The Application Effect of New Media Technology in Finance

Teaching Courses for Business College Students

Youqiang Ding

a

and Yufeng Hu

*b

School of Finance, Tongling University, Tongling, Anhui, China

Keywords: New Media Technology, Finance Teaching, Online Learning.

Abstract: To cope with the external impact caused by digital finance after COVID-19, new media technology has

been brought into finance teaching courses to increase students' learning performance. This paper used the

samples of 329 students from eight classes in two semesters of 2021-2022 to empirically analyze the

different effects between offline teaching and online teaching when the new media technology was used to

solve the space limitation between teachers and students. We found that online teaching has not achieved

better learning performance than offline teaching. Because the students are not adapted to the finance online

teaching using new media technology, based on economic knowledge, different grades, and gender of

students characteristics as key factors affecting their learning performance. So, the application effect of new

media technology in the future finance teaching process should be focused to choose a more suitable way

for students, such as the flipped classroom with virtual reality technology arouse the learning interest of

freshmen without any economic knowledge foundation; and it's better to increase the practical skills of

experimental students in virtual space through new media technology.

a

https://orcid.org/0000-0002-3523-2018

b

https://orcid.org/0000-0003-0487-3151

1 INTRODUCTION

With the necessary tool of cellphone connectivity,

new media becoming more popular among college

students. The finance teaching mode has no longer

been confined to classroom teaching. New media

educational technology is needed to transfer them

into online teaching, online-offline integration,

flipped classrooms, and immersive classroom

programs. As the COVID-19 pandemic has

accelerated the change of the traditional face-to-face

teaching pattern to online education platforms,

making the quality of online classes a concern for

tertiary education stakeholders (Chen et al., 2020;

Wei et al., 2021). This makes the online teaching

pattern become a mainstream learning for business

college students. At the same time, many scholars

proposed questions like Padnakumari (2022) that

every educational institution should face the biggest

challenge: how to provide quality education by

imparting the skills and knowledge online when

neither students nor teachers can meet face to face?

Finance teaching reform led by Internet

technology usually includes the following aspects:

First of all, moving the finance class to the Internet

platform from the face-to-face teaching method, and

establishing online teaching, practice, and evaluation

system (Chiasson et al., 2015; Yu, 2021); The

second is to break through the existing knowledge

system from the teaching content, and build a new

financial operation mechanism with block-chain,

data processing, and information technology as the

base frame structure (Li and Wu, 2019; Nie et al.,

2020); The third is to increase new media

technology to be a parallel learning Metaverse,

reproduce the real world currency circulation and

market trading so that students can practically

simulate the real financial operating system (Salt et

al., 2008; Park and Kim, 2022). These finance

teaching reforms revolve around online-offline

integration, focusing on the new media platform of

Internet technology links in the finance teaching

course, enhancing students' practical interaction

ability, and expanding the financial system of five

Ding, Y. and Hu, Y.

The Application Effect of New Media Technology in Finance Teaching Courses for Business College Students.

DOI: 10.5220/0011913700003613

In Proceedings of the 2nd International Conference on New Media Development and Modernized Education (NMDME 2022), pages 451-459

ISBN: 978-989-758-630-9

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

451

elements integration of residents, enterprises, banks,

governments, and foreigners.

Previous studies highlighted the feasibility of

Internet links to finance teaching but overestimated

the teaching results without recognizing the practical

problems. Comparing the actual situation of students

learning finance, this paper represents the online-

offline teaching method and finds out three aspects

of deviation: (i) It overestimated the advantages of

economics majors in learning finance more than

management majors. The result is that the reserves

of basic knowledge of economics promote the

performance of finance learning, rather than the

reason for the difference between the two majors;

(ii) The excellent students in the experimental class

will perform more prominently, whether the

economics major or the management major, can be

better than the students in the ordinary class, because

of better learning adaptability for new media

technology; (iii) Female students can achieve better

results in the finance teaching than male students, no

matter what kind of finance teaching methods are

used. But the difference in the learning effect of

male students under the online teaching mode is

relatively low. This study provides an important

reference for the online-offline teaching reform of

finance courses.

