The Influence of the Effect of Marketing Incentives on the Dynamics

of the Development of Classic and Cryptocurrency Payment Systems

Victor Dostov

1,2 a

, Pavel Pimenov

1b

, Pavel Shoust

1,2 c

and Victor Titov

1,3 d

1

Federal State Budgetary Educational Institution of Higher Education “Saint-Petersburg State University” 7-9

Universitetskaya Emb., St Petersburg, Russia

2

Distributed Ledger Technologies Center of Saint-Petersburg State University, 1-3 Cadet line of Vasilievsky Island, St

Petersburg, Russia

3

Modern Financial Technology Laboratory of Saint-Petersburg State University, 1-3 Cadet line of Vasilievsky Island, St

Petersburg, Russia

Keywords: Bass Model, Payment Systems, Cryptocurrency, Marketing Incentives, Social Hype.

Abstract: The article examines the role of marketing incentives and social hype on the growth rate and the number of

customers of developing payment systems, both classic and cryptocurrency. The authors prove that using

marketing incentives can have only a short-term positive effect, which does not provide changes in the typical

trend of the payment system development. The conclusions were confirmed by a comparative analysis of the

results of the modified Bass equation application and by an empirical study conducted by Indonesian

researchers in the form of a sociological survey. For this purpose, a trend for the number of transactions using

electronic money in Indonesia was built. The study confirmed generally the findings of Indonesian researchers.

Nevertheless, it is established that in contradiction with the conclusions of Indonesian researchers, marketing

incentives provide an effect on the market, however relatively small one. The same results were demonstrated

for Bitcoin and WebMoney payment systems dynamics.

1 INTRODUCTION

The development of payment systems is an important

aspect of the digitalization of society and its financial

system. The owners of the platform and the state are

interested in the rapid growth of the number of users

of their product and the number of transactions. In

this regard, to increase the involvement of the

population, the development of the payment system

is accompanied by various marketing incentives –

promotions, bonuses, etc.

Nevertheless, our previous research (Victor

Dostov, Pavel Shoust, 2019, 2020) and accumulated

empirical experience show that the effect of

marketing incentives is short-term and cannot

sufficiently affect the development of the payment

system. There are other studies on this topic, but they

are often limited to conducting statistically significant

a

https://orcid.org/0000-0003-4518-2883

b

https://orcid.org/0000-0002-4683-8525

c

https://orcid.org/0000-0002-2276-7523

d

https://orcid.org/0000-0002-2005-0123

surveys, which, nevertheless, demonstrate the

preferences of people who are already familiar with

digital technologies and the banking market.

In this paper, we want to show and prove that

marketing incentives have a limited impact on the

dynamics of payment systems development, and it

can be identified both using empirical statistical

methods (sociological surveys) and using

mathematical models. For this purpose, we analysed

the development of electronic money in Indonesia

from 2016 to 2021, as in the context of statistical

surveys conducted by other researchers, so as using

the modified Bass equation.

The practical effect of the study is to form an

evidence base for the revision of marketing plans of

payment system owners to reorient financial and time

resources to more important areas of interaction with

580

Dostov, V., Pimenov, P., Shoust, P. and Titov, V.

The Influence of the Effect of Marketing Incentives on the Dynamics of the Development of Classic and Cryptocurrency Payment Systems.

DOI: 10.5220/0011961700003612

In Proceedings of the 3rd International Symposium on Automation, Information and Computing (ISAIC 2022), pages 580-585

ISBN: 978-989-758-622-4; ISSN: 2975-9463

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

potential customers for the development of the

payment system.

