Pricing Strategies for Vehicle Production Under the Corporate

Average Fuel Consumption and New Energy Vehicle Credit Policy

Jiawei Zhang, Jiayu She, Shaoqi Zhang and Xiaoyu Gu

School of Economics and Management, Nanjing University of Science and Technology, Nanjing, China.

Keywords: CAFC and NEV Credit Policy; Electric and Gasoline Vehicle.

Abstract: China has a clear strategic positioning and phased development goals for electric vehicles, and has been

guaranteed through fiscal and tax encouragement and a series of policies. Based on the reality of the industry,

the operation and decision-making of traditional Gasoline vehicle and Electric vehicle is a common problem

for enterprises. Aiming at the important index of credit, this paper constructs a new automobile supply chain

model composed of electric / gasoline vehicle manufacturers, government, and customers, in order to study

the Corporate Average Fuel Consumption and New Energy Vehicle credit policy. On the other hand, the

government's regulation and control of gasoline consumption and other key indicators and market demand

factors affect the pricing decisions of enterprises. When the profit of the whole society reaches the maximum

value, the maximum profit, optimal sales price, and credit value of every agent in the supply chain are given.

This study puts forward management suggestions for the pricing decisions of automobile enterprises and

government implementation policies, which will contribute to the rapid development of the electric vehicle

industry.

1 INTRODUCTION

The CAFC (Corporate Average Fuel Consumption)

and NEV (New Energy Vehicle) credit policy has an

important influence on the coexistence of Gasoline

vehicle (GV, driven by the gasoline) and Electric

vehicle (EV, driven by the electricity as the new

energy vehicle) which is used to develop the

automobile market to promote the production and

marketing of new energy vehicle (Yin, 2021). With

this policy, how to make production pricing and

decision-making has become a hot issue of concern to

automobile enterprises and the government.

At present, there have been several related

research on CAFC and NEV credit policy of

automobile enterprises (Yin, 2021). Liu et al. (2018)

analysed the future development of electric vehicle

under policy incentives by setting four scenarios and

establishing a system dynamics model, and concluded

that large-scale market penetration requires strong

policy support. Yang et al. (2022) used optimization

theory to compare the government pricing model and

the market pricing model of the CAFC and NEV

credit, and discussed the effectiveness of the pricing

method for electric vehicle production. Diwu et al.

(2016) proposed a dual channel supply chain model

considering government subsidies to study the

optimal promotion strategy of new energy vehicle. On

the basis of game theory and credit market

equilibrium, Li et al. (2019) established a model of

market analysis quantify the influence of CAFC and

NEV credit on the purchase and sale mechanism of

the automobile industry.

Through the method of game

theory, Ma et al. (2022) studied the improvement

level and production situation of fuel economy of

traditional internal combustion engine vehicle and

electric vehicle, established the optimization model of

traditional automobile supply chain, and produced

new management opinions on the specific action plan.

According to the credit value, Wang et al. (2022)

studied the profit and loss of automobile

manufacturers based on different technology

combinations and summarized the most cost-effective

compliance strategies of these automobile

manufacturers. From the perspective of coexistence

of electric vehicle and Gasoline vehicle, Xu et al.

(2021) constructed a dynamic game model composed

of retailers, manufacturers and the government, and

considered the supply chain pricing strategy under the

Stackelberg game modelled by manufacturers to

formulate the optimal pricing strategy. To sum up,

scholars have achieved several research on

Zhang, J., She, J., Zhang, S. and Gu, X.

Pricing Strategies for Vehicle Production Under the Corporate Average Fuel Consumption and New Energy Vehicle Credit Policy.

DOI: 10.5220/0011906200003536

In Proceedings of the 3rd International Symposium on Water, Ecology and Environment (ISWEE 2022), pages 83-89

ISBN: 978-989-758-639-2; ISSN: 2975-9439

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

83

automobile industry with CAFC and NEV credit.

The innovation of this paper is to discuss the

optimal pricing and decision-making of GV and EV

produced by automobile enterprises in credit form,

and to establish an equilibrium model, which is solved

by optimization theory and method, and studies the

influence of credit coefficient, oil price and electricity

price on the total social profit, and analyses how the

CAFC and NEV credit affects the operation decision

of the enterprise. Especially aiming at the checks and

balances between the policy measures and market

factors of EV, this paper analyses the policy-oriented

decision-making behaviour of enterprises.

The structure of this paper is as follows. In the

second section, a three-level supply chain model

composed of EV/GV manufacturers, governments

and customers is constructed, and the optimal

decision-making problem of automobile enterprises

under CAFC and NEV credit is explained. In the third

section, the conclusion analysis is carried out based

on the model, that is, taking the given variable as an

example, the numerical results of the model are given,

and the influence of electricity price, oil price and

credit coefficient on the total profit is analysed by the

combination of numbers and shapes. Finally, the

paper summarizes the research conclusions of this

paper in the fourth section and provides a reference

for the development of the industry. In order to fill the

gap in the vehicle industry area, especially the

sustainable development of EVs, this paper focuses

on the impact of the optimal pricing of the overall

policy on enterprise pricing by using the equilibrium

theory of game theory. Finally, the average profit

level of auto industry enterprises is affected by

pricing.

