Research on Quantitative Investment Strategy of Stock Index Futures

Based on XGBoost Model

Hongxin Zhu and Anmin Zhu

College of Software Engineering, Shenzhen University, Shenzhen University, Nanshan District, Shenzhen, China

Keywords: XGBoost Model, Stock Index Futures Prediction, Quantitative Investment.

Abstract: In the past two decades, China’s economy has been developing continuously. The emergence of various

emerging industries has continuously introduced more value choices to the financial market, which has also

made the stock market more volatile. People have been studying and predicting the stock market for a long

time, hoping to find the rule of stock price fluctuations. It is believed that similar stock price fluctuations will

occur in the previous performance of stock price fluctuations at a certain time in the future, therefore

improving the accuracy of stock forecasts. In this paper, the prediction of the CSI 300 Index Futures is studied

based on the XGBoost model. It designs a quantitative investment strategy to trade the CSI 300 Index Futures

based on the prediction, to study the accuracy of the XGBoost model applied to financial market forecasts.

1 INTRODUCTION

As of August 2021, there are already more than 4,000

stocks in the Chinese stock market. At the same time,

the types of data provided by the exchanges are

constantly enriching, and the frequency of data

updates is constantly increasing. At present, the

monthly market data of the A-share market has

exceeded 1000G. In the A-share market, most private

investors invest in stocks through personal intuition,

experience, or policy analysis. But because of the lack

of scientific basis, there are great risks. Quantitative

investment can make trading strategies more

scientific and more systematic so that it can reduce

investment risks. It analyses historical data through

mathematical models to replace human subjective

judgments and obtains the investment portfolio that

obtains excess returns on the largest probability field.

Quantitative investment is to replace human

subjective judgments with mathematical models. It

uses data analysis technology to calculate the

investment portfolio that can obtain excess returns

from a large amount of historical data. In the 1970s,

quantitative investment began to develop in the US.

By the end of the third quarter of 2019, the scale of

quantitative hedge funds in the United States had

reached 1 trillion dollars. Well-known quantitative

investment companies such as Bridgewater,

Renaissance, and AQR Capital Management had

exceeded 60 billion dollars and obtained generous

returns for investors. In China, three major stock

index futures were launched in 2010 and the national

policy allowed private equity funds to participate in

the capital market in a more legal capacity in 2013,

which promoted the development of quantitative

investment in China. 2010 to 2015 is the golden

period of quantitative investment in the domestic

development. The scale of quantitative investment

has reached the level of ten billion RMB. After 2015,

due to the stock market turbulence, stock index

futures discounts and the failure of traditional

quantitative models, quantitative investment entered

a low ebb in 2016 and 2017. But after 2018, with the

maturity of the market and the promotion of relevant

policies on stock index futures, China's quantitative

investment has begun a new round of rapid growth.

By 2021, China's quantitative investment

management scale has exceeded 500 billion yuan.

Financial derivatives are constantly being enriched

and improved, market mechanisms are constantly

being optimized, and market transaction volume and

volatility are constantly being enlarged. There is still

broad room for development in China's quantitative

investment industry.

The technologies of machine learning and deep

learning are constantly developing. Applying them in

the financial field has played an important role in

promoting the development of quantitative

investment. SVM is a data mining method developed

Zhu, H. and Zhu, A.

Research on Quantitative Investment Strategy of Stock Index Futures Based on XGBoost Model.

DOI: 10.5220/0011825700003612

In Proceedings of the 3rd International Symposium on Automation, Information and Computing (ISAIC 2022), pages 31-36

ISBN: 978-989-758-622-4; ISSN: 2975-9463

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

31

from statistical theory, which is suitable for solving

small-sample, nonlinear and high-dimensional

pattern recognition problems (Li & Wang, 2018).

Machine learning was applied in the domestic

financial field 10 years ago. Wang Dong used the

SVM model and BP neural network to predict the

SSE 50 Index (Wang, 2007). The result shows that

the deviation of the SVM model is smaller than that

of the BP model and it has a higher direction

prediction accuracy. Until now, scholars have been

exploring and strengthening the application of

machine learning to stock forecasting. In the research

on the short-term stock price prediction of 10 stocks

using the SVM model with the RBF kernel function

(Liu et al., 2020), it was found that the prediction

model based on the support vector machine has

higher accuracy and better prediction effect than the

original prediction algorithm.