2 PREDICTOR ANALYSIS

Research on determining the impact of marketing

incentives on the pace of development of payment

systems mainly focuses on determining the factors

that encourage people to become users of the payment

system. Often the emphasis is on social aspects, as

well as comfort. For example, the study "Factors

Affecting the Acceptance of Mobile Payment

Systems in Jordan: The Moderating Role of Trust"

(Manaf Al-Okaily, Mohd Shaari Abd Rahman and

Azwadi Ali 2019), which begins a cycle of research

on the behavior of the JoMoPay payment system,

focuses on the study of the social effect, the price

effect and the conviction of potential customers in the

availability of ready-made infrastructure. In the third

article of the research cycle "An Empirical

Investigation on Acceptance of Mobile Payment

System Services in Jordan: Extending UTAUT2

Model with Security and Privacy" (Manaf Al-Okaily,

Mohd Shaari Abd Rahman, Emad Abu-Shanab and

Ra'Ed Masa'deh, 2020), the researchers conclude that

the expected application performance, social impact,

price, security and privacy have a significant effect on

the behavior of potential customers. However,

simplicity, the comfort of usage and customer

satisfaction are not important factors for starting

using the payment system.

Interesting study in the context of determining the

effect of marketing incentives is made in the paper

"Digital wallet war in Asia: Finding the drivers of

digital wallet adoption" by Putri Natasya Fanuel and

Ahmad Nurul Fajar (Putri Natasya Fanuel and Ahmad

Nurul Fajar 2021). Based on a survey of 457 users of

digital wallets using the extended technology

acceptance model (TAM2) and innovation diffusion

theory (IDT), the researchers found that the main

factors for choosing payment systems by customers

are usefulness, simplicity and innovation. At the same

time, the hypothesis about the influence of

advertising on customer behavior was rejected as

insignificant. This conclusion was made by using a

combination of coefficient of determinant, predictive

relevance, effect size of coefficient determinant and

effect size of predictive relevance. However, the

authors believe that different types of promotions will

be effective for different user demographics. In the

question of an effect from the experience of using the

payment system by other users (social effect), a small

relationship has been established. Nevertheless, the

authors of (Putri Natasya Fanuel and Ahmad Nurul

Fajar 2021) are sure that the influence of experience

takes place and the main reason for the low

correlation is the relative novelty of payment systems

in the Indonesian market.

For the purpose of this paper, a key issue is an

applicability of (Putri Natasya Fanuel and Ahmad

Nurul Fajar 2021) findings in other markets. The

specifics of Indonesia can be crucial in determining

the effect of marketing incentives for other countries.

It is necessary to find a way that could form an

understanding of the role of marketing for Indonesia

and the other regions.

3 APPLICATION OF THE BASS

EQUATION

We are sure that the hypotheses of the researchers can

also be verified by using mathematical methods for

predicting the development of payment systems.

In our previous studies (Victor Dostov, Pavel

Shoust, 2019, 2020a, 2020b), we aimed at providing

an analysis the possibility of predicting the behavior

of the payment system over time. We proceeded from

the assumption that payment systems developing is

customer-driven and it is defined by generalized

customer behavior. To confirm this hypothesis,

modified equations of Bass innovation diffusion and

Verhulst were used. The advantage of this approach

is that the indicators used in the model have a

pronounced economic aspect. The following

parameters used in the proposed trend building model

are (Victor Dostov, Pavel Shoust and Elizaveta

Popova, 2019):

current number of users x;

the maximum number of users, for example, the

entire audience of a given country, N. Therefore,

the number of potential users not currently

participating in the system is N-x;

audience capture rate, which reflects the

probability that a given user will start using the

service: a>0 (the reverse time of the decision)

within a given period;

audience fatigue rate which reflects the

probability that a given user will stop using the

service: b>0 (the reverse time of the decision)

within a given period.;

As it was shown in (Victor Dostov and Pavel

Shoust, 2020), the configuration of the modified Bass

equation largely depends on the type of relations that

arise between customers and companies within the

The Influence of the Effect of Marketing Incentives on the Dynamics of the Development of Classic and Cryptocurrency Payment Systems

