Designing and Creating Expert Advisor on Forex Based on Moving

Average Indicator Moving Average Indicators Using Martingale

System

Muhammad Farman Andrijasa

1a

, Anton Topadang

1

, Dwi Suprat Tandi

1

, Saiful Adli Ismail

2

and Norulhusna Ahmad

2b

1

Information of Technology, State Polytechnic of Samarinda, Cipto Mangun Kusomo Street, Samarinda, Indonesia

2

Razak Faculty of Technology and Informatics, Universiti Teknologi Malaysia, Kuala Lumpur, Malaysia

Keywords: Expert Advisor (EA), Forex, Metatrader, Moving Average, Martingale.

Abstract: The foreign exchange market is a form of a futures market where sellers and buyers of foreign exchange meet.

Although it is not tangible like the market that is commonly found, although only online this market is a large

capital market and has a physical office even though this market is online this market has problems that can

interfere with the comfort and stability of profits when trading manually in the forex market, namely lack

experience, psychological pressure, overconfidence, impatience, not being patient looking for opportunities,

carried away emotions, and also traders who have to be constantly in front of the computer to maintain and

always control the market situation. The creation of software contains a trading system using moving average

indicators using the martingale system. This software is made in the Meta Editor application which uses the

MQL language as its programming language which tends to be similar to the C++ language. Later this

application can run on the MetaTrader4 application. The expert advisors applied are expected to help traders

and be useful to facilitate trader performance to make it more effective and efficient to carry out trading

activities on the forex market. The created Expert Advisor has been tested in 2021 in EURUSD currency in

the M30 timeframe. The created application can make a profit of 57% of the value of the initial deposit.

1 INTRODUCTION

Forex investment is one of the lucrative business

lands because the level of return is very high. In the

forex market, the turnover of money reaches 3.8

trillion USD every day. Fluctuating price movements

and high levels of liquidity make forex investment

one of the commodities that have the potential to get

profits or large and fast profits. However, just like the

promised profits, this business also has the same risk

of loss as the promised profit (Busman et al., 2017).

Large risks can be minimized by conducting an

analysis of the market. Analysis is an activity that

takes into account, weighs and measures past events

or data until now to predict the direction of future

price movements. There are two types of analysis

known in the world of trading, namely technical

analysis and fundamental analysis. Fundamental

a

https://orcid.org/0000-0001-5016-8600

b

https://orcid.org/0000-0001-9991-343X

analysis is an analysis based on economic, political

and security situations and conditions globally, while

technical analysis is more based on market

movements.

Based on the problems in the description above, it

can be concluded that a trader must have preparation

in carrying out trading activities including

psychology when trading where every current

transaction can bring profits and losses, than

management of the balance or money owned, time

that cannot be taken into account when carrying out

trading activities, as well as good analysis in

determining selling or buying. For this reason, this

thesis takes the title: "Designing and Making Expert

Advisors on Forex Based on Moving Average

Indicators Using the Martingale System". The

research made will produce an application that can be

used by forex traders, which can make it easier for

Andrijasa, M., Topadang, A., Tandi, D., Ismail, S. and Ahmad, N.

Designing and Creating Expert Advisor on Forex Based on Moving Average Indicator Moving Average Indicators Using Martingale System.

DOI: 10.5220/0011813900003575

In Proceedings of the 5th International Conference on Applied Science and Technology on Engineering Science (iCAST-ES 2022), pages 461-465

ISBN: 978-989-758-619-4; ISSN: 2975-8246

Copyright © 2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

461

traders to make transactions automatically which

makes trading easier and more efficient.

2 RESEARCH METHODS

There are three main processes, namely the Initial,

Ticking, and Close processes. The Initial process is

the initial stage by which the trader gives orders of

input values. While Ticking is a process where the

Expert Advisor monitors the movement of price

values, which causes floating loss or floating profit.

According to the conditions that occur, ea will run the

martingale method if there is a floating loss. And

finally the Closing process, the EA will end the

transaction according to the conditions reached where

it stops at the point of profit or loss (Dinata, H., 2018).

Initial process, the input needed includes the

period of the moving average indicator, stop loss

point, profit take point, slippage, and martingale point

lots. The ticking process is to let the EA run

automatically so that the EA always observes price

movements continuously. In this process, the EA will

be ready to use the martingale system, depending on

the ongoing price movement. The last stage of the

process is close, this stage calculates the profit or loss

of each completed transaction.

