Corporate Financialization and Corporate Financing Constraints in

Non-Financial Companies of Listed Companies in China based on

Experimental and Mathematical Statistics Analysis

Sen Wang and Hong Wang

Department of Accounting and Corporate Finance, Business School of Sichuan University, Chengdu, Sichuan, China

Keywords: Corporate Financialization, Financing Constraints, State Ownership.

Abstract: The improvement of corporate financialization is of great significance for enterprises to ease financing

constraints. Based on the non-financial industry data of China's listed companies from 2007 to 2020, this

paper explores the impact of corporate financialization on corporate financing constraints based on the

moderating effect of state ownership. In order to test the impact of corporate financialization on financing

constraints, this paper adopts the fixed effect model and controls the corresponding variables. In the

robustness test, the lag variable and the Change model are adopted, and the results remain unchanged,

indicating that the improvement of corporate financialization can alleviate the financing constraints faced by

enterprises. The empirical study finds that the improvement of corporate financialization can relieve the

financing constraints faced by enterprises and improve the financing ability of enterprises. In the sample of

non-state-owned enterprises, the effect of corporate financialization on the alleviation of financing

constraints is more obvious.

1 INTRODUCTION

Since the 1980s, market demand has been declining,

and overcapacity in the real economy has led to a

decline in the return on investment of real

enterprises, which have invested more resources into

the high-yield financial industry to obtain returns.

This phenomenon of financialization has been noted

by scholars. Some scholars define financialization

and believe that it is an accumulation mode, and

profits are mainly obtained through financial

channels rather than through trade and commodity

production (Krippner, 2005).

Keynes put forward the "precautionary saving

theory" in 1936, believing that the saving behavior is

to prevent the shortage of cash flow from causing

adverse effects on enterprises. Scholars have found

that financial assets are characterized by short term

and high liquidity, and enterprises can change cash

flow and capital structure by trading financial assets

(Stulz, 1996). Enterprises can invest idle funds in the

financial industry with higher yields, and when they

need funds, they can sell the financial products

invested in the financial industry in time, which can

quickly form more cash flow, thus alleviating the

financing difficulties faced by enterprises.

The report of the World Bank shows that 75% of

non-financial enterprises in China face financing

constraints, the highest proportion among the 80

countries surveyed. Therefore, it is extremely urgent

to solve the difficulty of enterprise financing

constraint.

While corporate financialization and financing

constraints have become the focus of academic

attention, the linkage between the two has been

ignored. Will the improvement of corporate

financialization alleviate the financing constraints

faced by enterprises? Therefore, this paper will

mainly discuss the relationship between corporate

financialization and financing constraints. Compared

with the existing studies, the possible contribution of

this paper lies in that few papers discuss the impact

of corporate financialization on financing constraints.

This paper will also divide enterprises advice

according to the nature of corporate property rights,

and discuss the different properties of property rights

and the difference between the improvement of

financialization and the alleviation of corporate

financing constraints.

Wang, S. and Wang, H.

Corporate Financialization and Corporate Financing Constraints in Non-Financial Companies of Listed Companies in China based on Experimental and Mathematical Statistics Analysis.

DOI: 10.5220/0011754100003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 659-664

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

659

2 MATERIALS AND METHODS

2.1 Corporate Financialization

In the research on the causes of enterprise

financialization, there are mainly two viewpoints:

"reservoir" theory and "investment substitution"

theory. According to the "reservoir" theory, when

enterprises invest idle funds into the financial

industry, they can use financial derivatives to hedge

trading risks and prevent the risk of capital chain

breakage. In the face of future investment

opportunities, they can withdraw large amounts of

funds in time to reduce investment underinvestment

(Stulz, 1996; Bessembinder, 1991). Due to the strong

liquidity ability and low realization cost of financial

products, financial products held by enterprises can

play the role of funds, and can quickly replenish

funds when enterprises need funds to achieve the

"reservoir" effect.