581

payment system. In our early works (Victor Dostov,

Pavel Shoust and Elizaveta Popova, 2019), we

conditionally divided payment systems into two

types. The type of payment system may change over

time depending on the structure of the market, the size

of the payment system and the nature of the

management company functioning (Victor Dostov

and Pavel Shoust, 2019). Depending on the type of

payment system, its behavior is significantly

different. In customer-to-business, C2B payment

systems, a limited number of customers make

payments for a resource with unlimited capacity (for

example, contactless card payment). The dynamics of

the development of the C2B system can be described

by equation (1), hereinafter referred to as the first type

equation:

𝑑𝑥

𝑑𝑡

=𝑎

(

𝑁−𝑥

)

−𝑏𝑥 (1)

In person-to-person, P2P systems, payments are made

within a closed audience (for example, cross-border

transfers). It is important to note that the decision to

use the system is significantly affected by the

presence of other clients in this system at the point in

time. The P2P system is described by equation (2),

hereinafter referred to as the second type equation:

𝑑𝑥

𝑑𝑡

=𝑎

(

𝑁−𝑥

)

𝑥−𝑏𝑥 (2)

In graphical representation, this difference is

manifested in the different nature of development. If

C2B is characterized by initially high growth rates

and gradual attenuation of development, then for P2P

systems the growth rate increases gradually, reaches

an inflection point and slows down by analogy with a

C2B payment system. The difference in the dynamics

of the development of C2B and P2P payment systems

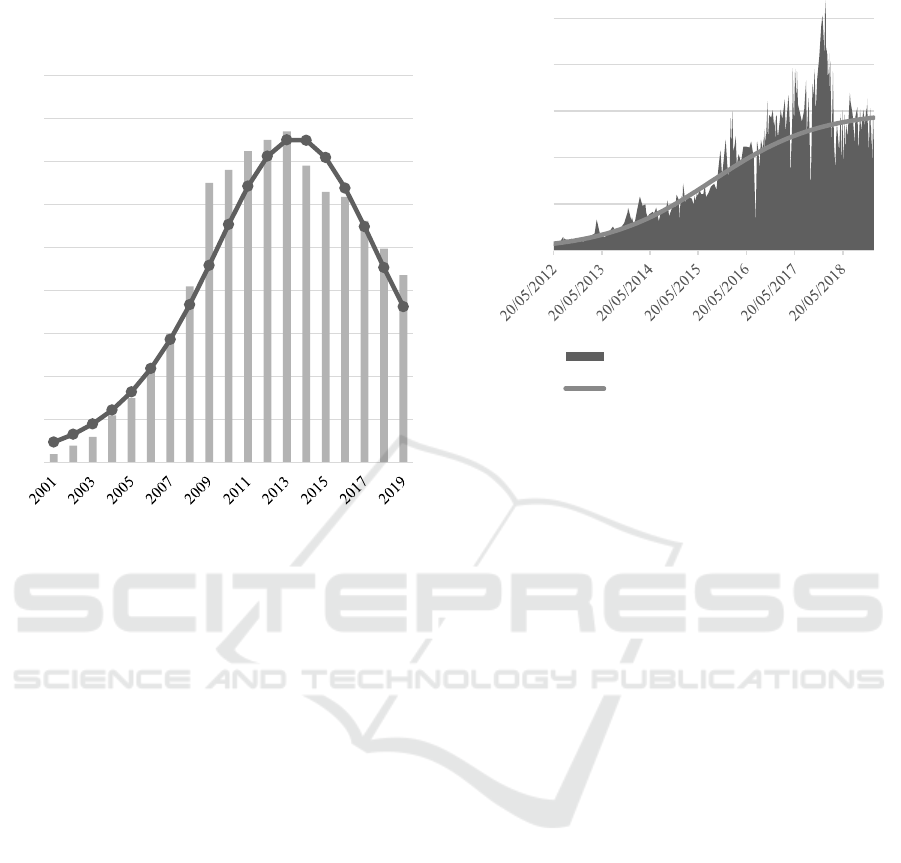

is shown in Figure 1 (Victor Dostov, Pavel Shoust

and Svetlana Krivoruchko 2020).