2 LITERATURE ANALYSIS

2.1 Financial Teaching Reform

Direction

With the rapid development of the financial

industry, the total social demand has changed

greatly, so it is imperative to cultivate talents with

Internet thinking of new business in the financial

industry (He et al., 2021). But the traditional

classroom teaching mode for finance learning is

relatively simple through a cramming method of

face-to-face teaching mainly by teachers according

to the content of finance teaching materials. As the

finance learning of college students is in the position

of passive acceptance, their learning enthusiasm is

not high which could easily make an inconsistency

result between teaching practice and learning effect

for financial cultivation. Although finance teachers

tried their best to teach in the classroom, students

themselves do not understand as well as expected.

As we know, finance teaching is a strong

application subject, which has been becoming a big

problem in improving the students' practical learning

ability and independent thinking ability from the

finance courses. This request obviously can not

realize through the traditional finance teaching

method. Thus, financial teaching reform must bring

in new media technology, such as Internet

technology, artificial intelligence technology, and

other high-tech integration was put into finance

teaching to form an online-offline integration and

virtual reality learning system.

The framework of finance teaching mainly

involves five basic elements, including money,

credit, interest rate, exchange rate, and financial

instruments. Both domestic currency and foreign

currency play an important role in economic

development, and their forms and values have been

changing into E-money or I-money (Mi and Wang,

2022). In particular, Block Chain technology's

application makes the digital currency the

mainstream form of possible future currency.

Even with the rapid development of internet

payment and mobile payment, E-money and I-

money make the current teaching mode of finance

fall behind the demand of financial practice. The

disconnection between theoretical knowledge and

practical application has become a key problem that

restricts finance teaching by teachers and finance

learning by students. Furthermore, in financial

markets, whether it is the construction of new digital

finance markets or market transactions in new forms

of money, not to mention the emergence of new

financial instruments, all these factors make the

finance teaching method need to carry on the

teaching reform direction of the combination of

offline teaching and online teaching by a new media

platform for business college students.

2.2 New Media for Finance Teaching

It is necessary to apply new media technology in

finance teaching courses to change the

disadvantages of traditional finance teaching and

adapt to the innovative products of new technology

in the finance field. Finance educators found that the

Internet is easier to access business information,

financial databases, statistical tools, and networks

for business college students (Shao et al., 1998).

With the continuous progress of science and

technology, Li et al. (2021) also found that the

Internet is deeply combined with education, which is

more open, comprehensive, and innovative than the

traditional teaching style.

So, the online-offline teaching mode has become

a new trend in finance teaching reform. It deeply

integrates offline teaching and online learning,

enabling students to form strong learning motivation

NMDME 2022 - The International Conference on New Media Development and Modernized Education

452

and significantly improve learning efficiency. To

deal with the use of educational technology to

overcome the unique challenges in online finance

teaching courses, Vatsala and Pissay (2015) found

that bloom's taxonomy, constructivist model, video

creation tools, and webinars are the most effective

educational technology tools for finance teaching.

We can effectively promote the integration of online

teaching and offline teaching in finance courses by

building an online-based teaching platform with a

new media educational technology, thus enabling

business college students to achieve better learning

results.

Many scholars have been concerned that the new

media technology can bring better results to the

finance teaching method. Sathye (2004) found that

while the content of the unit could be delivered

online very efficiently but many operational

problems could mar this mode from becoming an

effective teaching and learning mode by

investigating the challenges in the online teaching of

banking and finance. The article of Stephen (2015)

reviewed the literature on using videos in the

classroom and presents a pedagogical framework for

this instructional medium, followed by a discussion

on how to effectively integrate online video clips

within the finance curriculum. Based on big data

technology, the research of Sun (2021) shows that

the financial innovation of online teaching systems

can effectively expand the scope of assistance and

shorten the time of assistance. Lin (2021) thought

that it will enrich the teaching design and teaching

process of a flipped classroom with the help of the

increasingly advanced mobile Internet and

information technology.