"Alternative investment" phenomenon appeared

in the 1970s last century, America's economy

contracted phenomenon, most of the entity enterprise

losses, industrial investment yields down, enterprise

in order to get more rewards, maximizing benefits,

meet the requirement of maximize shareholder

returns, and had to put resources into other areas

(Stockhammer, 2006).

2.2 Financing Constraints

According to the definition of relevant scholars,

financing constraint is due to the imperfect market

mechanism and other problems, which leads to the

higher external financing cost than the internal

financing cost (Fazzari, 1988). More and more

scholars have noticed that enterprises are faced with

different degree of financing constraints and the

problems brought by financing constraints have

become a research hotspot. Some scholars have

found that enterprises facing financing constraints

will reduce innovation ability, hinder the process of

upgrading of global value chain, restrict the

participation of enterprises in export, and affect the

investment and growth of great business

(Schumpeter, 2003; Gorodnichenko, 2013; Stein,

2003; Sun Lingyan and Cui Xijun, 2012).

Some scholars have found that political

association can alleviate the financing constraints of

Chinese enterprises, and equity incentive can also

reduce the negative impact of financing constraints

(Yan Ruosen and Jiang Xiao, 2019; He Xiaoxing and

Ye Zhan, 2017). However, the existing literature has

not been able to provide sufficient evidence to

support the question of whether corporate

financialization can affect the financing constraints

of enterprises.

2.3 Research Hypothesis

2.3.1 Corporate Financialization and

Corporate Financing Constraints

In the process of production and management,

enterprises face the biggest problem is the problem

of capital chain fracture. How to obtain a large

amount of low-cost capital when the enterprise is in

urgent need of capital is the key factor for the

development and growth of enterprises. Some

scholars have found that the flexibility of financial

assets, compared with production investment, can

enable enterprises to gain profits quickly in the short

term and expand the cash flow of enterprises (Ran

and Duchin, 2010). Enterprises will invest their idle

funds in the financial industry to improve their

financialization and gain more profits, avoid capital

chain fracture caused by insufficient operating profit,

avoid risks and increase their ability to respond to

emergencies (Gehringer, 2013; Easley D, O'Hara M,

2004). The main motivation of the improvement of

corporate financialization is the "reservoir" effect,

which can effectively alleviate the financing

constraints of enterprises. Based on this, hypothesis 1

is proposed in this paper:

H1: The improvement of enterprise

financialization can effectively alleviate the problem

of enterprise financing constraint;

2.3.2 Adjust Action of Property Right Nature

Debt financing is the main financing channel in

China. Due to policy, environment and other factors,

state-owned banks play a dominant role in the

financial system, and financial resources also flow

more to state-owned enterprises. Non-state-owned

enterprises are faced with more serious letter of

credit policy in the process of applying for loans

(Easley and O'Hara, 2004; Li Jian and Chen

Chuanming, 2013). It is difficult for non-state-owned

enterprises to obtain loans from financial institutions.

In order to alleviate the problem of financing

constraints, they will invest part of their funds in the

financial industry, because the "reservoir" effect of

financialization is stronger than the crowding out

effect, which will broaden the financing channels of

enterprises and improve their financing capacity (Wu

and Zhang 2021). Based on this, hypothesis 2 is

proposed in this paper:

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

660

Table 1: Definition and description of major variables.

Variable types Variable name Variable name

Explained variable Financing constraints SA

Ex

p

lanator

y

variables Cor

p

orate financialization Fin

Control variables

Enter

p

rise scale Size

Debt ratio Lev

Return on assets ROA

Return on equit

y

ROE

Cash holdings CASH

Investment o

pp

ortunities TOBINQ

Growth rate of sales revenue Growth

Pro

p

ert

y

ri

g

hts SOE

Nature of the profit and loss LOSS

Largest shareholde

r

First

Board Size Boar

d

Pro

p

ortion of Inde

p

endent Directors ID

Se

p

aration rate of two wei

g

hts SEP

H2: Compared with state-owned enterprises, in

non-state-owned enterprises, the improvement of

corporate financialization can better alleviate the

financing constraints of enterprises.