Figure 1: Graphical representation of the modified Bass

equations.

In our previos work (Victor Dostov, Pavel Shoust and

Svetlana Krivoruchko 2020), we united the first and

second types of the equation. For further qualitative

purposes we will use simplified solution in the

following form, ignoring customer fatigue

coefficient:

𝑥=

𝑥

𝑁𝑒

𝑥

(

𝑒

–1

)

+𝑁

(3)

For the purposes of this work, it is important to note

that based on empirical data for all markets where the

modified Bass equation was applied, we have

repeatedly come to the following conclusions (Victor

Dostov, Pavel Shoust and Elizaveta Popova, 2019):

The growth rate of users does not depend on the

number of current and potential users in C2B

systems and is impacted significantly by these

parameters in P2P systems;

The moment of the start of using the payment

system by a typical user is random;

Marketing incentives do not affect the overall

dynamics of the payment system development.

These conclusions were confirmed by us based on

the analysis of the payment systems development

dynamic for the Russian, European and Asian

markets. In addition, the modified Bass equation

allowed us to assume that some cryptocurrencies also

have features of payment systems and their behavior

over long time intervals is quite predictable, typical

and obeys conclusions 1-3 (Victor Dostov, Pavel

Shoust and Svetlana Krivoruchko 2020).

In case of marketing incentives, the Bass equation

allows us to identify both the beginning of active

financing, gradual attenuation of the effect and the

return of dynamics to the predicted values. The prime

example is the dynamics of the development of the

Russian payment system named WebMoney (Figure

2) (Victor Dostov, Pavel Shoust and Elizaveta

Popova, 2019). In the case of constructing a modified

Bass equation, it can be noted that in 2009 the real

data exceed the predicted values. This is a complex

effect of the launch of new services of the company

(for example, a service for organizing and optimizing

task setting), which was accompanied by an active

marketing campaign. The analysis of news reports for

the period shows that the main methods of promotion

were various discounts and bonus programs for store

customers who pay for purchases using WebMoney.

Nevertheless, the growth did not lead to significant

changes in the payment system development – the

x(t)

t

1st type equation

ISAIC 2022 - International Symposium on Automation, Information and Computing

582

real data values drop to forecasted already in 2013

going back to predicted generalized Bass curve.

Figure 2: New Webmoney wallets, thousand per year.

Similar conclusions were obtained by analyzing

cryptocurrencies. Because cryptocurrencies were

initially considered as an alternative to traditional

payment systems, some of them demonstrate visibly

the main characteristic features of payment systems

instead of being pure speculative instruments (David

G.W. Birch 2020). In our previous works (Victor

Dostov, Pavel Shoust and Svetlana Krivoruchko

2020), we chose Bitcoin and Ethereum, because,

unlike other currencies that were originally created as

purely investment instruments, Bitcoin and Ethereum

retained many features of payment systems.

It was shown in our previous works (Victor

Dostov and Pavel Shoust, 2019, 2020) that during the

Bitcoin active growth in 2018, there was a quasi-

marketing effect – most people received information

about the value of the currency not through their

friends who actively use the product, but through the

media, which is, in fact, advertising. The declared

possibility of high profitability of the instrument due

to possible increase of it exchange rate to fiat

currencies, unusual for traditional payment systems,

resulted in sharp spike of Bitcoin usage (Figure 3),

but after passing the active wave of interest, the

average indicators of active wallets returned to the

predicted values obtained by applying the modified

Bass equation.

Figure 3. Bitcoin active wallets.

Such behavior of payment systems demonstrates

that marketing incentives or other nature’s hype can

provide a more significant growth of the payment

system, but the effect will be short-term and will not

affect the overall dynamics of development.