In the whole financial teaching process, new

media technology can provide different support in

three stages: Before class, it provides abundant

network teaching resources; In class, teachers and

students interact by solving problems and group

activities; After class, it provides Internet-based

teaching resources. All kinds of online platforms

answer questions and monitor and test students'

online learning at any time, to optimize the process

of students' knowledge internalization and ultimately

improve students' learning capability.

2.3 Finance Teaching Improving

Factors

In the online-offline teaching research for financial

students, most scholars think that new media

technology can affect the teaching process, and most

of them also think that it has achieved good results

for business college students. The factors that affect

online-offline teaching can be divided into two

types: one is the adaptability of students themselves;

the other is the level of teachers' application of

information technology.

From the view of students, the research of

Smolira (2008) found that the students' feeling

toward online homework increased their

understanding of the material, which was preferable

to traditional homework assignments that are turned

in to the instructor based on a survey of students'

enthusiasm for doing homework in finance courses.

Worthington (2002) indicated that expected grade,

ethnic background, gender, and age of student

characteristics are a significant influence on student

ratings by using an ordered probit model.

From the view of teachers, the study of Marlina

et al. (2021) shows that social influence, facility

conditions, and effort expectancy significantly

influence student behavior and performance. The

behavior determinant such as lecturer characteristics,

motivation and environment, and organizational

structure improve student performance. Mumtaz

(2000) revealed that several factors can influence

teachers' decisions to use the information and

communications technology in the classroom: access

to resources, quality of software and hardware, ease

of use, support and collegiality in their school,

commitment to professional learning, and

background in formal computer training. Ali et al.

(2022) indicated that system quality, course

material, instructor quality, information technology

(IT), and support service quality positively impacted

student e-learning satisfaction.

In summary, we build an online-offline

educational mode in financial knowledge and

experiment, as shown in Figure 1. We can see that

new media technology plays a key role in the

finance teaching and learning process.

The Application Effect of New Media Technology in Finance Teaching Courses for Business College Students

453

Figure 1: Online-offline educational mode

3 RESEARCH SUBJECTS AND

DATA SOURCES

This study takes 2021-2022 as the research

interval, which divides into two semesters to test

the different impacts between the offline

classroom and online platform. The first semester

adopts the traditional mode of offline teaching

face-to-face completely without any new media

technology. The second semester adds an online

platform for the COVID-19 epidemic. About half

of this time, we used online teaching methods for

college students to learn finance knowledge and

skills. We also used the Tencent Meeting (TM),

where teachers and students could learn about

finance courses through online classes. At the

same time, we put preview the text before class,

practiced exercises in class, did homework,

discussion, and shared information, and other

basic functions of online teaching with new media

technology by Learning Pass APP and WeChat.

In the two semesters, 329 students are

participating in the financial teaching research,

182 students in four classes in the first semester,

and 147 students in four classes in the second

semester. See descriptive statistics in Table 1. The

eight classes can be divided into two subjects, one

for economics, which was assigned a value of 1 if

the major is economics; and the other one for

management which was assigned 0; namely

variable Subject. The Grade variable was also

used by assigning a value of 1 if the student is a

freshman, the sophomore is 2, and the junior is 3.

Meanwhile, considering the importance of finance

and economics to the student’s major direction,

this paper divides the Major variable into five

dimensions: Management, Accounting, Trade,

Business, and Finance, and assigned a value of 1-

5 respectively. From Table 1, we can also see that

the time of enrollment in each major belongs to

the college students affected by the epidemic.