The XGBoost model is a machine learning model

proposed by Chen Tianqi (Chen & Guestrin, 2016). It

is a decision tree algorithm proposed based on the

idea of boosting, which has the advantages of fast

training speed, high training accuracy, and not easy to

overfit. Many scholars apply the XGBoost model to

the financial field to test whether the model can

achieve better results. Li Xiang (Li, 2017) applies the

XGBoost model to quantitative stock selection. The

research results show that the designed quantitative

stock selection program can outperform the market

return, and the total return of the selected stock

portfolio is 287%. In comparing the prediction effects

of neural network, SVM, and XGBoost models on 1-

minute high-frequency financial data (Huang & Xie,

2018), they selected CSI 300 stock index future as the

research data. It found that the predictive ability of the

XGBoost model is better than the traditional neural

network and SVM model. In the study of applying

XGBoost model to stock selection strategy (Li &

Zhang, 2019), it constructs a dynamic weighted

multi-factor stock selection strategy. The result

indicate that the model can improve the performance

of multi-factor stock selection strategies. Yan Wang

and Yuankai Guo (Wang & Guo, 2020) proposed the

DWT-ARIMA GSXGB hybrid model, which made

improvements on the XGBoost model. They found

that compared with the original model, the model has

better approximation ability and generalization

ability in stock price prediction. Yang Yang (Yang,

2021) proposed a predictive model of stock trading

behaviour selection and hyperparameter optimization

based on XGBoost model. Research has found that it

can effectively analyse attributes of different

dimensions and predict stock prices.

Stock index futures play an important role in risk

hedging in investment strategies. It has the

characteristics of hedging, value discovery and

investment arbitrage. The CSI 300 Index covers a

wide range. Its price changes are mainly affected by

systemic risks, so it is easier to predict than stocks.

Changes in stock index prices play an important

guiding role in the investment of individual stocks

and futures. Therefore, it is of great practical

significance to make accurate judgments on the rise

and fall of stock indexes. This paper will use the

XGBoost model to predict the rise and fall of the CSI

300 Index Futures prices. Then, according to the

forecast results, an investment strategy is constructed

to trade the main CSI 300 contracts. In the design of

price fluctuation prediction, the price fluctuation

judgment is designed into three situations, namely

"rising", "falling", and "fluctuating", rather than just

judging price rises and falls. Then, through empirical

testing, it studies the prediction effect of the XGBoost

model on the three types of price fluctuations of the

CSI 300 Index Futures and the profitability of the

constructed investment strategy.

The structure of this article is as follows. Chapter

One is Introduction. It briefly describes the research

background and status of applying machine learning

to the financial field, as well as the main research

content and structural arrangement of this paper. The

second chapter mainly introduces the relevant

theories of the XGBoost model. Chapter 3 describes

the construction and optimization of the model and

explains the investment strategy designed. The fourth

chapter uses historical data to train the model and

empirically test the model in the actual financial

market, and analyses the experimental results. The

fifth chapter summarizes this paper.

2 XGBoost MODEL

The XGBoost model is based on the idea that all base

classifiers of the Boosting algorithm are connected.

Each split of the tree in the model will generate a new

tree in the direction of the negative gradient of the

previous training. After training, the sum of all tree

scores is taken as the sample prediction value. The

goal of the algorithm is to have a considerable

generalization ability while the error of the

algorithm's predicted value is small. Because the

XGBoost model is based on the engineering of the

GBDT decision tree algorithm, it is also an additive

model composed of multiple decision trees. When

each leaf node of the tree is split, the model

enumerates all different tree structures. It uses a

ISAIC 2022 - International Symposium on Automation, Information and Computing

32

scoring function to find an optimal structure of the

tree and adds it to the model, which uses a greedy

algorithm to repeat this process. When traversing all

the feature points, in order to limit the depth of the

tree, the model adds a threshold. The leaf nodes are

split only when the gain is greater than the threshold.