4 APPLICATION OF THE BASS

EQUATION FOR THE

ANALYSIS OF THE

INDONESIAN PAYMENT

MARKET

Let's try to combine our results with the study of

Indonesian scientists. According to the work (Putri

Natasya Fanuel and Ahmad Nurul Fajar 2021) there

is a low role of marketing in deciding to start using

the payment system. In this case, it is logical to

assume that any marketing activity will lead to a

slight deviation from the forecast line constructed

based on the modified Bass equation. Putri Natasya

Fanuel and Ahmad Nurul Fajar confirm this position,

pointing out that the inefficiency of the usage of

marketing incentives can be indirectly confirmed by

the policy of the Indonesian payment service GoPay,

which in 2019 abandoned the practice marketing

incentives' usage (Putri Natasya Fanuel and Ahmad

Nurul Fajar 2021). Nevertheless, when answering

questionnaire questions, a person is often more

rational than in the conditions of a real marketing

influence. Therefore, we can assume a different

0

200 000

400 000

600 000

800 000

1 000 000

BTC active wallets

btc wallets by Bass equation

0

500

1 000

1 500

2 000

2 500

3 000

3 500

4 000

4 500

The Influence of the Effect of Marketing Incentives on the Dynamics of the Development of Classic and Cryptocurrency Payment Systems

583

configuration. Our research (Victor Dostov, Pavel

Shoust and Svetlana Krivoruchko 2020) shows that

marketing incentives are accompanied by a sharp

surge in user activity with a gradual fading of this

effect. This does not contradict the article (Putri

Natasya Fanuel and Ahmad Nurul Fajar 2021),

because Putri Natasya Fanuel and Ahmad Nurul Fajar

suggest as different types of promotions will be

effective for different user demographics.

For goals of analysis, let's take the dynamics of

the number of transactions with the usage of

electronic money in Indonesia (Statistik Sistem

Pembayaran (SSP) 2020). We consider this approach

relevant because GoPay was the first company to

change the approach to advertising. This confirms

that there were attempts to apply marketing incentives

in the market. In (Putri Natasya Fanuel and Ahmad

Nurul Fajar 2021) authors are also confirming this

position. The results of the study are shown in Figure

4 (Statistik Sistem Pembayaran (SSP) 2020).

Figure 4. Dynamics of transactions using electronic

payments in Indonesia.

To estimate marketing action effects, first, we take

pre-action data, find generalized Bass equation

solution (3) coefficients minimizing the standard

deviation of the trend from the real data. Then we plot

(3) for all ranges of data, estimating deviation of (3)

from real data in the post-action stage. If the deviation

is small, it means that marketing action did not

provide a long-term effect and vice versa. Concerning

obtained results, first of all, it should be noted that the

trend behavior shows the Indonesian e-money market

is a pronounced P2P. The graph clearly shows a

period of a smooth increase in the number of

transactions with the presence of an inflection of

growth rates characteristic of P2P and their gradual

slowdown. The behavior of the graph correlates with

studies, the authors of which are sure that there is an

effect from the experience of using the payment

system by other users.

It can be noted that the sharp increase in the

number of transactions in 2019 is also sharply

decreased at the beginning of 2020. It is worth

mentioning, however, that the fall is mainly due to the

COVID-19 epidemic, the active peak of which

account precisely for April-May 2020. Therefore, in

addition to the forecast based on the real data, we

maintained the dynamics of the number of

transactions’ growth rate and put a second trend line,

conditionally ignoring the negative impact of

COVID-19. The coefficients of the trend lines are

presented in Table 1.

Table 1: Indicators of the Bass equation for the Indonesian

market.

