Firm Value the Moderating Role of Risk Management: Growth, Size,

Age, and Profitability

Kiko Armenita Julito

1a

and Reynold Ari Reynaldo Ticoalu

2b

1

Universitas 17 Agustus 1945 Jakarta, Indonesia

2

Universitas Tarumanegara, Indonesia

Keywords: Firm Value, Banking, Growth, Size, Age, Profitability, Risk Management.

Abstract:

Firm value is one of the important indicators in describe the condition of the company. This study examines

the effects of firm growth, firm size, firm age, and firm profitability on firm value. In addition, this study also

includes risk management as a moderating variable in the relationship between firm growth, firm size, firm

age, and firm profitability on firm value. This study uses data from banking companies listed on the Indonesia

Stock Exchange with an observation period of 2016–2021 with a total of 234 observations through purposive

sampling. A panel data regression test using the fixed effect model is used to test the hypothesis. The test

results suggest that firm growth and firm age have a positive effect on firm value, while firm size and firm

profitability don’t affect firm value. Besides that, risk management assessment was able to strengthen the

positive influence of firm size and firm profitability on firm value partially, weakened the effect of firm age

on firm value, and did not strengthen the effect of firm growth on firm value. This research indicates that

management needs to increase growth and maintain business continuity because it’s an indicator of

assessment by the market.

1

INTRODUCTION

Maintaining a business existence is the biggest

challenge in running a firm. This is due to the

increasingly intense competition in business, so

companies are required to maintain optimal company

performance, including banking sector companies.

The banking sector is an attractive company for

investors (Ticoalu et al., 2021), and therefore, banks

need to maintain this attractiveness by maintaining

their firm performance.

Firm performance can be seen from firm value.

The value of a firm reflects the firm’s condition on

the consequences of the market’s response related to

the activities and actions carried out by the company.

Firm value is an investor's point of view about the

company's successful rate in managing resources,

which can be seen in the firm's share price (Chaidir et

al., 2021). The increase of stock price in the market

signifies the increase of confidence level of

shareholders (Savitri et al., 2020). The purpose of any

a

https://orcid.org/0000-0002-3722-0782

b

https://orcid.org/0000-0001-5272-464X

firm is to increase the amount of money received by

the shareholders (Suhadak et al., 2019). The value of

the firm is one of the important factors because it can

attract investors to invest (Firmansyah et al., 2021).

Firm needs to increase their value in order to achieve

the main goal of the firm, which is to improve the

prosperity of owners and shareholders.

Negative sentiment from the public can decrease

the value of the company. The decline in the

company's value must be addressed immediately by

the company as it is an important problem because it

will have an impact on the company's financial

condition and stability. One case of declining firm

value that occurred in Indonesia was the decline in the

value of Panin bank shares in line with the depressed

company's financial statements in 2020 (CNBC

Indonesia, 2021). Data from the Indonesia Stock

Exchange/BEI showed that Panin Bank shares fell

4.23% to Rp. 1.020/share (CNBC Indonesia, 2021).

In addition to the decrease in net profit, Panin Bank

was also investigated by the Corruption Eradication

Commission/KPK (23/03/21) regarding allegations

Julito, K. and Ticoalu, R.

Firm Value the Moderating Role of Risk Management: Growth, Size, Age, and Profitability.

DOI: 10.5220/0011976600003582

In Proceedings of the 3rd International Seminar and Call for Paper (ISCP) UTA â

˘

A

´

Z45 Jakarta (ISCP UTA’45 Jakarta 2022), pages 87-98

ISBN: 978-989-758-654-5; ISSN: 2828-853X

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

87

of tax bribery (CNN Indonesia, 2021).

The case above illustrates that the value of a firm

can decrease. Management has more information

related to the condition of the company and discloses

it to the public, with one of the objectives being to

give signals to investors and the market. Based on

signaling theory (Spence, 1973), investors evaluate

the company based on the disclosure of information

made by the company. The poor signal received by

investors about the condition of the company cannot

increase the value of the company through stock

prices (Setiawanta et al., 2019). The low value of the

company can also affect the perception and trust of

shareholders in the company's performance. A

continuous decrease in value can make the company's

financial statements corrected, and if not mitigated,

can have an impact on bankruptcy. A low company

value indicates poor company performance due to

low stock prices (Chaidir et al., 2021). Poor company

performance can disrupt the company's business

continuity. Seeing the importance of firm value for

the sustainability of the company, then the firm’s

value of the company needs to be tested further.

Research on firm value has been carried out by

several previous researchers. Research on firm value

is carried out by looking at the effect of firm growth

(Nugroho and Patrisia, 2021; Antoro et al., 2020;

Syaifulhaq et al., 2020), firm size (Sari and

Witjaksono, 2021; Natsir and Yusbardini, 2020;

Juhandi et al., 2019; Luqman, 2017; Purwohandoko,

2017), firm age (Susilawati and Suryaningsih, 2020;

Mandala et al., 2019; Samosir, 2018), profitability

(Chaidir et al., 2021; Sugiyanto et al., 2021;

Sondakh, 2019), risk management (Krause and Tse,

2016; Florio and Leoni, 2017; Horvey and Ankamah,

2020; Phan et al., 2020; Faisal and Challen, 2021),

governance (Fatma and Chouaibi, 2021; Suhadak et

al., 2018; Husaini and Saiful, 2019), carbon

emissions (Primanandari et al., 2021; Hardiyansah et

al., 2021), dividend policy (Budagaga, 2020; Endri

and Fathony, 2020; Lumapow and Tumiwa, 2017),

social responsibility (Kartika, 2021; Mohd Razali et

al., 2018; Harun et al., 2020), ownership structure

(Sugosha, 2020; Al Sa'Eed, 2018), Capital structure

(Ayuba et al., 2019; Sudiani and Wiksuana, 2018),

Audit Quality (Yolandita and Cahyonowati, 2022;

Monametsi and Agasha, 2020; Wijaya, 2020),

Leverage (Gusni et al., 2021; Husna and Satria, 2019;

Widyastuti, 2019).

The firm's growth illustrates how far the ability of

the firm to grow and develop, which can be seen from

the growth of the firm's assets (Fajaria and Isnalita,

2018). The high growth of the firm has an impact on

investors' assessment so that it can increase the firm

value (Putri & Rahyuda, 2020). Research conducted

by Suhandi, 2020; Putri & Rahyuda, 2020;

Puspitasari & Wiagustini, 2020; Fajaria & Isnalita,

2018; Ghozali et al., 2018; shows the results that firm

growth has a positive effect on firm value. In contrast,

research conducted by Pramesti et al., 2021; Endri &

Fathony, 2020; Antoro et al., 2020; shows the results

that the firm growth has no effect on firm value. The

existence of inconsistent results of previous tests

about firm growth makes this variable need to be

retested.

Firm size shows how well the company is able to

obtain maximum value by using working capital

derived from firm assets (Natsir and Yusbardini,

2020). Firm size shows the total amount of assets

owned by the company, where the larger the

company, the easier the company's access to obtain

funds from external sources so that it has the

opportunity to increase firm value (Gusni et al.,

2021). The results of research from Tabe et al., 2022;

Natsir and Yusbardini, 2020; Husna and Satria, 2019;

Ayuba et al., 2019; Lumapow and Tumiwa, 2017;

stated that there is a positive influence of firm size on

firm value. Meanwhile, the results of research by

Gusni et al., 2021; Endri and Fathony, 2020; Juhandi

et al., 2019; stated that firm size does not affect firm

value. Thus, the test of firm size against firm value

needs to be retested.

More experienced companies display superior

value (Horvey and Ankamah, 2020). The age of the

company implies better credibility and reputation in

the market (Mandala et al., 2019) so that it can

increase firm value. Several studies show that firm

age has a positive effect on firm value (Yulianto and

Widyasasi, 2020; Mandala et al., 2019; Susanti and

Restiana, 2018; Yumiasih and Isbanah, 2017).