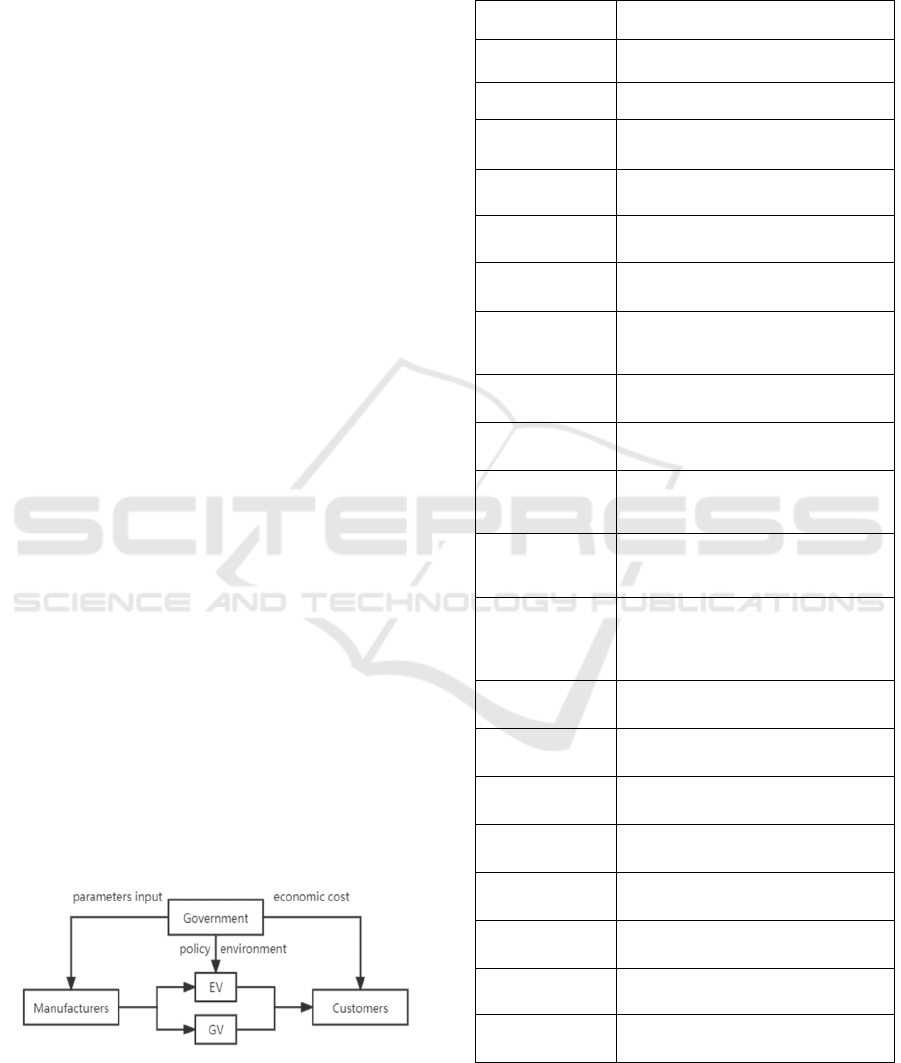

2 MODEL DESTRIBUTION

The model includes a tripartite relationship between

vehicle manufacturers, consumers and government,

as shown in Figure 1 below.

Figure 1: Model structure.

All the

parameters

and notations used in this paper are

shown in the table below.

Table 1: Parameters and notations

𝑆𝑦𝑚𝑏𝑜𝑙

Meaning

𝑘

Customer’s willingness to buy a

car 0 < k < 1

𝐿

Vehicle’s lifecycle (year)

𝑀

Average driven mileage per year

(km/year)

𝑝

fuel

/𝑝

elec

Price of fuel(£/L)/electricity

(£/kWh)

𝑒

fuel

/𝑒

elec

Mileage per fuel unit

(km/L)/electricity unit (km/kWh)

𝑣

Time value (£/h)

𝐻

refuel

/𝐻

recharging

Time cost in each fuel

refilling(h)/electricity recharging

(

h

)

𝑉

gv

/𝑉

ev

Gasoline tank volume (L)/ Battery

volume (kWh)

π

gv

/π

ev

GV/EV driving experience utility

(£)

𝐶

gv

/𝐶

ev

The total cost in GV/EV’s full life

cycle

θ

gv

,θ

ev

Environmental protection

awareness level for GV/EV user

(£)

𝐶

/𝐶

Negative Credits (Credits deducted

for one fuel car)/Positive Credits

(Credits added by one electric

vehicle

)

𝑝

Mgv

/𝑝

Mev

GV/EV manufacturer cost (£)

𝑝

Cgv

/𝑝

Cev

GV/EV price paid to the

manufacturer (£)

𝑃

gv

/𝑃

ev

The probability of buying a

GV/EV

𝑚

/

𝑚

𝑝

Money awarded for one unit of

Negative Credits / Positive Credits

𝑏

/𝑏

Regulation factor

𝐶

Annual treatment cost for carbon

dioxide treatment

π

Mgv

/π

Mev

Profit for GV/EV manufacturer (£)

π

gov

The social entire profit

For model simplification, we assume that 𝑘 satisfies

0≤𝑘≤1, where 𝑘=0 means customer will not

buy a car and 𝑘=1 means customer will buy a car.

