Empirical Evidence of Intangible Assets Improve the Financial

Performance of Slovak ICT Companies

Serhii F. Lehenchuk

1 a

, Tetiana A. Vakaliuk

1,2,3 b

, Tetiana P. Nazarenko

1 c

,

Zuzana Kuba

ˇ

s

ˇ

c

´

ıkov

´

a

4 d

and Zuzana Juh

´

aszov

´

a

4 e

1

Zhytomyr Polytechnic State University, 103 Chudnivsyka Str., Zhytomyr, 10005, Ukraine

2

Institute for Digitalisation of Education of the National Academy of Educational Sciences of Ukraine,

9 M. Berlynskoho Str., Kyiv, 04060, Ukraine

3

Kryvyi Rih State Pedagogical University, 54 Gagarin Ave., Kryvyi Rih, 50086, Ukraine

4

University of Economics in Bratislava, Dolnozemsk

´

a cesta 1, 852 35 Petr

ˇ

zalka, Slovakia

Keywords:

Intangible Assets, Intellectual Capital, Financial Performance, ICT Companies.

Abstract:

In the conditions of the knowledge economy, the financial performance of high-tech enterprises largely de-

pends on the efficiency of the processes of creating and using intangible assets. To increase it, it is necessary

to build an effective intangible investment policy, which should be based on an understanding of the role of cer-

tain types of intangible assets in increasing financial performance. The hypothesis of the study is the existence

of a significant positive impact of intangible assets on the financial performance of ICT companies. A sample

of 180 Slovak ICT companies for the period 2015–2019 has been investigated. The primary research method

was the regression analysis of panel data, which was carried out using the GRETL software package. Four re-

gression models were formed based on using such dependent variables as Return on Assets, Net Profit Margin,

Assets Turnover, and Return on Equity. Each of the selected models included eight independent variables –

Research and Development Intensity, Research and Development Intensity Squared, Software, Intellectual

Property Rights, Acquired Intangible Assets, Leverage, Size, and Dummy variable for ICT sub-sectors. For

each of the models, an estimate panel data parameter was chosen based on the F-statistics test, Breusch-Pagan

test, and Hausman test (Model 1-3 – Pooled OLS model, Model 4 – Fixed Effects Method). Adequacy of

each of the models to the generated data was checked on the basis of the Normality test, Autocorrelation test

(Wooldridge test for autocorrelation), and Heteroscedasticity test (White test, Wald test). The hypothesis of

the study was partially confirmed, since only RDI, RDI2 and AIA have a significant positive impact on the

financial performance of Slovak ICT companies. The strength and direction of influence of independent vari-

ables vary depending on the indicator characterizing financial performance. Only the independent variable

AIA has a permanent inverse effect on all indicators of financial performance of Slovak ICT companies. It

was established that the level of influence of control variables on indicators of financial performance is partial

and multidirectional, and applies only to certain types of them.

1 INTRODUCTION

Over the last three decades, a significant number of

scientists have been actively discussing the change in

the role of different types of capital in the process of

creating economic value of enterprises and ensuring

a

https://orcid.org/0000-0002-3975-1210

b

https://orcid.org/0000-0001-6825-4697

c

https://orcid.org/0000-0001-7702-8122

d

https://orcid.org/0000-0001-6739-1278

e

https://orcid.org/0000-0001-8592-0137

their sustainable and long -term success. In particular,

it is reminded on the determining role of intellectual

capital in this process by shift in the “production mix”

and management’s focus, moving from the industrial

focus (of capital and labour) to intellectual capital and

trade in ideas, based on intellectual property rights,

especially patents for its connection to technology

(Daum, 2002; Abeysekera, 2008; Moberly, 2014; Ull-

berg et al., 2021). Under these conditions, the value

of enterprises and their profitability become more de-

pendent on their ability to effectively realize their ex-

isting innovative potential and to use their capitalized

38

Lehenchuk, S., Vakaliuk, T., Nazarenko, T., KubaÅ ˛aÄ Ã kovà ˛a, Z. and Juhà ˛aszovà ˛a, Z.

Empirical Evidence of Intangible Assets Improve the Financial Performance of Slovak ICT Companies.

DOI: 10.5220/0011931000003432

In Proceedings of 10th International Conference on Monitoring, Modeling Management of Emergent Economy (M3E2 2022), pages 38-52

ISBN: 978-989-758-640-8; ISSN: 2975-9234

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

intangible assets. This issue is even more relevant

in the period of overcoming the consequences of the

COVID-19 pandemic and in the context of the intro-

duction of a proactive sanctions policy of world lead-

ers, which results in a reduction in trade in traditional

goods and services, given the growth of the market

of unique intellectual technologies, which ensure the

formation of a stable value for enterprises.

In such new conditions, the economy of devel-

oped countries becomes increasingly dependent on

the development of national intellectual capital. And

for a large number of enterprises their financial per-

formance depends on the effectiveness of implemen-

tation of the policy on creation of new and use of

available intangible assets, ensuring their incorpora-

tion into the activity of the enterprise, the establish-

ment of their effective partnership, stewardship and

control. At the same time, the activity of enterprises

under such conditions is characterized by frequent oc-

currence of network effects, high probability of occur-

rence of market and technological risks, which pro-

vides the necessity of rethinking their business strate-

gies, which will include realization of strategic initia-

tives on intangible values. This is especially relevant

for high-tech enterprises, whose activity is character-

ized by high level of usage of intangible assets and

is aimed at creation of innovative technological prod-

ucts and services.

The presence of such economic changes in the

global business environment makes it necessary to

search for new theories and policies that would enable

the scientific substantiation of decisions and behav-

ior of management of companies with a high share of

intangible assets used in the process of development

and design of technological products and services to

ensure their strong financial performance.

To determine impact of impossible assets on com-

panies performance, the activity of Slovak compa-

nies from information and communications technol-

ogy (ICT) sector was analyzed. Such enterprises,

which relate to processes of processing, storage and

transfer of information, production of computers and

telecommuting devices, and also provision of related

services, belong to high-tech enterprises, the process

of creating value in which depends to a large extent on

effective use of intangible assets. Investing in high-

tech intangible assets of ICT sector enterprises should

lead to the improvement of their financial indicators.

However, as the studies Hu

ˇ

nady et al. (Hu

ˇ

nady et al.,

2019), Slovakia still has only very small proportion

of business R&D in ICT sector. This is evidence of

the cautious policy of Slovak ICT companies to im-

plement intangible investments as a result of the exis-

tence of significant risks and uncertainty as to the re-

turn of such investments. Therefore, in order to min-

imize such risks and eliminate uncertainty, in order

to build an effective intangible investment policy at

ICT enterprises need to identify features of relations

between different types of intangible assets and dif-

ferent financial performance indicators.

In the Slovak Republic over the past ten years,

there has been active development of the ICT sector.

In particular, the number of employees involved in the

information and communication technology services

sector in Slovakia increased from 28905 in 2009 to

53676 in the 2019 year (SARIO, 2021). This shows

an increase in staff almost doubled in 10 years. ICT

industry currently occupies an important place in the

structure of the Slovak economy, representing 4,2%

of GDP, and at the same time has a noticeable influ-

ence on other related industries. This industry is very

attractive for investors due to the presence of signif-

icant potential for growth due to a number of advan-

tages in comparison with other branches of economy

in Slovakia: High level of adaptation of ICT to the

activity of enterprises; high value added and wages

(1,2 – 4,0 ths. eur.); well-developed ICT related edu-

cational system; well-developed ICT institutional net-

work; diversification of telecommunication segment;

strategic geographical location from the perspective

of time zonation; high quality data and network cover-

age; attractive investment incentives for the ICT sec-

tor (SARIO, 2021). In addition, ICT sector is ac-

tively supported by Slovak government, as a result,

investors are offered attractive investment incentives

for the ICT sector (tax reliefs; cash grants; contribu-

tions for the newly created jobs; rent/sale of real estate

for a discounted price) and special R&D tax regime

(200% of the R&D expenses can be deducted from

the tax base) (SARIO, 2021). Thus, impact research

of intangible assets impact on financial performance

of Slovak ICT companies in modern conditions, there

is a particularly urgent need to define the directions of

development and ways of adjustment of their intangi-

ble investment policy.

Based on the important role of intangible assets

in ensuring the efficiency of high-tech companies re-

search hypothesis was formulated. The hypothesis of

the study is the existence of a significant positive im-

pact of intangible assets on the financial performance

of ICT companies. Because the force of such influ-

ence may also depend from company size, level of

borrowed capital and belonging to sub-sector of ICT

industry, these factors should also be taken into ac-

count in the analysis impact of intangible assets on the

financial performance, and the results obtained should

be used in formulating recommendations to manage-

ment of Slovak ICT companies for investments in in-

Empirical Evidence of Intangible Assets Improve the Financial Performance of Slovak ICT Companies

39

tangible assets.

