secretary Xi Jinping, is

"special" in that the Party's leadership is integrated

into all aspects of corporate governance, and the

Party organization is embedded in the corporate

governance structure. The Party organization's role

in SOEs corporate governance grows as it becomes

more embedded, so its role path and governance

effects are worth further investigation, with the

inhibiting effect on inefficient investment being a

key aspect of the Party organization's participation

in SOEs corporate governance.

In recent years, empirical studies have confirmed

the effects of party organization participation in

SOEs corporate governance, and the findings show

that party organization participation in SOE

governance helps to enhance corporate information

transparency (Mao and Wei 2020), restrain the

problem of "insider control" (Ma et al 2012), reduce

bond credit risk (Tong et al 2021), curb corporate

surplus management behavior (Cheng et al 2020),

tax avoidance (Li et al 2020), and financial fraud

(Cheng and Zhang 2022), and help to improve

corporate performance (Cui 2021). Then, this paper

is concerned with whether the participation of party

organizations in SOEs corporate governance can

prevent inefficient investment behaviors. How do

the dynamics of inefficient investment change

before and after party organizations participate in

SOEs corporate governance? Is its inhibitory effect

on inefficient investment affected by the

heterogeneity of SOEs?

538

Cao, Y.

Can the Participation of Party Organizations in the Corporate Governance of Chinese State-Owned Enterprises Restrain Inefficient Investment? An Empirical Study Based on a Time-Varying

DID Model.

DOI: 10.5220/0011751600003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 538-544

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

2 RESEARCH HYPOTHESIS

Compared with private enterprises, SOEs can easily

alleviate financing constraints by obtaining financial

subsidies and credit support under the government's

"implicit guarantee" (Zhu et al 2015), so the main

reason for inefficient investment in SOEs is the

principal-agent problem, which is primarily

reflected in the following two aspects: First, the

principal-agent problem between shareholders and

management. The managers of SOEs may make

excessive investments that are contrary to the

long-term development of the enterprise due to the

tendency of "empire building" (Liu et al 2012) or to

gain political promotion (Xu 2019); they may also

under-invest due to their motives of risk avoidance,

laziness, and enjoyment of peace and stability (Li

2011). Following the party organization's

participation in the corporate governance of SOEs,

the executives of SOEs become members of the

party organization through the leadership

mechanism of "two-way entry and

cross-appointment" and tend to exercise

administrative supervision on behalf of the party and

the government as "stewards" (Ma 2013), thereby

helping to restrain their self-interest pursuing

behavior. Second, there is the issue of agency

between major shareholders and small and medium

shareholders. When large state shareholders interfere

with SOEs investment behavior for political, social,

and economic development purposes, party

organizations must coordinate and protect the

legitimate rights and interests of stakeholders such

as small and medium shareholders, employees, and

creditors of the company (Chen 2018). In summary,

the first research hypothesis is proposed in this

paper.

Hypothesis H1. Participation of party

organizations in SOEs corporate governance

discourages inefficient investment.

The general public welfare SOEs frequently

make investment decisions to protect people's

livelihoods, and it may be difficult for the party

organization to participate in their corporate

governance to suppress the resulting inefficient

investment behavior. Whereas commercial SOEs

operate commercially according to marketization

requirements, and their investment decisions are

more for market competition, and the party

organization's supervisory and check-and-balance

role helps to reduce inefficient investments caused

by executives' self-interest motives. As a result, the

second research hypothesis is proposed in this paper.

Hypothesis H2. When compared to public

welfare SOEs, participation of party organizations in

commercial SOEs corporate governance has a

greater inhibiting effect on inefficient investment.

Central SOEs tend to make investment decisions

to promote national economic development in mind,

and it may be difficult for party organizations to

influence their investment decisions. Whereas local

SOEs are subject to local government intervention,

and their executives may engage in unreasonable

investment behaviors that cater to local government

performance needs for political promotion, and the

deterrent effect of party organizations helps to

inhibit such behaviors. As a result, the third research

hypothesis is proposed in this paper.