Table 1: Descriptive statistics for the students

Semester

Class Name Male Female

Number of

students

Subject Grade

Time of

Enrollment

The first

semester of

2021-2022

Business Economics 15 23 38 0 3 2019

Internet Finance 24 33 57 1 2 2020

Real Estate

Management

15 13 28 0 2 2020

International Trade

A

19 40 59 1 2 2020

NMDME 2022 - The International Conference on New Media Development and Modernized Education

454

The second

semester of

2021-2022

Excellent

Accounting

3 34 37 0 2 2020

Accounting 19 23 42 0 2 2020

International Trade

B

9 28 37 1 1 2021

International Trade

C

8 23 31 1 1 2021

4 EMPIRICAL ANALYSIS

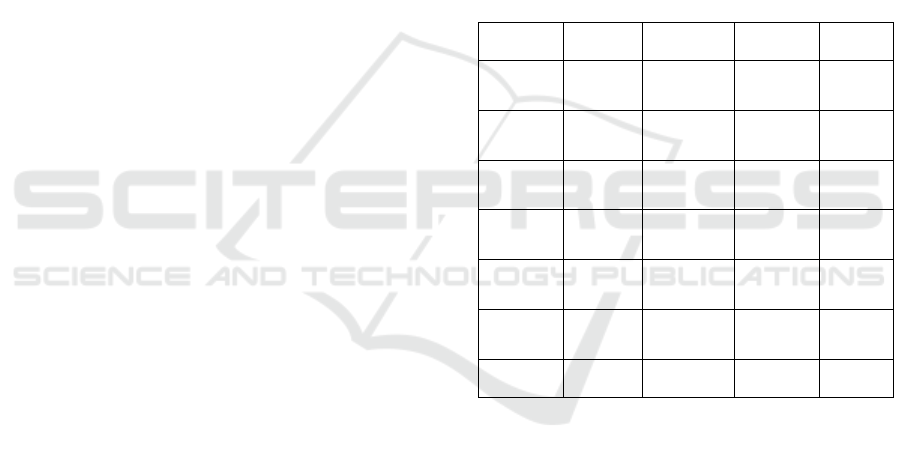

4.1 Mean-Variance Analysis

We compared the average score of the first semester

of offline learning with those of the second semester

of online learning, as shown in Table 2. When we

divided all the majors into two subjects, the average

score of the economics students was 78.10 in the

first semester, which was about four points higher

than the average score of the management students.

Then the obvious economics students' grades

decreased, lower than the first semester about 10

points. Further, we have listed the mean values for

the five majors. It is clear that students majoring in

Business Economics scored well in the first

semester, with the mean values being the highest of

all the samples, and students of International Trade

have the lowest professional achievement in the

second semester. Is this due to major differences?

It's not true that economics majors have an

advantage over management majors in studying

finance.

Table 2: The average score of the students

Variable Characteristics

Offline learning Online learning

Mean

score

Subject

Economics 78.10 68.70 74.34

Management 74.00 76.10 75.40

Major

Finance 74.00 -- 74.00

Business 83.00 -- 83.00

Trade 77.30 68.70 73.00

Accounting -- 76.10 76.10

Management 74.00 -- 74.00

Grade

Freshman

--

68.10 68.10

Sophomore 75.10 76.10 75.60

Junior 83.00

--

83.00

Group

Experimental class 83.00 79.20 81.10

Ordinary class 75.10 70.13 72.62

Gender

Female 79.16 72.40 75.78

Male 73.51 70.20 71.86

We continued to take grade point average, with

Business Economics majors topping out at 83.00 in

finance in the first semester of the offline course,

with freshmen in International Trade majors having

the lowest score of 68.10 in finance. Judging from

the results of two classes who are both economics

majors, but not in the same grade, the freshman

students have achieved lower results in studying

finance, which at least shows that it's not that

economics majors get good grades in finance but the

foundation in economics knowledge. Similarly,

sophomores in management majors who have

already studied a foundation in economics

knowledge, also did better in finance studies, even

though the second semester online was better than

the first semester, because the second-semester

experimental class was better than the first semester

students. In the class column, the performance is

more obvious, the first semester of online teaching

economics major experimental class than the second

The Application Effect of New Media Technology in Finance Teaching Courses for Business College Students

455

semester of online teaching of management major

experimental class had better results. The results of

the ordinary classes were the opposite, they were

more comfortable with the offline model, and in

general, both offline and online, the results of the

students in the experimental class are about 10

points higher than those in the ordinary class.