3 EMPIRICAL DESIGN

3.1 Sample and Data

This paper selects the samples of non-financial listed

companies from 2007 to 2020 for research. The

sample was processed as follows :(1) The ST class

and ST* class enterprise data were removed; (2)

Delete abnormal data and disclose incomplete data;

(3) In order to eliminate the influence of extreme

values and outliers, the upper and lower ends of all

variables were processed by 1%.

3.2 Model Construction and Index

Selection

To explore the impact of enterprise financialization

and financing constraints, the following models are

constructed:

𝑆𝐴

,

= 𝛼

+ 𝛼

𝐹𝑖𝑛

,

+ ∑𝛾𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠

,

+ ∑𝜂𝑌𝐸𝐴𝑅 + 𝜀

,

(1)

Firstly, the degree of financing constraint (SA).

Referring to the research method of Hadlock and

Pierce, this paper adopts SA index as the proxy

variable to measure the degree of financing

constraint, and the calculation formula

SA=-0.737Size+0.043 size^

2

-0.040 Age.

Second, corporate financialization (FIN). This

paper adopts the approach of accounting statement

reconstruction, and uses the ratio of ending financial

assets to the company's ending total assets to

measure the level of enterprise financialization.

Third, Controls. The definitions and explanations of

the main variables in this paper are shown in Table 1

4 EMPIRICAL ANALYSIS

4.1 Descriptive Statistics

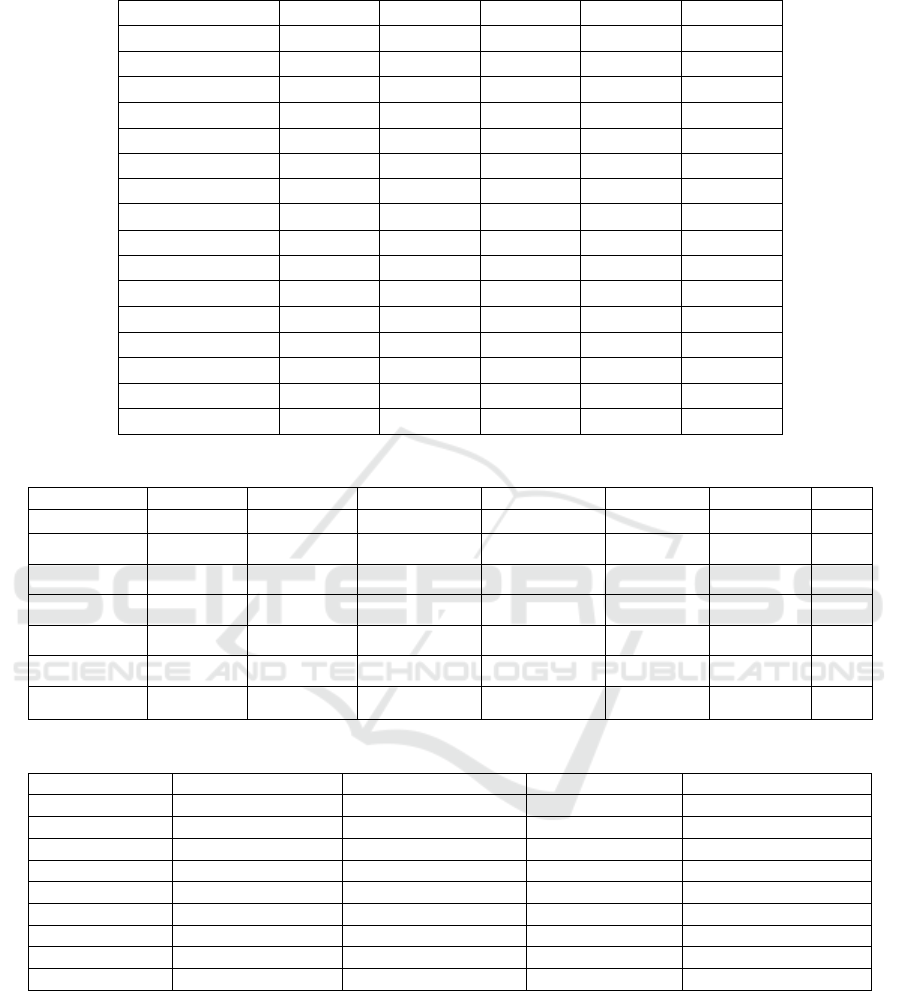

Table 2 is descriptive statistics of all variables. As

can be seen from the results in the table, the mean

value of financing constraint (SA) is -3.323. All

enterprises are faced with financing constraint of

different severity. The average value of corporate

financialization (FIN) is 6.62%, which indicates that

the financialization degree of Chinese enterprises is

not high and is still in the initial stage. In the selected

enterprise data, the average value of property right

nature (SOE) is 0.341, indicating that 34.1% of the

enterprise data are state-owned enterprises.

4.2 Correlation Analysis

Table 3 Pearson phase relation between the main