Hypothesis H3: When compared to central

SOEs, participation of party organizations in local

SOEs corporate governance has a greater inhibiting

effect on inefficient investment.

3 METHODOLOGY AND DATA

3.1 Sample Selection

The research object in this paper is A-share

state-owned listed companies from 2010 to 2020,

and the raw data are processed as follows by

existing research practice. (i) exclude samples from

the financial industry; (ii) exclude samples with the

years ST, *ST, and PT; (iii) exclude samples with a

listing time of less than one year; (iv) exclude

samples with an asset-liability ratio greater than or

equal to 1 or less than or equal to 0; and (v) exclude

samples with missing data for the main variables.

Finally, 9757 annual company observations from

1194 different companies were obtained.

Meanwhile, the continuous variables at the firm

level were subjected to a 1% winsorize to eliminate

the influence of extreme values. The personal

characteristics documents of directors and

supervisors provided by the CSMAR database and

annual reports of companies were used to construct

indicators related to party organizations'

participation in corporate governance of SOEs, and

all other financial data was obtained from the

CSMAR database. Excel 2010 and Stata 16.0 were

used to process the data in this work.

Can the Participation of Party Organizations in the Corporate Governance of Chinese State-Owned Enterprises Restrain Inefficient

Investment? An Empirical Study Based on a Time-Varying DID Model

539

3.2 Time-Varying DID Model

The most commonly used measure in estimating

treatment effects is DID model. In contrast to the

traditional DID model, which implements the policy

at a single point in time, time-varying DID model is

applicable to the progressive implementation of the

same policy in the impact group.

Given that party organizations are not involved

in the corporate governance of each SOE at the same

point in time during the sample selection period, this

paper develops a time-varying DID model for

testing to investigate whether party organization

participation in the corporate governance of SOEs

can suppress inefficient investment.

𝐼𝑛𝑒𝑓𝑓𝑖𝑐𝑖𝑒𝑛𝑡

,

= 𝛼

+ 𝛼

𝑝𝑜𝑠𝑡_𝑝𝑎𝑟𝑡𝑦

,

+ 𝛾𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠+ 𝜀

,

(1)

3.3 Variables and Data Description

Explained variables: This paper draws on

Richardson's (2006) investment efficiency model,

and the absolute value of the residuals in the model

is used to measure inefficient investment, with a

higher value indicating a more serious degree of

inefficient investment by the firm. The following is

the investment efficiency model that was used in this

paper.

𝐼𝑛𝑣𝑒𝑠𝑡

,

= 𝛽

+ 𝛽

𝑆𝑖𝑧𝑒

,

+ 𝛽

𝐿𝑒𝑣𝑒𝑙

,

+ 𝛽

𝐴𝑔𝑒

,

+𝛽

𝐺𝑟𝑜𝑤𝑡ℎ

,

+ 𝛽

𝑅𝑒𝑡𝑒𝑟𝑛

,

+ 𝛽

𝐶𝑎𝑠ℎ

,

+ 𝛽

𝐼𝑛𝑣𝑒𝑠𝑡

,

+ 𝐼𝑛𝑑𝑢𝑠𝑡𝑟𝑦

+ 𝑌𝑒𝑎𝑟+ 𝜀

(2)

Explanatory variables: In this paper, referring to

existing studies (Tong et al 2021; Cheng et al 2020;

Xie et al 2019), the members of enterprise party

organizations serve on the board of directors,

supervisory board, and managerial level are taken as

the measure of party organization participation in

corporate governance of SOEs, and due to the

inconsistent time points of party organization

participation in corporate governance of SOEs, the

dummy variable post_party is set, and the annual

interval after party organization participation in

corporate governance is assigned as 1, otherwise 0.

Its coefficient is the net policy effect of the

time-varying DID model.