ISWEE 2022 - International Symposium on Water, Ecology and Environment

84

Over the life cycle of a vehicle, costs include the

cost of fuel or electricity and the cost of time,

expressed by the equation:

𝐶

gv

=

fuel

fuel

+

refuel

fuel

gv

(1)

𝐶

ev

=

elec

elec

+

recharging

ev

(2)

We define the utility functions for fuel and electric

vehicle customers as:

𝑈

Cgv

=−𝐶

gv

+𝜃

gv

+𝜋

gv

𝑘 −𝑝

Cgv

=𝑣

gv

𝑘−𝑝

Cgv

(3)

𝑈

Cev

=

(

−𝐶

ev

+𝜃

ev

+𝜋

ev

)

𝑘−𝑝

Cev

=𝑣

ev

𝑘−𝑝

Cev

(4)

Moreover, we have following assumptions of this

model:

(1) User’s profit of GV and EV is unequal which

means 𝑣

>𝑣

ev

;

(2) According to Gu et al. (2016),

customers are

rational, so they will choose those with a high utility

function, i.e., good value for money.

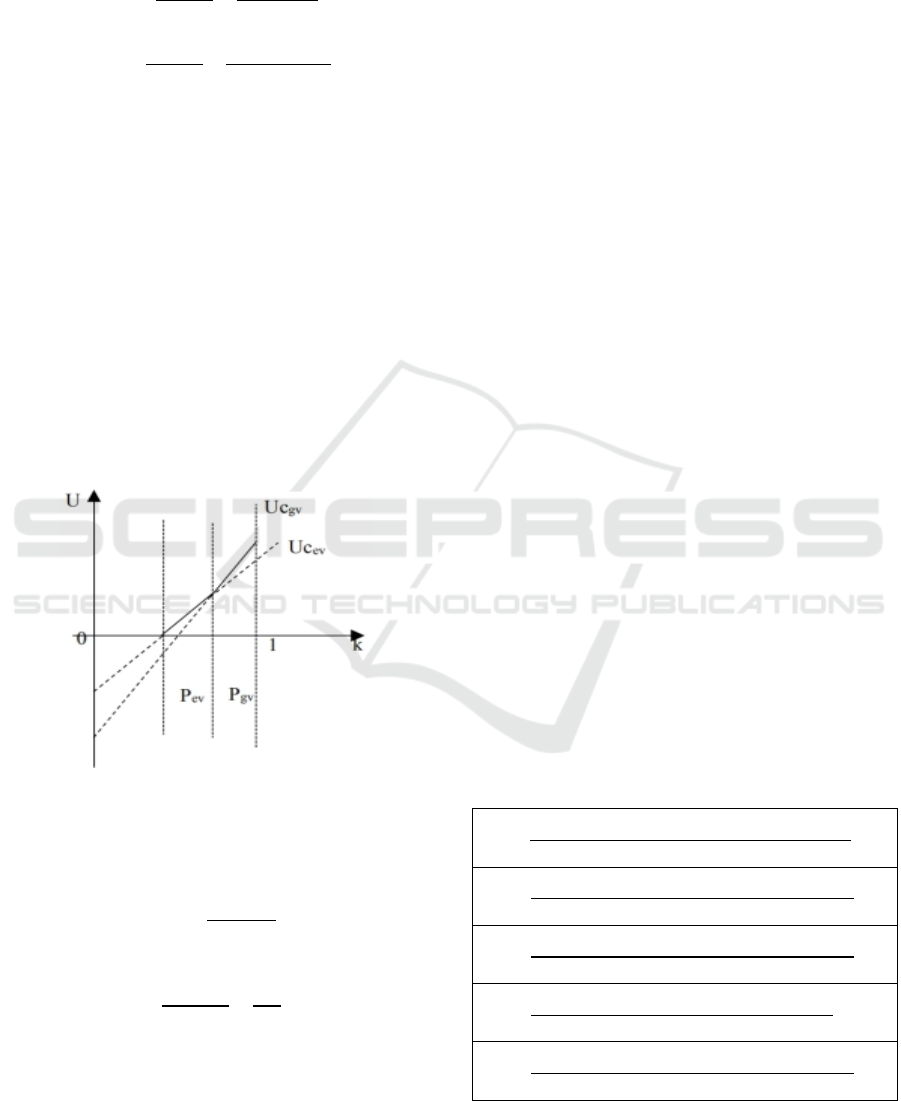

Table 2 indicates the probability of people buying an

electric and fuel car.