variables is the content of the table, we can see from

the table enterprise financing constraints (Sa) and

financialization (Fin), the correlation coefficient is

positive, and significant results are good, and can

preliminary validate assumptions, shows that the

enterprise financialization increase enterprise's cash

flow, relieve companies face financing constraints.

Corporate Financialization and Corporate Financing Constraints in Non-Financial Companies of Listed Companies in China based on

Experimental and Mathematical Statistics Analysis

661

Table 2: Descriptive Statistical Table.

DESCRIPTIVE (1) (2) (3) (4) (5)

VARIABLES N mean sd min max

Sa 14,422 -3.323 0.164 -3.690 -2.791

Fin 14,422 0.0662 0.0970 0 0.516

Size 14,422 22.19 1.287 19.79 26.06

Lev 14,422 0.433 0.203 0.0546 0.884

Roa 14,422 0.0450 0.0647 -0.232 0.232

Roe 14,422 0.0743 0.128 -0.591 0.394

Cash 13,975 0.179 0.126 0.0137 0.628

Tobinq 14,422 2.094 1.888 0.149 10.61

Growth 14,422 0.941 2.734 0 20.45

Loss 14,422 0.0919 0.289 0 1

First 14,422 33.69 14.20 9.780 72.63

Board 14,422 2.125 0.194 1.609 2.639

Id 14,422 0.375 0.0526 0.333 0.571

Sep 14,422 4.903 7.547 0 28.81

soe 14,422 0.341 0.474 0 1

Table 3: Table of correlation numbers.

VARIABLES Sa Fin Size Lev Roa Tobin

q

soe

Sa 1

Fin 0.037*** 1

Size 0.265*** 0.00100 1

Lev 0.016* 0.030*** 0.490*** 1

Roa -0.075*** 0.00800 -0.037*** -0.371*** 1

Tobinq -0.096*** 0.00600 -0.478*** -0.457*** 0.345*** 1

soe -0.143*** 0.065*** 0.0120 0.081*** 0.024*** -0.021** 1

Table 4: Hypothesis 1 Test results.

Test (1) (2) (3) (4)

VARIABLES Se

p

arate re

g

ression Full sam

p

le re

g

ression Se

p

arate re

g

ression Full sam

p

le re

g

ression

Fin 0.062*** 0.058*** 0.305*** 0.142***

(4.42) (4.40) (7.33) (4.35)

Controls NO YES NO YSE

Observations 14,422 13,975 14,422 13,975

R-s

q

uare

d

0.001 0.151 0.020 0.505

Com

p

an

y

FE NO NO YES YES

Year FE NO NO YES YES

R

2

_

a 0.00129 0.150 0.0200 0.504

Note: *, ** and *** represent the statistical significance level of 10%, 5% and 1%, respectively. T value in parentheses,

same as below.