Control variables: Size, Level, Growth, First,

Lnpay, Period, and Fcf were chosen as control

variables in this paper based on the design of

previous studies (Xie et al 2019).

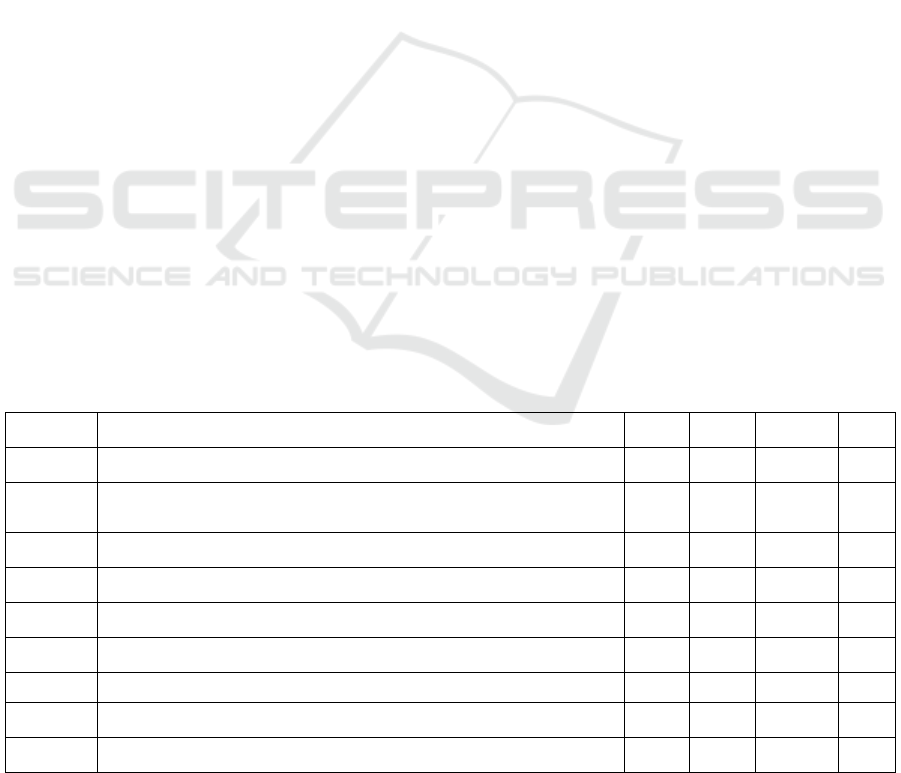

The variable definitions and descriptive statistics

results are shown in Table 1.

Table 1: Descriptive statistics of all variables.

Variables Description Mean StDev Min Max

Inefficient

The absolute value of the residuals in model (2).

0.0364 0.0422 0.000387 0.250

post_party

The annual interval after the participation of party organizations in

corporate governance of SOEs is assigned a value of 1, otherwise, it is 0.

0.775 0.417 0 1

Size

Natural logarithm of total assets at the end of the period. 22.82 1.401 20.14 26.94

Level Gearing ratio. 0.509 0.198 0.0853 0.909

Growth

Operating income growth rate. 0.127 0.343 -0.522 2.089

First

Number of shares held by the largest shareholder/total share capital. 38.90 15.16 11.49 76.13

Lnpay

Natural logarithm of the total compensation of the top three executives. 14.38 0.685 12.67 16.29