In addition, from the gender point of view,

female students are generally getting better

performance than male students in finance learning,

whether in an online platform or offline classroom.

And the differences in the effectiveness of offline

teaching are larger with online teaching making up

the difference slightly. However, the online teaching

model has not improved because of gender, and it is

clear that both male and female students perform

slightly worse than offline teaching.

Thus, we draw a basic conclusion: business

college students with a foundation in economics

knowledge learn finance faster than students without

a foundation in economics knowledge to achieve

better performance results. If a finance course is to

be taught online, it is necessary to treat different

students differently. We can use the method of

dividing classes to teach finance courses online,

which will help business college students quickly

accept the new media of teaching methods.

4.2 OLS Test Results Analysis

To further verify the above conclusions, we

construct an econometric model with teaching

achievement as the dependent variable, and then add

the variables of major, subject, semester, grade, and

gender into the model respectively, as shown in the

following formula.

E=β

0

+β

1

Major+β

2

Subject+β

3

Semester+β

4

Gen

der+β

5

Grade+ε

(1)

Where the dependent variable E represents the

students’ final score. The independent variables,

Major denotes that students major in five sample

majors, namely Management, Accounting, Trade

Business, and Finance, which are assigned values of

1-5 respectively; Subject stands for the major

category, which is divided into two major types

economics and management; Semester, the first

semester using offline teaching and the second-

semester using online teaching; Gender means 1 for

the female students and 0 for the male students;

Grade represents that 1 of freshman, 2 of

sophomore, and 3 of junior. ε represents the residual

variable. Then, the OLS test is performed and the

results are shown in Table 3.

In the case of no distinction between grades, the

division of majors will have a positive role in

promoting the learning effect, obviously having a

major in economics or finance obtain a better

learning effect, economics does not seem to be

dominant, on the contrary, management majors

dominate. That’s because, in the second semester,

sophomores in management do better than freshmen

in economics majors. Thus, after the grade division,

this analysis is valid, model (3) shows that higher

grades help to improve higher teaching

effectiveness, and economics majors significantly

improve teaching performance. In addition, divided

by gender, the female students can achieve better

results, this is significantly supported, in the (2)-(4)

model, we can see those female students show a

positive role in promoting the teaching effect.

Table 3: OLS test results

Variable (1) (2) (3) (4)

lnMajor

0.071

***

(0.025)

0.070

***

(0.024)

-0.064

**

(0.028)

Subject

-0.092

***

(0.025)

-0.097

***

(0.025)

0.101

***

(0.035)

Semester

-0.077

***

(0.013)

-0.089

***

(0.013)

0.051

**

(0.024)

-0.005

(0.017)

Gender

0.073

***

(0.013)

0.069

***

(0.012)

0.071

***

(0.012)

lnGrade

0.246

***

(0.035)

0.161

***

(0.024)

_cons

4.332

***

(0.020)

4.294

***

(0.020)

4.091

***

(0.034)

4.168

***

(0.022)

N 329 329 329 329

Note: t value in parentheses;

*

p < 0.1,

**

p < 0.05,

***

p < 0.01; similarly hereinafter.

4.3 DID Test Results Analysis

To compare the results of two semesters and analyze

the difference in learning effect between online and

offline teaching, we constructed a Differences-in-

Differences (DID) model, as shown in Formula 2.

E=β

0

+β

1

did+β

2

time+β

3

treated+β

4

controls+ε (2)

Where, if the class is an economics major, the

variable treated will be set to 1, otherwise, set to a

value of 0; if the class is used online educational

technology in the second semester, the variable time

is set to 1, or it will be set to 0 if that is in the first

semester. Then, we set up another variable did=

time*treated. This variable did represent the

NMDME 2022 - The International Conference on New Media Development and Modernized Education

456

economics major students who have adopted online

educational technology in the second semester. The

controls variable is including Homework, Grade,

and Gender for business college students.

