Flexible Evolutionary Model of Machine Learning of Organizational

Capital Development Strategies with Optimization of Spent Resources

Vasyl Porokhnya

1 a

, Vladyslav Penev

1

, Roman Ivanov

2 b

and Volodymyr Kravchenko

1

1

Classical private university, 70B Zhukovsky Str., Zaporizhzhia, 69061, Ukraine

2

Oles Honchar Dnipropetrovsk National University, 72 Gagarin Ave., Dnipro, 49000, Ukraine

Keywords:

Q-Leaning, Organizational Capital, Strategy, Q-Leaning, Optimization of Organizational Capital, Concept of

Alternative Selection.

Abstract:

As part of the follow-up, the conceptual pipeline was developed to the stage of machine learning Q-leaning

with the method of eliminating the most effective strategy for the development of organizational capital in the

structure of intellectual capital and increasing the reliability of taking away the results. In the final work, the

modeling of alternative strategies for the development of organizational capital with the alternatives of machine

learning was modeled. This simulation made it possible to simplify the search and development of options

for strategies for the development of organizational capital, real alternative ways, and to simplify management

decisions. For a more correct operation of machine learning, coefficients were introduced that affect the

decision-making by machine learning. Results indicate that the capital of the strategy is the acquisition of

innovative information potential and the capital of alternatives without intermediary victorious main functions

of formation and the establishment of mechanisms for managing intellectual capital in the aggregate with other

types of capital in them.

1 INTRODUCTION

The modern economy practically proves the effective-

ness of intellectual capital as one of the most effective.

The concept of intellectual capital is broader than the

concepts of intellectual property and intangible assets.

At the same time, it is close in meaning to the concept

of intangible capital, which has been used in works

on economic theory and econometrics since the be-

ginning of the 1970s (Brooking, 1996).

Daum (Daum, 2002) gave the definition of intan-

gible capital based on connections structured knowl-

edge and abilities that have the potential to develop

and create value.

Leontiev (Leontiev, 2002) defined intellectual

capital as the value of the set of intellectual assets

available to the enterprise, including intellectual prop-

erty, its natural and acquired intellectual abilities and

personnel skills, as well as accumulated knowledge

bases and useful relationships with other entities.

Roos et al. (Roos et al., 2005) defined intellectual

capital as all non-monetary and intangible resources

a

https://orcid.org/0000-0003-0820-8749

b

https://orcid.org/0000-0003-2086-5004

that participate in the creation of the organization’s

value and are fully or partially controlled by it.

Intellectual capital is difficult to research and cal-

culate its value due to the difficulty in determining

the components that belong to it. However, intellec-

tual capital can be divided into several capitals that

are part of it: human capital, organizational capital,

customer or consumer capital.

Each component of intellectual capital can be

structurally detailed:

1. Human capital, the value that the company’s em-

ployees bring through the application of skills,

know-how and expertise. Human capital is inher-

ent in people and can belong to an organization.

2. Organizational capital consists of: technological

capital; branding capital; capital of business cul-

ture; capital efficiency of added economic value

– EVA; capital of the strategy of attracting inno-

vations of the information potential. The criteria

for evaluating are manufacturability; productivity;

innovativeness; cooperativeness; adaptability; ef-

ficiency.

3. Customer equity, consisting of elements such

as customer relationships, supplier relationships,

Porokhnya, V., Penev, V., Ivanov, R. and Kravchenko, V.

Flexible Evolutionary Model of Machine Learning of Organizational Capital Development Strategies with Optimization of Spent Resources.

DOI: 10.5220/0011931400003432

In Proceedings of 10th International Conference on Monitoring, Modeling Management of Emergent Economy (M3E2 2022), pages 71-79

ISBN: 978-989-758-640-8; ISSN: 2975-9234

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

71

trademarks and trade names (which have value

only through customer relationships), licenses and

franchises.

Therefore, the presence of a multi-criteria ap-

proach to the application of intellectual capital creates

the complexity of its assessment. If we consider the

methods of measuring intellectual capital, the follow-

ing are the most common four categories proposed

by Sveiby (Sveiby, 2010): Direct Intellectual Capi-

tal Methods; Market Capitalization Methods; Return

on Assets methods; Scorecard Methods. But each of

them has certain disadvantages that should be consid-

ered in conjunction with machine learning methods.

Then there is an opportunity to build a general math-

ematical model with a unified machine learning algo-

rithm, and this affects the accuracy of estimates of all

structural elements of intellectual capital.