Furthermore, research conducted by Horvey and

Ankamah, 2020; Ayuba et al., 2019; shows that there

is no effect of firm age on firm value. The different

tests resulted in inconsistencies between previous

studies, so that they needed to be re-examined.

Profitability is the profit from operational

activities generated by the company based on its

performance measures (Antoro et al., 2020). The

higher profitability will be followed by the increase

of the company's share price, and it’ll have an impact

on increasing the firm’s value due to the good

company's performance being seen by investors, so

that investors will be interested in investing their

capital (Chaidir et al., 2021). Research conducted by

Chaidir et al., 2021; Endri & Fathony, 2020; Antoro

et al., 2020; Husna and Satria, 2019; Natsir and

Yusbardini, 2020; gives the result that profitability

has a positive effect on firm value. However, the

ISCP UTA’45 Jakarta 2022 - International Seminar and Call for Paper Universitas 17 Agustus 1945 Jakarta

88

results of research by Novitasari and Sunarto, 2021;

Surasmi et al., 2022; Hirdinis, 2019; Astuti et al.,

2018; stated that profitability does not affect firm

value. This shows that the effect of profitability is still

varied, so it is necessary to retest.

This study aims to examine the effects of firm

growth, firm size, firm age, and profitability on the

value of banking firms. Risk management is also used

in this study as a moderating variable in testing the

effects of firm growth, firm size, firm age, and

profitability on the value of banking firms, which are

still rarely found in previous studies. Risk

management is a major factor in business

competitiveness and a very important part of business

activities and organizations because it facilitates

controlling the company's internal systems (Yang et

al., 2018). The role of risk management is very

important for the company's needs in managing

financial risk, especially in banking companies.

Commitment to implementing risk management can

provide value for the company (Faisal & Challen,

2021). Based on this, the company's risk management

is considered relevant to be used as a moderating

variable in this study.

This study also used control variables, consisting

of leverage and auditor type. Leverage is a description

of the size of a firm's debt used to finance its

operational activities (Endri & Fathony, 2020).

Research conducted by Astuti et al., 2022 and Jihadi

et al., 2021 stated that there is a positive influence of

leverage on firm value. The type of auditor is an

indicator that is determined by looking at whether the

company uses the services of a public accounting firm

affiliated with the Big 4 or not. Public accounting

firms affiliated with the big 4 can improve a

company's reputation in the capital market (Afza and

Nazir, 2014). Research conducted by Wijaya, 2020

and Afza and Nazir, 2014 showed a significant

positive influence of the auditor’s type on firm value.

The results of this study are expected to provide

additional references related to firm growth, firm size,

firm age, and profitability for their influence on the

firm value of banking companies in Indonesia. The

results of this study can be used by companies that are

listed on the Indonesia Stock Exchange to look for

items that support the increase of firm value so that

special attention can be given by management to

maintain the company's business continuity.

2

LITERATURE REVIEW

Signaling theory explains about company information

disclosed by management with the objective of giving

signals to external parties regarding information on

the company's condition. (Spence, 1973). Signaling

theory states that a good company will deliberately

signal the market, thus the market is expected to be

able to distinguish between good and bad companies

(Suhadak et al., 2019). Basically, signaling theory

seeks to explain how to reduce the asymmetry of

information between two parties (Connelly et al.,

2011). External parties do not have the same

information as internal parties regarding the

company's prospects and risks (Sugiyanto et al.,

2021). Information about the company's financial

statements is a reflection of the company's value that

can provide positive signals and can influence the

opinions of investors and creditors (Kartika, 2021).

Shareholders and investors are the main parties who

need information related to the company's financial

condition (Suhono et al., 2021). The signal issued by

management is expected to be captured by investors

and shareholders as good information so that

investors are willing to pay for the company's shares

at a higher value, which will have an impact on

increasing the value of the company (Sugiyanto et al.,

2021).

Firm growth describes a measure of the success of

a company (Nugroho and Patrisia, 2021). Firm

growth provides an overview of the company's ability

to grow and develop (Fajaria and Isnalita, 2018).

Firms that have good growth will attract more

investors to invest in the company (Surasmi et al.,

2022), so the better the company is experiencing

growth, the more the value of the company will

increase (Antoro et al., 2020). Suhandi, 2020; Putri

and Rahyuda, 2020; Puspitasari and Wiagustini,

2020; Fajaria and Isnalita, 2018; Ghozali et al., 2018;

concluded that firm growth can increase the value of

the company positively. Firm growth brings positive

signals for investors in analyzing the company's

future, and this information can be used for making

decisions in order to invest. Firms with increased

growth tend to be able to provide a good image to the

market, and the market responds to this image, which

is seen with the increasing value of the company.

Therefore, the first hypothesis in this study is:

H

1

: Firm growth has a positive effect on firm value

Firm size shows the estimated size of a company

(Purwohandoko, 2017). The size of a company can be

determined by looking at the total assets owned by the

company (Gusni et al., 2021). Investors are attracted

to large-scale companies (Astuti et al., 2022). Firm

size provides security guarantees for shareholders on

the continuity of the company's business (Wijaya,

2020). A large company size can show that the

Firm Value the Moderating Role of Risk Management: Growth, Size, Age, and Profitability

89

company is experiencing development and is a good

signal for investors, so it can increase the stock price

and at the same time increase the firm value (Antoro

et al., 2020). Tabe et al., 2022; Natsir and

Yusbardini, 2020; Husna and Satria, 2019; Ayuba et

al., 2019; Lumapow and Tumiwa, 2017; concluded

that firm size can increase firm value positively. Firm

size implies the firm's ability to carry out their

business activities, which is a positive signal for

investors, showing that the company can operate well,

which brings the opportunity to increase the firm

value. Therefore, the second hypothesis in this study

is:

H

2

: Firm size has a positive effect on firm value

Firm age shows the ability of the company to

maintain thier business continuity (Yulianto and

Widyasasi, 2020). The age of the company provides

a better picture of the company's credibility and

reputation in the market (Mandala et al., 2019). The

age of the company can affect the quality of the

company's financial statements because it relates to

the development and growth of the company (Susanti

and Restiana, 2018). Firm age can show superior

value (Horvey and Ankamah, 2020), so it can

increase the value of the firm. Yulianto and

Widyasasi, 2020; Mandala et al., 2019; Susanti and

Restiana, 2018; Yumiasih and Isbanah, 2017;

concluded that firm age can increase the value of the

company positively. The longer a company stands

and operates, it indicates that the company is able to

deal with the tight of business competition, which is

competitive, so it can finally be a signal for investors

in making decisions so the value of the firm can be

increased. Therefore, the third hypothesis in this

study is:

H

3

: Firm Age has a positive effect on firm value

Profitability is the ability of a company to earn profits

within a certain period at a certain level of sales,

assets, and share capital (Chaidir et al., 2021).

Profitability is an illustration of management's

performance in managing their company (Hirdinis,

2019). Profitability shows the level of net profit

earned by a company (Sugosha, 2020). The company

always wants a high and stable level of profitability

(Purwohandoko, 2017). The high profitability of the

company shows that the company has a better

prospect, so investors will respond positively to these

signals, which are expected to increase firm value

(Endri and Fathony, 2020). Chaidir et al., 2021; Endri

and Fathony, 2020; Antoro et al., 2020; Husna and

Satria, 2019; Natsir and Yusbardini, 2020; concluded

that profitability has an effect on increasing the value

of the firm. High profitability provides information to

investors that the company has the ability to earn

profits where this is the main goal of investors to

invest their money, so it can increase firm value.