4.3 Regression Analysis

4.3.1 Corporate Financing Constraint Is

Related to Corporate Financialization:

In view of Hypothesis 1 proposed above, this paper

tests the impact of firm financialization (FIN) on

firm financing constraints (SA) according to Model

(1). The empirical results are shown in Table 4.

Among the above four regression results, the

relationship between enterprise financialization

(FIN) and enterprise financing constraint (SA) is all

positively correlated, which are significant at the

significance level of 1%. It shows that the fixed

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

662

effect model is correct, verifies Hypothesis 1, and

indicates that the improvement of firm

financialization (FIN) can alleviate the financing

constraints (SA) faced by firms.

4.3.2 Adjust Action of Property Rights:

In the sample grouping of private enterprises, before

and after adding the control variables, there is a

positive correlation between financialization (FIN)

and financing constraints (SA), which is significant

at the significance level of 1%, indicating that in

private enterprises, the improvement of

financialization can alleviate the financing

constraints faced by enterprises. In the sample group

of state-owned enterprises, although the

improvement of enterprise financialization (FIN) can

also alleviate the financing constraint (SA) of

enterprises, the significance level is low and the

effect is not obvious. Hypothesis 2 is verified, which

indicates that in private enterprises, the regulating

effect of property right nature is more significant.

4.3.3 Robustness Test

Change Model and Perform Lag Tests on Variables:

To further eliminate the endogeneity problem caused

by the omitted variables, this paper also uses the

Change Model to test again the impact of the

financing constraints of the financialization of

enterprises. Regression results of Change model are

shown in column (1) of Table 6. Both in the full

sample regression and in the sub-sample group test,

the conclusions are consistent with the above. In

conclusion, a variety of endogenetic tests have

shown that the conclusion of this paper is still valid

after overcoming problems such as missing variables

5 CONCLUSION

5.1 The Research Conclusion

The results show that :(1) the improvement of

corporate financialization can effectively alleviate

the financing constraints of enterprises. (2) Among

non-state-owned enterprises, the improvement of

corporate financialization has a more obvious effect

on alleviating financing constraints.

Table 5: Hypothesis 2 Test results.

Test (1) (2) (3) (4)

VARIABLES SOE=0 SOE=0 SOE=1 SOE=1

Fin

0.382***

(9.99)

0.173***

(5.73)

0.109

(1.07)

0.096

(1.61)

Controls NO YES NO YES

Observations 9,509 9,317 4,913 4,658

R-s

q

uare

d

0.048 0.488 0.001 0.552

Com

p

an

y

FE YES YES YES YES

Year FE YES YES YES YES

R

2

_

a 0.0482 0.487 0.00116 0.551

Table 6: Robustness test results.

Test Change Model The variables are delayed by two periods

VARIABLES All samples SOE=0 SOE=1 All samples SOE=0 SOE=1

D.Fin

0.035**

(2.02)

0.046**

(2.53)

-0.029

(-0.96)

L2.Fin

0.236***

(4.24)

0.185***

(4.72)

0.085

(1.17)

Observations 11,506 7,248 3,879 9,539 5,891 3,473

Company FE YES YES YES YES YES YES

Year FE YES YES YES YES YES YES

Controls NO YES YES NO YES YES

R

2

_a 0.00329 0.120 0.0459 0.0100 0.445 0.506

Corporate Financialization and Corporate Financing Constraints in Non-Financial Companies of Listed Companies in China based on

Experimental and Mathematical Statistics Analysis

663

5.2 Policy Suggestions

5.2.1 Strengthen the Screening and

Supervision of the Financialization of

Enterprises

The state should encourage enterprises to moderately

financialize rather than excessively financialize, and

avoid the hollowing out of the national real industry

and excessive prosperity of the virtual economy,

resulting in serious economic bubbles.