2 RESULTS

If we consider the structure of Organizational Capi-

tal (OC) as a set of its qualities and properties, their

ratios, which directly affect labor productivity, which

increases the income for personnel, the company as a

whole, society, and the nation, then there is an oppor-

tunity to cover all possible options for its evaluation.

1. Assessment of the level of manufacturability

Let’s move on to the assessment of the properties

of the components of manufacturability capital. We

will use its structure, which consists in determining

the share a

k

t

of the t-th property in the formation of the

k-th type of components of manufacturability capital

(k

t

k

), which allows us to establish the probable level of

the k-th type of manufacturability capital:

KT

t

k

=

n

ip

∑

k=1

k

k

t

∗ a

k

t

, (1)

where

KT

t

k

– technological capital;

k

k

t

– exploitation and repair manufacturability of

the structure to k item for t-th indicator (materials,

energy, labor, compatibility, etc.);

a

k

t

– volatility of the injection of the t-th indicator

for manufacturability of k item.

2. Capital assessment of business culture

CC

k

t

=

n

ip

∑

k=1

c

k

t

∗ b

k

t

(2)

where

CC

k

t

is the capital of business culture;

c

k

t

– organizational and corporate culture of a cer-

tain business model of doing business according to the

t-th indicator (liberty and democracy, monoactivity of

the business culture type; polyactivity of the business

culture type; reactivity of the business culture type,

etc.);

b

k

t

– the importance of the impact of the t-th indi-

cator on the cultural capital of the k-th business model

of doing business.

3. The efficiency capital of added economic value

The productivity of the production process has a

significant range of properties, the characteristic fea-

tures of which are formed and reflected by a signif-

icant network of indicators that have branched rela-

tionships of quantitative and qualitative capital assess-

ment of performance. Among the important features

of performance, the following should be noted:

• Activation of human heuristic abilities and struc-

turing of discovered knowledge and verification

according to the criterion of objectivity;

• Orderliness of the communication process for the

exchange of information flows, emotions, social

and individual values, economic interests;

• Formation and growth of the fundamental and

market value of the enterprise as a criterion of per-

formance.

• Identification and elimination of dysfunctions in

enterprise management, which arise due to a mal-

function.

Capital assessment of efficiency of added eco-

nomic value. Performance is assessed as the level of

intellectual leverage (LIL) and is calculated according

to the formula:

LIL =

△EVA%

△NOPLAT %

(3)

where:

△EVA% is the rate of profit growth;

△NOPLAT % is the growth rate of economic

added value.

LIL – the degree of sensitivity of profit to changes

in economic added value.

The level of intellectual leverage shows: how

many times the growth rate of economic added value

exceeds the growth rate of profit. This excess is pro-

vided with the help of the effect of intellectual lever-

age, one of the components of which is its differen-

tial (the ratio of the involved intellectual capital to its

own).

4. The capital of the strategy of attracting innova-

tions of the information potential

The information capital of the strategy or the cap-

ital of the strategy of attracting innovations of the in-

formation potential determines the trajectory of intel-

lectual capital and the direction of the implementa-

tion of the proposed strategy within the framework

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

72

of the implementation of innovations of the informa-

tion potential, which is aimed at increasing the value

of capital and depends on the speed of updating this

strategy. Informational capital and its potential act as

investment capital to maximize the value of intellec-

tual capital:

∑

k

i=1

EVA

ROI

opt

−WACC

−CAPITAL

→ max (4)

where

ROI

opt

is the economic profitability of intellectual

capital;

WACC – weighted average interest rate of the in-

volved intellectual capital;

CAPITAL – the capital of the strategy of attracting

innovations of the information potential.

5. Capital of turning knowledge into a result

The capital of the transformation of knowledge

into a result declares the path of transformations from

an idea to the formalization of knowledge in official

documents and its structuring for communicative use

(Porokhnya, 2009). Therefore, its components are

the following indicators that reflect the characteristic

properties of transformations: an idea as a creative

and spiritual message, and the level of formalization

of knowledge in official documents.

An idea has its own depth of penetration into the

macro or micro world (Roos et al., 2005). Based on

Einstein’s thesis that the development of society re-

quires the improvement of everyday thinking, it is ap-

propriate to consider an idea-concept as a complex of

properties and relationships that determine the char-

acteristics of the image of the object of research. we

can establish a connection between intellectual capital

(figuratively speaking, the mass of intellectual sub-

stance that is at rest or in motion, that is, in its use)

and the strategy of interaction of processes in an eco-

nomic object and its results. The question arises, does

the strategy have energy? It is known that the strategy

has different value, that is, weight. Suppose that, like

any economic potential, it has potential energy, and

when the process of its realization takes place, it also

has kinetic energy. That is, strategy is the energy of

capital that goes to the realization of an idea-concept.