Figure 2: GV/EV usage utility with different purchase

intention in EV early development stage.

It is easy to find that the probability of buying a GV

is

𝑃

gv

=1−

Cgv

Cev

gv

ev

(5)

The probability of purchasing an EV is

𝑃

ev

=

Cgv

Cev

gv

ev

−

Cev

ev

(6)

For credits, we require the positive credits minus the

negative credits to be greater than 0.

𝑏

𝐶

−𝑏

𝐶

=𝑅 (R>0) (7)

So, the profit for a car manufacturer to produce a fuel

car is

π

Mgv

=𝑃

gv

𝑝

Cgv

−𝑝

Mgv

−𝐶

𝑚

(8)

And the profit from the production of an electric

vehicle is

π

Mev

=𝑃

ev

𝑝

Cev

−𝑝

Mev

𝐶

𝑚

(9)

Based on lemma 1, we can work out the best price:

𝑝

Cgv

=𝐴

𝐶

+𝐴

𝐶

+

(

𝐴

+𝐴

)

(10)

𝑝

Cev

=

𝐴

𝐶

+𝐴

𝐶

+

(

𝐴

+𝐴

+𝐴

+𝐴

+𝐴

)

(11)

(To simplify the expressions and highlight the focus

of the study, we replace all the coefficients before 𝐶

and 𝐶

with a new variable, such as A1, A2 in table2,

in order to subsequently visualize the relationship

between total social profit and the key study

variables).

Therefore, the probability about purchasing an GV is

𝑃

gv

=𝐵

𝐶

+𝐵

𝐶

+𝐵

(12)

And the possibility of buying an EV is

𝑃

ev

=𝐵

𝐶

+𝐵

𝐶

+𝐵

(13)

In turn, we can find the profits of car manufacturers

producing fuel and electric vehicles:

π

Mgv

=𝐵

𝐶

+𝐵

𝐶

+𝐵

𝐴

𝐶

+𝐴

𝐶

+(𝐴

+

𝐴

)−𝐶

𝑚

−𝑝

Mgv

(14)

π

Mev

=𝐵

𝐶

+𝐵

𝐶

+𝐵

𝐴

𝐶

+𝐴

𝐶

+(𝐴

+

𝐴

+𝐴

+𝐴

+𝐴

)+𝐶

𝑚

−𝑝

Mev

(15)

In order to optimize the total profit of the vehicle

manufacturer, we define

π

gov

=π

Mev

+π

Mgv

−𝐶

=𝑇

𝐶

𝐶

+𝑇

𝐶

+

𝑇

𝐶

+𝑇

𝐶

+𝑇

𝐶

+𝑇

(16)

All formulas mentioned above are expressed in Table

2 below.

Table 2: Simplifying expressions.

𝐴

=

2𝑚

𝐶

gv

−

θ

gv

−π

gv

−𝐶

ev

+4𝐶

g

v

+

θ

ev

+π

ev

−4

θ

g

v

−4π

g

v

𝐴

=

𝑚

𝐶

g

v

−

θ

g

v

−π

g

v

−𝐶

e

v

+4𝐶

gv

+

θ

e

v

+π

e

v

−4

θ

gv

−4π

gv

𝐴

=

𝐶

g

v

−

θ

g

v

−π

g

v

2𝐶

e

v

−2𝐶

g

v

+𝑝

Me

v

−𝐶

e

v

+4𝐶

g

v

+

θ

e

v

+π

e

v

−4

θ

g

v

−4π

g

v

𝐴

=

2

𝐴

−

θ

e

v

−π

e

v

+

θ

g

v

+π

g

v

+𝑝

Mg

v

2𝐶

e

v

−2𝐶

gv

+𝑝

Me

v

𝐴

=

2𝑚

𝐶

g

v

−

θ

g

v

−π

g

v

−𝐶

e

v

+4𝐶

g

v

+

θ

e

v

+π

e

v

−4

θ

g

v

−4π

g

v

Pricing Strategies for Vehicle Production Under the Corporate Average Fuel Consumption and New Energy Vehicle Credit Policy

85

𝐴

=

𝑚

(

−𝐶

e

v

+

θ

e

v

+π

e

v

)

𝐶

ev

−4𝐶

gv

−

θ

ev

−π

ev

+4

θ

gv

+4π

gv

𝐴

=

−𝐶

e

v

+π

e

v

π

g

v

+π

e

v

𝑝

Mg

v

−π

e

v

+2π

g

v

𝑝

Me

v

𝐶

ev

−4𝐶

gv

−

θ

ev

−π

ev

+4

θ

gv

+4π

gv

𝐴

=

π

g

v

θ

e

v

−2π

e

v

θ

e

v

+

θ

e

v

𝑝

Mg

v

𝐶

ev

−4𝐶

gv

−

θ

ev

−π

ev

+4

θ

gv

+4π

gv

𝐴

=

−𝐶

g

v

(

θ

e

v

+π

e

v

+2𝑝

Me

v

)