Bass

equation

Current

number of

transactions

(x0)

Maximum

number of

transactions

(N)

Audience

capture

rate (a)

Including

the impact

of

COVID-

19

41 300 860 447 031 653 0.081

Excluding

the impact

of

COVID-

19

41 300 860 636 213 098 0.074

The characteristic period of a sharp increase in the

number of transactions and the attenuation of the

growth rate by the beginning of 2020 are

characteristic markers of marketing incentives' usage

in the market. Based on the assumed configuration,

we have built a forecast graph without the COVID-19

influence. In both cases, since March 1, 2019, there

are values on the chart that are greater than forecast

ones. The behavior of real data completely repeats

similar configurations of payment systems that have

been appeared in our previous studies. Generally, we

can say, that both “positive” influence of marketing

actions and “negative” effect of COVID-19 still

affects long-term behavior in 2021, but this influence

is very low comparing to peak amplitudes provided

0,00

100 000 000,00

200 000 000,00

300 000 000,00

400 000 000,00

500 000 000,00

600 000 000,00

Number of transactions

Modified Bass equation without COVID-

19 influence

Modified Bass equation with COVID-19

influence

ISAIC 2022 - International Symposium on Automation, Information and Computing

584

by these factors. As we see, in 2021 real data behavior

is quite close to prediction based upon pre-action and

pre-COVID data.

5 CONCLUSIONS

The results of the study show that the application of

the modified Bass equation empirically mostly

confirms the results of the statistical analysis by Putri

Natasya Fanuel and Ahmad Nurul Faja about the

absence of a significant long-term positive effect

from marketing incentives. Moreover, we were able

to demonstrate that this effect does not depend on

regional characteristics or the demographic structure.

Nevertheless, the application of the modified Bass

equation on the Indonesian market, as well as

cryptocurrency market and other payment markets,

shows that the effect of marketing incentives is

present, but to a low extent and not in long terms,

which is partially contrary to the conclusions of

Indonesian researchers. However, this discrepancy is

understandable and does not affect the main thesis of

the paper.

The research of Indonesian scientists also

provides opportunities for the formation of predictive

values of the modified Bass equation parameters.

This will allow us to form effective forecasts of the

development of payment systems from the beginning

of their development. This issue will be considered by

us in the next studies.

REFERENCES

Victor Dostov, Pavel Shoust and Elizaveta Popova 2019

Using Mathematical Models to Describe the Dynamics

of the Spread of Traditional and Cryptocurrency

Payment Systems Misra S. et al. (eds) Computational

Science and Its Application. ICCSA 2019 11620 457-

471

Victor Dostov and Pavel Shoust 2020 A Generalization of

Bass Equation for Description of Diffusion of

Cryptocurrencies and Other Payment Methods and

Some Metrics for Cooperation on Market Misra S. et al.

(eds) Computational Science and Its Applications –

ICCSA 2020 12251 3-13

Victor Dostov, Pavel Shoust and Svetlana Krivoruchko

2020 A Using mathematical models for analysis and

prediction of payment systems behaviour Proceedings

of Fifth International Congress on Information and

Communication Technology – ICICT 2020 2

Manaf Al-Okaily, Mohd Shaari Abd Rahman and Azwadi

Ali 2019 Factors Affecting the Acceptance of Mobile

Payment Systems in Jordan: The Moderating Role of

Trust Journal of Information System and Technology

Management 4(15) 16-26

Manaf Al-Okaily, Mohd Shaari Abd Rahman, Emad Abu-

Shanab and Ra'Ed Masa'deh 2020 An Empirical

Investigation on Acceptance of Mobile Payment

System Services in Jordan: Extending UTAUT2 Model

with Security and Privacy International Journal of

Business Information Systems 1(1) 1

Putri Natasya Fanuel and Ahmad Nurul Fajar 2021 Digital

wallet war in Asia: Finding the drivers of digital wallet

adoption Journal of Payments Strategy & Systems 15

(1) 79-91

David G.W. Birch 2020 The Currency Cold War: Cash and

Cryptography, Hash Rates and Hegemony

(Perspectives) London Publishing Partnership 256 p

Statistik Sistem Pembayaran (SSP) 2020 Bank Indonesia

https://www.bi.go.id/id/statistik/ekonomi-

keuangan/ssp/uang-elektronik-infrastruktur.aspx

The Influence of the Effect of Marketing Incentives on the Dynamics of the Development of Classic and Cryptocurrency Payment Systems

585