Therefore, it can have its own dimension. Strategy,

like any energy, consists of the energy of rest and the

momentum of intellectual capital. As the speed of this

impulse, we will take the speed of the generation of

an idea-concept in the direction predetermined by the

strategy. To measure images-properties, that is, the

amount of intellectual substance, a unit is introduced,

– image.

Any image of intellectual substance contains the

same number of images-properties that reflect the

properties of the object of the real world. For exam-

ple, the number of images-properties that character-

ize a person is a constant value, a number that can

be established experimentally, as Avogadro’s number

was established at one time (the principle of equiv-

alence in nature). But each person has a different

number of images-relationships characterizing his in-

tellectual capital. This value of images-relationships,

corresponding to intellectual capital, will be assigned

the unit of measurement – intel. Intel measures the

level (mass) of intellectual capital of a person, enter-

prise, state.

The definition of images-properties is a conse-

quence of the same type of process properties during

the realization of an idea-concept in time, which con-

tain a certain number of these images in one unit. We

denote the number of images-properties by N

img

:

N

img

=

100

image

− const (5)

From here we can determine the amount of the

level (mass) of the intellectual capital of the economic

system, which corresponds to the capital of trans-

forming knowledge into a result:

ic =

N

N

img

M

ic

(6)

where

N – the number of images-properties, respectively,

ideas-concepts,

M

ic

- the intellectual mass of image-properties per

image-property for a specific phenomenon, intel / im-

age.

The level of an idea-concept can be represented

in four quantitative measurements with the introduc-

tion of a unit of measurement – id, which contains a

certain integral number of images-objects that char-

acterize the properties of this very idea-concept using

established criteria:

• Elementary level (household, cognitive, which

does not require the formation of new knowl-

edge), where id = 1.

• The technological level associated with the emer-

gence of new technologies, etc., where id =

1000 = 1K.

• Conceptual level containing new knowledge and

discoveries, where id = 1000000 = 1M = 1000K.

• The planetary level is determined by the depth

of penetration of human activity into the macro

and micro world, where id = 1000000000 = 1G =

1000M = 1000000K.

In fConvert

t

k

– informativeness as a measure of

usefulness. The level of structuring of knowledge of

Flexible Evolutionary Model of Machine Learning of Organizational Capital Development Strategies with Optimization of Spent Resources

73

special and general scientific terms and its verifica-

tion according to the criterion of objectivity of the

k-th type of the indicator of capital transformations

according to the t-th component of this indicator.

In fCap

t

k

= In fConvert

t

k

/TotalExp – the level of

orderliness of the communication process for the ex-

change of information flows, emotions, social and in-

dividual values, economic interests of the k-th type of

the indicator of capital transformations according to

the t-th component of this indicator.

Evaluation of the capital of the transformation of

knowledge into a result

CP

t

k

=

n

ip

∑

k=1

(ic

t

k

+ In f Convert

t

k

+ In f Cap

t

k

)d

t

k

(7)

where

CP

t

k

– the capital of transforming knowledge into

a result;

ic

t

k

– the capital level of the transformation of

knowledge into the result of the k-th type of the indi-

cator of capital transformations according to the t-th

component of this indicator;

d

t

k

– the weight of the influence of the k-th indi-

cator of transformations on the capital of the trans-

formation of knowledge into a result according to the

t-th component of this indicator of transformations.

For a preliminary analysis of the capital criteria,

their importance, influence on the choice of the best

alternative for the development of the properties of or-

ganizational capital, we will use the method of hierar-

chical comparisons when evaluating the level of pri-

orities of alternatives, the results of which are shown

in the table 1.

The structure of OK is primarily related to brand-

ing capital, which is the main relative indicator of the

company’s attractiveness on the market and to some

extent attests to the fate of the firm’s market capital,

which is adjusted to its organizational, i.e., intellec-

tual capital.