2 THEORETICAL BACKGROUND

Problems of influence of intangible assets in their

broad (economic) understanding on financial perfor-

mance of high-tech companies are paid considerable

attention of academicians. First of all, this is condi-

tioned by the decisive role of intellectual capital for

such enterprises in the context of the development of

knowledge economy, which is based on ideas, R&D,

innovations and technological progress. Scientists an-

alyze of the impact of different intangible values on fi-

nancial performance: intangible assets (the concept of

IAS 38 (Deloitte Touche Tohmatsu Limited, 2022)),

intellectual capital (as a combination of human, orga-

nizational, and client capital), or separate components

of two data. These studies cover different types of en-

terprises from different countries of the world, which

represent different sectors of the economy. Since in-

tellectual capital includes, to the most extent, all in-

tangible assets that are the result of human intellectual

activity, this article also analyzes the impact of intel-

lectual capital and its components on the financial per-

formance of ICT companies. In addition, a number

of researchers are conducting studies of the impact

of intangible assets both on individual components of

financial performance, in particular, on profitability,

and on broader categories, in particular, on total per-

formance of the company or companies value.

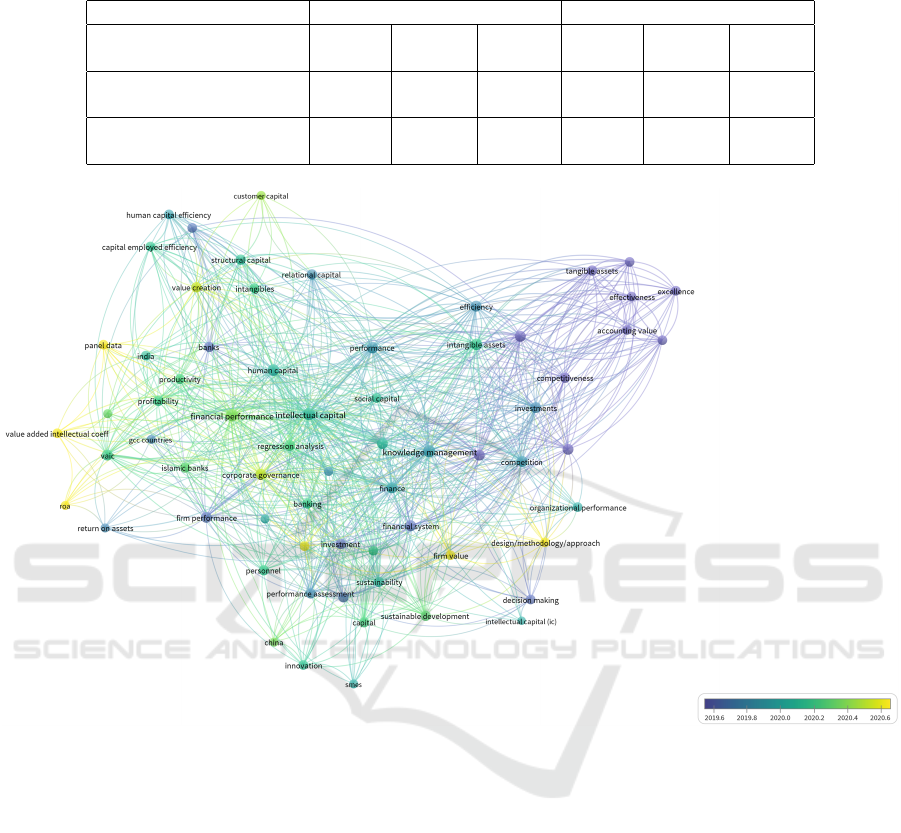

Table 1 lists the number of articles and their quota-

tions, which reveal the relationship between “Intangi-

ble assets” / “Intellectual capital” and “Financial per-

formance” in science-based databases of Scopus, Web

of Science and Google Scholar.

The results of analysis of scientific databases are

obtained (table 1) testify to the existence of a consid-

erable number of publications in this direction of re-

searches, as well as their influence on scientific works

of other authors, which is confirmed by a considerable

number of references to data of other authors and their

constant growth from year to year. The cluster analy-

sis of the key words of the articles from the databases

of the Scopus and Web of Science on the basis of the

use of VOSviewer allowed to confirm this conclusion.

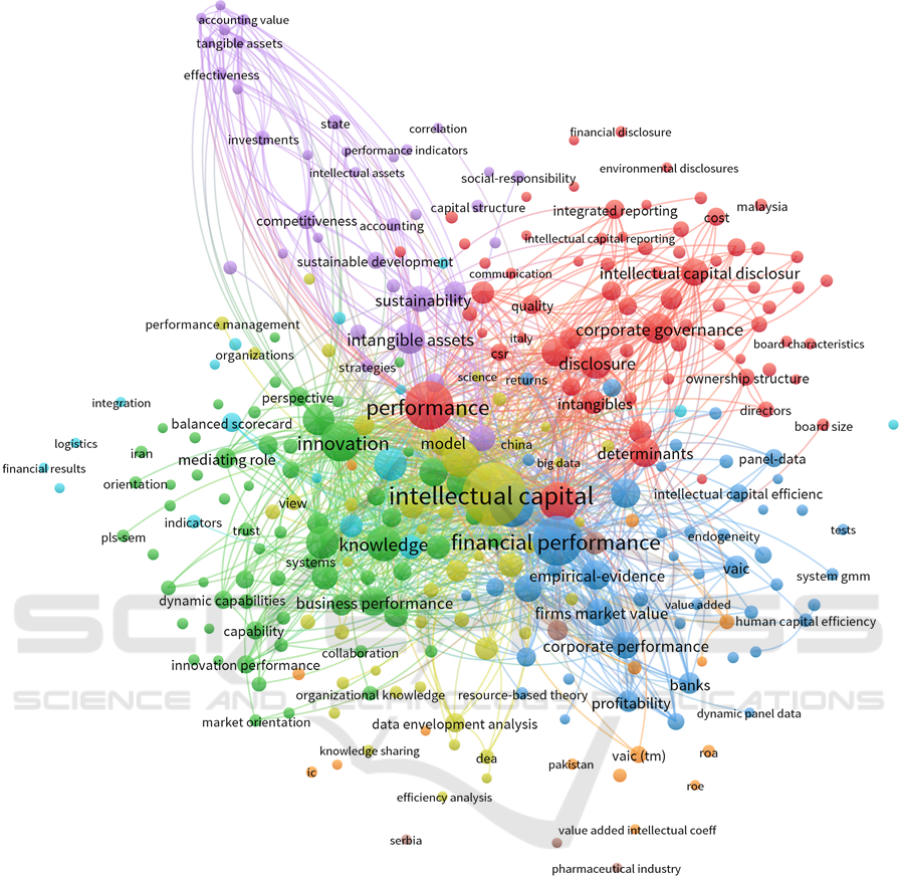

There was also a large number of publications that

examined the impact of structural elements of intan-

gible assets or intellectual capital (research and devel-

opment, intangible resources, customer capital, struc-

tural capital, human capital, social capital, relational

capital) on financial performance (figure 1). In addi-

tion, publications have been identified that investigate

the impact of intangible assets or intellectual capital

on other types of indicators that characterize the per-

formance of the enterprise – firm performance, busi-

ness performance, corporate performance, firm value,

effectiveness, efficiency, profitability, ROA, competi-

tive advantage etc. (figure 2).

Little attention is paid directly to the issue of im-

pact of intangible values on financial performance of

ICT companies, although the presence of significant

positive relationships between with two variables is

confirmed in the vast majority of results. Gan and

Saleh (Gan and Saleh, 2008) the connection between

intellectual capital components was studied corporate

performance of high-techn companies listed on Bursa

Malaysia, in particular, profitability, and productivity.

Based on the use of regression analysis, it was found

that companies with larger intellectual capital as a rule

have better profitability (ROA) and more efficient pro-

ductivity (ATO).

Li and Wang (Li and Wang, 2014) investigated the

impact of different intangible assets (R&D expendi-

ture, employee benefit, sales training) on profitability

indicators (ROA) of Hong Kong Listed IT companies

using regression analysis. They found a positive rela-

tionship between intangible assets and ROA.

D

ˇ

zenopoljac et al. (D

ˇ

zenopoljac et al., 2016) ex-

amined the role of intellectual capital and its key com-

ponents in provision for financial performance (ROA,

ROE, ROIC, ATO) of Serbian ICT sector companies

during 2009–2013. They used Value-added intellec-

tual coefficient (VAIC) as a measure of the IC contri-

bution to value creation. The results obtained by the

authors revealed that only one component of VAIC –

CEE (capital-employed efficiency) had a significant

impact on financial performance indicators, except

for the indicator ROIC. Khan (Khan, 2018) also used

VAIC as firms intangibility measure when analyzed

the impact of intellectual capital on the financial per-

formance of the 51 Indian IT companies for the period

2006–2016. He found a significant positive associa-

tion of VAIC with profitability, and an insignificant

relationship with productivity, and significant positive

association of CEE with profitability and productivity

of Indian IT companies.