Period

Retained earnings/total assets at end of period. 0.152 0.165 -0.499 0.579

Fcf Net cash flow from operating activities per share. 0.554 1.009 -2.563 4.578

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

540

4 RESULTS AND ROBUSTNESS

TEST

4.1 Main Results

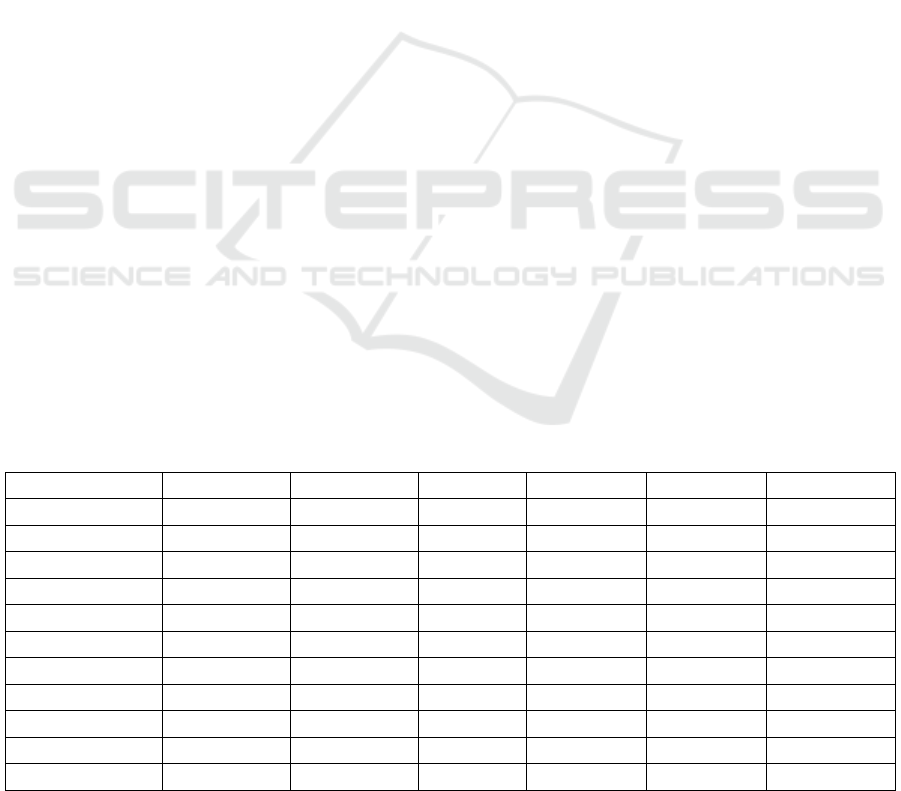

The basic regression results from the time-varying

DID model are shown in Table 2. Column (1)

demonstrates that, in the absence of control

variables, participation of party organizations in

SOEs corporate governance significantly reduces

inefficient investment (coefficient of -0.005, which

is statistically significant). Column (2) demonstrates

that the results remain robust after the inclusion of

control variables, and the regression coefficient is

negative at the 1% significance level, indicating that

the level of inefficient investment in SOEs where the

party organization is involved in corporate

governance decreases by 0.3 percent when

compared to SOEs where the party organization is

not involved in corporate governance, and the

inhibitory effect of the party organization is

significant. Thus, hypothesis H1 is confirmed.

Because the potential inhibitory effects of party

organization participation in corporate governance

of different types of SOEs on inefficient investment

differ, this paper runs grouped regressions based on

the basic regression results according to the

functional positioning and management level of

SOEs.

The regression coefficient of post_party in

column (3) of Table 2 is not significant, most likely

because the investment decisions of public welfare

SOEs are centered on safeguarding people's

livelihood and serving society, and it is difficult for

the party organization to influence the resulting

inefficient investment phenomenon. Whereas the

regression coefficient of post_party in column (4) is

negative and significant at the 5% level, indicating

that in commercial SOEs, the party organization

effectively suppresses the inefficient investment

phenomenon. As a result, hypothesis H2 is

confirmed.

The regression coefficient of post_party in Table

2 column (5) is not significant, most likely because

central SOEs cover major industries related to

national security and the lifeline of the national

economy, and it is difficult for the party organization

to play a decisive role in major investment decisions

after participating in the corporate governance of

central SOEs. Whereas the regression coefficient of

post_party in column (6) is -0.004 and significant at

the 1% level, indicating that the party organization

participation in corporate governance of local SOEs

plays a significant inhibitory role in inefficient

investment. As a result, hypothesis H3 is confirmed.