Therefore, the fourth hypothesis in this study is:

H

4

: Profitability has a positive effect on firm value

Firm growth is a factor in supporting economic

growth, industrial growth, and also showing the

company's management performance (Wijaya, 2020).

Firm growth is managed by agents or management

companies, which have a direct influence on the

company's stock price because the principal gives a

positive response by buying the firm’s shares

(Setiawanta et al., 2019). Firm value will increase if

firm growth is also improving (Antoro et al., 2020).

Companies need to maintain their growth because it

is one of the important indicators that are seen by the

market. One way to maintain it is by implementing

risk management. Risk management is an important

part because every company has the responsibility to

provide value to stakeholders and at the same time as

planning the company's strategy through

management decisions at all levels (Chairani and

Siregar, 2021). With the implementation of risk

management, the company can determine the

company's business performance is safe from risk so

that the company can continue to experience growth

where this will be important information for investors

in analyzing the company and finally cause firm value

to increase. Therefore, the fifth hypothesis in this

study is:

H

5

: Risk management strengthen the positive effect of

firm growth on firm value

Firm size indicates the size of assets owned by the

company (Gusni et al., 2021). Large companies will

have the advantages of being able to get venture

capital easily and having strong power to bargain

(Fajaria and Isnalita, 2018). Firm size can illustrate

the company's high commitment to continue to grow

so that the market will be willing to invest because

they feel confident that they'll get the expected return

from the firm, so it can increase the value of the

company (Sugiyanto et al., 2021). Investor trust in

firm size as an indicator in reviewing the company

needs to be considered by management, so they have

to provide evidence that the company is committed to

operating the company, one of which is by

implementing risk management. Firm size will be

followed by the complexity of risk, so implementing

risk management and disclosing it can give an

indication that management has made an effort to

minimize the risks, both from system support and

ISCP UTA’45 Jakarta 2022 - International Seminar and Call for Paper Universitas 17 Agustus 1945 Jakarta

90

from competitive resources (Ticoalu et al., 2021).

The implementation of risk management can be a

good signal for investors that the company is aware

of the risks it faces as it grows the company size, so it

can increase firm value. Therefore, the sixth

hypothesis in this study is:

H

6

: Risk management strengthen the positive effect of

firm size on firm value

Firm age can be seen by how long the company has

been established or how long the firm has aged from

its initial public offering (Susanti and Restiana,

2018). The firm’s reputation and credibility in the

market can also be seen from how long the firm has

been established (Mandala et al., 2019). The age of

the company can have a positive influence on firm

performance (Horvey and Ankamah, 2020). Firm age

has become an important indicator that is assessed by

investors in making investment decisions, so

management needs to provide assurance to the

investors that the company can maintain their

business continuity, which one of them is with

implementing risk management. The implementation

of risk management by the company can reduce the

overall risk of failure in a business (Saeidi et al.,

2021) so that the company can maintain their business

continuity. The implementation of risk management

is a positive signal received by investors, convincing

them that management is taking the company

seriously about maintaining its business sustainability

so it can increase firm value. Therefore, the seventh

hypothesis in this study is:

H

7

: Risk management strengthen the positive effect of

firm age on firm value

Profitability is an indicator in looking at

management's performance in managing company

wealth as indicated by company profits (Sondakh,

2019). Profitability can provide an overview of the

company's ability to obtain high profits for

shareholders (Suhono et al., 2021). The higher a

firm’s profitability, the greater the firm's ability to pay

dividends to shareholders where this certainly attracts

investor’s attention and also gives an idea that the

company has good performance (Sugosha, 2020).

Company profitability is one way that can be done in

assessing the level of return that'll be obtained from

investment activities, precisely (Sudiani and

Wiksuana, 2018). As an important indicator in

attracting investors, management must strive to

increase their profitability, one of the way is by

avoiding risks. Risk management is an important

factor in improving the company's financial

performance (Horvey and Ankamah, 2020). With the

implementation of risk management, firms can

manage and avoid inherent risk in business so they

can continue steadily to make a profit. High

profitability is one of the indicators used by investors

in analyzing the company's performance so it can

increase the value of the company. Therefore, the

eighth hypothesis in this study is:

H

8

: Risk management strengthen the positive effect of

profitability on firm value

3 METHODS

In this study, the population consists of banking

sector companies listed on the Indonesia Stock

Exchange (IDX) with an observation starting from

2016 to 2021. This study chose financial sector

companies, specifically banking companies, as

objects of research because this sector has an

important role in the development process of a

country (Ben Fatma & Chouaibi, 2021). This study

employs the 2016–2021 periods considering the

Indonesia Financial Services Authority (OJK)

Circular Letter No. 32/POJK.03/2016 concerning

Transparency and Publication of Bank Statements.

Purposive sampling, which is sampling by the

specified criteria, was adopted in this research. The

criteria in this research are as follows: (1) Companies

in the banking sector listed on the Indonesia Stock

Exchange from 2016 to 2021; (2) the company

publishes annual reports from 2016 to 2021. The final

sample is composed of 39 banks, so in total this

research had 234 observations.

The dependent variable used in this study is the

firm value. This study employs the proxy for firm

value as Tobin’s Q, which is also used in the research

of Liew and Devi, 2021; Chairani and Siregar, 2021;

Faisal and Challen, 2021; and Al-Sa'eed, 2018; which

is shown in the following equation:

Tobin's Q =

EMV + BVD

BVA

Where :

EMV = Equity Market Value

BVD = Book Value of Debt

BVA = Book Value of Asset

The independent variables used in this study are

firm growth, firm size, firm age, and profitability.

firm growth is measured by looking at the growth of

company assets as used in the research of Nugroho

and Patrisia, 2021; Sugiyanto et al., 2021; Syaifulhaq

et al., 2020; Purwohandoko, 2017 with the following

Firm Value the Moderating Role of Risk Management: Growth, Size, Age, and Profitability

91

formula:

Firm Growth =

Total Assets

t

–

Total Assets

t

-1

Total Assets

t

-1

Firm size is calculated by looking at the size of

assets owned by the bank and using the natural

logarithm of it as used in research by Natsir and

Yusbardini, 2020; Sari and Witjaksono, 2021;

Antoro et al., 2020; Luqman et al., 2017; with the

formula as follows :

Firm Size = LN (Total Assets)

Firm age is calculated by looking at the age of the

bank since the bank was registered in the capital

market, which was also used in the research of

Horvey and Ankamah, 2020; Susilawati and

Suryaningsih, 2020; Mandala et al., 2019; Samosir,

2018; with the following formula :

Firm Age =

LN (Year of Observation –

Year of Listed Company in

capital market)

Profitability is calculated using the Return On

Asset (ROA) ratio, which was also used in the

research of Chaidir et al., 2021; Endri and Fathony,

2020; Husna and Satria, 2019; Sukmawardini and

Ardiansari, 2018 with the following formula:

ROA =

Net Profit

Total Assets

The moderating variable in this study is risk

management. In this study, the index was followed by

the research of Ticoalu et al., (2021), which was

compiled from the research of Horvey and Ankamah

(2020) and Supriyadi and Setyorini (2020). The

compiled index consists of five disclosure items,

namely: risk information, types of auditors, risk

management committees, risk monitoring

committees, and internal auditor competencies. If the

item in the measurement is disclosed, it is given 1,

and otherwise 0. The total score will then be divided

by the total criteria so that the final value formed

ranges from 0–1 where a value close to 1 is a better

disclosure of risk management. The risk management

formula is as follows :

RM =

Criteria Fulfilled

Total Criteria

This study also used control variables, which are

leverage and auditor type. Leverage is calculated

using the debt to asset (DAR). The proxy for leverage

follows Farooq et al., 2022; Widyastuti, 2019; with

the following formula:

DAR =

Total Debt

Total Assets

The auditor type in this study is measured using

the dummy method, whereby companies audited by

public accounting firms affiliated with the Big 4 will

be given a value of 1 and 0 otherwise. This method is

also used to measure audit quality in the research of

Yolandita and Cahyonowati (2022) and Wijaya

(2020).