Zhang (Zhang, 2017) analysed the relationship be-

tween degree of intangible assets and profitability for

17 Chinese listed telecommunication firms’ for the

period from 2014 to 2016. He found a positive and

significant effect of Intangible assets ratio on ROA.

Also, he emphasized the possibility of the inaccuracy

of the obtained results due to the conservative nature

of Chinese accounting standards rules in measuring

intangible assets.

Hu

ˇ

nady et al. (Hu

ˇ

nady et al., 2019) examined the

role of innovations in performance of ICT sector com-

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

40

Table 1: Number of scientific articles by direction of researches and their quotations in academic literature for the period

2018–2022 as of July 01, 2022 (via Scopus, Web of Science and Google Scholar databases).

Results found Sum of the times cited

Searching phrases Scopus Web of Google Scopus Web of Google

Science Scholar Science Scholar

“Intangible assets” and 161 576 21 894 16100 38

“Financial performance”

“Intellectual capital” and 329 970 494 2530 13904 2235

“Financial performance”

Figure 1: Bibliometric map of publications’ keywords on the query “Intangible assets”, “Intellectual capital” and “Financial

performance” according to Scopus database in 2018–2022.

panies from 24 countries during the years 2008–2016.

Using regression analysis for macro-level data, they

found positive effect of R&D expenditure on apparent

labour productivity and value added in ICT sector.

Qureshi and Siddiqui (Qureshi and Siddiqui,

2020) analyzed an effect of intangible assets on finan-

cial performance (ROA, ROE, ROIC, ATO and NPM)

of the 80 global technology firms for the period from

2015 to 2018. They confirmed a significant nega-

tive effect of intangible assets on ROE, ROIC, ATO,

and insignificant positive impact on companies’ prof-

itability. Moreover, the force of this influence consid-

erably varies depending on the country’s innovative

development.

Lopes and Ferreira (Lopes and Ferreira, 2021)

also investigated the impact of intangibles on the

performance indicators of major world technologi-

cal firms (Turnover, ROA, ROE, ROS, EPS), have

received evidence of existence of negative correla-

tion between all intangible variables, control variables

(Size, Leverage) with ROA. These conclusions are

also confirmed in labor Sundaresan et al. (Sundare-

san et al., 2021), which investigated the impact of

intangible assets on financial performance of 38 Tai-

wanese listed technology firms for the period 2015–

2019. The authors also revealed the existence of a

lack of a significant relationship between intangible

assets and ROA, but found significant influence of

size on ROA. At the same time, they confirmed signif-

icant impact of intangibles on ROE. Received Lopes

and Ferreira (Lopes and Ferreira, 2021), Sundaresan

et al. (Sundaresan et al., 2021) the results of the ROA

are in direct contradiction with most of the conclu-

sions obtained by the authors who studied impact of

Empirical Evidence of Intangible Assets Improve the Financial Performance of Slovak ICT Companies

41

Figure 2: Bibliometric map of publications’ keywords on the query “Intellectual capital” and “Financial performance” ac-

cording to Web of Science database in 2018–2022.

intangibles on performance of ICT companies.

Radoni

´

c et al. (Radoni

´

c et al., 2021) studied the

role of intellectual capital components (human, rela-

tional, structural and innovation capital) in ensuring

the achievement of financial performance indicators

(ROA, ROE, Net Profit, etc.) of South-East Europe

IT industry companies. In their study, as a theoretical

background they used a resource-based view on intel-

lectual capital, which involves analyzing the impact

of its individual components on financial performance

indicators. In particular, the authors established that

innovation capital has the strongest impact and hu-

man capital has an indirect impact on the financial

performance of IT companies. A similar resource-

based approach was also used by Serpeninova et al.

(Serpeninova et al., 2022), who as a result of a study

of the impact of intellectual capital on the profitabil-

ity of Slovak software development companies (ROA,

NPM, GPM, EBITM) found an absence of a signifi-

cant relationship between them. The authors consid-

ered the main reason for this to be the imperfection

of the current accounting standards, for instance, IAS

38, in terms of criteria for recognizing and evaluating

the intellectual capital of enterprises.

The analysis of studies on the issues of the re-

search made it possible to establish the existence of

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

42

mutually contradictory evidence regarding the impact

of intangible assets on the financial performance. In

general, this does not allow the management of enter-

prises to effectively control intangible values aimed

at creating internal value, and for investors – to re-

ceive clear signals for making effective investments.

Considering the above, the following objectives were

formulated: to measure the relationship between in-

tangible assets and the financial performance of Slo-

vak ICT companies; to investigate which components

of intangible assets have the most significant or in-

significant impact on the financial performance of

Slovak ICT companies; to form recommendations for

improving the investment policy of ICT companies,

based on the level of significance of the elements of

intangible assets from the point of view of increasing

financial results.

3 DATA AND METHODOLOGY

Sample selection. To determine whether intangible

assets stimulate financial performance, was analyzed

sample of 180 Slovak ICT companies for the period

2015–2019. In particular, the panel data information

from financial statements of such enterprises, avail-

able in the open access, as well as the information

from database “FinStat” was used to form panel data.

Only those companies, for which the necessary infor-

mation for the 5-year period was available, were in-

cluded in the sample. The selected 180 companies

provide a valid and complete set of data in order to

carry out relevant statistical analysis.

Investigated enterprises proceeding from EU Eco-

nomic Activity Classification and from the SK NACE

2 classification belongs to group 26 “Manufacture

of computer, electronic and optical products”, in-

cludes direct production of computers, computer pe-

ripheral equipment (input device, output device, in-

put/output device), communication equipment (public

switching equipment, transmission equipment, cus-

tomer premises equipment), measuring, medical, nav-

igation, radio, optical and other electronic equipment,

as well as production of various types of accessories

for such products (electrical boards, magnetic and op-

tical media, etc.). In order to take into account the

influence sub-sectors affiliation on financial perfor-

mance of ICT companies two groups were allocated

in their composition. The first group included enter-

prises dealing with the production of different types of

electronics and components, and the second group in-

volved enterprises producing communication equip-

ment and components.

Based on the form of ownership, most of the com-

panies investigated – 160, companies with limited li-

ability, 16 – is a joint-stock company, 2 – production

cooperative, 1 – limited partnership, 1 – general part-

nership. By type of ownership, the companies investi-

gated are divided as follows: private domestic – 64%;

foreign – 21%; international with a predominant pri-

vate sector – 13%; cooperative – 1%; state – 1%.