The relevance of the use of machine learning in

the field of economics (Kobets and Novak, 2021) al-

lows us to consider many aspects of the strategy for

the development of organizational capital and ways

to optimize the cost of resources for its development

in different ways. Learning to find the most optimal

and less resource-intensive way of developing organi-

zational capital can be presented as a continuous cy-

cle that will end only after the specified conditions are

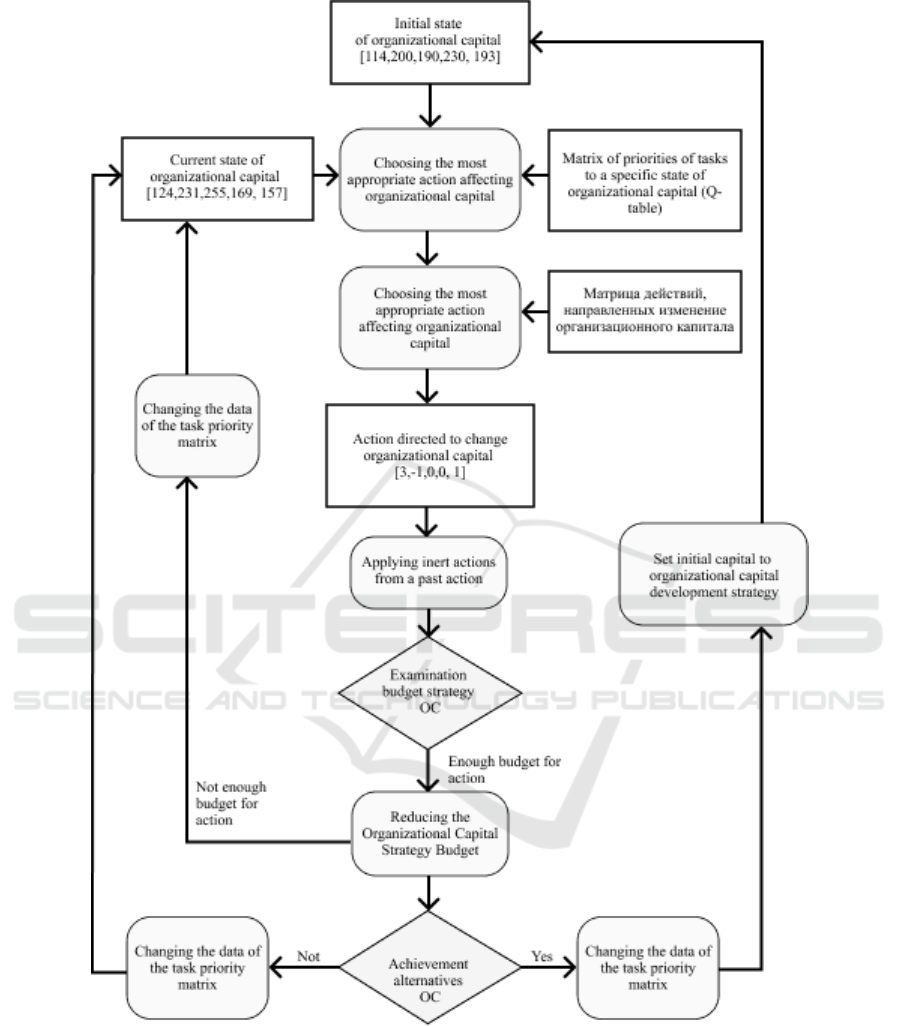

reached. (figure 1).

In the reinforcement learning algorithm, the

agent’s actions are directed to the steps to achieve suc-

cess with a reward estimate. After △t steps into the

next step, the human capital will decide some next

step. The weight for this step is calculated as γ

△t

,

Table 1: Influence of criteria on a choice of alternatives

(properties) of improvement of the level of capital.

Criteria

Properties

Intellectual

Communicative

Strategic

Cognitive

Innovative

Branding

capital

0.14 0.12 0.14 0.1 0.09

Technology

capital

0.12 0.14 0.13 0.14 0.1

Capital efficiency

of added economic

value

0.11 0.12 0.11 0.13 0.12

Capital of

business culture

0.11 0.12 0.13 0.11 0.12

The capital of the

strategy of

attracting

innovations of the

information

potential

0.1 0.12 0.13 0.12 0.1

General approach

0.11 0.12 0.13 0.115 0.11

where γ is the discount factor, which can take a value

from 0 and 1 (0 ≤ γ ≤ 1) and has the effect of eval-

uating actions that are aimed at achieving the human

capital goal. γ can be called the level of success in

achieving the desired state by human capital, when

the investment data changes at the △t step.

Thus, we can conclude that a function is required

that will determine the quality of combinations of the

state of human capital and the action aimed at it:

Q ÷ S × A → R. (8)

At the beginning of training, Q is initialized, pos-

sibly with an arbitrary fixed value – 0. After initial-

ization, at each moment of time t, the agent selects an

action, observes a reward, enters a new state (that may

depend on both the previous state and the selected ac-

tion), and Q is updated. The core of the algorithm is a

Bellman (Bellman, 1957) equation as a simple value

iteration update, using the weighted average of the old

value and the new information(Watkins and Dayan,

1992):

Q

new

(s

t

,a

t

) ← Q(s

t

,a

t

) + α×

(r

t

+ γ × maxQ(s

t+1

,a) − Q(s

t

,a

t

)), (9)

where r

t

is the reward received when moving from the

state S

t

to the state S

t+1

, and 0 < α ≤ 1;

Note that S

new

(s

t

, α

t

) is the sum of three factors:

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

74

Figure 1: Machine learning of alternative development of human capital of the enterprise.