−

θ

e

v

𝐶

ev

−4𝐶

gv

−

θ

ev

−π

ev

+4

θ

gv

+4π

gv

𝐴

=

𝐶

ev

𝐶

gv

+2

θ

ev

+2π

ev

−

θ

gv

−π

gv

−𝑝

Mgv

𝐶

e

v

−4𝐶

g

v

−

θ

e

v

−π

e

v

+4

θ

g

v

+4π

g

v

𝐴

=

π

e

v

θ

g

v

+

θ

e

v

θ

g

v

+2

θ

g

v

𝑝

Me

v

𝐶

ev

−4𝐶

gv

−

θ

ev

−π

ev

+4

θ

gv

+4π

gv

𝐵

=

𝐴

−

𝐴

𝑣

e

v

−𝑣

gv

𝐵

=

𝐴

−

𝐴

𝑣

e

v

−𝑣

gv

𝐵

=

(

𝐴

+

𝐴

)

−

(

𝐴

+

𝐴

+

𝐴

+

𝐴

+

𝐴

)

𝑣

e

v

−𝑣

g

v

+1

𝐵

=

𝐴

𝑣

g

v

−

𝐴

𝑣

e

v

𝑣

e

v

𝑣

e

v

−𝑣

g

v

𝐵

=

𝐴

𝑣

g

v

−

𝐴

𝑣

e

v

𝑣

e

v

𝑣

e

v

−𝑣

g

v

𝐵

=

(

𝐴

+

𝐴

+

𝐴

+

𝐴

+

𝐴

)

𝑣

g

v

−

(

𝐴

+

𝐴

)

𝑣

e

v

𝑣

e

v

𝑣

e

v

−𝑣

g

v

𝑇

=𝐵

𝐴

+𝑚

+

𝐴

𝐵

𝑇

=𝐵

(

𝐴

−𝑚

)

+

𝐴

𝐵

𝑇

=

⎝

⎜

⎛

𝐵

𝐴

+𝑚

+𝐵

𝐴

+

𝐴

+

𝐴

+

𝐴

+

𝐴

−𝑝

Mev

+𝐵

(

𝐴

+

𝐴

)

−𝑝

Mg

v

+

𝐴

𝐵

⎠

⎟

⎞

𝑇

=

⎝

⎜

⎛

𝐵

(

𝐴

−𝑚

)

+𝐵

𝐴

+

𝐴

+

𝐴

+

𝐴

+

𝐴

−𝑝

Mev

+𝐵

(

𝐴

+

𝐴

)

−𝑝

Mg

v

+

𝐴

𝐵

⎠

⎟

⎞

𝑇

=𝐵

(

𝐴

−𝑚

)

+𝐵

𝐴

+𝑚

+

𝐴

𝐵

+

𝐴

𝐵

𝑇

=𝐵

(

𝐴

+

𝐴

+

𝐴

+

𝐴

+

𝐴

)

−𝑝

Me

v

+𝐵

(

𝐴

+

𝐴

)

−𝑝

Mg

v

3 NUMERICAL ANALYSIS AND

DISCUSSION

In this section, we analyse the above model and

analyse the parameters in the model based on

mathematical examples

3.1 Numerical Example

The initial values for each variable are shown in Table

3 below.

Table 3: Value of initial variables:

𝑴

L1

=𝟏𝟎𝟎𝟎𝟎

𝑳=𝟏𝟎 𝒑

fuel

=𝟏

𝒑

elec

=𝟎.𝟓 𝑒

fuel

=10 𝑒

elec

=6

𝒗

𝒕

=𝟖 𝐻

refuel

=0.15

𝐻

recharging

=0.5

𝑽

gv

=𝟓𝟎

𝑉

e

v

=400

θ

gv

=3000

𝛉

e

v

=𝟓𝟎𝟎𝟎

π

g

v

=120000

π

e

v

=105000

𝒑

Mg

v

=𝟏𝟒𝟎𝟎𝟎

𝑝

Me

v

=15000 𝑚

=3000

𝒎

𝒑

=𝟒𝟎𝟎𝟎 𝑏

=3 𝑏

=4

R=5

𝐶

envir

=50

Through substituting initial values above into

equation (16), we can find that equation (16) is a

quadratic function on 𝐶

, and in order to maximize

profit, the optimal value of positive credits𝐶

and

negative credits 𝐶

of can be derived as.

𝐶

=1.4685 (17)

𝐶

=0.2913 (18)

And the total profit is:

𝜋

= 8055.14 (19)

Specifically, these results means that the average

production of an electric car will give the company

1.4685 CAFC Credits and the average production of

a fuel car will give the company 0.2913 NEV credits,

at which point the average production of an electric

ISWEE 2022 - International Symposium on Water, Ecology and Environment

86

car and a fuel car will bring the company a profit of

8,055.14. The CAFC Credits factor is much larger

than the NEV credits factor, which encourages

enterprises to produce electric vehicles and reduce the

number of fuel vehicles, which is conducive to the

implementation of CAFC and NEV credit policy.