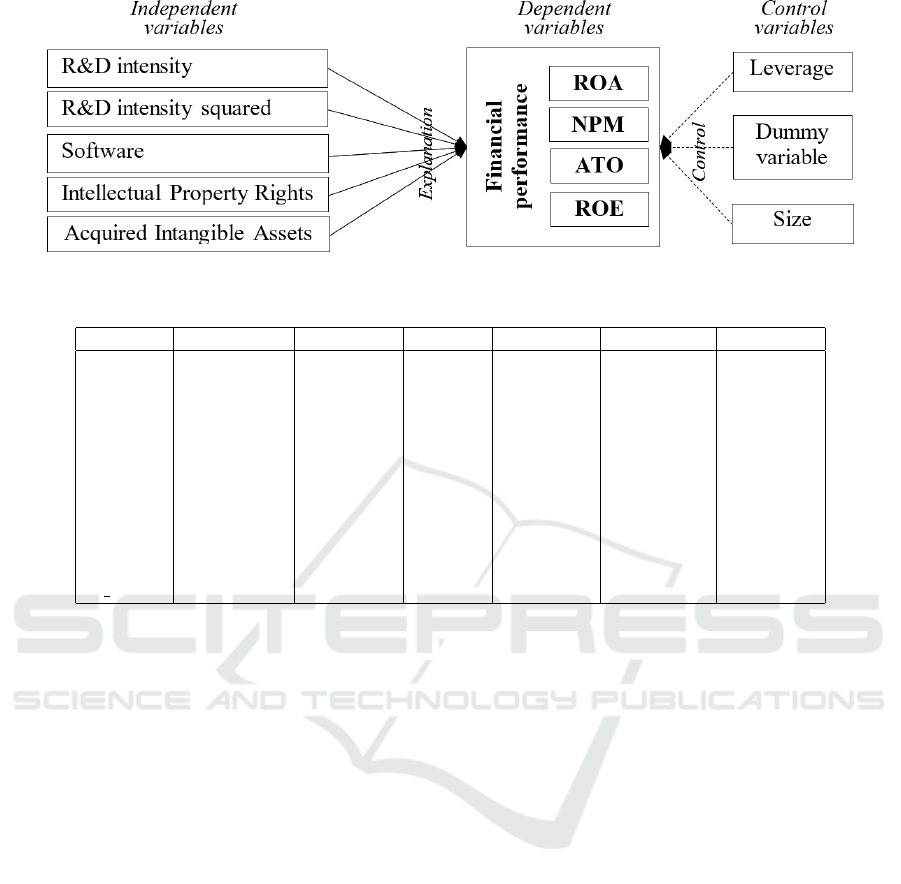

Variables. In the research for characteristics of

financial performance of ICT companies were used

four dependent variables – Return on Assets, Net

Profit Margin, Return on Equity, Assets Turnover,

and used in their work by researchers for simiral em-

pirical analysis of the relationship between intangi-

bles values and company financial performance (Gan

and Saleh, 2008; D

ˇ

zenopoljac et al., 2016; Qureshi

and Siddiqui, 2020; Sundaresan et al., 2021; Radoni

´

c

et al., 2021; Serpeninova et al., 2022). For explana-

tion of a relation between intangible assets and finan-

cial performance of ICT companies used intangible

assets variables – Research and Development Inten-

sity, Research and Development Intensity Squared,

Software, Intellectual Property Rights, Acquired In-

tangible Assets. The election of such independent

variable is justified by the financial statements of Slo-

vak ICT companies in the disclosure of information

about intangible assets. As it was revealed Hu

ˇ

nady

et al. (Hu

ˇ

nady et al., 2019), the firm’s ICT sector

account for significant share of total business R&D

expenditure in economy in most countries. There-

fore, in the analysis impact of intangible assets on fi-

nancial performance of ICT sector an important role

should be assigned to R&D indicators. As a result,

the study does not use the indicator of R&D costs

but uses two calculation ratios that characterize the

R&D of the companies. In addition, based on pre-

vious studies (Ievdokymov et al., 2020; Zavalii et al.,

2022; Serpeninova et al., 2022) in our study used three

control variables – Leverage, Size and Dummy vari-

able for ICT sub-sectors. Use of these variables will

allow to control for a significant effects of company

size, level of borrowing capital, and unseen role of

ICT sub-sectors affiliation.

Types, calculation procedures, and abbreviations

used in the Variables study are shown in table 2.

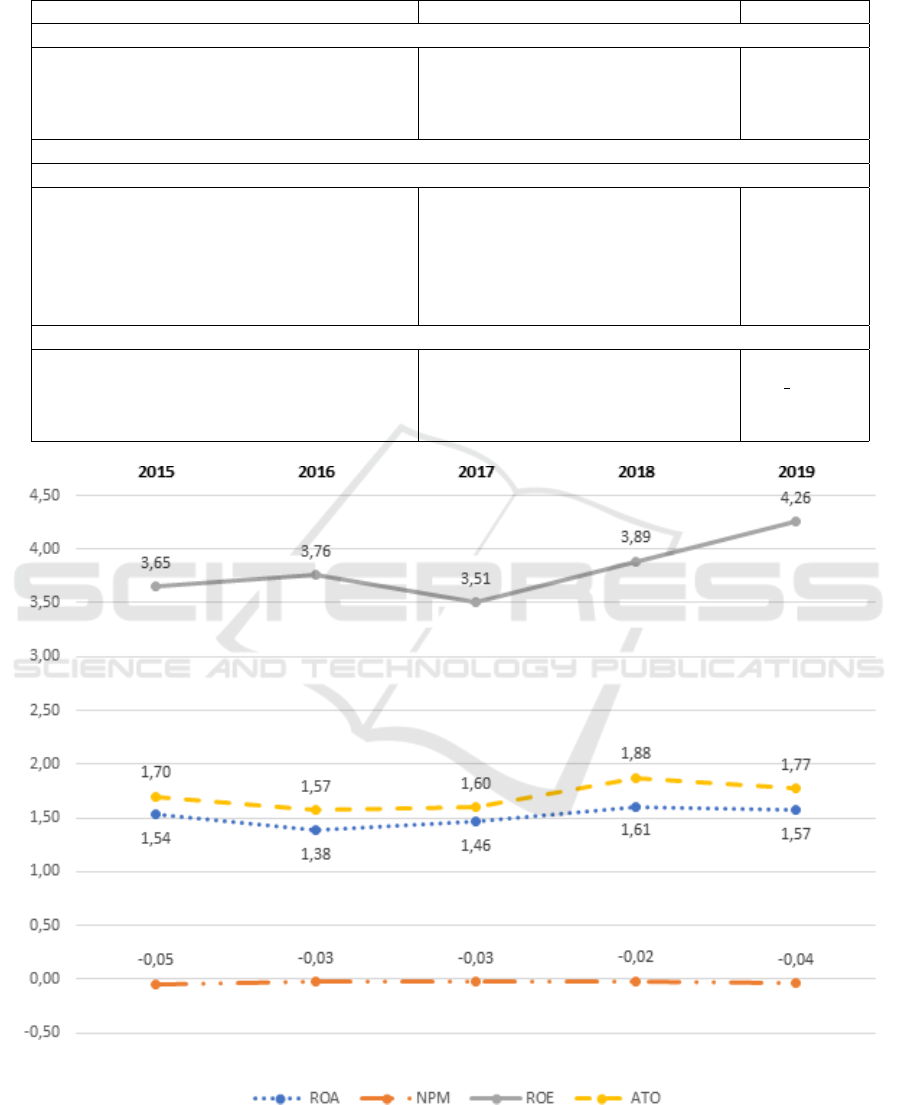

The dynamics of four indicators, that character-

ize financial performance of Slovak ICT companies

(ROA, NPM, ROE, ATO) for the period 2015–2019

showed in figure 3.

Figure 1 displays the change in time of financial

performance indicators for the 2015–2019 period. It

allows to identify a number of common trends: Si-

multaneous growth in all indicators for 2017–2018

years; decrease in ATO, ROA and NPM indicators for

2015–2016 years, their growth in 2016–2018 years,

Empirical Evidence of Intangible Assets Improve the Financial Performance of Slovak ICT Companies

43

Table 2: Variable definitions and abbreviations.

Variable Calculation (Source) Abbreviation

Dependent Variables

Return on Assets Net turnover / Total Assets ROA

Net Profit Margin Net profit / Total Sales NPM

Assets Turnover Total Sales / Total Assets ATO

Return on Equity Net profit / Total Equity ROE

Independent Variables

Intangible Assets Variables

Research and Development Intensity Capitalized R&D Costs / Total Sales RDI

Research and Development Intensity Squared Squared function of RDI RDI2

Software Software (Intangible Asset) SOFT

Intellectual Property Rights Valuable Intellectual Property Rights IPR

Acquired Intangible Assets Acquired long-term intangible assets AIA

are charged until the time of their use

Control Variables

Leverage Total liabilities / Total Assets LEV

Size Logarithm of Total Assets l SIZE

Dummy variable for ICT sub-sectors 1 for electronic producers, DVICTSS

0 for communication producers

Figure 3: Dynamics of financial performance indicators of Slovak ICT companies for the 2015-2019 period.

as well as their simultaneous decrease in 2018–2019;

during 2018–2019 years only growth of ROE indica-

tor occurs. In general, common behavior was found

for ATO, ROA and NPM, as well as almost com-

pletely different behavior of ROE compared to these

indicators.

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

44

4 RESEARCH MODELS

To understand the relationship between intangible as-

sets and financial performance indicators, this study

examined four following models:

Model 1: ROA

it

= α + β

1

· RDI

it

+ β

2

· RDI2

it

+

β

3

· SOFT

it

+ β

4

· IPR

it

+ β

5

· AIA

it

+ β

6

· LEV

it

+ β

7

·

l SIZE

it

+ β

8

· DVICTSS

it

+ ε

it

Model 2: NPM

it

= α + β

1

· RDI

it

+ β

2

· RDI2

it

+

β

3

· SOFT

it

+ β

4

· IPR

it

+ β

5

· AIA

it

+ β

6

· LEV

it

+ β

7

·

l SIZE

it

+ β

8

· DVICTSS

it

+ ε

it

Model 3: ATO

it

= α + β

1

· RDI

it

+ β

2

· RDI2

it

+

β

3

· SOFT

it

+ β

4

· IPR

it

+ β

5

· AIA

it

+ β

6

· LEV

it

+ β

7

·

l SIZE

it

+ β

8

· DVICTSS

it

+ ε

it

Model 4: ROE

it

= α + β

1

· RDI

it

+ β

2

· RDI2

it

+

β

3

· SOFT

it

+ β

4

· IPR

it

+ β

5

· AIA

it

+ β

6

· LEV

it

+ β

7

·

l SIZE

it

+ β

8

· DVICTSS

it

+ ε

it

where: ROA, NPM, ATO, ROE – dependent vari-

ables, where i is entity and t is time;

α – Identifier;

µ – Variance introduced by the unit-specific effect

for unit i;

β – Regression coefficient;

RDI, RDI2, SOFT, IPR, AIA – independent intan-

gible variables, LEV, l SIZE, DVICTSS – indepen-

dent control variables;

ε

it

– error term.