2.1 Moving Average

Average is an indicator that calculates the average

price of an asset in a certain period, then connects in

the form of a line. The average value can come from

the opening price (Open), close (Close), high (high),

lowest (Low), or mid (Median) of a chart candle for a

certain period.

Average is part of the lagging indicator. This

means that this calculation method is based on

previous events and explains information about

market history data. The use of the Moving Average

indicator is as a predictive tool, but rather provides

confirmation. The Simple Moving Average has the

simplest protection pattern and is often used by

traders. This method can be calculated by adding to

the current price series of a period, and then limiting

the number of periods.

Moving Averages can help traders recognize the

prevailing trend of market price values. If the price

currently occupies an area on the Moving Average

line, it means that the price tends to fall or be bearish.

Conversely, prices that are above the Moving

Average line provide bullish trend information or

tend to rise.

𝑆𝑀𝐴

𝑝𝑀 𝑝𝑀 1 ⋯𝑝𝑀𝑛1

𝑛

(1)

Information:

p = actual number

M = time or period

n = lots of actual data

2.2 Martingale Theory

Martingale is a strategy that existed since the 18th

century in France. This strategy was used by gamblers

at that time, where gamblers needed to double their

bets every loss. the goal is to recover the previous

losses coupled with the gains. Martingale is a

sequence of random variables or rather processes at a

given time in a realized order, the expectation of the

next value in its order is equal to the observed value.

The martingale system is a fairly interesting

probability system, which can be applied to various

aspects of life. There are some situations where in

order to be able to implement a martingale system, to

increase the knowledge of application about to real

situations not just theoretical propaganda. One of its

areas of application is a brief prediction of market

prices. The martingale concept can be known more

about the opportunities and possible outcomes of

future predictions. (Victor, O,O. 2015).