3.2 Analysis

Using the above values for 𝐶

and 𝐶

as reference

values, we discuss the impact of each parameter in the

model on total profit.

Figure 3: Impact of Positive Credits vs total profit.

Figure 3 indicates that there is an

optimal value of 𝐶

that

maximizes the total profit, the value of 𝐶

found in

3.1 section. There is an optimal value of 𝐶

that

maximizes total social profit. The reality behind is

that the subsidies for electric vehicle enterprises

should not be too high, too high policy subsidies will

affect the profitability of fuel companies, but also lead

to a decline in the competitiveness of electric vehicle

enterprises themselves.

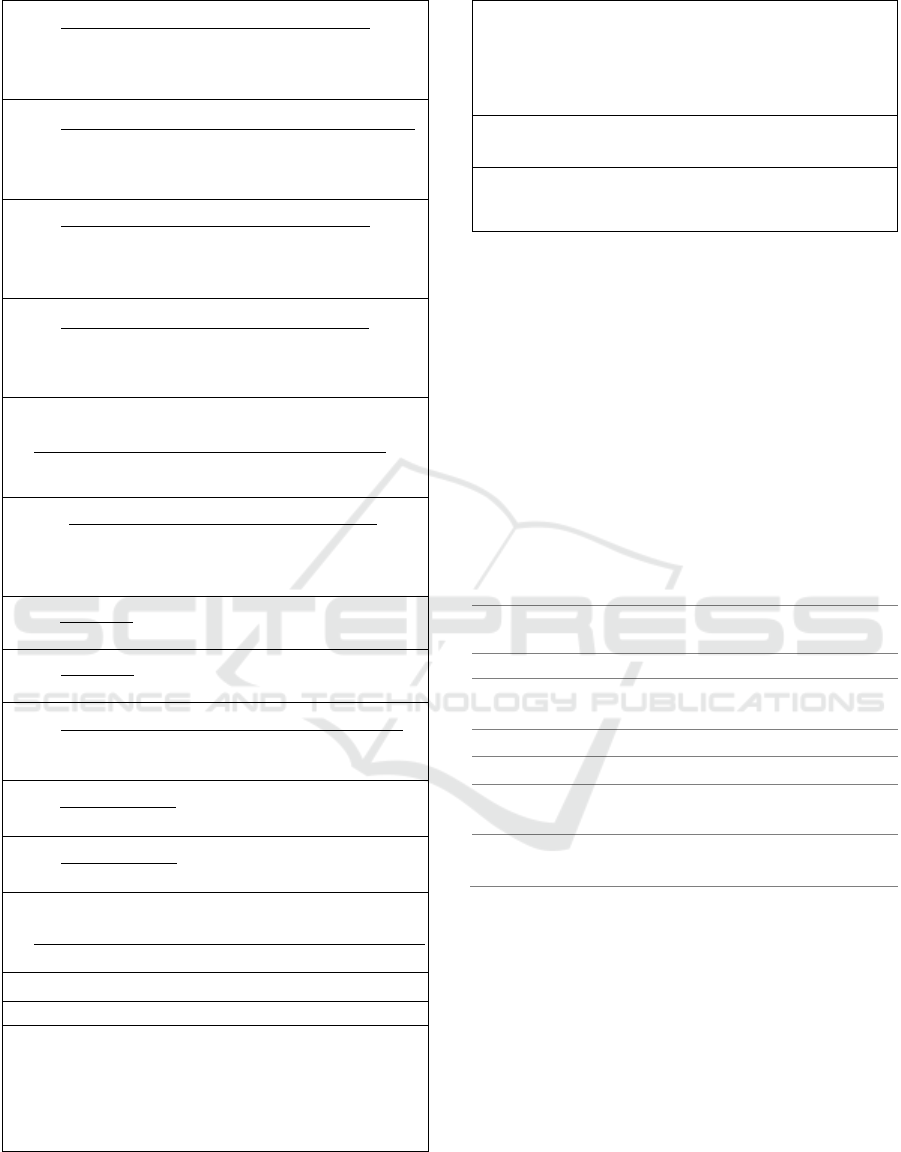

Moreover, as can be seen in Figure 4 below, the

blue line indicates 𝐶

=0 (no penalty for fuel car

producing enterprises) and the yellow line indicates

𝐶

≠0 (penalty for fuel car producing enterprises).

When the cost of environmental treatment is low, the

total social profit of not penalizing fuel car producing

enterprises is higher than that of penalizing fuel car

producing enterprises; when the cost of

environmental treatment is high, the total social profit

of penalizing fuel car producing enterprises is higher

than that of not penalizing fuel car producing

enterprises.

Figure 4: 𝐶

(Environmental treatment cost) vs total

profit.