Figure 4 shows the conceptual framework of the

study.

5 RESULTS

5.1 Descriptive Statistics and

Correlations

The descriptive statistics (observation, mean, median,

standard deviation, minimum, maximum) of a full

sample are presented in table 3.

From table 3 it can be observed that the full sam-

ple is measured with 180 units. The largest devia-

tions in variables are related to SOFT (5,95·10

4

), IPR

(2,89·10

4

), AIA (1,61·10

5

) and ROE (4,30). Large

differences between the minimum and the maximum

values of ROA, ATO, and ROE show that the finan-

cial performance levels of ICT companies are quite

distinct. For some variables (ATO, LEV, IPR, AIA,

l SIZE) the mean value is greater than the standard

deviation value, as a result, the data in these variables

have a small distribution. ROA, NPM, and ROE have

a higher standard deviation than their mean. This in-

dicates a relatively large set of ratios that will char-

acterize the normal distribution curve and will not be

outliers. The closeness of the mean (13,5) and me-

dian (13,3) values for l SIZE indicates a high level of

symmetry in the distribution of range values, that is,

the size of the studied enterprises. The mean value of

the LEV ratio is 0,438, and this means that approxi-

mately 44% of the total assets of ICT companies are

financed through borrowed resources.

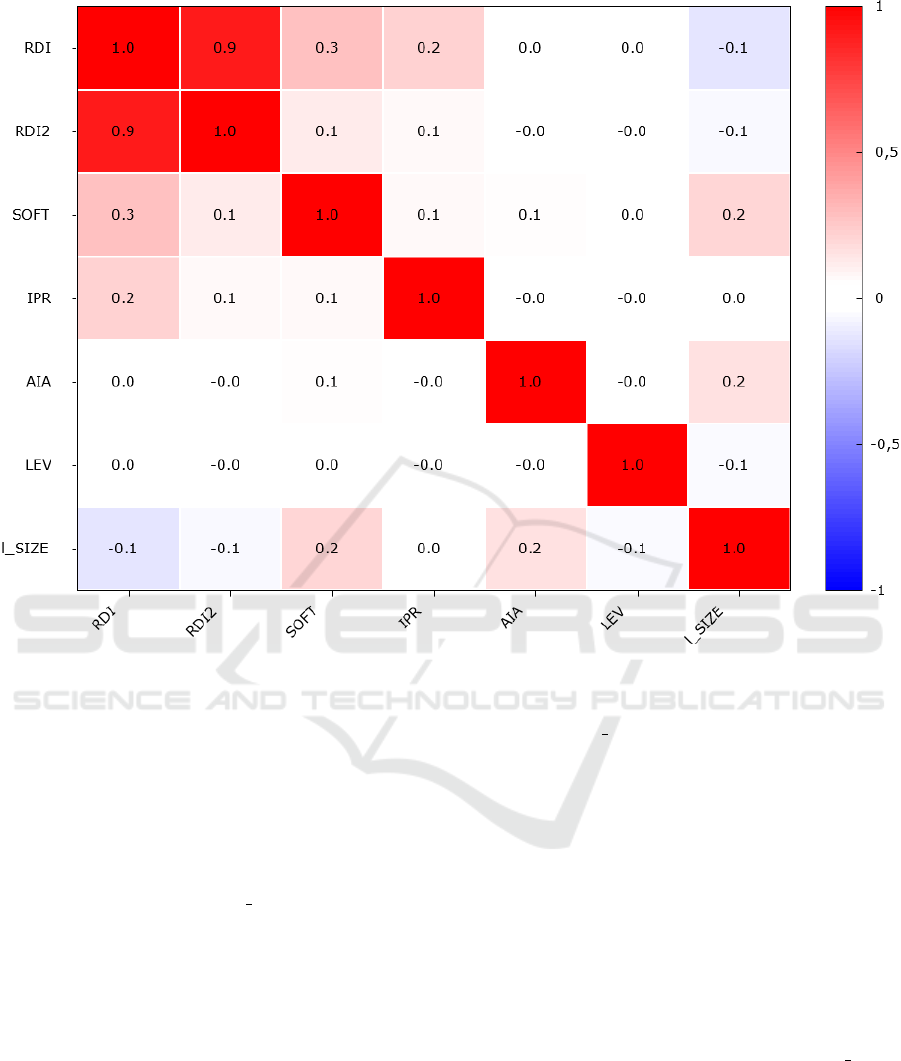

In general, correlation matrix of variables used

in Models 1-4 (figure 5), testifies to absence multi-

collinearity problem, since in most cases, the corre-

lation coefficient is less than 0,5 (–0,5). The only

exception is the high correlation coefficient between

variables RDI and RDI2 (0,9), which is understand-

able given that RDI2 is a squared function of RDI.

However, as

¨

Ozkan (

¨

Ozkan, 2022) notes, the prac-

tice of applying such mutually-correcting indicators is

normal in the regression analysis performed to check

the effect of interrelated variables on financial perfor-

mance indicators. In particular, simultaneous use in

regression models of variables RDI and RDI2 allows

to detect presence U-inverted relation between R&D

and financial performance of a company.

5.2 Selection of Estimate Panel Data

Parameter

The choice of estimate panel data parameter for each

of the selected models plays an important role in

the regression analysis of panel data. This param-

eter should be adequately correlated with the data

used in the corresponding model. Proceeding from

F-statistics test for Model 1 F(179; 712) = 1,17767

with p-value 0,0766456, which is more than 0,05 and

confirms null hypothesis in relation to pooled OLS

model. The need for such a choice estimate pa-

rameter for Model 1 also confirmed the application

Breusch-Pagan test, according to which chi-square (1)

> 2,04561 p-value = 0,152645, which is larger than

0.05 and confirms zero hypotheses. The use of F-

statistics test and Breusch-Pagan test also confirmed

the need for use pooled OLS model as a quality esti-

mate parameter for Model 2. For Model 3 after ap-

plication F-statistics test it was received F(179; 712)

= 1,23387 with p-value 0,0331413, that is less than

0,05 and testifies to the adequacy of application Fixed

effects method (FEM). However, this conclusion is

refuted as a result Breusch-Pagan test, according to

chi-square (1) > 3,58479 p-value = 0,0583107, which

is larger than 0,05 and confirms zero hypothesis of

adequacy pooled OLS model. Considering the re-

sults Hausman test (p-value = prob(chi-square (8) >

4,34179) = 0,825045), according to which more ap-

propriate is the application of Random effects method

(REM) than FEM, for Model 3 more appropriate also

Empirical Evidence of Intangible Assets Improve the Financial Performance of Slovak ICT Companies

45

Figure 4: Conceptual framework of the study.

Table 3: Descriptive statistics of variables (based on observations 1:1 – 180:5).

Variables Observation Mean Median St. Dev. Minimum Maximum

ROA 180 1,51 1,27 1,52 2,75e-005 24,9

NPM 180 -0,0325 0,00798 0,501 -6,80 2,97

ATO 180 1,70 1,39 1,61 6,88e-005 24,6

ROE 180 3,81 2,33 4,30 0,000120 38,2

LEV 180 0,438 0,429 0,265 0,000 0,988

RDI 180 0,129 0,000 0,652 -0,0346 9,91

RDI2 180 0,442 0,000 4,96 0,000 98,2

SOFT 180 2,00e+004 0,000 5,95e+004 0,000 5,18e+005

IPR 180 8,27e+003 0,000 2,89e+004 -2,57e+004 2,67e+005

AIA 180 2,00e+004 0,000 1,61e+005 0,000 3,20e+006

l SIZE 180 13,5 13,3 2,00 8,35 18,9

consider the application of pooled OLS model. For

Model 4 after application of F-statistics test F(179;

712) = 1,32394 of p-value 0,00693691, which is less

than 0,05 and shows the adequacy of application of

FEM. This is the test followed by the p-value = P(chi-

square (1) > 6,04321) = 0,0139599.

5.3 Assumption Test Results

To verify the adequacy of the Panel data for Mod-

els 1-4 that is collected about ICT companies, it

should be diagnosed using Normality test, Autocor-

relation test and Heteroscedasticity test. Normality

test for all Models 1-4 allowed to detect abnormal

distribution of the error. For example, for Model 1

for chi-square (2) = 4119,75 p-value = 0, which is

less than 0,05, and does not confirm zero hypothe-

ses about the normal distribution of balances. Re-

view null hypothesis about no first-order autocorre-

lation based on usage Wooldridge test for autocor-

relation allowed to confirm it for all four models.