This study used panel data regression analysis in

conducting hypothesis testing. Hypothesis testing is

done by first determining the best regression model

among the common effect model, fixed effect model,

and random effect model using the Lagrange

Multiplier test, Hausman test, and Chow test. This

study used two research models : Model 1 for H

1

, H

2

,

H

3

, and H

4

tests, while Model 2 tests for H

5

, H

6

, H

7

,

and H

8

. The research model is as follows:

Model 1 :

Tobin's Q

it

=

α

0

+ β

1

Growth

it

+ β

2

Size

it

+ β

3

Age

it

+

β

4

ROA

it

+ β

5

DAR

it

+ β

6

Type

it

+

εit

Model 2 :

Tobin's Q

it

= α

0

+ β

1

Growth

it

+ β

2

Size

it

+ β

3

Age

it

+ β

4

ROA

it

+ β

5

(Growth * RM)

it

+

β

6

(Size * RM)

it

+ β

7

(Age * RM)

it

+

β

8

(ROA * RM)

it

+ β

9

DAR

it

+

β

10

Type

it

+

εit

Where :

Tobin's Q

it

= Frim value i in year t

Growth

it

= Firm Growth i in year t

Size

it

= Firm Size i in year t

Age

it

= Firm Age i in year t

ROA

it

= Profitability of the Firm i in year t

RM

it

= Risk Management Firm i in year t

DAR

it

= Leverage of the Firm i in year t

Type

it

=Auditor type of the firm i in year t

α

0

= constant

β

1 - 10

= Variable regression coefficient

εit

= error

4

RESULTS AND DISCUSSION

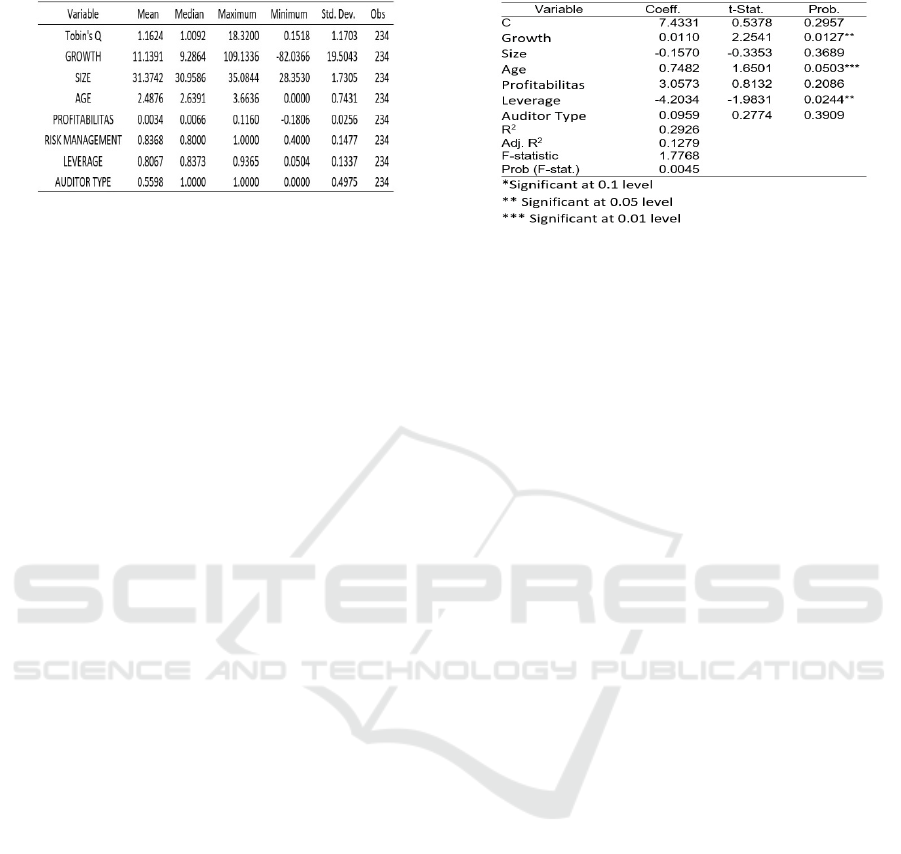

Table one has the summary of descriptive statistics

for each variable in the study. The components are the

mean, median, maximum value, Minimum Value and

standard deviation over the past six years.

ISCP UTA’45 Jakarta 2022 - International Seminar and Call for Paper Universitas 17 Agustus 1945 Jakarta

92

Table 1: Summary of Descriptive Statistics.

Source: Processed Data

The value of Tobin's Q has an average value of

1.1624, with a maximum value of 18.3200 owned by

BBHI in 2021 and a minimum value of 0.1518 owned

by PNBS in 2017. The standard deviation value for

the firm value variable is 1.1703. Firm growth has an

average value of 11.1391, with a minimum value of -

82.0366 owned by BBYB in 2016 and a maximum

value of 109.1336 owned by BBYB in 2021. The

standard deviation value for the firm growth variable

is 19.5043. Firm size has an average of 31.3742, with

a minimum value of 28.3530 owned by BBHI in

2016, a maximum value of 35.0844 owned by BMRI

in 2021, and a standard deviation of 1.7305. Firm age

has an average value of 2.4876, with a minimum

value of 0 owned by BBHI and BBYB in 2016, a

maximum value of 3.6636 owned by PNBN in 2021,

and a standard deviation of 0.7431. Profitability has

an average value of 0.0034, with a minimum value of

-0.1806 owned by AGRO in 2021, and a maximum

value of 0.1160 owned by MEGA in 2017. The

standard deviation of the profitability variable is

0.0256. Risk management has an average value of

0.8368, with a minimum value of 0.4 owned by

several companies, such as BSWD in 2017, a

maximum value of 1 owned by several companies,

such as BTPN in 2021, and a standard deviation value

of 0.1477. Leverage has an average value of 0.8067,

with a minimum value of 0.0504 owned by PNBS in

2021, a maximum value of 0.9365 owned by BBKP

in 2017 and a standard deviation value for leverage of

0.1337. The auditor type has an average value of

0.5598, with a minimum value of 0 owned by several

companies, such as BBMD in 2016, and a maximum

value of 1 owned by several companies, such as NISP

in 2016. The standard deviation for the auditor type is

0.4975.

Furthermore, after testing the best model selection

for model one, the selected model to use in testing the

hypothesis in this study is the fixed effect model.

Table two presents a summary of the results of

hypothesis testing for hypotheses one to four.

Table 2: The results of hypothesis testing (First Model).

Source: Processed Data

The test results show that growth has a positive

effect on firm value (H

1

is accepted). This research is

in line with Sugiyanto et al., 2021; Syaifulhaq et al.,

2020; but not in line with the research Nugroho &

Patrisia, 2021; Endri & Fathony, 2020; Novitasari &

Sunarto, 2021; Antoro et al., 2020. The effect of

growth variable in this study shows that companies

that experience growth will be well received by

investors, so that they are able to increase the value of

the company. Increasing growth due to changes in

total assets can affect the value of the company

(Puspitasari & Wiagustini, 2020). Companies that

have high-value assets provide information to

investors that the firm is growing, which is good

information to assess the company. This result is able

to support the signal theory, where companies that

experience growth can provide positive signals for

investors in analyzing the company's future so that it

can provide an increase in company value.

The results of hypothesis testing indicate that firm

size does not affect firm value (H

2

is rejected). This

test result is not in line with the research of Sari &

Witjaksono, 2021; Natsir & Yusbardini, 2020;

Lumapow & Tumiwa, 2017. The results of this study

are in line with Sugosha, 2020; Juhandi et al., 2019.