(1 − α)Q(s

t

,α

t

): the current value weighted by

the learning rate. Values of the learning rate near to 1

made faster the changes in Q;

αr

t

: the reward r

t

= r(s

t

,a

t

) to obtain if action a

t

is taken when in state s

t

(weighted by learning rate);

αγmax Q(s

t+1

,α): the maximum reward that can

be obtained from state s

t+1

(weighted by learning rate

and discount factor).

Each action has its own parameters, and system

changes can be limited by parameters that can be cor-

related with the required resource costs to apply the

action chosen by machine learning. Thus, each itera-

tion of training implies two possible effects:

1. Changes in the coefficient of effectiveness of the

Flexible Evolutionary Model of Machine Learning of Organizational Capital Development Strategies with Optimization of Spent Resources

75

action, depending on the state that the system ac-

quires as a result of the application of the action.

2. Return of the iteration to the initial state due to

non-compliance with the specified restrictions for

machine learning.

For the application of Q-Learning, the following

parameters were selected:

• Impact on the Intellectual Capital criteria

• Time spent in days

• Resource costs equivalent to monetary units

• The coefficient of the complexity of the action

• Risk ratio of failure to take action

• Inert influence on the system

• Coefficient of possibility of inert influence on the

system

Each action parameter is used in the calculation of

the effectiveness of the action taken at each training

step. Applied properties of actions can be represented

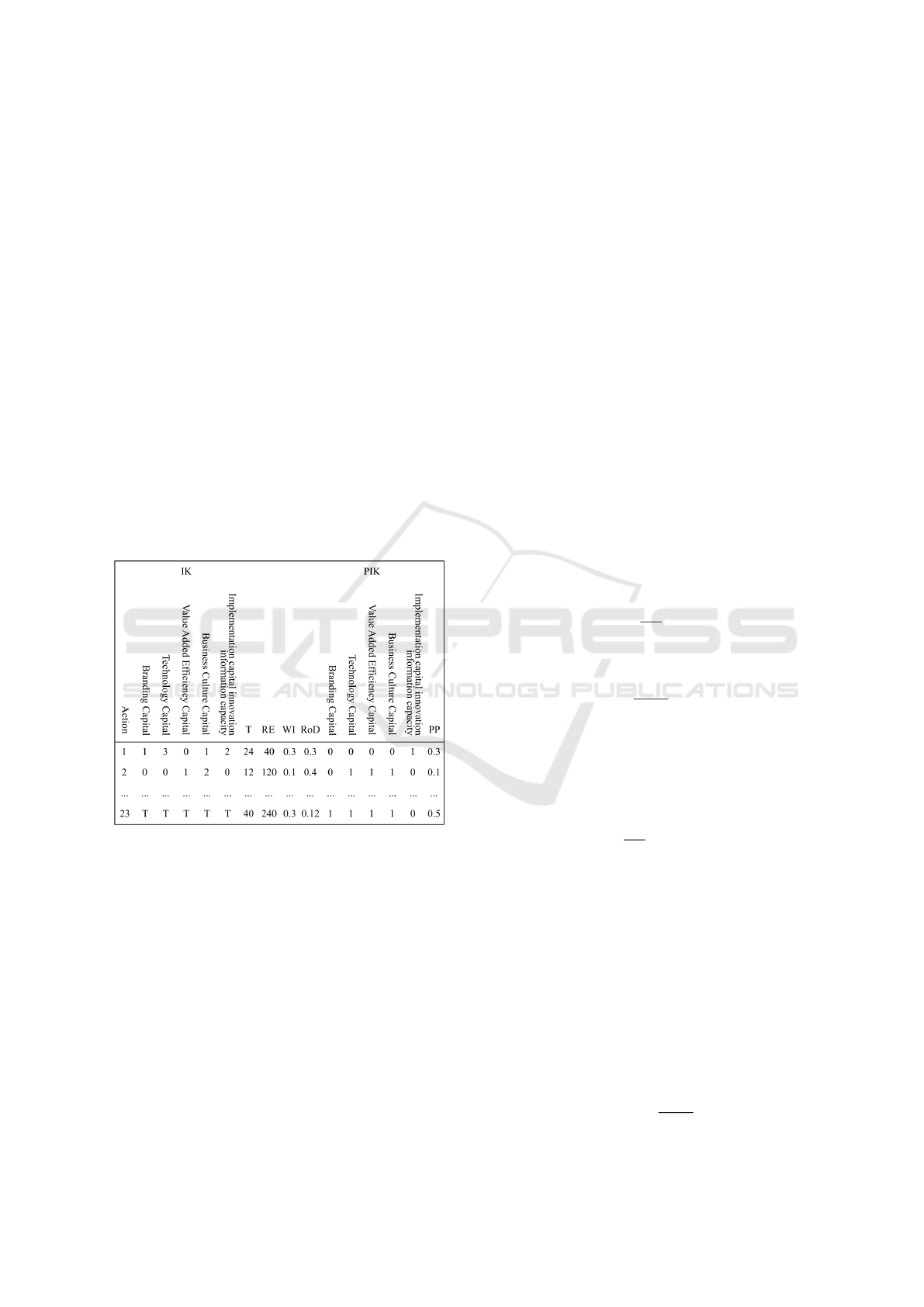

as a table of actions, which is presented in figure 2.

Figure 2: Action properties used in machine learning with

resource cost parameters.

Thus, at each iteration, the system calculates a

promising system that has already been acted upon

and recalculates the result of intellectual capital with

new parameters.

Thus, we can say that the calculation of the effec-

tiveness of the action is carried out according to the

following formula:

AE = IK

t+n

, (10)

where

AE – action efficiency;

IK – the cost of intellectual capital;

IK

t+n

— the cost of intellectual capital after ap-

plying the action.

So the value of AE will be rewards for moving to

the next machine learning state.

Q

new

(s

t

,a

t

) ← Q(s

t

,a

t

) + α×

(AE + γ × maxQ(s

t+1

,a) − Q(s

t

,a

t

)),

(11)

However, each action additionally has a time cost

parameter for performing this action, which can op-

tionally be included in the formula. For greater accu-

racy of calculations, you can use hours, days, months

or quarters. In this case, integer values of days were

used.

Thus, the new formula for calculating efficiency

can be represented as follows:

AE = IK

t+n

∗ T, (12)

where AE – action efficiency, T is the time spent on