In particular, for all Models 1-4 p-value it is more

than 0,05 (0,73367; 0,923389; 0,193049; 0,227822),

confirming null hypothesis. White test was used to

check the heteroscedasticity of a models 1–3. Since

the obtained p-value for each of the three models

(0,284134; 0,999935; 0,421088) is more than the crit-

ical value, the zero hypothesis about the absence of

heteroscedasticity is forgiven. For Model 4 with es-

timate parameter FEM was applied non-parametric

Walk test, which also was established the presence

of heteroscedasticity. In particular, chi-square(180)

= 78593,1 p-value = 0 was received. Since p-value is

less than 0,05, there is an inhomogeneous observation

and a different variance of a Model 4 random error,

which confirms the existence of heteroscodesticity.

To solve the problem of inadequacy of all Mod-

els 1–4 used by this data due to the problem of im-

proper distribution of the error and heteroscedasticity,

the use of robust estimators is proposed. They help

minimize or eliminate impact of outliers in a Mod-

els 1-4, improving the results of panel data regres-

sion analysis. Practice of use robust standard errors

in regression analysis was also used in research of sci-

entists who study the impact of intangible assets and

their components on the performance of enterprises

(

¨

Ozkan, 2022; Serpeninova et al., 2022).

5.4 Panel Data Regression Results

Model 1 (ROA). Tables 4–5 show the results of

regression analysis performed using pooled OLS

model. They show how the independent variable will

affect the dependent variable, which of the regres-

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

46

Figure 5: Correlation matrix of variables used in Models 1-4 (calculated via GRETL software package).

sions have significant influence, force and direction

of such influence.

Model 1 can be interpreted through the following

equation:

ˆy = 1, 83324 − 1, 16410 · 10

−6

x

1

+ 0, 110937x

2

+

1, 65440 · 10

−6

x

3

+ 1, 34184 · 10

−6

x

4

− 4, 98766 ·

10

−7

x

5

− 0, 137738x

6

− 0, 0379800x

7

+ 0, 168307x

8

where: ˆy – ROA; x

1

– RDI; x

5

– AIA; x

2

– RDI2;

x

6

– LEV; x

3

– SOFT; x

7

– l SIZE; x

4

– IPR; x

8

–

DVICTSS.

Based on the results of the regression analysis,

const, RDI, RDI2, SOFT and AIA are statistically

significant (there are stars in the last column of ta-

ble 4), having the highest level of significance at the

1% level. Accordingly, these indicators have the high-

est impact on ROA. In addition to RDI and AIA, other

significant indicators have a direct impact on ROA

and RDI and AIA are rotating. The presence of a dif-

ferent direction of influence in RDI and RDI2 indi-

cates the presence of U-inverted relationship between

R&D and ROA (Lehenchuk et al., 2022). Similar

U-inverted behavior is common to most of the costs

of non-material nature, in particular, social and envi-

ronmental costs (Sokil et al., 2020). The results also

show that there is no significant influence of control

variables (Lev, l SIZE, DVICTSS) on ROA.

The overall content of the regression coefficient of

Model 1 is that with an increase of 1 directly influenc-

ing the ROA, the last increase in the ratio will be in-

creased. For example, if SOFT is increased by 1, the

ROA will increase by 1,65440 ·10

06

. And for indica-

tors that have a positive impact on ROA, their increase

by 1 for ICT enterprises will result in corresponding

decrease of ROA (depending on the coefficient of re-

gression).

Table 5 indicates that the coefficient of determina-

tion (R-squared) of Model 1 is 0,047173. This means

only that 4,7% of the variation of ROA can be ex-

plained by the variation of the independent variables

(const, RDI, RDI2, SOFT, IPR, AIA, LEV, l SIZE,

DVICTSS).

Model 2 (NPM). Model 2 can be interpreted

through the following equation:

ˆy = −0, 274718 + 0, 0626252x

1

−

0, 00669466x

2

− 5, 13111 · 10

−8

x

3

+ 2, 00654 ·

10

−7

x

4

− 5, 88982 · 10

−8

x

5

− 0, 0630010x

6

+

0, 0269143x

7

− 0, 0517929x

8

where: ˆy – NPM; x

1

− x

8

– the same as in Model 1.

Empirical Evidence of Intangible Assets Improve the Financial Performance of Slovak ICT Companies

47

Table 4: Model 1 (ROA). Pooled OLS model (Robust standard errors), using the observations 1–900.

Variable Coefficient Standard error z P-value Significance by t-statistics

const 1,83324 0,632512 2,898 0,0038 ***

RDI −1,16410 0,157720 −7,381 <0,0001 ***

RDI2 0,110937 0,0175566 6,319 <0,0001 ***

SOFT 1,65440·10

−6

5,38521·10

−7

3,072 0,0021 ***

IPR 1,34184·10

−6

9,24827·10

−7

1,451 0,1468

AIA −4,98766·10

−7

1,38889·10

−6

−3,591 0,0003 ***

LEV −0,137738 0,214780 −0,6413 0,5213

l SIZE −0,0379800 0,0454674 −0,8353 0,4035

DVICTSS 0,168307 0,105500 1,595 0,1106

Note: *** Significant at the 1% level.

Table 5: Model 1 (ROA). Pooled OLS model (Robust standard errors), using the observations 1–900.

Indicator Value Indicator Value

Mean dependent var. 1,511304 S.D. dependent var. 1,524745

Sum squared resid. 1991,445 S.E. of regression 1,495014

R-squared 0,047173 Adjusted R-squared 0,038618

F(8, 179) 21,20706 P-value (F) 1,86·10

−22

Table 6: Model 2 (NPM). Pooled OLS model (Robust standard errors), using the observations 1–900.

Variable Coefficient Standard error z P-value Significance by t-statistics

const –0,274718 0,116547 –2,357 0,0184 **

RDI 0,0626252 0,0295138 2,122 0,0338 **

RDI2 –0,00669466 0,00314309 –2,130 0,0332 **

SOFT –5,13111·10

−8

1,17552·10

−7

–0,4365 0,6625

IPR 2,00654·10

−7

1,99115·10

−7

1,008 0,3136

AIA –5,88982·10

−8

2,90523·10

−8

–2,027 0,0426 **

LEV –0,0630010 0,0813673 –0,7743 0,4388

l SIZE 0,0269143 0,00838749 3,209 0,0013 ***

DVICTSS –0,0517929 0,0272405 –1,901 0,0573 *

Note: * Significant at the 10% level; ** Significant at the 5% level; *** Significant at the 1% level.

Table 7: Model 2 (NPM). Pooled OLS model (Robust standard errors), using the observations 1–900.

Indicator Value Indicator Value

Mean dependent var. -0,032511 S.D. dependent var. 0,501315

Sum squared resid. 222,9308 S.E. of regression 0,500203

R-squared 0,013291 Adjusted R-squared 0,004432

F(8, 179) 2,238141 P-value (F) 0,026686

Based on table 6, the most significant effect on

NPM is changed to l SIZE. Accordingly, with the

growth of the enterprise volume by 1 increases the

value of the NPM indicator by 0,0269143. Signifi-

cant at the 5% level in NPM explanation have regres-

sors const, RDI, RDI2 and AIA. Also significant at

the 10% level is the DVICTSS regression, which has

an indirect effect. Indirect effects on NPM are also

affected by the RDI2 and AIA indicators. This means

that, as investments in such types of intangible assets

increase, the corresponding (depending on the regres-

sion coefficient) reduction of the dependent variable

will occur. By comparing the coefficient of Model 2

with RDI and RDI2, it is possible to note the existence

of the upper limit of investments in R&D of Slovak

ICT companies, after which their negative impact on

NPM will already be observed.

Table 7 indicates that the R-squared of Model 2

is 0,01, a very low value and does not allow to speak

about the significant role of intangible assets in NPM

provision. This means that 1,33% of the variation of

the NPM can be explained by the variation of regres-

sors.

Model 3 (ATO). Model 3 can be interpreted

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

48

Table 8: Model 3 (ATO). Pooled OLS model (Robust standard errors), using the observations 1–900.

Variable Coefficient Standard error z P-value Significance by t-statistics

const 2,80330 0,637648 4,396 <0,0001 ***

RDI –1,42622 0,174982 –8,151 <0,0001 ***

RDI2 0,134772 0,0192228 7,011 <0,0001 ***

SOFT 2,76920·10

−6

6,38619·10

−7

4,336 <0,0001 ***

IPR 4,61116·10

−6

1,59970·10

−6

2,883 0,0039 ***

AIA –4,38715·10

−7

1,36505·10

−7

–3,214 0,0013 ***

LEV –0,139781 0,233510 –0,5986 0,5494

l SIZE –0,0951285 0,0438796 –2,168 0,0302 **

DVICTSS 0,150857 0,124085 1,216 0,2241

Note: ** Significant at the 5% level; *** Significant at the 1% level.