This result shows that investors do not use the size of

the company as the benchmark in making investment

decisions. The level of effectiveness and efficiency of

the company is not reflected in the number of assets

owned by the company, so it does not have an

influence on investor policy in investing (Pratiwi,

2020). The results of this study are unable to support

signal theory, where the size of the company can give

a signal that the company is able to carry out business

activities and can operate properly so that it has the

opportunity to increase firm value.

The test results stated that firm age has a positive

effect on the firm value (H

3

is accepted). It is in line

with the research of Yulianto & Widyasasi, 2020;

Mandala et al., 2019; Susanti & Restiana, 2018;

Yumiasih & Isbanah, 2017, but not in line with the

Firm Value the Moderating Role of Risk Management: Growth, Size, Age, and Profitability

93

research of Horvey & Ankamah research, 2020;

Ayuba et al., 2019. A company that has been standing

for a long time indicates that the company is able to

compete with their competitors, which gets a positive

response from investors to invest in the company so

that it can increase firm value. The age of the

company shows the company's ability to maintain

business continuity (Yulianto & Widyasasi, 2020).

Companies that have long been established have good

credibility and reputation in the capital market

(Mandala et al., 2019). These results are able to

support the signal theory where the longer the

company stands and operates, the more it indicates

that the company is able to maintain their business

stability, which this can make a positive signal for

investors and finally can increase the value of the

company.

The results shows that profitability has no effect

on firm value (H

4

is rejected). The results of this test

are in line with research Novitasari & Sunarto, 2021;

Hirdinis, 2019; and Astuti et al., 2018. However, this

is not in line with research Susilawati &

Suryaningsih, 2020; Antoro et al., 2020; Natsir &

Yusbardini, 2020. The results of this test indicate that

profitability cannot increase firm value. This is

possible because investors tend to look at other

information besides profitability in assessing

companies, especially the banking sector, because

banking is a sector that is supervised by the

government so that it is considered safe to invest in

regardless of the company's profit level. The results

of this study cannot support the signal theory where

high profitability is a good signal for investors

because it provides information that the company has

the ability to earn profits so as to increase the value.

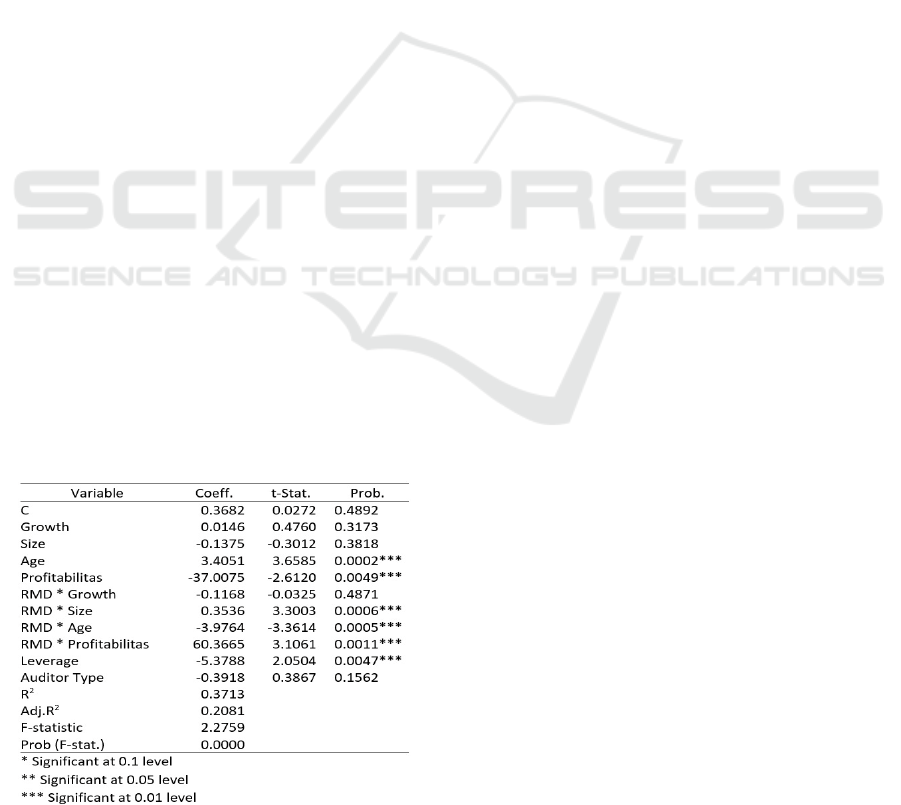

Furthermore, table three shows the results of

model two for hypotheses five to eight.

Table 3: The results of hypothesis testing (Second Model).

Source: Processed Data

The results prove that risk management is not able

to strengthen the influence of firm growth on firm

value (H

5

is rejected). These results prove that risk

management is not able to strengthen the influence of

firm growth on firm value. Investors tend to give a

positive response to the company's growth and do not

see risk management information in assessing the

company, so that risk management information has

no effect on increasing company value. Besides risk

management, it is possible for investors to view other

information in assessing the company.

The results of the test show that risk management

is able to strengthen the positive relationship between

firm size and firm value (H

6

is accepted). The

interaction between risk management and firm size

can increase firm value. Large-scale companies tend

to be more trusted by investors than small companies.

The implementation of risk management in large-

scale companies will make investors give a positive

response, which can increase the value of the

company. Besides, the implementation of risk

management carried out by large companies is

considered a form of company transparency.

Investors assume that large-scale companies have

stable financial conditions (Ticoalu et al., 2021) so

that risk management information carried out by

large-scale companies can increase investor and

potential investor confidence to invest, which in turn

can increase the value of the company.

The results prove that risk management is not

able to strengthen the influence of firm age on firm

value (H7 is rejected). The interaction that occurs

between risk management and age can reduce the

firm's value. Investors believe that companies that

have been around for a long time have more trust from

investors, but information on risk management will

be able to reduce investor responses to the continuity

of investment in the company. In addition, investors

also assume that the disclosure of risk management

by long-established companies related to the risks

will result in a negative signal from investors.

Investors perceive that risk management should be

disclosed by newly established companies,

considering that newly established companies are

vulnerable to risk.

The results of the last test show that risk

management can strengthen the positive effect of

profitability on the firm value (H

8

is accepted). The

interaction of risk management and profitability is

able to increase the value of the firm. Risk

management is an important factor in improving the

company's financial performance (Horvey &

Ankamah, 2020). With the implementation of risk

management, companies can manage and avoid the

ISCP UTA’45 Jakarta 2022 - International Seminar and Call for Paper Universitas 17 Agustus 1945 Jakarta

94

inherent risks in their business so that they can

continue to make profits, which is a positive signal for

investors in making investment policies. High

profitability is one of the indicators for investors in

analyzing the company's performance so that, with

the implementation of risk management, the company

is able to maintain and increase its profitability.

The testing result in panel data model one (table

two) also analyzes the control variables on the

dependent variable. The test results prove that the

leverage owned by the company has an effect on firm

value. High leverage indicates that the higher the

leverage ratio owned by the company, the lower the

investor's confidence in the company, resulting in a

decrease in firm value. A high leverage value gives a

negative signal to investors that the company has high

debt, which will lead to company risks such as failed

payments and increased company expenses, which

reduce the company's profit. Furthermore, the test

results prove that the type of auditor has no effect on

firm value. The type of auditor who has no effect

indicates that although the financial statements are

audited by the services of a Big 4 public accounting

firm affiliated, this is not able to provide a positive

signal for investors in making investment policies so

that they do not contribute to increasing the firm

value. This can be interpreted as the auditor making

no distinction between the quality of audit reports

based on whether or not public accounting firms are

affiliated with the Big 4.