In order to prevent over-fitting, the model adds a

regular term to the objective function. The objective

function of the XGBoost model is as follows:

𝑂𝑏𝑗

𝑙𝑦

, 𝑦

Ω

𝑓

𝐶

(1)

𝑦

𝑦

𝑓

𝑥

(2)

𝑓

𝑇

1

2

‖

𝑤

‖

(3)

In formula (1), 𝑙is the loss function,

𝑓

is

the regular term function, where

is the

hyperparameter, and 𝑇 is the total number of leaf

nodes.

‖

𝑤

‖

is the L2 regular term, where 𝑤 is

the weight of the leaf node. Penalizing leaf nodes with

larger weights through the L2 regular term can reduce

the occurrence of over-fitting. 𝐶 is a constant term.

Unlike the GBDT model, the XGBoost model

uses Taylor's second-order expansion, which is more

conducive to the speed and accuracy of gradient

descent. The formula of the XGBoost model after

Taylor's second-order expansion is as follows:

𝑂𝑏𝑗

𝑙

𝑦

,𝑦

𝑔

𝑓

𝑥

1

2

ℎ

𝑓

𝑥

𝑓

𝐶

(4)

𝑔

𝐿𝑦

,𝑦

𝑦

(5)

ℎ

𝐿𝑦

,𝑦

𝑦

(6)

When the tree is split according to the objective

function, the model cannot be split endlessly. So the

maximum depth of the tree and the sample weight

threshold need to be set in the model. When the

maximum depth is exceeded or when the sum of the

sample weights is less than the set threshold, the

splitting of the tree needs to be stopped to prevent

overfitting.

3 MODEL BUILDING

3.1 Feature Engineering

Because the research is to predict the rise, fall and

flutuation of the CSI 300 Index Futures. According to

the momentum effect, that is, the stock return tends to

continue the original direction of movement, the

research selects the momentum factor as the leading

technical indicator as the input feature. The research

selected 15 input features, namely, opening price

(open), highest price (high), lowest price (low),

closing price (close), trading volume (volume),

Moving Average Convergence and Divergence

(macd), logarithmic rate of return (logreturn),

amplitude (diffreturn), William index (lwr1, lwr2),

differential Value (dif), means of similarities and

slow smooth moving average (dea), moving average

indicator (ma, mar10, mar50). The model training

data has 1500 trading days of the CSI 300 Index

Futures trading data. In order to test the effectiveness

of the feature vector, this paper uses the XGBoost

model to calculate the information gain of the initial

feature vector, which is used to express the

importance of each feature value. The result is shown

in Figure 1.

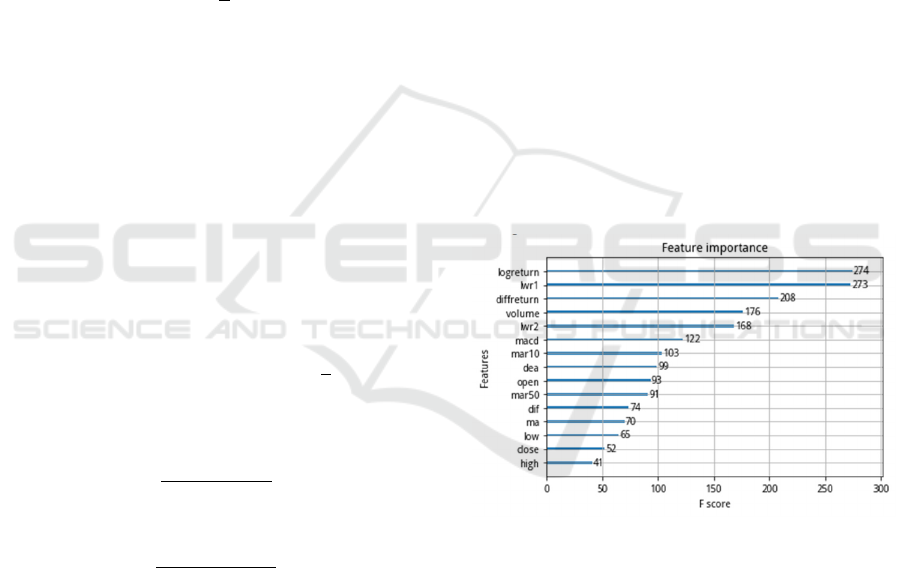

Figure 1: Feature Importance.