applying the action

Also, an optional parameter can be resource costs,

which are presented in monetary terms. To simplify

the loads and quick calculations, all action parameters

can be divided by a certain coefficient Mk. In this

case, Mk = 1000.

Thus, if Action 1 has a resource cost (FE) of

1300000, then the resources spent can be represented

as RE and calculated by the formula:

RE =

FE

Mk

∗ T. (13)

Taking into account resource costs, the action ef-

ficiency formula will look like this:

AE =

IK

t+n

RE

∗ T. (14)

The calculation of resource costs can also include

the coefficient of complexity of performing an action

(W I), which can be represented by a value in the range

from 0.1 to 1.0. Thus, now the resource costs can be

represented as:

RE =

FE

Mk

∗ T ∗W I. (15)

Also, given the individuality of the systems to

which actions can be applied, it is worth considering

the risks of not performing an action (RoD) or its suc-

cess in execution.

The risk of investing in organizational capital is

the possibility that the accumulated organizational

capital will not bring the expected return, will not

be in demand in the market, or will not bring the

expected return. This value can be represented as a

range from 0 to 1. A low value of this coefficient

means a low level of success of the action and its high

risks. Given the risk ratio, the formula for the effec-

tiveness of action can be represented as follows:

RE = RoD

IK

t+n

RE

. (16)

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

76

The relationship of all parameters of intellectual

capital does not exclude the influence of the develop-

ment of some parameters on the possibility of devel-

oping other parameters as a result of these actions.

Thus, each action has the values of the inert de-

velopment of intellectual capital and the coefficient

of the possibility of this development.

Given these parameters, the formula for the effec-

tiveness of actions can be represented as follows:

RE = ROD

IK

t+n

RE

+ PIK ∗ PP ∗ RoD, (17)

where PIK is the value of the possible inert devel-

opment of intellectual capital, PP is the probability

coefficient of the development of intellectual capital.

Thus, each iteration of training affects the value

of intellectual capital by changing the values of its

parameters. However, it is the efficiency values of the

action that are written to the state table, not the cost of

capital. Having an unlimited resource of investments,

achieving the desired value of the cost of intellectual

capital had a large set of action algorithms, but given

the parameters of each of the actions, machine learn-

ing will find the most optimal algorithm for this sys-

tem.

The development of Intellectual capital occurs

with the choice of an alternative to which the capital

must approach as a result of learning.