5

CONCLUSIONS

Firm growth and firm age are partially indicators of

information that can be used by management in order

to give signals to investor’s as a basis for making their

investment decisions. In addition, the size of the firm

and the firm’s profitability are partially not affecting

investors' decisions to invest. Furthermore, large-

scale firms can influence investors' decisions in

making investment decisions when accompanied by

the disclosure information of risk management

implementation. Then, the level of a firm’s

profitability, if followed by risk management

disclosure, can be a positive signal for investors about

the firm's performance. In addition, companies that

have growth and disclose information about the

implementation of risk management do not always

receive a positive response from investors when this

information cannot increase the value of the firm.

Furthermore, long-established companies that

disclose their risk management are considered able to

reduce investor confidence in the company. Investors

give more attention to the implementation of risk

management for companies that are generally new to

business.

This study has some limitations. This research

uses banking companies listed on the Indonesia Stock

Exchange where the results of this study cannot be

generalized to all company sectors, especially in the

non-financial sector. Furthermore, firm value, firm

growth, and the level of firm profitability in this study

only use one of several measurement ratios that can

be used to measure variables. The index that is built

to look at risk management is still incomplete because

it is possible that there are other indicators that can be

used in building the risk management index.

Further research can use data from non-financial

sector companies to compare research results and can

also use data on all sectors to get more comprehensive

results. Further research can also use different ratios

in measuring variables so that they can be used as

comparisons of research results. Further research can

also use different proxies to look at risk management

disclosures, either by using indices built from ISO

31000 or from COSO ERM, which are both major

standards in risk management. This research suggests

that a company’s management should pay attention to

the value of firm growth and business continuity

because they are positive signals for investors in

making investment decisions. The company is also

expected to disclose the implementation of corporate

risk management as a form of corporate responsibility

in managing the company.

REFERENCES

Afza, T., & Nazir, M. S. (2014). Audit Quality And Firm

Value: A Case Of Pakistan. Research Journal Of

Applied Sciences, Engineering And Technology, 7(9),

1803–1810. Https://Doi.Org/10.19026/Rjaset.7.465

Al Sa’eed, M. (2018). The Impact Of Ownership Structure

And Dividends On Firm’s Performance: Evidence

From Manufacturing Companies Listed On The

Amman Stock Exchange. Australasian Accounting,

Business And Finance Journal, 12(3), 87–106.

Https://Doi.Org/10.14453/Aabfj.V12i3.7

Antoro, W., Sanusi, A., & Asih, P. (2020). The Effect Of

Profitability, Company Size, Company Growth On

Firm Value Through Capital Structure In Food And

Beverage Companies On The Indonesia Stock

Exchange 2014-2018 Period. International Journal Of

Advances In Scientific Research And Engineering,

06(09), 36–43.

Astuti, D., Kristianto, D., & Setyoningsih, H. (2022). The

Effect Of Leverage And Company Size On Company

Value Moderated By Corporate Social Responsibility

Firm Value the Moderating Role of Risk Management: Growth, Size, Age, and Profitability

95

(CSR)(Case Study On LQ 45 Stock Company 2017-

2019 …. Budapest International Research And Critics

Institute-Journal (BIRCI-Journal), 5(1), 471–480.

Http://Bircu-

Journal.Com/Index.Php/Birci/Article/View/3635

Astuti, Wahyudi, S., & Mawardi, W. (2018). Analysis Of

Effect Of Firm Size, Institutional With Corporate

Social Responsibility (CSR) Disclosure As Intervening

Variable (Study On Banking Companies Listed On BEI

Period 2012 - 2016). Jurnal Bisnis Strategi, 27(2), 95–

109. Https://Doi.Org/10.14710/Jbs.27.2.95-109

Ayuba, H., Bambale, A., Ibrahim, M., & Sulaiman. (2019).

Effects Of Financial Performance, Capital Structure

And Firm Size On Firms Value Of Insurance

Companies In Nigeria. Journal Of Finance,

Accounting, And Management, 10(1), 57–74.

Ben Fatma, H., & Chouaibi, J. (2021). Corporate

Governance And Firm Value: A Study On European

Financial Institutions. International Journal Of

Productivity And Performance Management.

Https://Doi.Org/10.1108/IJPPM-05-2021-0306

Budagaga, A. R. (2020). Dividend Policy And Market

Value Of Banks In MENA Emerging Markets: Residual

Income Approach. Journal Of Capital Markets Studies,

4(1), 25–45. Https://Doi.Org/10.1108/Jcms-04-2020-

0011

Chaidir, R., Rosidi, R., & Andayani, W. (2021). The Effect

Of Policy On Debt And Profitability With Firm Values

With Corporate Governance As Moderate Variables.

International Journal Of Research In Business And

Social Science (2147- 4478), 10(8), 39–46.

Chairani, C., & Siregar, S. V. (2021). The Effect Of

Enterprise Risk Management On Financial

Performance And Firm Value: The Role Of

Environmental, Social And Governance Performance.

Meditari Accountancy Research, 29(3), 647–670.

Https://Doi.Org/10.1108/MEDAR-09-2019-0549

Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C.

R. (2011). Signaling Theory: A Review And

Assessment. Journal Of Management, 37(1), 39–67.

Https://Doi.Org/10.1177/0149206310388419

Endri, E., & Fathony, M. (2020). Determinants Of Firm’s

Value: Evidence From Financial Industry. Management

Science Letters, 10(1), 111–120.

Https://Doi.Org/10.5267/J.Msl.2019.8.011

Faisal, M., & Challen, A. E. (2021). Enterprise Risk

Management And Firm Value: The Role Of Board

Monitoring. Asia Pacific Fraud Journal, 6(1), 182.

Https://Doi.Org/10.21532/Apfjournal.V6i1.204

Fajaria, A. Z., & Isnalita. (2018). The Effect Of

Profitability, Liquidity, Leverage And Firm Growth Of

Firm Value With Its Dividend Policy As A Moderating

Variable.

International Journal Of Managerial Studies

And Research, 6(10), 55–69.

Https://Doi.Org/10.20431/2349-0349.0610005

Farooq, M., Noor, A., & Ali, S. (2022). Corporate

Governance And Firm Performance: Empirical

Evidence From Pakistan. Corporate Governance

(Bingley), 22(1), 42–66. Https://Doi.Org/10.1108/CG-

07-2020-0286

Firmansyah, A., Husna, M. C., & Putri, M. A. (2021).

Corporate Social Responsibility Disclosure, Corporate

Governance Disclosures, And Firm Value In Indonesia

Chemical, Plastic, And Packaging Sub-Sector

Companies. Accounting Analysis Journal, 10(1), 9–17.

Https://Doi.Org/10.15294/Aaj.V10i1.42102

Florio, C., & Leoni, G. (2017). Enterprise Risk

Management And Firm Performance: The Italian Case.

British Accounting Review, 49(1), 56–74.

Https://Doi.Org/10.1016/J.Bar.2016.08.003

Ghozali, I., Handriani, E., & Hersugondo. (2018). The Role

Of Sales Growth To Increase Firm Performance In

Indonesia. International Journal Of Civil Engineering

And Technology, 9(7), 1822–1830.

Gusni, Nadia, A., Sofia, F., Sherina, G., & Zakyyatu.

(2021). The Effect Of Leverage, Agency Cost, And

Firm Size On Firm Value. Psychology And Education,

58(1), 6214–6221.

Hardiyansah, M., Agustini, A. T., & Purnamawati, I.

(2021). The Effect Of Carbon Emission Disclosure On

Firm Value: Environmental Performance And

Industrial Type. Journal Of Asian Finance, Economics

And Business, 8(1), 123–133.