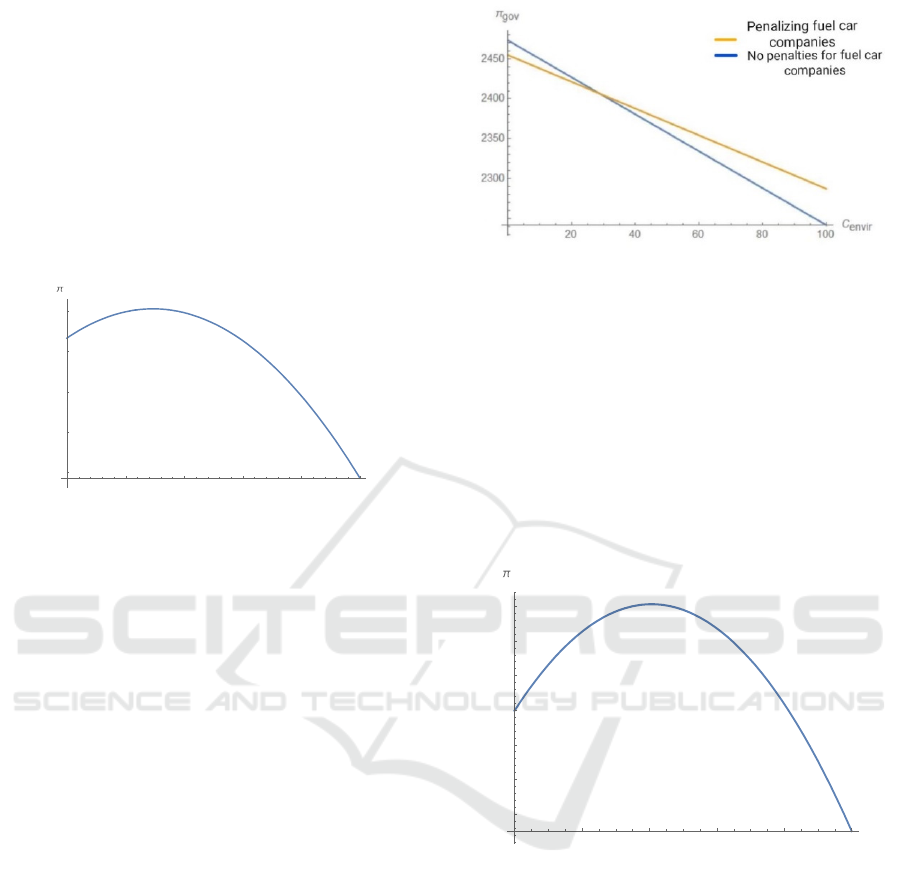

We find that the total profit as a function of 𝑚

is

a quadratic function with a downward opening when

𝑚

is fixed. As 𝑚

increases, the axis of symmetry and

the maximum value of the total profit as a function of

𝑚

become larger. The reverse is also true. And by

doing the calculations, we can find the range of total

profit.

5233.45≤π

gov

≤11504. (0<𝑚

<8000,

0<𝑚

<8000)

Figure 5: 𝑚

(Money awarded for one unit of Negative

Credits) vs total profit.

Then we then discuss the impact of oil and

electricity prices on total profits. Figure 6 shows the

image of total profit as a function of oil price at an

electricity price of 0.5

1 2 3 4 5

cp

5000

6000

7000

8000

gov

2000 4000 6000 8000 10 000

mp

2

000

3

000

4

000

5

000

6

000

7

000

8

000

gov

Pricing Strategies for Vehicle Production Under the Corporate Average Fuel Consumption and New Energy Vehicle Credit Policy

87

Figure 6: Oil price vs total profit.

Total profit decreases with increasing oil prices

between approximately 0 and 2.

Figure 7 shows the image of total profit as a

function of electricity price at an oil price of 1.

Figure 7: Electricity price vs total profit.

As can be seen, total profit increases with the price of

electricity between approximately 0 and 5. Finally,

we discuss the effect of the coefficients of 𝐶

and 𝐶

on total profit.

Figure 8 shows the effect of 𝑏

on total profit

when 𝑏

is 3 while Figure 9 shows the effect of 𝑏

on

total profit when 𝑏

is 4. ( 𝑏

is equal to 4 to ensure

that the value of 𝐶

is greater than 0).

Figure 8: The effect of 𝑏

on total profit when 𝑏

is 3.

Figure 9:

The effect of 𝑏

on total profit when 𝑏

is 4.

The larger the 𝑏

(Factor to adjust the ratio of 𝐶

to 𝐶

), the larger the𝐶

, the greater the penalty for

producing fuel cars, and the lower the total social

profit. The larger the 𝑏

(Factor to adjust the ratio of

𝐶

to 𝐶

), the smaller the 𝐶

,the smaller the penalty

for producing fuel cars, and the higher the total social

profit. We can optimize the total social profit by

appropriately adjusting the ratio of 𝐶

to 𝐶

.