Among them, the greater the information gain of

the feature, the stronger the classification ability. It

can be seen from the figure that each feature vector

has a certain degree of contribution to the model。

This guarantees the validity of each feature vector.

The most important thing in the process of

building a model is to learn the relationship between

the training sample set and the label. The appropriate

label is related to the effect and direction of the model

learning. Since this article designs three types of price

change trends: "rising", "falling" and "fluctuating",

the labels of stock index rise and fall should also be

Research on Quantitative Investment Strategy of Stock Index Futures Based on XGBoost Model

33

designed into three. Table 1 illustrates the logic of the

label design.

Table 1: Interpretation table of the label.

Label Condition

+1

𝑚𝑎5

𝑚𝑎5

0

and 𝑃

𝑃

0

-1

𝑚𝑎5

𝑚𝑎5

0

and 𝑃

𝑃

0

0 othe

r

When today’s 5-day moving average is greater

than yesterday’s 5-day moving average, and today’s

price is greater than yesterday’s closing price, it

means a rising situation. Then the y label is recorded

as "+1". When today’s 5-day moving average is

smaller than yesterday’s 5-day moving average, and

today’s price is lower than yesterday’s closing price,

it means a falling situation. Then the y label is

recorded as "-1". Other conditions are price

fluctuations, and the y label is recorded as "0".

Finally, the XGBoost model is used to learn the

correlation between the input vector and the results of

the CSI 300 Stock Index to study the accuracy of the

model’s prediction of the stock index and the return

of the quantitative investment strategy based on the

XGBoost model.

3.2 Model Optimization

Different combinations of model parameters will

have different effects on the results of the model. In

order to find the optimal combination of parameters,

this paper adopts a grid search to optimize the model

so that the model can obtain the highest rate of return.

For the parameters of the XGBoost model, four key

parameters, the number of iterations (n_estimators),

learning rate (learning_rate), maximum tree depth

(max_depth), and gamma were selected for tuning in

this paper. The specific method is to specify the

number of iterations parameter candidate sequence as

[30,50,100,150,300,400], the learning rate parameter

candidate sequence as [0.01,0.05,0.1,0.3,0.5], and the

maximum tree depth parameter candidate sequence as

[ 4,5,6,7,8], specify the gamma parameter candidate

sequence as [0.1,0.2,0.3,0.4], and then use the grid

search method to select the most suitable parameter

from each parameter candidate sequence for the

model to use.