4.2 Robustness Test

4.2.1 Parallel-Trend Test

The parallel trend test was used in this study five

years before and five years after party organizations

participated in corporate governance, and the results

are shown in Figure 1. The development trend

between the experimental group and the control

group is basically the same before the participation

of party organizations in corporate governance of

SOEs, and there is no significant difference, so it

satisfies the parallel trend test. However, after the

participation of party organizations in corporate

governance of SOEs, there is a significant difference

between the control group and the experimental

Table 2: The estimation results in the time-varying DID model.

Variables (1) (2) (3) (4) (5) (6)

post_party -0.005*** -0.003*** -0.002 -0.003** -0.002 -0.004***

(-4.39) (-2.71) (-0.47) (-2.50) (-1.08) (-2.58)

Constant 0.041*** 0.087*** 0.081** 0.086*** 0.087*** 0.087***

(39.84) (7.92) (2.29) (7.35) (4.33) (6.02)

Controls NO YES YES YES YES YES

Year YES YES YES YES YES YES

Industry YES YES YES YES YES YES

Observations 9,757 9,757 1,470 8,287 3,269 6,488

R-squared 0.116 0.163 0.134 0.181 0.239 0.162

r2_a 0.109 0.149 0.0717 0.166 0.204 0.141

F 19.23 7.178 1.378 7.062 4.576 4.718

Note: The t-values in parentheses, *, **,***, denote significance at the 10%, 5%, and 1% levels, respectively.

Can the Participation of Party Organizations in the Corporate Governance of Chinese State-Owned Enterprises Restrain Inefficient

Investment? An Empirical Study Based on a Time-Varying DID Model

541

Figure 1: The results of parallel-trend test.

Figure 2: The results of placebo test.

group, and the coefficient of inefficient investment

is significantly higher. As a result, the parallel trend

test was passed by the time-varying DID model built

in this paper.

4.2.2 Placebo Test

To further eliminate the endogeneity effect, the

following steps were taken in this study: To begin,

the same number of firms (1000) as in the previous

experimental group was chosen at random from the

sample to create a pseudo-experimental group.

Second, a pseudo-policy time dummy variable is

created by randomly selecting one year between

2010 and 2020. Finally, interaction terms for

regression were created, and the above test

procedure was repeated 500 times. The placebo test

results are shown in Figure 2. As shown in Figure 2,

the regression coefficients obtained from 500

repeated round-robin tests are concentrated around

0, and the majority of p-values are greater than 0.1.

The placebo test results show that the reduction in

the degree of inefficient investment in SOEs is due

to the party organization governance effect, not time

trends or other random factors, demonstrating the

validity of the time-varying DID model established

in this research.

5 INFLUENCE MECHANISM

The following model is developed in this paper

using the three-step method of mediating effects to

further test whether there is a mediating effect of

agency costs on the effect between the participation

of party organizations in corporate governance of

SOEs and inefficient investment.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

542

𝑇𝑡𝑐

,

= 𝑏

+ 𝑏

𝑝𝑜𝑠𝑡_𝑝𝑎𝑟𝑡𝑦

,

+ 𝛾𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠

+ 𝜀

,

(3)

𝐼𝑛𝑒𝑓𝑓𝑖𝑐𝑖𝑒𝑛𝑡

,

= 𝑐

+ 𝑐

𝑝𝑜𝑠𝑡_𝑝𝑎𝑟𝑡𝑦

,

+ 𝑐

𝑇𝑡𝑐

,

+ 𝛾𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠

+ 𝜀

,

(4)