Table 4: DID test results

Variable (1) (2) (3) (4)

did

-

0.147

***

(0.029)

-

0.129

***

(0.028)

0.098

**

(0.045)

0.099

**

(0.043)

time

0.028

(0.025)

0.010

(0.023)

0.001

(0.023)

-0.010

(0.023)

treated

0.053

**

(0.022)

0.044

**

(0.021)

0.014

(0.021)

0.006

(0.020)

lnHomework

0.319

***

(0.073)

0.398

***

(0.069)

0.346

***

(0.067)

lnGrade

0.276

***

(0.042)

0.273

***

(0.040)

Gender

0.063

***

(0.011)

_cons

4.291

***

(0.020)

2.875

***

(0.321)

2.332

***

(0.307)

2.537

***

(0.297)

N 329 326 326 326

In models (1) and (2), we can see that the

economic students do not achieve good performance

results in the use of e-learning technology, but

significantly inhibit the teaching effect. Even after

the addition of some learning homework on the

Internet, it did not change the teaching effect on

students. Why is that? We added a grade variable to

model (3), where we see that it can change the

teaching effect so that economics students get better

results after online educational technology, because

of the economic foundation, and there has been a

certain basis for finance online learning, the basis of

economics will have a better role in promoting

finance. From model (4), after controlling the gender

variables, it is obvious that the improvement of the

teaching effect will be promoted, further reinforcing

the conclusion that female students are more

adaptable to this teaching model.

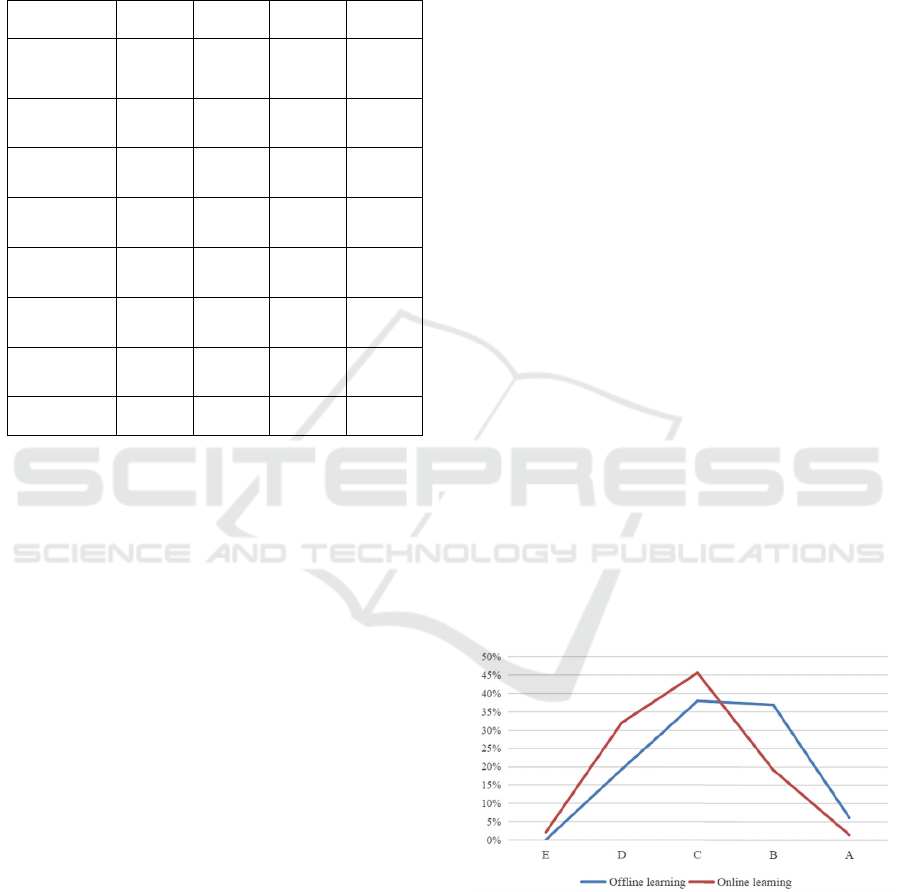

4.4 Discussion

From the above research, we can see that the

application of new media technology has not

brought effective results, and need to reconsider the

internal characteristics of students, and the external

environment of teachers (See Figure 2). The main

performance for the following aspects.