5.2.2 Broaden Financing Channels

Non-state-owned enterprises are faced with many

difficulties when borrowing from banks. Therefore,

enterprises have to invest resources in the financial

industry to expand financing channels.

REFERENCES

Bessembinder, Hendrik. "Forward contracts and firm

value: Investment incentive and contracting effects."

Journal of Financial and quantitative Analysis (1991):

519-532.

Easley D, O'Hara M. Information and the Cost of

Capital[J]. Journal of Finance, 2004, 59(4):1553-1583.

FAZZARI S,HUBBARD M,PETERSEN R G, et al.

Financing corporate constraints investment[J].

Brookings Papers on Economic Activity, 1988,

1:141-206.

Gorodnichenko Y, Schnitzer M. Financial constraints and

innovation: Why poor countries don’t catch up[J].

Journal of the European Economic association, 2013,

11(5): 1115-1152.

Gehringer A. Growth, productivity and capital

accumulation: The effects of financial liberalization in

the case of European integration[J]. International

Review of Economics & Finance, 2013, 25(1):

291-309.

He Xiaoxing, Ye Zhan. Do Equity Incentives Affect Firms'

Financial Constraints?——Empirical Evidence from

Public Firms in China[J]. Business Management

Journal,, 2017,39(01):84-99.

Hadlock C J, Pierce J R. New Evidence on Measuring

Financial Constraints: Moving Beyond the KZ

Index[J]. Review of Financial Studies, 2010, 23(5):

1909-1940.

Krippner G R. The financialization of the American

economy[J]. Socio-Economic Review, 2005(2):

173-208.

Li Jian, Chen Chuanming. Entrepreneurs' political

affiliation, ownership and corporate debt maturity

structure: An empirical study based on the background

of transition economy system[J]. Journal of Financial

Reserch,2013(03):157-169.

RAN, DUCHIN. Cash Holdings and Corporate

Diversification[J]. Journal of Finance, 2010.

Stulz R M. Rethinking Risk Management[J]. Journal of

Applied Corporate Finance, 1996, 9(3):8-25.

Song Jun, Lu Yang. U-shape Relationship between

Non-currency Financial Assets and Operating Profit:

Evidence from Financialization of Chinese Listed

Non-financial Corporates[J]. Journal of Financial

Research,2015(06):111-127.

Stockhammer E. Financialisation and the slowdown of

accumulation[J]. Working Papers, 2000, 28(5):

719-741.

Stockhammer E. Shareholder value orientation and the

investment-profit puzzle[J]. JPKE: Journal of Post

Keynesian Economics, 2006, 28(2): p.193-215.

Schumpeter J, Backhaus U. The theory of economic

development[M]//Joseph Alois Schumpeter. Springer,

Boston, MA, 2003: 61-116.

Stein J C. Agency, information and corporate

investment[J]. Handbook of the Economics of

Finance, 2003, 1: 111-165.

Sun Lingyan, Cui Xijun. How Does FDI Affect Private

Firms’ Financing Constraints?——Firm-Level

Evidence from China [J]. South China Journal of

Economics, 2012(01):47-57.

Tornell, Aaron. "Real vs. financial investment can Tobin

taxes eliminate the irreversibility distortion?." Journal

of Development Economics 32.2 (1990): 419-444.

Wu Weiwei, Zhang Tianyi. The Asymmetric Influence of

Non-R&D Subsidies and R&D Subsidies on

Innovation Output of New Ventures [J]. Management

World,2021,37(03):137-160+10.

Yan Ruosen, Jiang Xiao. The Multiple Relationship

Model and Empirical Research of Institutional

Environment, Political Connections, Financing

Constraints and R&D Investment[J]. Chinese Journal

of Management,2019,16(01):72-84.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

664