3.3 Model Optimization

After constructing a prediction model based on the

XGBoost model, this paper will use the model to

predict the price fluctuation trend of the CSI 300

Index Futures. Then it combines the prediction results

of the model to design investment strategies. Figure 2

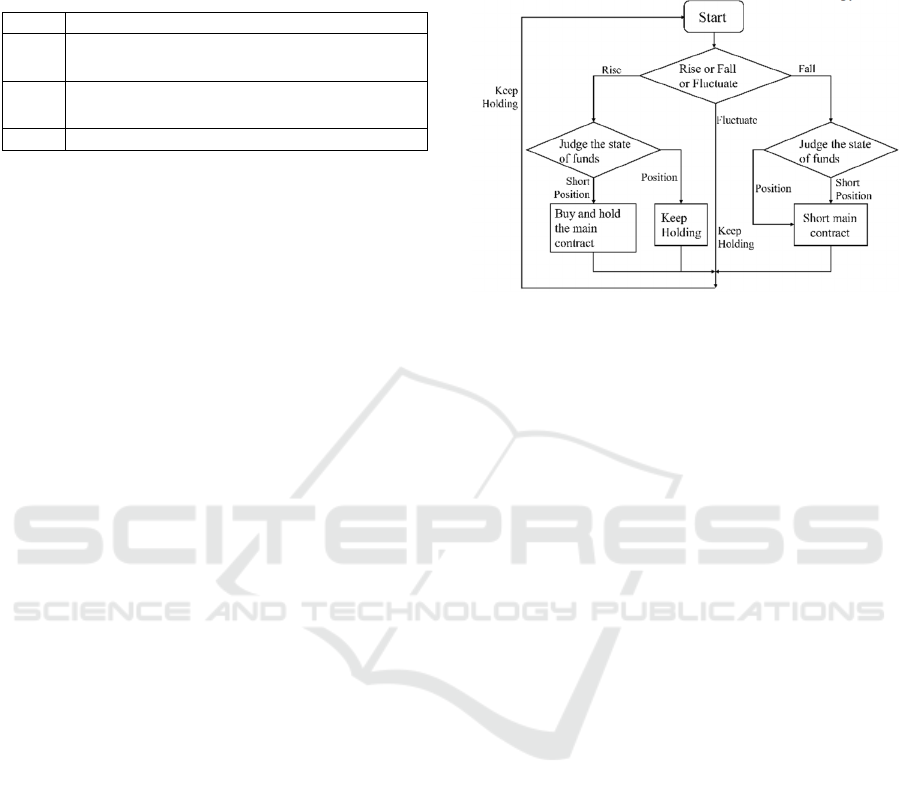

shows the framework of the investment strategy.

Figure 2: Investment strategy framework.

The main idea of the investment strategy is to

judge the position status when the forecast result is

that the price change trend of the next trading day is

rising. If the position is short, it will buy the nearest

CSI 300 main contract, and if the position is open, it

will keep the position unchanged. When the forecast

result is that the price change trend of the next trading

day is down, it will judge the position status. If the

position is open, it will close the position. If it is a

short position, it will perform short selling. The rest

is that if the price trend of the next trading day

fluctuates, the position will continue to be

maintained. In order to keep up with the market trend,

the model makes daily judgments and conducts

transactions based on investment strategies. Since this

investment strategy is to verify the actual effect of the

forecasting model, there is no division processing in

the investment strategy.

4 EMPIRICAL TEST

All the data in this article comes from the Jukuan

quantitative trading platform, and the investment

strategy backtest is carried out on this platform. In

this range, the market returns not only rise and fall,

but also have more volatility. It can effectively test

whether the XGBoost model can judge different stock

index trends and show the return of quantified

investment strategies based on the XGBoost model.

This chapter shows the strategy backtest graph based

on the XGBoost model and the strategy backtest

graph after optimizing model parameters using grid

search.