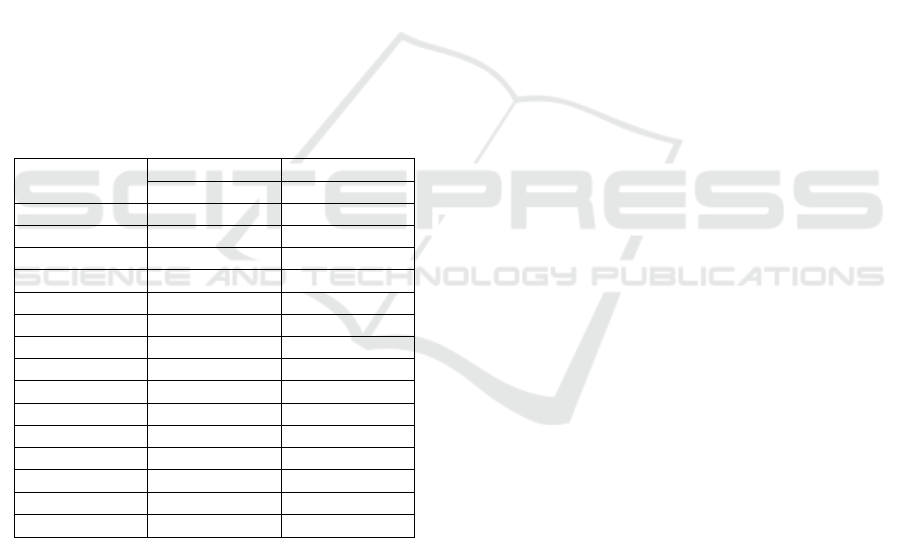

The total asset turnover ratio is used to measure

the firm's agency cost in this paper, drawing on Luo

(2014). Because asset turnover ratios are less

volatile and difficult to manipulate. A higher asset

turnover ratio indicates that the firm's agency cost is

lower. The post_party regression coefficient in

column (1) of Table 3 is 0.046 and significant at the

1% level, indicating that party organization

participation in SOEs corporate governance

significantly increases the total asset turnover rate.

In column (2), the regression coefficient of Ttc is

-0.009 and significant at the 1% level, indicating

that party organization participation in SOEs

corporate governance can suppress inefficient

investment by increasing total asset turnover to

reduce agency costs, confirming the mediating effect

of total asset turnover.

Table 3: The results for the influence mechanisms.

Variables (1) (2)

Ttc Inefficient

post_party 0.046*** -0.003**

(4.06) (-2.36)

Ttc -0.009***

(-8.59)

Constant -0.232** 0.085***

(-2.25) (7.75)

Controls YES YES

Year YES YES

Industry YES YES

Observations 9,757 9,757

R-squared 0.427 0.170

Year YES YES

Industry YES YES

r2_a 0.418 0.156

F 12.00 8.076

6 CONCLUSION

This paper investigates the relationship between

party organization participation in SOEs corporate

governance and inefficient investment by

developing a time-varying DID model with A-share

listed SOEs as the research sample from 2010 to

2020, and the empirical results show that party

organization participation in SOEs corporate

governance significantly inhibits inefficient

investment behavior. Based on the heterogeneity of

SOEs, it is discovered that the inhibitory effect of

party organization participation in corporate

governance on inefficient investment exists in

commercial SOEs and local SOEs than in public

welfare SOEs and central SOEs. In terms of its

influence mechanism, participation in corporate

governance by party organizations reduces agency

costs by increasing total asset turnover, thereby

inhibiting inefficient investment.

This paper provides important policy

implications for China to further promote the

participation of party organizations in the corporate

governance of SOEs as follows: First, a large part of

the inefficient investment phenomenon in SOEs is

due to executives' self-interest motives. As a result,

the Party should fully exercise the role of

supervision and checks and balances, as well as the

role of "direction" in SOE investment decisions and

other major decisions to maintain the integrity of

state-owned assets. Second, the state should fully

understand the positive role of party organizations,

improve the path and methods of party

organizations' participation in SOEs corporate

governance, bring the superiority of the modern

SOE system with Chinese characteristics into play,

and accelerate SOEs digitalization, to improve the

development of the national digital economy and

stabilize the high-quality development of the

national economy.