For more effective training and achievement of

the most favorable conditions for achieving the de-

sired alternative, development alternatives were intro-

duced. Development alternatives are coefficients for

each of the parameters of actions that affect the state

of capital. Using the hierarchy analysis method, the

following coefficients were introduced (table 2).

Table 2: Alternatives of the development method for man-

aging the choice of effective action.

Accelerated

Safe

Risky

Budgetary

Effective

IK 0.21 0.26 0.31 0.2 0.32

T 0.23 0.12 0.2 0.08 0.13

FE 0.12 0.12 0.12 0.09 0.12

W I 0.12 0.16 0.13 0.32 0.1

RoD 0.1 0.07 0.08 0.09 0.13

PIK 0.1 0.19 0.1 0.08 0.08

PP 0.12 0.07 0.06 0.14 0.12

For this study, a risky alternative of the method of

developing capital for machine learning was chosen.

Thus, each iteration of learning and applying ac-

tions to the system will affect the state table and cal-

culate its new values according to the following for-

mula:

AE = (RoD a

5

)

IK

t+n

a

1

(FE a

3

) (T a

2

)

+

(RoD a

5

) (PIK a

6

) (PP a

7

) (18)

After carrying out the calculations with the initial

data, the results describing the strategy for investing

in organizational capital shown in table 3.

Table 3: Factor of importance of action properties for learn-

ing.

IK T FE W I RoD PIK PP

a

1

a

2

a

3

a

4

a

5

a

6

a

7

0.31 0.2 0.12 0.13 0.08 0.1 0.06

It should be noted that the coefficients of capital

alternatives and development alternatives affect value

preferences and spending.

The first stages of training provide impressive in-

dicators of cost optimization for investment in orga-

nizational capital. With an increase in training cycles,

obtaining a better result becomes more rare.

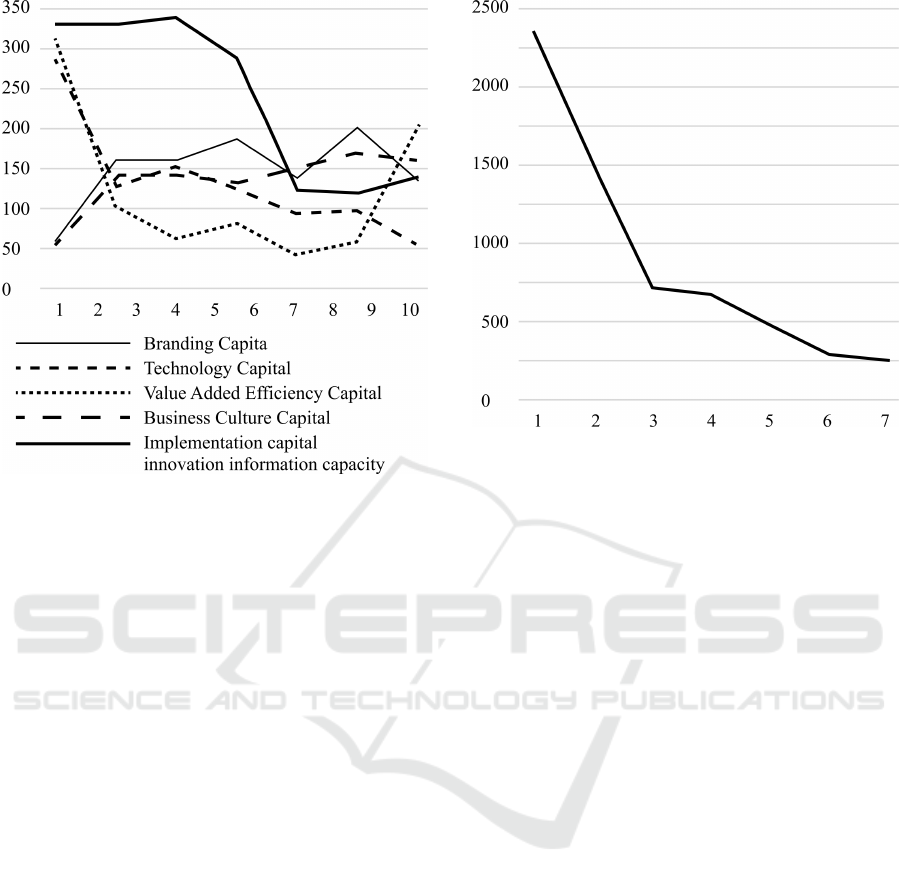

The data in the table 4 and in the figure 3 show

optimization costs of developing organizational capi-

tal to achieve the cost of organizational capital, taking

into account the chosen alternative. It can be con-

cluded that in order to achieve the best results, it is

necessary to conduct a sufficient number of training

cycles.