4 CONCLUSION

This paper examines the profits of car manufacturers

and the impact of each factor on total profits under the

CAFC and NEV credit policy. We have the following

conclusions:

(1) The effect of 𝐶

and 𝐶

on total profit is a

quadratic function, there is an optimal value of 𝐶

and

𝐶

that maximises total profit. For the government,

the policy of double points should be stipulated

according to the market conditions to maximize the

total social profit. In the examples in this paper, the

optimal values for 𝐶

and 𝐶

are 1.4685 and 0.2913,

the car manufacturer should deduct 0.2913 credits for

the production of a fuel car and add 1.2865 credits for

the production of an electric car.

(2) The effect of 𝑚

and 𝑚

on total profit is also a

quadratic function. In order to increase the proportion

of electric vehicles, we should improve the utility it

brings to consumers, such as raising oil prices,

reducing electricity charges or giving more incentives

to 𝐶

, which can better increase the proportion of

electric vehicles.

(3)

For the market, the specific pricing of 𝐶

and𝐶

will be affected by the proportion of fuel vehicles and

electric vehicles. This simplifies the quantitative

relationship between them. In combination with the

above discussion on oil price, electricity price and

0.5 1.0 1.5 2.0

pfuel

2000

4000

6000

8000

10

000

12000

go

v

1 2 3 4 5

pfuel

5000

10

000

15000

2

0

000

gov

2 4 6 8 10

bp

16

000

1

7

000

18

000

19

000

2

0

000

gov

2 4 6 8 10

bn

17

600

17800

18

000

18

200

gov

g

ISWEE 2022 - International Symposium on Water, Ecology and Environment

88

annual environmental treatment cost to the total social

profit, the current domestic oil price is generally too

high, the electricity price is relatively cheap, and the

annual environmental treatment cost is high.

Therefore, it is necessary to support the development

of electric vehicle enterprises and punish the fuel

vehicle enterprises. In combination with the national

carbon neutral policy and from the perspective of

long-term development, it is necessary to punish

electric vehicles. Although this punishment will affect

the total social profit in the short term, it is necessary

in the long term.

To summarise, this paper expands on the

application of CAFC and NEV credit in the

automotive sector and can provide a reference for

those in this industry.

We hope to complete the

structural transformation of the automobile industry,

promote the development of new energy vehicles,

help achieve carbon neutrality and achieve

sustainable social development by implementing

CAFC and new energy automobile credit. In the

future, we will discuss in more depth the impact of the

CAFC and NEV policy on other parts of electric

vehicles, especially on the battery industry.

ACKNOWLEDGEMENT

This research is funded by project supported by the

National Science Foundation (Grant No. 71901121,

71972101, 71931006); and Support by Fundamental

Research Funds for the Central Universities (Grant

No. 30919013202).

REFERENCES

Gu X , Ieromonachou P , Li Z . A game theory approach in

subsidizing electric vehicle supply chain[C]// 2016

International Conference on Logistics, Informatics and

Service Sciences (LISS). IEEE, 2016.

Li Y, Zhang Q, Li H et al (2019) The impact of Dual-credit

Scheme on the Development of the New Energy

Vehicle Industry. Elsevier Ltd, Hong Kong, China

Ma, H., Lou, G., Fan, T., Chan, H. and Chung, S., 2022.

Conventional automotive supply chains under China's

dual-credit policy: fuel economy, production and

coordination.

Ou S, Lin Z, Qi L et al (2018) The dual-credit policy:

Quantifying the policy impact on plug-in electric

vehicle sales and industry profits in China. Energy

Policy 121:597–610

Wang, Y., Zhao, F., Yuan, Y., Hao, H. and Liu, Z., 2022.

Analysis of Typical Automakers’ Strategies for

Meeting the Dual-Credit Regulations Regarding CAFC

and NEVs.

Yin, Y., Zhan, Z. (2021). Research on “Dual-Credits”

Policy of Automobile Enterprises. In: Proceedings of

China SAE Congress 2019: Selected Papers. Lecture

Notes in Electrical Engineering, vol 646. Springer,

Singapore.

Yang, DX., Yang, L., Chen, XL. et al. Research on credit

pricing mechanism in dual-credit policy: is the

government in charge or is the market in charge?.

Environ Dev Sustain (2022).

Yu, Y., Zhou, D., Zha, D., Wang, Q. and Zhu, Q., 2021.

Optimal production and pricing strategies in auto

supply chain when dual credit policy is substituted for

subsidy policy.

Liu, D., Xiao, B. 2018. Exploring the development of

electric vehicles under policy incentives: A scenario-

based system dynamics model, Energy Policy, vol. 120,

pp. 238-249.

Diwu. S, Zhang. X, 2016. Dual-channel ordering strategy of

new energy vehicles, 2016 International Conference on

Logistics, Informatics and Service Sciences (LISS),

2016, pp. 1-5.

Xu. X, Tao. R, 2021. Study on Supply Chain Pricing

Strategy of Government-Subsidized Manufacturers.

2021 5th Annual International Conference on Data

Science and Business Analytics (ICDSBA), 2021, pp.

554-559.

Pricing Strategies for Vehicle Production Under the Corporate Average Fuel Consumption and New Energy Vehicle Credit Policy

89