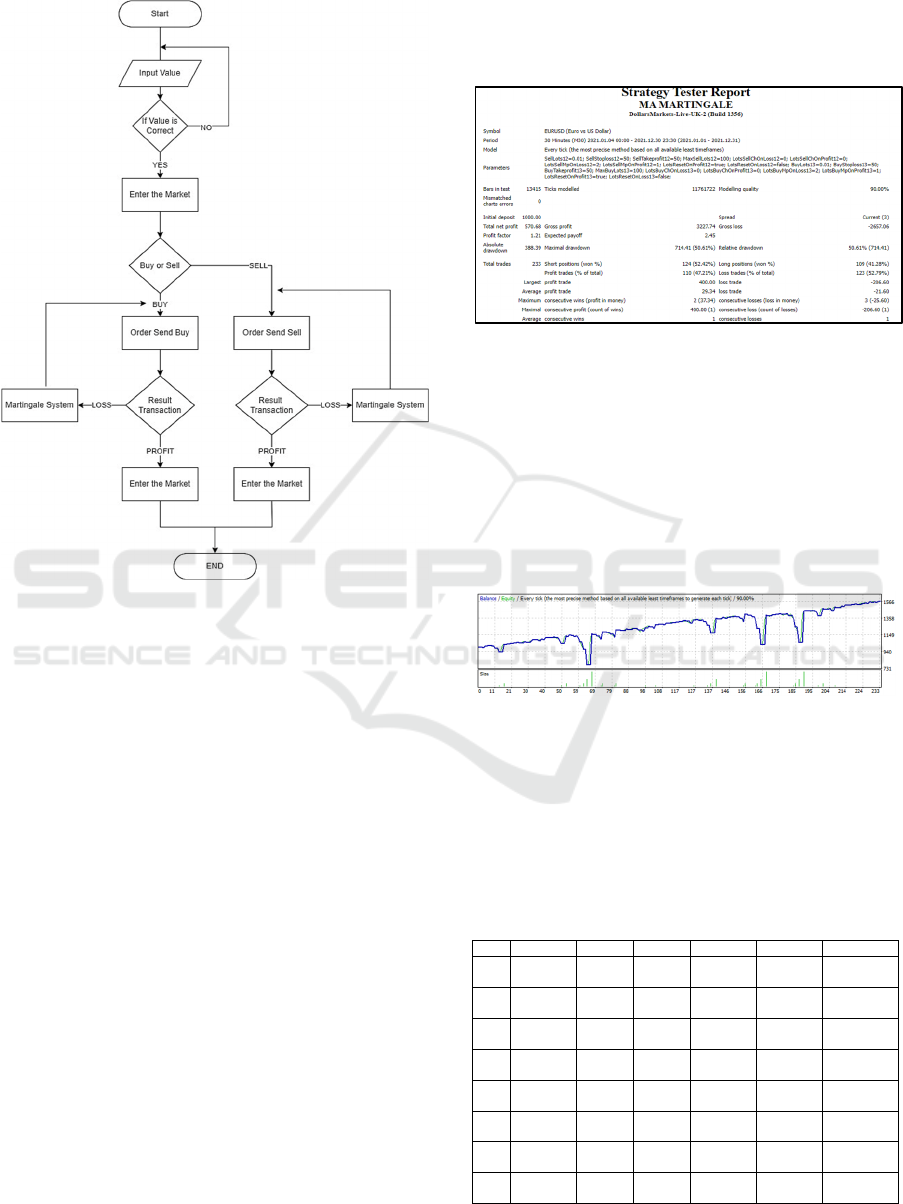

Figure 1: Martingale System.

Example:

It can be seen in figure 2.7 for example, a trader

opened an Open Buy eur/USD with lots of 0.1 at a

price of 2,100, but it turned out that the price moved

down to the level of 2,050 so that it experienced a

floating loss of -50. Then again open buy with lots of

0.2 at the price of 2,050 at that moment. That way, it

now means that there are 2 open postions. The first

position is a floating loss of -50 and the second

position is 0. If the price then rises towards 2,100 then

the first position rises to 0 (BEP) and the 2nd position

becomes a profit of 100 (lots 0.2 x 50 pips = 100|lots

0.2 then 1 pips = $2|).

iCAST-ES 2022 - International Conference on Applied Science and Technology on Engineering Science

462

2.3 Design of Expert Advisor

Figure 2: Flowchart Program Code.

Figure 2 illustrates the series of expert advisor

programs starting from the user or trader who inputs

the value in the parameters into the expert advisor,

where the value inputted on the MetaEditor platform

returns whether it is correct then the indicator is

appropriate then it is ready to run. After the program

is ready, the EA will wait where the parameters of the

moving average indicator line inputted earlier will cut

each other, then the EA will execute with an open

order, namely opening a sell or buy transaction

according to the intersection of the moving average

indicator line.

After the transaction occurs, if you get a loss, the

expert advisor will reopen a new transaction with a

larger lot value, after getting a profit, the lot value will

return to the initial lots value of 0.01 lots. In the Close

section, it serves to delete all objects contained in the

previous graphic chart when the expert advisor ran

before, when the expert advisor is turned off, the

objects that were previously will disappear into the

default view or to the default view.

3 RESULT EVALUATION AND

VALIDATION

3.1 Backtesting EA Martingale

Figure 3: Report EA Martingale.

Figure 3 is a report from the results of the EA

backtesting test martingale. That is done information

about the EURUSD currency market. With a period of

30 minutes (M30) with data in 2021. It uses the every

tick model which is an example of a test model that is

closest to the original market. The candlestick chart

bars that have been used in the test are as many as

13415. With an initial balance of $1000, use the current

spread. With such backtesting tests it yielded 570$.

Figure 4: Graphic Account Balance.

Figure 4 is information about the movement of the

user's balance since the beginning of the deposit. There

is a chart that shows a fairly deep decrease in the

balance and subsequently experienced a very drastic

increase. Which shows that martingale theory can

work according to the design of the program code.

Table 1: Transaction EA Martingale.

# Time T

yp

e Lo

t

Price Result Balance

1

4/1/21

21:30

Sell 0.01 1.2248 1000

2

4/1/21

21:30

Modify 0.01 1.2248

3

5/1/21

21:30

Buy 0.01 1.2251

4

5/1/21

21:30

Modify 0.01 1.2251

5

5/1/21

18:45

S/L 0.01 1.2298 -6.24 992.76

6

5/1/21

19:00

Sell 0.02 1.2294

7

5/1/21

19:00

modify 0.02 1.2294

8

5/1/21

19:07

T/P 0.01 1.2301 6.18 999.94

Designing and Creating Expert Advisor on Forex Based on Moving Average Indicator Moving Average Indicators Using Martingale System

463

The results of the martingale expert advisor test

that provides information about the current

transaction date which includes date and time

information. All tests had 699 transactions on the test.