Https://Doi.Org/10.13106/Jafeb.2021.Vol8.No1.123

Harun, M. S., Hussainey, K., Mohd Kharuddin, K. A., &

Farooque, O. Al. (2020). CSR Disclosure, Corporate

Governance And Firm Value: A Study On GCC Islamic

Banks. International Journal Of Accounting And

Information Management, 28(4), 607–638.

Https://Doi.Org/10.1108/IJAIM-08-2019-0103

Hirdinis. (2019). Capital Structure And Firm Size On Firm

Value Moderated By Profitability. International

Journal Of Economics And Business Administration,

7(1), 174–191. Https://Doi.Org/10.35808/Ijeba/204

Horvey, S. S., & Ankamah, J. (2020). Enterprise Risk

Management And Firm Performance: Empirical

Evidence From Ghana Equity Market. Cogent

Economics And Finance, 8(1), 1–23.

Https://Doi.Org/10.1080/23322039.2020.1840102

Husaini, & Saiful. (2017). Enterprise Risk Management,

Corporate Governance And Firm Value: Empirical

Evidence From Indonesian Public Listed Companies

International Association Of HR Experts (IAHRE)

View Project The Substitution Role Of Audit

Committee Effectiveness And Audit Quali.

Internasional Journal Of Advances In Management

And Economic, 6(6), 16–23.

Www.Managementjournal.Info

Husna, A., & Satria, I. (2019). Effects Of Return On Asset,

Debt To Asset Ratio, Current Ratio, Firm Size, And

Dividend Payout Ratio On Firm Value. International

Journal Of Economics And Financial Issues, 9(5), 50–

54. Https://Doi.Org/10.32479/Ijefi.8595

Jihadi, Vilantika, E., Hashemi, S. M., Arifin, Z., Bachtiar,

Y., & Sholichah, F. (2021). The Effect Of Liquidity ,

Leverage , And Profitability On Firm Value : Empirical

Evidence From Indonesia. Journal Of Asian Finance

And Business, 8(3), 423–431.

Https://Doi.Org/10.13106/Jafeb.2021.Vol8.No3.0423

Juhandi, N., Fahlevi, M., Abdi, M. N., & Noviantoro, R.

ISCP UTA’45 Jakarta 2022 - International Seminar and Call for Paper Universitas 17 Agustus 1945 Jakarta

96

(2019). Liquidity, Firm Size And Dividend Policy To

The Value Of The Firm (Study In Manufacturing Sector

Companies Listed On Indonesia Stock Exchange).

Advancess In Economics, Business And Management,

100(Icoi), 313–317.

Kartika, I. (2021). Corporate Governance, Corporate Social

Responsibility And Firm Value: Evidence From

Indonesia. International Journal Of Business

Economics (IJBE), 3(1), 64–80.

Https://Doi.Org/10.30596/Ijbe.V3i1.7912

Krause, T. A., & Tse, Y. (2016). Risk Management And

Firm Value: Recent Theory And Evidence.

International Journal Of Accounting And Information

Management, 24(1), 56–81.

Liew, C. Y., & Devi, S. S. (2021). Family Firms, Banks

And Firm Value: Evidence From Malaysia. Journal Of

Family Business Management, 11(1), 51–85.

Https://Doi.Org/10.1108/JFBM-03-2019-0015

Lumapow, L. S., & Tumiwa, R. A. F. (2017). The Effect Of

Dividend Policy, Firm Size, And Productivity To The

Firm Value. Research Journal Of Finance And

Accounting, 8(22), 20–24.

Luqman, O., Bamidele, I., & Fatai, L. (2017). The Effect Of

Firm Size On Performance Of Firms In Nigeria.

Internasional Journal Of Finance, 15(2), 2–21.

Https://Doi.Org/10.5605/IEB.15.4

Mandala, G. N., Sirisetti, S., Srinivasa Rao, K., Gandreti,

V. R. R., & Gupta, N. (2019). The Influence Of Firm

Age On The Relationship Between The Capital

Structure Determinants And Firm Value. International

Journal Of Scientific And Technology Research, 8(11),

2958–2962.

Mohd Razali, M. W., Sin, W. H. S., Lunyai, J. A., Hwang,

J. Y. T., & Md Yusoff, I. Y. (2018). Corporate Social

Responsibility Disclosure And Firm Performance Of

Malaysian Public Listed Firms. International Business

Research, 11(9), 86.

Https://Doi.Org/10.5539/Ibr.V11n9p86

Monametsi, G. L., & Agasha, E. (2020). Audit Quality And

Firm Performance: Evidence From Botswana And

Uganda. Journal Of Accounting Finance And Auditing

Studies (JAFAS), 6(4), 79–95.

Https://Doi.Org/10.32602/Jafas.2020.029

Natsir, K., & Yusbardini, Y. (2020). The Effect Of Asset

Structure And Firm Size On Firm Value With Capital

Structure As Intervening Variable. Journal Of Business

& Financial Affairs, 06(04), 218–224.

Novitasari, T., & Sunarto. (2021). Profitability On Firm

Value ( Empire Study On Mining Sector. Jurnal

Akuntansi, Audit Dan Sistem Informasi Akuntansi, 5(3),

512–525.

Nugroho, T., & Patrisia, D. (2022). The Effect Of Capital

Structure, And Growth On Firm Value On Real Estate

And Property Companies Listed On BEI (2015-2019

Period). Fianancial Management Studies, 1(2), 67–78.

Phan, T. D., Dang, T. H., Nguyen, T. D. T., Ngo, T. T. N.,

& Hoang, T. H. Le. (2020). The Effect Of Enterprise

Risk Management On Firm Value: Evidence From

Vietnam Industry Listed Enterprises. Accounting, 6(4),

473–480. Https://Doi.Org/10.5267/J.Ac.2020.4.011

Pramesti, N. P. E., Yasa, P. N. S., & Ningsih, N. L. A. P.

(2021). The Effect Of Capital Structure And Sales

Growth On Company Profitability And Value In

The Cosmetics Manufacturing And Household Needs

Manufacturing Companies. Jurnal Ekonomi & Bisnis

JAGADITHA, 8(2), 187–193.

Https://Doi.Org/10.22225/Jj.8.2.2021.187-193

Pratiwi, R. D. (2020). Do Capital Structure, Profitability,

And Firm Size Affect Firm Value? Jurnal Penelitan

Ekonomi Dan Bisnis, 5(2), 194–202.

Https://Doi.Org/10.33633/Jpeb.V5i2.3717

Primanandari, C., Ayu, G., & Budiasih, N. (2021). The

Effect Of Carbon Emission Disclosure Andcorporate

Social Responsibility Disclosure On Firm Value(Study

On Mining Companies Listed On The Indonesia Stock

Exchange 2016-2019). American Journal Of

Humanities And Social Sciences Research, 5, 423–431.

Www.Ajhssr.Com

Purwohandoko. (2017). The Influence Of Firm’s Size,

Growth, And Profitability On Firm Value With Capital

Structure As The Mediator: A Study On The

Agricultural Firms Listed In The Indonesian Stock

Exchange. International Journal Of Economics And

Finance, 9(8), 103–110.

Puspitasari, L., & Wiagustini. (2020). The Effect Of Capital

Structure And Firm Size On Firm Value Through

Profitability As Intervening Variable. Internasional

Journal Of Economics, Commerce And Management,

7(12), 69–84.

Https://Doi.Org/10.2991/Aebmr.K.200626.040

Putri, G., & Rahyuda, H. (2020). Effect Of Capital Structure

And Sales Growth On Firm Value With Profitability As

Mediation. International Research Journal Of

Management, IT And Social Sciences, 7(1), 145–155.

Https://Doi.Org/10.21744/Irjmis.V7n1.833

Saeidi, P., Saeidi, S. P., Gutierrez, L., Streimikiene, D.,

Alrasheedi, M., Saeidi, S. P., & Mardani, A. (2021).