(i) In the first semester, management students

scored the lowest in both the highest and average

scores, generally lower than the other three

economics majors. It seems that the management

major has influenced the learning effect of finance.

But in the second semester, the two management

classes outperformed the two economics classes. In

this way, the study of finance should not be

attributed to the effect of a management major and

economics major. A freshman in economics major

without economics background is no better than a

sophomore in management major with an economics

background. But the junior in economics major has a

higher achievement, also further explained that it is a

good economics foundation for an essential

condition to study the finance courses.

(ii) In each one of the eight classes, there is a

high percentage of female students in every class,

and there is a large imbalance between the

proportion of male and female students. There is

also a general phenomenon of higher academic

performance of female students than that of male

students, and the highest scores are also mostly for

female students. That is to say, the current teaching

and evaluation of finance learning are in favor of

female students but the online teaching method is in

favor of male students. Whether this is due to nature

or nurture needs to be further studied.

(iii) The students of the experimental class have

good grades. Their average score is nearly 10 points

higher than the students of the same period. All of

them are selected to have a good economic

foundation for students in learning methods.

However, most of the students do not respond to the

effect of the online teaching method well.

Figure 2: Score distribution curve

5 CONCLUSIONS

Under the situation that the current finance teaching

method urgently needs to carry on the teaching

reform, we discussed the learning effect of the

The Application Effect of New Media Technology in Finance Teaching Courses for Business College Students

457

online-offline blended teaching mode added to the

new media technology. After analyzing the teaching

situation of eight classes of economics major and

management major students in two semesters of

2021-2022, we found that: the current use of the

blended teaching model has indeed caused some

burden to business college students and has not fully

met the requirements of expectations. The main

reasons are as follows: Firstly, there is no good

learning foundation, especially for freshmen, more

lack of effective learning methods and self-learning

ability; Secondly, having a certain economic

foundation is a necessary condition for business

college students to study finance knowledge and

skills, which can promote the improvement of

financial performance; Thirdly, female students are

more likely to obtain high financial performance

than male students, whether this is caused by

congenital factors, acquired learning factors, or

system design factors need to be further studied. In

other words, the main reason for the deviation of

online finance teaching is adaptability where has a

big deviation between the mean of blended teaching

and the law of student learning.

Therefore, we put forward the following

solutions for the online-offline teaching and learning

of finance knowledge and skills: (i) We should

recognize that the online-offline teaching model will

inevitably become the mainstream form of the

future, and the key factor of study performance is to

enhance students’ ability to adapt to the finance

online teaching using new media technology. (ii) We

can change the evaluation method of financial

teaching which emphasizes the result to the

evaluation method which emphasizes the process,

making use of online-based teaching platforms and

teaching resources. (iii) Adjusting the sequence of

finance programs should be at least put after the

basic teaching of economics knowledge, let students

have a good understanding of micro-economics and

macro-economics before they proceed to study

finance courses. (iv) Making full use of the

experimental class teaching model, which can also

be to accounting experimental class or economics

experimental class, separate fast and slow learning

in financial knowledge and skills. So, finance

educators must improve the new media technology

adapted to the law of students' learning and make

them resonate with each other to meet the

requirements of mutual adaptation.

ACKNOWLEDGMENTS

This research is financially supported by the Major

Project of Higher Educational Humanity and Social

Sciences Foundation of Anhui Province

(SK2021ZD0084), and the Scientific Research

Foundation for Talent Introduction of Tongling

University (2021tlxyrc06).

REFERENCES

Ali, M., Puah, C. H., Fatima, S., Hashmi, A., & Ashfaq,

M. (2022). Student e-learning service quality,

satisfaction, commitment and behaviour towards

finance courses in COVID-19 pandemic. International

Journal of Educational Management. 8, 9.