With the type of transaski sell, modify, or buy. Size is

the amount of lots traded, price is the market price

when the transaction is carried out with stop losses or

takeprofit points that have been determined in writing

the program code. The profit column provides

information about losses or profits obtained, the

balance column is the user's balance information after

the transaction ends.

3.2 Backtesting EA Moving Average

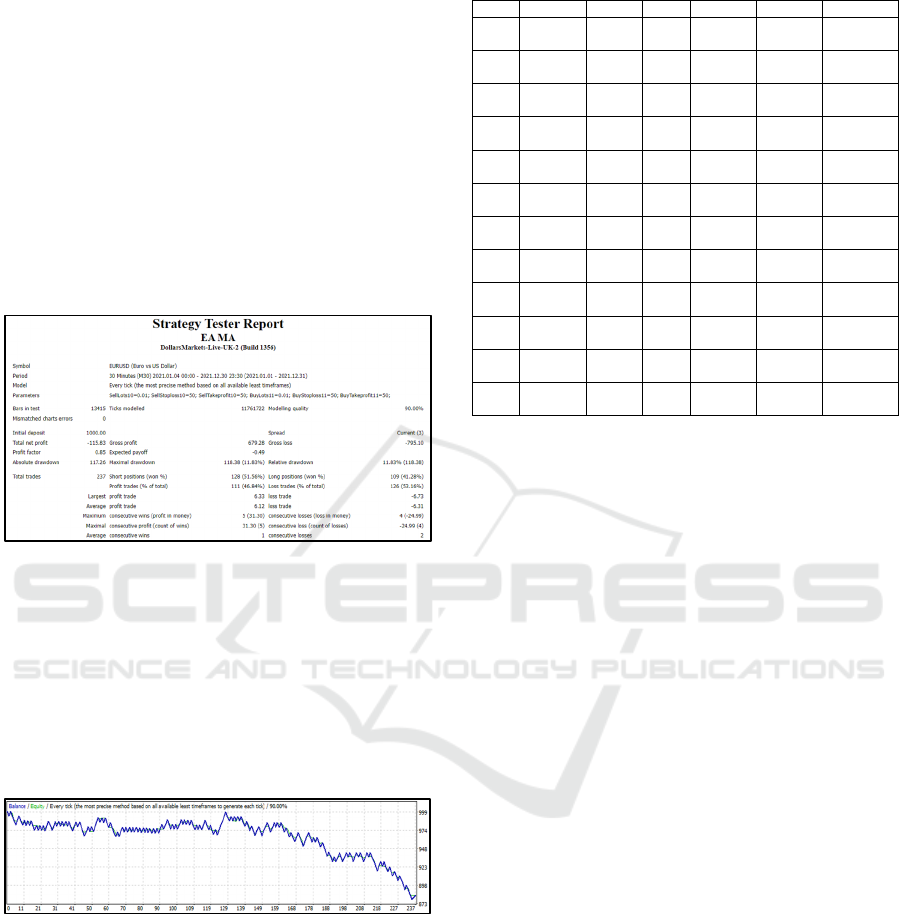

Figure 5: Report EA Moving Average.

In the results of backtesting testing with moving

average expert advisors, it can be seen from the

information in the figure 5. Providing test information

was carried out on the EURUSD market, with a

period of 30 minutes from January 1, 2021, to

December 30, 2021. The test uses the every tick

model, with parameters corresponding to the written

program code.

Figure 6: Graphic Account Balance.

Figure 6 is information about the movement of the

user's balance from the beginning of the deposit. The

graph shows a continuous decline. This is because it

only uses moving averages as a reference for

transactions, without using theory martingale in the

program code flow. The difference in EA made

without the use of martingale theory is very obvious

in the movement of the user's balance in figure 6.

Table 2: Transaction EA Moving Average.