Table 4: Initialized data affecting machine learning training

in the search for optimal investments in organizational cap-

ital.

Impact values on organizational capital

Action number

Salary

Branding Capital

Technology Capital

Value Added Efficiency Capital

Business Culture Capital

Implementation capital

innovation information capacity

16637 2219 52 286 313 45 333

25352 1431 155 121 95 128 318

74521 725 157 151 54 138 340

168348 684 184 115 74 123 286

2236341 485 133 87 33 142 118

14330450 336 197 90 51 165 114

17735547 294 127 44 201 153 134

Flexible Evolutionary Model of Machine Learning of Organizational Capital Development Strategies with Optimization of Spent Resources

77

Figure 3: Machine learning of alternative development of

organizational capital of the enterprise.

Thus, after each stage of learning new indica-

tors, alternatives should be identified and calculations

should be made that determine subsequent invest-

ments in human capital. It should also be borne in

mind that each the alternative has its own character-

istic features and characteristics, behavioral connec-

tions and influence on the choice of options capital

investment.

Taking into account the dynamics of changes in

results, it can be concluded that subsequent train-

ing cycles can bring more optimized costs. Figure 4

shows the optimization of the costs of organizational

capital development, taking into account the same

level of organizational capital development.

It is also worth noting that when the input data

changes, machine learning will be able to rebuild and

generate calculations and optimize the result better

and faster than a person.

3 CONCLUSIONS

The study substantiates a conceptual approach to the

application of Q-leaning in order to obtain the most

effective strategy for the development of organiza-

tional capital in the structure of intellectual capital

and increase the reliability of the results obtained.

Consequently, the capital of the strategy for at-

tracting innovations of information potential and the

capital of alternatives directly perform the main func-

tions of the formation and application of intellectual

Figure 4: Machine learning of alternative development of

organizational capital of the enterprise.

capital management mechanisms in conjunction with

other types of capital and independently of them.

The main difficulty of this approach to choos-

ing alternative solutions for finding options for us-

ing organizational capital is the correct selection of

indicators of significance (return) of contributions to

the development of types of organizational capital,

on the basis of which systemic learning cycles oc-

cur. Such an approach can simplify the search and

development of options for organizational capital de-

velopment strategies, real alternative paths and sim-

plify management decisions.

It is worth noting that training tuning with chang-

ing the training parameters, namely the amount of

reward and the value of data optimization, training

constraints, can achieve better results by accelerat-

ing training and therefore obtaining data on a more

trained AI that can give better results.

Using machine learning to optimize organiza-

tional capital development costs is the best method.

Speed, lack of subjectivity and the ability to quickly

respond to external changes is an advantage over a

person.

To improve the results, it is worth making adjust-

ments to these actions and selecting the right alterna-

tives for choosing actions.

REFERENCES

Bellman, R. (1957). Dynamic Programming.

Princeton University Press, New York.

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

78

https://www.gwern.net/docs/statistics/decision/

1957-bellman-dynamicprogramming.pdf.

Brooking, A. (1996). Intellectual Capital: Core Assets for

the Third Millenium. International Thompson Busi-

ness Press.

Daum, J. H. (2002). Intangible Assets, pages 152–154. Wi-

ley.

Kobets, V. and Novak, O. (2021). EU countries clustering

for the state of food security using machine learning

techniques. Neiro-Nechitki Tekhnolohii Modelyuvan-

nya v Ekonomitsi, 2021(10):86–118. https://doi.org/

10.33111/nfmte.2021.086.

Leontiev, B. B. (2002). Tcena intellekta. Intellektualnyi

kapital v rossiiskom biznese [The price of intelligence.

Intellectual capital in Russian business]. Moscow.

Porokhnya, V. (2009). The general theory of relativity of

economic growth. State and regions. Economy and

entrepreneurship series, pages 153–160.

Roos, G., Pike, S., and Fernstrom, L. (2005). Managing

Intellectual Capital in Practice. Butterworth-

Heinemann. https://www.researchgate.net/

publication/274392498.

Sveiby, K.-E. (2010). Methods for Measuring In-

tangible Assets. https://www.sveiby.com/article/

Methods-for-Measuring-Intangible-Assets.

Watkins, C. J. C. H. and Dayan, P. (1992). Q-learning.

Machine Learning, 8(3):279–292. https://doi.org/10.

1007/BF00992698.

Flexible Evolutionary Model of Machine Learning of Organizational Capital Development Strategies with Optimization of Spent Resources

79