Table 9: Model 3 (ATO). Pooled OLS model (Robust standard errors), using the observations 1–900.

Indicator Value Indicator Value

Mean dependent var. 1,703817 S.D. dependent var. 1,614880

Sum squared resid. 2212,759 S.E. of regression 1,575898

R-squared 0,056170 Adjusted R-squared 0,047696

F(8, 179) 15,95424 P-value (F) 1,15·10

−17

through the following equation:

ˆy = 2, 80330 − 1, 42622x

1

− 0, 134772x

2

+

2, 76920 · 10

−6

x

3

+ 4, 61116 · 10

−6

x

4

− 4, 38715 ·

10

−7

x

5

− 0, 139781x

6

− 0, 0951285x

7

+ 0, 150857x

8

where: ˆy – ATO; x

1

− x

8

– the same as in Model 1.

For dependent variable ATO except for LEV and

DVICTSS, all other regressions are significant. In

particular, l SIZE significant at the 5% level, and all

other regressions (const, RDI, RDI2, SOFT, IPR and

AIA) significant at the 1% level. Direct effects on

ATO from the regression data are RDI2, SOFT and

IPR, while others are affected. In particular, as in

Model 1 for ROA, making a small amount of invest-

ments in R&D of Slovak ICT companies has a nega-

tive impact on ATO. Only their implementation from

a certain volume, in particular, in the volume of RDI2,

ensures the growth of ATO. Based on an equal to

1,3 RDI2 growth by 1 increases the NPM value by

0,0269143. Table 9 indicates that the R-squared of

Model 3 is 0,056. This means that 5,61% of the vari-

ation of the ATO can be explained by the variation of

regressors.

Model 4 (ROE). Model 4 can be interpreted

through the following equation:

ˆy = −1, 06067 − 2, 79903x

1

+ 0, 272431x

2

+

5, 89712 · 10

−6

x

3

+ 8, 97938 · 10

−7

x

4

− 1, 27997 ·

10

−6

x

5

+ 8, 94081x

6

+ 0, 0265371x

7

+ 0, 392670x

8

where: ˆy – ROE; x

1

− x

8

– the same as in Model 1.

Model 4 has five statistically significant regres-

sors – RDI, RDI2, SOFT, AIA and LEV (table 10).

All of them have the highest level of significance –

1%, therefore they have the greatest influence on the

dependent variable (ROE). The equation of Model 4

shows that most of the independent variables (RDI2,

SOFT, IPR, LEV, l

SIZE and DVICTSS) have a di-

rect influence, and only two variables (const, RDI and

AIA) have a rotational influence on the ROE. As in

Models 1 and 3, Model 4 has a U-inverted relationship

between R&D and ROA, characterized by the need to

increase investment in R&D of Slovakia ICT compa-

nies to ensure their positive impact on ROE.

Table 11 indicates that the LSDV R-squared of

Model 4 is 0,51. This is quite a high value compared

to the 1–3 models, but not enough to speak about the

significant role of intangible assets in providing of fi-

nancial performance of ICT companies. This means

that 51,61% of the variation of the ROE can be ex-

plained by the variation of the regressors.

6 DISCUSSION

The results obtained in the article partially confirm

the conclusions of the analyzed works on the role of

intangible assets in the promotion of financial per-

formance of high-tech companies. As for some re-

gressions, they are in conflict with such conclusions.

The existence of a positive and significant relation-

ship between intangible assets and some financial per-

formance measures was confirmed, which is also set

in the works of Li and Wang (Li and Wang, 2014),

D

ˇ

zenopoljac et al. (D

ˇ

zenopoljac et al., 2016), Zhang

(Zhang, 2017). The presence was also established of

negative and significant impact of AIA on all finan-

cial performance indicators, this confirms the results

of the research (Qureshi and Siddiqui, 2020; Lopes

Empirical Evidence of Intangible Assets Improve the Financial Performance of Slovak ICT Companies

49

Table 10: Model 4 (ROE). FEM (Robust standard errors), using the observations 1–900.

Variable Coefficient Standard error z P-value Significance by t-statistics

const –1,06067 1,27812 –0,8299 0,4066

RDI –2,79903 0,466001 –6,006 <0,0001 ***

RDI2 0,272431 0,0565526 4,817 <0,0001 ***

SOFT 5,89712·10

−6

2,18175·10

−6

2,703 0,0069 ***

IPR 8,97938·10

−7

3,30604·10

−6

0,2716 0,7859

AIA –1,27997·10

−6

3,62115·10

−7

–3,535 0,0004 ***

LEV 8,94081 0,614350 14,55 <0,0001 ***

l SIZE 0,0265371 0,0848603 0,3127 0,7545

DVICTSS 0,392670 0,344744 1,139 0,2547

Note: *** Significant at the 1% level.

Table 11: Model 4 (ROE). FEM (Robust standard errors), using the observations 1–900.

Indicator Value Indicator Value

Mean dependent var. 3,812005 S.D. dependent var. 4,304137

Sum squared resid. 8058,382 S.E. of regression 3,364216

LSDV R-squared 0,516144 Within R-squared 0,348421

and Ferreira, 2021). At the same time, the direction

and influence of different types of regressions used in

the study are not the same in all formed models, but

depends on a particular kind of financial performance

indicator. One of the reasons for this is that the rela-

tionship between intangible assets on financial perfor-

mance may depend on macroeconomic factors, in par-

ticular, on the level of science capacity in the industry

and on the level of innovation in the country, which is

noted by Qureshi and Siddiqui (Qureshi and Siddiqui,

2020). Another reason for such results may be incom-

plete information about intangible assets disclosed in

the financial statements of Slovak ICT companies. In

turn, this is a consequence of the conservatism of

the current methodology of recognizing and evalu-

ating intangible assets, which Zhang (Zhang, 2017)

also points out, Radoni

´

c et al. (Radoni

´

c et al., 2021).

Therefore, the findings of this study confirm the pro-

posal of Serpeninova et al. (Serpeninova et al., 2022)

regarding the necessity of expanding the criteria for

recognizing and the structure of financial reporting for

high-tech companies regarding intangible assets.

The results of the survey refutes the conclusions

of Gan and Saleh (Gan and Saleh, 2008) on the pos-

itive impact of the company’s size on the improve-

ment of financial performance (ROA), but such an

impact was found with respect to NPM. The above

confirms the hypothesis of Del Monte and Papagni

(Del Monte and Papagni, 2003) that to increase the re-

turns from intangible investments should be provided

with their proper quality level, not quantitative imita-

tions. Therefore, an intangible investment policy of

ICT companies should be based not only on quanti-

tative parameters, that is, not on the basis of total in-

vestment in the company, but on the individual role

of certain types of intangible assets in improving of

financial performance.

The study has some limitations, which should be

taken into account by other scientists when evaluat-

ing the results of a study. Firstly, given the sufficient

breadth of the term “financial performance”, a list of

dependent variables used in the study can be speci-

fied. Second, the list of independent variables used

in a study can be expanded by uncapitalized intangi-

ble assets that also affect the financial performance

of Slovakia ICT companies. However, it is necessary

to separate from the composition of different types of

expenses of ICT companies those expenses connected

with creation of intangible assets (client, ecological,

social, etc.), as such data are not in financial state-

ments of companies. Third, to determine the role of

intangible assets in improvement of financial perfor-

mance, research can be carried out not only on the

examples of companies of ICT industry, but also on

the example of other branches of economy. This will

allow to carry out an interindustry comparison and es-

tablish in which areas of management of enterprises

should pay the most attention to development of an

intangible investment policy.

7 CONCLUSION

The present research was performed in order to study

the effects of intangible assets on the financial perfor-

mance of high-tech companies. For this purpose, the

activity of 180 Slovak ICT companies over the period

2015–2019 was analyzed. Such research is especially

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

50

relevant in the conditions of the ICT sector’s impor-

tant role in the development of the Slovak economy.

As a result, Slovak Government creates the necessary

favorable institutional conditions for further develop-

ment of ICT companies and implements special pro-

grams to stimulate investment in this sector.

Panel data regression analysis was used as the ba-

sic method of research. Return on assets, Net Profit

Margin, Assets Turnover and Return on Equity were

selected as dependent variables that characterize fi-

nancial performance. For each of these indicators a

model was formed, which included eight independent

variables. It is intangible assets variables (Research

and Development Intensity, Research and Develop-

ment Intensity Squared, Software, Intellectual Prop-

erty Rights, Acquired Intangible Assets), and three –

control variables (Leverage, Size, Dummy variable

for ICT sub-sectors) for the 2015–2019 period. For

each of the models the estimate panel data parameter

was chosen based on F-statistics test, Breusch-Pagan

test and Hausman test (Model 1–3 – pooled OLS

model, Model 4 – FEM). The adequacy of each of the

models of the formed data was tested on the basis of

the Normality test, Autocorrelation test (Wooldridge

test for autocorrelation) and Heteroscedasticity test

(White test, Walk test) with the application of the

GRETL software package. Based on the incomplete

adequacy of the models to the generated data the ex-

pediency of robust standard errors use was substanti-

ated.