# Time T

yp

e Lot Price Result Balance

1

4/1/21

00:01

Sell 0.01 1.2280 1000

2

4/1/21

00:01

Modify 0.01 1.2280

3

4/1/21

11:16

S/L 0.01 1.2290 -6.25 993.75

4

4/1/21

11:16

Sell 0.01 1.2287

5

4/1/21

11:16

Modify 0.01 1.2287

6

4/1/21

21:30

Buy 0.01 1.2251

7

4/1/21

21:30

modify 0.01 1.2251

8

5/1/21

19:07

T/P 0.01 1.2301 6.18 999.93

9

5/1/21

19:07

Buuy 0.01 1.2304

10

5/1/21

19:07

Modify 0.01 1.2304

11

6/1/21

09:10

S/L 0.01 1.2237 -6.24 992.7

12

6/1/21

09:10

S/L 0.01 1.2301 -6.53 987.17

The results of the moving average expert advisor

test in table 2 provide information about the current

transaction date which includes date and time

information. All tests conducted using moving

average expert advisors resulted in 711 transactions.

With the type of transaction sell, modify, or buy. Size

is the number of lots traded, price is the market price

when the transaction is carried out with stop losses or

take profit points that have been determined in

writing the program code. The profit column provides

information about losses or profits obtained, the

balance column is the user's balance information after

the transaction ends. Table 2 only shows 12 of the

total transactions of 711

4 CONCLUSION

The conclusions that can be drawn after conducting

this study. Comparing the results of an Expert

Advisor who uses the Martingale system, it is more

profitable, but must have enough capital or deposit in

order to be able to run the program from the robot.

For Expert Advisors who only use the Moving

Average indicator, the results get a loss which can be

seen from the backtest test results in figure 5. The

results of the backtest test on the Expert Advisor

using the Martingale system are found in figure 3

which gets a profit of 57% of the deposit value or

initial capital.

The suggestions that the Expert Advisor made can

be even better at carrying out transactions with

additional features such as trailing stop, which is a

modification of an ongoing transaction whose value

iCAST-ES 2022 - International Conference on Applied Science and Technology on Engineering Science

464

is based on a certain percentage of the asset price in

the current market situation, to make losses more

minimized and profits can be maximized.

Furthermore, a feature can be added that can set the

value of Lots so that it can change according to the

balance or balance contained in the account of each

trader so that the expert advisor can be used without

the need for large capital.

REFERENCES

Busman, B., Nurhayati, N., Amali, F., & Muttaqin, Z.

(2017). Penerapan Big Data Pada Forex Trading

Menggunakan Analisa Statistik Dengan Breakout

Strategy. Pseudocode, 4(2), 137–143.

https://doi.org/10.33369/pseudocode.4.2.137-143

Dinata, H. (2018). Implementasi Expert Advisor Dengan

Algoritma Fibonacci Pada Analisa Teknikal Untuk

Perdagangan Forex. Journal on Information Systems,

Technology of Information and Communications, 1,

47–56. http://repository.ubaya.ac.id/32480/11/Jurnal

Nasional 2 Full Text-HENDRA DINATA.pdf

Victor, O. O. (2015). Martingale Theory. Eastern

Mediterranean University North Cyprus: Master of

Science in Applied Matheatics and Computer Science.

Alqodri, F., Lestari, S., & Wardani, N. E. (2015). Teknologi

Trading Berbasis Expert Advisor ( Ea ) Pada Pasar

Valuta Asing Dengan Teknik Kalender Ekonomi.

Seminar Nasional Teknologi Informasi Dan

Multimedia, 6–8.

Yudifera, S., Pattah, D., Santoso, L. W., & Santoso, M.

(2004). Pembuatan Aplikasi Perdagangan Valas

Dengan Metode Elman Neural Network. 1–6.

Lamperti, J. (1977). Martingale Theory. September, 234–

249. https://doi.org/10.1007/978-1-4684-9358-0_10

Widjiyati, N. (2022). Analisa Prediksi Algoritma Simple

Moving Average Dengan Pendekatan Multi Periode.

Smart Comp: Jurnalnya Orang Pintar Komputer, 11(1),

96–99.https://doi.org/10.30591/smartcomp.v11i1.3206

Designing and Creating Expert Advisor on Forex Based on Moving Average Indicator Moving Average Indicators Using Martingale System

465