Chen, T., Peng, L., Yin, X., Rong, J., Yang, J., & Cong, G.

(2020). Analysis of user satisfaction with online

education platforms in China during the COVID-19

pandemic. In Healthcare . 8, 3, 200.

Chiasson, K., Terras, K., & Smart, K. (2015). Faculty

perceptions of moving a face-to-face course to online

instruction. Journal of College Teaching & Learning,

12, 3, 321-240.

He, H., Yin, L., & Liu, W. (2021). Research on intelligent

teaching of finance based on hypermedia. The

International Journal of Electrical Engineering &

Education, 1, 11, 0020720920983529.

Li, Y., Bai, L., & Liu, Z. (2021). The teaching effects of

online-offline hybrid mode in the course of finance: A

questionnaire-based analysis. In 2021 2nd

International Conference on Information Science and

Education, 11, 181-184.

Li, L., & Wu, X. (2019). Research on school teaching

platform based on blockchain technology. In 2019

14th International Conference on Computer Science &

Education, 8, 38-43.

Lin, J. (2021). Design and research of inverted classroom

teaching of information technology integrating into the

major of finance and economics. IPEC 2021: 2021

2nd Asia-Pacific Conference on Image Processing,

Electronics and Computers, 4, 892-895.

Marlina, E., Tjahjadi, B., & Ningsih, S. (2021). Factors

affecting student performance in e-learning: A case

study of higher educational institutions in Indonesia.

The Journal of Asian Finance, Economics and

Business, 8, 4, 993-1001.

Mi, J. & Wang, Y. (2022). New research progress on

digital currency and its economic impact. Economic

Perspectives. 5, 127-142.

Mumtaz, S. (2000). Factors affecting teachers' use of

information and communications technology: A

review of the literature. Journal of information

technology for teacher education, 9, 3, 319-342.

Nie, D., Panfilova, E., Samusenkov, V., & Mikhaylov, A.

(2020). E-learning financing models in Russia for

sustainable development. Sustainability, 12, 11, 4412.

NMDME 2022 - The International Conference on New Media Development and Modernized Education

458

Padmakumari, L. (2022). Lessons learnt from teaching

finance during COVID-19 pandemic: My two cents.

Management and Labour Studies, 1, 23,

0258042X211068947.

Park, S. M., & Kim, Y. G. (2022). A Metaverse:

Taxonomy, components, applications, and open

challenges. IEEE Access, 10, 4209-4251.

Salt, B., Atkins, C., & Blackall, L. (2008). Engaging with

Second Life: Real education in a virtual world.

Retrieved June, 17.

Sathye, M. (2004). Teaching banking and finance online: a

case study. Indian Journal of Open Learning, 13, 3,

303-312.

Shao, L. P., & Shao, D. H. (1998). The Internet: An

essential technology for academic finance

professionals. Journal of Teaching in International

Business, 10, 1, 19-34.

Smolira, J. C. (2008). Student perceptions of online

homework in introductory finance courses. Journal of

Education for Business, 84, 2, 90-95.

Stephen, S. A. (2015). Enhancing the learning experience

in finance using online video clips. Journal of

Financial Education, 103-116.

Sun, T. (2021). Design of online teaching system for

innovation and entrepreneurship of finance major

based on big data. In International Conference on E-

Learning, E-Education, and Online Training, 7, 143-

153.

Vatsala, L., & Pissay, S. (2015). How educational

technology tools can solve challenges in teaching an

online finance course? Titleglobal Learn, 4, 1-7.

Wei, C. Y., Kuah, Y. C., Liew, F. M., Lee, C. L., & Koh,

C. M. (2021). Online learning mode during Covid-19

pandemic: Learner’s perception qualitatively in

finance courses. Asian Journal of Research in

Education and Social Sciences, 3, 2, 41-53.

Yu, Y. (2021). The influence of new media technology on

ideological education in colleges. Journal of Shanxi

University of Finance and Economics, 4, 43, 91-97.

The Application Effect of New Media Technology in Finance Teaching Courses for Business College Students

459