ISAIC 2022 - International Symposium on Automation, Information and Computing

34

4.1 Strategic Performance

This article uses historical data for backtesting on the

JoinQuant quantitative trading platform. This article

uses historical data for backtesting on the Jukuan

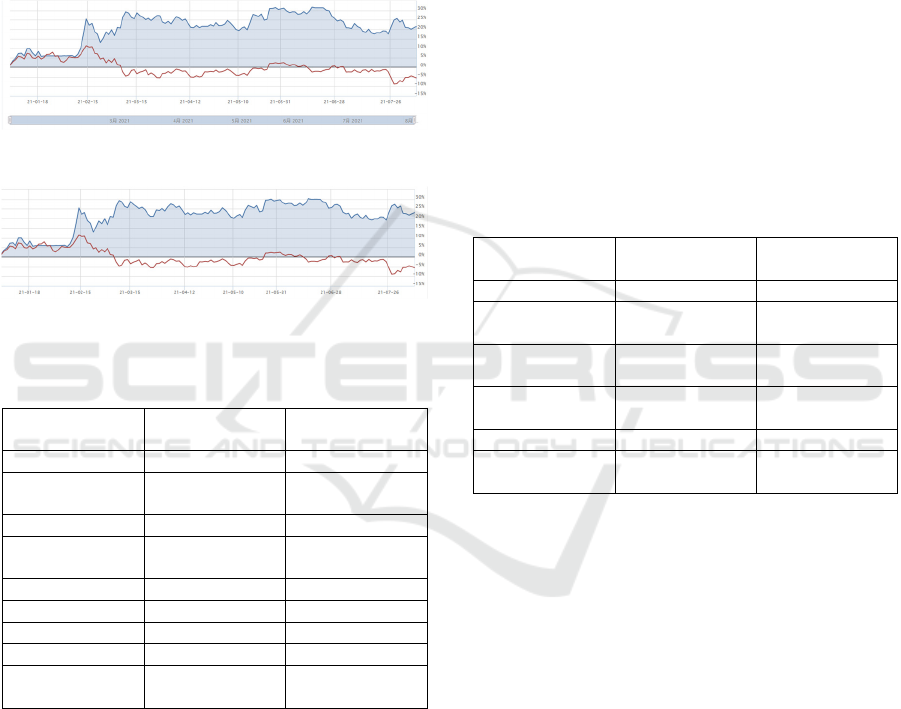

quantitative trading platform. Figure 3 and Figure 4

show the investment strategy return graphs obtained

by the experimental model in the real market. The

blue line represents the return of the strategy, and the

red line represents the benchmark return of the

market.

Figure 3: Original model backtesting result.

Figure 4: Backtesting result after optimization.

Table 2: Comparison of strategy backtesting results of

before optimization and after optimization.

Before

O

p

timization

Optimized

Return 21.61% 23.21%

Annualized

Rate of Return

40.11% 43.32%

Excess Return 28.76% 30.47%

Benchmark

Rate of return

-5.56% -5.56%

Al

p

ha 0.385 0.419

Beta 0.181 0.192

Sharpe 1.326 1.455

Winning Rate 0.250 0.222

Maximum

Drawdown Rate

9.86% 9.86%

From Figure 3 and Table 2, it can be seen that the

cumulative return of the strategy after grid search

optimization is 23.21%, which is higher than the

benchmark return. The annualized rate of return is

43.32%, the Alpha value is 0.419, the Beta value is

0.192, the Sharpe ratio is 1.455, and the maximum

drawdown rate is 9.86%. It can be seen that the return

of strategy can effectively lead the benchmark return

of the market. This shows that the XGBoost model is

accurate in predicting the ups and downs and

volatility trends of stock indexes. However,

considering that when designing an investment

strategy, the stock index price was always held when

the stock index price fluctuated, which resulted in the

stock index futures not making buying and selling

operations during the small fluctuations during the

fluctuations. So the rate of return remains at a leading

position of about 20%. However, the model can still

effectively predict and carry out buying and selling

operations in the case of large rises and falls, and

obtain high profits. Therefore, in general, the

quantitative investment strategy of stock index

futures based on the XGBoost model is effective.

The original XGBoost model has accurately

predicted a large increase and decrease. The

parameter combination optimized by grid search has

brought an overall improvement to the prediction

result. The parameter comparison before and after

optimization is shown in Table 3.

Table 3: Comparison of model parameter settings before

and after optimization.

Parameter

Before

O

p

timization

Optimized

Learning Rate 0.05 0.3

Iteration

(

n

_

estimatiors

)

400 100

Maximum

Depth

4 8

Minimum Child

Weight

5 1

Gamma 0.1 0.1

Experiment

Time

344s 172s

Due to the reduction in the number of iterations,

the backtest time has also been largely optimized. The

backtest time is reduced to half of the original model.

4.2 Result Analysis

The XGBoost model can be effectively applied to the

forecast of the target price in the financial market. It

performs well in predicting the future trend of the CSI

300 Index Futures. The investment strategy

constructed based on the three stock price fluctuations

(rising, falling, and flutuating) established based on

price fluctuation forecasts is also effective. However,

holding futures contracts when stock prices fluctuate

in the stock index futures market will have an impact

on earnings. After optimizing the parameters, the

prediction performance of the XGBoost model has

also been improved, and the backtest time has been

greatly improved. It is of great significance in the

second-level trading operation process in the current

financial market.