The hypothesis of the study was partially con-

firmed as a result of the conducted research. The re-

sults of panel regression analysis have shown that not

all types of intangible assets have a significant posi-

tive impact on the financial performance of Slovakia

ICT companies. Only RDI, RDI2 and AIA have sig-

nificant influence of different forces on all four types

of dependent indicators, which characterize the finan-

cial performance of the company. This is evidence of

the expediency of management making investments

in these types of intangible assets of the Slovak ICT

companies. The presence of different directions of

influence of RDI and RDI2 on indicators of the finan-

cial performance testifies to existence of U-inverted

relationship between R&D and such indicators of two

types. By the first type (Models 1, 3, 4) RDI is out of

the zone of return of investments in R&D, and RDI2

is within it. And by the second type (Model 2) RDI

enters the profit zone, and RDI2 is already outside it.

Based on these results, management of ICT compa-

nies may decide to make additional investments in

R&D or to reduce them in order to provide better

financial performance of the company. In all mod-

els studied, the independent variable AIA has a high

level of significance, but turns to the performance

of financial performance of Slovak ICT companies.

This shows that long-term intangible assets have not

yet been put into operation, and therefore need to be

more quickly brought into business processes of Slo-

vak ICT companies. In addition, there should be an

effective system of planning processes for acquisition

of intangible assets in accordance with the company’s

needs as an element of its intangible investment pol-

icy.

Research results also show that when using lever-

age, Size and Dummy variable for ICT sub-sectors

as a control variables only l SIZE has a significant

impact on NPM (1% level) and ATO (5% level),

DVICTSS on NPM (10% level) and LEV on ROE

(1% level). That is, the level of influence of control

variables on the indicators of financial performance is

partial and varied, and applies only to certain types of

them, in particular, not at all affecting ROA.

ACKNOWLEDGEMENTS

This article is an output of the project of the Scientific

Grant Agency of the Ministry of Culture of the Slovak

Republic and Slovak Academy of Sciences (VEGA)

no. 1/0517/20 (2020–2022) “Virtual Cryptochains as

a Relevant Tool to Eliminate Economic Crime”

REFERENCES

Abeysekera, I. (2008). Intellectual Capital Accounting:

Practices in a developing country. Routledge, Lon-

don. https://doi.org/10.4324/9780203937617.

Daum, J. H. (2002). Intangible Assets and Value Creation.

John Wiley & Sons Ltd., Chichester.

Del Monte, A. and Papagni, E. (2003). R&D and the growth

of firms: Empirical analysis of a panel of Italian firms.

Research Policy, 32(6):1003–1014. https://doi.org/10.

1016/S0048-7333(02)00107-5.

Deloitte Touche Tohmatsu Limited (2022). IAS 38 — Intan-

gible Assets. https://www.iasplus.com/en/standards/

ias/ias38.

D

ˇ

zenopoljac, V., Jano

ˇ

sevic, S., and Bontis, N. (2016).

Intellectual capital and financial performance in

the Serbian ICT industry. Journal of Intellec-

tual Capital, 17(2):373–396. https://doi.org/10.1108/

JIC-07-2015-0068.

Gan, K. and Saleh, Z. (2008). Intellectual Capital and Cor-

porate Performance of Technology-Intensive Compa-

nies: Malaysia Evidence. Asian Journal of Business

and Accounting, 1(1):113–130. https://ajba.um.edu.

my/article/view/2197.

Hu

ˇ

nady, J., Pisar, P., and Durcekova, I. (2019). Busi-

ness R&D Expenditure in the ICT Sector: Effects on

Empirical Evidence of Intangible Assets Improve the Financial Performance of Slovak ICT Companies

51

Business Performance Indicators. In Proceedings of

the ENTRENOVA - ENTerprise REsearch InNOVAtion

Conference, volume 5, pages 519–530, Rovinj, Croa-

tia. https://www.econstor.eu/handle/10419/207714.

Ievdokymov, V., Ostapchuk, T., Lehenchuk, S., Grytsyshen,

D., and Marchuk, G. (2020). Analysis of the impact

of intangible assets on the companies’ market value.

Naukovyi Visnyk Natsionalnoho Hirnychoho Univer-

sytetu, 3:164–170. https://doi.org/10.33271/nvngu/

2020-3/164.

Khan, A. M. (2018). An Empirical Study of the Impact of

Intellectual Capital on the Financial Performance of

the Indian IT Sector. Journal of Corporate Finance

Research, 15(1):7–19. http://dx.doi.org/10.17323/j.

jcfr.2073-0438.12.1.2018.7-19.

Lehenchuk, S., Tumpach, M., Vyhivska, I., Makarovych,

V., and Laichuk, S. (2022). The Impact of Innovation

on the Profitability of Slovak Pharmaceutical Com-

panies. Marketing and Management of Innovations,

2:184–296. https://doi.org/10.21272/mmi.2022.2-25.

Li, H. and Wang, W. (2014). Impact of Intangible Assets on

Profitability of Hong Kong Listed Information Tech-

nology Companies. Business and Economic Research,

4(2):98–113. https://doi.org/10.5296/ber.v4i2.6009.

Lopes, I. T. and Ferreira, C. F. P. (2021). Intangibles

as innovative drivers for competitive businesses. In-

ternational Journal of Business Innovation and Re-

search, 24(2):238–260. https://doi.org/10.1504/ijbir.

2020.10024988.

Moberly, M. D. (2014). Safeguarding Intangible As-

sets. Butterworth-Heinemann. https://doi.org/10.

1016/C2013-0-15617-6.

Qureshi, M. J. and Siddiqui, D. A. (2020). The Effect of In-

tangible Assets on Financial Performance, Financial

Policies, and Market Value of Technology Firms: A

Global Comparative Analysis. Asian Journal of Fi-

nance & Accounting, 12(1):26–57. https://doi.org/10.

5296/ajfa.v12i1.16655.

Radoni

´

c, M., Milosavljevi

´

c, M., and Kne

ˇ

zevi

´

c, S. (2021).

Intangible Assets as Financial Performance Drivers

of IT Industry: Evidence from an Emerging Market.

E&M Economics and Management, 24(2):119–135.

https://doi.org/10.15240/tul/001/2021-2-008.

SARIO (2021). Information & Communications Technol-

ogy Sector in Slovakia. SARIO. Slovak Investment

and Trade Development Agency, Bratislava. https:

//sario.sk/sites/default/files/sario-ict-2021-02-05.pdf.

Serpeninova, Y., Lehenchuk, S., Mate

´

a

ˇ

sov

´

a, M.,

Ostapchuk, T., and Polishchuk, I. (2022). Im-

pact of intellectual capital on profitability:

Evidence from software development compa-

nies in the Slovak Republic. Problems and

Perspectives in Management, 20(2):411–425.

https://doi.org/10.21511/ppm.20(2).2022.34.

Sokil, O., Zvezdov, D., Zhuk, V., Kucherkova, S., and

Sakhno, L. (2020). Social and environmental costs:

The impact of accounting and analytical support on

enterprises’ sustainable development in Germany and

Ukraine. Economic Annals-XXI, 181(1–2):124–136.

http://dx.doi.org/10.21003/ea.V181-11.

Sundaresan, M., Linh, T. P. N., and Rey, M. (2021).

The Effects of Intangible Assets on Financial Per-

formance and Financial Policies of Listed Technol-

ogy Firms in Thailand. Apheit International Journal,

10(1):1–17. https://www.journals.apheit.org/jounal/

Inter-vol10no1/INT-01.pdf.

Ullberg, E., Edvinsson, L., and Yeh-Yun Lin, C. (2021). In-

tangible Asset Gap in Global Competitiveness: Map-

ping and Responding to the New Economy. Springer-

Briefs in Business. Springer, Cham. https://doi.org/

10.1007/978-3-030-55666-2.

Zavalii, T., Vikarchuk, O., and Constantinou, C. (2022).

Do marketing-related intangible assets affect the com-

pany’s net income? Public Policy and Accounting,

1(4):3–14. https://doi.org/10.26642/ppa-2022-1(4)

-3-14.

Zhang, N. (2017). Relationship between intangible as-

sets and financial performance of listed telecommu-

nication firms in China, based on empirical anal-

ysis. African Journal of Business Management,

11(24):751–757. https://doi.org/10.5897/AJBM2017.

8429.

¨

Ozkan, N. (2022). R&D spending and financial per-

formance: an investigation in an emerging mar-

ket. International Journal of Management Economics

and Business, 18(1):38–58. https://doi.org/10.17130/

ijmeb.964849.

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

52