Furthermore, because whether or not party

organizations are involved in corporate governance

is not required information for state-owned listed

companies to disclose, the involvement of party

organizations in corporate governance of

state-owned enterprises derived from the CSMAR

database of individual characteristics documents of

directors, supervisors, and executives in this paper

may differ from the actual situation. As a result,

under the modern SOE system with Chinese

characteristics, the relevant authorities should make

it mandatory for listed SOEs to disclose their

participation in corporate governance by party

organizations. Future research should develop a

model that accurately measures party organization

participation in governance based on the disclosed

data in order to empirically test the effectiveness of

party organization governance and analyze the

economic phenomena associated with it using

econometric models.

Can the Participation of Party Organizations in the Corporate Governance of Chinese State-Owned Enterprises Restrain Inefficient

Investment? An Empirical Study Based on a Time-Varying DID Model

543

REFERENCES

Cheng, H., Hu, Y., Na, C. (2018). Party organization

participation in corporate governance, managerial

power, and the pay gap. J. Journal of Shanxi

University of Finance and Economics. 40(02), 84-97.

Cui, J. (2021). Party Committee Participation in

Governance, Internal Control Quality, and SOE

Performance. J. Journal of Guizhou University of

Finance and Economics. 04, 15-23.

Cheng, H., Li, M.,Wang, Y. (2020). The impact of party

organization participation in governance on surplus

management of state-owned listed companies. J.

China Economic Issues. 02, 45-62.

Cheng, Y., Zhang, W. (2022). Can Party Organizations in

State-Owned Enterprises Effectively Curb Financial

Fraud? --A quasi-natural experiment based on the

"discussion front" mechanism. J. China Soft Science.

01, 182-192.

Liu, H., Wu, L., Wang, Y. (2012). Restructuring of

state-owned enterprises, board independence, and

investment efficiency. J. Financial Research. 09,

127-140.

Luo, M. (2014). Corporate property rights, agency costs,

and corporate investment efficiency--empirical

evidence based on Chinese listed companies. J. China

Soft Science. 07, 172-184.

Li, M., Liu, X., Cheng, H. (2020). The impact of party

organization participation in governance on tax

avoidance behavior of listed companies. J. Financial

Research. 46(03), 49-64.

Li, W., Lin, B., Song, L. (2011). The role of internal

control in corporate investment: efficiency promoter

or inhibitor? J. Management World. 02, 81-99+188.

Ma, L., Wang, Y., Shen, X. (2013). Party organization

governance, redundant employees, and executive

compensation contracts in state-owned enterprises. J.

Management World. 05, 100-115+130.

Ma, L., Wang, Y., Shen, X. (2012). A study on the

governance effects of party organizations in Chinese

state-owned enterprises: an insider control

perspective. J. China Industrial Economy. 08, 82-95.

Mao, Z., Wei, Y. (2020). A study on the impact of party

organization embedding on information transparency -

empirical evidence from state-owned enterprises. J.

Soft Science. 34(08), 12-18.

Richardson S .(2006). Over-investment of free cash flow.

J. Review of Accounting Studies. 11(2-3), 159-189.

Tong, Y., Li, X., Zhong, K. (2021). Party organization

participation in corporate governance and bond credit

risk prevention. J. Economic Review. 04, 20-41.

Xie, H., Lv, Z., Chen, Y. (2019). Party organizations

embedded in the board of directors, SOE classification

reform, and investment efficiency. J. Finance and

Accounting Newsletter. 36, 21-26.

Xu, Y. (2019). Progress of research on the political

promotion of senior executives in state-owned

enterprises. J. Journal of Zhongnan University of

Economics and Law. 04, 36-45.

Zhu, J., Qi, X., Tang, G. (2015). Nature of property rights,

government intervention and corporate financial

distress response-a multi-case study based on China

COSCO, Suntech Power and Li Ning. J. Accounting

Research. 05, 28-34+94.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

544