Research on Quantitative Investment Strategy of Stock Index Futures Based on XGBoost Model

35

5 CONCLUSION

As one of the popular directions of artificial

intelligence, machine learning has made great

achievements in speech recognition, text mining, and

autonomous driving. How to apply machine learning

in the field of financial investment is also a problem

that the industry and academia have been actively

exploring in recent years. This paper applies the

XGBoost model to the CSI 300 Index Futures. It

forecasts and builds a quantitative investment

strategy based on the forecast to test the model. Data

such as the opening price, trading volume and

logarithmic rate of return can be used as input

variables to effectively predict the future trend of the

CSI 300 Index Futures. Moreover, the CSI 300 Index

is designed to have three states as "rising", "falling"

and "fluctuating", which is more suitable to the

fluctuation of the CSI 300 Index. Finally, the excess

return is obtained through the investment strategy

test. The effectiveness of machine learning in the field

of financial asset price prediction is proved. By

optimizing the parameters of the XGBoost model, the

prediction performance of the model can be improved

to a certain extent. Therefore, the strategy can obtain

higher returns.

The XGBoost model uses the first and second

derivatives in the process of optimizing the loss

function, and adds a regular term to control the

overfitting problem, which improves the prediction

accuracy of the model. This method can also be used

to construct investment strategies in combination

with the selection of stock factors or be applied to

more financial investment fields.

ACKNOWLEDGEMENTS

This work was partly supported by the Natural

Science Foundation of China (61273354) and

Shenzhen stability support program for university

(20200812112522002).

REFERENCES

Chen, T., & Guestrin, C. (2016). XGBoost: A Scalable Tree

Boosting System. Proceedings of the 22nd ACM

SIGKDD International Conference on Knowledge

Discovery and Data Mining, Association for

Computing Machinery, New York, USA, 785–794.

Huang, Q., & Xie, H. (2018). Research on the Application

of Machine Learning Methods in Stock Index Futures

Forecasting--Comparative Analysis Based on BP

Neural Network, SVM and XGBoost. Practice and

Understanding of Mathematics, 48(08), 297-307. (in

Chinese)

Li, H., & Wang, H. (2018). Stock Index Prediction Model

Based on Improved Fractal Interpolation and SVM

Model. Journal of Jishou University (Natural Science

Edition), 39(03), 14-19. (in Chinese)

Li, J., & Zhang, R. (2019). Dynamic Weighting Multi

Factor Stock Selection Strategy Based on XGboost

Machine Learning Algorithm. Proceedings of 2018

IEEE International Conference of Safety Produce

Informatization, IICSPI 2018 2018 IEEE International

Conference of Safety Produce Informatization, IICSPI

2018, December 10, 2018 - December 12, 2018,

Chongqing, China.

Li, X. (2017). Design of Multi-factor Quantitative Stock

Selection Based on XGBoost Algorithm, Unpublished

master’s thesis, Shanghai Normal University. (in

Chinese)

Liu, Z., Dang, Z., & Yu, J. (2020). Stock price prediction

model based on RBF-SVM algorithm.Proceedings -

2020 International Conference on Computer

Engineering and Intelligent Control, ICCEIC 2020

2020 International Conference on Computer

Engineering and Intelligent Control, ICCEIC 2020,

November 6, 2020 - November 8, 2020, Virtual,

Chongqing, China.

Wang, D. (2007). Research on Timing and Stock Selection

Based on Support Vector Machine. Unpublished

doctoral disseration, Shanghai Jiaotong University.

Wang, Y., & Guo, Y. (2020). Forecasting Method of Stock

Market Volatility in Time Series Data Based on Mixed

Model of ARIMA and XGBoost. Chinese

Communications, 17(03), 205-221. (in Chinese)

Yang, Y. (2021). Market Forecast using XGboost and

Hyperparameters Optimized by TPE.2021 IEEE

International Conference on Artificial Intelligence and

Industrial Design, AIID 2021 2021 IEEE International

Conference on Artificial Intelligence and Industrial

Design, AIID 2021, May 28, 2021 - May 30, 2021,

Virtual, Guangzhou, China.

ISAIC 2022 - International Symposium on Automation, Information and Computing

36