The Influence Of Enterprise Risk Management On Firm

Performance With The Moderating Effect Of

Intellectual Capital Dimensions. Economic Research-

Ekonomska Istrazivanja, 34(1), 122–151.

Https://Doi.Org/10.1080/1331677X.2020.1776140

Samosir, F. (2018). Effect Of Cash Conversion Cycle, Firm

Size, And Firm Age To Profitability. Journal Of

Applied Accounting And Taxation Article History, 3(1),

50–57.

Sari, R., & Witjaksono, A. (2021). The Effect Of Enterprise

Risk Management, Firm Size, Profitability, And

Leverage On Firm Value. EAJ (Economic And

Accounting Journal), 4(1), 71.

Savitri, E., Gumanti, T. A., & Yulinda, N. (2020).

“Enterprise Risk-Based Management Disclosures And

Firm Value Of Indonesian Finance Companies.”

Problems And Perspectives In Management, 18(4),

414–422.

Setiawanta, Y., Purwanto, A., & Hakim, M. A. (2019).

Financial Performance And Firm Value Lesson From

Mining Sub-Sector Companies On The Indonesia Stock

Exchange. JDA Jurnal Dinamika Akuntansi, 11(1), 70–

80.

Firm Value the Moderating Role of Risk Management: Growth, Size, Age, and Profitability

97

Sondakh, R. (2019). The Effect Of Dividend Policy,

Liquidity, Profitability And Firm Size On Firm Value

In Financial Service Sector Industries Listed In

Indonesia Stock Exchange 2015-2018 Period.

Accountability, 8(2), 91.

Spence. (1973). Market Signaling. The Quarterly Journal

Of Economics, 87(3), 355–374.

Sudiani, & Wiksuana. (2018). Capital Structure, Investment

Opportunity Set, Dividend Policy And Profitability As

A Firm Determinants. Russian Journal Of Agricultural

And Socio-Economic Sciences, 9(81), 37–51.

Sugiyanto, E., Trisnawati, R., & Kusumawati, E. (2021).

Corporate Social Responsibility And Firm Value With

Profitability , Firm Size , Managerial Ownership , And

Board Of Commissioners As Moderating Variables.

Jurnal Riset Akuntansi Dan Keuangan Indonesia, 6(1),

18–26.

Sugosha, M. J. (2020). The Role Of Profitability In

Mediating Company Ownership Structure And Size Of

Firm Value In The Pharmaceutical Industry On The

Indonesia Stock Exchange. International Research

Journal Of Management, IT And Social Sciences, 7(1),

104–115. Https://Doi.Org/10.21744/Irjmis.V7n1.827

Suhadak, Kurniaty, Handayani, S. R., & Rahayu, S. M.

(2019). Stock Return And Financial Performance As

Moderation Variable In Influence Of Good Corporate

Governance Towards Corporate Value. Asian Journal

Of Accounting Research, 4(1), 18–34.

Suhandi, N. P. (2021). The Effect Of Institutional

Ownership, Capital Structure, Dividend Policy, And

Company Growth On Company Value. International

Journal Of Management And Business (IJMB), 2(2),

97–109. Https://Doi.Org/10.46643/Ijmb.V1i1.5

Suhono, Disman, N., & Sari, M. (2021). Effect Of Debt And

Profitability. Journal Og Accounting, 6(1), 57–69.

Sukmawardini, D., & Ardiansari, A. (2018). The Influence

Of Intitutional Ownership, Profitability, Liquidity,

Dividend Policy, Debt Policy On Firm Value.

Management Analysis Journal, 7(2), 211–222.

Supriyadi, A., & Setyorini, C. T. (2020). Pengaruh

Pengungkapan Manajemen Risiko Terhadap Nilai

Perusahaan Melalui Kinerja Keuangan Di Industri

Perbankan Indonesia. Owner (Riset Dan Jurnal

Akuntansi), 4(2), 467.

Https://Doi.Org/10.33395/Owner.V4i2.257

Surasmi, I. A., Putra, I. B. U., & Yasa, I. M. J. (2022).

Moderating Effect Of Capital Structure On The Effect

Of Sales Growth On The Value Of Manufacturing

Companies Listed On The Indonesia Stock Exchange.

Jurnal Ekonomi & Bisnis JAGADITHA, 9(1), 1–6.

Https://Doi.Org/10.22225/Jj.9.1.2022.1-6

Susanti, N., & Restiana, N. G. (2018). What’s The Best

Factor To Determining Firm Value? Jurnal Keuangan

Dan Perbankan,

22(2), 301–309.

Https://Doi.Org/10.26905/Jkdp.V22i2.1529

Susilawati, S., & Suryaningsih, M. (2020). Firm Value

Analysis On Lq45 Companies In 2016-2017. IRE

Journals, 4(5), 36–43.

Syaifulhaq, D., Herwany, A., & Layyinaturrobaniyah.

(2020). Capital Structure And Firm’s Growth In

Relations To Firm Value At Oil And Gas Companies

Listed In Indonesia Stock Exchange. Journal Of

Accounting Auditing And Business, 3(1), 14–28.

Tabe, R., Lapian, S. L. V. J., Sam, U., Manado, R., &

Maramis, J. B. (2022). The Effect Of Firm Size,

Investment Opportunity Set, And Capital Structure On

Firm Value. The Seybold Report, 17(5), 56–74.

Https://Doi.Org/10.5281/Zenodo.6592088

Ticoalu, R., Januardi, Firmansyah, A., & Estralita, T.

(2021). Nilai Perusahaan, Manajemen Risiko, Tata

Kelola Perusahaan: Peran Moderasi Ukuran

Perusahaan. Studi Akuntansi …, 4(2), 89–103.

Widyastuti, M. (2019). Analysis Of Liquidity, Activity,

Leverage, Financial Performance And Company Value

In Food And Beverage Companies Listed On The

Indonesia Stock Exchange. International Journal Of

Economics And Management Studies, 6(5), 52–58.

Https://Doi.Org/10.14445/23939125/Ijems-V6i5p109

Wijaya, A. L. (2020). The Effect Of Audit Quality On Firm

Value: A Case In Indonesian Manufacturing Firm.

Journal Of Accounting Finance And Auditing Studies

(JAFAS), 6(1), 1–15.

Https://Doi.Org/10.32602/Jafas.2020.001

Yang, S., Ishtiaq, M., & Anwar, M. (2018). Enterprise Risk

Management Practices And Firm Performance, The

Mediating Role Of Competitive Advantage And The

Moderating Role Of Financial Literacy. Journal Of

Risk And Financial Management, 11(3), 2–17.

Https://Doi.Org/10.3390/Jrfm11030035

Yolandita, A. A., & Cahyonowati, N. (2022). The Effects

Of Audit Quality On Firm Value Of Indonesian

Financial Service Sector (FSS). Diponegoro Journal Of

Accounting, 11(29), 1–8.

Https://Ejournal3.Undip.Ac.Id/Index.Php/Accounting/

Article/View/33071

Yulianto, & Widyasasi. (2020). Faktor-Faktor Yang

Mempengaruhi Nilai Perusahaan. Jurnal Paradigma

Akuntansi, 3(3), 576–58.

Https://Doi.Org/10.24912/Jpa.V3i3.14879

Yumiasih, L., & Isbanah, Y. (2017). Pengaruh Kompensasi,

Ukuran Perusahaan, Usia Perusahaan, Dan Leverage

Terhadap Nilai Perusahaan Sektor Pertanian Yang

Terdaftar Di Bei Periode 2012-2015. Jurnal

Manajemen Fakultas Ekonomi Universitas Negeri

Surabaya, 5(3), 1–9.

ISCP UTA’45 Jakarta 2022 - International Seminar and Call for Paper Universitas 17 Agustus 1945 Jakarta

98